Logitech Expects Tenth Consecutive Year of Growth in Fiscal Year 2023; Confirms Long-Term Financial Model

March 02 2022 - 9:00PM

Business Wire

Company Well Positioned to Benefit from Ongoing

Secular Growth Trends

SIX Swiss Exchange Ad hoc announcement pursuant to Art. 53 LR —

Logitech International (SIX:LOGN) (Nasdaq:LOGI), in advance of a

meeting to be held with financial analysts and investors, today

provided an update on its financial outlook and long-term business

model.

- Current Fiscal Year 2022 Outlook: Logitech confirmed its

recently increased current Fiscal Year 2022 outlook of between 2

and 5 percent sales growth in constant currency, and between $850

million and $900 million in non-GAAP operating income.

- Fiscal Year 2023 Outlook: Logitech announced its Fiscal

Year 2023 outlook. Sales growth in constant currency is expected to

be in the mid single digits, and non-GAAP operating income is

expected to be between $900 million and $950 million.

- Long-Term Business Model: Logitech reaffirmed its

long-term business model. Long-term, the expectation for sales

growth in constant currency continues to be from 8 to 10 percent.

The expected long-term non-GAAP gross margin target is maintained

at between 39 and 44 percent. The expected long-term non-GAAP

operating margin target is maintained at between 14 and 17

percent.

“As a leader in large and growing markets, with world-class

design and innovation capabilities, Logitech is well positioned for

long-term growth,” said Bracken Darrell, Logitech president and

chief executive officer. “For many years, Logitech’s growth has

been fueled by market trends in remote work, video collaboration,

esports, and digital content creation. Those trends are poised to

continue to grow strongly into the future, and Logitech is poised

to grow strongly along with them.”

Analyst and Investor Day Videoconference and

Livestream

At Logitech's Analyst and Investor Day, Company executives will

present how capabilities such as design, innovation, operations,

sustainability, go-to-market, marketing, and more are contributing

to current and future growth. The event will be held on March 3 at

9:00 a.m. Eastern Standard Time and 3:00 p.m. Central European Time

through videoconference. A livestream, replay of the event, and

slide presentation will be available on the Logitech corporate

website at http://ir.logitech.com.

Use of Non-GAAP Financial Information and Constant

Currency

To facilitate comparisons to Logitech’s historical results,

Logitech has included non-GAAP adjusted measures, which exclude

share-based compensation expense, amortization of intangible

assets, impairment of intangible assets, acquisition-related costs,

change in fair value of contingent consideration for business

acquisition, restructuring charges (credits), loss (gain) on

investments, non-GAAP income tax adjustment, and other items

detailed in our “GAAP to Non-GAAP Reconciliation” under

“Supplemental Financial Information” in our quarterly earnings

press release and posted to our website at http://ir.logitech.com.

Logitech also presents percentage sales growth in constant

currency, a non-GAAP measure, to show performance unaffected by

fluctuations in currency exchange rates. Percentage sales growth in

constant currency is calculated by translating prior period sales

in each local currency at the current period’s average exchange

rate for that currency and comparing that to current period sales.

Logitech believes this information, used together with the GAAP

financial information, will help investors to evaluate its current

period performance and trends in its business. With respect to the

Company’s outlook for non-GAAP operating income, most of these

excluded amounts pertain to events that have not yet occurred and

are not currently possible to estimate with a reasonable degree of

accuracy. Therefore, no reconciliation to the GAAP amounts has been

provided for Fiscal Years 2022 or 2023.

About Logitech

Logitech helps all people pursue their passions by designing

experiences so everyone can create, achieve, and enjoy more.

Logitech designs and creates products that bring people together

through computing, gaming, video, streaming and creating, and

music. Brands of Logitech include Logitech, Logitech G, ASTRO

Gaming, Streamlabs, Blue Microphones and Ultimate Ears. Founded in

1981, and headquartered in Lausanne, Switzerland, Logitech

International is a Swiss public company listed on the SIX Swiss

Exchange (LOGN) and on the Nasdaq Global Select Market (LOGI). Find

Logitech at www.logitech.com, the company blog or @Logitech.

This press release contains forward-looking statements within

the meaning of the federal securities laws, including, without

limitation, statements regarding: our outlook for Fiscal Years 2022

and 2023, long-term business model, long-term growth potential, and

market trends. The forward-looking statements in this press release

involve risks and uncertainties that could cause Logitech’s actual

results and events to differ materially from those anticipated in

these forward-looking statements, including, without limitation: if

our product offerings, marketing activities and investment

prioritization decisions do not result in the sales, profitability

or profitability growth we expect, or when we expect it; if we fail

to innovate and develop new products in a timely and cost-effective

manner for our new and existing product categories; if we do not

successfully execute on our growth opportunities or our growth

opportunities are more limited than we expect; the effect of demand

variability, supply shortages, and other supply chain challenges;

the effect of pricing, product, marketing and other initiatives by

our competitors, and our reaction to them, on our sales, gross

margins and profitability; if we are not able to maintain and

enhance our brands; if our products and marketing strategies fail

to separate our products from competitors’ products; the COVID-19

pandemic and its impact; our expectations regarding economic

conditions in international markets, including China, Russia and

Ukraine; macroeconomic, geopolitical, and other challenges and

uncertainties globally as a result of the current armed conflict

between Russia and Ukraine; if we do not efficiently manage our

spending; if there is a deterioration of business and economic

conditions in one or more of our sales regions or product

categories, or significant fluctuations in exchange rates; changes

in trade regulations, policies and agreements and the imposition of

tariffs that affect our products or operations and our ability to

mitigate; risks associated with acquisitions; and the effect of

changes to our effective income tax rates. A detailed discussion of

these and other risks and uncertainties that could cause actual

results and events to differ materially from such forward-looking

statements is included in Logitech’s periodic filings with the

Securities and Exchange Commission (SEC), including our Annual

Report on Form 10-K for the fiscal year ended March 31, 2021, our

Quarterly Report on Form 10-Q for the fiscal quarter ended December

31, 2021, and our subsequent reports filed with the SEC, available

at www.sec.gov, under the caption Risk Factors and elsewhere.

Logitech does not undertake any obligation to update any

forward-looking statements to reflect new information or events or

circumstances occurring after the date of this press release.

Note that unless noted otherwise, comparisons are year over

year.

Logitech and other Logitech marks are trademarks or registered

trademarks of Logitech Europe S.A and/or its affiliates in the U.S.

and other countries. All other trademarks are the property of their

respective owners. For more information about Logitech and its

products, visit the company’s website at www.logitech.com.

(LOGIIR)

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220302006151/en/

Nate Melihercik, Head of Global Investor Relations -

lir@logitech.com Nicole Kenyon, Head of Global Corporate &

Employee Communications - USA (510) 988-8553 Ben Starkie, Corporate

Communications - Europe +41 (0) 79-292-3499

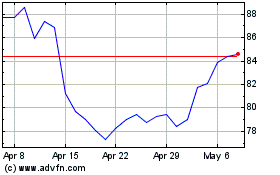

Logitech (NASDAQ:LOGI)

Historical Stock Chart

From Mar 2024 to Apr 2024

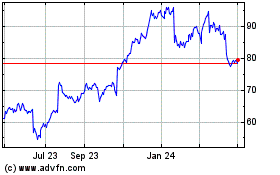

Logitech (NASDAQ:LOGI)

Historical Stock Chart

From Apr 2023 to Apr 2024