Liberty Latin America Ltd. ("Liberty Latin America") (NASDAQ:

LILA and LILAK, OTC Link: LILAB) today announced the pricing of

$350 million aggregate principal amount of its 2.0% convertible

Senior Notes due 2024 (the “Notes”) in a private placement to

qualified institutional buyers pursuant to Rule 144A under the

Securities Act of 1933, as amended (the “Securities Act”). Liberty

Latin America has also granted the initial purchasers of the Notes

a 13-day option to purchase up to an additional $52.5 million

aggregate principal amount of the Notes in connection with the

offering. The offering is expected to close on June 28, 2019,

subject to the satisfaction of certain customary closing

conditions.

The Notes will be general unsecured senior obligations of

Liberty Latin America, bear interest at a rate of 2.0% per annum,

payable semi-annually in arrears on January 15 and July 15 of each

year, beginning on January 15, 2020, mature on July 15, 2024

(unless earlier repurchased, redeemed or converted), and be

convertible into Liberty Latin America’s Class C common shares,

cash, or a combination of shares and cash, at Liberty Latin

America’s election. The conversion rate for the Notes will

initially equal 44.9767 Class C common shares per $1,000 principal

amount of the Notes, which is equivalent to an initial conversion

price of approximately $22.23 per Class C common share and is

subject to adjustment, which represents an approximately 22.5%

conversion premium over the last reported sale price of $18.15 per

share of Liberty Latin America's Class C common shares on Nasdaq on

June 25, 2019.

Prior to January 15, 2024, the Notes will be convertible only

upon satisfaction of certain conditions and during certain periods,

and thereafter, at any time until the close of business on the

second scheduled trading day immediately preceding the maturity

date.

Other than a redemption for a change in certain tax laws,

Liberty Latin America may not redeem the Notes prior to July 19,

2022. On or after July 19, 2022, Liberty Latin America may redeem

for cash all or a portion of the Notes if the last reported sale

price of Liberty Latin America’s Class C common shares has been at

least 130% of the conversion price then in effect on (i) each of at

least 20 trading days (whether or not consecutive) during the 30

consecutive trading day period ending on, and including, the

trading day immediately preceding the date Liberty Latin America

provides notice of redemption and (ii) the trading day immediately

preceding the date Liberty Latin America provides such notice.

Liberty Latin America expects to use approximately $39.7 million

of the net proceeds from the sale of the Notes to fund the cost of

the capped call transactions described below and use the remaining

funds for other general corporate purposes. If the initial

purchasers exercise in full their option to purchase additional

Notes, Liberty Latin America expects to use approximately $6.0

million of the net proceeds from the sale of the additional Notes

to enter into additional capped call transactions and use the

remaining funds for other general corporate purposes.

In connection with the offering of the Notes, Liberty Latin

America entered into privately negotiated capped call transactions

with the initial purchasers of the Notes or their affiliates (the

“option counterparties”). The capped call transactions have an

initial strike price of approximately $22.23 per Class C common

share and an initial cap price of $31.76 per Class C common share,

subject to certain adjustments. The capped call transactions cover,

subject to customary adjustments, approximately 15.74 million Class

C common shares of Liberty Latin America. The capped call

transactions are expected to reduce the potential dilution to

Liberty Latin America’s Class C common shares upon any conversion

of the Notes and/or offset the cash payments Liberty Latin America

is required to make in excess of the principal amount of converted

Notes, as the case may be, with such reduction and/or offset

subject to a cap. If the initial purchasers exercise their option

to purchase additional Notes, Liberty Latin America intends to

enter into additional capped call transactions with the option

counterparties. In connection with establishing their initial hedge

of the capped call transactions, Liberty Latin America expects that

the option counterparties will purchase Liberty Latin America’s

Class C common shares and/or enter into various derivative

transactions with respect to Liberty Latin America’s Class C common

shares concurrently with or shortly after the pricing of the Notes.

These activities could have the effect of increasing, or reducing

the size of a decline in, the market price of Liberty Latin

America’s Class C common shares or the Notes concurrently with, or

shortly following, the pricing of the Notes. In addition, the

option counterparties (and/or their respective affiliates) may

modify their hedge positions by entering into or unwinding various

derivatives with respect to Liberty Latin America’s common shares

and/or purchasing or selling Liberty Latin America’s Class C common

shares or other securities of Liberty Latin America in secondary

market transactions following the pricing of the Notes and prior to

the maturity of the Notes (and are likely to do so during any

observation period related to a conversion of Notes). Any of these

activities could cause or avoid an increase or a decrease in the

market price of Liberty Latin America’s Class C common shares or

the Notes and, to the extent any of these activities occurs during

any observation period related to a conversion of Notes, could

affect the number of shares and value of the consideration that a

noteholder will receive upon conversion of the Notes.

In addition, if any such capped call transaction fails to become

effective, whether or not this offering of Notes is completed, the

option counterparty party thereto may unwind its hedge positions

with respect to Liberty Latin America’s Class C common shares,

which could adversely affect the value of Liberty Latin America’s

Class C common shares and, if the Notes have been issued, the value

of the Notes.

This press release does not constitute an offer to sell or the

solicitation of an offer to buy the Notes, nor shall there be any

sale of the Notes in any jurisdiction in which, or to any person to

whom, such an offer, solicitation or sale would be unlawful. Any

offer of the Notes will be made only by means of a private offering

memorandum.

The Notes and the Class C common shares issuable upon conversion

of the Notes have not been, and will not be, registered under the

Securities Act or the securities laws of any other jurisdiction and

may not be offered or sold absent registration or an applicable

exemption from registration requirements under the Securities Act

and applicable state securities laws.

FORWARD LOOKING STATEMENTS

This press release includes certain forward-looking statements

within the meaning of the Private Securities Litigation Reform Act

of 1995, including statements relating to the private offering of

Notes, the anticipated use of proceeds therefrom and certain

related capped call transactions. These forward-looking statements

involve many risks and uncertainties that could cause actual

results to differ materially from those expressed or implied by

such statements, including, without limitation, general market

conditions. These forward-looking statements speak only as of the

date of this press release, and Liberty Latin America Ltd.

expressly disclaims any obligation or undertaking to disseminate

any updates or revisions to any forward-looking statement contained

herein to reflect any change in its expectations with regard

thereto or any change in events, conditions or circumstances on

which any such statement is based. Please refer to the publicly

filed documents of Liberty Latin America Ltd., including its most

recent Annual Report on Form 10-K and Quarterly Report on Form

10-Q, for risks and uncertainties related to Liberty Latin America

Ltd.’s business which may affect the statements made in this press

release.

ABOUT LIBERTY LATIN AMERICA

Liberty Latin America is a leading telecommunications company

operating in over 20 countries across Latin America and the

Caribbean under the consumer brands VTR, Flow, Liberty, Más Móvil,

BTC, UTS and Cabletica. The communications and entertainment

services that we offer to our residential and business customers in

the region include digital video, broadband internet, telephony and

mobile services. Our business products and services include

enterprise-grade connectivity, data center, hosting and managed

solutions, as well as information technology solutions with

customers ranging from small and medium enterprises to

international companies and governmental agencies. In addition,

Liberty Latin America operates a sub-sea and terrestrial fiber

optic cable network that connects over 40 markets in the region.

Liberty Latin America has three separate classes of common shares,

which are traded on the NASDAQ Global Select Market under the

symbols "LILA" (Class A) and "LILAK" (Class C), and on the OTC link

under the symbol "LILAB" (Class B).

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190625006079/en/

Investor Relations: Kunal

Patel +1 786 274 7552

Media Relations: Claudia

Restrepo +1 786 218 0407

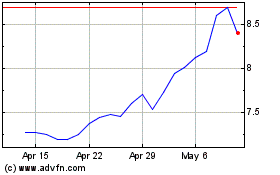

Liberty Latin America (NASDAQ:LILAK)

Historical Stock Chart

From Oct 2024 to Nov 2024

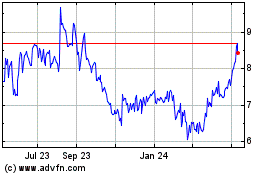

Liberty Latin America (NASDAQ:LILAK)

Historical Stock Chart

From Nov 2023 to Nov 2024