0001721484

false

0001721484

2023-08-16

2023-08-16

0001721484

LGVN:ClassCommonStock0.001ParValuePerShareMember

2023-08-16

2023-08-16

0001721484

LGVN:TransferableSubscriptionRightsMember

2023-08-16

2023-08-16

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): August 16, 2023

Longeveron Inc.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-40060 |

|

47-2174146 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer

Identification

No.) |

1951

NW 7th Avenue, Suite

520, Miami,

Florida 33136

(Address

of principal executive offices)

Registrant’s

telephone number, including area code: (305) 909-0840

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Class A Common Stock, $0.001 par value per share |

|

LGVN |

|

The Nasdaq Capital Market |

| Transferable Subscription Rights |

|

LGVNR |

|

The Nasdaq Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter)

Emerging

growth company

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period

for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

8.01 Other Events.

On August 16, 2023, Longeveron

Inc. issued a press release announcing that the registration statement regarding its rights offering had been declared effective and the

rights offering calendar finalized. A copy of the press release is filed as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated

by reference into this Item 8.01.

Item

9.01. Financial Statements and Exhibits.

The

exhibits listed in the following Exhibit Index are filed as part of this Current Report on Form 8-K.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

LONGEVERON

INC. |

| |

|

| Date:

August 16, 2023 |

/s/ Lisa A. Locklear |

| |

Name: |

Lisa A. Locklear |

| |

Title: |

Chief

Financial Officer |

2

Exhibit

99.1

Longeveron

Rights Offering Declared Effective and Calendar Finalized

MIAMI,

August 16, 2023 (GLOBE NEWSWIRE) -- Longeveron Inc. (NASDAQ: LGVN) (“Longeveron” or “Company”), a clinical

stage biotechnology company developing cellular therapies for life-threatening and chronic aging-related conditions such as

hypoplastic left heart syndrome (HLHS), Alzheimer’s disease and Aging-related Frailty, announced today that its registration

statement previously filed with the Securities and Exchange Commission to conduct a tradable subscription rights offering has been

declared effective, and that it has finalized the rights offering calendar.

The

rights offering is being made through a distribution of five tradable subscription rights (to be listed on The NASDAQ Capital Market

under the ticker symbol LGVNR) to purchase shares of Class A common stock for each share of common stock and warrant to purchase common

stock owned on the record date, at a $3.00 subscription price per share.

The

rights offering includes an over-subscription privilege, entitling each rights holder that exercises all of its basic subscription rights

in full the ability to purchase additional shares of Class A common stock that remain unsubscribed at the expiration of the rights offering,

subject to the availability and pro rata allocation of shares among those exercising this over-subscription privilege.

The

registration statement also covers the placement of unsubscribed shares of Class A common stock for an additional period of up to 45

days following expiration of the offering, as well as the potential resale of subscription rights by the Company’s principal stockholders,

directors and executive officers during the period for which the subscription rights may be transferred in accordance with the terms

of the rights offering.

The

calendar for the rights offering is as follows:

| Thursday, August 17 |

|

LGVNV Rights begin to trade. |

| |

|

|

| Friday, August 18 |

|

Ex-Rights Day - LGVN shares trade without the

rights attached. |

| |

|

|

| Friday, August 18 |

|

Record Date – This is the cutoff date

that determines the eligibility of stockholders to receive rights. |

| |

|

|

| Tuesday, August 22 |

|

Subscription Period Begins – LGVNR rights

are credited to brokerage accounts through DTCC. |

| |

|

|

| Thursday, September 21 |

|

Subscription Period Ends – 5:00 PM ET

unless extended at the Company’s sole discretion |

See

our Securities and Exchange Commission filings here for more details about the rights offering as well as information on the Company.

EDGAR Search Results (sec.gov)

A

registration statement relating to the rights was filed with the Securities and Exchange Commission and was declared effective on August

14, 2023. The rights offering is being made only by means of a prospectus filed by the Company with the Securities and Exchange Commission

on August 14, 2023. Copies of the prospectus, which contains further details regarding the rights offering, and related rights offering

materials, will be provided to all stockholders and participating warrant holders as of the record date.

Longeveron

has engaged R.F. Lafferty & Co., Inc. to act as dealer-manager for the rights offering. Broker-dealers can contact R.F. Lafferty

& Co., Inc. by email at offerings@rflafferty.com or by telephone at (212) 293-9090 to learn more about participating in the rights

offering.

If

you have any questions or need further information about the rights offering or to request a copy of the prospectus, please call Okapi

Partners, Longeveron’s information agent for the rights offering, at (212) 297-0720 (bankers and brokers) or (844) 201-1170 (all

others) or email at info@okapipartners.com

This

press release does not constitute an offer to sell or the solicitation of an offer to buy securities, nor will there be any sale of any

securities referred to in this press release in any state or jurisdiction in which such offer, solicitation or sale would be unlawful

prior to registration or qualification under the securities laws of such state or jurisdiction.

About

Longeveron Inc.

Longeveron

is a clinical stage biotechnology company developing regenerative medicines to address unmet medical needs. The Company’s lead

investigational product is Lomecel-B™ an allogeneic medicinal signaling cell (MSC) therapy product isolated from the bone marrow

of young, healthy adult donors. Lomecel-B™ has multiple potential mechanisms of action encompassing pro-vascular, pro-regenerative,

anti-inflammatory, and tissue repair and healing effects with broad potential applications across a spectrum of disease areas. Longeveron

is currently advancing Lomecel-B™ through clinical trials in three indications: hypoplastic left heart syndrome (HLHS), Alzheimer’s

disease, and Aging-related Frailty. Additional information about the Company is available at www.longeveron.com.

About

R.F. Lafferty & Co., Inc.

It’s

not an accident that R.F. Lafferty’s clients enjoy a standard of personalized service that is unique in the industry. R.F.

Lafferty was established in 1946, and has remained committed to the idea that each and every client was the company’s most

valued asset. A new generation of financial professionals leading the firm remain true to the original vision. Today, R.F. Lafferty

is an independent, family-owned firm and has expanded in breadth and clientele one relationship at a time. Clients can expect an

exceptional level of experience, continuity in service and true dedication from the people they work with at R.F. Lafferty. R.F.

Lafferty has evolved over its 70-year history to help its clients stay ahead in a ever-changing industry. What remains unchanged is

its commitment to unrivaled service that helps clients succeed in their goal. It’s all backed by the integrated expertise of

accomplished professionals, sophisticated tools and a robust product mix for today’s clients.

Forward-Looking

Statements

Certain

statements in this press release that are not historical facts are forward-looking statements made pursuant to the safe harbor

provisions of the Private Securities Litigation Reform Act of 1995, which reflect management’s current expectations, assumptions,

and estimates of future operations, performance and economic conditions, and involve risks and uncertainties that could cause actual

results to differ materially from those anticipated by the statements made herein. Forward-looking statements are generally

identifiable by the use of forward-looking terminology such as “believe,” “expects,” “may,”

“looks to,” “will,” “should,” “plan,” “intend,” “on condition,”

“target,” “see,” “potential,” “estimates,” “preliminary,” or

“anticipates” or the negative thereof or comparable terminology, or by discussion of strategy or goals or other future

events, circumstances, or effects. Factors that could cause actual results to differ materially from those expressed or implied in

any forward-looking statements in this release include, but are not limited to, statements regarding the offer and sale of

securities, the terms of the offering, about the ability of Longeveron’s clinical trials to demonstrate safety and efficacy of

the Company’s product candidates, and other positive results; the timing and focus of the Company’s ongoing and future

preclinical studies and clinical trials and the reporting of data from those studies and trials; the size of the market opportunity

for the Company’s product candidates, including its estimates of the number of patients who suffer from the diseases being

targeted; the success of competing therapies that are or may become available; the beneficial characteristics, safety, efficacy and

therapeutic effects of the Company’s product candidates; the Company’s ability to obtain and maintain regulatory

approval of its product candidates in the U.S., Japan and other jurisdictions; the Company’s plans relating to the further

development of its product candidates, including additional disease states or indications it may pursue; the Company’s plans

and ability to obtain or protect intellectual property rights, including extensions of existing patent terms where available and its

ability to avoid infringing the intellectual property rights of others; the need to hire additional personnel and the

Company’s ability to attract and retain such personnel; the Company’s estimates regarding expenses, future revenue,

capital requirements and needs for additional financing; the Company’s need to raise additional capital, and the difficulties

it may face in obtaining access to capital, and the dilutive impact it may have on its investors; the Company’s financial

performance and ability to continue as a going concern, and the period over which it estimates its existing cash and cash

equivalents will be sufficient to fund its future operating expenses and capital expenditure requirements. Additionally, Longeveron

makes no assurance that any public offering of its securities as described herein will occur at all, or that any such transaction

will occur on the timelines, in the manner or on the terms anticipated due to numerous factors. Further information relating to

factors that may impact the Company’s results and forward-looking statements are disclosed in the Company’s filings with the

Securities and Exchange Commission, including Longeveron’s Annual Report on Form 10-K for the year ended December 31, 2022,

filed with the Securities and Exchange Commission on March 14, 2023 and its Quarterly Report on Form 10-Q for the second quarter of

2023 filed with the SEC on August 11, 2023. The forward-looking statements contained in this press release are made as of the date

of this press release, and the Company disclaims any intention or obligation, other than imposed by law, to update or revise any

forward-looking statements, whether as a result of new information, future events, or otherwise.

Investor

Contact

Mike Moyer

LifeSci Advisors

Tel: 617-308-4306

Email:

mmoyer@lifesciadvisors.com

3

v3.23.2

Cover

|

Aug. 16, 2023 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 16, 2023

|

| Entity File Number |

001-40060

|

| Entity Registrant Name |

Longeveron Inc.

|

| Entity Central Index Key |

0001721484

|

| Entity Tax Identification Number |

47-2174146

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

1951

NW 7th Avenue

|

| Entity Address, Address Line Two |

Suite

520

|

| Entity Address, City or Town |

Miami

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

33136

|

| City Area Code |

305

|

| Local Phone Number |

909-0840

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Class A Common Stock, $0.001 par value per share |

|

| Title of 12(b) Security |

Class A Common Stock, $0.001 par value per share

|

| Trading Symbol |

LGVN

|

| Security Exchange Name |

NASDAQ

|

| Transferable Subscription Rights |

|

| Title of 12(b) Security |

Transferable Subscription Rights

|

| Trading Symbol |

LGVNR

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=LGVN_ClassCommonStock0.001ParValuePerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=LGVN_TransferableSubscriptionRightsMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

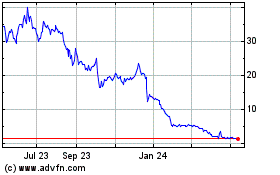

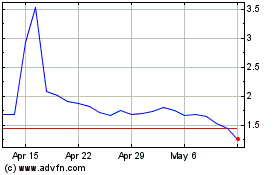

Longeveron (NASDAQ:LGVN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Longeveron (NASDAQ:LGVN)

Historical Stock Chart

From Apr 2023 to Apr 2024