Lyell Immunopharma, Inc. (Nasdaq: LYEL), a clinical‑stage T-cell

reprogramming company advancing a diverse pipeline of cell

therapies for patients with solid tumors today reported financial

results and business highlights for the first quarter ended

March 31, 2024.

“The initial clinical and translational data from the Phase 1

trial of LYL797, our lead CAR T-cell product candidate, will

provide the first insights into our ability to reprogram ROR1 CAR T

cells that can expand, infiltrate solid tumors and kill cancer

cells in patients,” said Lynn Seely, M.D., Lyell’s President and

CEO. “Our strong cash position is expected to fund operations

through multiple milestones into 2027, including initial clinical

data from our lead TIL program in the second half of this year, and

to the continued advancement of multiple product candidates with

potential to offer better options for patients with cancer.”

First Quarter Updates and Recent

Business Highlights

Lyell is advancing four wholly-owned product candidates. Two

product candidates, LYL797 and LYL845 are in Phase 1 clinical

development. Two additional product candidates, LYL119, a

ROR1-targeted Chimeric Antigen Receptor (CAR) T‑cell product

candidate and a second-generation tumor infiltrating lymphocyte

(TIL) product candidate, are in preclinical development.

LYL797 – A ROR1-targeted CAR T-cell product candidate

genetically reprogrammed to overexpress c-Jun and epigenetically

reprogrammed using Lyell’s proprietary

Epi-R™ manufacturing protocol designed for

differentiated potency and durability

- Enrollment in the Phase 1 clinical

trial of LYL797 is ongoing. The study includes patients with

relapsed or refractory triple-negative breast cancer (TNBC) or

non-small cell lung cancer (NSCLC).

- Initial data from at least 20 patients

from the Phase 1 clinical trial of LYL797 are expected this

quarter.

LYL845 – A TIL product candidate epigenetically

reprogrammed using Lyell’s proprietary Epi-R manufacturing

protocol, designed for differentiated potency and

durability

- Enrollment in the Phase 1 clinical

trial of LYL845 is ongoing. The study includes patients with

relapsed or refractory metastatic or locally advanced melanoma,

NSCLC and colorectal cancer.

- Initial clinical and translational data

from the Phase 1 trial of LYL845 are expected in the second half of

2024.

LYL119 – A ROR1-targeted CAR T-cell product candidate

incorporating Lyell’s four stackable and complementary

reprogramming technologies designed for enhanced

cytotoxicity

- LYL119 is a ROR1-targeted CAR T-cell

product enhanced with Lyell’s four novel genetic and epigenetic

reprogramming technologies: c-Jun overexpression, NR4A3 knockout,

Epi-R manufacturing protocol and Stim‑R™ T-cell activation

technology.

- An investigational new drug (IND)

application for LYL119 is expected to be submitted this

quarter.

- Presented a poster with new nonclinical

data on LYL119 at the American Association for Cancer Research

(AACR) Annual Meeting 2024. In this study, LYL119, compared to ROR1

CAR T cells reprogrammed with only two or three technologies,

demonstrated reduced CAR T‑cell exhaustion, enhanced CAR T‑cell

function, enhanced proliferation capacity and sustained antitumor

activity in a mouse xenograft tumor model across a 10-fold dose

range, including at very low cell doses. In addition, following

repeated rounds of tumor cell killing, LYL119 displayed reduced

expression of exhaustion-related gene signatures and retained

unique cell subsets characterized by upregulation of memory and

effector-associated gene signatures.

First Quarter Financial

Results

Lyell reported a net loss of $60.7 million for the first quarter

ended March 31, 2024, compared to a net loss of

$67.0 million for the same period in 2023. Non‑GAAP net loss,

which excludes non-cash stock-based compensation, non‑cash expenses

related to the change in the estimated fair value of success

payment liabilities and certain non-cash investment gains and

charges, was $37.5 million for the first quarter ended

March 31, 2024, compared to $44.8 million for the same period

in 2023.

GAAP and Non-GAAP Operating Expenses

- Research and development (R&D)

expenses were $43.2 million for the first quarter ended

March 31, 2024, compared to $44.6 million for the same period

in 2023. The decrease in first quarter 2024 R&D expenses of

$1.5 million was primarily driven by a decrease in

personnel-related expenses associated with Lyell’s

November 2023 reduction in workforce. Non‑GAAP R&D

expenses, which exclude non-cash stock-based compensation and

non-cash expenses related to the change in the estimated fair value

of success payment liabilities for the first quarter ended

March 31, 2024, were $38.9 million, compared to

$40.6 million for the same period in 2023. The decrease in

first quarter 2024 non-GAAP R&D expenses was primarily driven

by a decrease in personnel-related expenses.

- General and administrative (G&A)

expenses were $13.5 million for the first quarter ended

March 31, 2024, compared to $19.3 million for the same period

in 2023. The decrease in first quarter 2024 G&A expenses was

primarily driven by decreases in non-cash stock-based compensation.

Non‑GAAP G&A expenses, which exclude non-cash stock‑based

compensation, for the first quarter ended March 31, 2024, were

$8.1 million, compared to $10.0 million for the same

period in 2023. The decrease in 2024 non-GAAP G&A expenses was

primarily driven by a decrease in personnel-related expenses

associated with Lyell’s November 2023 reduction in workforce.

A discussion of non-GAAP financial measures, including

reconciliations of the most comparable GAAP measures to non‑GAAP

financial measures, is presented below under “Non-GAAP Financial

Measures.”

Cash, cash equivalents and marketable securities

Cash, cash equivalents and marketable securities as of

March 31, 2024, were $526.3 million, compared to $562.7

million as of December 31, 2023. Lyell believes that its cash,

cash equivalents and marketable securities balances will be

sufficient to meet working capital and capital expenditure needs

into 2027.

About Lyell Immunopharma, Inc.

Lyell is a clinical-stage T-cell reprogramming company advancing

a diverse pipeline of cell therapies for patients with solid

tumors. Lyell is currently enrolling a Phase 1 clinical trial

evaluating a ROR1-targeted CAR T-cell therapy in patients with

relapsed refractory triple-negative breast cancer and non-small

cell lung cancer (NSCLC) and a second Phase 1 clinical trial

evaluating reprogrammed tumor infiltrating lymphocytes (TIL) in

patients with advanced melanoma, NSCLC and colorectal cancer. The

technologies powering its product candidates are designed to

address barriers that limit consistent and long-lasting responses

to cell therapy for solid tumors: T-cell exhaustion and lack of

durable stemness, which includes the ability to persist and

self-renew to drive durable tumor cytotoxicity. Lyell is applying

its proprietary ex vivo genetic and epigenetic reprogramming

technologies to address these barriers in order to develop new

medicines with improved durable clinical outcomes. Lyell is based

in South San Francisco, California with facilities in Seattle and

Bothell, Washington. To learn more, please visit

www.lyell.com.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. Forward-looking statements expressed or implied in this press

release include, but are not limited to, statements regarding:

Lyell’s anticipated progress, business plans, business strategy and

clinical trials; Lyell’s advancement of its pipeline and its

research, development and clinical capabilities; the potential

clinical benefits and therapeutic potential of Lyell’s product

candidates; the advancement of Lyell’s technology platform; Lyell’s

expectation that its financial position and cash runway will

support advancement of its pipeline through multiple clinical

milestones into 2027; Lyell’s plans to submit an IND for LYL119 and

the timing thereof; expectations around enrollment and the timing

of initial clinical and translational data from Lyell’s Phase 1

trials for LYL797 and LYL845; and other statements that are not

historical fact. These statements are based on Lyell’s current

plans, objectives, estimates, expectations and intentions, are not

guarantees of future performance and inherently involve significant

risks and uncertainties. Actual results and the timing of events

could differ materially from those anticipated in such

forward-looking statements as a result of these risks and

uncertainties, which include, but are not limited to, risks and

uncertainties related to: the effects of geopolitical instability;

macroeconomic conditions, including actual or perceived changes in

interest rates and economic inflation; Lyell’s ability to submit

planned INDs or initiate or progress clinical trials on the

anticipated timelines, if at all; Lyell’s limited experience as a

company in enrolling and conducting clinical trials, and lack of

experience in completing clinical trials; Lyell’s ability to

manufacture and supply its product candidates for its clinical

trials; the nonclinical profiles of Lyell’s product candidates or

technology not translating in clinical trials; the potential for

results from clinical trials to differ from nonclinical, early

clinical, preliminary or expected results; significant adverse

events, toxicities or other undesirable side effects associated

with Lyell’s product candidates; the significant uncertainty

associated with Lyell’s product candidates ever receiving any

regulatory approvals; Lyell’s ability to obtain, maintain or

protect intellectual property rights related to its product

candidates; implementation of Lyell’s strategic plans for its

business and product candidates; the sufficiency of Lyell’s capital

resources and need for additional capital to achieve its goals;

anticipated benefits and financial impact of Lyell’s workforce

restructuring; and other risks, including those described under the

heading “Risk Factors” in Lyell’s Annual Report on Form 10-K for

the year ended December 31, 2023, filed with the Securities

and Exchange Commission (SEC) on February 28, 2024, and the

Quarterly Report on Form 10-Q for the quarter ended March 31,

2024, being filed with the SEC today. Forward-looking statements

contained in this press release are made as of this date, and Lyell

undertakes no duty to update such information except as required

under applicable law.

Lyell Immunopharma,

Inc.Unaudited Selected Consolidated Financial

Data(in thousands)

Statement of Operations Data:

| |

Three Months Ended March 31, |

|

|

|

2024 |

|

|

|

2023 |

|

| Revenue |

$ |

3 |

|

|

$ |

65 |

|

| Operating expenses: |

|

|

|

|

Research and development(1) |

|

43,174 |

|

|

|

44,630 |

|

|

General and administrative |

|

13,494 |

|

|

|

19,279 |

|

|

Other operating income, net |

|

(1,090 |

) |

|

|

(1,288 |

) |

|

Total operating expenses |

|

55,578 |

|

|

|

62,621 |

|

| Loss from operations |

|

(55,575 |

) |

|

|

(62,556 |

) |

|

Interest income, net |

|

6,819 |

|

|

|

4,497 |

|

|

Other income, net(1) |

|

1,090 |

|

|

|

1,100 |

|

|

Impairment of other investments |

|

(13,001 |

) |

|

|

(10,000 |

) |

|

Total other loss, net |

|

(5,092 |

) |

|

|

(4,403 |

) |

| Net loss |

$ |

(60,667 |

) |

|

$ |

(66,959 |

) |

|

(1) |

Lyell’s success payment liability was recognized at fair value as

Fred Hutch had provided the requisite service obligation to earn

the potential success payment consideration under the continued

collaboration. The change in the estimated fair value of Fred Hutch

success payment liabilities beginning in Q1 2023 was recognized

within other income, net in the unaudited Condensed Consolidated

Statements of Operations and Comprehensive Loss. |

| |

|

Balance Sheet Data:

| |

As of March 31, 2024 |

|

As of December 31, 2023 |

| |

|

|

|

|

Cash, cash equivalents and marketable securities |

$ |

526,300 |

|

$ |

562,729 |

| Property and equipment,

net |

$ |

97,836 |

|

$ |

102,654 |

| Total assets |

$ |

694,220 |

|

$ |

750,029 |

| Total stockholders’

equity |

$ |

603,157 |

|

$ |

654,952 |

| |

|

|

|

|

|

Non-GAAP Financial Measures

To supplement our financial results and guidance presented in

accordance with U.S. generally accepted accounting principles

(GAAP), we present non-GAAP net loss, non-GAAP R&D expenses and

non-GAAP G&A expenses. Non‑GAAP net loss and non-GAAP R&D

expenses exclude non-cash stock-based compensation expense and

non-cash expenses related to the change in the estimated fair value

of success payment liabilities from GAAP net loss and GAAP R&D

expenses. Non-GAAP net loss further adjusts non‑cash investment

gains and charges, as applicable. Non‑GAAP G&A expenses exclude

non-cash stock-based compensation expense from GAAP G&A

expenses. We believe that these non-GAAP financial measures, when

considered together with our financial information prepared in

accordance with GAAP, can enhance investors’ and analysts’ ability

to meaningfully compare our results from period to period, and to

identify operating trends in our business. We have excluded

stock-based compensation expense, changes in the estimated fair

value of success payment liabilities and non-cash investment gains

and charges from our non‑GAAP financial measures because they are

non-cash gains and charges that may vary significantly from period

to period as a result of changes not directly or immediately

related to the operational performance for the periods presented.

We also regularly use these non-GAAP financial measures internally

to understand, manage and evaluate our business and to make

operating decisions. These non-GAAP financial measures are in

addition to, and not a substitute for or superior to, measures of

financial performance prepared in accordance with GAAP. In

addition, these non-GAAP financial measures have no standardized

meaning prescribed by GAAP and are not prepared under any

comprehensive set of accounting rules or principles and, therefore,

have limits in their usefulness to investors. We encourage

investors to carefully consider our results under GAAP, as well as

our supplemental non-GAAP financial information, to more fully

understand our business.

Lyell Immunopharma,

Inc.Unaudited Reconciliation of GAAP to Non-GAAP

Net Loss(in thousands)

| |

Three Months Ended March 31, |

|

|

|

2024 |

|

|

|

2023 |

|

| Net loss - GAAP |

$ |

(60,667 |

) |

|

$ |

(66,959 |

) |

| Adjustments: |

|

|

|

|

Impairment of other investments |

|

13,001 |

|

|

|

10,000 |

|

|

Stock-based compensation expense |

|

9,155 |

|

|

|

13,882 |

|

|

Change in the estimated fair value of success payment

liabilities |

|

968 |

|

|

|

(1,708 |

) |

| Net loss - Non-GAAP(1) |

$ |

(37,543 |

) |

|

$ |

(44,785 |

) |

|

(1) |

There was no income tax effect related to the adjustments made to

calculate non-GAAP net loss because of the full valuation allowance

on our net U.S. deferred tax assets for all periods presented. |

|

|

|

Lyell Immunopharma,

Inc.Unaudited Reconciliation of GAAP to Non-GAAP

Research and Development Expenses(in thousands)

| |

Three Months Ended March 31, |

|

|

|

2024 |

|

|

|

2023 |

|

| Research and development -

GAAP |

$ |

43,174 |

|

|

$ |

44,630 |

|

| Adjustments: |

|

|

|

|

Stock-based compensation expense |

|

(3,792 |

) |

|

|

(4,612 |

) |

|

Change in the estimated fair value of success payment

liabilities(1) |

|

(525 |

) |

|

|

608 |

|

| Research and development -

Non-GAAP |

$ |

38,857 |

|

|

$ |

40,626 |

|

|

(1) |

Lyell’s success payment liability was recognized at fair value as

Fred Hutch had provided the requisite service obligation to earn

the potential success payment consideration under the continued

collaboration. The change in the estimated fair value of Fred Hutch

success payment liabilities beginning in Q1 2023 was recognized

within other income, net in the unaudited Condensed Consolidated

Statements of Operations and Comprehensive Loss. |

| |

|

Lyell Immunopharma,

Inc.Unaudited Reconciliation of GAAP to Non-GAAP

General and Administrative Expenses(in thousands)

| |

Three Months Ended March 31, |

|

|

|

2024 |

|

|

|

2023 |

|

| General and administrative -

GAAP |

$ |

13,494 |

|

|

$ |

19,279 |

|

| Adjustments: |

|

|

|

|

Stock-based compensation expense |

|

(5,363 |

) |

|

|

(9,270 |

) |

| General and administrative -

Non-GAAP |

$ |

8,131 |

|

|

$ |

10,009 |

|

Contact:

Ellen RoseSenior Vice President, Communications

and Investor Relationserose@lyell.com

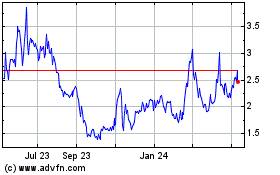

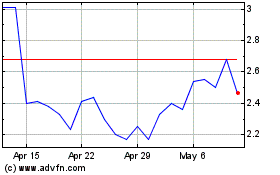

Lyell Immunopharma (NASDAQ:LYEL)

Historical Stock Chart

From Jan 2025 to Feb 2025

Lyell Immunopharma (NASDAQ:LYEL)

Historical Stock Chart

From Feb 2024 to Feb 2025