Lilium N.V. (NASDAQ: LILM) (“Lilium” or the “Company”), developer

of the first all-electric vertical take-off and landing (“eVTOL”)

jet and global pioneer in Regional Air Mobility (RAM), announced

today that it has launched an underwritten public offering of the

Company’s Class A ordinary shares (the “Shares”) and warrants to

purchase Shares (the “Warrants” and, together with the Shares, the

“Securities”), as well as a concurrent private placement offering

of Shares and warrants to purchase Shares (“PIPE Warrants”)

including to BIT Capital, Earlybird Venture Capital and Aceville

Pte. Limited, an affiliate of Tencent Holdings Limited

(“Aceville”), as well as certain Lilium board members (the “PIPE”).

Additionally, the Company will issue to Aceville (i) a pro

rata warrant to purchase Shares (the “Aceville Pre-Funded Warrant”)

and Aceville has agreed to partially prepay a portion of the total

exercise price of the Aceville Pre-Funded Warrant (the “Aceville

Pre-Funding”) and (ii) an accompanying PIPE Warrant to purchase

Shares, subject to satisfaction of customary closing conditions and

the receipt of shareholder approval for an increase in the

Company’s authorized share capital.

In connection with the underwritten public

offering, the Company expects to grant to the underwriter an option

to purchase up to 15% additional Shares and accompanying Warrants

sold in the underwritten public offering during the 30 days after

the offering prices, solely to cover over-allotments. B. Riley

Securities is serving as the sole bookrunner and underwriter for

the underwritten public offering. The underwritten public offering

is subject to market, regulatory and other conditions and there can

be no assurance as to whether or when the offering may be

completed, or as to the actual size or terms of the offering.

The Securities being offered pursuant to the

underwritten public offering are being offered pursuant to a shelf

registration statement on Form F-3 (File No. 333-267719) previously

filed with the U.S. Securities and Exchange Commission (the “SEC”),

which the SEC declared effective on October 12, 2022. A preliminary

prospectus supplement related to the underwritten public offering

will be filed with the SEC, will form a part of the effective

registration statement, and will be available on the SEC’s website

located at http://www.sec.gov or may be obtained from B. Riley

Securities, Attention: Prospectus Department, 1300 North 17th

Street, Suite 1300, Arlington, Virginia 22209; Telephone: (703)

312-9580, or by emailing prospectuses@brileyfin.com.

In connection with the concurrent PIPE, a number

of investors, including BIT Capital, Earlybird Venture Capital and

Aceville, as well as certain Lilium board members, agreed to

purchase Shares for $1.05 per Share and accompanying warrant. Each

PIPE Warrant will be exercisable for one Share at an exercise price

of $1.50 per Share following the receipt of shareholder approval

for an increase in the Company’s authorized share capital. The PIPE

Warrants will expire six years from the date of issuance. The

securities purchase agreements contain customary registration

rights.

The Company intends to use the net proceeds from

the underwritten public offering, the PIPE and the Aceville

Pre-Funding to continue to fund the development and operations of

the Company and for general corporate purposes.

Neither the underwritten public offering nor the

PIPE is conditional on the other. The securities sold in the PIPE

are being issued pursuant to the exemptions provided by Section

4(a)(2) of the Securities Act of 1933, as amended (the “Securities

Act”), and Regulation S, have not been registered under the

Securities Act or any state or other applicable jurisdiction’s

securities laws, and may not be offered or sold in the United

States absent registration or an applicable exemption from the

registration requirements of the Securities Act and applicable

state or other jurisdiction's securities laws.

This press release does not constitute an offer

to sell nor a solicitation of an offer to buy, nor shall there be

any sale of the Shares or warrants in any state or jurisdiction in

which such an offer, solicitation or sale would be unlawful prior

to registration or qualification under the securities laws of any

such state or jurisdiction.

Contact Information for Media:Rainer Ohler+49

172 4890353press@lilium.com

Contact Information for Investors:Rama

BondadaVice President, Investor Relationsinvestors@lilium.com

About Lilium

Lilium (NASDAQ: LILM) is creating a sustainable

and accessible mode of high-speed, regional transportation for

people and goods. Using the Lilium Jet, an all-electric vertical

take-off and landing jet, designed to offer leading capacity, low

noise, and high performance with zero operating emissions, Lilium

is accelerating the decarbonization of air travel. Working with

aerospace, technology, and infrastructure leaders, and with

announced sales and indications of interest in Europe, the United

States, China, Brazil, the UK, the United Arab Emirates, and the

Kingdom of Saudi Arabia, Lilium’s 1000+ strong team includes

approximately 500 aerospace engineers and a leadership team

responsible for delivering some of the most successful aircraft in

aviation history. Founded in 2015, Lilium’s headquarters and

manufacturing facilities are in Munich, Germany, with teams based

across Europe and the U.S. To learn more, visit www.lilium.com.

Important information

No announcements or information regarding the

underwritten public offering may be disseminated to the public in

jurisdictions where a prior registration or approval is required

for such purpose. No steps have been taken, or will be taken, for

the offering of the Shares of the warrants in any jurisdiction

where such steps would be required. The issue or sale of the Shares

and the warrants, and the subscription for or purchase of the

Shares and the warrants, are subject to special legal or statutory

restrictions in certain jurisdictions. Lilium is not liable if

these restrictions are not complied with by any other person.

This press release is not a prospectus for the

purposes of Regulation (EU) 2017/1129 of the European Parliament

and of the Council of 14 June 2017 (the “Prospectus Regulation”)

and has not been approved by any regulatory authority in any

jurisdiction. Lilium has not authorized any offer to the public of

the Shares or the warrants in any member state of the European

Economic Area (“EEA”) and no prospectus has been or will be

prepared in connection therewith. In any EEA member state, this

communication is only addressed to and is only directed at

qualified investors in that member state within the meaning of the

Prospectus Regulation.

In the United Kingdom, this document and any

other materials in relation to the Shares and the warrants

described herein is only being distributed to, and is only directed

at, and any investment or investment activity to which this

document relates is available only to, and will be engaged in only

with, “qualified investors” who are (i) persons having professional

experience in matters relating to investments who fall within the

definition of “investment professionals” in Article 19(5) of the

Financial Services and Markets Act 2000 (Financial Promotion) Order

2005 (the “Order”); or (ii) high net worth entities falling within

Article 49(2)(a) to (d) of the Order (all such persons together

being referred to as “relevant persons”). In the United Kingdom,

any investment or investment activity to which this communication

relates is available only to, and will be engaged in only with,

relevant persons. Persons who are not relevant persons should not

take any action on the basis of this document and should not act or

rely on it.

Forward-Looking Statements

This press release contains certain

forward-looking statements within the meaning of the U.S. federal

securities laws, including, but not limited to, the expected

consummation of the underwritten public offering, the PIPE and the

Aceville Pre-Funding described herein and the use of proceeds

therefrom. These forward-looking statements generally are

identified by the words “anticipate,” “believe,” “expect,”

“estimate,” “future,” “intend,” “may,” “plan,” “project,” “should,”

“strategy,” “will,” “would” and similar expressions.

Forward-looking statements are predictions, projections and other

statements about future events that are based on management’s

current expectations with respect to future events and are based on

assumptions and are subject to risks and uncertainties that are

subject to change at any time. Actual events or results may differ

materially from those contained in the forward-looking statements.

Factors that could cause actual future events to differ materially

from the forward-looking statements in this press release include

the risk that the offerings described herein are not consummated on

a timely basis or at all as well as those risks and uncertainties

discussed in Lilium’s filings with the U.S. Securities and Exchange

Commission (the “SEC”), including in the section titled “Risk

Factors” in our Annual Report on Form 20-F for the year ended

December 31, 2023, on file with the SEC, and similarly titled

sections in Lilium’s other SEC filings, all of which are available

at www.sec.gov. We caution investors not to rely on the

forward-looking statements contained in this press release. You are

encouraged to read our filings with the SEC available at

www.sec.gov for a discussion of these and other risks or

uncertainties. Forward-looking statements speak only as of the date

they are made. You are cautioned not to put undue reliance on

forward-looking statements, and Lilium assumes no obligation to,

and does not intend to, update or revise these forward-looking

statements, whether as a result of new information, future events

or otherwise. Lilium’s business is subject to substantial risks and

uncertainties including those described in Lilium’s filings with

the SEC referenced above. Investors, potential investors and others

should give careful consideration to these risks and

uncertainties.

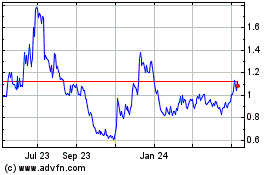

Lilium NV (NASDAQ:LILM)

Historical Stock Chart

From Nov 2024 to Dec 2024

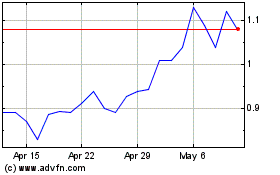

Lilium NV (NASDAQ:LILM)

Historical Stock Chart

From Dec 2023 to Dec 2024