GM's Operating Profit Hurt by China Results, U.S. Production Cuts

April 30 2019 - 8:47AM

Dow Jones News

By Mike Colias

General Motors Co.'s operating profit declined in the first

quarter, dragged down by weaker results in China and a planned cut

in production of big sport-utility vehicles in the U.S.

GM said its operating profit for the January-through-March

period totaled $2.3 billion, down 11% from a year earlier.

Operating earnings per share were $1.41, surpassing Wall Street

analysts' average estimate of $1.10 per share. Those results were

lifted 31 cents by revaluations of GM's stake in ride-hailing firm

Lyft Inc. and French auto maker PSA Group.

Net income more than doubled, to $2.16 billion, from a year

earlier when GM recorded hefty restructuring charges in South

Korea. Revenue fell 3%, to $34.9 billion.

GM executives said in January that the first quarter would be

its weakest of the year, partly because of its plan to temporarily

stop building big, high-margin SUVs at the company's factory in

Arlington, Texas, to prepare the facility to make new versions.

Production at the plant, which makes the Chevrolet Suburban,

Cadillac Escalade and other SUVs, fell 27% during the quarter,

according to an estimate from WardsAuto.com

The results show that GM's bottom line is increasingly reliant

on its highly profitable pickup truck and large-SUV lines,

especially as profits from its sizable operation in China ebb amid

an industry wide slowdown in the Chinese auto market. GM's

first-quarter income from China fell 37% from a year earlier, to

$376 million.

Auto-industry sales in China dropped last year for the first

time in more than two decades and sank another 11% in the first

quarter, while GM's declined nearly 18%.

Write to Mike Colias at Mike.Colias@wsj.com

(END) Dow Jones Newswires

April 30, 2019 08:32 ET (12:32 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

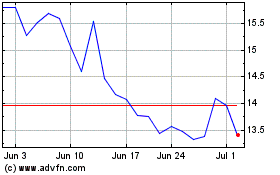

Lyft (NASDAQ:LYFT)

Historical Stock Chart

From Aug 2024 to Sep 2024

Lyft (NASDAQ:LYFT)

Historical Stock Chart

From Sep 2023 to Sep 2024