LCNB Corp. Announces the Retirement of Matthew P. Layer EVP and Chief Lending Officer

July 17 2024 - 5:10PM

Business Wire

Layer to retire on September 30, 2024

Jeff D. Meeker, LCNB’s current SVP and Chief

Credit Officer, to assume the EVP and Chief Lending Officer

Role

LCNB Corp. (“LCNB”) (Nasdaq: LCNB) today announced that Matthew

P. Layer, EVP and Chief Lending Officer, will retire from the

Company effective September 30, 2024. As part of the Company’s

established succession plan, Jeff D. Meeker, LCNB’s current SVP and

Chief Credit Officer, will assume the role of EVP and Chief Lending

Officer at September 30, 2024.

“On behalf of everyone at LCNB, I want to thank Matt for his

years of dedication and service. Matt joined LCNB in 1982 and has

been an important part of LCNB’s success and growth over the past

42 years. During this period, LCNB’s loan portfolio has grown from

$31 million to over $1.6 billion at March 31, 2024. During his

tenure at LCNB, Matt cultivated a credit culture focused on

maintaining excellent asset quality and prudent underwriting

standards. Matt has been a trusted advisor and partner to the Bank.

He has been a mentor to many of LCNB’s team members and always

showed an interest in helping others succeed. I wish him all the

best in his well-deserved retirement,” said Eric J. Meilstrup,

LCNB’s President and Chief Executive Officer.

Jeff D. Meeker to Assume EVP and Chief Lending Officer

Role

Meeker joined LCNB in 2013 through the acquisition of Citizens

National Bank, and he has 38 years of banking experience. Since

September 2021, Meeker has served as LCNB’s Senior Vice President

& Chief Credit Officer overseeing the Bank’s commercial,

residential, consumer and agricultural lending areas. In January

2021, he was appointed LCNB’s Head of Loan Operations. Prior to

2021, Meeker held additional positions of increasing responsibility

in the Bank’s lending areas. Prior to joining LCNB, Meeker was the

CFO of the Citizens National Bank of Chillicothe and was the CEO

and President of Clarksburg National Bank. Meeker is a graduate of

Wilmington College (Ohio).

Mr. Meilstrup continued, “Reflective of LCNB’s established

succession plan and deep bench of talent, I am pleased to announce

that Jeff Meeker will assume the EVP and Chief Lending Officer

role. As LCNB’s current Chief Credit Officer, the former CEO and

president of Clarksburg National Bank, and the former CFO of

Citizens National Bank of Chillicothe, Jeff is a proven banker and

leader with a record of lending experience well aligned with LCNB’s

value-driven credit culture. Jeff and Matt have worked closely

together over the past 11 years, and Jeff brings a strong knowledge

of LCNB’s markets, while continuing our strong lending culture and

prudent focus on maintaining excellent asset quality. I look

forward to Jeff’s additional responsibilities and contributions as

a member of LCNB’s executive team.”

About LCNB Corp.

LCNB Corp. is a financial holding company headquartered in

Lebanon, Ohio. Through its subsidiary, LCNB National Bank (the

“Bank”), it serves customers and communities in Southwest and

South-Central Ohio and Northern Kentucky. A financial institution

with a long tradition for building strong relationships with

customers and communities, the Bank offers convenient banking

locations in Butler, Clermont, Clinton, Fayette, Franklin,

Hamilton, Montgomery, Preble, Ross, and Warren Counties, Ohio. The

Bank also provides community-oriented banking services to customers

in Northern Kentucky through a bank office in Boone County,

Kentucky. The Bank continually strives to exceed customer

expectations and provides an array of services for all personal and

business banking needs including checking, savings, online banking,

personal lending, business lending, agricultural lending, business

support, deposit and treasury, investment services, trust and IRAs

and stock purchases. LCNB Corp. common shares are traded on the

NASDAQ Capital Market Exchange® under the symbol “LCNB.” Learn more

about LCNB Corp. at www.lcnb.com.

Safe Harbor Statement:

Statements made in this news release that are not historical

facts are “forward-looking statements” within the meaning of

Section 27A of the Securities Act of 1933, as amended, Section 21E

of the Securities Exchange Act of 1934, as amended, and the Private

Securities Litigation Reform Act of 1995. These statements are

subject to certain risks and uncertainties including, but not

limited to, adverse changes in economic conditions; the impact of

competitive products and pricing; and other risks and

uncertainties, including those set forth in LCNB’s Annual Report on

Form 10-K for the year ended December 31, 2023, as well as its

other filings with the SEC. As a result, actual results may differ

materially from the forward-looking statements in this news

release.

LCNB encourages readers of this news release to understand

forward-looking statements to be strategic objectives rather than

absolute targets of future performance. LCNB undertakes no

obligation to update these forward-looking statements to reflect

events or circumstances after the date of this news release or to

reflect the occurrence of unanticipated events, except as required

by applicable legal requirements. Copies of documents filed by LCNB

with the SEC are available free of charge at the SEC’s website at

www.sec.gov and/or from LCNB’s website.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240717646681/en/

Company Contact: Eric J. Meilstrup President and Chief

Executive Officer LCNB National Bank (513) 932-1414

Shareholderrelations@lcnb.com

Investor and Media Contact: Andrew M. Berger Managing

Director SM Berger & Company, Inc. (216) 464-6400

andrew@smberger.com

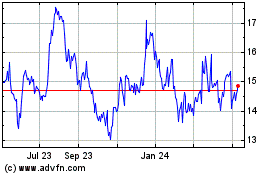

LCNB (NASDAQ:LCNB)

Historical Stock Chart

From Jun 2024 to Jul 2024

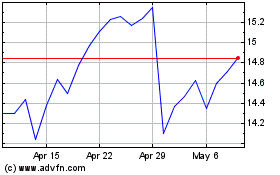

LCNB (NASDAQ:LCNB)

Historical Stock Chart

From Jul 2023 to Jul 2024