Qualcomm Ruling Weighs on ETFs With High Exposure

May 22 2019 - 3:19PM

Dow Jones News

By Francesca Fontana

A number of ETFs with high exposure to Qualcomm Inc. (QCOM)

dived Wednesday after a U.S. judge found that the semiconductor

company illegally suppressed competition for cellphone chips.

Among the ETFs trading lower are Direxion Daily Semiconductor

Bull 3X Shares ETF (SOXL), iShares PHLX Semiconductor ETF (SOXX)

and Invesco Dynamic Networking ETF (PXQ).

SOXL, issued by Rafferty Asset Management, is a leveraged ETF

that seeks to provide 300% of the exposure to the PHLX

Semiconductor Sector Index, according to ETF.com. Among its top 10

holdings are Texas Instruments Inc. and Nvidia Corp. SOXL dropped

5.6% to $119.69, according to FactSet. The PHLX is down 1.8%.

SOXX, issued by BlackRock, tracks a modified market-cap-weighted

index of U.S.-listed semiconductor companies, ETF.com says. Among

its top 10 holdings are Broadcom Inc. and Intel Corp. SOXX lost

1.9% to $183.41.

PXQ, issued by Invesco, tracks a quantitatively driven index of

30 U.S. networking companies weighted in tiers, according to

ETF.com. Among its top 10 holdings are VMware Inc. and Cisco

Systems Inc. PXQ dipped 0.6% to $58.18.

Qualcomm shares fell more than 11% in recent trading, leading

the broader market lower. The losses followed Tuesday's rebound for

chip stocks after the Trump administration granted temporary

exemptions to an export blacklist against Huawei Technologies.

Write to Francesca Fontana at francesca.fontana@wsj.com.

(END) Dow Jones Newswires

May 22, 2019 15:04 ET (19:04 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

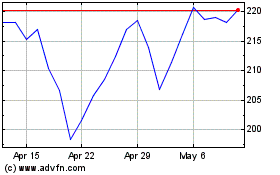

iShares Semiconductor ETF (NASDAQ:SOXX)

Historical Stock Chart

From Jan 2025 to Feb 2025

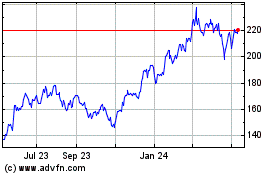

iShares Semiconductor ETF (NASDAQ:SOXX)

Historical Stock Chart

From Feb 2024 to Feb 2025