FALSE000161724200016172422024-10-242024-10-24

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_____________________________

FORM 8-K

_____________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 24, 2024

_____________________________

KEARNY FINANCIAL CORP.

(Exact name of Registrant as Specified in Its Charter)

_____________________________

| | | | | | | | |

| Maryland | 001-37399 | 30-0870244 |

(State or Other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | |

120 Passaic Avenue Fairfield, New Jersey | | 07004 |

(Address of Principal Executive Offices) | | (Zip Code) |

Registrant’s Telephone Number, Including Area Code: (973) 244-4500

(Former Name or Former Address, if Changed Since Last Report)

_____________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $0.01 par value | | KRNY | | The NASDAQ Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operation and Financial Condition

On October 24, 2024, Kearny Financial Corp. (the “Company”), the holding company for Kearny Bank, issued a press release reporting its financial results for the period ended September 30, 2024.

A copy of the press release announcing the results is included as Exhibit 99.1 to this Current Report on Form 8-K and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933.

Item 7.01 Regulation FD Disclosure

On October 24, 2024, the Company released a slide presentation that will be used in upcoming meetings with potential investors and current shareholders of the Company.

A copy of the slide presentation that will be used in the Company’s presentation is filed as Exhibit 99.2 to this Current Report on Form 8-K and is incorporated herein by reference. The information included in this Current Report pursuant to this Item 7.01 is being furnished to, and not filed with, the Securities and Exchange Commission.

Item 8.01 Other Events

On October 24, 2024, the Company’s Board of Directors announced a quarterly cash dividend of $0.11 per share, payable on November 20, 2024 to stockholders of record as of November 6, 2024.

Item 9.01 Financial Statements and Exhibits

(a)Financial Statements of Business Acquired. Not applicable.

(b)Pro Forma Financial Information. Not applicable.

(c)Shell Company Transaction. Not applicable.

(d)Exhibits.

| | | | | | | | |

| Exhibit Number | | Description |

| 99.1 | | |

| 99.2 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | |

| KEARNY FINANCIAL CORP. |

| | |

Date: October 24, 2024 | By: | /s/ Sean Byrnes |

| | Sean Byrnes |

| | Executive Vice President and Chief Financial Officer |

Exhibit 99.1

FOR IMMEDIATE RELEASE

October 24, 2024

For further information contact:

Keith Suchodolski, Senior Executive Vice President and Chief Operating Officer, or

Sean Byrnes, Executive Vice President and Chief Financial Officer

Kearny Financial Corp.

(973) 244-4500

KEARNY FINANCIAL CORP. ANNOUNCES FIRST QUARTER FISCAL 2025 RESULTS

AND DECLARATION OF CASH DIVIDEND

Fairfield, N.J., October 24, 2024 – Kearny Financial Corp. (NASDAQ GS: KRNY) (the “Company”), the holding company of Kearny Bank (the “Bank”), reported net income for the quarter ended September 30, 2024 of $6.1 million, or $0.10 per diluted share, compared to a GAAP net loss of $90.1 million, or $1.45 per diluted share, for the quarter ended June 30, 2024. The net loss for the quarter ended June 30, 2024 included a goodwill impairment of $95.3 million, as previously disclosed. Excluding this item, net income for the quarter ended September 30, 2024 increased $496,000 from adjusted net income of $5.6 million for the quarter ended June 30, 2024.

The Company also announced that its Board of Directors has declared a quarterly cash dividend of $0.11 per share, payable on November 20, 2024, to stockholders of record as of November 6, 2024.

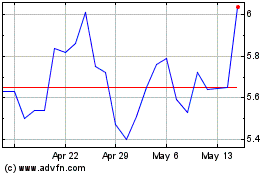

Craig L. Montanaro, President and Chief Executive Officer, commented, “I’m pleased to report that this quarter saw our net interest margin reach its inflection point and begin to ascend. Despite four basis points of quarterly compression, each successive month of the quarter reflected an increase in our net interest margin. The recent fed funds rate reduction of 50 basis points has already begun translating into a cost of funds benefit in October. Additional fed funds rate cuts, which the market is anticipating, will be a positive catalyst for our liability-sensitive balance sheet.”

Mr. Montanaro continued, “Regarding asset quality, our loan portfolio remains strong. Minimal exposure to New York City rent-regulated multifamily and office real estate, coupled with our robust commercial real estate ACL coverage ratios and peer-leading charge-off ratios, leaves us well-positioned in the current environment.”

Balance Sheet

•Total assets were $7.77 billion at September 30, 2024, an increase of $88.9 million, or 1.2%, from June 30, 2024.

•Investment securities totaled $1.20 billion at September 30, 2024, a decrease of $5.5 million, or 0.5%, from June 30, 2024.

•Loans receivable totaled $5.78 billion at September 30, 2024, an increase of $51.5 million, or 0.9%, from June 30, 2024, primarily reflecting growth in one- to four-family residential mortgage loans and construction loans.

•Deposits were $5.47 billion at September 30, 2024, an increase of $312.4 million, or 6.1%, from June 30, 2024. This increase was largely the result of a reallocation from Federal Home Loan Bank (“FHLB”) advances into brokered certificates of deposits, due to the relatively more favorable economics of brokered deposits compared to advances.

•Borrowings were $1.48 billion at September 30, 2024, a decrease of $229.9 million, or 13.4%, from June 30, 2024, primarily reflecting a decrease in FHLB borrowings offset by an increase in brokered certificates of deposits, as noted above.

•At September 30, 2024, the Company maintained available secured borrowing capacity with the FHLB and the Federal Reserve Discount Window of $2.06 billion, an increase of $240.0 million from June 30, 2024, and represents 26.5% of total assets.

Earnings

Net Interest Income and Net Interest Margin

•Net interest margin contracted four basis points to 1.80% for the quarter ended September 30, 2024. The decrease for the quarter was driven by increases in the cost and average balances of interest-bearing deposits and a decrease in the average balance of interest-earning assets, partially offset by decreases in the average balances of interest-bearing borrowings and higher yields on interest-earning assets.

•For the quarter ended September 30, 2024, net interest income decreased $830,000 to $32.4 million from $33.3 million for the quarter ended June 30, 2024. Included in net interest income for the quarters ended September 30, 2024 and June 30, 2024, respectively, was purchase accounting accretion of $649,000 and $612,000, and loan prepayment penalty income of $52,000 and $366,000.

Non-Interest Income

•Non-interest income decreased $1.2 million to income of $4.6 million for the quarter ended September 30, 2024, from $5.8 million for the quarter ended June 30, 2024. Included in non-interest income for the quarter ended June 30, 2024 was a non-recurring contract renewal bonus of $750,000 and $1.1 million in non-recurring payments on two life insurance policies, partially offset by a $392,000 non-recurring exchange charge related to the December 2023 Bank Owned Life Insurance (“BOLI”) restructure. No such non-recurring items were recorded during the quarter ended September 30, 2024.

•Income from BOLI decreased $642,000 to $2.6 million for the quarter ended September 30, 2024 from $3.2 million for the quarter ended June 30, 2024, primarily driven by the non-recurring items recorded for the quarter ended June 30, 2024, as disclosed above.

Non-Interest Expense

•For the quarter ended September 30, 2024, non-interest expense decreased $96.8 million, or 76.5%, to $29.8 million from $126.6 million for the quarter ended June 30, 2024, driven by a non-cash goodwill impairment recognized in the prior comparative period. Excluding the goodwill impairment, adjusted non-interest expense increased $605,000 from $29.2 million, primarily driven by increases in salary and benefits expense and other expense.

•Salary and benefits expense increased $232,000 primarily driven by annual merit increases and higher payroll taxes, partially offset by a non-recurring decrease in stock-based compensation.

•Other expense increased $344,000 primarily driven by an increase of $243,000 in the provision for credit losses on off balance sheet commitments.

Income Taxes

•Income tax expense totaled $1.1 million for the quarter ended September 30, 2024, compared to an income tax benefit of $917,000 for the quarter ended June 30, 2024. The increase in income tax expense was primarily due to higher pre-tax income in the current quarter, coupled with a partial reversal of the deferred tax liability associated with the previously recorded goodwill impairment in the prior quarter.

Asset Quality

•The balance of non-performing assets remained steady at $39.9 million, or 0.51% of total assets, at September 30, 2024, and $39.9 million, or 0.52% of total assets, at June 30, 2024, respectively.

•Net charge-offs totaled $124,000, or 0.01% of average loans, on an annualized basis, for the quarter ended September 30, 2024, compared to $3.5 million, or 0.25% of average loans, on an annualized basis, for the quarter ended June 30, 2024.

•For the quarter ended September 30, 2024, the Company recorded a provision for credit losses of $108,000, compared to $3.5 million for the quarter ended June 30, 2024. The provision for credit loss expense for the quarter ended September 30, 2024 was primarily driven by loan growth.

•The allowance for credit losses (“ACL”) was $44.9 million, or 0.78% of total loans, at September 30, 2024 and remained unchanged from June 30, 2024.

Capital

•For the quarter ended September 30, 2024, book value per share decreased $0.06, or 0.5%, to $11.64 while tangible book value per share decreased $0.05, or 0.5%, to $9.85.

•At September 30, 2024, total stockholders’ equity included after-tax net unrealized losses on securities available for sale of $76.0 million, partially offset by after-tax unrealized gains on derivatives of $11.0 million. After-tax net unrecognized losses on securities held to maturity of $8.2 million were not reflected in total stockholders’ equity.

•At September 30, 2024, the Company’s tangible equity to tangible assets ratio equaled 8.31% and the regulatory capital ratios of both the Company and the Bank were in excess of the levels required by federal banking regulators to be classified as “well-capitalized” under regulatory guidelines.

This earnings release should be read in conjunction with Kearny Financial Corp.’s Q1 2025 Investor Presentation, a copy of which is available through the Investor Relations link located at the bottom of the page of our website at www.kearnybank.com and via a Current Report on Form 8-K on the website of the Securities and Exchange Commission at www.sec.gov.

Statements contained in this news release that are not historical facts are forward-looking statements as that term is defined in the Private Securities Litigation Reform Act of 1995. Such forward-looking statements are subject to risks and uncertainties which could cause actual results to differ materially from those currently anticipated due to a number of factors, which include, but are not limited to, factors discussed in documents filed by the Company with the Securities and Exchange Commission from time to time. The Company does not undertake and specifically disclaims any obligation to update any forward-looking statement, whether written or oral, that may be made from time to time by or on behalf of the Company.

Category: Earnings

| | |

| Linked-Quarter Comparative Financial Analysis |

Kearny Financial Corp.

Consolidated Balance Sheets

(Unaudited)

| | | | | | | | | | | | | | |

(Dollars and Shares in Thousands,

Except Per Share Data) | September 30,

2024 | June 30,

2024 | Variance

or Change | Variance

or Change Pct. |

| | | | |

| Assets | | | | |

| Cash and cash equivalents | $ | 155,574 | | $ | 63,864 | | $ | 91,710 | | 143.6 | % |

| Securities available for sale | 1,070,811 | | 1,072,833 | | (2,022) | | -0.2 | % |

| Securities held to maturity | 132,256 | | 135,742 | | (3,486) | | -2.6 | % |

| Loans held-for-sale | 8,866 | | 6,036 | | 2,830 | | 46.9 | % |

| Loans receivable | 5,784,246 | | 5,732,787 | | 51,459 | | 0.9 | % |

| Less: allowance for credit losses on loans | (44,923) | | (44,939) | | (16) | | — | % |

| Net loans receivable | 5,739,323 | | 5,687,848 | | 51,475 | | 0.9 | % |

| Premises and equipment | 45,189 | | 44,940 | | 249 | | 0.6 | % |

| Federal Home Loan Bank stock | 57,706 | | 80,300 | | (22,594) | | -28.1 | % |

| Accrued interest receivable | 29,467 | | 29,521 | | (54) | | -0.2 | % |

| Goodwill | 113,525 | | 113,525 | | — | | — | % |

| Core deposit intangible | 1,805 | | 1,931 | | (126) | | -6.5 | % |

| Bank owned life insurance | 300,186 | | 297,874 | | 2,312 | | 0.8 | % |

| Deferred income taxes, net | 50,131 | | 50,339 | | (208) | | -0.4 | % |

| | | | |

| Other assets | 67,540 | | 98,708 | | (31,168) | | -31.6 | % |

| Total assets | $ | 7,772,379 | | $ | 7,683,461 | | $ | 88,918 | | 1.2 | % |

| | | | |

| Liabilities | | | | |

| Deposits: | | | | |

| Non-interest-bearing | $ | 592,099 | | $ | 598,366 | | $ | (6,267) | | -1.0 | % |

| Interest-bearing | 4,878,413 | | 4,559,757 | | 318,656 | | 7.0 | % |

| Total deposits | 5,470,512 | | 5,158,123 | | 312,389 | | 6.1 | % |

| Borrowings | 1,479,888 | | 1,709,789 | | (229,901) | | -13.4 | % |

| Advance payments by borrowers for taxes | 17,824 | | 17,409 | | 415 | | 2.4 | % |

| Other liabilities | 52,618 | | 44,569 | | 8,049 | | 18.1 | % |

| Total liabilities | 7,020,842 | | 6,929,890 | | 90,952 | | 1.3 | % |

| | | | |

| Stockholders' Equity | | | | |

| Common stock | 646 | | 644 | | 2 | | 0.3 | % |

| Paid-in capital | 493,523 | | 493,680 | | (157) | | — | % |

| Retained earnings | 342,522 | | 343,326 | | (804) | | -0.2 | % |

| Unearned ESOP shares | (20,430) | | (20,916) | | 486 | | 2.3 | % |

| Accumulated other comprehensive loss | (64,724) | | (63,163) | | (1,561) | | -2.5 | % |

| Total stockholders' equity | 751,537 | | 753,571 | | (2,034) | | -0.3 | % |

| Total liabilities and stockholders' equity | $ | 7,772,379 | | $ | 7,683,461 | | $ | 88,918 | | 1.2 | % |

| | | | |

| Consolidated capital ratios | | | | |

| Equity to assets | 9.67 | % | 9.81 | % | -0.14 | % | |

Tangible equity to tangible assets (1) | 8.31 | % | 8.43 | % | -0.12 | % | |

| | | | |

| Share data | | | | |

| Outstanding shares | 64,580 | 64,434 | 146 | 0.2 | % |

| Book value per share | $ | 11.64 | | $ | 11.70 | | $ | (0.06) | | -0.5 | % |

Tangible book value per share (2) | $ | 9.85 | | $ | 9.90 | | $ | (0.05) | | -0.5 | % |

_________________________

(1)Tangible equity equals total stockholders' equity reduced by goodwill and core deposit intangible assets. Tangible assets equals total assets reduced by goodwill and core deposit intangible assets.

(2)Tangible book value equals total stockholders' equity reduced by goodwill and core deposit intangible assets.

Kearny Financial Corp.

Consolidated Statements of Income (Loss)

(Unaudited)

| | | | | | | | | | | | | | | |

(Dollars and Shares in Thousands,

Except Per Share Data) | Three Months Ended | Variance

or Change | Variance

or Change Pct. | |

September 30,

2024 | June 30,

2024 | |

| Interest income | | | | | |

| Loans | $ | 66,331 | | $ | 65,819 | | $ | 512 | | 0.8 | % | |

| Taxable investment securities | 14,384 | | 14,802 | | (418) | | -2.8 | % | |

| Tax-exempt investment securities | 71 | | 80 | | (9) | | -11.3 | % | |

| Other interest-earning assets | 2,466 | | 2,289 | | 177 | | 7.7 | % | |

| Total interest income | 83,252 | | 82,990 | | 262 | | 0.3 | % | |

| | | | | |

| Interest expense | | | | | |

| Deposits | 35,018 | | 32,187 | | 2,831 | | 8.8 | % | |

| Borrowings | 15,788 | | 17,527 | | (1,739) | | -9.9 | % | |

| Total interest expense | 50,806 | | 49,714 | | 1,092 | | 2.2 | % | |

| Net interest income | 32,446 | | 33,276 | | (830) | | -2.5 | % | |

| Provision for credit losses | 108 | | 3,527 | | (3,419) | | -96.9 | % | |

| Net interest income after provision for credit losses | 32,338 | | 29,749 | | 2,589 | | 8.7 | % | |

| | | | | |

| Non-interest income | | | | | |

| Fees and service charges | 635 | | 580 | | 55 | | 9.5 | % | |

| | | | | |

| Gain on sale of loans | 200 | | 111 | | 89 | | 80.2 | % | |

| | | | | |

| Income from bank owned life insurance | 2,567 | | 3,209 | | (642) | | -20.0 | % | |

| Electronic banking fees and charges | 391 | | 1,130 | | (739) | | -65.4 | % | |

| Other income | 833 | | 776 | | 57 | | 7.3 | % | |

| Total non-interest income | 4,626 | | 5,806 | | (1,180) | | -20.3 | % | |

| | | | | |

| Non-interest expense | | | | | |

| Salaries and employee benefits | 17,498 | | 17,266 | | 232 | | 1.3 | % | |

| Net occupancy expense of premises | 2,798 | | 2,738 | | 60 | | 2.2 | % | |

| Equipment and systems | 3,860 | | 3,785 | | 75 | | 2.0 | % | |

| Advertising and marketing | 342 | | 480 | | (138) | | -28.8 | % | |

| Federal deposit insurance premium | 1,563 | | 1,532 | | 31 | | 2.0 | % | |

| Directors' compensation | 361 | | 360 | | 1 | | 0.3 | % | |

| Goodwill impairment | — | | 97,370 | | (97,370) | | -100.0 | % | |

| Other expense | 3,364 | | 3,020 | | 344 | | 11.4 | % | |

| Total non-interest expense | 29,786 | | 126,551 | | (96,765) | | -76.5 | % | |

| Income (loss) before income taxes | 7,178 | | (90,996) | | 98,174 | | 107.9 | % | |

| Income taxes | 1,086 | | (917) | | 2,003 | | -218.4 | % | |

| Net income (loss) | $ | 6,092 | | $ | (90,079) | | $ | 96,171 | | 106.8 | % | |

| | | | | |

| Net income (loss) per common share (EPS) | | | | | |

| Basic | $ | 0.10 | | $ | (1.45) | | $ | 1.55 | | | |

| Diluted | $ | 0.10 | | $ | (1.45) | | $ | 1.55 | | | |

| | | | | |

| Dividends declared | | | | | |

| Cash dividends declared per common share | $ | 0.11 | | $ | 0.11 | | $ | — | | | |

| Cash dividends declared | $ | 6,896 | | $ | 6,903 | | $ | (7) | | | |

| Dividend payout ratio | 113.2 | % | -7.7 | % | 120.9 | % | | |

| | | | | |

| Weighted average number of common shares outstanding | | | | | |

| Basic | 62,389 | 62,254 | 135 | | |

| Diluted | 62,420 | 62,254 | 166 | | |

Kearny Financial Corp.

Average Balance Sheet Data

(Unaudited)

| | | | | | | | | | | | | | |

| (Dollars in Thousands) | Three Months Ended | Variance

or Change | Variance

or Change Pct. |

September 30,

2024 | June 30,

2024 |

| Assets | | | | |

| Interest-earning assets: | | | | |

| Loans receivable, including loans held for sale | $ | 5,761,593 | | $ | 5,743,008 | | $ | 18,585 | | 0.3 | % |

| Taxable investment securities | 1,314,945 | | 1,343,541 | | (28,596) | | -2.1 | % |

| Tax-exempt investment securities | 12,244 | | 13,737 | | (1,493) | | -10.9 | % |

| Other interest-earning assets | 131,981 | | 128,257 | | 3,724 | | 2.9 | % |

| Total interest-earning assets | 7,220,763 | | 7,228,543 | | (7,780) | | -0.1 | % |

| Non-interest-earning assets | 467,670 | | 466,537 | | 1,133 | | 0.2 | % |

| Total assets | $ | 7,688,433 | | $ | 7,695,080 | | $ | (6,647) | | -0.1 | % |

| | | | |

| Liabilities and Stockholders' Equity | | | | |

| Interest-bearing liabilities: | | | | |

| Deposits: | | | | |

| Interest-bearing demand | $ | 2,282,608 | | $ | 2,310,521 | | $ | (27,913) | | -1.2 | % |

| Savings | 668,240 | | 631,622 | | 36,618 | | 5.8 | % |

| Certificates of deposit | 1,755,589 | | 1,613,798 | | 141,791 | | 8.8 | % |

| Total interest-bearing deposits | 4,706,437 | | 4,555,941 | | 150,496 | | 3.3 | % |

| Borrowings: | | | | |

| Federal Home Loan Bank advances | 1,325,583 | | 1,507,192 | | (181,609) | | -12.0 | % |

| Other borrowings | 237,011 | | 228,461 | | 8,550 | | 3.7 | % |

| Total borrowings | 1,562,594 | | 1,735,653 | | (173,059) | | -10.0 | % |

| Total interest-bearing liabilities | 6,269,031 | | 6,291,594 | | (22,563) | | -0.4 | % |

| Non-interest-bearing liabilities: | | | | |

| Non-interest-bearing deposits | 599,095 | | 589,438 | | 9,657 | | 1.6 | % |

| Other non-interest-bearing liabilities | 69,629 | | 62,978 | | 6,651 | | 10.6 | % |

| Total non-interest-bearing liabilities | 668,724 | | 652,416 | | 16,308 | | 2.5 | % |

| Total liabilities | 6,937,755 | | 6,944,010 | | (6,255) | | -0.1 | % |

| Stockholders' equity | 750,678 | | 751,070 | | (392) | | -0.1 | % |

| Total liabilities and stockholders' equity | $ | 7,688,433 | | $ | 7,695,080 | | $ | (6,647) | | -0.1 | % |

| | | | |

| Average interest-earning assets to average interest-bearing liabilities | 115.18 | % | 114.89 | % | 0.29 | % | 0.3 | % |

Kearny Financial Corp.

Performance Ratio Highlights

(Unaudited)

| | | | | | | | | | | |

| Three Months Ended | Variance

or Change |

| September 30,

2024 | June 30,

2024 |

| Average yield on interest-earning assets: | | | |

| Loans receivable, including loans held for sale | 4.61 | % | 4.58 | % | 0.03 | % |

| Taxable investment securities | 4.38 | % | 4.41 | % | -0.03 | % |

Tax-exempt investment securities (1) | 2.32 | % | 2.32 | % | — | % |

| Other interest-earning assets | 7.47 | % | 7.14 | % | 0.33 | % |

| Total interest-earning assets | 4.61 | % | 4.59 | % | 0.02 | % |

| | | |

| Average cost of interest-bearing liabilities: | | | |

| Deposits: | | | |

| Interest-bearing demand | 3.13 | % | 3.06 | % | 0.07 | % |

| Savings | 1.05 | % | 0.63 | % | 0.42 | % |

| Certificates of deposit | 3.51 | % | 3.35 | % | 0.16 | % |

| Total interest-bearing deposits | 2.98 | % | 2.83 | % | 0.15 | % |

| Borrowings: | | | |

| Federal Home Loan Bank advances | 3.82 | % | 3.86 | % | -0.04 | % |

| Other borrowings | 5.28 | % | 5.24 | % | 0.04 | % |

| Total borrowings | 4.04 | % | 4.04 | % | — | % |

| Total interest-bearing liabilities | 3.24 | % | 3.16 | % | 0.08 | % |

| | | |

Interest rate spread (2) | 1.37 | % | 1.43 | % | -0.06 | % |

Net interest margin (3) | 1.80 | % | 1.84 | % | -0.04 | % |

| | | |

| Non-interest income to average assets (annualized) | 0.24 | % | 0.30 | % | -0.06 | % |

| Non-interest expense to average assets (annualized) | 1.55 | % | 6.58 | % | -5.03 | % |

| | | |

Efficiency ratio (4) | 80.35 | % | 323.81 | % | -243.46 | % |

| | | |

| Return on average assets (annualized) | 0.32 | % | -4.68 | % | 5.00 | % |

| Return on average equity (annualized) | 3.25 | % | -47.97 | % | 51.22 | % |

Return on average tangible equity (annualized) (5) | 3.89 | % | 3.33 | % | 0.56 | % |

_________________________

(1)The yield on tax-exempt investment securities has not been adjusted to reflect their tax-effective yield.

(2)Interest income divided by average interest-earning assets less interest expense divided by average interest-bearing liabilities.

(3)Net interest income divided by average interest-earning assets.

(4)Non-interest expense divided by the sum of net interest income and non-interest income.

(5)Average tangible equity equals total average stockholders’ equity reduced by average goodwill and average core deposit intangible assets.

| | |

|

| Five-Quarter Financial Trend Analysis |

Kearny Financial Corp.

Consolidated Balance Sheets

| | | | | | | | | | | | | | | | | |

(Dollars and Shares in Thousands,

Except Per Share Data) | September 30,

2024 | June 30,

2024 | March 31,

2024 | December 31,

2023 | September 30,

2023 |

| (Unaudited) | (Audited) | (Unaudited) | (Unaudited) | (Unaudited) |

| Assets | | | | | |

| Cash and cash equivalents | $ | 155,574 | | $ | 63,864 | | $ | 71,027 | | $ | 73,860 | | $ | 57,219 | |

| Securities available for sale | 1,070,811 | | 1,072,833 | | 1,098,655 | | 1,144,175 | | 1,215,633 | |

| Securities held to maturity | 132,256 | | 135,742 | | 139,643 | | 141,959 | | 143,730 | |

| Loans held-for-sale | 8,866 | | 6,036 | | 4,117 | | 14,030 | | 3,934 | |

| Loans receivable | 5,784,246 | | 5,732,787 | | 5,758,336 | | 5,745,629 | | 5,736,049 | |

| Less: allowance for credit losses on loans | (44,923) | | (44,939) | | (44,930) | | (44,867) | | (46,872) | |

| Net loans receivable | 5,739,323 | | 5,687,848 | | 5,713,406 | | 5,700,762 | | 5,689,177 | |

| Premises and equipment | 45,189 | | 44,940 | | 45,053 | | 45,928 | | 46,868 | |

| Federal Home Loan Bank stock | 57,706 | | 80,300 | | 81,347 | | 83,372 | | 81,509 | |

| Accrued interest receivable | 29,467 | | 29,521 | | 31,065 | | 30,258 | | 29,766 | |

| Goodwill | 113,525 | | 113,525 | | 210,895 | | 210,895 | | 210,895 | |

| Core deposit intangible | 1,805 | | 1,931 | | 2,057 | | 2,189 | | 2,323 | |

| Bank owned life insurance | 300,186 | | 297,874 | | 296,493 | | 256,064 | | 294,491 | |

| Deferred income taxes, net | 50,131 | | 50,339 | | 47,225 | | 46,116 | | 56,500 | |

| Other real estate owned | — | | — | | — | | 11,982 | | 12,956 | |

| Other assets | 67,540 | | 98,708 | | 100,989 | | 136,242 | | 129,865 | |

| Total assets | $ | 7,772,379 | | $ | 7,683,461 | | $ | 7,841,972 | | $ | 7,897,832 | | $ | 7,974,866 | |

| | | | | |

| Liabilities | | | | | |

| Deposits: | | | | | |

| Non-interest-bearing | $ | 592,099 | | $ | 598,366 | | $ | 586,089 | | $ | 584,130 | | $ | 595,141 | |

| Interest-bearing | 4,878,413 | | 4,559,757 | | 4,622,961 | | 4,735,500 | | 4,839,027 | |

| Total deposits | 5,470,512 | | 5,158,123 | | 5,209,050 | | 5,319,630 | | 5,434,168 | |

| Borrowings | 1,479,888 | | 1,709,789 | | 1,722,178 | | 1,667,055 | | 1,626,933 | |

| Advance payments by borrowers for taxes | 17,824 | | 17,409 | | 17,387 | | 16,742 | | 16,907 | |

| Other liabilities | 52,618 | | 44,569 | | 44,279 | | 46,427 | | 47,324 | |

| Total liabilities | 7,020,842 | | 6,929,890 | | 6,992,894 | | 7,049,854 | | 7,125,332 | |

| | | | | |

| Stockholders' Equity | | | | | |

| Common stock | 646 | | 644 | | 644 | | 645 | | 652 | |

| Paid-in capital | 493,523 | | 493,680 | | 493,187 | | 493,297 | | 497,269 | |

| Retained earnings | 342,522 | | 343,326 | | 440,308 | | 439,755 | | 460,464 | |

| Unearned ESOP shares | (20,430) | | (20,916) | | (21,402) | | (21,889) | | (22,375) | |

| Accumulated other comprehensive loss | (64,724) | | (63,163) | | (63,659) | | (63,830) | | (86,476) | |

| Total stockholders' equity | 751,537 | | 753,571 | | 849,078 | | 847,978 | | 849,534 | |

| Total liabilities and stockholders' equity | $ | 7,772,379 | | $ | 7,683,461 | | $ | 7,841,972 | | $ | 7,897,832 | | $ | 7,974,866 | |

| | | | | |

| Consolidated capital ratios | | | | | |

| Equity to assets | 9.67 | % | 9.81 | % | 10.83 | % | 10.74 | % | 10.65 | % |

Tangible equity to tangible assets (1) | 8.31 | % | 8.43 | % | 8.34 | % | 8.26 | % | 8.20 | % |

| | | | | |

| Share data | | | | | |

| Outstanding shares | 64,580 | 64,434 | 64,437 | 64,445 | 65,132 |

| Book value per share | $ | 11.64 | | $ | 11.70 | | $ | 13.18 | | $ | 13.16 | | $ | 13.04 | |

Tangible book value per share (2) | $ | 9.85 | | $ | 9.90 | | $ | 9.87 | | $ | 9.85 | | $ | 9.77 | |

_________________________

(1)Tangible equity equals total stockholders' equity reduced by goodwill and core deposit intangible assets. Tangible assets equals total assets reduced by goodwill and core deposit intangible assets.

(2)Tangible book value equals total stockholders' equity reduced by goodwill and core deposit intangible assets.

Kearny Financial Corp.

Supplemental Balance Sheet Highlights

(Unaudited)

| | | | | | | | | | | | | | | | | |

| (Dollars in Thousands) | September 30,

2024 | June 30,

2024 | March 31,

2024 | December 31,

2023 | September 30,

2023 |

| Loan portfolio composition: | | | | | |

| Commercial loans: | | | | | |

| Multi-family mortgage | $ | 2,646,187 | | $ | 2,645,851 | | $ | 2,645,195 | | $ | 2,651,274 | | $ | 2,699,151 | |

| Nonresidential mortgage | 950,771 | | 948,075 | | 965,539 | | 947,287 | | 946,801 | |

| Commercial business | 145,984 | | 142,747 | | 147,326 | | 144,134 | | 149,229 | |

| Construction | 227,327 | | 209,237 | | 229,457 | | 221,933 | | 230,703 | |

| Total commercial loans | 3,970,269 | | 3,945,910 | | 3,987,517 | | 3,964,628 | | 4,025,884 | |

| One- to four-family residential mortgage | 1,768,230 | | 1,756,051 | | 1,741,644 | | 1,746,065 | | 1,689,051 | |

| Consumer loans: | | | | | |

| Home equity loans | 44,741 | | 44,104 | | 42,731 | | 43,517 | | 42,896 | |

| Other consumer | 2,965 | | 2,685 | | 3,198 | | 2,728 | | 2,644 | |

| Total consumer loans | 47,706 | | 46,789 | | 45,929 | | 46,245 | | 45,540 | |

| Total loans, excluding yield adjustments | 5,786,205 | | 5,748,750 | | 5,775,090 | | 5,756,938 | | 5,760,475 | |

| Unaccreted yield adjustments | (1,959) | | (15,963) | | (16,754) | | (11,309) | | (24,426) | |

| Loans receivable, net of yield adjustments | 5,784,246 | | 5,732,787 | | 5,758,336 | | 5,745,629 | | 5,736,049 | |

| Less: allowance for credit losses on loans | (44,923) | | (44,939) | | (44,930) | | (44,867) | | (46,872) | |

| Net loans receivable | $ | 5,739,323 | | $ | 5,687,848 | | $ | 5,713,406 | | $ | 5,700,762 | | $ | 5,689,177 | |

| | | | | |

| Asset quality: | | | | | |

| Nonperforming assets: | | | | | |

| Accruing loans - 90 days and over past due | $ | — | | $ | — | | $ | — | | $ | — | | $ | — | |

| Nonaccrual loans | 39,854 | | 39,882 | | 39,546 | | 28,089 | | 37,912 | |

| Total nonperforming loans | 39,854 | | 39,882 | | 39,546 | | 28,089 | | 37,912 | |

| Nonaccrual loans held-for-sale | — | | — | | — | | 9,700 | | — | |

| Other real estate owned | — | | — | | — | | 11,982 | | 12,956 | |

| Total nonperforming assets | $ | 39,854 | | $ | 39,882 | | $ | 39,546 | | $ | 49,771 | | $ | 50,868 | |

| | | | | |

| Nonperforming loans (% total loans) | 0.69 | % | 0.70 | % | 0.69 | % | 0.49 | % | 0.66 | % |

| Nonperforming assets (% total assets) | 0.51 | % | 0.52 | % | 0.50 | % | 0.63 | % | 0.64 | % |

| | | | | |

| Classified loans | $ | 119,534 | | $ | 118,700 | | $ | 115,772 | | $ | 94,676 | | $ | 98,616 | |

| | | | | |

| Allowance for credit losses on loans (ACL): | | | | | |

| ACL to total loans | 0.78 | % | 0.78 | % | 0.78 | % | 0.78 | % | 0.81 | % |

| ACL to nonperforming loans | 112.72 | % | 112.68 | % | 113.61 | % | 159.73 | % | 123.63 | % |

| Net charge-offs | $ | 124 | | $ | 3,518 | | $ | 286 | | $ | 4,110 | | $ | 2,107 | |

| Average net charge-off rate (annualized) | 0.01 | % | 0.25 | % | 0.02 | % | 0.29 | % | 0.15 | % |

Kearny Financial Corp.

Supplemental Balance Sheet Highlights

(Unaudited)

| | | | | | | | | | | | | | | | | |

| (Dollars in Thousands) | September 30,

2024 | June 30,

2024 | March 31,

2024 | December 31,

2023 | September 30,

2023 |

| Funding composition: | | | | | |

| Deposits: | | | | | |

| Non-interest-bearing deposits | $ | 592,099 | | $ | 598,367 | | $ | 586,089 | | $ | 584,130 | | $ | 595,141 | |

| Interest-bearing demand | 2,247,685 | | 2,308,915 | | 2,349,032 | | 2,347,262 | | 2,236,573 | |

| Savings | 681,709 | | 643,481 | | 630,456 | | 646,182 | | 689,163 | |

| Certificates of deposit (retail) | 1,215,746 | | 1,199,127 | | 1,235,261 | | 1,283,676 | | 1,300,382 | |

| Certificates of deposit (brokered and listing service) | 733,273 | | 408,234 | | 408,212 | | 458,380 | | 612,909 | |

| Interest-bearing deposits | 4,878,413 | | 4,559,757 | | 4,622,961 | | 4,735,500 | | 4,839,027 | |

| Total deposits | 5,470,512 | | 5,158,124 | | 5,209,050 | | 5,319,630 | | 5,434,168 | |

| | | | | |

| Borrowings: | | | | | |

| Federal Home Loan Bank advances | 1,209,888 | | 1,534,789 | | 1,457,178 | | 1,432,055 | | 1,456,933 | |

| Overnight borrowings | 270,000 | | 175,000 | | 265,000 | | 235,000 | | 170,000 | |

| Total borrowings | 1,479,888 | | 1,709,789 | | 1,722,178 | | 1,667,055 | | 1,626,933 | |

| | | | | |

| Total funding | $ | 6,950,400 | | $ | 6,867,913 | | $ | 6,931,228 | | $ | 6,986,685 | | $ | 7,061,101 | |

| | | | | |

| Loans as a % of deposits | 105.1 | % | 110.4 | % | 109.8 | % | 107.4 | % | 104.8 | % |

| Deposits as a % of total funding | 78.7 | % | 75.1 | % | 75.2 | % | 76.1 | % | 77.0 | % |

| Borrowings as a % of total funding | 21.3 | % | 24.9 | % | 24.8 | % | 23.9 | % | 23.0 | % |

| | | | | |

| Uninsured deposits: | | | | | |

Uninsured deposits (reported) (1) | $ | 1,799,726 | | $ | 1,772,623 | | $ | 1,760,740 | | $ | 1,813,122 | | $ | 1,734,288 | |

Uninsured deposits (adjusted) (2) | $ | 773,375 | | $ | 764,447 | | $ | 718,026 | | $ | 694,510 | | $ | 683,265 | |

_________________________

(1)Uninsured deposits of Kearny Bank.

(2)Uninsured deposits of Kearny Bank adjusted to exclude deposits of its wholly-owned subsidiary and holding company and collateralized deposits of state and local governments.

Kearny Financial Corp.

Consolidated Statements of Income (Loss)

(Unaudited)

| | | | | | | | | | | | | | | | | |

| Three Months Ended |

(Dollars and Shares in Thousands,

Except Per Share Data) | September 30,

2024 | June 30,

2024 | March 31,

2024 | December 31,

2023 | September 30,

2023 |

| Interest income | | | | | |

| Loans | $ | 66,331 | | $ | 65,819 | | $ | 64,035 | | $ | 63,384 | | $ | 62,769 | |

| Taxable investment securities | 14,384 | | 14,802 | | 15,490 | | 16,756 | | 16,265 | |

| Tax-exempt investment securities | 71 | | 80 | | 85 | | 84 | | 87 | |

| Other interest-earning assets | 2,466 | | 2,289 | | 2,475 | | 2,401 | | 2,047 | |

| Total interest income | 83,252 | | 82,990 | | 82,085 | | 82,625 | | 81,168 | |

| | | | | |

| Interest expense | | | | | |

| Deposits | 35,018 | | 32,187 | | 32,320 | | 30,340 | | 27,567 | |

| Borrowings | 15,788 | | 17,527 | | 15,446 | | 16,446 | | 14,441 | |

| Total interest expense | 50,806 | | 49,714 | | 47,766 | | 46,786 | | 42,008 | |

| Net interest income | 32,446 | | 33,276 | | 34,319 | | 35,839 | | 39,160 | |

| Provision for credit losses | 108 | | 3,527 | | 349 | | 2,105 | | 245 | |

| Net interest income after provision for credit losses | 32,338 | | 29,749 | | 33,970 | | 33,734 | | 38,915 | |

| | | | | |

| Non-interest income | | | | | |

| Fees and service charges | 635 | | 580 | | 657 | | 624 | | 748 | |

| Loss on sale and call of securities | — | | — | | — | | (18,135) | | — | |

| Gain (loss) on sale of loans | 200 | | 111 | | (712) | | 104 | | 215 | |

| Loss on sale of other real estate owned | — | | — | | — | | (974) | | — | |

| Income from bank owned life insurance | 2,567 | | 3,209 | | 3,039 | | 1,162 | | 1,666 | |

| Electronic banking fees and charges | 391 | | 1,130 | | 464 | | 396 | | 367 | |

| Other income | 833 | | 776 | | 755 | | 811 | | 1,014 | |

| Total non-interest income | 4,626 | | 5,806 | | 4,203 | | (16,012) | | 4,010 | |

| | | | | |

| Non-interest expense | | | | | |

| Salaries and employee benefits | 17,498 | | 17,266 | | 16,911 | | 17,282 | | 17,761 | |

| Net occupancy expense of premises | 2,798 | | 2,738 | | 2,863 | | 2,674 | | 2,758 | |

| Equipment and systems | 3,860 | | 3,785 | | 3,823 | | 3,814 | | 3,801 | |

| Advertising and marketing | 342 | | 480 | | 387 | | 301 | | 228 | |

| Federal deposit insurance premium | 1,563 | | 1,532 | | 1,429 | | 1,495 | | 1,524 | |

| Directors' compensation | 361 | | 360 | | 360 | | 393 | | 393 | |

| Goodwill impairment | — | | 97,370 | | — | | — | | — | |

| Other expense | 3,364 | | 3,020 | | 3,286 | | 3,808 | | 3,309 | |

| Total non-interest expense | 29,786 | | 126,551 | | 29,059 | | 29,767 | | 29,774 | |

| Income (loss) before income taxes | 7,178 | | (90,996) | | 9,114 | | (12,045) | | 13,151 | |

| Income taxes | 1,086 | | (917) | | 1,717 | | 1,782 | | 3,309 | |

| Net income (loss) | $ | 6,092 | | $ | (90,079) | | $ | 7,397 | | $ | (13,827) | | $ | 9,842 | |

| | | | | |

| Net income (loss) per common share (EPS) | | | | | |

| Basic | $ | 0.10 | | $ | (1.45) | | $ | 0.12 | | $ | (0.22) | | $ | 0.16 | |

| Diluted | $ | 0.10 | | $ | (1.45) | | $ | 0.12 | | $ | (0.22) | | $ | 0.16 | |

| | | | | |

| Dividends declared | | | | | |

| Cash dividends declared per common share | $ | 0.11 | | $ | 0.11 | | $ | 0.11 | | $ | 0.11 | | $ | 0.11 | |

| Cash dividends declared | $ | 6,896 | | $ | 6,903 | | $ | 6,844 | | $ | 6,882 | | $ | 6,989 | |

| Dividend payout ratio | 113.2 | % | -7.7 | % | 92.5 | % | -49.8 | % | 71.0 | % |

| | | | | |

| Weighted average number of common shares outstanding | | | | | |

| Basic | 62,389 | 62,254 | 62,205 | 62,299 | 63,014 |

| Diluted | 62,420 | 62,254 | 62,211 | 62,299 | 63,061 |

Kearny Financial Corp.

Average Balance Sheet Data

(Unaudited)

| | | | | | | | | | | | | | | | | |

| Three Months Ended |

| (Dollars in Thousands) | September 30,

2024 | June 30,

2024 | March 31,

2024 | December 31,

2023 | September 30,

2023 |

| Assets | | | | | |

| Interest-earning assets: | | | | | |

| Loans receivable, including loans held-for-sale | $ | 5,761,593 | | $ | 5,743,008 | | $ | 5,752,477 | | $ | 5,726,321 | | $ | 5,788,074 | |

| Taxable investment securities | 1,314,945 | | 1,343,541 | | 1,382,064 | | 1,509,165 | | 1,516,393 | |

| Tax-exempt investment securities | 12,244 | | 13,737 | | 14,614 | | 15,025 | | 15,483 | |

| Other interest-earning assets | 131,981 | | 128,257 | | 125,155 | | 139,740 | | 130,829 | |

| Total interest-earning assets | 7,220,763 | | 7,228,543 | | 7,274,310 | | 7,390,251 | | 7,450,779 | |

| Non-interest-earning assets | 467,670 | | 466,537 | | 577,411 | | 554,335 | | 568,723 | |

| Total assets | $ | 7,688,433 | | $ | 7,695,080 | | $ | 7,851,721 | | $ | 7,944,586 | | $ | 8,019,502 | |

| | | | | |

| Liabilities and Stockholders' Equity | | | | | |

| Interest-bearing liabilities: | | | | | |

| Deposits: | | | | | |

| Interest-bearing demand | $ | 2,282,608 | | $ | 2,310,521 | | $ | 2,378,831 | | $ | 2,301,169 | | $ | 2,245,831 | |

| Savings | 668,240 | | 631,622 | | 635,226 | | 664,926 | | 719,508 | |

| Certificates of deposit | 1,755,589 | | 1,613,798 | | 1,705,513 | | 1,824,316 | | 1,968,512 | |

| Total interest-bearing deposits | 4,706,437 | | 4,555,941 | | 4,719,570 | | 4,790,411 | | 4,933,851 | |

| Borrowings: | | | | | |

| Federal Home Loan Bank advances | 1,325,583 | | 1,507,192 | | 1,428,801 | | 1,513,497 | | 1,386,473 | |

| Other borrowings | 237,011 | | 228,461 | | 210,989 | | 142,283 | | 158,098 | |

| Total borrowings | 1,562,594 | | 1,735,653 | | 1,639,790 | | 1,655,780 | | 1,544,571 | |

| Total interest-bearing liabilities | 6,269,031 | | 6,291,594 | | 6,359,360 | | 6,446,191 | | 6,478,422 | |

| Non-interest-bearing liabilities: | | | | | |

| Non-interest-bearing deposits | 599,095 | | 589,438 | | 581,870 | | 597,294 | | 612,251 | |

| Other non-interest-bearing liabilities | 69,629 | | 62,978 | | 65,709 | | 62,387 | | 66,701 | |

| Total non-interest-bearing liabilities | 668,724 | | 652,416 | | 647,579 | | 659,681 | | 678,952 | |

| Total liabilities | 6,937,755 | | 6,944,010 | | 7,006,939 | | 7,105,872 | | 7,157,374 | |

| Stockholders' equity | 750,678 | | 751,070 | | 844,782 | | 838,714 | | 862,128 | |

| Total liabilities and stockholders' equity | $ | 7,688,433 | | $ | 7,695,080 | | $ | 7,851,721 | | $ | 7,944,586 | | $ | 8,019,502 | |

| | | | | |

| Average interest-earning assets to average interest-bearing liabilities | 115.18 | % | 114.89 | % | 114.39 | % | 114.65 | % | 115.01 | % |

Kearny Financial Corp.

Performance Ratio Highlights

| | | | | | | | | | | | | | | | | |

| Three Months Ended |

| September 30,

2024 | June 30,

2024 | March 31,

2024 | December 31,

2023 | September 30,

2023 |

| Average yield on interest-earning assets: | | | | | |

| Loans receivable, including loans held-for-sale | 4.61 | % | 4.58 | % | 4.45 | % | 4.43 | % | 4.34 | % |

| Taxable investment securities | 4.38 | % | 4.41 | % | 4.48 | % | 4.44 | % | 4.29 | % |

Tax-exempt investment securities (1) | 2.32 | % | 2.32 | % | 2.32 | % | 2.25 | % | 2.25 | % |

| Other interest-earning assets | 7.47 | % | 7.14 | % | 7.91 | % | 6.87 | % | 6.26 | % |

| Total interest-earning assets | 4.61 | % | 4.59 | % | 4.51 | % | 4.47 | % | 4.36 | % |

| | | | | |

| Average cost of interest-bearing liabilities: | | | | | |

| Deposits: | | | | | |

| Interest-bearing demand | 3.13 | % | 3.06 | % | 3.08 | % | 2.91 | % | 2.58 | % |

| Savings | 1.05 | % | 0.63 | % | 0.46 | % | 0.44 | % | 0.47 | % |

| Certificates of deposit | 3.51 | % | 3.35 | % | 3.11 | % | 2.82 | % | 2.49 | % |

| Total interest-bearing deposits | 2.98 | % | 2.83 | % | 2.74 | % | 2.53 | % | 2.23 | % |

| Borrowings: | | | | | |

| Federal Home Loan Bank advances | 3.82 | % | 3.86 | % | 3.55 | % | 3.82 | % | 3.54 | % |

| Other borrowings | 5.28 | % | 5.24 | % | 5.22 | % | 5.65 | % | 5.46 | % |

| Total borrowings | 4.04 | % | 4.04 | % | 3.77 | % | 3.97 | % | 3.74 | % |

| Total interest-bearing liabilities | 3.24 | % | 3.16 | % | 3.00 | % | 2.90 | % | 2.59 | % |

| | | | | |

Interest rate spread (2) | 1.37 | % | 1.43 | % | 1.51 | % | 1.57 | % | 1.77 | % |

Net interest margin (3) | 1.80 | % | 1.84 | % | 1.89 | % | 1.94 | % | 2.10 | % |

| | | | | |

| Non-interest income to average assets (annualized) | 0.24 | % | 0.30 | % | 0.21 | % | -0.81 | % | 0.20 | % |

| Non-interest expense to average assets (annualized) | 1.55 | % | 6.58 | % | 1.48 | % | 1.50 | % | 1.49 | % |

| | | | | |

Efficiency ratio (4) | 80.35 | % | 323.81 | % | 75.43 | % | 150.13 | % | 68.97 | % |

| | | | | |

| Return on average assets (annualized) | 0.32 | % | -4.68 | % | 0.38 | % | -0.70 | % | 0.49 | % |

| Return on average equity (annualized) | 3.25 | % | -47.97 | % | 3.50 | % | -6.59 | % | 4.57 | % |

Return on average tangible equity (annualized) (5) | 3.89 | % | 3.33 | % | 4.68 | % | -8.84 | % | 6.07 | % |

_________________________

(1)The yield on tax-exempt investment securities has not been adjusted to reflect their tax-effective yield.

(2)Interest income divided by average interest-earning assets less interest expense divided by average interest-bearing liabilities.

(3)Net interest income divided by average interest-earning assets.

(4)Non-interest expense divided by the sum of net interest income and non-interest income.

(5)Average tangible equity equals total average stockholders’ equity reduced by average goodwill and average core deposit intangible assets.

The following tables provide a reconciliation of certain financial measures calculated in accordance with Generally Accepted Accounting Principles (“GAAP”) (as reported) and non-GAAP measures. These non-GAAP measures provide additional information which allow readers to evaluate the ongoing performance of the Company. They are not a substitute for GAAP measures; they should be read and used in conjunction with the Company’s GAAP financial information. In all cases, it should be understood that non-GAAP per share measures do not depict amounts that accrue directly to the benefit of shareholders.

Kearny Financial Corp.

Reconciliation of GAAP to Non-GAAP

(Unaudited)

| | | | | | | | | | | | | | | | | |

| Three Months Ended |

(Dollars and Shares in Thousands,

Except Per Share Data) | September 30,

2024 | June 30,

2024 | March 31,

2024 | December 31,

2023 | September 30,

2023 |

| Adjusted net income: | | | | | |

| Net income (loss) (GAAP) | $ | 6,092 | | $ | (90,079) | | $ | 7,397 | | $ | (13,827) | | $ | 9,842 | |

| Non-recurring transactions - net of tax: | | | | | |

| | | | | |

| Net effect of sale and call of securities | — | | — | | — | | 12,876 | | — | |

| | | | | |

| | | | | |

| Net effect of bank-owned life insurance restructure | — | | 392 | | — | | 6,286 | | — | |

| Goodwill impairment | — | | 95,283 | | — | | — | | — | |

| Adjusted net income | $ | 6,092 | | $ | 5,596 | | $ | 7,397 | | $ | 5,335 | | $ | 9,842 | |

| | | | | |

| Calculation of pre-tax, pre-provision net revenue: | | | | | |

| Net income (loss) (GAAP) | $ | 6,092 | | $ | (90,079) | | $ | 7,397 | | $ | (13,827) | | $ | 9,842 | |

| Adjustments to net income (GAAP): | | | | | |

| Provision for income taxes | 1,086 | | (917) | | 1,717 | | 1,782 | | 3,309 | |

| Provision for credit losses | 108 | | 3,527 | | 349 | | 2,105 | | 245 | |

| Pre-tax, pre-provision net revenue (non-GAAP) | $ | 7,286 | | $ | (87,469) | | $ | 9,463 | | $ | (9,940) | | $ | 13,396 | |

| | | | | |

| Adjusted earnings per share: | | | | | |

| Weighted average common shares - basic | 62,389 | 62,254 | 62,205 | 62,299 | 63,014 |

| Weighted average common shares - diluted | 62,420 | 62,330 | 62,211 | 62,367 | 63,061 |

| | | | | |

| Earnings per share - basic (GAAP) | $ | 0.10 | | $ | (1.45) | | $ | 0.12 | | $ | (0.22) | | $ | 0.16 | |

| Earnings per share - diluted (GAAP) | $ | 0.10 | | $ | (1.45) | | $ | 0.12 | | $ | (0.22) | | $ | 0.16 | |

| | | | | |

| Adjusted earnings per share - basic (non-GAAP) | $ | 0.10 | | $ | 0.09 | | $ | 0.12 | | $ | 0.09 | | $ | 0.16 | |

| Adjusted earnings per share - diluted (non-GAAP) | $ | 0.10 | | $ | 0.09 | | $ | 0.12 | | $ | 0.09 | | $ | 0.16 | |

| | | | | |

| Pre-tax, pre-provision net revenue per share: | | | | | |

| Pre-tax, pre-provision net revenue per share - basic (non-GAAP) | $ | 0.12 | | $ | (1.41) | | $ | 0.15 | | $ | (0.16) | | $ | 0.21 | |

| Pre-tax, pre-provision net revenue per share - diluted (non-GAAP) | $ | 0.12 | | $ | (1.40) | | $ | 0.15 | | $ | (0.16) | | $ | 0.21 | |

| | | | | |

| Adjusted return on average assets: | | | | | |

| Total average assets | $ | 7,688,433 | | $ | 7,695,080 | | $ | 7,851,721 | | $ | 7,944,586 | | $ | 8,019,502 | |

| | | | | |

| Return on average assets (GAAP) | 0.32 | % | -4.68 | % | 0.38 | % | -0.70 | % | 0.49 | % |

| Adjusted return on average assets (non-GAAP) | 0.32 | % | 0.29 | % | 0.38 | % | 0.27 | % | 0.49 | % |

| | | | | |

| Adjusted return on average equity: | | | | | |

| Total average equity | $ | 750,678 | | $ | 751,070 | | $ | 844,782 | | $ | 838,714 | | $ | 862,128 | |

| | | | | |

| Return on average equity (GAAP) | 3.25 | % | -47.97 | % | 3.50 | % | -6.59 | % | 4.57 | % |

| Adjusted return on average equity (non-GAAP) | 3.25 | % | 2.98 | % | 3.50 | % | 2.54 | % | 4.57 | % |

Kearny Financial Corp.

Reconciliation of GAAP to Non-GAAP

(Unaudited)

| | | | | | | | | | | | | | | | | |

| Three Months Ended |

(Dollars and Shares in Thousands,

Except Per Share Data) | September 30,

2024 | June 30,

2024 | March 31,

2024 | December 31,

2023 | September 30,

2023 |

| Adjusted return on average tangible equity: | | | | | |

| Total average equity | $ | 750,678 | | $ | 751,070 | | $ | 844,782 | | $ | 838,714 | | $ | 862,128 | |

| Less: average goodwill | (113,525) | | (113,525) | | (210,895) | | (210,895) | | (210,895) | |

| Less: average other intangible assets | (1,886) | | (2,006) | | (2,138) | | (2,277) | | (2,411) | |

| Total average tangible equity | $ | 635,267 | | $ | 635,539 | | $ | 631,749 | | $ | 625,542 | | $ | 648,822 | |

| | | | | |

| Return on average tangible equity (non-GAAP) | 3.89 | % | 3.33 | % | 4.68 | % | -8.84 | % | 6.07 | % |

| Adjusted return on average tangible equity (non-GAAP) | 3.89 | % | 3.58 | % | 4.68 | % | 3.41 | % | 6.07 | % |

| | | | | |

| Adjusted non-interest expense ratio: | | | | | |

| Non-interest expense (GAAP) | $ | 29,786 | | $ | 126,551 | | $ | 29,059 | | $ | 29,767 | | $ | 29,774 | |

| Non-recurring transactions: | | | | | |

| | | | | |

| | | | | |

| | | | | |

| Goodwill impairment | — | | (97,370) | | — | | — | | — | |

| Non-interest expense (non-GAAP) | $ | 29,786 | | $ | 29,181 | | $ | 29,059 | | $ | 29,767 | | $ | 29,774 | |

| | | | | |

| Non-interest expense ratio (GAAP) | 1.55 | % | 6.58 | % | 1.48 | % | 1.50 | % | 1.49 | % |

| Adjusted non-interest expense ratio (non-GAAP) | 1.55 | % | 1.52 | % | 1.48 | % | 1.50 | % | 1.49 | % |

| | | | | |

| Adjusted efficiency ratio: | | | | | |

| Non-interest expense (non-GAAP) | $ | 29,786 | | $ | 29,181 | | $ | 29,059 | | $ | 29,767 | | $ | 29,774 | |

| | | | | |

| Net interest income (GAAP) | $ | 32,446 | | $ | 33,276 | | $ | 34,319 | | $ | 35,839 | | $ | 39,160 | |

| Total non-interest income (GAAP) | 4,626 | | 5,806 | | 4,203 | | (16,012) | | 4,010 | |

| Non-recurring transactions: | | | | | |

| Net effect of sale and call of securities | — | | — | | — | | 18,135 | | — | |

| | | | | |

| Net effect of bank-owned life insurance restructure | — | | 392 | | — | | 573 | | — | |

| Total revenue (non-GAAP) | $ | 37,072 | | $ | 39,474 | | $ | 38,522 | | $ | 38,535 | | $ | 43,170 | |

| | | | | |

| Efficiency ratio (GAAP) | 80.35 | % | 323.81 | % | 75.43 | % | 150.13 | % | 68.97 | % |

| Adjusted efficiency ratio (non-GAAP) | 80.35 | % | 73.92 | % | 75.43 | % | 77.25 | % | 68.97 | % |

OCTOBER 24, 2024 I N V E S T O R P R E S E N T A T I O N F I R S T Q U A R T E R F I S C A L 2 0 2 5 Exhibit 99.1

Forward Looking Statements & Financial Measures 2 This presentation may include certain “forward-looking statements,” which are made in good faith by Kearny Financial Corp. (the “Company”) pursuant to the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are subject to risks and uncertainties, such as statements of the Company’s plans, objectives, expectations, estimates and intentions that are subject to change based on various important factors (some of which are beyond the Company’s control). In addition to the factors described under Item 1A. Risk Factors in the Company’s Annual Report on Form 10-K, and subsequent filings with the Securities and Exchange Commission, the following factors, among others, could cause the Company’s financial performance to differ materially from the plans, objectives, expectations, estimates and intentions expressed in such forward-looking statements: • the strength of the United States economy in general and the strength of the local economy in which the Company conducts operations, • the effects of, and changes in, trade, monetary and fiscal policies and laws, including interest rate policies of the Board of Governors of the Federal Reserve System, inflation, interest rates, market and monetary fluctuations, • the impact of changes in laws, regulations and government policies regarding financial institutions (including laws concerning taxation, banking, securities and insurance), • changes in accounting policies and practices, as may be adopted by regulatory agencies, the Financial Accounting Standards Board (“FASB”) or the Public Company Accounting Oversight Board, • technological changes, • competition among financial services providers, and • the success of the Company at managing the risks involved in the foregoing and managing its business. The Company cautions that the foregoing list of important factors is not exhaustive. Readers should not place any undue reliance on any forward looking statements, which speak only as of the date made. The Company does not undertake any obligation to update any forward-looking statement, whether written or oral, that may be made from time to time by or on behalf of the Company. This presentation contains financial information determined by methods other than in accordance with accounting principles generally accepted in the United States of America (“GAAP”). Management uses these “non-GAAP” measures in its analysis of the Company’s performance. Management believes these non-GAAP financial measures allow for better comparability of period to period operating performance. Additionally, the Company believes this information is utilized by regulators and market analysts to evaluate a company’s financial condition and therefore, such information is useful to investors. These disclosures should not be viewed as a substitute for operating results determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies. A reconciliation of the non-GAAP measures used in this presentation to the most directly comparable GAAP measures is provided in the Appendix to this presentation.

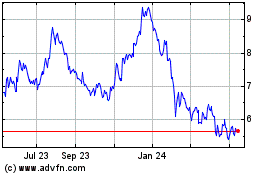

Kearny Financial Corp. Company Overview NASDAQ: KRNY Founded: 1884 Assets: $7.8 billion Loans $5.8 billion Deposits $5.5 billion TBV Per Share: $9.85 Market Cap: $443.7 million1 1 As of June 30, 2024 2 As of June 30, 2024 Source: S&P Global Market Intelligence & Company Filings 3 Branch/Office Footprint Company Profile Top 10 New Jersey-based financial institution by assets & deposits 43 full-service branches in 12 counties throughout New Jersey and New York City Active acquirer, having completed 7 whole-bank acquisitions since 1999 Focus is on helping our clients achieve their financial goals for today and aspirations for tomorrow – creating communities that thrive. Source: Company Filings 1 As of September 30, 2024.

4 Founded Kearny, NJ 1884 Obtained Federal Charter 1941 South Bergen Savings Bank Acquired 1999 Pulaski Bancorp Acquired 2003 West Essex Bank Acquired 2004 Completed First-Step Mutual Conversion & IPO of $218.2M 2005 Central Jersey Bancorp Acquired 2011 Atlas Bank Acquired 2014 Formed the KearnyBank foundation funded with $10M 2015 Completed Second-Step Conversion and $717.5M Stock Offering 2015 Converted to NJ State - Chartered Savings Bank 2017 Clifton Bancorp Acquired 2018 MSB Financial Corp. Acquired 2020 Introduced Private Client Services 2021 Established Kearny Investment Services 2022 140 Years: Franchise Milestones “Serving our Communities and Clients”

1Q25 Financial Highlights 1 GAAP to Adjusted reconciliation on page 18. 2 Excludes Yield Adjustments. Source: Company Filings. 5 Net Income GAAP Adjusted1 $6.1 million $6.1 million Diluted EPS GAAP Adjusted1 $0.10 $0.10 Net Interest Income CET-1 Ratio $32.4 million 14.60% Total Assets $7.8 billion Total Deposits Total Loans2 $5.5 billion $5.8 billion ASSET QUALITY Asset quality remains strong as non- performing assets improved to 0.51% of total assets compared to 0.52% in the quarter ended June 30, 2024. Net charge-offs totaled $124,000, or 0.01% of average loans, on an annualized basis, for the quarter ended September 30, 2024, which remains relatively low compared to peers in the industry. EARNINGS Reported net income for the quarter ended September 30, 2024 of $6.1 million, or $0.10 per diluted share. Despite a four-basis point contraction to 1.80% for the quarter ended September 30, 2024, our net interest margin improved each month within the quarter. BALANCE SHEET Total assets were $7.8 billion at September 30, 2024, an increase of $88.9 million, or 1.2%, from June 30, 2024 with loans increasing $51.5 million, or 0.9%, from June 30, 2024. Total Deposits & Borrowings increased $82.5 million, net of the reallocation of FHLB advances into brokered CDs driven by more favorable economics of brokered CDs to advances. CAPITAL Common Equity Tier 1 Capital ratio of 14.60%, as of September 30, 2024, remains in excess of regulatory minimums and peer comparisons.

Capital Strength Equity Capitalization Level 1 Kearny Financial Corp. (NASDAQ: KRNY) Regulatory Capital Ratios as of September 30, 2024 are preliminary. 2 Equity to Asset ratio, for September 30, 2024 going forward, was impacted by previously disclosed goodwill impairment. Source: Company Filings. 6 Regulatory Capital Ratios1,2 8.20% 8.26% 8.34% 8.43% 8.31% 10.65% 10.74% 10.83% 9.81% 9.67% 1Q24 2Q24 3Q24 4Q24 1Q25 Tangible Common Equity / Tangible Assets Equity / Assets 2 9.14% 14.60% 14.60% 15.46% 5.00% 6.50% 8.00% 10.00% Tier 1 Leverage Common Equity Tier 1 Tier 1 Risk-Based Capital Total Risk-Based Capital KRNY Well Capitalized Regulatory Minimum

Track Record of Strong Credit Performance 1 Data provided by Federal Reserve Bank of St. Louis. Source: Company Filings. 7 From 2006 to 2023, inclusive of the Global Financial Crisis and the COVID-19 Pandemic, KRNY’s net charge-offs to average total loans totaled 9 bps per year compared to 48 bps for all commercial banks (US Banks not among the top 100)1. Net Charge-offs to Average Total Loans 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 1Q25 Commercial Banks (not among top 100) KRNY Global Financial Crisis Hurricane Sandy COVID-19 Pandemic Cumulative charge-offs for KRNY between 2006 and 1Q25 were minimal, totaling $38.7 million.

Diversified Loan Portfolio Loan Composition1 Geographic Distribution1 Loan Trend 1 As of September 30, 2024. Source: S&P Global Market Intelligence & Company Filings. 8 ($ millions) $1,689 $1,746 $1,742 $1,756 $1,768 $2,699 $2,651 $2,645 $2,646 $2,646 $947 $947 $966 $948 $951 $5,760 $5,757 $5,775 $5,749 $5,786 1Q24 2Q24 3Q24 4Q24 1Q25 1-4 Family Home Equity Multi-family CRE Construction C&I New York 33.5% New Jersey 55.7% Pennsylvania 5.9% Other 4.9% 1-4 Family 30.6% Home Equity 0.8% Multi-family 45.7% CRE 16.4% Construction 3.9% C&I 2.5% QTD Yield on Loans 4.61% LTV 60.9%

Multifamily Loan Portfolio Multifamily Loan Portfolio Composition1 New York City (“NYC”) Multifamily1 Source: Company Filings 1 As of September 30, 2024. 9 Outstanding asset quality over multiple credit cycles Less than half of our Multifamily portfolio is collateralized by properties in NYC Only 5.5% of our Multifamily portfolio is collateralized by majority or fully rent-regulated NYC properties There is a minimal amount of maturing or repricing NYC Multifamily loans in calendar 2024 and 2025 66.4% of the Company’s NYC Multifamily portfolio is located in Brooklyn, NY NYC Multifamily Loan Portfolio Loan Value % Brooklyn $816 66.4% Queens 155 12.6% Manhattan 140 11.4% Bronx 117 9.5% Total NYC MF Loan Portfolio $1,229 100.0% Observations Majority NYC Free Market 40.9% Outside NYC 53.6% Fully NYC Rent Regulated 2.2% Majority NYC Rent Regulated 3.3%Total MF $2.6B NYC Multifamily Portfolio: $1.2 billion Average Loan Balance: $3.48 million Weighted Average LTV: 62.1% Nonperforming Loans / Total MF Loans: 0.83% Oct to Dec 2024 Maturity & Repricing: $25.8 million Calendar Year 2025 Maturity & Repricing: $115.3 million

CRE Loan Detail Source: Company Filings. 1 As of September 30, 2024. 10 CRE Portfolio by Collateral Type1 CRE Loan Geographic Distribution1 Retail 34.1% Mixed Use 28.5% Office 11.3% Industrial 16.6% Specialty & Other 5.1% Medical 4.4% New Jersey 56.7% Brooklyn 9.3% New York (Ex. Brooklyn) 25.8% Pennsylvania 4.8% Other 3.4% Total CRE $951M LTV 52.5%

Office Portfolio 1 As of September 30, 2024. Source: Company Filings. 11 Office Portfolio by Contractual Maturity1 Office Portfolio Profile 11.3% of total CRE portfolio or $107 million Average loan size of $1.6 million ($ millions) Office Loan Geographic Distribution1 $0 $3 $9 $35 $18 $9 $31 $0 $10 $20 $30 $40 2024 2025 2026 2027 2028 2029 2030+ Manhattan 21.7% New York (Excl. Manhattan) 6.1% New Jersey 69.4% Other 2.9% LTV 47.9% DSCR 1.9x Total Office $107M

Asset Quality Metrics Non-Performing Assets / Total Assets Non-Performing Loans1 Allowance for Credit Losses 1 As of September 30, 2024; amounts shown in millions. Source: S&P Global Market Intelligence & Company Filings. 12 Net Charge-Offs / Average Loans $ in millions 0.64% 0.63% 0.50% 0.52% 0.51% 0.45% 0.55% 0.65% 0.75% 1Q24 2Q24 3Q24 4Q24 1Q25 Multi-family $22.0 CRE $9.2 C&I $0.6 1-4 Family $8.1 0.15% 0.29% 0.02% 0.25% 0.01% 0.00% 0.10% 0.20% 0.30% 0.40% 1Q24 2Q24 3Q24 4Q24 1Q25 Increase driven by a single commercial real estate relationship Increase driven by a single C&I relationship $45.0 $44.7 $44.7 $44.1 $44.2 $1.9 $0.2 $0.2 $0.9 $0.8 0.81% 0.78% 0.78% 0.78% 0.78% 0.00% 0.20% 0.40% 0.60% 0.80% 1.00% $0.0 $20.0 $40.0 $60.0 $80.0 $100.0 1Q24 2Q24 3Q24 4Q24 1Q25 ACL Balance - Collectively Evaluated ACL Balance - Individually Analyzed ACL to Total Loans Receivable NPL’s $39.9M

Granular Deposit Franchise 1 As of September 30, 2024. 2 Excludes wholesale and state & local government deposits. Source: S&P Global Market Intelligence & Company Filings. 13 Deposit Trend Non-Maturity Deposit Mix1 ($ millions) $1,300 $1,284 $1,235 $1,199 $1,216 $612 $458 $408 $408 $733 $689 $646 $630 $643 $682 $2,237 $2,347 $2,350 $2,309 $2,248 $595 $584 $586 $598 $592 $5,434 $5,320 $5,209 $5,158 $5,471 1Q24 2Q24 3Q24 4Q24 1Q25 Retail CDs Wholesale CDs Savings Interest Bearing DDA Non-interest Bearing DDA Consumer 64.2% Commercial 22.0% Government 13.8% 22.2% 13.4% 12.5% 41.1% 10.8% Deposit Composition Product # of Accounts Balance ($ millions) Average Balance per Account Checking 52,843 $ 2,361 $ 44,684 Savings 30,590 $ 674 22,018 CDs 24,707 $ 1,212 49,079 Total Retail Deposits 108,140 $ 4,247 $ 39,276 Deposit Segmentation1,2

Liquidity Available for Uninsured Deposits Estimated Uninsured Deposits Analysis1,2 1 Estimated amount of uninsured deposits reported in September 30, 2024 Call Report. 2 As of September 30, 2024. 14 Available liquidity is 2.7x greater than estimated uninsured deposits (excluding items above) Liquidity Capacity2 1 Estimated Uninsured Deposit Analysis ($ millions) Estimated Uninsured Deposits 1,800$ Less: Collateralized State & Local Government Deposits (475) Less: Bank's wholly-owned subsidiary & Holding Company Deposits (552) Estimated uninsured deposits excluding items above: 773$ Total Deposits 5,471$ Estimated uninsured deposits, excluding items above, as a % of Total Deposits 14.1% Sources of Liquidity ($ millions) Liquidity Capacity Funding Utilized Available Capacity Internal Sources: Free Securities and other 63$ -$ 63$ External Sources: FRB 764 100 664 FHLB 2,459 1,126 1,333 Total Liquidity 3,286$ 1,226$ 2,060$

Investment Securities 1 As of September 30, 2024. 2 Comprised entirely of securitized federal education loans with 97% U.S. government guarantees. 3 Assumes 29% marginal tax rate. Source: S&P Global Market Intelligence & Company Filings. 15 Securities Composition1 Securities Average Balance & Yield Trend Total Effective Duration ≈ 3.2 years Floating rate securities ≈ 36.6% At September 30, 2024, the after-tax net unrecognized loss on securities held-to-maturity was $11.0 million, or 1.73% of tangible equity3 Corporate Bonds 11.1% CLO 31.4% ABS Student Loans 6.2% Agency MBS 50.4% Municipal Bonds 1.0% AFS 89.0% HTM 11.0% $1,532 $1,524 $1,397 $1,357 $1,327 4.27% 4.42% 4.46% 4.39% 4.36% 1Q24 2Q24 3Q24 4Q24 1Q25 Securities Portfolio Yield on Investments AFS/HTM & Effective Duration ($ millions) 2

Best-in-Class Operating Efficiency 1 Adjusted for non-routine transactions. GAAP to Adjusted reconciliation on page 19 Source: S&P Global Market Intelligence & Company Filings. 16 Adjusted Non-interest Expense to Average Assets1 Deposits per Branch 1.76% 1.73% 1.61% 1.55% 1.62% 1.69% 1.51% 1.50% 1.55% 2017 2018 2019 2020 2021 2022 2023 2024 1Q25 $68 $74 $75 $96 $114 $130 $131 $120 $127 1 21 41 61 81 101 121 2017 2018 2019 2020 2021 2022 2023 2024 1Q25 1.9x ($ millions)

17 Conservative Underwriting Culture Comprehensive CRE / Multifamily Underwriting Highly disciplined LTV and DSCR standards Interest rates stressed a minimum of +300bps at origination DSCR based on in-place rents, not projections, with conservative allowances for vacancy NOI underwritten to include forecasted expense increases and full taxes (where a tax abatement exists) Approval Authority & Underwriting Consistency Lending authority aggregated by borrower/group of related borrowers Technology ensures consistent and efficient underwriting and risk rating process Multi-faceted Loan Review & Stress Testing Semi-annual third-party loan-level stress testing and annual capital-based stress testing Quarterly third-party portfolio loan review with 65% of total portfolio reviewed on an annual basis Annual internal loan reviews on all commercial loans with balances of $2.5 million or greater Proactive Workout Process Dedicated team of portfolio managers and loan workout specialists Weekly meetings comprised of loan officers, credit personnel and special assets group to pre-emptively address delinquencies or problem credits Philosophy of aggressively addressing impaired assets in a timely fashion Senior Credit Officer Approval Management Loan Committee Approval Board Loan Committee Approval

Non-GAAP Reconciliation 18 Reconciliation of GAAP to Non-GAAP For the quarter ended For the quarter ended For the quarter ended For the quarter ended For the quarter ended (Dollars and Shares in Thousands, Except Per Share Data) September 30, 2024 June 30, 2024 March 31, 2024 December 31, 2023 September 30, 2023 Adjusted net income: Net income (loss) (GAAP) $6,092 ($90,079) $7,397 ($13,827) $9,842 Non-recurring transactions - net of tax: Net effect of sale and call of securities - - - 12,876 - Net effect of bank-owned life insurance restructure - 392 - 6,286 - Goodwill impairment - 95,283 - - - Adjusted net income $6,092 $5,596 $7,397 $5,335 $9,842 Calculation of pre-tax, pre-provision net revenue: Net income (loss) (GAAP) $6,092 ($90,079) $7,397 ($13,827) $9,842 Adjustments to net income (GAAP): Provision for income taxes $1,086 ($917) $1,717 $1,782 $3,309 Provision for (reversal of) credit losses $108 $3,527 $349 $2,105 $245 Pre-tax, pre-provision net revenue (non-GAAP) $7,286 ($87,469) $9,463 ($9,940) $13,396 Adjusted earnings per share: Weighted average common shares - basic 62,389 62,254 62,205 62,299 63,014 Weighted average common shares - diluted 62,420 62,330 62,211 62,367 63,061 Earnings per share - basic (GAAP) $0.10 ($1.45) $0.12 ($0.22) $0.16 Earnings per share - diluted (GAAP) $0.10 ($1.45) $0.12 ($0.22) $0.16 Adjusted earnings per share - basic (non-GAAP) $0.10 $0.09 $0.12 $0.09 $0.16 Adjusted earnings per share - diluted (non-GAAP) $0.10 $0.09 $0.12 $0.09 $0.16 Pre-tax, pre-provision net revenue per share: Pre-tax, pre-provision net revenue per share - basic (non-GAAP) $0.12 ($1.41) $0.15 ($0.16) $0.21 Pre-tax, pre-provision net revenue per share - diluted (non-GAAP) $0.12 ($1.40) $0.15 ($0.16) $0.21 Adjusted return on average assets: Total average assets $7,688,433 $7,695,080 $7,851,721 $7,944,586 $8,019,502 Return on average assets (GAAP) 0.32% -4.68% 0.38% -0.70% 0.49% Adjusted return on average assets (non-GAAP) 0.32% 0.29% 0.38% 0.27% 0.49% Adjusted return on average equity: Total average equity $750,678 $751,070 $844,782 $838,714 $862,128 Return on average equity (GAAP) 3.25% -47.97% 3.50% -6.59% 4.57% Adjusted return on average equity (non-GAAP) 3.25% 2.98% 3.50% 2.54% 4.57%

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(g) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection g

| Name: |

dei_Security12gTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |