iRhythm Technologies, Inc. (NASDAQ: IRTC), a leading digital health

care company focused on creating trusted solutions that detect,

prevent, and predict disease, today reported financial results for

the three months ended September 30, 2022.

Third Quarter 2022 Financial

Results

- Revenue of $103.9 million, a 21.6%

increase compared to third quarter 2021

- Gross margin of 68.3%, a 2.6

percentage point improvement compared to third quarter 2021

- Cash, cash equivalents and

short-term investments of $203.5 million as of September 30,

2022

- Updating fiscal year 2022 revenue

guidance to a range of approximately $407 million to $411

million

- Improving profitability profile,

including updated fiscal year 2022 adjusted EBITDA guidance of

negative $10 to negative $12 million

Recent Operational

Highlights

- Third quarter registration growth

of 22% year-over-year

- Presentations at the European

Society of Cardiology (ESC) in August highlighted Zio XT increased

arrhythmia detection rates by 216% and reduced time to detection as

compared to traditional Holter monitors1

- Detailed refreshed vision and

mission, long-term growth strategies, innovation pipeline and

financial goals during analyst and investor day in September

- Upcoming data presentations at the

American Heart Association (AHA) in Chicago, IL, from November 5-7,

2022

"Despite the ongoing staffing and capacity

challenges, we grew registration volumes by more than 20% in the

third quarter, achieving our highest daily registration volumes

ever as we exited September," said iRhythm CEO and President,

Quentin Blackford. "However, within the quarter, we also realized

softness in returned devices - which impacted our ability to

perform our services and realize revenue which muted our growth. We

view this as persisting into the fourth quarter. These dynamics, as

well as fourth quarter trends in account staffing and capacity

challenges as well as Zio AT utilization, have led to us reducing

our full year revenue guidance."

"While disappointing, we continue to be

encouraged by the underlying momentum of the business as

demonstrated by the accelerating daily registration growth in the

third quarter. As we shared during our Investor and Analyst Day in

September, we continue to believe iRhythm's innovative device with

differentiated AI capabilities and clinically actionable data

insights is the gold standard in the space and sets us apart in the

marketplace. We remain confident in the strong fundamentals of our

business and are dedicated to bringing our innovative solutions to

the millions of patients who may benefit," concluded Mr.

Blackford.

Third Quarter Financial

ResultsRevenue for the three months ended

September 30, 2022 increased 21.6% to $103.9 million, from

$85.4 million during the same period in 2021. The increase was

primarily driven by Zio XT and AT volume growth as well as an

increase in net average selling price.

Gross profit for the third quarter of 2022 was

$70.9 million, up 26.4% from $56.1 million during the same

period in 2021, while gross margins were 68.3%, up from 65.7%

during the same period in 2021. The increase in gross profit was

primarily due to increased volume and average selling price,

partially offset by increases in cost per unit.

Adjusted operating expenses for the third

quarter of 2022 were $89.7 million, compared to $79.4 million

during the same period in 2021. This increase in adjusted operating

expenses resulted primarily from increased resources to scale and

higher bad debt expense as a result of incremental volumes.

Operating expenses for the third quarter of 2022 were $92.0

million, compared to $79.4 million for the same period in 2021.

Adjusted net loss for the third quarter of 2022

was $19.1 million, or a loss of $0.63 per share, compared with an

adjusted net loss of $23.7 million, or a loss of $0.81 per share,

for the same period in 2021. Net loss for the third quarter of 2022

was $21.5 million, or a loss of $0.71 per share, compared with net

loss of $23.7 million, or a loss of $0.81 per share, for the same

period in 2021.

Cash, cash equivalents and short-term

investments were $203.5 million as of September 30, 2022.

Updated 2022 Annual Guidance

Given volume trends in the third quarter and anticipated volume

contributions in the fourth quarter, iRhythm is updating its fiscal

year 2022 revenue guidance to range from approximately $407 to $411

million, which represents approximately 26% to 27% growth over the

prior year results. This compares to prior fiscal year 2022 revenue

guidance of $415 to $420 million.

Gross margin for the fiscal year 2022 is

expected to range from approximately 68% to 69% and adjusted

operating expenses are expected to range between approximately $360

and $365 million. Adjusted EBITDA for the full year 2022 is

expected to range from negative $10 to negative $12 million. This

compares to prior fiscal year 2022 adjusted operating expense

guidance of $375 and $385 million and prior fiscal year 2022

adjusted EBITDA guidance of negative $12.5 to negative $17.5

million.

Webcast and Conference Call

InformationiRhythm’s management team will host a

conference call today beginning at 1:30 p.m. PT/4:30 p.m. ET.

Investors interested in listening to the conference call may do so

by accessing the live and archived webcast of the event, which will

be available on the investors section of the Company’s website at

investors.irhythmtech.com.

About iRhythm Technologies,

Inc.iRhythm is a leading digital health care company that

creates trusted solutions that detect, predict, and prevent

disease. Combining wearable biosensors and cloud-based

data analytics with powerful proprietary algorithms, iRhythm

distills data from millions of heartbeats into clinically

actionable information. Through a relentless focus on patient care,

iRhythm’s vision is to deliver better data, better insights, and

better health for all.

Use of Non-GAAP Financial

Measures We refer to certain financial measures that are

not recognized under U.S. generally accepted accounting principles

(GAAP) in this press release, including adjusted EBITDA, adjusted

net loss, adjusted net loss per share and adjusted operating

expenses. We use these non-GAAP financial measures for financial

and operational decision-making and as a means to evaluate

period-to-period comparisons. See the schedules attached to this

press release for additional information and reconciliations of

such non-GAAP financial measures.

Adjusted EBITDA excludes non-cash operating

charges for stock-based compensation, depreciation and amortization

as well as non-operating items such as interest income, interest

expense, impairment and restructuring charges, and transformation

costs.

We exclude the following items from non-GAAP

financial measures for adjusted net loss, adjusted net loss per

share and adjusted operating expenses:

- impairment and restructuring charges, and

- transformation costs to scale the organization.

Forward-Looking StatementsThis

news release contains forward-looking statements within the meaning

of Section 27A of the Securities Act of 1933 and Section 21E of the

Securities Exchange Act of 1934 and the Private Securities

Litigation Reform Act of 1995. These statements include statements

regarding financial guidance, market opportunity, the potential

impact of Medicare reimbursement rates for the CPT codes primarily

relied upon for the Company’s Zio XT services, ability to penetrate

the market, anticipated productivity improvements and expectations

for growth. Such statements are based on current assumptions that

involve risks and uncertainties that could cause actual outcomes

and results to differ materially. These risks and uncertainties,

many of which are beyond our control, include risks described in

the section entitled “Risk Factors” and elsewhere in our filing

made with the Securities and Exchange Commission, including those

on the Form 10-Q expected to be filed on or about November 3, 2022.

These forward-looking statements speak only as of the date hereof

and should not be unduly relied upon. iRhythm disclaims any

obligation to update these forward-looking statements.

|

Investor Relations Contact: |

Media Contact: |

| Stephanie Zhadkevich |

Morgan Mathis |

| (919) 452-5430 |

(310) 528-6306 |

| investors@irhythmtech.com |

irhythm@highwirepr.com |

- Ameenathul M. Fawzy MB, Jade

Edmonds, Anthony Shannon, David J. Wright MD. A Service Evaluation

of Zio XT: The Liverpool Experience. In: ESC Congress 2022, August

26 - 29, 2022 Barcelona, Spain.

IRHYTHM TECHNOLOGIES,

INC.Condensed Consolidated Balance

Sheets(unaudited)(in

thousands)

| |

September 30, |

|

December 31, |

|

|

|

2022 |

|

|

|

2021 |

|

| Assets |

|

|

|

| Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

71,222 |

|

|

$ |

127,562 |

|

|

Short-term investments |

|

132,316 |

|

|

|

111,569 |

|

|

Accounts receivable, net |

|

60,534 |

|

|

|

46,430 |

|

|

Inventory |

|

14,452 |

|

|

|

10,268 |

|

|

Prepaid expenses and other current assets |

|

7,326 |

|

|

|

9,693 |

|

|

Total current assets |

|

285,850 |

|

|

|

305,522 |

|

| Property and equipment, net |

|

71,515 |

|

|

|

55,944 |

|

| Operating lease right-of-use

assets |

|

62,010 |

|

|

|

84,587 |

|

| Goodwill |

|

862 |

|

|

|

862 |

|

| Other assets |

|

20,153 |

|

|

|

16,052 |

|

|

Total assets |

$ |

440,390 |

|

|

$ |

462,967 |

|

| Liabilities and

Stockholders’ Equity |

|

|

|

| Current liabilities: |

|

|

|

|

Accounts payable |

$ |

7,404 |

|

|

$ |

10,509 |

|

|

Accrued liabilities |

|

60,264 |

|

|

|

51,486 |

|

|

Deferred revenue |

|

3,003 |

|

|

|

3,049 |

|

|

Debt, current portion |

|

— |

|

|

|

11,667 |

|

|

Operating lease liabilities, current portion |

|

12,920 |

|

|

|

11,142 |

|

|

Total current liabilities |

|

83,591 |

|

|

|

87,853 |

|

| Debt, noncurrent portion |

|

34,931 |

|

|

|

9,690 |

|

| Other noncurrent

liabilities |

|

1,163 |

|

|

|

697 |

|

| Operating lease liabilities,

noncurrent portion |

|

81,481 |

|

|

|

85,212 |

|

|

Total liabilities |

|

201,166 |

|

|

|

183,452 |

|

| Stockholders’ equity: |

|

|

|

|

Preferred Stock |

|

— |

|

|

|

— |

|

|

Common stock |

|

28 |

|

|

|

27 |

|

|

Additional paid-in capital |

|

741,879 |

|

|

|

685,594 |

|

|

Accumulated other comprehensive loss |

|

(681 |

) |

|

|

(61 |

) |

|

Accumulated deficit |

|

(502,002 |

) |

|

|

(406,045 |

) |

| Total stockholders’ equity |

|

239,224 |

|

|

|

279,515 |

|

| Total liabilities and

stockholders’ equity |

$ |

440,390 |

|

|

$ |

462,967 |

|

| |

|

|

|

IRHYTHM TECHNOLOGIES,

INC.Condensed Consolidated Statements of

Operations(unaudited)(in

thousands, except share and per share data)

| |

Three Months Ended September

30, |

|

Nine Months Ended September

30, |

|

|

|

2022 |

|

|

|

2021 |

|

|

|

2022 |

|

|

|

2021 |

|

| Revenue, net |

$ |

103,875 |

|

|

$ |

85,432 |

|

|

$ |

298,304 |

|

|

$ |

241,021 |

|

| Cost of revenue |

|

32,954 |

|

|

|

29,284 |

|

|

|

95,379 |

|

|

|

78,737 |

|

| Gross profit |

|

70,921 |

|

|

|

56,148 |

|

|

|

202,925 |

|

|

|

162,284 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

Research and development |

|

11,448 |

|

|

|

8,685 |

|

|

|

33,935 |

|

|

|

26,801 |

|

|

Selling, general and administrative |

|

80,559 |

|

|

|

70,745 |

|

|

|

235,468 |

|

|

|

203,227 |

|

|

Impairment and restructuring charges |

|

— |

|

|

|

— |

|

|

|

26,608 |

|

|

|

— |

|

|

Total operating expenses |

|

92,007 |

|

|

|

79,430 |

|

|

|

296,011 |

|

|

|

230,028 |

|

| Loss from operations |

|

(21,086 |

) |

|

|

(23,282 |

) |

|

|

(93,086 |

) |

|

|

(67,744 |

) |

| Interest expense |

|

(614 |

) |

|

|

(279 |

) |

|

|

(3,125 |

) |

|

|

(921 |

) |

| Other income (expense),

net |

|

365 |

|

|

|

(76 |

) |

|

|

450 |

|

|

|

103 |

|

| Loss before income taxes |

|

(21,335 |

) |

|

|

(23,637 |

) |

|

|

(95,761 |

) |

|

|

(68,562 |

) |

| Income tax provision |

|

116 |

|

|

|

94 |

|

|

|

196 |

|

|

|

308 |

|

| Net loss |

$ |

(21,451 |

) |

|

$ |

(23,731 |

) |

|

$ |

(95,957 |

) |

|

$ |

(68,870 |

) |

| Net loss per common share,

basic and diluted |

$ |

(0.71 |

) |

|

$ |

(0.81 |

) |

|

$ |

(3.22 |

) |

|

$ |

(2.35 |

) |

| Weighted-average shares, basic

and diluted |

|

30,055,166 |

|

|

|

29,397,845 |

|

|

|

29,836,601 |

|

|

|

29,294,559 |

|

| |

|

|

|

|

|

|

|

IRHYTHM TECHNOLOGIES,

INC.Reconciliation of GAAP to Non-GAAP Financial

Information(unaudited)(in

thousands, except per share data)

| |

Three Months EndedSeptember

30, |

|

Nine Months EndedSeptember

30, |

|

Adjusted EBITDA reconciliation |

|

2022 |

|

|

|

2021 |

|

|

|

2022 |

|

|

|

2021 |

|

| Net loss |

$ |

(21,451 |

) |

|

$ |

(23,731 |

) |

|

$ |

(95,957 |

) |

|

$ |

(68,870 |

) |

| Income tax provision |

|

116 |

|

|

|

94 |

|

|

|

196 |

|

|

|

308 |

|

| Depreciation and

amortization |

|

3,436 |

|

|

|

2,549 |

|

|

|

9,930 |

|

|

|

6,738 |

|

| Interest expense, net |

|

15 |

|

|

|

223 |

|

|

|

2,198 |

|

|

|

717 |

|

| Stock-based compensation |

|

12,945 |

|

|

|

12,160 |

|

|

|

41,946 |

|

|

|

42,651 |

|

| Impairment and restructuring

charges |

|

— |

|

|

|

— |

|

|

|

26,608 |

|

|

|

— |

|

| Transformation costs |

|

2,315 |

|

|

|

— |

|

|

|

2,748 |

|

|

|

— |

|

| Adjusted EBITDA |

$ |

(2,624 |

) |

|

$ |

(8,705 |

) |

|

$ |

(12,331 |

) |

|

$ |

(18,456 |

) |

| |

Three Months EndedSeptember

30, |

|

Nine Months EndedSeptember

30, |

|

|

|

2022 |

|

|

|

2021 |

|

|

|

2022 |

|

|

|

2021 |

|

| Adjusted net loss

reconciliation |

|

|

|

|

|

|

|

| Net loss, as reported |

$ |

(21,451 |

) |

|

$ |

(23,731 |

) |

|

$ |

(95,957 |

) |

|

$ |

(68,870 |

) |

| Impairment and restructuring

charges |

|

— |

|

|

|

— |

|

|

|

26,608 |

|

|

|

— |

|

| Transformation costs |

|

2,315 |

|

|

|

— |

|

|

|

2,748 |

|

|

|

— |

|

| Adjusted net loss |

$ |

(19,136 |

) |

|

$ |

(23,731 |

) |

|

$ |

(66,601 |

) |

|

$ |

(68,870 |

) |

| |

|

|

|

|

|

|

|

| Adjusted net loss per

share reconciliation |

|

|

|

|

|

|

|

| Net loss per share, as

reported |

$ |

(0.71 |

) |

|

$ |

(0.81 |

) |

|

$ |

(3.22 |

) |

|

$ |

(2.35 |

) |

| Impairment and restructuring

charges per share |

|

— |

|

|

|

— |

|

|

|

0.89 |

|

|

|

— |

|

| Transformation costs per

share |

|

0.08 |

|

|

|

— |

|

|

|

0.09 |

|

|

|

— |

|

| Adjusted net loss per

share |

$ |

(0.63 |

) |

|

$ |

(0.81 |

) |

|

$ |

(2.24 |

) |

|

$ |

(2.35 |

) |

| |

|

|

|

|

|

|

|

| Adjusted operating

expense reconciliation |

|

|

|

|

|

|

|

| Operating expense, as

reported |

$ |

92,007 |

|

|

$ |

79,430 |

|

|

$ |

296,011 |

|

|

$ |

230,028 |

|

| Impairment and restructuring

charges |

|

— |

|

|

|

— |

|

|

|

(26,608 |

) |

|

|

— |

|

| Transformation costs |

|

(2,315 |

) |

|

|

— |

|

|

|

(2,748 |

) |

|

|

— |

|

| Adjusted operating

expense |

$ |

89,692 |

|

|

$ |

79,430 |

|

|

$ |

266,655 |

|

|

$ |

230,028 |

|

| |

|

|

|

|

|

|

|

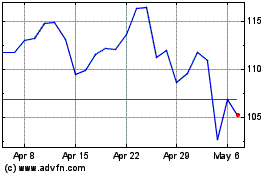

iRhythm Technologies (NASDAQ:IRTC)

Historical Stock Chart

From Aug 2024 to Sep 2024

iRhythm Technologies (NASDAQ:IRTC)

Historical Stock Chart

From Sep 2023 to Sep 2024