Johnson Outdoors Inc. Announces Fiscal 2006 First Quarter Results

January 26 2006 - 6:00AM

Business Wire

Johnson Outdoors Inc. (Nasdaq:JOUT), a leading global outdoor

recreation company, today announced net sales of $72.6 million for

the first quarter ended December 30, 2005, a decrease of 3%

compared to $75.0 million for the prior year quarter. Net income

was slightly down year-over-year with a net loss of $1.1 million

this quarter versus a net loss of $1.0 million in the prior year

period. Net earnings were flat at $0.12 per diluted share in both

this and the prior year quarter. FIRST QUARTER RESULTS Quarterly

sales are historically lowest during the first fiscal quarter when

the Company is ramping up for the primary selling period of its

seasonal outdoor recreation products. Excluding the anticipated

$4.6 million decline in military tent revenue, total Company sales

would have been up $2.2 million. Key changes included: --

Watercraft continued its positive momentum with sales 2% ahead of

last year's first quarter due to the favorable reception of new

products. -- Marine Electronics had an 8% increase in quarterly

sales due primarily to the continued growth of Humminbird(R), and

the acquisition of Cannon(R) and Bottomline(R) brands completed on

October 3, 2005 which added $1.2 million in sales to the division

during the period. -- Diving revenues declined 3% due to

unfavorable currency translation. -- Outdoor Equipment revenues

decreased 23% due entirely to a 29% decline in military sales from

the prior year quarter. Total Company operating loss of $0.8

million in the first quarter compared unfavorably to an operating

loss of $0.1 million in the prior year quarter. Key impacts were

from: -- The significant drop in military sales compared with the

prior year quarter, resulting in a $1.8 million decline in Outdoor

Equipment operating profits. -- Increased spending in R&D and

marketing in Marine Electronics, which has now fully integrated the

Cannon(R) and Bottomline(R) brands. The Company reported a net loss

during the seasonally slow first quarter of $1.1 million or $0.12

per diluted share. This compares to a net loss of $1.0 million, or

$0.12 per diluted share, in the same quarter last year. The

Company's tax rate was 38.7% versus 1.4% in the prior year quarter

due to the non-deductibility of expenses associated with the

terminated buy-out proposal in the prior year quarter. "While first

quarter results are not indicative of the year's overall

performance, we are very pleased with the favorable reception

to-date for our 2006 new product line-up. Overall, about a third of

total Company net sales this quarter came from new products in our

core consumer brands, which is helping to offset the anticipated

decline in the non-core military segment. We have built capability

and capacity to strengthen operations, and a healthy new product

pipeline to help drive profitable growth and enhance long-term

shareholder value. I remain excited about the future of Johnson

Outdoors," said Helen Johnson-Leipold, Chairman and Chief Executive

Officer. "Importantly, our strong cash position continues to enable

us to capitalize on strategic growth opportunities when they arise,

such as the acquisition of Cannon(R) and Bottomline(R) brands this

quarter. We added brands and sales without adding complexity or

infrastructure ensuring a rapid and efficient integration to better

capture and maximize existing synergies." OTHER FINANCIAL

INFORMATION The Company's debt to total capitalization stood at 29%

at the end of the quarter versus 25% at December 31, 2004. Debt,

net of cash, was $20.6 million at the end of this quarter versus

$19.8 million in the prior year quarter. Depreciation and

amortization was $2.2 million year-to-date, slightly lower than

last year's $2.6 million in the first quarter. Capital spending

totaled $1.5 million in the quarter compared with $1.7 million in

the same period last year. "A healthy balance sheet and solid cash

position give us a strong financial foundation on which to build as

we enter our main selling season. Strict inventory management is a

key focus across all divisions, which, aided in part by favorable

currency translation, resulted in a $2.8 million reduction in total

Company inventory this quarter despite the addition of the

Cannon(R) and Bottomline(R) brand assets. Overall, currency

translation had a net unfavorable impact on sales of -1.4% and a

negligible unfavorable impact on profit. While the prior year

quarter included $0.9 million of expenses associated with the

terminated buy-out proposal, there were no one-time items that had

a material impact on earnings this quarter," said David W. Johnson,

Vice President and Chief Financial Officer. MILITARY UPDATE The

quarterly decline in military sales is consistent with the

Company's stated projections throughout fiscal 2004 and 2005. No

military tent orders or contracts were received during the first

quarter of fiscal 2006. At this time, the Company continues to

expect fiscal 2006 military sales to be in the $30 - $40 million

range. INNOVATION UPDATE Johnson Outdoors delivers meaningful

innovation to the outdoor recreation marketplace driven by unique

consumer insights. The Company's new product designers utilize

sophisticated, rapid-prototyping technology to ensure continuous

consumer feedback from product concept to commercialization. Smart

innovation also delivers meaningful results, with new products this

quarter representing about a third of total Company revenue. This

was led by the Marine Electronics and Watercraft divisions, both of

which reported about 40% of net sales from new products, such as:

-- The new Humminbird(R) 700 and 300 series of products, both

offering higher resolution screen technology, and new industrial

design housing for easy dashboard mounting to enhance the appeal in

the OEM channel (boat manufacturers). Unique to the 700 series is

Hemispherical Viewing(TM) technology that provides crystal clear,

page-like viewing from every angle and in every level of sunlight.

-- The Old Town(R) Dirigo(TM), named 2005 recreational kayak of the

year by Paddler Magazine, generated 25% of the brand's kayak sales

in fiscal 2005 and production capacity has been increased this year

to keep up with the continued high consumer demand. Two new

additions to the Necky(R) Manitou(TM) series of touring kayaks are

generating excitement in the marketplace: a 14-footer for greater

stability for beginning paddlers, and the Manitou II(TM), the first

tandem kayak in the series. WEBCAST The Company will host a

conference call and audio web cast on Thursday, January 26, 2006 at

10:00 a.m. Central Time. A live listen-only web cast of the

conference call may be accessed at Johnson Outdoors' home page. A

replay will also be available on Johnson Outdoors' home page, or by

dialing (888) 286-8010 or (617) 801-6888 and providing confirmation

code 86959537. The replay will be available through February 2,

2006 by phone and for 30 days on the Internet. ABOUT JOHNSON

OUTDOORS INC. Johnson Outdoors is a leading global outdoor

recreation company that turns ideas into adventure with innovative,

top-quality products. The Company designs, manufactures and markets

a portfolio of winning, consumer-preferred brands across four

categories: Watercraft, Marine Electronics, Diving and Outdoor

Equipment. Johnson Outdoors' familiar brands include, among others:

Old Town(R) canoes and kayaks; Ocean Kayak(R) and Necky(R) kayaks;

Escape(R) electric boats; Minn Kota(R) motors; Cannon(R)

downriggers; Humminbird(R), Bottomline(R) and Fishin' Buddy(R)

fishfinders; Scubapro(R) and UWATEC(R) dive equipment; Silva(R)

compasses and digital instruments; and Eureka!(R) tents. Visit us

on line at http://www.johnsonoutdoors.com SAFE HARBOR STATEMENT

Certain matters discussed in this press release are

"forward-looking statements," intended to qualify for the safe

harbors from liability established by the Private Securities

Litigation Reform Act of 1995. Statements other than statements of

historical fact are considered forward-looking statements. Such

forward-looking statements are subject to certain risks and

uncertainties, which could cause actual results or outcomes to

differ materially from those currently anticipated. Factors that

could affect actual results or outcomes include changes in consumer

spending patterns; the Company's success in implementing its

strategic plan, including its focus on innovation; actions of

companies that compete with the Company; the Company's success in

managing inventory; movements in foreign currencies or interest

rates; the Company's success in restructuring of its European

Diving operations; unanticipated issues related to the Company's

military tent business; the success of suppliers and customers; the

ability of the Company to deploy its capital successfully; adverse

weather conditions; events related to the terminated Buy-Out

transaction; and other risks and uncertainties identified in the

Company's filings with the Securities and Exchange Commission.

Shareholders, potential investors and other readers are urged to

consider these factors in evaluating the forward-looking statements

and are cautioned not to place undue reliance on such

forward-looking statements. The forward-looking statements included

herein are only made as of the date of this press release and the

Company undertakes no obligation to publicly update such

forward-looking statements to reflect subsequent events or

circumstances. - - - FINANCIAL TABLES FOLLOW - - - -0- *T JOHNSON

OUTDOORS INC. AND SUBSIDIARIES (thousands, except per share

amounts)

----------------------------------------------------------------------

Operating Results THREE MONTHS ENDED

----------------------------------------------------------------------

Dec 30 Dec 31 2005 2004

----------------------------------------------------------------------

Net sales $72,563 $74,982 Cost of sales 43,134 44,710

----------------------------------------------------------------------

Gross profit 29,429 30,272 Operating expenses 30,241 30,347

----------------------------------------------------------------------

Operating loss (812) (75) Interest expense, net 903 1,090 Other

expenses (income), net 69 (119)

----------------------------------------------------------------------

Loss before income taxes (1,784) (1,046) Income tax benefit (690)

(15)

----------------------------------------------------------------------

Net loss $(1,094) $(1,031)

----------------------------------------------------------------------

Net loss basic and diluted per common share $(0.12) $(0.12)

----------------------------------------------------------------------

Diluted average common shares outstanding 8,977 8,599

----------------------------------------------------------------------

Segment Results Net sales: Marine electronics $29,974 $27,851

Outdoor equipment 14,524 18,851 Watercraft 12,284 12,066 Diving

15,818 16,324 Other/eliminations (37) (108)

----------------------------------------------------------------------

Total $72,563 $74,982

----------------------------------------------------------------------

Operating profit (loss): Marine electronics $2,416 $2,887 Outdoor

equipment 1,648 3,408 Watercraft (2,491) (2,819) Diving 66 (136)

Other/eliminations (2,451) (3,415)

----------------------------------------------------------------------

Total $(812) $(75)

----------------------------------------------------------------------

Balance Sheet Information (End of Period) Cash and short-term

investments $45,206 $34,980 Accounts receivable, net 62,465 57,736

Inventories, net 62,704 65,523 Total current assets 184,353 177,095

Total assets 286,247 278,117 Short-term debt 45,000 17,024 Total

current liabilities 91,713 64,508 Long-term debt 20,800 37,800

Shareholders' equity 163,918 168,259

----------------------------------------------------------------------

*T

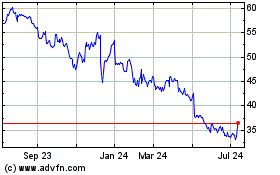

Johnson Outdoors (NASDAQ:JOUT)

Historical Stock Chart

From Dec 2024 to Jan 2025

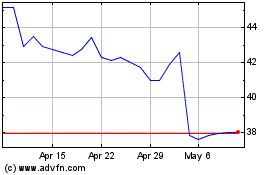

Johnson Outdoors (NASDAQ:JOUT)

Historical Stock Chart

From Jan 2024 to Jan 2025