0000885307

false

2023

FY

0000885307

2022-09-01

2023-08-31

0000885307

2023-02-28

0000885307

2023-11-27

0000885307

2023-08-31

0000885307

2022-08-31

0000885307

2021-09-01

2022-08-31

0000885307

us-gaap:CommonStockMember

2021-08-31

0000885307

us-gaap:AdditionalPaidInCapitalMember

2021-08-31

0000885307

us-gaap:RetainedEarningsMember

2021-08-31

0000885307

2021-08-31

0000885307

us-gaap:CommonStockMember

2022-08-31

0000885307

us-gaap:AdditionalPaidInCapitalMember

2022-08-31

0000885307

us-gaap:RetainedEarningsMember

2022-08-31

0000885307

us-gaap:CommonStockMember

2021-09-01

2022-08-31

0000885307

us-gaap:AdditionalPaidInCapitalMember

2021-09-01

2022-08-31

0000885307

us-gaap:RetainedEarningsMember

2021-09-01

2022-08-31

0000885307

us-gaap:CommonStockMember

2022-09-01

2023-08-31

0000885307

us-gaap:AdditionalPaidInCapitalMember

2022-09-01

2023-08-31

0000885307

us-gaap:RetainedEarningsMember

2022-09-01

2023-08-31

0000885307

us-gaap:CommonStockMember

2023-08-31

0000885307

us-gaap:AdditionalPaidInCapitalMember

2023-08-31

0000885307

us-gaap:RetainedEarningsMember

2023-08-31

0000885307

jctcf:JewettCameronSeedCompanyMember

2022-09-01

2023-08-31

0000885307

jctcf:GreenwoodProductsIncMember

2022-09-01

2023-08-31

0000885307

jctcf:JewettCameronCompanyMember

2022-09-01

2023-08-31

0000885307

srt:MinimumMember

us-gaap:OfficeEquipmentMember

2023-08-31

0000885307

srt:MaximumMember

us-gaap:OfficeEquipmentMember

2023-08-31

0000885307

srt:MinimumMember

us-gaap:EquipmentMember

2023-08-31

0000885307

srt:MaximumMember

us-gaap:EquipmentMember

2023-08-31

0000885307

srt:MinimumMember

us-gaap:BuildingMember

2023-08-31

0000885307

srt:MaximumMember

jctcf:BuildingsMember

2023-08-31

0000885307

jctcf:CarryingAmountMember

2023-08-31

0000885307

jctcf:FairValueMember

2023-08-31

0000885307

jctcf:CarryingAmountMember

2022-08-31

0000885307

jctcf:FairValueMember

2022-08-31

0000885307

us-gaap:FairValueInputsLevel1Member

2023-08-31

0000885307

us-gaap:FairValueInputsLevel2Member

2023-08-31

0000885307

us-gaap:FairValueInputsLevel3Member

2023-08-31

0000885307

2023-09-01

0000885307

jctcf:RestrictedSharePlanMember

2023-08-31

0000885307

jctcf:RestrictedSharePlanMember

jctcf:OfficersDirectorsAndEmployeesMember

2021-09-01

2022-08-31

0000885307

jctcf:RestrictedSharePlanMember

jctcf:OfficersDirectorsAndEmployeesMember

2022-08-31

0000885307

jctcf:EmployeesMember

jctcf:RestrictedSharePlanMember

2021-09-01

2022-08-31

0000885307

jctcf:RestrictedSharePlanMember

srt:ChiefExecutiveOfficerMember

2021-09-01

2022-08-31

0000885307

srt:ChiefExecutiveOfficerMember

jctcf:RestrictedSharePlanMember

2022-08-31

0000885307

jctcf:EmployeesMember

jctcf:RestrictedSharePlanMember

2020-09-01

2021-08-31

0000885307

jctcf:EmployeesMember

jctcf:RestrictedSharePlanMember

2021-08-31

0000885307

jctcf:RestrictedSharePlanMember

2022-09-01

2023-08-31

0000885307

jctcf:RestrictedSharePlanMember

srt:DirectorMember

2022-09-01

2023-08-31

0000885307

jctcf:OfficersAndEmployeesMember

jctcf:RestrictedSharePlanMember

2022-09-01

2023-08-31

0000885307

jctcf:IndustrialWoodProductsMember

2022-09-01

2023-08-31

0000885307

jctcf:IndustrialWoodProductsMember

2021-09-01

2022-08-31

0000885307

jctcf:PetFencingAndOtherMember

2022-09-01

2023-08-31

0000885307

jctcf:PetFencingAndOtherMember

2021-09-01

2022-08-31

0000885307

jctcf:SeedProcessingAndSalesMember

2022-09-01

2023-08-31

0000885307

jctcf:SeedProcessingAndSalesMember

2021-09-01

2022-08-31

0000885307

jctcf:CorporateAndAdministrativeMember

2022-09-01

2023-08-31

0000885307

jctcf:CorporateAndAdministrativeMember

2021-09-01

2022-08-31

0000885307

jctcf:IndustrialWoodProductsMember

2023-08-31

0000885307

jctcf:IndustrialWoodProductsMember

2022-08-31

0000885307

jctcf:PetFencingAndOtherMember

2023-08-31

0000885307

jctcf:PetFencingAndOtherMember

2022-08-31

0000885307

jctcf:SeedProcessingAndSalesMember

2023-08-31

0000885307

jctcf:SeedProcessingAndSalesMember

2022-08-31

0000885307

jctcf:CorporateAndAdministrativeMember

2023-08-31

0000885307

jctcf:CorporateAndAdministrativeMember

2022-08-31

0000885307

country:US

2022-09-01

2023-08-31

0000885307

country:US

2021-09-01

2022-08-31

0000885307

country:CA

2022-09-01

2023-08-31

0000885307

country:CA

2021-09-01

2022-08-31

0000885307

jctcf:MexicoLatinAmericaCaribbeanMember

2022-09-01

2023-08-31

0000885307

jctcf:MexicoLatinAmericaCaribbeanMember

2021-09-01

2022-08-31

0000885307

srt:EuropeMember

2022-09-01

2023-08-31

0000885307

srt:EuropeMember

2021-09-01

2022-08-31

0000885307

srt:AsiaPacificMember

2022-09-01

2023-08-31

0000885307

srt:AsiaPacificMember

2021-09-01

2022-08-31

0000885307

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

jctcf:TwoCustomersMember

2022-09-01

2023-08-31

0000885307

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

jctcf:TwoCustomersMember

2021-09-01

2022-08-31

0000885307

us-gaap:SubsequentEventMember

2023-09-29

2023-09-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934 |

For the fiscal year ended AUGUST 31,

2023

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934 |

For the Transition period from _________ to

_________________

Commission File Number: 000-19954

JEWETT-CAMERON TRADING CO LTD

(Name of registrant as specified in its charter)

| British Columbia, Canada A1 |

00-0000000 |

|

(State or Other Jurisdiction of

Incorporation or Organization) |

(IRS Employer

Identification No.) |

| 32275 NW Hillcrest, North Plains, OR, USA |

97133 |

| (Address of principal executive offices) |

(Zip Code) |

Registrant’s Telephone Number 503-647-0110

Securities registered pursuant to Section 12(b)

of the Act:

| Title of Each Class |

Trading Symbol(s) |

Name of Each Exchange on Which Registered |

| Common Stock, no par value |

JCTCF |

NASDAQ Capital Market |

Securities registered

pursuant to Section 12(g) of the Act:

None

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined by Rule 405 of the Securities Act ☐ Yes ☒ No

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ☐ Yes ☒

No

Indicate by check mark

whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during

the preceding twelve months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject

to such filing requirements for the past 90 days.

☒

Yes ☐ No

Indicate by check

mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of

Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files)

☒

Yes ☐ No

Indicate by check mark

whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an

emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller

reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ |

Accelerated filer ☐ |

| Non-accelerated filer ☒ |

Smaller Reporting Company ☒ |

| |

Emerging Growth Company ☐ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.. ☐ Yes ☐

No

Indicate

by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness

of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered

public accounting firm that prepared or issued its audit report. ☐

If

securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant

included in the fi ling reflect the correction of an error to previously issued financial statements. ☐

Indicate

by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive- based compensation

received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark

whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

☐

Yes ☒ No

State the aggregate

market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common

equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s

most recently completed second fiscal quarter:

February 28, 2023 =

$13,202,420

Indicate the number

of shares outstanding of each of the registrant’s classes of common stock, as of November 27, 2023: 3,498,899

Jewett-Cameron Trading Company Ltd.

Form 10-K Annual Report

Fiscal Year Ended August 31, 2023

TABLE OF CONTENTS

PART I

ITEM 1. BUSINESS

Forward-Looking Statements

This Annual Report on Form 10-K contains forward-looking

statements, within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by

the use of words like “plans”, “expects”, “aims”, “believes”, “projects”,

“anticipates”, “intends”, “estimates”, “will”, “should”, “could”

and similar expressions in connection with any discussion, expectation, or projection of future operating or financial performance, events

or trends. Forward-looking statements are based on management's current expectations and assumptions, which are inherently subject to

uncertainties, risks and changes in circumstances that are difficult to predict. Actual outcomes and results may differ materially from

these expectations and assumptions due to changes in global political, economic, business, competitive, market, regulatory and other factors.

We undertake no obligation to publicly update or review any forward-looking information, whether as a result of new information, future

developments or otherwise.

These factors include, but are not limited to the

fact that the Company is in a highly competitive business and may seek additional financing to expand its business, and are set forth

in more detail elsewhere in this Annual Report, including in the sections, ITEM 1A, “Risk Factors”, and ITEM 7, “Management's

Discussion and Analysis of Financial Condition and Results of Operations”.

Introduction

Jewett-Cameron Trading Company Ltd. is organized under

the laws of British Columbia, Canada. In this Annual Report, the “Company”, “we”, “our” and “us”

refer to Jewett-Cameron Trading Company Ltd. and its subsidiaries.

The Company’s operations are classified into

three reportable operating segments and the parent corporate and administrative segment, which were determined based on the nature of

the products offered along with the markets being served. The segments are as follows:

| · | Industrial wood products |

| · | Seed processing and sales |

| · | Corporate and administration |

Effective September 1, 2013, the Company reorganized

certain of its subsidiaries. Jewett-Cameron Lumber Corporation (“JCLC”) was changed to JC USA Inc. (“JC USA”),

which has the following three wholly-owned subsidiaries.

The industrial wood products segment reflects the

business conducted by Greenwood Products, Inc. (“Greenwood”). Greenwood is a processor and distributor of industrial wood

products. A major product category is treated plywood that is sold to the transportation industry.

The pet, fencing and other segments reflect the business

of the Jewett-Cameron Company (“JCC”). JCC is a wholesaler of products based in these categories. Pet products range from

enclosures/kennels of varying types and construction primarily out of metal, to items that support the pet “home” such as

beds, bowls and compostable dog waste bags. Fencing and containment products include such products as proprietary gate and fencing components,

including trademarked and patented post systems, wood and other fencing infill products, as well as kitted security fencing solutions.

Other products include garden, landscaping and miscellaneous products for the home. JCC uses contract manufacturers to make all products.

Some of the products that JCC distributes flow through the Company’s distribution center located in North Plains, Oregon, and some

are shipped direct to the customer from the manufacturer. Primary customers are home centers, eCommerce providers, other retailers, and

direct sales to consumers.

The seed processing and sales segment reflects the

business of Jewett-Cameron Seed Company (“JCSC”). JCSC processed and distributed agricultural seed. Most of this segment’s

sales were derived from selling seed to distributors with a lesser amount of sales derived from cleaning seed. During the fiscal year

ended August 31, 2023, the Company decided to close its JCSC seed subsidiary effective August 31, 2023. JCSC has sold all of its seed

inventory and is presently working to sell the segment’s remaining equipment in preparation for being wound-up. JCSC is continuing

to store some seed for its customers while they arrange alternate storage, but the facility is expected to be fully closed by December

31, 2023.

JC USA provides professional and administrative services,

including accounting and credit services, to each of its wholly-owned subsidiary companies.

Total Company sales were approximately $54.3 million

and $62.9 million during fiscal years ended August 31, 2023 and 2022, respectively.

The Company's principal office is located at 32275

NW Hillcrest Street, North Plains, Oregon; and the Company’s website address is www.jewettcameron.com.

The Company’s primary mailing address is P.O. Box 1010, North Plains, OR 97133. The Company’s phone number is (503) 647-0110,

and the fax number is (503) 647-2272.

The Company files reports and other information with

the Securities and Exchange Commission located at 100 F Street NE, Washington, D.C. 20549. Copies of these filings may be accessed through

their website at www.sec.gov. Reports are also filed under Canadian regulatory requirements on

SEDAR, and these reports may be accessed at www.sedar.com.

The contact person for the Company is Chad Summers,

President and CEO.

The Company’s authorized capital includes 21,567,564

common shares without par value; and 10,000,000 preferred shares without par value. As of August 31, 2023 and November 27, 2023, there

were 3,498,899 common shares outstanding. The Company's common shares are listed on the NASDAQ Capital Market in the United States with

the symbol “JCTCF”.

The Company's fiscal year ends on August 31st.

General Development

of Business

Incorporation

and Subsidiaries

Jewett-Cameron Trading Company Ltd. was incorporated

under the Company Act of British Columbia on July 8, 1987 as a holding company for Jewett-Cameron Lumber Corporation (“JCLC”),

which was incorporated in September 1953 in Oregon, USA. Jewett-Cameron Trading Company, Ltd. acquired all the shares of JCLC through

a stock-for-stock exchange on July 13, 1987, and at that time JCLC became a wholly owned subsidiary. Effective September 1, 2013, the

Company completed a reorganization of certain of its subsidiaries and JCLC’s name was changed to JC USA Inc. (“JC USA”).

JC USA has the following wholly owned subsidiaries. Jewett-Cameron Seed Company, (“JCSC”), incorporated in October 2000, Greenwood

Products, Inc. (“Greenwood”), incorporated in February 2002, and Jewett-Cameron Company (“JCC”) incorporated in

September 2013. Jewett-Cameron Trading Company, Ltd. and its subsidiaries have no significant assets in Canada.

Corporate

Development

Incorporated in 1953, JC USA operated as a small lumber

wholesaler based in Portland, Oregon. In September 1984, the original stockholders sold their interest in the corporation to a new group

of investors. Two members of that group remained active in the Company. These individuals are Donald Boone, who passed away in May, 2019,

and who was the previous Chairman and Director and the former President, Chief Executive Officer, Treasurer, and Principal Financial Officer,

transitioning to strictly the Board Chair in 2017; and Michael Nasser, who retired from day-to-day involvement in the business as of December

2022 but remained engaged as a Director. In October 2023, Mr. Nasser voluntarily resigned from the Board of Directors but is available

as an advisor to the Board.

In July 1987, the Company acquired JC USA in what

was not an arms-length transaction.

In February 2002, Greenwood was incorporated in anticipation

of JC USA acquiring the business and certain assets of Greenwood Forest Products Inc. Greenwood is involved in the processing and distribution

of specialty wood products.

In June 2012, the Company acquired land and fixed

assets located in Manning, Oregon for $250,000 cash. The property was sold in an arms-length transaction in the second quarter of fiscal

2019 for $325,000 cash.

In May 2019 Chairman and Co-Founder of the Company

Donald M. Boone passed away. Mr. Boone served as President and CEO from 1984 until 2017 when he

voluntarily retired from his officer positions and oversaw the addition and successful integration of new management and directors.

In April 2023, the Board of Directors decided to close

the Company’s JCSC seed division. JCSC operates as a seed storage, processing and sales business and was incorporated by the Company

in October 2000 in anticipation of JC USA acquiring the business and certain assets of a firm called Agrobiotech Inc. JCSC has been receiving

lower quantities of seed for processing, and the demand for its marketing and sales services have declined as costs have been rising.

JCSC’s facilities and equipment are near the end of the expected useful life and would require significant capital investment to

remain operating. Regular operations at JCSC ended effective August 31, 2023, but seed storage operations are expected to continue through

approximately December 31, 2023 in order to provide customers time to obtain alterative storage. The entire seed inventory was sold in

early October, and the remaining equipment is in the process of being sold. The Company has prioritized career development and retention,

and some of the JCSC personnel are being moved to different positions within the Company.

Narrative

Description of Business

The Company’s operations are classified into

four segments: Industrial wood products; Pet, Fencing and Other; Seed processing and sales; and corporate and administration. Sales, income

before taxes, assets, depreciation and amortization, capital expenditures, and interest expense by segment are shown in the financial

statements under Note 12 “Segment Information”.

Pet, Fencing and Other – JCC

The pet, fencing and other segments reflect the business

of Jewett-Cameron Company (JCC), which is a manufacturer and distributor of specialty products and a wholesaler of products formerly conducted

by JCLC.

JCC operates out of a 5.6 acre owned facility located

in North Plains, Oregon that includes offices, a warehouse, and a paved yard. This business is a wholesaler, and a manufacturer and distributor

of products that include an array of pet enclosures, kennels, and pet welfare and comfort products, proprietary gate support systems,

perimeter fencing, greenhouses, and fencing in-fill products made of wood, metal and composites. Examples of the Company’s brands

include Lucky Dog®, for pet products; Adjust-A-Gate®, Fit-Right®, Perimeter Patrol®, and Lifetime Post™ for gates

and fencing; Early Start, Spring Gardner™, Greenline®, and Weatherguard for greenhouses. JCC has also recently become the exclusive

distributor of MyEcoWorld® sustainable bag products in the US and Canada. JCC uses contract manufacturers to manufacture its products.

Some of the products that JCC distributes flow through the Company’s facility in North Plains, Oregon, and some are shipped direct

to the customer from the manufacturer. Primary customers are home centers, eCommerce partners, on-line direct consumers as well as other

retailers.

The home improvement business is seasonal, with higher

levels of sales occurring between February and August. Inventory buildup occurs until the start of the season in February and then gradually

declines to seasonal low levels at the end of the summer.

JCC has concentrated on building a customer base for

lawn, garden, and pet related products. Management believes this market is less sensitive to downturns in the U.S. economy than is the

market for new home construction as its products serve both new and existing home and pet owners.

The wood products that JCC distributes are not unique

and are available from multiple suppliers. However, the metal products that JCC manufactures and distributes may be somewhat differentiated

from similar products available from other suppliers. The company has been successful garnering key patents and trademarks on multiple

products that assist their ability to continue to differentiate based on design and functionality.

JCC owns the patents and manufacturing rights connected

with the Adjust-A-Gate® and Fit-Right™ products, which are the gate support systems for wood, vinyl, chain link, and composite

fences. The Company completed its purchase of the full trademark rights for Adjust-A-Gate® and filed its registration with the US

Patent and Trademark Office in February 2023. Management believes the ownership of these patents and trademarks is an important competitive

advantage for these and certain other products. During fiscal 2023, in addition to the additional trademark rights for Adjust-A-Gate®,

the Company applied for 2 patents (fiscal 2022 – one) and received 0 patents (2022 – Nil).

Backlog orders are a factor in this business as customers

may place firm priced orders for products for shipments to take place three to four months in the future.

Industrial Wood Products - Greenwood

Greenwood is a wholesale distributor of a variety

of specialty wood products. Operations are co-located in the building utilized by JCC.

Historically, a major product category was treated

plywood that was sold into the marine industry. It migrated from that segment and focused more into the transportation industry. Greenwood’s

total sales for fiscal 2023 and 2022 were 5% and 4% respectively of total Company sales.

The primary market in which Greenwood competes has

decreased in economic sensitivity as users are incorporating products into the municipal and mass transit transportations sectors. However,

these markets sustained some contractions due to COVID-19 as work shifted from offices to homes, and many individuals utilized transit

less due to concerns over exposure. In addition, this segment is prone to disruption of supply chain support which can impact other commodities

outside of those specific to the disruption.

Inventory is maintained at non-owned warehouse and

wood treating facilities throughout the United States and is primarily shipped to customers on a just-in-time basis. Inventory is generally

not purchased on a speculative basis in anticipation of price changes.

Greenwood has no significant backlog of orders.

Seed Processing and Sales - JCSC

JCSC operates out of an approximately 12 acre owned

facility located adjacent to North Plains, Oregon. JCSC processes and distributes agricultural seed. Most of this segment’s sales

come from selling seed to distributors with a lesser amount of sales derived from cleaning seed. Sales of seed has seasonality, but it

is most affected by weather patterns in multiple parts of the United States that utilize cyclical planting. The annual weather plays an

important part in year-to-year sales volatility and specific crop demand. However, profitability around and after the month of August

may be higher based on a seasonal surge in cleaning sales, which are more profitable than product sales.

The Company ended regular operations at JCSC effective

August 31, 2023. The Company has now sold all of its remaining seed inventory and is working to sell the remaining JCSC equipment. Seed

storage operations are expected to continue through approximately December 31, 2023 in order to provide customers time to obtain alternative

storage.

Administrative Services – JC USA

JC USA is the parent company for the Company’s

wholly-owned subsidiaries as described above. JC USA operates out of the Company’s offices in North Plains, Oregon. It provides

professional and administrative services, including warehousing, accounting and credit services, to its subsidiary companies.

Tariffs

The Company’s metal and other products are largely

manufactured in China and are imported into the United States. The Office of the United States Trade Representative (“USTR”)

instituted new tariffs on the importation of a number of products into the United States from China effective September 24, 2018. These

new tariffs are a response to what the USTR considers to be certain unfair trade practices by China. The tariffs began at 10%, and subsequently

were increased to 25% as of May 10, 2019. A number of the Company’s products manufactured in China remain subject to duties of 25%

when imported into the United States.

Customer Concentration

The top ten customers were responsible for 88% and

84% of total Company sales for the years ended August 31, 2023 and August 31, 2022, respectively. Also, the Company’s single largest

customer was responsible for 35% and 28% of total Company sales for the years ended August 31, 2023 and August 31, 2022 respectively.

Employees

As of August 31, 2023 the Company had 68 full-time

employees (August 31, 2022 – 75 full-time employees). By segment these employees were located as follows: Greenwood 1, JCC 40, JCSC

8, and JC USA 19. Subsequent to the end of the fiscal year, the Company ceased regular operations at JCSC. 4 of the JCSC employees are

being transferred to JCC, and the remainder were terminated and offered transition assistance. None of these employees are represented

by unions at the Company. Jewett-Cameron Trading Company Ltd. has no direct employees, and the CEO of the Company is employed by JC USA.

ITEM

1A. RISK FACTORS

Investors should carefully consider the following

risk factors and all other information contained in this Annual Report. There is a great deal of risk involved in the business of the

company, and any of the following risks could affect our business, its financial condition, its potential profits or, and could result

in you losing your entire investment if our business became insolvent. The risks and uncertainties described below are not the only ones

we face. Additional risks and uncertainties, including those not presently known to us or that we currently deem immaterial, also may

result in decreased revenues, increased expenses or other events which could result in a decline in the price of our common stock.

Risks Related to Our Common Stock

We may decide to acquire assets or enter into

business combinations, which could be paid for, either wholly or partially with our common stock and if we decide to do this our current

shareholders would experience dilution in their percentage of ownership.

Our Articles of Incorporation give our Board of Directors

the right to enter into any contract without the approval of our shareholders. Therefore, our management could decide to make an investment

(buy shares, loan money, etc.) without shareholder approval. If we acquire an asset or enter into a business combination, this could include

exchanging a large amount of our common stock, which could dilute the ownership interest of present stockholders.

Future stock distributions could be structured

in such a way as to be 1) diluting to our current shareholders or 2) could cause a change in control to new investors.

If we raise additional funds by selling more of our

stock, the new stock may have rights, preferences or privileges senior to those of the rights of our existing stock. If common stock is

issued in return for additional funds, the price per share could be lower than that paid by our current stockholders. The result of this

would be a lessening of each present stockholder’s relative percentage interest in our company.

The Company’s common shares currently trade

within the NASDAQ Capital Market in the United States. The average daily trading volume of our common stock was approximately 5,000 shares

on NASDAQ for the fiscal year ended August 31, 2023. With this limited trading volume, investors could find it difficult to purchase or

sell our common stock.

Risks Related to Our Business

A contagious disease outbreak,

such as the recent COVID-19 pandemic emergency, could have an adverse effect on our operations and financial condition

Our business could be negatively affected by an outbreak

of an infectious disease due to the consequences of the actions taken by companies and governments to contain and control the virus. These

consequences include:

| · | The inability of our third-party manufacturers in China and elsewhere to

manufacture or deliver products to us in a timely manner, if it all. |

| · | Isolation requirements may prevent our employees from being able to report

to work or being required to work from home or other off-site location which may prevent us from accomplishing certain functions, including

receiving products from our suppliers and fulfilling orders for our customers, which may result in an inability to meet our obligations. |

| · | Our new products may be delayed or require unexpected changes to be made

to our new or existing products. |

| · | The effect of the outbreak on the economy may be severe, including an economic

downturn and decrease in employment levels which could result in a decrease in consumer demand for our products. |

The financial impact of such an outbreak are

outside our control and are not reasonable to estimate but may be significant. The costs associated with any outbreak may have an adverse

impact on our operations and financial condition and not be fully recoverable or adequately covered by insurance.

We could experience a decrease in the demand

for our products resulting in lower sales volumes.

In the past we have at times experienced decreasing

products sales with certain customers. The reasons for this can be generally attributed to: increased competition; general economic conditions;

demand for products; and consumer interest rates. If economic conditions deteriorate or if consumer preferences change, we could experience

a significant decrease in profitability.

If our top customers were lost, we could experience

lower sales volumes.

For the fiscal year ended August 31, 2023 our top

ten customers represented 88% of our total sales, and our single largest customer was responsible for 35% of our total sales. We would

experience a significant decrease in sales and profitability and would have to cut back our operations, if these customers were lost and

could not be replaced. Our top ten customers are located in North America and are primarily in the retail home improvement and pet industries.

We could experience delays in the delivery of

our products to our customers causing us to lose business.

We purchase our products from other vendors and a

delay in shipment from these vendors to us could cause significant delays in our delivery to our customers. This could result in a decrease

in sales orders to us and we would experience a loss in profitability.

Governmental actions, such as tariffs, and/or

foreign policy actions could adversely and unexpectedly impact our business.

Since the bulk of our products are supplied from other

countries, political actions by either our trading country or our own domestic policy could impact both availability and cost of our products.

Currently, we see this in regard to tariffs being levied on foreign sourced products entering into the United States, including from China.

The continuing tariffs by the United States on certain Chinese goods include some of our products that we purchase from suppliers in China.

The company has multiple options to assist in mitigating the cost impacts of these government actions. However, we cannot control the

duration or depth of such actions which may increase our product costs which would in turn reduce our margins and potentially decrease

the competitiveness of our products. These actions could have a negative effect on our business, results of operations, or financial condition.

We could lose our credit agreement and could

result in our not being able to pay our creditors.

We have a line of credit with U.S. Bank in the amount

of $10 million, of which the entire amount is available. We are currently in compliance with the requirements of our existing line of

credit. If we lost access to this line of credit it could negatively affect our ability to pay some of our creditors on a timely basis.

Our information technology systems are susceptible

to certain risks, including cyber security breaches, which could adversely impact our operations and financial condition.

Our operations involve information technology systems

that process, transmit and store information about our suppliers, customers, employees, and financial information. These systems face

threats including telecommunication failures, natural disasters, and cyber security threats, including computer viruses, unauthorized

access to our systems, and other security issues. While we have taken aggressive steps to implement security measures to protect our systems

and initiated an ongoing training program to address many of the primary causes of cyber threat with all our employees, such threats change

and morph almost daily. There is no guarantee our actions will secure our information systems against all threats and vulnerabilities.

The compromise or failure of our information systems could have a negative effect on our business, results of operations, or financial

condition.

If we fail to maintain an effective system of

internal controls, we may not be able to detect fraud or report our financial results accurately, which could harm our business and we

could be subject to regulatory scrutiny.

We have completed a management assessment of internal

controls as prescribed by Section 404 of the Sarbanes-Oxley Act, which we were required to do in connection with our year ended August

31, 2023. Based on this process we did not identify any material weaknesses. Although we believe our internal controls are operating effectively,

we cannot guarantee that in the future we will not identify any material weaknesses in connection with this ongoing process.

ITEM

1B. UNRESOLVED STAFF COMMENTS

--- No Disclosure Necessary ---

ITEM 2. PROPERTIES

The Company’s executive offices are located

at 32275 NW Hillcrest Street, North Plains, OR 97133. The 5.6 acre facility, which is owned, consists of 55,250 square feet of covered

space (10,000 office and 47,250 warehouse), a little over three acres of paved yard space, and was originally completed in October 1995.

A 12,000 square foot warehouse expansion was completed in fiscal 2017 which the Company is using for several new product lines. In fiscal

2021, the Company completed the conversion of 2,000 square feet of older warehouse space into 4,000 square feet of office and meeting

space on two levels. The facility provides office space for JC USA, including all of the Company’s executive offices, and is used

as a distribution center to service the Company’s customer base for JCC and Greenwood. During fiscal 2022, the Company leased an

additional 4,700 square feet of warehouse space located in North Plains.

The property associated with JCSC, which is owned,

consists of 11.7 acres of land, 105,000 square feet of buildings, rolling stock, and equipment. It is currently used for seed processing

and storage. It is located at 31345 NW Beach Road, Hillsboro, OR 97124, which is adjacent to North Plains, OR. With the closure of the

seed business, the ultimate disposition of JCSC’s property has not been determined and will be evaluated by the Board.

During fiscal 2010, the Company purchased a 2,000

square foot building adjacent to the Company’s main facilities that previously housed a seed testing lab located at 31895 NW Hillcrest

Street, North Plains, OR 97133. The Company formerly leased the property for $729 per month until the expiration of the lease on January

4, 2010. At that time, the Company exercised its option to buy the land and building for a total cost of $150,946. In fiscal 2020, the

Company began a renovation of this building into its new innovation center which will focus on new product development for the Company’s

subsidiaries. The renovation was completed during fiscal 2021.

ITEM

3. LEGAL PROCEEDINGS

A consortium of California District Attorneys contacted

the Company in regard to possible liabilities related to environmental labeling of its plant-based Lucky Dog Poop Bags previously sold

in the State of California. The Company has since modified its product marketing statements in response to their concerns, and during

the period ended May 31, 2022, accrued $300,000 in anticipation of a settlement. In June 2022, a settlement was finalized which required

the Company to pay the previously accrued $300,000 as a cash fine over a four-month period with no admission of guilt by the Company.

The Company was one of three named defendants in a

Civil Action in Pennsylvania. The matter arises out of a dog allegedly escaping from a Jewett-Cameron kennel product and causing personal

injuries to three individuals. The Company’s applicable liability insurer provided the defense covering the Company’s legal

fees and costs. During the fiscal year ended August 31, 2022, the case was settled within the Company’s insurance policy limits

with no admission of guilt by the Company, and there were no additional costs incurred.

In fiscal 2021,

the Company initiated arbitration against a former distributor asserting a breach of the distribution agreement and seeking damages. The liability arbitration

hearing was held in December 2022. In February 2023, the arbitrator issued its decision and ruled in favor of the Company on the

majority of all of its claims. A damages hearing was held in August 2023. In September 2023, the Company settled

its arbitration for a cash payment of $2,450,000 which was received in October 2023.

ITEM

4. MINE SAFETY DISCLOSURES

--- No Disclosure Necessary ---

PART II

| ITEM 5. | Market for Registrant’s Common Equity, Related

Stockholder Matters and Issuer Purchases of Equity Securities |

Market

Information

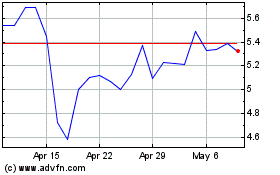

Our common shares trade on the NASDAQ Capital Market

(formerly the NASDAQ Small Cap Market) in the United States. The trading symbol for the common stock is “JCTCF” and the CUSIP

number for the stock is 47733C-20-7. The common stock began trading on the NASDAQ Small Cap Market in April 1996.

Table No. 1 lists the volume of trading along with

the high, low, and closing sales prices on the NASDAQ Capital Market for the Company's common shares.

Table No. 1

NASDAQ Capital Market

Common Shares Trading Activity

(US Dollars)

Period

Ended | | |

Volume | | |

High | | |

Low | | |

Closing | |

| | | |

| | |

| | |

| | |

| |

| | Monthly | | |

| | | |

| | | |

| | | |

| | |

| | 9/30/23 | | |

| 64,900 | | |

$ | 4.84 | | |

$ | 4.50 | | |

$ | 4.65 | |

| | Quarterly | | |

| | | |

| | | |

| | | |

| | |

| | 8/31/23 | | |

| 471,700 | | |

$ | 5.62 | | |

$ | 3.70 | | |

$ | 4.52 | |

| | 5/31/23 | | |

| 206,500 | | |

$ | 5.90 | | |

$ | 4.67 | | |

$ | 4.65 | |

| | 2/28/23 | | |

| 296,200 | | |

$ | 5.98 | | |

$ | 4.95 | | |

$ | 5.50 | |

| | 11/30/22 | | |

| 274,800 | | |

$ | 6.54 | | |

$ | 4.85 | | |

$ | 5.08 | |

| | | | |

| | | |

| | | |

| | | |

| | |

| | 8/31/22 | | |

| 162,600 | | |

$ | 7.09 | | |

$ | 6.19 | | |

$ | 6.36 | |

| | 5/31/22 | | |

| 271,500 | | |

$ | 8.25 | | |

$ | 5.50 | | |

$ | 6.72 | |

| | 2/28/22 | | |

| 153,800 | | |

$ | 9.84 | | |

$ | 7.15 | | |

$ | 7.98 | |

| | 11/30/21 | | |

| 254,100 | | |

$ | 13.74 | | |

$ | 9.02 | | |

$ | 9.15 | |

| | | | |

| | | |

| | | |

| | | |

| | |

| | Annually | | |

| | | |

| | | |

| | | |

| | |

| | 8/31/23 | | |

| 1,249,200 | | |

$ | 6.54 | | |

$ | 3.70 | | |

$ | 4.52 | |

| | 8/31/22 | | |

| 842,000 | | |

$ | 13.74 | | |

$ | 5.50 | | |

$ | 6.36 | |

| | 8/31/21 | | |

| 1,305,400 | | |

$ | 12.00 | | |

$ | 7.23 | | |

$ | 10.60 | |

| | 8/31/20 | | |

| 455,600 | | |

$ | 8.78 | | |

$ | 5.00 | | |

$ | 7.55 | |

| | 8/31/19 | | |

| 1,318,200 | | |

$ | 10.00 | | |

$ | 6.23 | | |

$ | 8.04 | |

Holders

Computershare Investor Services Inc. which is located

in Vancouver, British Columbia, Canada is the registrar and transfer agent for the common shares.

On October 13, 2023 there

were 26 registered shareholders and 3,498,899 shares of the Company’s common shares outstanding.

Dividends

The Company has not declared any dividends since incorporation

and does not anticipate that it will do so in the foreseeable future. The present policy of the Company is to retain earnings for use

in its operations, expansion of its business, and the possible repurchase of Company shares. There are no restrictions that limit the

ability of the Company to pay dividends on common equity or that are likely to do so in the future. Any dividends paid by the Company

to U.S. shareholders would be subject to Canadian withholding tax.

Recent Sales of Securities:

Use of Proceeds from Securities

The Company has sold no securities in the last 3 fiscal

years.

Purchases of equity

securities by the issuer and affiliated purchasers

The Company has not repurchased any common shares

during the years ended August 31, 2023 or August 31, 2022.

ITEM 6. [RESERVED]

Item

7. Management’s Discussion and Analysis of Financial Condition and Results of Operation

The Company’s operations are classified into

three reportable operating segments and the parent corporate and administrative segment, which were determined based on the nature of

the products offered along with the markets being served. The segments are as follows:

| · | Industrial wood products |

| · | Seed processing and sales |

| · | Corporate and administration |

Quarterly Results

The following table summarizes quarterly financial

results in fiscal 2023 and fiscal 2022. (Figures are thousands of dollars except per share amounts).

| | |

For the Year Ended August 31, 2023 | |

| | |

First | | |

Second | | |

Third | | |

Fourth | | |

Full | |

| | |

Quarter | | |

Quarter | | |

Quarter | | |

Quarter | | |

Year | |

| | |

| | |

| | |

| | |

| | |

| |

| Sales | |

$ | 12,578 | | |

$ | 8,143 | | |

$ | 18,946 | | |

$ | 14,622 | | |

$ | 54,289 | |

| Gross profit | |

| 2,860 | | |

| 1,921 | | |

| 4,413 | | |

| 3,053 | | |

| 12,247 | |

| Net income (loss) | |

| (74 | ) | |

| (972 | ) | |

| 735 | | |

| 290 | | |

| (21 | ) |

| Basic earnings per share | |

$ | (0.02 | ) | |

$ | (0.28 | ) | |

$ | 0.21 | | |

$ | 0.08 | | |

$ | (0.01 | ) |

| Diluted earnings per share | |

$ | (0.02 | ) | |

$ | (0.28 | ) | |

$ | 0.21 | | |

$ | 0.08 | | |

$ | (0.01 | ) |

| | |

For the Year Ended August 31, 2022 | |

| | |

First | | |

Second | | |

Third | | |

Fourth | | |

Full | |

| | |

Quarter | | |

Quarter | | |

Quarter | | |

Quarter | | |

Year* | |

| | |

| | |

| | |

| | |

| | |

| |

| Sales | |

$ | 12,918 | | |

$ | 14,061 | | |

$ | 20,922 | | |

$ | 15,001 | | |

$ | 62,902 | |

| Gross profit | |

| 2,465 | | |

| 3,424 | | |

| 5,353 | | |

| 2,551 | | |

| 13,793 | |

| Net income (loss) | |

| (391 | ) | |

| 270 | | |

| 1,494 | | |

| (209 | ) | |

| 1,164 | |

| Basic earnings (loss) per share | |

$ | (0.11 | ) | |

$ | 0.08 | | |

$ | 0.43 | | |

$ | (0.06 | ) | |

$ | 0.33 | |

| Diluted earnings (loss) per share | |

$ | (0.11 | ) | |

$ | 0.08 | | |

$ | 0.43 | | |

$ | (0.06 | ) | |

$ | 0.33 | |

| * | Fiscal 2023 quarterly per share earnings were calculated using weighted average number of common shares

outstanding as of August 31, 2023 of 3,498,899 (2022 – 3,493,807). The sum of the quarterly earnings per share may not equal the

full year earnings per share due to the use of the full year’s weighted average share figure and rounding. |

RESULTS

OF OPERATIONS

Fiscal 2023 was a difficult year in our markets. Our

operations confronted a number of challenges, including poor weather, negative economic trends and inflationary pressures, and changing

consumer spending habits.

The primary selling season for our outdoor products

in the spring and summer months was greatly shortened by the historically wet and unseasonably cold winter weather which extended across

much of the United States well into April. This delayed, and ultimately significantly reduced, our orders from many of our customers,

particularly retail hardware and Big Box stores. They maintained their winter inventory longer than usual which reduced their selling

period for warm weather products. As a result, they ordered less product from our outdoor lines this year than in ordinary weather years.

The post-COVID shift of consumer spending habits,

which has been compounded by persistently high levels of inflation, had a negative effect on our sales for the year. These forces were

particularly prominent within our home improvement and pet product lines, as consumers reduced their spending on these types of discretionary

products from the elevated levels experienced during the pandemic. Our fiscal 2023 sales of $54.2 million is 21% higher than our sales

of $44.9 in the last pre-pandemic year of 2020. Although inflation has raised our selling price of our products since 2020, this 21% increase

in the dollar amount of sales is still greater than the cumulative inflation rate in the US during the same period.

Fencing sales were largely steady year-over-year,

with several product lines exceeding expectations. This performance was especially encouraging considering the poor Spring weather across

the country which reduced consumer demand for fence lumber and hardware. Our efforts to increase the visibility of our hardware products

and maintain their in-stock availability with several retailers has also contributed to this year’s sales. We remain at the desired

warehouse inventory levels for our key fence products and are experiencing no shipping delays to our customers.

During fiscal

2023, we signed a new sales agreement with one of major lumber customers which changed how we inventory, sell and record our sales for

this customer. Our expectation that this new arrangement would provide us with more consistent and predictable fencing sales, while improving

the availability of the product in their stores, has been confirmed. Although this agreement requires us to maintain higher levels of

fencing inventory than we had in the past, we are pleased with how the arrangement has progressed. In the future, it may be possible to

extend this agreement to more of this customer’s distribution centers that we continue to serve under our prior sales agreements.

The pet industry

overall has recently experienced a spending downturn from the surge of sales recorded in the prior two years. During the pandemic many

Americans worked from home. They acquired new pets and purchased additional supplies for all their pets. This increased spending subsided

as many people returned to work outside the home. The higher levels of inflation prevailing over the last 18 months has also dampened

consumer spending in the sector. Demand for our pet products have similarly been affected. We relaunched one of our kennel products

during 2023, and we also resolved a sales interruption with a significant on-line retailer, both of which have had positive results on

sales. Our pet product inventory levels remain higher than usual. Many retailers have a higher than normal level of pet supply inventory

on hand due to increasing their purchases during the pandemic prior to the sudden downturn in consumer demand. As a result, we expect

overall demand from retailers to remain depressed into 2024 until they are able to work through their own high inventory levels. We

remain committed to maintaining our list prices on our primary pet products. There is no urgency to move this inventory as it will not

degrade or spoil over time. For our slower moving pet products, we continue to explore opportunities to accelerate sales in those items.

We launched our new MyEcoWorld® sustainable bag

products during the 4th quarter of fiscal 2023. Under our distribution agreement with SECOS Group of Australia, Jewett-Cameron

is the exclusive distributor of their MyEcoWorld® sustainable bag products in the US and Canada. We expect it will take time for sales

of these new and innovative premium products to gain traction with retailers and consumers. Since these products are consumables, once

they are established, recurring sales will build over time. We are optimistic of the potential of this new product line to grow into a

meaningful segment of our business. Consumers are increasingly seeking more environmentally friendly alternatives to conventional hydrocarbon

derived plastic products. Our success with our compostable poop bag since its launch several years ago indicates these products are less

seasonal and can provide positive contributions to our historically lower revenue quarters.

Greenwood’s primary customers are in the transit

sector, which is an industry among the most affected by the COVID-19 pandemic. Transit is beginning to recover from the severe decline

in ridership and other serious issues, including shortages of vehicle components and trained drivers and mechanics, that reduced the number

of vehicles on the road and the need for Greenwood’s engineered wood products. With transit’s recovery, Greenwood’s

sales have increased from the pandemic periods but were flat in 2023 compared to 2022. We continue to see a number of marketing opportunities

for Greenwood’s products in both its current markets and in new sectors, such as construction. We have been actively searching to

hire new traders to pursue these new business opportunities, and a new trader was successfully hired in September 2023.

During fiscal 2023, management concluded a comprehensive

strategic review of the seed segment. As a result of this review, the Board of Directors made the difficult decision to close JCSC effective

August 31, 2023. The review of JCSC, which last reported a full-year profit in fiscal 2020, was initiated due to the segment’s declining

revenue, higher costs, and the lack of success in generating new customers over the last several years. When the seed operation was first

opened in 1965, and then acquired by the Company in 2000, the local area around the JCSC operations was rural and dominated by large farming

operations, including grass seed farms which made up JCSC’s customers. Over the last decade, many agricultural customers in the

area around JCSC are converting their acreage from growing cyclical and commoditized grass seed to more specialized higher value crops,

such as berries and filberts. Consequently, JCSC has been receiving lower quantities and quality of seed for processing and experiencing

less demand for its marketing and sales in recent years. In addition, JCSC’s building and equipment are nearing the end of their

expected operating life. Over the last several years, the higher costs of maintenance required to maintain operations have had a substantial

negative effect on JCSC’s margins and has been an important factor in JCSC’s operating losses. Taking into consideration the

current economic and market trends, and the high cost of new equipment, the Board determined an orderly wind-down of operations and closure

of JCSC was the most prudent action.

The wind-down of regular operations including seed

cleaning was effective August 31, 2023. The process was greatly aided by the retention of the entire JCSC operating staff. As of August

31st, nearly all of the seed inventory had been sold, with the entire remaining inventory sold in September. Some of the equipment

and other assets have also been sold, with the remainder being marketed for disposal by the end of calendar 2023. We are providing seed

storage for our prior customers through December 2023 to allow them to arrange for new storage and seed cleaning services. We expect full

closure of the facility to occur on or about January 1, 2024. Some of the JCSC staff are being moved to other roles within the Company,

and transition services were offered for the remainder who were terminated effective August 31, 2023.

JCSC owns 11.7 acres of land and 105,000 square feet

of buildings in Hillsboro, Oregon. The land is very well located at a major interchange immediately adjacent to busy US Highway 26, which

is a primary route linking Metro Portland to its Northwest suburbs and then to the Coast beaches. Its close proximity to Portland has

meant that since 1990, Hillsboro has been one of the fastest growing cities in Oregon. Much of its original farmland has already been

converted into residential areas and new business and industrial developments, including high-technology campuses. Currently, JCSCs land,

which lies west of downtown Hillsboro, is zoned for agricultural use. However, there have been ongoing governmental discussions about

extending the Urban Growth Boundaries further to the west. These proposed boundary changes could encompass JCSC’s land and allow

for a rezoning to residential, commercial or industrial use. Therefore, management and the Board have already begun to receive unsolicited

inquiries from third-parties about any future sale of JCSC’s building and land which would potentially take advantage of the valuable

rezoning opportunity. At this time the property has not been listed for sale. The ultimate disposition of these assets has not been determined

but will be studied by the Board before any final decision is reached.

Our inventory as of August 31, 2023 was

$18.3 million, which was a decline of over $2.3 million from the end of the prior fiscal year-end, but are higher than we have carried

in years prior to fiscal 2022. Some of the change is due to the new fencing distribution agreement with a customer. We are required to

maintain a higher level of lumber inventory than we have previously to ensure the availability of these products for this customer, which

also serves to optimize our sales. We will continue to maintain higher lumber inventories in future period. Some of our higher inventory

level is attributable to changes in our customers’ purchasing practices in some of our key categories, as many have slowed their

purchasing rates post-pandemic in response to widespread changes in the purchasing behaviors of American consumers. A portion of our higher

inventory is a result of the supply chain disruptions and other macro-economic issues experienced over the last several years. Some of

our products, including our larger and bulkier items, were late in arriving from the manufacturer in China which contributed to our missing

much of the busy selling season last year. Since our purchases of these manufactured goods have a protracted lead time, additional orders

which in a normal year would have been needed to replace the goods we expected to sell and ship last summer instead stacked up behind

the late arriving inventory in our warehouse. Fortunately, this excess inventory does not spoil or turn obsolete. The Company remains

committed to selling this inventory as we rework these specific distribution channels, but we expect this to take some time.

Our management continues to proactively face these

challenges and find innovative ways to improve our operations. In response to the supply chain logistic issues and delays we have successfully

negotiated new purchase terms with several of our major suppliers which include reducing prepayments and in some cases extended balance

due deadlines. Additionally we have arranged for stock of our key products to be produced and stored at the factory with blanket purchase

orders and minimal down payment to be available for shipment quicker to meet market demand. When we do make an order for these items the

supplier will now be able to pull finished product from this pre-produced supply instead of waiting to begin the production process only

after our order has been received. This will quicken the time to fulfil customer direct shipment orders as well as the time for us to

receive shipments at our warehouse in Oregon. In addition to shortening our order cycle, these agreements also improve our inventory management

and enhances our cash flow.

We utilized our bank line of credit for working capital

to primarily fund inventory purchases during the pandemic and during the post-pandemic supply chain disruptions in order to ensure we

had sufficient inventory on-hand to fulfill as many customer orders as possible. As those supply issues have subsided, we have been able

to reduce our need to borrow against the line of credit. Because the Company’s current inventory

position is strong and we are not purchasing large amounts of new inventory, we have been able to direct much of our positive cash flow

generated during our traditionally busy 3rd and 4th fiscal quarters to pay down the bank line of credit. The amounts

borrowed under the line of credit have decreased to $1.26 million as of the end of the 4th quarter. As of early October 2023,

the remaining $1.26 million borrowed against the line of credit has been repaid and all $10 million of the line is available. The Company’s

revenues and cash flow continue to be seasonal and highly variable, with the 3rd and 4th quarters of the fiscal

year being much busier than the 1st and 2nd quarters due to the Company’s current product offerings. Therefore,

the availability of a line of credit is important to provide financial flexibility, and management expects to continue to maintain a credit

line and draw against it as needed. We are studying the possibility of restructuring or replacing the existing line, as different

credit arrangements may potentially provide the Company with greater financial flexibility.

Gross margin for the fiscal year was 22.6%, which

is an improvement over the 21.9% gross margin from the prior year. Although our shipping and some raw-material costs have declined from

their highs experienced in the last several years, we continue to work off our higher priced inventory acquired when these costs were

at their highest. As we sell this high-cost inventory, our costs of goods sold declines. The high inflation rate which has prevailed over

the last 24 months has also depressed our margins. Inflation affects our costs of goods more quickly than our ability to raise our selling

prices. Any price hikes we introduce takes time to be accepted by our customers and consumers, and also have to be made more gradually

in stages. The recent moderation of the inflation rate is allowing our increased selling prices to catch up to our higher costs of goods

sold, which is improving our margins.

In fiscal 2021,

we filed for arbitration against one of our former distributors asserting a breach of the distribution agreement. The liability arbitration

hearing was held in December 2022. In February 2023, the arbitrator issued its decision in favor of the Company on the majority of all of

our claims. A damages hearing was held in August 2023. Subsequent to the end of the fiscal year, we reached a favorable agreement

with the defendant to settle the case. The settlement, which was received in early October, covers our substantial legal

fees and some losses due to the breach. We are pleased to have settled the case and that we will no longer have to expend time and

money pursuing this case. Our costs to pursue this action have been sizeable, particularly during fiscal 2023, which were included in

our selling, general and administrative costs and reduced our income from operations accordingly. Even though the costs in this case were

material, we believe it is critical to defend our valuable intellectual property and will take action against any future infringements

of our patents, trademarks and contractual agreements.

The Board of Directors approved the adoption of an

Advance Notice Policy for the nominations of directors by the Company’s shareholders. This policy provides shareholders, directors

and management with a precise framework for advance notice of nominations of directors by its shareholders. Among other things, the Advance

Notice Policy fixes a deadline by which shareholders must submit nominations to the Company before any annual or special meeting of the

shareholders, and sets forth the minimum information that a shareholder must include in such notice. The Advance Notice Policy became

effective immediately upon its approval by the Board of Directors in May 2023. Common shareholders of the Company will be asked to approve

the Advance Notice Policy at the next meeting of shareholders, which is expected to be held in early calendar 2024.

The Company

has now reached its 70th year in operation. The business has changed and evolved dramatically since it was first incorporated

in September 1953. Over the last several years, we have invested substantial amounts of capital into modernizing our organization and

streamlining the business to focus on our strengths and core product lines. The resulting operational improvements have strengthened the

Company and will allow us to more efficiently deploy our capital towards further growth. The closure of JCSC and conclusion of

the expensive arbitration against its former distributor should reduce our operating cash requirements, and improve our operating margins,

beginning in fiscal 2024.

Fiscal Years Ended August

31, 2023 and August 31, 2022

Fiscal 2023 sales totaled $54,289,303 compared to

sales of $62,901,831 in fiscal 2022, which was a decrease of $8,612,528, or 14%.

Gross margin improved to 22.6% from fiscal 2022’s

21.9%. Shipping and transportation expenses have declined from the much higher rates that prevailed in fiscal 2022. High inflation rates

also moderated as fiscal 2023 progressed, which allowed us to increase our product sales prices to catch up to the earlier increases in

our costs of goods.

Operating expenses fell slightly by $7,065 to $11,816,441

from $11,823,506 in fiscal 2022. Selling, general and administrative expenses were largely flat at $3,973,055 compared to $4,008,166.

Wages and employee benefits fell to $7,445,464 from $7,495,723 as the broad wage inflation continuing in most industries throughout the

area and the United States was offset by a lower employee count during the current year. Depreciation and amortization increased to $397,922

from $319,617. Income from operations decreased to $430,684 from $1,969,553 due to the lower level of sales and the higher costs.

Other items in fiscal 2023 totaled a loss of ($388,213)

compared to a loss of ($388,553) in fiscal 2022. These items include interest expense on the bank line of credit of $458,463 in 2023 compared

to $163,045 in fiscal 2022, with the increase due to a higher level of borrowing and a significantly higher interest rate in fiscal 2023.

Gain on sale of property, plant and equipment was $70,250 in fiscal 2023 and $4,526 in fiscal 2022. Other items in fiscal 2022 also included

a payment of $300,000 for the settlement of claims.

Including other items, income before income taxes

was $42,471 compared to income of $1,581,000 in fiscal 2022. Income tax expense for fiscal 2023 was $63,097 compared to expense of $416,877

in fiscal 2022. The Company calculates income tax expense based on combined federal and state rates that are currently in effect.

Net loss in fiscal 2023 was ($20,626), or ($0.01)

per share, compared to net income of $1,164,123, or $0.33 per common share, in fiscal 2022. The weighted number of shares outstanding

were 3,495,342 in fiscal 2023 and 3,493,807 in fiscal 2022.

Pet, Fencing and Other

- JCC

Sales for JCC in fiscal 2023 were $49,219,224 compared

to sales of $57,915,828 in fiscal 2022, which represents a decline of $8,696,604, or 15%. Sales of JCC seasonal warmer weather outdoor

products was negatively affected by the cold and wet weather that extended into April across much of the United States. This caused many

of our customers, including big box retailers, to delay their orders of these products until later into spring. This caused reduction

in our sales volume for the season and for the year.

Sales of many of our pet products have not yet recovered

to their pandemic period levels. The entire pet supply industry is currently suffering through a downturn of consumer demand. As a result,

many retailers currently have excess inventory which has alleviated their need to reorder product. During fiscal 2023, we also experienced

production quality issues with a manufacturer on a particular product line. We suspended sales of the line until the problem was corrected,

which has successfully been accomplished and sales of the line have resumed.

The following table shows a breakdown between the

pet, fencing and other categories in this segment. The figures for fiscal 2022 have been revised from those previously reported to reflect

the reclassification of certain bag products from pet to other.

| | | |

Sales in Millions of

Dollars | | |

Percent of Total Sales | |

| Fiscal

Year | | |

Pet | | |

Fencing | | |

Other | | |

Pet | | |

Fencing | | |

Other | |

| | 2023 | | |

$ | 11,217,733 | | |

$ | 36,078,696 | | |

$ | 1,922,795 | | |

| 23 | % | |

| 73 | % | |

| 4 | % |

| | 2022 | | |

$ | 16,856,059 | | |

$ | 37,935,911 | | |

$ | 3,123,858 | | |

| 29 | % | |

| 66 | % | |

| 5 | % |

Industrial Wood Products

- Greenwood

Sales at Greenwood in fiscal 2023 were $2,605,926,

which was almost unchanged from sales of $2,626,209 in fiscal 2022. Greenwood’s sales were heavily impacted by the COVID-19 pandemic,

as many of their products are sold to municipalities and larger transit operators which experienced lower rider demand and supply shortages

of important components and skilled personnel. Since the end of the pandemic and many employees returning to offices, transit industry

budgets have increased and demand for Greenwood’s products is beginning to recover.

Management believes there are significant opportunities

to increase Greenwood’s sales by targeting new customers not only in the transportation industry, but also in other industries and

sectors which Greenwood has not traditionally targeted, such as housing and construction. We have been seeking to add new traders to expand

Greenwood’s sales efforts, and a new trader was hired in September 2023.

For fiscal 2023, Greenwood had an operating loss of

($46,307) compared to operating income of $21,865 for fiscal 2022.

Seed Processing and Sales

- JCSC

During fiscal 2023, the Board of Directors made the

difficult decision to permanently close JCSC effective August 31, 2023. Sales for JCSC in fiscal 2023 were $2,464,153 compared to sales

of $2,359,794 in fiscal 2022. JCSC had an operating loss of ($251,261) in fiscal 2023 compared to an operating loss of ($517,453) in fiscal

2022.

Corporate – JC USA

JC USA, the holding company that provides professional

and administrative services for the wholly-owned operating subsidiaries had operating income of $962,459 in fiscal 2023 compared to income

of $819,139 in fiscal 2022. The results of JC USA are inter-company transactions and are eliminated on consolidation.

LIQUIDITY AND CAPITAL

RESOURCES

Fiscal

Year Ended August 31, 2023

As of August 31, 2023, the Company had working capital

of $19,134,810 compared to working capital of $19,207,874 as of August 31, 2022. The largest change affecting working capital is a decrease

in inventory of $2,293,265 to $18,339,048 from $20,632,313. Other changes in components of working capital include a decrease in cash

of $400,767, a decrease in accounts receivable of $1,556,722, a decrease in prepaid expenses of $481,787, and a decrease in prepaid income

taxes of $208,963. The decrease in cash is related to the repayment of funds borrowed against the bank line of credit. Prepaid expenses,

which is mostly deposits paid for future inventory, declined as the Company’s large current inventory position has reduced the need

for additional inventory purchases in the near term.

Accounts payable rose to $2,181,194 from $1,566,047

which is related to the timing of payments due to suppliers. Accrued liabilities increased by $257,154 to $2,113,193 from $1,856,039.

Bank indebtedness, which is from the Company’s line of credit and has primarily been used to acquire inventory, was $1,259,259 as

of August 31, 2023 compared to $7,000,000 as of August 31, 2022. Deferred tax assets rose to $319,875 from $Nil.

As of August 31, 2023, accounts receivable and inventory

represented 97% of current assets and 80% of total assets. As of August 31, 2022, accounts receivable and inventory represented 94% of

current assets and 81% of total assets. Our customers continue to pay on-time, with almost all of our outstanding receivables classified

as current.

For the fiscal year ended August 31, 2023, the accounts

receivable collection period or DSO was 38 days compared to 42 days for the year ended August 31, 2022. Inventory turnover for the year

ended August 31, 2023 was 169 days compared to 130 days for the year ended August 31, 2022.

Short-term and Long-term

Debt

External sources of liquidity include a line of credit

from U.S. Bank of $10 million, of which approximately $8.74 million was available as of August 31, 2023.

Borrowing under the line of credit is secured by an

assignment of accounts receivable and inventory. Interest was previously calculated solely on the one-month LIBOR rate plus 175 basis

points. Beginning with the monthly interest payment due March 31, 2022, the Company’s Bank line of credit agreement was revised

to change the calculation of the interest rate from the one-month LIBOR rate to the one-month Secured Overnight Financing Rate (SOFR).

Interest is now calculated based on the one-month SOFR plus 157 basis points, which as of August 31, 2023 was 6.88% (5.31% + 1.57%). The

line of credit has certain financial covenants. The Company is in compliance with these covenants.

Subsequent to the end of the year, the Company repaid

the remaining balance of $1.26 million borrowed against the line of credit utilizing both cash flow and a portion of the cash received

from the arbitration settlement.

Current Working Capital

Requirements

In October 2023, the Company received the cash payment

under the arbitration settlement agreement with its former distributor. A portion of this payment was used to repay some of the amount

borrowed under the Line of Credit, with the remainder held as working capital.

Based on the Company’s current working capital

position, the anticipated reduction in cash needs due to the closure of JCSC, and the unused borrowing capacity under its current line

of credit, the Company expects to have sufficient liquidity available to meet its working capital requirements for fiscal 2024.

OTHER

MATTERS

Contractual

Obligations and Commercial Commitments

The Company currently has no material contractual

obligations or commercial commitments other than to suppliers of products or services.

Historically, inflation has not been a significant

issue for the Company. However, beginning in fiscal 2021, a number of product costs increased substantially, including raw materials,

energy, and transportation/logistical related costs.

These higher costs have negatively affected the Company’s

gross margins. Typically, the Company passes cost increases on to the customer, and is currently raising its product prices as much as

the market will bear. Retailers are currently more receptive to such increases than in the past due to a mutual understanding of the current

inflationary environment and the objective reasons for such. Since the ability of the Company to pass through all of the current increase