Liberty Global Completes the Sale of its Austrian Operations to T-Mobile Austria

July 31 2018 - 4:22AM

Business Wire

Liberty Global plc (“Liberty Global”) (NASDAQ: LBTYA, LBTYB and

LBTYK) today announced that it has completed the previously

announced sale of UPC Austria to T-Mobile Austria for an enterprise

value of €1.9 billion1 ($2.2 billion2), equal to nearly 11x UPC

Austria’s estimated 2017 adjusted3 segment operating cash flow. The

proceeds, after taking into account the repayment of debt that we

attribute to UPC Austria, will be approximately €900 million ($1.1

billion2). These proceeds will be used to increase our share

repurchase program by $500 million and to repay additional debt

across select credit pools of Liberty Global.

Liberty Global’s Board of Directors authorized this increase to

the buyback program in connection with the closing of the sale. The

increase supplements our previously announced $2.0 billion share

repurchase program, which we intend to complete by year-end 2018.

The incremental $500 million announced today can be spent at any

time over the next 12 months. Under the buyback program, Liberty

Global may acquire from time to time its Class A ordinary shares,

Class C ordinary shares, or any combination of Class A and Class C

ordinary shares. The program may be effected through open market

transactions and/or privately negotiated transactions, which may

include derivative transactions. The timing of the repurchase of

shares will depend on a variety of factors, including market

conditions and applicable law. Buybacks under the program may be

implemented in conjunction with brokers for the Company and other

financial institutions with whom the Company has relationships

within certain pre-set parameters and purchases may continue during

closed periods in accordance with applicable restrictions. The

buyback program may be suspended or discontinued at any time.

About Liberty Global

Liberty Global is the world’s largest international TV and

broadband company, with operations in 11 European countries under

the consumer brands Virgin Media, Unitymedia, Telenet and UPC. We

invest in the infrastructure and digital platforms that empower our

customers to make the most of the video, internet and

communications revolution. Our substantial scale and commitment to

innovation enable us to develop market-leading products delivered

through next-generation networks that connect 22 million customers

subscribing to 46 million TV, broadband internet and telephony

services. We also serve over 7 million mobile subscribers and offer

WiFi service through 12 million access points across our

footprint.

In addition, Liberty Global owns 50% of VodafoneZiggo, a joint

venture in the Netherlands with 4 million customers subscribing to

10 million fixed-line and 5 million mobile services, as well as

significant investments in ITV, All3Media, ITI Neovision, Casa

Systems, LionsGate, the Formula E racing series and several

regional sports networks.

For more information, please visit www.libertyglobal.com.

________________________________________________

1 Cash proceeds approximated €1.8 billion ($2.1 billion2) after

considering debt, working capital and minority interests

adjustments.

2 Convenience translation based on USD/EUR spot rate of 1.173

For the purpose of the purchase price multiple calculation, the

estimated 2017 segment operating cash flow of UPC Austria has been

reduced by €9 million, representing the estimated net amount of

transitional services to be provided by Liberty Global during the

first year following closing.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180731005387/en/

Liberty GlobalInvestor Relations:Matt

Coates, +44 20 8483 6333John Rea, +1 303 220 4238Stefan Halters, +1

303 784 4528orCorporate Communications:Bill

Myers, +1 303 437 5880Matt Beake, +44 20 8483 6428

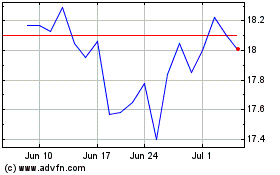

Liberty Global (NASDAQ:LBTYK)

Historical Stock Chart

From Dec 2024 to Jan 2025

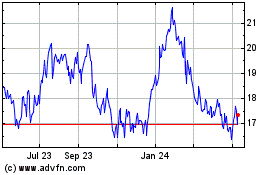

Liberty Global (NASDAQ:LBTYK)

Historical Stock Chart

From Jan 2024 to Jan 2025