Johnson Outdoors Inc - Current report filing (8-K)

February 19 2008 - 11:56AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of

the

Securities Exchange Act of 1934

Date of

Report (Date of earliest event reported):

February 12,

2008

|

Johnson

Outdoors Inc.

|

|

(Exact

name of registrant as specified in its

charter)

|

|

Wisconsin

|

|

0-16255

|

|

39-1536083

|

|

(State

or other jurisdiction of incorporation)

|

|

(Commission

File Number)

|

|

(IRS

Employer Identification No.)

|

|

555

Main Street, Racine, Wisconsin 53403

|

|

(Address

of principal executive offices, including zip

code)

|

|

(262)

631-6600

|

|

(Registrant's

telephone number, including area

code)

|

|

Not

Applicable

|

|

(Former

name or former address, if changed since last

report)

|

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following

provisions:

|

£

|

Written communications pursuant

to Rule 425 under the Securities Act (17 CFR

230.425)

|

|

£

|

Soliciting material pursuant to

Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12)

|

|

£

|

Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR

240.14d-2(b))

|

|

£

|

Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR

240.13e-4(c))

|

Section

1 - Registrant's Business and Operations

|

Item

1.01

|

Entry

into a Material Definitive

Agreement

|

On

February 12, 2008, Johnson Outdoors, Inc. (the "Company") entered into a

Term Loan Agreement, dated as of February 12, 2008 (the Term Loan Agreement”),

with JPMorgan Chase Bank N.A., as lender and agent and the other lenders named

therein. On the same date, the Company entered into an Amended and

Restated Credit Agreement (the "Amended Credit Agreement"), with JPMorgan Chase

Bank, N.A., as lender and agent, and the other lenders named therein. This

amendment updates the Company's October 7, 2005 credit facility.

The new credit facility consists of a

$60 million term loan maturing in five years from the date of the Term Loan

Agreement. The term loan bears interest at a LIBOR rate plus an applicable

margin. The applicable margin is based on the Company’s ratio of consolidated

debt to earnings before interest, taxes, depreciation and amortization (EBITDA)

and varies between 1.25% and 2.00%. At February 12, 2008, the margin in effect

was 1.50% for LIBOR loans. Under the terms of the credit facility, the Company

will be required to comply with certain financial and non-financial covenants.

Among other restrictions, the Company will be restricted in its ability to pay

dividends, incur additional debt and make acquisitions above certain amounts.

The key financial covenants include minimum fixed charge coverage and leverage

ratios. The most significant changes to the previous covenants include the

minimum fixed charge coverage ratio increasing from 2.0 to 2.25 and the pledge

of 65% of the shares of material foreign subsidiaries.

The Term

Loan Agreement is attached hereto as Exhibit 99.1 and is incorporated

herein by reference. The Amended Credit Agreement is attached

hereto as Exhibit 99.2 and is incorporated herein by

reference.

Section

2 - Financial Information

|

Item

2.03

|

Creation

of a Direct Financial Obligation or an Obligation under an Off-Balance

Sheet Arrangement of a Registrant

|

On

February 12, 2008, the Company became obligated on a direct financial obligation

pursuant to the Term Loan Agreement, as described in Item 1.01

above.

Section

9 - Financial Statements and Exhibits

|

Item

9.01

|

Financial

Statements and Exhibits

|

(d) Exhibits

The

following exhibits are filed herewith:

Exhibit 99.1

– Term Loan Agreement, dated as of

February 12, 2008, among Johnson Outdoors, Inc., JPMorgan Chase Bank, N.A.,

as lender and agent, and the other lenders named therein.

Exhibit 99.2

- Amended and Restated Credit Agreement,

dated as of February 12, 2008, among Johnson Outdoors, Inc., JPMorgan Chase

Bank, N.A., as lender and agent, and the other lenders named

therein.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has

duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

|

|

|

JOHNSON

OUTDOORS INC.

|

|

|

|

|

|

|

|

|

|

|

|

Date: February

19, 2008

|

|

By:

|

/s/

David

W.

Johnson

|

|

|

|

|

David

W. Johnson, Vice President and Chief Financial

Officer

|

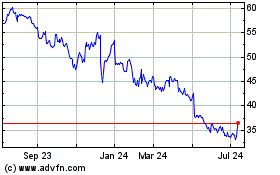

Johnson Outdoors (NASDAQ:JOUT)

Historical Stock Chart

From Dec 2024 to Jan 2025

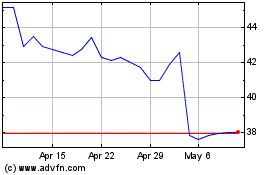

Johnson Outdoors (NASDAQ:JOUT)

Historical Stock Chart

From Jan 2024 to Jan 2025