As filed with the Securities and Exchange Commission on November 30, 2023

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-8

REGISTRATION STATEMENT

Under

The Securities Act of 1933

Lumentum Holdings Inc.

(Exact name of Registrant as specified in its charter)

| | | | | | | | |

Delaware

(State or other jurisdiction of

incorporation or organization) | | 47-3108385

(I.R.S. Employer

Identification Number) |

1001 Ridder Park Drive

San Jose, California 95131

(Address of principal executive offices, including zip code)

Amended and Restated Share Option Scheme of Cloud Light Optoelectronics Limited

(Full title of the plan)

Alan S. Lowe

President and Chief Executive Officer

Lumentum Holdings Inc.

1001 Ridder Park Drive

San Jose, California 95131

(408) 546-5483

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| | | | | |

Lisa L. Stimmell

Wilson Sonsini Goodrich & Rosati

Professional Corporation

650 Page Mill Road

Palo Alto, California 94304

(650) 493-9300 | |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large accelerated filer | ☒ | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

PART I

INFORMATION REQUIRED IN THE SECTION 10(A) PROSPECTUS

The documents containing the information specified in this Part I will be delivered to the participants in the Amended and Restated Share Option Scheme of Cloud Light Optoelectronics Limited covered by this Registration Statement as required by Rule 428(b)(1) of the Securities Act of 1933, as amended (the “Securities Act”). Such documents are not required to be filed with the Securities and Exchange Commission (the “Commission”) as part of this Registration Statement in accordance with the provisions of Rule 428 under the Securities Act and the introductory note to Part I of Form S-8.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item 3. Incorporation of Documents by Reference.

Lumentum Holdings Inc. (the “Registrant”) hereby incorporates by reference into this Registration Statement the following documents previously filed with the Commission:

(1) The Registrant’s Annual Report on Form 10-K for the fiscal year ended July 1, 2023, filed with the Commission on August 23, 2023 (the “Annual Report”); (2) All other reports of the Registrant filed pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) since the end of the fiscal year covered by the Annual Report (other than the portions of these documents not deemed to be filed); and

(3) The Registrant’s Registration Statement on Form 10, initially filed with the Commission on February 26, 2015, as amended, including the description of the Registrant’s common stock contained therein, and any amendment or report filed for the for the purpose of updating such description.

All documents filed by the Registrant pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act on or after the date of this Registration Statement and prior to the filing of a post-effective amendment to this Registration Statement that indicates that all securities offered have been sold or that deregisters all securities then remaining unsold shall be deemed to be incorporated by reference in this Registration Statement and to be part hereof from the date of filing of such documents; provided, however, that documents or information deemed to have been furnished and not filed in accordance with the rules of the Commission shall not be deemed incorporated by reference into this Registration Statement.

Any statement contained in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for purposes of this Registration Statement to the extent that a statement contained herein or in any subsequently filed document which also is or is deemed to be incorporated by reference herein modifies or supersedes such statement. Any such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this Registration Statement.

Item 4. Description of Securities.

Not applicable.

Item 5. Interests of Named Experts and Counsel.

Not applicable.

Item 6. Indemnification of Directors and Officers.

Reference is made to Section 102(b)(7) of the Delaware General Corporation Law (the “DGCL”), which permits a corporation in its certificate of incorporation or an amendment thereto to eliminate or limit the personal liability of a director for violations of the director’s fiduciary duty, except (i) for any breach of the director’s fiduciary duty of loyalty to the corporation or its stockholders, (ii) for acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law, (iii) pursuant to Section 174 of the DGCL (providing for liability of directors for unlawful payment of dividends or unlawful stock purchases or redemptions), or (iv) for any transaction from which the director derived an improper personal benefit. The Registrant’s amended and restated certificate of incorporation contains the provisions permitted by Section 102(b)(7) of the DGCL.

Reference is made to Section 145 of the DGCL, which provides that a corporation may indemnify any persons, including directors and officers, who are, or are threatened to be made, parties to any threatened, pending or completed legal action, suit or proceeding, whether civil, criminal, administrative or investigative (other than an action by or in the right of such corporation), by reason of the fact that such person is or was a director, officer, employee or agent of such corporation, or is or was serving at the request of such corporation as a director, officer, employee or agent of another corporation or enterprise. The indemnity may include expenses (including attorney’s fees), judgments, fines and amounts paid in settlement actually and reasonably incurred by such person in connection with such action, suit or proceeding, provided such director,

officer, employee or agent acted in good faith and in a manner he or she reasonably believed to be in or not opposed to the corporation’s best interests and, with respect to any criminal actions or proceedings, had no reasonable cause to believe that his or her conduct was unlawful. A Delaware corporation may indemnify directors and/or officers in an action or suit by or in the right of the corporation under the same conditions, except that no indemnification is permitted without judicial approval if the director or officer is adjudged to be liable to the corporation. Where a director or officer is successful on the merits or otherwise in the defense of any action referred to above, the corporation must indemnify him or her against the expenses which such director or officer actually and reasonably incurred.

The Registrant’s bylaws provide indemnification of directors and officers to the fullest extent permitted by applicable law. The Registrant has obtained liability insurance for each director and officer for certain losses arising from claims or charges made against them while acting in their capacities as the Registrant’s directors or officers. The Registrant has entered into indemnification agreements with each of its executive officers and directors. These agreements provide that, subject to limited exceptions and among other things, the Registrant will indemnify each of its executive officers and directors to the fullest extent permitted by law and advance expenses to each indemnitee in connection with any proceeding in which a right to indemnification is available.

Item 7. Exemption from Registration Claimed.

Not applicable.

Item 8. Exhibits.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Exhibit | | | | Incorporated by Reference |

| Number | | Exhibit Description | | Form | | File No. | | Exhibit | | Filing Date |

| | | | | | | | | | |

4.1 | | | | 8-K | | 001-36861 | | 3.1 | | August 6, 2015 |

| | | | | | | | | | |

4.2 | | | | 8-K | | 001-36861 | | 3.2 | | August 6, 2015 |

| | | | | | | | | | |

4.3* | | | | | | | | | | |

| | | | | | | | | | |

5.1* | | | | | | | | | | |

| | | | | | | | | | |

23.1* | | | | | | | | | | |

| | | | | | | | | | |

23.2* | | | | | | | | | | |

| | | | | | | | | | |

24.1* | | | | | | | | | | |

| | | | | | | | | | |

107.1* | | | | | | | | | | |

* Filed herewith.

Item 9. Undertakings.

A. The undersigned Registrant hereby undertakes:

(1) To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(i) To include any prospectus required by Section 10(a)(3) of the Securities Act of 1933;

(ii) To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than a 20 percent change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement; and

(iii) To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement.

Provided, however, that paragraphs (A)(1)(i) and (A)(1)(ii) do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Commission by the Registrant pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in this registration statement.

(2) That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(3) To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

B. The undersigned Registrant hereby undertakes that, for purposes of determining any liability under the Securities Act of 1933, each filing of the Registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Securities Exchange Act of 1934 (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Securities Exchange Act of 1934) that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

C. Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons of the Registrant pursuant to the foregoing provisions, or otherwise, the Registrant has been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Securities Act of 1933 and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the Registrant of expenses incurred or paid by a director, officer or controlling person of the Registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the Registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act of 1933 and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, as amended, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of San Jose, State of California, on the 30th day of November, 2023.

| | | | | | | | |

|

LUMENTUM HOLDINGS INC. |

| | |

| By: | /s/ Alan Lowe |

| | Alan Lowe |

| | President and Chief Executive Officer |

POWER OF ATTORNEY

KNOW ALL PERSONS BY THESE PRESENTS, that each person whose signature appears below hereby constitutes and appoints Alan Lowe, Wajid Ali and Judy Hamel, and each of them, as their true and lawful attorney-in-fact and agent with full power of substitution, for him or her in any and all capacities, to sign any and all amendments to this Registration Statement and to file the same, with all exhibits thereto and other documents in connection therewith, with the Commission, granting unto said attorney-in-fact, proxy and agent full power and authority to do and perform each and every act and thing requisite and necessary to be done in connection therewith, as fully for all intents and purposes as he or she might or could do in person, hereby ratifying and confirming all that said attorney-in-fact, proxy and agent, or his or her substitute, may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act, this Registration Statement and the Power of Attorney has been signed by the following persons in the capacities and on the dates indicated.

| | | | | | | | | | | | | | |

| Signature | | Title | | Date |

| | | | | |

| /s/ Alan Lowe | | President, Chief Executive Officer and Director | | November 30, 2023 |

| Alan Lowe | | (Principal Executive Officer) | | |

| | | | | |

| /s/ Wajid Ali | | Executive Vice President, Chief Financial Officer | | November 30, 2023 |

| Wajid Ali | | (Principal Financial Officer) | | |

| | | | |

| /s/ Matthew Sepe | | Chief Accounting Officer | | November 30, 2023 |

| Matthew Sepe | | (Principal Accounting Officer) | | |

| | | | | |

| /s/ Harold Covert | | Director | | November 30, 2023 |

| Harold Covert | | | | |

| | | | | |

| /s/ Pamela Fletcher | | Director | | November 30, 2023 |

| Pamela Fletcher | | | | |

| | | | | |

| /s/ Isaac Harris | | Director | | November 30, 2023 |

| Isaac Harris | | | | |

| | | | | |

| /s/ Penelope Herscher | | Director | | November 30, 2023 |

| Penelope Herscher | | | | |

| | | | | |

| /s/ Julie Johnson | | Director | | November 30, 2023 |

| Julie Johnson | | | | |

| | | | | |

| /s/ Brian Lillie | | Director | | November 30, 2023 |

| Brian Lillie | | | | |

| | | | | |

| /s/ Ian Small | | Director | | November 30, 2023 |

| Ian Small | | | | |

/s/ Janet Wong | | Director | | November 30, 2023 |

| Janet Wong | | | | |

Exhibit 107.1

Calculation of Filing Fee Tables

Form S-8

(Form Type)

Lumentum Holdings Inc.

(Exact name of registrant as specified in its charter)

Table 1 – Newly Registered Securities

| | | | | | | | | | | | | | | | | | | | | | | |

| Security Type | Security Class Title | Fee Calculation Rule | Amount

Registered(1) | Proposed

Maximum

Offering

Price

Per Unit | Maximum

Aggregate

Offering Price | Fee Rate | Amount of

Registration

Fee |

| Equity | Common Stock, par value $0.001 per share, reserved for issuance pursuant to option awards under the Amended and Restated Share Option Scheme of Cloud Light Optoelectronics Limited (the “Cloud Light Plan”) | Rule 457(h) | 894,807(2) | $7.6966(3) | $6,886,971.56(3) | 0.00014760 | $1,016.52 |

| Equity | Common Stock, par value $0.001 per share, reserved for issuance pursuant to the Cloud Light Plan | Rule 457(c) and Rule 457(h) | 668,916(4) | $42.09(5) | $28,154,674.44(5) | 0.00014760 | $4,155.63 |

| Total Offering Amounts | | $35,041,646 | | $5,172.15 |

Total Fee Offsets(6) | | | | -- |

| Net Fee Due | | | | $5,172.15 |

| | | | | |

| (1) | Pursuant to Rule 416(a) under the Securities Act of 1933, as amended (the “Securities Act”), this Registration Statement shall also cover any additional securities that may be necessary to adjust the number of shares reserved for issuance pursuant to the Cloud Light Plan by reason of any stock split, stock dividend or similar adjustment effected without the Registrant’s receipt of consideration that results in an increase in the number of outstanding shares of the Registrant’s common stock. |

| (2) | Pursuant to the Agreement and Plan of Merger, dated as of October 29, 2023, by and among the Registrant, Crius Merger Sub Inc., Cloud Light Optoelectronics Limited (“Cloud Light”), and Fortis Advisors LLC as Securityholder Representative (the “Merger Agreement”), upon the closing of the transactions contemplated by the Merger Agreement on November 7, 2023, the Registrant assumed certain outstanding options to purchase shares of common stock of Cloud Light under the Cloud Light Plan and such options became exercisable to purchase shares of the Registrant’s common stock, subject to appropriate adjustments to the number of shares and the exercise price of each such option as provided in the Merger Agreement. |

| (3) | Estimated solely for purposes of calculating the registration fee pursuant to Rule 457(h) under the Securities Act on the basis of the weighted average exercise price of options outstanding under the Cloud Light Plan and assumed by the Registrant. |

| (4) | Pursuant to the Merger Agreement, the Registrant assumed the Cloud Light Plan and the amount reflects the number of shares of common stock reserved for issuance pursuant to future awards under the Cloud Light Plan. |

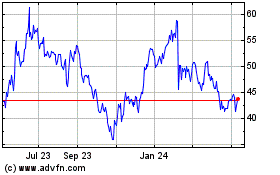

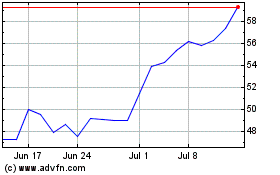

| (5) | Estimated solely for purposes of calculating the registration fee in accordance with Rules 457(c) and (h) under the Securities Act. The proposed maximum offering price of $42.09 per share is based on the average of the reported high and low sales prices for Registrant’s common stock as reported on the Nasdaq Global Select Market on November 28, 2023. |

| (6) | The Registrant does not have any fee offsets. |

Table 2 – Fee Offset Claims and Sources

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | |

| | Registrant

or Filer

Name | | Form or

Filing

Type | | File

Number | | Initial

Filing Date | | Filing

Date | | Fee

Offset

Claimed | | Security

Type

Associated

with Fee

Offset

Claimed | | Unsold

Securities

Associated

with Fee

Offset

Claimed | | Unsold

Aggregate

Offering

Amount

Associated

with Fee

Offset

Claimed | | Fee Paid

with Fee

Offset

Source |

| Rule 457(p) |

| | | | | | | | | | |

| Fee Offset Claims | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | |

| Fee Offset Sources | | | | | | | | | | | | | | | | | | | | |

Exhibit 4.3

CLOUD LIGHT OPTOELECTRONICS LIMITED

(雲暉光電有限公司)

(Incorporated in the British Virgin Islands with limited liability)

AMENDED AND RESTATED SHARE OPTION SCHEME

Adopted by a resolution of the shareholders of

CLOUD LIGHT OPTOELECTRONICS LIMITED

(雲暉光電有限公司)

on 25 June 2021

and

Amended by a resolution of the shareholders of

CLOUD LIGHT OPTOELECTRONICS LIMITED

(雲暉光電有限公司)

on 29 October 2023

and

Amended and Restated on November 30, 2023

CONTENTS

| | | | | | | | |

| Clause | Headings | Page |

| 1. | DEFINITIONS | 1 |

| 2. | CONDITIONS | 7 |

| 3. | PURPOSES OF THE SCHEME | 7 |

| 4. | DETERMINATION OF ELIGIBILITY | 8 |

| 5. | DURATION AND ADMINISTRATION | 8 |

| 6. | GRANT OF OPTIONS | 10 |

| 7. | SUBSCRIPTION PRICE AND THE SCHEME LIMIT | 12 |

| 8. | EXERCISE OF OPTIONS | 12 |

| 9. | LAPSE OF OPTIONS | 14 |

| 10. | SHARE CAPITAL | 15 |

| 11. | [RESERVED] | 19 |

| 12. | ALTERATION OF THE SCHEME | 19 |

| 13. | TERMINATION | 20 |

| 14. | CANCELLATION | 20 |

| 15. | MISCELLANEOUS | 20 |

| 16. | RESTRICTED STOCK UNITS | 21 |

CLOUD LIGHT OPTOELECTRONICS LIMITED

(雲暉光電有限公司)

(Incorporated in the British Virgin Islands with limited liability)

AMENDED AND RESTATED SHARE OPTION SCHEME

1. DEFINITIONS

1.01 In this Scheme the following expressions have the following meanings:

| | | | | |

“Acquiror” | means Lumentum Holdings Inc., a Delaware corporation. |

“Acquiror Group” | means, the Acquiror and any entity in which the Acquiror directly or indirectly holds any equity interests. |

“Adoption Date” | 25 June 2021, the date on which the Scheme was adopted by the Shareholders by way of a written resolution. |

“Affiliate” | of any person means another person that directly or indirectly through one of more intermediaries controls, is controlled by or is under common control with, such first person. |

“Articles of Association” | means the memorandum of association and articles of association of Cloud Light, as may be amended and restated from time to time. |

“Authorised Director” | means, prior to the Merger Effective Time, the Director as authorised by the Board to implement and administer the Scheme, and, on and following the Merger Effective Time, the Board. |

| “Award” | means any Option or RSU granted to a Participant under the Scheme. |

| “Award Agreement” | means a written document, in such form as the Board prescribes from time to time, setting forth the terms and conditions of an Award. The Board may provide for the use of electronic, internet or other non-paper Award Agreements, and the use of electronic, internet or other non-paper means for the acceptance thereof and actions thereunder by a Participant. |

| | | | | |

“Board” | means, prior to the Merger Effective Time, the board of directors of Cloud Light, and, on and following the Merger Effective Time, the board of directors of the Acquiror. |

“business day” | a day (other than a Saturday or Sunday) on which banks are open for general business in Hong Kong. |

“Cause” | means any of the following with respect to a Grantee: (a) the Grantee’s gross negligence or willful misconduct in the performance of the Grantee’s duties to Acquiror or any Affiliate thereof; (b) a material and willful violation of any federal or state law by the Grantee that if made public would injure the business or reputation of Acquiror or any of its Affiliates; (c) refusal or willful failure by the Grantee to comply with any specific, lawful direction or order Acquiror or any of its Affiliates or the material policies and procedures of Acquiror or any of its Affiliates that have been previously made available to the Grantee, including but not limited to any Code of Business Conduct and Inside Information and Securities Transactions policy, as well as any obligations concerning proprietary rights and confidential information of Acquiror or any of its Affiliates; (d) the Grantee’s material breach of any contract between the Grantee, on the one hand, and Acquiror or any of its Affiliates, on the other hand that causes material harm to Acquiror or any of its Affiliates; (e) conviction (including a plea of nolo contendere) of the Grantee of a felony, or of a misdemeanor that would have a material adverse effect on the goodwill of Acquiror or any of its Affiliates if the Grantee were to be retained as an service provider of Acquiror or any of its Affiliates; or (f) substantial and continuing willful refusal by the Grantee to perform duties ordinarily performed by an employee in the same position and having similar duties as the Grantee; provided, that, in each case of (a), (c), (d), and (f), Acquiror or its applicable Affiliate shall only be permitted to terminate the Grantee for Cause, after written notice describing the alleged grounds for “Cause” has been delivered to the Grantee by Acquiror, and the Grantee fails to substantially cure such noticed matters, as applicable, within thirty (30) days after such notice has been given to the Grantee. |

| | | | | |

“Cloud Light” | means CLOUD LIGHT OPTOELECTRONICS LIMITED (雲暉光電有限公司), a company incorporated in the British Virgin Islands with limited liability (BVI Company number: 2037335). |

“Committee” | means the committee of the Board described in Clause 5. |

“Company” | means, on and prior to the Merger Effective Time, Cloud Light; and, after the Merger Effective Time, the Acquiror. |

“Director(s)” | means, prior to the Merger Effective Time, director(s) of the Company, and, on and after the Merger Effective Time, the Board. |

| “Disability” | means, with respect to a Grantee, a mental or physical disability, illness or injury, evidenced by medical reports from a duly qualified medical practitioner, which renders the Grantee unable to perform the essential duties of the Grantee’s position after the provision of reasonable accommodation and which can be expected to result in death or which has lasted or can be expected to last for a continuous period of not less than 12 months. |

“Exercise Period” | any of the periods referred to in Clauses 8.03 (d), (e), (f) and (g), unless otherwise determined by the Board at its sole discretion and notified by a Director to a particular Grantee in respect of a particular Offer. |

| “Fair Market Value” | means, as of any date, the value of Ordinary Shares determined as follows: (i)If the Ordinary Shares are listed on any established stock exchange or a national market system, including without limitation the Nasdaq Global Select Market, the Nasdaq Global Market or the Nasdaq Capital Market of The Nasdaq Stock Market, the Fair Market Value of a Share will be the closing sales price for such shares (or, if no closing sales price was reported on that date, as applicable, on the last trading date such closing sales price was reported) as quoted on such exchange or system on the day of determination, as reported in The Wall Street Journal or such other source as the Board deems reliable; (ii)If the Ordinary Shares are regularly quoted by a recognized securities dealer but selling prices are not reported, the Fair Market Value will be the mean between the high bid and low asked prices for an Ordinary Share on the day of determination (or, if no bids and asks were reported on that date, as applicable, on the last trading date such bids and asks were reported), as reported in The Wall Street Journal or such other source as the Board deems reliable; or In the absence of an established market for the Ordinary Shares, the Fair Market Value will be determined in good faith by the Board. |

| | | | | |

| “Good Reason” | means, with respect to a Grantee, the Grantee’s resignation from Acquiror or its applicable Affiliate following any of the following events without the Grantee’s express written consent: (a) a reduction of the Grantee’s base salary as in effect immediately prior to such reduction other than a reduction in the Grantee’s base salary as a result of an across-the-board compensation reduction applicable to similarly-situated employees or other service providers of Acquiror or any of its Affiliates; (b) a relocation of the Grantee’s principal work location to a facility or location (i) more than fifty (50) miles from the Grantee’s then present principal work location, (ii) from one country to another, or (iii) from Hong Kong, the special administrative region of the People’s Republic of China (“Hong Kong”), to an area of the People’s Republic of China that is not in Hong Kong or vice versa (provided, however, that this clause (b) shall not give rise to “Good Reason” in the event that Grantee is not legally authorized to work in their principal work location); or (c) a material breach by Acquiror or any of its Affiliates of a written agreement between Acquiror or any of its Affiliates and the Grantee. No Grantee will resign for Good Reason without first providing Acquiror with a written notice describing the alleged grounds for “Good Reason” within ninety (90) days of the initial existence of the alleged grounds for “Good Reason” (“Good Reason Notice”) and Acquiror or one of its Affiliates, as applicable, fails to substantially cure such noticed matters within thirty (30) days after such notice has been given to Acquiror. |

“Grantee” | any Participant who accepts the Offer of the grant of any Option in accordance with the terms of the Scheme or where the context so permits, a person entitled to any such Option in consequence of the death of the original Grantee or the legal personal representative(s) of such person. |

“Group” | the Company and any entity in which the Company directly or indirectly holds any equity interests. |

“Hong Kong” | the Hong Kong Special Administrative Region of the People’s Republic of China. |

“HK$” | Hong Kong dollars, the lawful currency of Hong Kong. |

| “Involuntary Termination” | means, with respect to a Grantee, the Grantee’s Service with Acquiror and its Affiliates, including Cloud Light, is terminated (a) (x) by Acquiror or any of its Affiliates, including Cloud Light, as applicable, without Cause or (y) on account of Grantee’s death or Disability; or (b) as a result of Grantee’s resignation for Good Reason. |

| | | | | |

“legal personal representative” | a person legally appointed to administer the estate of another person. |

| “Merger” | means the merger of Merger Sub, with and into Cloud Light, as contemplated by, and subject to the terms and conditions of, the Merger Agreement. |

| “Merger Agreement” | means that certain Agreement and Plan of Merger, by and among Acquiror, Cloud Light, Merger Sub, and Fortis Advisors LLC. |

| “Merger Closing Date” | means the date upon which the Merger is consummated. |

| “Merger Effective Time” | means the effective time of the Merger. |

| “Merger Sub” | means Crius Merger Sub, Inc., a BVI business company with limited liability incorporated under the laws of the British Virgin Islands and a direct or indirect wholly owned subsidiary of Acquiror. |

“Offer” | an offer of the grant of an Option made in accordance with Clause 6. |

“Offer Date” | the date on which an Option is offered to a Participant. |

“Option” | an option to subscribe for Ordinary Shares granted and accepted pursuant to the Scheme and for the time being subsisting and “Options” shall be construed accordingly. |

“Option Period” | a period of 10 years commencing from and including the relevant Offer Date, unless otherwise determined by the Board at its sole discretion and notified by a Director to a particular Grantee in respect of a particular Offer. |

| | | | | |

“Ordinary Shares” | with respect to Options granted prior to the Merger Effective Time, the ordinary shares in the authorized share capital of Cloud Light, par value US$0.01 per share, with the rights, privileges and restrictions as set forth in the Articles of Association, and such other securities as may be substituted for Ordinary Shares pursuant to Clause 10.02; and, with respect to Awards granted after the Merger Effective Time by Acquiror, shares of the common stock, par value $0.001 per share, of Acquiror, and such other securities as may be substituted for Ordinary Shares pursuant to Clause 10.02. |

“Participant” | means any person who has been granted an Option or RSU hereunder. |

| “Post-Closing Eligible Participant” | means, any person who, immediately prior to the Merger Effective Time, was (a) a full-time or part-time employee of any member of the Group; (b) a director of any member of the Group; or (c) a consultant or adviser of any member of the Group, and who, at the time of grant of an Option or RSU hereunder is (a) a full-time or part-time employee of any member of the Acquiror Group; (b) a director of the Acquiror; or (c) a consultant or adviser of any member of the Acquiror Group. |

“Qualified IPO” | the initial public offering of the Shares or shares of any holding company of the Company and listing on the main board or the GEM of The Stock Exchange of Hong Kong Limited or any other stock exchange, by way of a new issue and/or offer for sale and/or placing. |

| “Restricted Stock Unit” or “RSU” | means a bookkeeping entry representing an amount equal to the Fair Market Value of one Ordinary Share, granted pursuant to Clause 16. Each Restricted Stock Unit or RSU represents an unfunded and unsecured obligation of the Company. |

| “RSU Offer” | means an offer of the grant of an RSU made in accordance with Clause 16. |

| “RSU Offer Date” | means the date on which an RSU is offered to a Participant. |

| | | | | |

“Scheme” | this share option scheme in its present form or as amended in accordance with the provisions hereof. |

“Series B Preferred Shares” | means the Series B convertible redeemable preferred shares of Cloud Light, par value US$0.01 per share, with the rights, privileges and restrictions as set forth in the Articles and Association. |

| “Service” | means, with respect to a Grantee, the Grantee’s employment by, or engagement to provide bona fide consulting or similar services to, Acquiror or any of its Affiliates, including Cloud Light. |

“Share(s)” | means the Ordinary Share(s) and the Series B Preferred Share(s), and such other securities as may be substituted for Ordinary Shares and Series B Preferred Share(s) pursuant to Clause 10.02. |

“Shareholder(s)” | holder(s) of the Shares from time to time. |

“Subscription Price” | means the price per Ordinary Share at which a Grantee may subscribe for Ordinary Shares on the exercise of an Option as described in Clause 7, subject to adjustment as provided in Clause 10.02. |

“US$” | United States dollars, the lawful currency of United States of America. |

1.02 Clause headings are inserted for convenience of reference only and shall be ignored in the interpretation of the Scheme. References herein to Clauses are to clauses of this Scheme.

1.03 References to masculine gender include references to the feminine and neuter gender and references to the singular include references to the plural and vice versa.

1.04 Any reference to a time of a day in the Scheme is a reference to Hong Kong time.

1.05 References to persons include bodies corporate, corporations, partnerships, sole proprietorships, organizations, associations, enterprises, branches and entities of any other kind whether or not having separate legal entity.

2. CONDITION

2.01 The Scheme took effect upon the passing of the necessary resolution to approve and adopt the Scheme by the Shareholders.

2.02 The Scheme was assumed by Acquiror in connection with the Merger, and each Option then outstanding under the Scheme as of the Merger Effective Time was terminated or assumed and converted as provided in Clause 10.02(d).

2.03 The Scheme was amended and restated on November 30, 2023 in connection with its assumption by Acquiror, in order to incorporate prior amendments.

3. PURPOSES OF THE SCHEME

3.01 The purposes of the Scheme are to attract and retain the best available personnel, to provide additional incentive to employees (full-time and part-time), directors, consultants and advisers of the Group and to promote the success of the business of the Group.

3.02 The Scheme will give the Participants an opportunity to have a personal stake in the Company and will help achieve the following objectives:

(a)motivate the Participants to optimise their performance and efficiency; and

(b)attract and retain the Participants whose contributions are important to the long-term growth and profitability of the Group.

4. DETERMINATION OF ELIGIBILITY

4.01 The Board may, at its absolute discretion, invite any Post-Closing Eligible Participant to become a new Participant of the Scheme and/or to be granted a new Award under this Scheme. Each such Award shall be evidenced by an Award Agreement. Each Award Agreement shall include such provisions, not inconsistent with the Scheme, as may be specified by the Board.

4.02 The basis of eligibility of any Participant to the grant of any Option shall be determined by the Authorised Director from time to time on the basis of the Participant’s contribution or potential contribution to the development and growth of the Group.

5.DURATION AND ADMINISTRATION

5.01 Subject to Clauses 2 and 14, the Scheme shall be valid and effective for a period of 10 years commencing on the Adoption Date, after which period no further Awards shall be offered or granted but the provisions of the Scheme shall remain in full force and effect in all other respects to the extent necessary to give effect to the exercise or payment of any Awards granted prior thereto or otherwise as may be required in accordance with the provisions of the Scheme. Options granted during the life of the Scheme shall continue to be exercisable in accordance with their terms of grant within their Exercise Period.

5.02 Administration.

(a) The Scheme shall be administered by a Committee appointed by the Board (which Committee shall consist of at least two members of the Board) or, at the discretion of the Board from time to time, the Scheme may be administered by the Board. It is intended that at least two of the directors appointed to serve on such Committee shall be “non-employee directors” (within the meaning of Rule 16b-3 promulgated under the 1934 Act) and that any such members of such Committee who do not so qualify shall abstain from participating in any decision to make or administer Awards that are made to Participants who at the time of consideration for such Award are persons subject to the short-swing profit rules of Section 16 of the 1934 Act.

However, the mere fact that a Committee member shall fail to qualify under either of the foregoing requirements or shall fail to abstain from such action shall not invalidate any Award made by the Committee which Award is otherwise validly made under the Plan. The members of the Committee shall be appointed by, and may be changed at any time and from time to time in the discretion of, the Board. Unless and until changed by the Board, effective as of the Merger Effective Time, the Compensation Committee of the Board is designated as the Committee to administer the Scheme. The Board may reserve to itself any or all of the authority and responsibility for administration of the Scheme or may act as administrator of the Scheme for any and all purposes. To the extent the Board has delegated any authority and responsibility for administration of the Scheme to a Committee, any reference herein to the Board (other than in this Clause 5.02(a)) shall include the Committee. To the extent any action of the Board under the Scheme conflicts with actions taken by a Committee, the actions of the Board shall control.

(b) For purposes of administering the Scheme, the Board may from time to time adopt rules, regulations, guidelines and procedures for carrying out the provisions and purposes of the Scheme and make such other determinations, not inconsistent with the Scheme, as the Board may deem appropriate. The Board’s interpretation of the Scheme, any Awards granted under the Scheme, any Award Agreement and all decisions and determinations by the Board with respect to the Scheme are final, binding, and conclusive on all parties. Each member of the Board is entitled to, in good faith, rely or act upon any report or other information furnished to that member by any officer or other employee of the Board or any Affiliate, the Acquiror’s or an Affiliate’s independent certified public accountants, Acquiror counsel or any executive compensation consultant or other professional retained by the Acquiror to assist in the administration of the Plan.

(c) Except as provided below, the Board has the exclusive power, authority and discretion under the Scheme to:

(i) Grant Awards;

(ii) Designate Participants;

(iii) Determine the type or types of Awards to be granted to each Participant;

(iv) Determine the number of Awards to be granted and the number of Ordinary Shares to which an Award will relate;

(v) Determine the terms and conditions of any Award granted under the Scheme, including but not limited to, the exercise price, base price, or purchase price, any restrictions or limitations on the Award, any schedule for lapse of forfeiture restrictions or restrictions on the exercisability of an Award, and accelerations or waivers thereof, based in each case on such considerations as the Board in its sole discretion determines;

(vi) Accelerate the vesting, exercisability or lapse of restrictions of any outstanding Award, in accordance with Clause 10.02, based in each case on such considerations as the Board in its sole discretion determines;

(vii) Determine whether, to what extent, and under what circumstances an Award may be settled in, or the exercise price of an Award may be

paid in, cash, Ordinary Shares, other Awards, or other property, or an Award may be canceled, forfeited, or surrendered;

(viii) Prescribe the form of each Award Agreement, which need not be identical for each Participant;

(ix) Decide all other matters that must be determined in connection with an Award;

(x) Establish, adopt or revise any rules, regulations, guidelines or procedures as it may deem necessary or advisable to administer the Scheme;

(xi) Make all other decisions and determinations that may be required under the Scheme or as the Board deems necessary or advisable to administer the Scheme;

(xii) Amend the Scheme or any Award Agreement as provided herein; and

(xiii) Adopt such modifications, procedures, and subplans as may be necessary or desirable to comply with provisions of the laws of the United States or any non-U.S. jurisdictions in which the Acquiror or any Affiliate may operate, in order to assure the viability of the benefits of Awards granted to Participants located in such other jurisdictions and to meet the objectives of the Scheme.

6.GRANT OF OPTIONS

6.01 On and subject to the terms of the Scheme, the Authorised Director shall be entitled at any time and from time to time within 10 years after the Adoption Date to make an Offer to any Participant as the Authorised Director may in its absolute discretion select, and subject to such vesting conditions and performance targets as the Board may think fit, including (i) the length of association with the Group commencing from the relevant date of employment; (ii) the performance of the Group to be assessed annually with reference to the net profit of the Group; (iii) the individual performance of the relevant Grantee to be assessed annually, or under such conditions as the Board may at its absolute discretion determine, to subscribe during the Exercise Period for such number of Ordinary Shares as the Authorised Director may determine at the Subscription Price provided always that an Offer made to such Participant will not constitute an invitation to the public to subscribe for the Shares under any applicable legislations.

6.02 For the avoidance of doubt, vesting of an Option in a Grantee upon fulfilment of the relevant vesting conditions as may be determined by the Authorised Director and set out in an Offer means that such Grantee is entitled to an absolute right to the Option which, save in any of the events as set out in Clause 9, shall not lapse or be cancelled, revoked or terminated. The exercise of an Option shall be subject to Clause 8.

6.03 An Offer shall be made to a Participant on a business day in writing in such form as the Authorised Director may from time to time determine, requiring the Participant to undertake to hold the Option on the terms on which it is to be granted and to be bound by the provisions of the Scheme and shall remain open for acceptance by the Participant concerned for a period of 28 days from the Offer Date (inclusive of the Offer Date) upon which provided that no such offer shall be open for acceptance after the expiry of the Scheme (subject to early termination thereof).

6.04 An Offer shall be deemed to have been accepted and an Option to which the Offer relates shall be deemed to have been granted and accepted and to have taken effect

when a letter in such form as the Authorised Director may from time to time determine signifying acceptance of the Option duly signed by the Grantee is received by the Company within 28 days from the Offer Date (inclusive of the Offer Date). Upon the Offer being accepted by the Grantee pursuant to this Clause 6.04, the Option shall be deemed to have been granted by the Company to the Grantee on the Offer Date.

6.05 Any Offer must be accepted in its entirety and can under no circumstances be accepted of less than the number of Ordinary Shares for which it is offered. To the extent that the Offer of the grant of an Option is not accepted within 28 days in the manner indicated in Clause 6.04, it will be deemed to have been irrevocably rejected by the Participant and the Offer shall lapse and become null and void.

6.06 Notwithstanding anything in the Scheme, any Offer or any other agreement or summary with respect to any Option, other than an agreement or action approved or taken by the Board that expressly supersedes this Clause 6.06, effective immediately prior to the Merger Effective Time:

(a) (i) Each Option granted under the Scheme prior to the Merger Effective Time that remains outstanding as of immediately prior to the Merger Effective Time (after giving effect to any Option Cancellation Agreement (as defined in the Merger Agreement)) (each, a “Revested Option”) will be vested only with respect to twenty-five percent (25%) of the Ordinary Shares subject to such Option and shall be treated in the Merger as contemplated by Clause 10.02(d)(i) of this Scheme and Section 1.3(e)(i) the Merger Agreement; and (ii) the remaining seventy-five percent (75%) of the Ordinary Shares subject to such Revested Option will be unvested and unexercisable as of immediately prior to the Merger Effective Time, shall be treated in the Merger as contemplated by Clause 10.02(d)(ii) of this Scheme and Section 1.3(ii) of the Merger Agreement and will vest and become exercisable in substantially equal monthly installments on the first thirty-six monthly anniversaries of the Merger Effective Time (or on the last day of an applicable month if the applicable anniversary does not occur before such day), in each case subject to the Grantee’s continued service as an employee or consultant of the Group through the applicable date. For avoidance of doubt, the vesting conditions applicable to each Revested Option in effect prior to the effective time of this Section 6.06(a), including any conditions contingent on service or individual or company (or group) performance, will be superseded in their entirety hereby, including with respect to any portion of such Revested Option previously vested thereunder upon satisfaction of such vesting conditions.

(b) Notwithstanding anything in Clause (a) to the contrary, in the event that the Grantee is subject to an Involuntary Termination at the time of, or any time following, the Merger Effective Time, then, subject to Grantee signing a release of claims containing reasonable and customary provisions relating to the release of claims one hundred percent (100%) of the then-remaining unvested shares subject to the Revested Options held by such Grantee shall immediately vest (it being understood that the vesting provided for in this sentence shall occur immediately prior to the effective date of such Involuntary Termination).

7.SUBSCRIPTION PRICE AND THE SCHEME LIMIT

7.01 Subject to any adjustments made pursuant to Clause 10.02, the Subscription Price shall be a price determined solely by the Board and notified to a Participant.

7.02 Subject to adjustment as provided in Clause 10.2, the maximum number of Ordinary Shares in respect of which Awards may be granted under the Scheme from the

Adoption Date forward shall be 50,851,412 Ordinary Shares; provided that the maximum number of Ordinary Shares in respect of which Awards may be granted under the Scheme from the Merger Effective Time forward (after adjustment for the Exchange Rate (as defined in the Merger Agreement)) shall be 668,916 Ordinary Shares. Any Ordinary Shares distributed pursuant to an Award may consist, in whole or in part, of authorized and unissued shares, treasury shares or shares purchased on the open market.

8.EXERCISE OF OPTIONS

8.01 An Option shall be personal to the Grantee. Except for the transmission of an Option on the death of a Grantee to his legal personal representative(s), the Option shall not be assignable and no Grantee shall in any way sell, transfer, charge, mortgage, encumber or otherwise dispose or create any interest in favour of any third party over or in relation to any Option (where the Grantee is a company, any change of its major shareholder or any substantial change in its management will be deemed to be a sale or transfer of interest as aforesaid, if so determined by the Authorised Director at its sole discretion). Any breach of the foregoing by a Grantee shall entitle the Company to cancel, revoke or terminate any Option granted to such Grantee to the extent not already exercised.

8.02 Subject to Clause 8.03, an Option may be exercised in whole or in part in the manner as set out in Clauses 8.03 and 8.04 by the Grantee giving notice in writing to the Company in such form as the Authorised Director may from time to time determine stating that the Option is thereby exercised and the number of Ordinary Shares in respect of which it is exercised. Each such notice must be accompanied by a remittance for the full amount of the aggregate Subscription Price of the Ordinary Shares in respect of which the notice is given together with any reasonable administration fee specified by the Company from time to time. Within 28 days after receipt of the notice and the remittance, the Company shall allot and issue the relevant Ordinary Shares, credited as fully paid, and a share certificate for the relevant Ordinary Shares so allotted to the Grantee.

8.03 Subject as hereinafter provided in the Scheme, an Option (to the extent already vested) shall only be exercisable by the Grantee at any time during the Exercise Period provided that:

(a)in the event that the Grantee (being an individual) dies before exercising the Option in full, subject to compliance with applicable laws, his legal personal representative(s) may exercise the Option up to the Grantee’s entitlement within the Exercise Period (to the extent which has become exercisable and not already exercised) provided that any of the events set out in Clause 8.03(d) occurs prior to his death or within the period of 12-month following his death and provided further that if within a period of 4 years prior to the Grantee’s death, the Grantee had committed any of the acts as specified in Clause 9(d) which would have entitled the Company to terminate his employment prior to his death, the Authorised Director may at any time forthwith terminate the Option of the Grantee (to the extent not already exercised) by written notice to his legal personal representatives and the Option (to the extent not already exercised) shall lapse on the date of the relevant notification;

(b)in the event that the Grantee is an employee of the Group when an Offer is made to him and he subsequently ceases to be an employee of the Group for any reason other than his death or the termination of his employment on one or more of the grounds specified in Clause 9(d), the Option (to the extent not already exercised) shall lapse on the expiry of 3 months after the date of cessation of such employment (which date will be the last actual working day

on which the Grantee was physically at work with the Company or the relevant member of the Group whether salary is paid in lieu of notice or not);

(c)in the event that the Grantee is an employee of the Group when an Offer is made to him and he subsequently ceases to be an employee by reason of a termination of his employment on one or more of the grounds specified in Clause 9(d) and the Grantee has exercised the Option in whole or in part pursuant to Clause 8.02, but the Ordinary Shares have not been allotted to him, the Grantee shall, unless the Authorised Director determines otherwise, be deemed not to have so exercised such Option and the Company shall return to the Grantee the amount of the Subscription Price for the Ordinary Shares in respect of the purported exercise of such Option;

(d)in the event a notice is given by the Company to its members to convene a general meeting for the purposes of considering, and if thought fit, approving a resolution to voluntarily wind-up the Company, the Company shall on the same date as or soon after it despatches such notice to each member of the Company give notice thereof to all Grantees and thereupon, each Grantee (or in case of the death of the Grantee, his personal representative(s)) shall be entitled to exercise all or any of his Options (to the extent not already exercised) at any time not later than 2 business days prior to the proposed general meeting of the Company by giving notice in writing to the Company in accordance with Clause 8.02, accompanied by a remittance for the full amount of the aggregate Subscription Price of the Ordinary Shares in respect of which the notice is given whereupon the Company shall as soon as possible and, in any event, no later than the business day immediately prior to the date of the proposed general meeting referred to above, allot and issue the relevant Ordinary Shares to the Grantee credited as fully paid.

8.04 The Ordinary Shares issued upon the exercise of an Option or payment of an RSU will entitle the holders to participate in all dividends or other distributions paid or made paid or made with respect to Ordinary Shares, or to participate in any vote of the holders of Ordinary Shares, in each case with a record date that occurs after the date of such issuance and before such holder’s distribution of such Ordinary Shares.

8.05 Notwithstanding anything in the Scheme, any Offer or any other agreement with respect to any Option, during the period beginning on the date on which the Merger Agreement is executed and delivered by the parties thereto and ending on the earlier to occur of (a) the first calendar day following the Merger Closing Date and (b) the termination of the Merger Agreement pursuant to its terms, no Option granted under the Scheme will be exercisable, and any effort to exercise an Option during this period will be void and of no effect.

9. LAPSE OF OPTION

An Option, irrespective of whether it has been vested in the relevant Grantee or not, shall lapse automatically and not be exercisable (to the extent not already exercised) on the earliest of:-

(a)the expiry of the Option Period;

(b)the expiry of any of the periods referred to in Clause 8.03(a), (b) or (d);

(c)subject to Clause 8.03(d), the date of the commencement of the winding-up of the Company;

(d)in the event that the Grantee is an employee of the Group when an Offer is made to him and he subsequently ceases to be an employee of the Group on any one or more of the grounds that he has been guilty of serious misconduct, or has committed an act of bankruptcy or has become insolvent or has made any arrangement or composition with his or her creditors generally, or has been convicted of any criminal offence involving his integrity or honesty or (if so determined by the Authorised Director) on any other ground on which an employer would be entitled to terminate his employment at common law or pursuant to any applicable laws or under the Grantee’s service contract with the Group, the date of cessation of his employment with the Group. A confirmation from the management of the Company to the effect that employment of a Grantee has or has not been terminated on one or more of the grounds specified in this Clause 9(d) shall be conclusive and binding on the Grantee;

(e)the occurrence of any act of bankruptcy, insolvency or entering into of any arrangements or compositions with his creditors generally by the Grantee, or conviction of the Grantee of any criminal offence involving his integrity or honesty; or

(f)the date on which the Director exercises the Company’s right to cancel, revoke or terminate the Option on the ground that the Grantee commits a breach of Clause 8.01 in respect of that or any other Option.

10. SHARE CAPITAL

10.01 On the Adoption Date, the Shareholders have given the general authority to the Authorised Director to grant Options and to issue Ordinary Shares upon any exercise of such Options.

10.02 Adjustments; Dissolution or Liquidation; Merger or Reorganization

(a) Adjustments. In the event that any dividend (other than an ordinary dividend) or other distribution (whether in the form of cash, Ordinary Shares, other securities, or other property), recapitalization, stock split, reverse stock split, reorganization, merger, consolidation, split-up, spin-off, combination, repurchase, or exchange of Shares or other securities of the Company (or, after the Merger Effective Time, the Acquiror), or other change in the corporate structure of the Company (or, after the Merger Effective Time, the Acquiror), affecting the Ordinary Shares occurs, the Board, in order to prevent diminution or enlargement of the benefits or potential benefits intended to be made available under the Scheme, will, in its exercise of reasonable and good faith discretion in order to accomplish the foregoing, adjust the number and class of shares that may be delivered under the Scheme and/or the number, class, and price of shares covered by each outstanding Award and/or provide cash compensation to the holders of each outstanding Award, which cash compensation may be subject to the same vesting schedule or other terms of such Award, as reasonably and in good faith determined by the Board.

(b) Dissolution or Liquidation. In the event of the dissolution or liquidation of the Company (or, after the Merger Effective Time, the Acquiror), the Board will notify each Participant as soon as practicable prior to the effective date of such proposed transaction. To the extent it has not been previously exercised after the Board provides the Grantee with reasonable advance written notice of the right to exercise and the consequences of failure to do so, an Award will terminate immediately prior to the consummation of such proposed action.

(c) Merger or Reorganization. In the event of a merger or reorganization of the Acquiror following the Merger Effective Time with or into another corporation or other entity, each outstanding Award will be treated as follows, as the Board determines (subject to the provisions described in subclauses (i)-(iv) below and the other paragraphs of this Clause 10.02(c)) without a Participant’s consent: (i) Awards will be assumed, or substantially equivalent awards will be substituted, by the acquiring or succeeding corporation (or an Affiliate thereof) with appropriate adjustments as to the number and kind of shares and prices; (ii) outstanding Awards will vest and become exercisable, realizable, or payable, or restrictions applicable to an Award will lapse, in whole or in part prior to or upon consummation of such merger or reorganization, and, to the extent the Board reasonably and in good faith determines, terminate upon or immediately prior to the effectiveness of such merger or reorganization to the extent not previously exercised after the Board provides the Grantee with reasonable advance written notice of the right to exercise and the consequences of failure to do so; (iii) (A) the termination of an Award in exchange for an amount of cash and/or property, if any, equal to the amount that would have been attained upon the exercise of such Award or realization of the Participant’s rights as of the date of the occurrence of the transaction (and, for the avoidance of doubt, if as of the date of the occurrence of the transaction the Board determines in good faith that no amount would have been attained upon the exercise of such Award or realization of the Participant’s rights, then such Award may be terminated by the Acquiror without payment), or (B) the replacement of such Award with other rights or property selected by the Board in its sole exercise of reasonable and good faith discretion; or (iv) any combination of the foregoing. In taking any of the actions permitted under this clause, the Board will not be obligated to treat all Awards, all Awards held by a Participant, or all Awards of the same type, similarly.

In the event that the successor corporation does not assume or substitute for the Award (or portion thereof), the Participant will fully vest in and have the right to exercise all of his or her outstanding Options, including Ordinary Shares as to which such Awards would not otherwise be vested or exercisable, all restrictions on RSUs will lapse, and, with respect to Awards with performance-based vesting, all performance goals or other vesting criteria will be deemed achieved at one hundred percent (100%) of target levels and all other terms and conditions met, in all cases, unless specifically provided otherwise under the applicable Award Agreement or other written agreement authorized by the Board between the Participant and the Acquiror or any member of the Acquiror Group, as applicable. In addition, unless specifically provided otherwise under the applicable Award Agreement or other written agreement authorized by the Board between the Participant and the Acquiror or any member of the Acquiror Group, as applicable, if an Option is not assumed or substituted in the event of a merger or reorganization, the Board will notify the Participant in writing or electronically that the Option will be exercisable for a period of time determined by the Board in its sole exercise of reasonable and good faith discretion, and the Option will terminate upon the expiration of such period.

For the purposes of this Clause 10.02(c), an Award will be considered assumed if, following the merger or reorganization, the Award confers the right to purchase or receive, for each Share subject to the Award immediately prior to the merger or reorganization, the consideration (whether shares, cash, or other securities or property) received in the merger or reorganization by holders of Ordinary Shares for each Ordinary Share with respect to such Award on the effective date of the transaction (and if holders were offered a choice of consideration, the type of consideration chosen by the holders of a

majority of the outstanding Ordinary Shares); provided, however, that if such consideration received in the merger or reorganization is not solely common stock of the successor corporation or its parent, the Board may, with the consent of the successor corporation, provide for the consideration to be received upon the exercise of an Option or upon the payout of an RSU, for each Ordinary Share subject to such Award, to be solely common stock of the successor corporation or its parent equal in fair market value to the per share consideration received by holders of Ordinary Shares in the merger or reorganization.

Notwithstanding anything in this Clause 10.02(c) to the contrary, an Award that vests, is earned or paid-out upon the satisfaction of one or more performance goals will not be considered assumed if the Acquiror or its successor modifies any of such performance goals without the Participant’s consent, in all cases, unless specifically provided otherwise under the applicable Award Agreement or other written agreement authorized by the Board between the Participant and the Acquiror or any member of the Acquiror Group, as applicable; provided, however, a modification to such performance goals only to reflect the successor corporation’s post-merger or reorganization corporate structure will not be deemed to invalidate an otherwise valid Award assumption.

(d) Adjustments in the Merger. Notwithstanding anything in this Scheme or this Clause 10.02, in connection with the Merger, the Options will be treated as follows after giving effect to Clause 6.06 of this Scheme:

(i) Vested Company Options. At the Merger Effective Time, by virtue of the Merger and without any action on the part of Acquiror, Merger Sub, the Company, any Securityholder (as defined in the Merger Agreement), or any other Person, each Vested Company Option (as defined in the Merger Agreement) (or portion thereof), that is unexpired, unexercised and outstanding immediately prior to the Merger Effective Time (after giving effect to the Scheme Amendment (as defined in the Merger Agreement) and the Option Cancellation Agreements (as defined in the Merger Agreement)), by virtue of the Merger, shall be automatically cancelled and extinguished and converted into the right to receive, upon the terms and subject to the conditions set forth in the Merger Agreement (including the withholding, holdback, escrow, and indemnification provisions set forth in the Merger Agreement), for each Ordinary Share subject to such Vested Company Option, an amount of cash, without interest, equal to (A) the Per Share Closing Consideration (as defined in the Merger Agreement) less (B) the per share exercise price of such Vested Company Option, plus (C) the Per Share Final Adjustment Amount (as defined in the Merger Agreement) (if any).

(ii) Unvested Company Options. At the Merger Effective Time, by virtue of the Merger and without any action on the part of Acquiror, Merger Sub, the Company, any Securityholder (as defined in the Merger Agreement), or any other Person:

(A) Each Unvested Company Option (as defined in the Merger Agreement) (or portion thereof) that is unexpired, unexercised and outstanding immediately prior to the Merger Effective Time (after giving effect to the Scheme Amendment) and held by a Person that is not a Specified Optionee (as defined in the Merger Agreement) shall be assumed by Acquiror as an Acquiror Option (as defined in the Merger Agreement). Each

such Unvested Company Option so assumed by Acquiror pursuant to Section 1.3(e)(ii)(A) of the Merger Agreement shall continue to have, and be subject to, the same terms and conditions (including vesting terms and any applicable accelerated vesting provisions) set forth in the Scheme and the option agreements relating to such Unvested Company Option (which, for the avoidance of doubt, may include employment agreements, offer letters or side letters entered into by and between the Company and each such optionee), as in effect immediately prior to the Merger Effective Time (after giving effect to the Scheme Amendment), except that (x) such assumed Unvested Company Option shall be exercisable for that number of whole shares of Acquiror Common Stock (as defined in the Merger Agreement) equal to the product of the number of Company Shares (as defined in the Merger Agreement) that were issuable upon exercise of such Unvested Company Option immediately prior to the Merger Effective Time multiplied by the Exchange Ratio (as defined in the Merger Agreement), with the result rounded down to the nearest whole number of shares of Acquiror Common Stock and (y) the per share exercise price for the shares of Acquiror Common Stock issuable upon exercise of such assumed Unvested Company Option shall be equal to the quotient obtained by dividing the exercise price per Company Share at which such assumed Unvested Company Option was exercisable immediately prior to the Merger Closing Date by the Exchange Ratio, with the result rounded up to the nearest whole cent.

(B) Each Unvested Company Option (as defined in the Merger Agreement) (or portion thereof) that is unexpired, unexercised and outstanding immediately prior to the Merger Effective Time (after giving effect to the Scheme Amendment) and held by a Person that is a Specified Optionee (as defined in the Merger Agreement) shall be cancelled and substituted by Acquiror with an Acquiror Option (as defined in the Merger Agreement), subject to compliance with applicable laws. With respect to each such Unvested Company Option so cancelled pursuant to Section 1.3(e)(ii)(B) of the Merger Agreement, Acquiror shall grant to the holder thereof, from the Scheme, an Acquiror Option having the same terms and conditions (including vesting terms and any applicable accelerated vesting provisions) set forth in the Scheme and the option agreements relating to such Unvested Company Option (which, for the avoidance of doubt, may include employment agreements, offer letters or side letters entered into by and between the Company and each such optionee), as in effect immediately prior to the Merger Effective Time (after giving effect to the Scheme Amendment), except that (x) such newly granted substituted Acquiror Option shall be exercisable for that number of whole shares of Acquiror Common Stock (as defined in the Merger Agreement) equal to the product of the number of Company Shares (as defined in the Merger Agreement) that were issuable upon exercise of such cancelled Unvested Company Option immediately prior to the Merger Effective Time multiplied by the Exchange Ratio (as defined in the Merger Agreement), with the result rounded down to the nearest whole number of shares of Acquiror Common Stock and (y) the per share exercise price

for the shares of Acquiror Common Stock issuable upon exercise of such newly granted substituted Acquiror Option shall be equal to the quotient obtained by dividing the exercise price per Company Share at which such cancelled Unvested Company Option was exercisable immediately prior to the Merger Closing Date by the Exchange Ratio, with the result rounded up to the nearest whole cent.

(iii) Cancelled Options. Notwithstanding the foregoing, if the per share exercise price of any Company Option (as defined in the Merger Agreement) that is unexpired, unexercised and outstanding as of immediately prior to the Merger Effective Time, whether held by a Specified Optionee (as defined in the Merger Agreement) or any other Person, is equal to or greater than the Per Share Closing Consideration, such Company Option will be cancelled at the Merger Effective Time without any consideration paid therefor.

11. [RESERVED]

12. AMENDMENT AND TERMINATION OF THE SCHEME

12.01 Amendment and Termination. The Board may at any time amend, alter, suspend or terminate the Scheme.

12.02 Stockholder Approval. The Company will obtain stockholder approval of any Scheme amendment to the extent necessary and desirable to comply with applicable laws.

12.03 Effect of Amendment or Termination. No amendment, alteration, suspension or termination of the Scheme will materially impair the rights of any Participant under an outstanding Award, unless mutually agreed otherwise between the Participant and the Board, which agreement must be in writing and signed by the Participant and the Acquiror. Termination of the Scheme will not affect the Board’s ability to exercise the powers granted to it hereunder with respect to Awards granted under the Scheme prior to the date of such termination.

13. TERMINATION

The Company, by resolution in general meeting or the Board may at any time terminate the operation of the Scheme and in such event no further Options will be offered but Options granted prior to such termination shall continue to be valid and exercisable in accordance with the provisions of the Scheme.

14. CANCELLATION

Any cancellation of Options granted but not exercised may be effected on such terms as may be agreed with the relevant Grantee, as the Authorised Director may in its absolute discretion sees fit and in a manner that complies with all applicable legal requirements for such cancellation. Where the Company cancels Options granted and issues new Options to the same Grantee, the issue of such new Options may only be made under the Scheme with available unissued Options (excluding the cancelled Options) and in compliance with the terms of the Scheme.

15. MISCELLANEOUS

15.01 The Scheme shall not constitute, affect or form part of any contract of employment or appointment between the Company or any member of the Group and any Participant

nor confer upon such person any right to employment or continued employment with the Company or any member of the Group and the rights and obligations of any Participant under the terms of his or her office or employment or appointment shall not be affected by his participation in the Scheme or any right which he may have to participate in it and the Scheme shall afford such a Participant no additional rights to compensation or damages in consequence of the termination of such office or employment or appointment for any reason.

15.02 The Scheme shall not confer on any person any legal or equitable rights (other than those constituting the Options themselves) against the Company directly or indirectly or give rise to any cause of action at law or in equity against the Company.

15.03 No person shall, under any circumstances, hold the Board and/or the Company and/or other Participants liable for any costs, losses, expenses and/or damages whatsoever arising from or in connection with the Scheme or the administration thereof.

15.04 Save for liabilities referred to in Clause 15.07, the Company shall bear the costs of establishing and administering the Scheme.

15.05 Any notice or other communication between the Company and a Grantee may be given by sending the same by prepaid post or by personal delivery to, in the case of the Company, the headquarters of the Company, or the registered office of the Company in Hong Kong or as notified to the Grantees from time to time and, in the case of the Grantee, his or her address (as the case may be) as notified to the Company from time to time.

15.06 Any notice or other communication served by post:

(a)by the Company shall be deemed to have been served (i) 24 hours after the same was put in the post in case the address of the Grantee is in Hong Kong; or (ii) 72 hours after the same was put in the post in case the address of the Grantee is outside Hong Kong; and

(b)by the Grantee shall not be deemed to have been received until the same shall have been received by the Company.

15.07 A Grantee shall be responsible for obtaining any governmental or other official consent that may be required by any country or jurisdiction in order to permit the grant or exercise of the Option. The obtaining of such consents shall be a condition precedent to an acceptance of an Offer and an exercise of his Option by a Grantee. By accepting an Offer or exercising his Option, the Grantee is deemed to have represented to the Company that he has duly fulfilled such condition. The Company shall not be responsible for any failure by a Grantee to obtain any such consent or for any tax or other liability to which a Grantee may become subject as a result of his participation in the Scheme, the grant of an Option to him and/or the exercise of the Option by him.

15.08 The Scheme and all Awards granted hereunder shall be governed by and construed in accordance with the laws of the State of Delaware; provided that with respect to any Options granted under the Scheme prior to the Merger Effective Time, the Scheme and Award Agreement shall be governed by and construed in accordance with the laws of Hong Kong.

16. RESTRICTED STOCK UNITS

16.01 On and subject to the terms of the Scheme, the Board shall be entitled at any time and from time to time after the Merger Effective Time and within 10 years after the Adoption Date, at its absolute discretion, to make an RSU Offer to any Post-Closing

Eligible Participant with respect to such number of RSUs as the Board may determine, subject to such vesting conditions and performance targets as the Board may think fit.

16.02 An RSU Offer shall be made to a Participant in writing pursuant to an Award Agreement in such form as the Board may from time to time determine, requiring the Participant to undertake to hold the RSUs on the terms on which they are granted and to be bound by the provisions of such Award Agreement and of the Scheme. An Award Agreement shall set forth the terms, conditions and restrictions related to the grant of RSUs offered, including the number of RSUs, and will remain open for acceptance by the Participant concerned for a period of 28 days from the RSU Offer Date (inclusive of the RSU Offer Date) provided that no such offer shall be open for acceptance after the expiry of the Scheme (subject to early termination thereof).