UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant

☐

Check the appropriate box:

| ☒ |

Preliminary Proxy Statement |

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ |

Definitive Proxy Statement |

| ☐ |

Definitive Additional Materials |

| ☐ |

Soliciting Material Pursuant to §240.14a-12 |

IPOWER INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other

Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| |

☒ |

No fee required. |

| |

☐ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| |

|

|

| |

(1) |

Title of each class of securities to which transaction applies: |

| |

|

|

| |

(2) |

Aggregate number of securities to which transaction applies: |

| |

|

|

| |

(3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

|

|

| |

(4) |

Proposed maximum aggregate value of transaction: |

| |

|

|

| |

(5) |

Total fee paid: |

| |

|

|

| |

☐ |

Fee paid previously with preliminary materials: |

| |

|

|

| |

☐ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| |

(1) |

Amount Previously Paid: |

| |

|

|

| |

(2) |

Form, Schedule or Registration Statement No.: |

| |

|

|

| |

(3) |

Filing Party: |

| |

|

|

| |

(4) |

Date Filed: |

| |

|

|

iPower Inc.

2399 Bateman Avenue

Duarte, CA 91010

Dear Shareholders,

We want to thank you for your interest in and support

of iPower in 2022. This was a strong year for the company, as the company achieved a number of important milestones, introduced a number

of new products and outperformed its peer group on a number of fundamental metrics. We were able to do this despite a number of macro

and industry sector headwinds, and a challenging geopolitical environment. We are proud of our achievements and our dedicated team who

made this possible.

First, we grew revenues by 47% in our fiscal year

ended June 30, 2022, after posting over 35% revenue growth in the prior fiscal year. Both these years exceed our historical organic growth

rate of 25%. Second, we introduced a number of new products that expanded our product reach outside of hydroponics and which contributed

strongly to our growth profile. We have a highly efficient, data-driven product development engine and a robust supplier base. This allows

us to quickly enter product categories with designs well suited to customer requirements, and to get those products in the hands of customers.

Third, our development engine allowed us to increase our in house product revenue contribution to over 80% of total revenue exiting the

fiscal year. Our customers love our value proposition and our product portfolio. Finally, we completed our first meaningful M&A transaction

with the acquisition of DHS. DHS was a trusted partner of ours in Asia, providing us with value added engineering, quality assurance,

logistics and sales support. Bringing the DHS team in house was a critical element in our ongoing journey as an end-to-end ecommerce company.

In closing, our business and the world continue

to face challenges including inflation, an uncertain global economy and geopolitical unrest, and ongoing supply chain volatility. As the

world tries to reset in a post pandemic world, our company’s focus remains unchanged. We will continue introducing new, category-leading

products and continue developing our service offerings for partners and brands looking to take advantage of the ecommerce ecosystem. At

our core, we are a data and technology driven company, and will continue investing in our fundamental technology platform. This will strengthen

our current operation, and lay the foundation for our continued expansion into adjacent product and service categories. We are confident

this will provide us momentum for the next several years of iPower’s journey. While 2023 will be a year of continued challenges,

we believe iPower will emerge stronger, more resilient and well positioned for the future.

| |

Sincerely,

/s/ Lawrence Tan

Lawrence Tan

Chairman and CEO |

IPOWER INC.

2399 Bateman Avenue

Duarte, CA 91010

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

to be held on April 26, 2023

TO THE SHAREHOLDER OF IPOWER INC.:

The Annual Meeting of the

shareholders of iPower Inc., a Nevada corporation (“Company”), will be held on April 26, 2023, at 10:00 a.m. (ET), at the

offices of the Company, located at 2399 Bateman Avenue, Duarte, CA 91010, and will be accessible virtually at www.virtualshareholdermeeting.com/IPW2023,

for the following purposes:

| |

1. |

To elect five (5) directors; |

| |

|

|

| |

2. |

To the ratify appointment of the UHY LLP, as Company’s

independent accountants, for the fiscal year ending June 30, 2023; |

| |

|

|

| |

3. |

To conduct an advisory vote approving executive compensation; |

| |

|

|

| |

4. |

To approve an amendment to our Sixth Amended and Restated Articles of Incorporation (the “Articles of Incorporation” or “Charter”) to effect, at the discretion of our Board of Directors, a reverse stock split of our common stock at a stock split ratio between 1-for-2 and 1-for-4, with the ultimate ratio to be determined by the Board of Directors in its sole discretion (the “Reverse Stock Split”), the implementation and timing of which shall be subject to the discretion of the Board of Directors; and |

| |

|

|

| |

5. |

To transact any other business as may properly be presented at the Annual Meeting or any adjournment thereof. |

A proxy statement providing

information and a form of proxy to vote with respect to the foregoing matters accompany this notice.

| |

By Order of the Board of Directors, |

| |

|

| |

/s/ Chenlong Tan |

| |

Chenlong Tan |

| |

Chief Executive Officer |

Dated: March [ ], 2023

IMPORTANT

Whether or not you expect to attend the Annual

Meeting, please complete, date and sign the accompanying proxy card and return it promptly in the enclosed return envelope or follow the

instructions contained in the Proxy Materials to vote on the Internet or by telephone. If you grant a proxy, you may revoke it at any

time prior to the Annual Meeting and will still have the opportunity to vote in person at the Annual Meeting.

PLEASE NOTE: If your shares are held in street

name, your broker, bank, custodian or other nominee holder cannot vote your shares in the election of directors unless you direct the

nominee holder how to vote by marking your proxy card.

iPower Inc.

2399 Bateman Avenue

Duarte, CA 91010

PROXY STATEMENT

for the

Annual Meeting of Shareholders

to be held on April 26, 2023

PROXY SOLICITATION

The Company is soliciting

proxies on behalf of the Board of Directors in connection with the Company’s annual meeting of shareholders on April 26, 2023, and

at any adjournment thereof. The Company will bear the entire cost of preparing, assembling, printing and mailing this Proxy Statement,

the accompanying proxy card, and any additional materials that may be furnished to shareholders. Broadridge Financial Solutions, Inc.

has been engaged to solicit proxies and distribute materials to brokers, banks, custodians, and other nominee holders for forwarding to

beneficial owners of the Company’s stock, and the Company will pay Broadridge Financial Solutions, Inc. for these services and reimburse

certain of its expenses. In addition, the Company will reimburse nominee holders their forwarding costs. Proxies also may be solicited

through the mail or direct communication with certain shareholders or their representatives by Company officers, directors or employees,

who will receive no additional compensation for their efforts.

On or about March 27, 2023,

the Company will mail to all shareholders of record, as of March 14, 2023 (the “Record Date”), a copy of this Proxy Statement,

the proxy card and the Company’s Annual Report.

GENERAL INFORMATION ABOUT VOTING

Who can vote?

You can vote your shares of

common stock if our records show that you owned the shares on the Record Date. As of the close of business on the Record Date, a total

of 29,572,382 shares of common stock are entitled to vote at the Annual Meeting. Each share of common stock is entitled to one vote on

all matters presented at the Annual Meeting.

If I am a shareholder of record, how do I cast

my vote?

We encourage you to vote your

proxy over the Internet or telephone. You may vote by proxy over the Internet by going to www.proxyvote.com to complete an electronic

proxy card or you may submit your vote by calling 1-800-690-6903. In order to ensure that your vote counts, we must receive your vote

must by no later than 11:59 p.m. U.S. Pacific Time on April 25, 2023.

We provide Internet proxy

voting to allow you to vote your shares on-line, using procedures designed to ensure the authenticity and correctness of your proxy vote

instructions. However, please be aware that you must bear any costs associated with your Internet access, such as usage charges from your

Internet service provider and telephone company.

You may also vote by proxy

using the enclosed proxy card. If you choose to vote using the proxy card, please complete, sign and date your proxy card and return it

promptly in the envelope provided.

If you are a shareholder of

record, you may also vote in person at the Annual Meeting. We will give you a ballot when you arrive.

What if other matters come up at the Annual

Meeting?

The matters described in this

proxy statement are the only matters we know of that will be voted on at the Annual Meeting. If other matters are properly presented at

the meeting, the proxy holders will vote your shares as they see fit.

Can I change my vote after I return my proxy

card?

Yes. You can revoke your proxy

at any time before it is exercised at the Annual Meeting in any of three ways:

| |

• |

by submitting written notice revoking your proxy card to the Secretary of the Company; |

| |

|

|

| |

• |

by submitting another proxy via the Internet or by mail that is dated after your original proxy vote and, if by mail, it is properly signed; or |

| |

|

|

| |

• |

by voting in person at the Annual Meeting. |

Can I vote in person at the Annual Meeting

rather than by completing the proxy card?

Although we encourage you

to complete and return the proxy card or vote by proxy on the Internet to ensure that your vote is counted, you can attend the Annual

Meeting and vote your shares in person.

Why are we seeking shareholder approval for

these proposals?

Proposal No. 1: The

Nevada Revised Statutes, as amended, and the rules of the NASDAQ Stock Market require corporations to hold elections for directors each

year.

Proposal No. 2: The

Company appointed UHY LLP to serve as the Company’s independent auditors for the 2023 fiscal year. The Company elects to have its

shareholders ratify such appointment.

Proposal No. 3: The

Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (the “Dodd-Frank Act”), provides an advisory vote by shareholders

to approve the compensation paid to the Company’s named executive officers.

Proposal No. 4: The

Company is seeking approval for an amendment to our Sixth Amended and Restated Articles of Incorporation

(the “Articles of Incorporation” or “Charter”) to effect, at the discretion of our Board of Directors, a reverse

stock split of our common stock at a stock split ratio between 1-for-2 and 1-for-4, with the ultimate ratio to be determined by the Board

of Directors in its sole discretion (the “Reverse Stock Split”) as may be deemed necessary to maintain the Company’s

Nasdaq listing requirements, the implementation and timing of which shall be subject to the discretion of the Board of Directors.

Votes Required to Approve each Proposal

The holders of a majority

in interest of all stock issued, outstanding and entitled to vote at a meeting, present in person or represented by proxy will constitute

a quorum for the transaction of business at the Annual Meeting. Shares of common stock represented in person or by proxy (including shares

which abstain or do not vote with respect to one or more of the matters presented for shareholder approval) will be counted for purposes

of determining whether a quorum is present at the Annual Meeting. If a quorum is not present, the meeting may be adjourned until a quorum

is obtained.

The following votes are required

for approval of the proposals being presented at the Annual Meeting:

Proposal No. 1: Election

of Directors. Votes may be cast: “FOR ALL” nominees, “WITHHOLD ALL” nominees or “FOR ALL EXCEPT”

those nominees noted by you on the appropriate portion of your proxy or voting instruction card. At the Meeting, five directors are to

be elected, which number shall constitute our entire Board, to hold office until the next annual meeting of shareholders and until their

successors shall have been duly elected and qualified. Pursuant to our bylaws, as amended, directors are to be elected by a plurality

of the votes of the shares present in person or represented by proxy at the Meeting and entitled to vote on the election of directors.

This means that the five candidates receiving the highest number of affirmative votes at the Meeting will be elected as directors. Proxies

cannot be voted for a greater number of persons than the number of nominees named or for persons other than the named nominees. Withholding

a vote from a director nominee will not be voted with respect to the director nominee indicated and will have no impact on the election

of directors although it will be counted for the purposes of determining whether there is a quorum. Broker non-votes will have no effect

on the outcome of this proposal.

Proposal No. 2: To Ratify

the Selection of UHY LLP as the Company’s independent registered public accounting firm for the fiscal year ending June 30, 2023. Votes

may be cast: “FOR,” “AGAINST” or “ABSTAIN.” the affirmative vote of the holders

of shares of common stock representing a majority of the shares of common stock cast at the meeting in person or by proxy is required

for the ratification of the selection of UHY LLP as our independent registered public accounting firm for the current fiscal year. Abstentions

will have no effect on the outcome of this proposal. There will be no broker non-votes with respect to this proposal.

Proposal No. 3: To Approve

the Compensation of the Company’s Named Executive Officers. Votes may be cast: “FOR,” “AGAINST”

or “ABSTAIN.” The affirmative vote of the holders of shares of common stock representing a majority of the shares of common

stock cast at the meeting in person or by proxy is required for the approval, on a non-binding advisory basis, of the compensation of

the Company’s named executive officers as disclosed in the accompanying proxy statement. Abstentions and broker non-votes will have

no effect on the outcome of this proposal.

Proposal No. 4: To Recommend

an Amendment to the Company’s Sixth Amended and Restated Articles of Incorporation. Votes may be cast: “FOR,”

“AGAINST” or “ABSTAIN. The affirmative vote of holders of shares of common stock representing a majority of the outstanding

voting shares of common stock is required for the approval of this proposal to amend the Company’s Sixth Amended and Restated Articles

of Incorporation. Abstentions and broker non-votes are counted for purposes of determining whether a quorum is present at the Annual Meeting

for purposes of this proposal.

How are votes counted?

Votes will be counted by the

inspector of elections appointed for the meeting, who will separately count “For,” “Abstain” and

“Against” votes, and broker non-votes. Abstentions will not be counted as votes for any matter.

Who pays for this proxy solicitation?

We do. In addition to sending

you these materials and posting them on the Internet, some of our employees may contact you by telephone, by mail, by fax, by email or

in person. None of these employees will receive any extra compensation for doing this. We may reimburse brokerage firms and other custodians

for their reasonable out-of-pocket costs in forwarding these proxy materials to shareholders.

Is my vote kept confidential?

Proxy instructions, ballots

and voting tabulations that identify individual shareholders are handled in a manner that protects your voting privacy. Your vote will

not be disclosed either within the Company or to third parties, except:

| • |

as necessary to meet applicable legal requirements; |

| |

|

| • |

to allow for the tabulation and certification of votes; and |

| |

|

| • |

to facilitate a successful proxy solicitation. |

Occasionally, shareholders provide written comments

on their proxy cards, which may be forwarded to the Company’s management and the Board.

How can I find out the results of the voting

at the Annual Meeting?

Preliminary voting results

will be announced at the Annual Meeting. Final voting results will be disclosed in a Current Report on Form 8-K filed after the Annual

Meeting.

PROPOSAL NO. 1

ELECTION OF DIRECTORS

Nominees to the Board of Directors

All of our directors hold

office for one-year terms until the election and qualification of their successors. Officers are appointed by our Board and serve at the

discretion of the Board, subject to applicable employment agreements. The following table sets forth information relating to our executive

officers and members of our Board.

| Name |

|

Age |

|

|

Position |

| Chenlong Tan |

|

|

40 |

|

|

Chairman, CEO, President, and Director |

| Kevin Vassily |

|

|

55 |

|

|

Chief Financial Officer and Director |

| Bennet Tchaikovsky |

|

|

53 |

|

|

Independent Director |

| Kevin Liles |

|

|

53 |

|

|

Independent Director |

| Hanxi Li |

|

|

36 |

|

|

Independent Director |

Chenlong Tan.

Mr. Tan cofounded our Company in 2018 and is the Chairman, Chief Executive Officer and President. He has held the position of Chief Executive

Officer since April 2018 and assumed the positions of Chairman, President and Interim Chief Financial Officer in January 2020. Mr. Tan

held the position of Interim Chief Financial Officer until January 2021. From 2010 until 2018, Mr. Tan was the cofounder, Chief Executive

Officer and Chief Information Officer at our predecessor, BizRight LLC, where he built the business from the ground up to achieve $20

million in sales through data driven development. From 2002 until 2010, Mr. Tan served as a Solution Architect and Senior Software Engineer

at various companies, where he took a lead role, managing consultants, business architects and project managers, in working with healthcare

companies in completing scoping requirements, solution gathering and project management, among other things. Mr. Tan received his B. Sc.

at the University of Auckland in New Zealand, where he graduated with honors.

Kevin Vassily.

Mr. Vassily serves as our Chief Financial Officer, a position he has held since January 2021. Mr. Vassily was also appointed as a member

of our board of directors in March 2021. Prior to joining iPower, from 2019 to January 2021, Mr. Vassily served as Vice President of Market

Development for Facteus, a financial analytics company focused on the Asset Management industry. From March 2019 through 2020, he served

as an advisor at Woodseer, a financial technology firm providing global dividend forecasts. From 2018 through its acquisition in 2020,

Mr. Vassily served as an advisor at Go Capture, where he was responsible for providing strategic, business development, and product development

advisory services for the company’s emerging “Data as a Service” platform. Since November 2019, Mr. Vassily has served

as a director of Zhongchao Inc., a provider of healthcare information, education and training services to healthcare professionals and

the public in China. Since July 2018, Mr. Vassily has also served as an advisor at Prometheus Fund, a Shanghai- based merchant bank/PE

firm focused on the “green” economy. And from 2015 through 2018, Mr. Vassily served as an associate director of research at

Keybanc Capital Markets, and helped to co-manage the Technology Research vertical. From 2010 to 2014, he served as the director of research

at Pacific Epoch, where he was responsible for a complete overhaul of product and a complete business model restart post acquisition,

re focusing the firm around a “data-first” research offering. From 2007 to 2010, he served as the Asia Technology business

development representative and as a senior analyst at Pacific Crest Securities, responsible for establishing the firm’s presence

and relevance covering Asia Technology. From 2003 to 2006, he served as senior research analyst in the semiconductor technology group

at Susquehanna International Group, responsible for research in semiconductor and related technologies. From 2001 to 2003, Mr. Vassily

served as the vice president and senior research analyst for semiconductor capital equipment at Thomas Weisel Partners, responsible for

publishing research and maintaining financial models on each of the companies under coverage. Mr. Vassily began his career on Wall Street

in 1998, as a research associate covering the semiconductor industry at Lehman Brothers. He holds a B.A. in liberal arts from Denison

University and an M.B.A. from the Tuck School of Business at Dartmouth College.

Bennet Tchaikovsky.

Mr. Tchaikovsky serves as a member of our board of directors, a position has held since May 2021, following completion of our

initial public offering, and serves as chair of the audit committee. Since January 2020, Mr. Tchaikovsky has been a member of the board

of directors for Oriental Culture Holding Group, Ltd. (NASDAQ: OCG) where he serves as a member of the audit committee, Chairperson of

the compensation committee and a member of the corporate governance and nominating committee. Since August 2014, Mr. Tchaikovsky has been

a full-time professor at Irvine Valley College and a part-time accounting instructor at Long Beach City College since September 2020.

From August 2018 to May 2019, Mr. Tchaikovsky was a part-time instructor at Chapman University. From November 2013 to August 2019, Mr.

Tchaikovsky served as a board member and chairman of the audit committee of Ener-Core, Inc. (OTCMKTS: ENCR). From August 2013 to May 2014,

Mr. Tchaikovsky was a part-time faculty member of Irvine Valley College and a part-time faculty member of Pasadena City College. Mr. Tchaikovsky

has served as a director on the board of directors of China Jo-Jo Drugstores, Inc. (NASDAQ: CJJD) from August 2011 to January 2013 and

as its chief financial officer from September 2009 to July 2011. From April 2010 to August 2013, Mr. Tchaikovsky has served as chief financial

officer of VLOV, Inc. From May 2008 to April 2010, Mr. Tchaikovsky has served as chief financial officer of Skystar Bio-Pharmaceutical

Company. From March 2008 to November 2009, Mr. Tchaikovsky served as a director on the board of directors of Ever-Glory International

Group (NASDAQ: EVK), where he served as chairman of the audit committee and was a member of the compensation committee. From December

2008 through November 2009, Mr. Tchaikovsky served as a director of Sino Clean Energy, Inc. Mr. Tchaikovsky received his Juris Doctorate

degree from Southwestern Law School in December 1996 and his Bachelor of Arts degree in Business Economics from University of California

at Santa Barbara in August 1991. Mr. Tchaikovsky is a licensed Certified Public Accountant in California and is an active member of the

California State Bar. We believe that Mr. Tchaikovsky’s extensive experience in accounting and business will benefit the Company’s

business and operations and make him a valuable member of the board of directors and its committees.

Kevin Liles.

Mr. Liles serves as a member of our board of directors, a position he has held since May 2021, following completion of our initial public

offering, and serves as chair of the nominating and corporate governance committee. Since 2012, Mr. Liles has been co-founder of 300 Entertainment,

a music company whose roster includes acts across multiple genres including hip-hop, rock, pop, electronic, and alternative. From 2009

until present, Mr. Liles is a founder of KWL Enterprise, a niche brand management solutions company. From 2004 until 2009, Mr. Liles was

an executive vice president of Warner Music, where he oversaw global strategy and was pivotal in building the artist services division

into what is now a $200 million business. From 1998 until 2004, Mr. Liles was president of Def Jam Recordings and executive vice president

of The Island Def Jam Music Group, where he amplified the brand’s influence through introducing Def College Jam, opening five international

offices, launching successful video game franchises, and doubling revenue to $400 million. Mr. Liles has long been focused on philanthropic

work, with a focus on global education and entrepreneurship, culminating in his receipt of the 2010 Medaille de la Ville de Paris award

for his contribution to Parisian culture. Mr. Liles holds an honorary Doctor of Law degree from Morgan State University, where he studied

engineering and electrical engineering as an undergraduate. We believe Mr. Liles’ extensive entrepreneurial and business experience,

as well as his extensive knowledge in the area of social media, will assist us in our growth plans going forward.

Hanxi Li. Ms.

Li serves as a member of our board of directors, a position she has held since January 2022, and serves as chair of the compensation committee.

Ms. Li has more than a decade of marketing experience working with Fortune 50 companies and international conferences. Since 2019, Ms.

Li has served as Vice President of Marketing for Elegantz Productions LLC. In this role, she executed branding and marketing campaigns

targeting the United States region for Sequoia Capital and Xiaomi. She also formed a long-term partnership with ByteDance Ltd. and Ciwen

Media. From 2017 to 2018, she was the marketing director of the Company’s predecessor, Bizright LLC, where she was in charge of

the company’s branding and marketing strategies, including the expansion of the company’s social media marketing. From 2013

to 2016, Ms. Li was a partner at a private video studio where she worked with top companies across industries, including Bluefocus, and

executed a performance project in China National Olympic Park. From 2011 to 2014, as publicity supervisor for the China National Convention

Center, Ms. Li led efforts for branding and media channels for national and international meetings. Her long track record as a successful

marketing leader makes her ideally suited to serving as a member of our board of directors.

Family Relationships

There are no family relationships

among any of our officers or directors.

Involvement in Certain Legal Proceedings

To our knowledge, during the

past ten years, none of our directors, executive officers, promoters, control persons, or nominees has:

| |

· |

had any bankruptcy petition filed by or against the business or property of the person, or of any partnership, corporation or business association of which he was a general partner or executive officer, either at the time of the bankruptcy filing or within two years prior to that time; |

| |

· |

been convicted in a criminal proceeding or been subject to a pending criminal proceeding (excluding traffic violations and other minor offenses); |

| |

· |

been subject to any order, judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction or federal or state authority, permanently or temporarily enjoining, barring, suspending or otherwise limiting, his involvement in any type of business, securities, futures, commodities, investment, banking, savings and loan, or insurance activities, or to be associated with persons engaged in any such activity; |

| |

· |

been found by a court of competent jurisdiction in a civil action or by the SEC or the Commodity Futures Trading Commission to have violated a federal or state securities or commodities law, and the judgment has not been reversed, suspended, or vacated; |

| |

· |

been the subject of, or a party to, any federal or state judicial or administrative order, judgment, decree, or finding, not subsequently reversed, suspended or vacated (not including any settlement of a civil proceeding among private litigants), relating to an alleged violation of any federal or state securities or commodities law or regulation, any law or regulation respecting financial institutions or insurance companies including, but not limited to, a temporary or permanent injunction, order of disgorgement or restitution, civil money penalty or temporary or permanent cease-and-desist order, or removal or prohibition order, or any law or regulation prohibiting mail or wire fraud or fraud in connection with any business entity; or |

| |

· |

been the subject of, or a party to, any sanction or order, not subsequently reversed, suspended or vacated, of any self-regulatory organization (as defined in Section 3(a)(26) of the Exchange Act), any registered entity (as defined in Section 1(a)(29) of the Commodity Exchange Act), or any equivalent exchange, association, entity or organization that has disciplinary authority over its members or persons associated with a member. |

Board Operations

All directors hold office

until the next annual meeting of shareholders and until their successors have been duly elected and qualified. Directors elected at the

annual meetings serve for one-year terms. Officers are elected by, and serve at the discretion of, the Board. Our Board shall hold meetings

on at least a quarterly basis.

Mr. Tan holds the positions

of Chief Executive Officer and Chairman of the Board of the Company. The Board believes that Mr. Tan’s services as both Chief Executive

Officer and Chairman of the Board is in the best interest of the Company and its shareholders. Mr. Tan possesses detailed and in-depth

knowledge of the issues, opportunities and challenges facing us in our business and is thus best positioned to develop agendas that ensure

that the Board’s time and attention are focused on the most critical matters relating to the Company’s business. His combined

role enables decisive leadership, ensures clear accountability, and enhances the Company’s ability to communicate its message and

strategy clearly and consistently to our shareholders, employees and customers.

The Board has not designated

a lead director. The independent directors can call and plan their executive sessions collaboratively and, between meetings of the Board,

communicate with management and one another directly. Under these circumstances, the directors believe designating a lead director to

take on responsibility for functions in which they all currently participate might detract from rather than enhance performance of their

responsibilities as directors.

The Board receives regular

reports from the Chief Executive Officer and members of senior management on operational, financial, legal and regulatory issues and risks.

The Audit Committee of the Board additionally is charged under its charter with oversight of financial risk, including the Company’s

internal controls, and it receives regular reports from management, the Company’s internal auditors and the Company’s independent

auditors. Whenever a committee of the Board receives a report involving risk identification, risk management or risk mitigation, the chairman

of the committee reports on that discussion, as appropriate, to the full Board during the next board meeting.

The Company’s Board

held six meetings and acted by written consent on four occassions during the year ended June 30, 2022. During that time, no director attended

fewer than 75% of the meetings of the Board and Board committees of which the director was a member.

Board Committees

Our board of directors has

established an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee. Each of these committees

operates under a charter that has been approved by our board of directors, as set forth below.

Audit Committee.

Our Audit Committee consists of three independent directors. The members of the Audit Committee are Mr. Tchaikovsky, Mr. Liles and Ms.

Li. The Audit Committee consists exclusively of directors who are financially literate and Mr. Tchaikovsky serves as chair of the Audit

Committee. As a licensed certified public accountant, Mr. Tchaikovsky is considered an “audit committee financial expert”

as defined by the SEC’s rules and regulations.

The audit committee responsibilities include:

| |

· |

overseeing the compensation and work of and performance by our independent auditor and any other registered public accounting firm performing audit, review or attestation services for us; |

| |

· |

engaging, retaining and terminating our independent auditor and determining the terms thereof; |

| |

· |

assessing the qualifications, performance and independence of the independent auditor; |

| |

· |

evaluating whether the provision of permitted non-audit services is compatible with maintaining the auditor’s independence; |

| |

· |

reviewing and discussing the audit results, including any comments and recommendations of the independent auditor and the responses of management to such recommendations; |

| |

· |

reviewing and discussing the annual and quarterly financial statements with management and the independent auditor; |

| |

· |

producing a committee report for inclusion in applicable SEC filings; |

| |

· |

reviewing the adequacy and effectiveness of internal controls and procedures; |

| |

· |

establishing procedures regarding the receipt, retention and treatment of complaints received regarding the accounting, internal accounting controls, or auditing matters and conducting or authorizing investigations into any matters within the scope of the responsibility of the audit committee; and |

| |

· |

reviewing transactions with related persons for potential conflict of interest situations. |

The Audit Committee held four

meetings and acted by written consent on zero occasions during the fiscal year ended June 30, 2022.

Compensation Committee.

Our Compensation Committee consists of three independent directors. The members of the Compensation Committee are Ms. Li, Mr. Tchaikovsky

and Mr. Liles. Ms. Li serves as the chair of the Compensation Committee. The committee has primary responsibility for:

| |

· |

reviewing and recommending all elements and amounts of compensation for each executive officer, including any performance goals applicable to those executive officers; |

| |

· |

reviewing and recommending for approval the adoption, any amendment and termination of all cash and equity-based incentive compensation plans; |

| |

· |

once required by applicable law, causing to be prepared a committee report for inclusion in applicable SEC filings; |

| |

· |

approving any employment agreements, severance agreements or change of control agreements that are entered into with the CEO and certain executive officers; and |

| |

· |

reviewing and recommending the level and form of non-employee director compensation and benefits. |

The Compensation Committee

held one meeting during the fiscal year ended June 30, 2022 and acted by written consent on three occasions.

Nominating and Governance

Committee. The Nominating and Governance Committee consists of three independent directors. The members of the Nominating and

Governance Committee are Mr. Liles, Mr. Tchaikovsky and Ms. Li. Mr. Liles serves as chair of the Nominating and Corporate Governance Committee.

The Nominating and Corporate Governance Committee’s responsibilities include:

| |

· |

recommending persons for election as directors by the shareholders; |

| |

· |

recommending persons for appointment as directors to the extent necessary to fill any vacancies or newly created directorships; |

| |

· |

reviewing annually the skills and characteristics required of directors and each incumbent director’s continued service on the board; |

| |

· |

reviewing any shareholder proposals and nominations for directors; |

| |

· |

advising the board of directors on the appropriate structure and operations of the board and its committees; |

| |

· |

reviewing and recommending standing board committee assignments; |

| |

· |

developing and recommending to the board Corporate Governance Guidelines, a Code of Business Conduct and Ethics and other corporate governance policies and programs and reviewing such guidelines, code and any other policies and programs at least annually; |

| |

· |

making recommendations to the board as to determinations of director independence; and |

| |

· |

making recommendations to the board regarding corporate governance based upon developments, trends, and best practices. |

The Nominating and Governance

Committee will consider shareholder recommendations for candidates for the Board.

The Nominating and Corporate

Governance Committee held no meetings during the fiscal year ended June 30, 2022 and acted by written consent on one occasion.

Code of Business Conduct and Ethics

The Company has adopted a

formal Code of Business Conduct and Ethics that is applicable to every officer, director, employee and consultant (the “Employees”)

of the Company and its affiliates. The Code reaffirms the high standards of business conduct required of all of the Company’s Employees.

Insider Trading Policy

The Company has adopted an

insider trading policy to help the Company’s Employees comply with federal and state securities laws, prevent insider trading and

govern the terms and conditions at which the Employees can trade in the Company’s securities.

Limitation of Directors Liability and Indemnification

The Nevada Revised Statutes

(“NRS”) authorizes corporations to limit or eliminate, subject to certain conditions, the personal liability of directors

to corporations and their shareholders for monetary damages for breach of their fiduciary duties.

iPower maintains stand-alone

director and officer liability insurance to cover liabilities our directors and officers may incur in connection with their services to

us, including matters arising under the Securities Act. In addition, Nevada law and our bylaws provide that we will indemnify our directors

and officers who, by reason of the fact that he or she is an officer or director, is involved in a legal proceeding of any nature.

There is no pending litigation

or proceeding against any of our directors, officers, employees or agents in which indemnification will be required or permitted. We are

not aware of any threatened litigation or proceeding which may result in a claim for such indemnification.

Indemnification Agreements

To date, we have no specific

indemnification agreements with our directors or executive officers. However, our officers and directors are entitled to indemnification

through our bylaws and to the extent allowed pursuant to the Nevada Revised Statutes, federal securities law and our directors and officers

liability insurance.

Director Compensation

We

reimburse all members of our board of directors for their direct out of pocket expenses incurred in attending meetings of our board. This

table summarizes the compensation paid to each of our independent directors who served in such capacity during the fiscal year ended June

30, 2022.

| Name |

|

Fees Earned or Paid in Cash

($USD) |

|

Stock Based Awards

($USD) |

|

Others

($USD) |

|

Total

($USD) |

| Bennet Tchaikovsky |

|

$ |

30,000 |

|

|

$ |

30,000 |

|

|

$ |

– |

|

|

$ |

60,000 |

|

| Kevin Liles |

|

$ |

25,000 |

|

|

$ |

30,000 |

|

|

$ |

– |

|

|

$ |

55,000 |

|

| Hanxi Li |

|

$ |

12,500 |

|

|

$ |

15,000 |

|

|

$ |

– |

|

|

$ |

27,500 |

|

| Danilo Cacciamatta(1) |

|

$ |

12,500 |

|

|

$ |

15,000 |

|

|

$ |

– |

|

|

$ |

27,500 |

|

_______________________

| (1) |

Mr. Cacciamatta resigned from his position as independent director at the end of December 2021 and Ms. Hanxi Li was appointed to the position of director on December 23, 2021 |

Our

independent directors have each entered into letter agreements with the Company pursuant to which each receive (i) $25,000 annual cash

compensation, payable in equal quarterly installments, and (ii) $30,000 in restricted stock units (“RSUs”), which were issued

pursuant to our 2020 Equity Incentive Plan upon completion of our IPO and began quarterly vesting commencing 90 days after the completion

of our initial public offering. In addition, the chairman of our audit committee is entitled to receive an additional $5,000 annual retainer

for his additional responsibilities, which retainer will be payable in equal quarterly installments. Directors will also be reimbursed

for reasonable expenses incurred in connection with the performance of their duties. No additional director compensation has been awarded

to any directors who were serving as executive officers for the fiscal years ended June 30, 2022 and 2021.

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING

COMPLIANCE

Section 16(a) of the Securities

Exchange Act requires our executive officers and directors, and persons who own more than 10% of our common stock, to file reports regarding

ownership of, and transactions in, our securities with the Securities and Exchange Commission and to provide us with copies of those filings.

Based solely on our review of the copies of such forms furnished to us and written representations by our officers and directors regarding

their compliance with applicable reporting requirements under Section 16(a) of the Exchange Act, we believe that all Section 16(a) filing

requirements for our executive officers, directors and 10% shareholders were met during the year ended June 30, 2022.

EXECUTIVE OFFICE COMPENSATION

Summary Compensation Table

The following table presents

information regarding the total compensation earned by our executive officers who were serving as executive officers as of June 30, 2022

for services rendered in all capacities to us for the fiscal years ended June 30, 2022 and 2021.

| Name and Principal Position |

|

Year |

|

|

Salary

($USD) |

|

|

Bonus

($USD) |

|

|

Stock Based Awards

($USD) |

|

|

Others

($USD) |

|

|

Total

($USD) |

|

| Chenlong Tan |

|

|

2022 |

|

|

|

264,000 |

|

|

|

94,250 |

|

|

|

– |

|

|

|

62,647 |

(1) |

|

|

420,897 |

|

| Chairman, CEO, President |

|

|

2021 |

|

|

|

240,000 |

|

|

|

– |

|

|

|

– |

|

|

|

33,554 |

(1) |

|

|

270,429 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Kevin Vassily |

|

|

2022 |

|

|

|

240,000 |

|

|

|

120,000 |

|

|

|

60,000 |

|

|

|

– |

|

|

|

420,000 |

|

| Chief Financial Officer |

|

|

2021 |

|

|

|

90,952 |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

90,952 |

|

_______________________

(1) Consists of the costs of leasing

a car.

Employment Agreement with Chenlong Tan

On July 1, 2020, we entered

into an employment agreement with our Chief Executive Officer, Chenlong Tan. Under Mr. Tan’s employment agreement, Mr. Tan receives

base compensation of $20,000 per month, is entitled to performance cash bonus compensation based on achievement of certain pre-determined

goals, and from time to time may be granted restricted common shares and/or options to purchase shares of the Company’s common stock,

subject to Board or Compensation Committee approval. In addition, during the term of Mr. Tan’s employment agreement, we are also

leasing a motor vehicle for Mr. Tan’s daily use. Mr. Tan is not entitled to any severance rights under his employment agreement.

Mr. Tan’s employment agreement has a term of five years, is thereafter renewable on an annual basis, and may be terminated upon

30 days’ notice upon the mutual agreement of Mr. Tan and the Company.

Employment Agreement with Kevin Vassily

On January 29, 2021, we entered

into an employment agreement with our Chief Financial Officer, Kevin Vassily. Under Mr. Vassily’s employment agreement, Mr. Vassily

receives base compensation of $240,000, is entitled to an annual guaranteed bonus of $60,000 upon achievement of certain milestones and

up to an additional $60,000 in the sole discretion of the Company’s Board of Directors at January 29, 2022. Mr. Vassily is also

entitled to 12,000 restricted stock units upon completion of our IPO. Thereafter, stock grants will be adjusted based on the awards from

each prior year. Mr. Vassily is not entitled to any severance rights under his employment agreement and may be terminated upon 30 days’

written notice by either party.

Outstanding Equity Awards at June 30, 2022

The following table provides

information regarding outstanding equity awards held by our named executive officers as of June 30, 2022.

| |

|

|

|

Options |

|

Restricted Stock Unit Awards |

| Name |

|

Grant Date |

|

Number of securities Underlying Options (#)

Vested |

|

|

Number of Securities Underlying Options (#)

Unvested |

|

|

Option

Exercise

Price

($) |

|

|

Option

Expiration

date |

|

Number of Securities Underlying RSUs (#) Vested |

|

|

Number of Securities Underlying RSUs(#) Unvested |

|

| Lawrence Tan |

|

5/13/2022 |

|

|

0 |

|

|

|

3,000,000 |

|

|

$ |

1.12 |

|

|

5/12/2032 |

|

|

– |

|

|

|

– |

|

| Kevin Vassily (1) |

|

5/11/2021 |

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

– |

|

|

12,000 |

|

|

|

– |

|

| |

|

5/13/2022 |

|

|

0 |

|

|

|

330,000 |

|

|

$ |

1.12 |

|

|

5/12/2032 |

|

|

– |

|

|

|

– |

|

_______________________

(1) Total number of RSUs granted was

12,000, all of which had vested as of June 30, 2022.

Equity Incentive Plan

On October 15, 2020, the Company’s

Board adopted, and its stockholders approved and ratified, the iPower Inc. 2020 Equity Incentive Plan. Further on May 5, 2021, the Company’s

Board of Directors adopted, and its stockholders approved and ratified, the iPower Inc. Amended and Restated 2020 Equity Incentive Plan

(the “Plan”). The Plan allows for the issuance of up to 5,000,000 shares of common stock, whether in the form of options,

restricted stock, restricted stock units, stock appreciation rights, performance units, performance shares and other stock or cash awards.

The general purpose of the Plan is to provide an incentive to the Company’s directors, officers, employees, consultants and advisors

by enabling them to share in the future growth of the Company’s business. The board of directors believes that granting of equity-based

compensation serves to promote continuity of management and provide for a shared interest in the welfare, growth and development of the

Company. The Company believes that the Plan will serve to advance the Company’s interests by enhancing its ability to (i) attract

and retain employees, consultants, directors and advisors who are able to contribute to the Company’s ongoing success and development,

(ii) reward those employees, consultants, directors and advisors for their contributions to the Company, and (iii) encourage employees,

consultants, directors and advisors to participate in the Company’s long-term growth and success.

Following completion of the

IPO on May 11, 2021, pursuant to their letter agreements, the Company awarded 46,546 restricted stock units (“RSUs”) under

the Plan to its independent directors, Chief Financial Officer, and certain other employees and consultants, all of which are subject

to certain vesting conditions in the next 12 months and restrictions until filing of a Form S-8 for registration of the shares. During

the year ended June 30, 2022, the Company granted additional 97,128 shares of RSUs to employees and consultants,

On May 13, 2022, the Company

grant stock options (the “Option Grants”) in the amount of (i) 3,000,000 shares to Chenlong Tan, CEO and (ii) 330,000 shares

to Kevin Vassily, CFO. The Option Grants have an exercise price of $1.12 per share (the closing price on the grant date) and have a term

of 10 years, will vest in stages upon the Company’s achievement of certain pre-determined market capitalization and revenue or operating

income targets set forth in the grant agreements.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

AND MANAGEMENT

The following table sets forth

the number of shares of common stock beneficially owned as of March [_], 2023 by:

| |

· |

each of our shareholders who is known by us to beneficially own 5% or more of our common stock; |

| |

· |

each of our executive officers; |

| |

· |

each of our directors; and |

| |

· |

all of our directors and current executives as a group. |

Beneficial ownership is determined

based on the rules and regulations of the SEC. A person has beneficial ownership of shares if such individual has the power to vote and/or

dispose of shares. This power may be sole or shared and direct or indirect. Applicable percentage ownership in the following table is

based on the total of [26,488,682] shares of common stock outstanding as of March 14, 2023. In computing the number of shares beneficially

owned by a person and the percentage ownership of that person, shares of common stock that are subject to options or warrants held by

that person and exercisable as of, or within sixty (60) days of, the date of this Annual Report. These shares, however, are not counted

as outstanding for the purposes of computing the percentage ownership of any other person(s). Except as may be indicated in the footnotes

to this table and pursuant to applicable community property laws, each person named in the table has sole voting and dispositive power

with respect to the shares of common stock set forth opposite that person’s name. Unless indicated below, the address of each individual

listed below is c/o iPower Inc., 2399 Bateman Avenue, Duarte, CA 91010.

| Name of Beneficial Owner |

|

No. of Shares Common Stock Beneficially Owned |

|

|

Total Percentage of Common Stock Owned |

|

| Chenlong Tan (1) |

|

8,023,334 |

|

|

27.13% |

|

| Kevin Vassily (2) |

|

12,000 |

|

|

Less than 0.1% |

|

| Bennet Tchaikovsky (3) |

|

6,000 |

|

|

Less than 0.1% |

|

| Kevin Liles (4) |

|

6,000 |

|

|

Less than 0.1% |

|

| Hanxi Li (5) |

|

6,608 |

|

|

Less than 0.1% |

|

| All Officers and Directors (5 Persons) |

|

8,053,942 |

|

|

27.23% |

|

| |

|

|

|

|

|

|

| Beneficial Owners of more than 5% |

|

|

|

|

|

|

| Allan Huang (6) |

|

8,023,334 |

|

|

27.13% |

|

_______________________

| (1) |

Chenlong Tan is our co-Founder, Chairman, Chief Executive Officer and President. |

| (2) |

Kevin Vassily is our Chief Financial Officer. |

| (3) |

Mr. Tchaikovsky is a member of our board of directors. |

| (4) |

Mr. Liles is a member of our board of directors. |

| (5) |

Ms. Li is a member of our board of directors. Her reported holdings do not include 6,608 RSUs which remain subject to vesting under the Company’s 2020 Equity Incentive Plan. |

| (6) |

Allan Huang is our co-Founder and a consultant and was previously our Chief Executive Officer, President and a director. |

Certain Relationships and Related Transactions

and Director Independence

Unless described below, during

the last two fiscal years, there are no transactions or series of similar transactions to which we were a party or will be a party, in

which:

| |

· |

the amounts involved exceed or will exceed $120,000; and |

| |

· |

any of our directors, executive officers or holders of more than 5% of our capital stock, or any member of the immediate family of any of the foregoing had, or will have, a direct or indirect material interest. |

On May 18, 2021, the Company

entered into equity purchase agreements (“Equity Purchase Agreements”) with the shareholders of each of our variable interest

entities, E Marketing Solution Inc. (“E Marketing”) and Global Product Marketing Inc. (“GPM”), pursuant to which

we acquired 100% of the equity interests of each of E Marketing and GPM. The Company paid nominal consideration of $10.00 for the acquisition

of each of E Marketing and GPM, which then became the Company’s wholly owned subsidiaries.

Prior to April 14, 2021, we

had two classes of authorized common stock, Class A Common Stock and Class B Common Stock that entitled the holders to 10 votes per share.

On April 14, 2021, Messrs. Huang and Tan, our two founders, converted all of their 14,000,000 shares of Class B Common Stock into 1,400,000

additional shares of Class A Common Stock, bringing their total ownership to an aggregate of 16,046,668 shares of Class A Common Stock

or 60.67% of the 26,448,663 shares of Class A Common Stock outstanding as of the date of this report. On April 14, 2021, we amended and

restated our articles of incorporation to permit the immediate conversion of the Class B Common Stock and to eliminate any future issuances

of Class B Common Stock, and on April 23, 2021, we further amended and restated our articles of incorporation to eliminate all references

to the Class A and Class B Common Stock and authorized for issuance 180,000,000 shares which are solely designated as common stock.

On April 27, 2021, Mr. Chenlong

Tan, our Chairman, President and Chief Executive Officer and a beneficial owner more than 5% of our common stock, has agreed to reimburse

us for any judgments, fines and amounts paid or actually incurred by us or an indemnitee in connection with such legal action or in connection

with any settlement agreement entered into by us or an indemnitee up to a maximum of $3.5 million in the aggregate, with the sole source

of funding of such reimbursement to come from sales of shares then owned by Mr. Tan, against any damages that the Company may owe Boustead

or the underwriters, should Boustead be successful in any action against the Company related to this initial public offering.

Starting March 1, 2022, the

Company subleases 50,000 square feet of its warehouse space to Box Harmony, LLC, which is a 40% owned joint venture of the Company. For

the year ended June 30, 2022, the Company recorded sublease fees of $330,000 as other non-operating income. As of June 30, 2022, other

receivables due from Box Harmony were $51,762.

On February 15, 2022, the

Company assumed $92,246 of advance payments from shareholders of DHS as a result of the Company’s acquisition of Anivia. This advance

payments were for capital injections pending capital inspection by the local government in accordance with the PRC rules. As of

June 30, 2022, the balance of advance from shareholders was $92,246.

Policies and Procedures For Related Party Transactions

Our Audit Committee Charter

provides that our Audit Committee will be responsible for reviewing and approving in advance any related party transaction. Transactions

requiring such pre-approval will include, with certain exceptions set forth in Item 404 of Regulation S-K, any transaction, arrangement

or relationship, or any series of similar transactions, arrangements or relationships in which we were or are to be a participant, where

the amount involved exceeds $120,000 and a related person had or will have a direct or indirect material interest, including, without

limitation, purchases of goods or services by or from the related person or entities in which the related person has a material interest,

indebtedness, guarantees of indebtedness and employment by us of a related person.

PROPOSAL NO. 1

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR”

THE ELECTION OF ALL OF

THE NOMINEES TO THE BOARD OF DIRECTORS.

PLEASE NOTE: If your shares

are held in street name, your broker, bank, custodian, or other nominee holder cannot vote your shares in the election of directors, unless

you direct the holder how to vote, by marking your proxy card.

PROPOSAL NO. 2

RATIFICATION OF THE APPOINTMENT OF INDEPENDENT

ACCOUNTANTS

The Audit Committee has appointed

UHY LLP as the Company’s independent accountants for the fiscal year ended June 30, 2022, subject to ratification by the Company’s

shareholders. Representatives of UHY LLP may be present virtually or by tele-conference at the Annual Meeting to respond to appropriate

questions and will have an opportunity to make a statement, if they so desire.

In the event the shareholders

fail to ratify the selection of UHY LLP, the Audit Committee will reconsider whether or not to retain the firm. Even if the selection

is ratified, the Audit Committee and the Board of Directors in their discretion may direct the appointment of a different independent

accounting firm at any time during the year if they determine that such a change would be in the best interests of the Company and its

shareholders.

Services and Fees of Independent Accountants

The following table represents

fees for professional audit services for the audit of the Company’s annual financial statements for the fiscal years ended June

30, 2022 and 2021, rendered by UHY LLP.

| | |

Fiscal year ended June 30, | |

| | |

2022 | | |

2021 | |

| Audit fees (1) | |

$ | 338,150 | | |

$ | 170,637 | |

| Audit-related fees (2) | |

| – | | |

| – | |

| Total fees | |

$ | 338,150 | | |

$ | 170,637 | |

_________________________

| (1) |

Audit fees consist of fees for professional services rendered by the

principal accountant for the audit of the Company’s annual financial statements and review of the financial statements included

in the Company’s Initial Public Offering, Form 10-K and Form 10-Q and for services that are normally provided by the accountant

in connection with statutory and regulatory filings or engagements. |

| |

|

| (2) |

Audit-related fees consist primarily of fees for assurance and related

services by the accountant that are reasonably related to the performance of the audit or review of the Company’s financial

statements. |

Audit Committee Pre-Approval Policies and Procedures

The Audit Committee shall

pre-approve any non-audit services proposed to be provided to the Company by the independent auditors. In accordance with the SEC’s

auditor independence rules, the Audit Committee has established the following policies and procedures by which it approves in advance

any audit or permissible non-audit services to be provided to the Company by its independent auditor.

Prior to the engagement of

the independent auditor for any fiscal year’s audit, management submits to the Audit Committee for approval lists of recurring audit,

audit-related, tax and other services expected to be provided by the auditor during that fiscal year. The Audit Committee adopts pre-approval

schedules describing the recurring services that it has pre-approved, and is informed on a timely basis, and in any event by the next

scheduled meeting, of any such services rendered by the independent auditor and the related fees.

The fees for any services

listed in a pre-approval schedule are budgeted, and the Audit Committee requires the independent auditor and management to report actual

fees versus the budget periodically throughout the year. The Audit Committee will require additional pre-approval if circumstances arise

where it becomes necessary to engage the independent auditor for additional services above the amount of fees originally pre-approved.

Any audit or non-audit service not listed in a pre-approval schedule must be separately pre-approved by the Audit Committee on a case-by-case

basis. Every request to adopt or amend a pre-approval schedule or to provide services that are not listed in a pre-approval schedule must

include a statement by the independent auditors as to whether, in their view, the request is consistent with the SEC’s rules on

auditor independence.

The Audit Committee will not

grant approval for:

| |

· |

any services prohibited by applicable law or by any rule or regulation of the SEC or other regulatory body applicable to the Company; |

| |

|

|

| |

· |

provision by the independent auditor to the Company of strategic consulting services of the type typically provided by management consulting firms; or |

| |

|

|

| |

· |

the retention of the independent auditor in connection with a transaction initially recommended by the independent auditor, the tax treatment of which may not be clear under the Internal Revenue Code and related regulations and which it is reasonable to conclude will be subject to audit procedures during an audit of the Company’s financial statements. |

Subject to certain exceptions,

tax services proposed to be provided by the auditor to any director, officer or employee of the Company who is in an accounting role or

financial reporting oversight role must be approved by the Audit Committee on a case-by-case basis where such services are to be paid

for by the Company, and the Audit Committee will be informed of any services to be provided to such individuals that are not to be paid

for by the Company.

In determining whether to

grant pre-approval of any non-audit services in the “all other” category, the Audit Committee will consider all relevant facts

and circumstances, including the following four basic guidelines:

| |

· |

whether the service creates a mutual or conflicting interest between the auditor and the Company; |

| |

|

|

| |

· |

whether the service places the auditor in the position of auditing his or her own work; |

| |

|

|

| |

· |

whether the service results in the auditor acting as management or an employee of the Company; and |

| |

|

|

| |

· |

whether the service places the auditor in a position of being an advocate for the Company. |

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE

“FOR” RATIFICATION OF

THE APPOINTMENT OF THE COMPANY’S INDEPENDENT

ACCOUNTANTS.

Audit Committee Report

The primary purpose of the

Audit Committee is to assist the Board in fulfilling its responsibility to oversee our financial reporting activities. The Audit Committee

is responsible for reviewing with both our independent registered public accounting firm and management, our accounting and reporting

principles, policies and practices, as well as our accounting, financial and operating controls and staff. The Audit Committee has reviewed

and discussed our audited financial statements with management, and has discussed with our independent registered public accounting firm

the matters required to be discussed by Statement on Auditing Standards No. 61, as amended (Codification of Statements on Auditing Standards,

AU 380), as adopted by the Public Company Accounting Oversight Board (the “PCAOB” ) in Rule 3200T. Additionally,

the Audit Committee has received the written disclosures and the letter from our independent registered public accounting firm, as required

by the applicable requirements of the PCAOB, and has discussed with the independent registered public accounting firm the independent

registered public accounting firm’s independence. Based upon such review and discussion, the Audit Committee recommended to the

Board that the audited financial statements be included in our Annual Report on Form 10-K for the last fiscal year ended June 30,

2022 to be filed with the SEC.

Bennet Tchaikovsky

Kevin Liles

Hanxi Li

The information contained

in this proxy statement with respect to the Audit Committee’s report above and the independence of the members of the Audit Committee

shall not be deemed to be “soliciting material” or to be “filed” with the SEC, nor shall such information be incorporated

by reference into any future filing under the Securities Act of 1933, as amended (the “Securities Act” ),

or the Exchange Act, except to the extent that the Company specifically incorporates it by reference in such filing.

PROPOSAL NO. 3

ADVISORY VOTE TO APPROVE EXECUTIVE COMPENSATION

Pursuant to Securities Exchange

Act Section 14A, we are submitting to shareholders an advisory vote to approve the compensation paid to the Company’s named executive

offices, as disclosed under the caption “Election of Directors—Executive Compensation,” pursuant to Item 402 of Regulation

S-K, including the compensation tables, and narrative discussion.

The advisory vote is not binding

on the Company, the Board of Directors, or management; if executive compensation is not approved by the vote of a majority of shares present

in person or by proxy at the meeting and entitled to vote, the Compensation Committee will take account of this fact when considering

executive compensation in future years.

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE

“FOR”

THE FOLLOWING ADVISORY RESOLUTION:

RESOLVED, that the compensation paid to

Company’s named executive offices, as disclosed under the caption “Election of Directors—Executive Compensation,”

pursuant to Item 402 of Regulation S-K, including the compensation tables, and narrative discussion, be, and hereby is, approved.

PROPOSAL NO. 4

AMENDMENT TO THE COMPANY’S

SIXTH AMENDED AND RESTATED ARTICLES OF INCORPORATION TO EFFECT THE REVERSE STOCK SPLIT

THE REVERSE STOCK SPLIT

Background and Proposed Amendment

Our Charter currently authorizes

the Company to issue a total of 180,000,000 shares of the common stock, and up to 20,000,000 shares of preferred stock, par value $0.0001

per share, of the Company (the “Preferred Stock”), in one or more series, and expressly authorizes the Board, subject to limitations

prescribed by law, to establish and fix for each such series such voting powers, full or limited, and such designations, preferences and

relative, participating, optional or other special rights and such qualifications, limitations and restrictions of the shares of such

series.

On March __, 2023, subject

to stockholder approval, the Board approved an amendment to our Charter to, at the discretion of the Board, effect the Reverse Stock Split

of the common stock at a ratio of between 1-for-2 and 1-for-4, with the exact ratio to be determined by the Board of the Company at its

discretion. The primary goal of the Reverse Stock Split is to increase the per share market price of our common stock to meet the minimum

per share bid price requirements for continued listing on The Nasdaq Capital Market. We believe that proposing multiple ratios for the

Reverse Stock Split provides us with the most flexibility to achieve the desired results of the Reverse Stock Split. The Reverse Stock

Split is not intended as, and will not have the effect of, a “going private transaction” covered by Rule 13e-3 promulgated

under the Exchange Act. The Reverse Stock Split is not intended to modify the rights of existing stockholders in any material respect.

If the Reverse Stock Split

Proposal is approved by our stockholders and the Reverse Stock Split is effected, up to every four shares of our outstanding common stock

would be combined and reclassified into one share of common stock. The actual timing for implementation of the Reverse Stock Split and

the specific split ratio would be determined by the Board based upon its evaluation as to when such action would be most advantageous

to the Company and its stockholders, but in no event later than the one-year anniversary of the date on which the Reverse Stock Split

is approved by the Company’s stockholders at the Special Meeting. Notwithstanding approval of the Reverse Stock Split Proposal by

our stockholders, the Board will have the sole authority to elect whether or not and when to amend our Charter to effect the Reverse Stock

Split. If the Reverse Stock Split Proposal is approved by our stockholders, the Board will make a determination as to whether effecting

the Reverse Stock Split is in the best interests of the Company and our stockholders in light of, among other things, the Company’s

ability to increase the trading price of our common stock to meet the minimum stock price standards of The Nasdaq Capital Market without

effecting the Reverse Stock Split, the per share price of the common stock immediately prior to the Reverse Stock Split and the expected

stability of the per share price of the common stock following the Reverse Stock Split. If the Board determines that it is in the best

interests of the Company and its stockholders to effect the Reverse Stock Split, it will hold a Board meeting to determine the ratio of

the Reverse Stock Split and will publicly announce the chosen ratio at least five business days prior to the effectiveness of the reverse

stock split. For additional information concerning the factors the Board will consider in deciding whether to effect the Reverse Stock

Split, see “— Determination of the Reverse Stock Split Ratio” and “— Board Discretion

to Effect the Reverse Stock Split.”

The text of the proposed amendment

to the Company’s Charter to effect the Reverse Stock Split is included as Annex A to this proxy statement

(the “Reverse Stock Split Charter Amendment”). If the Reverse Stock Split Proposal is approved by the Company’s stockholders,

the Company will have the authority to file the Reverse Stock Split Charter Amendment with the Secretary of State of the State of Nevada,

which will become effective upon its filing. The Board has determined that the amendment is advisable and in the best interests of the

Company and its stockholders and has submitted the amendment for consideration by our stockholders at the Special Meeting.

Reasons for the Reverse Stock Split

Maintain Nasdaq Listing

We are submitting this proposal

to our stockholders for approval in order to increase the trading price of our common stock to meet the minimum per share bid price requirement

for continued listing on The Nasdaq Capital Market. Accordingly, we believe that the Reverse Stock Split is in our stockholders’

best interests.

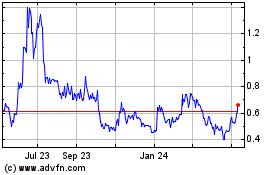

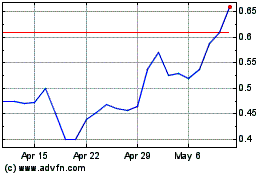

On November 9, 2022, the Company

received a notification letter from the Listing Qualifications Department of Nasdaq notifying the Company that, because the closing bid

price for the Company’s common stock listed on The Nasdaq Capital Market was below $1.00 for 30 consecutive trading days, the Company

no longer met the Minimum Bid Price Requirement. In accordance with Nasdaq Listing Rule 5810(c)(3)(A), we have been given 180 calendar

days from September 9, 2022, or until May 8, 2023, to regain compliance with Rule 5550(a)(2). Thus, if at any time before May 8, 2023

the bid price of our common stock closes at $1.00 per share or more for a minimum of 10 consecutive business days, Nasdaq will provide

us with written confirmation that we have regained compliance.

To qualify, we are required

to meet the continued listing requirement for market value of publicly held shares and all other initial listing standards for The Nasdaq

Capital Market, with the exception of the Minimum Bid Price Requirement, and we need to provide written notice of our intention to cure

the deficiency during the second compliance period, by effecting a reverse stock split, if necessary. If so required in order to maintain

compliance with the Nasdaq listing standards, the Board currently intends to effect the Reverse Stock Split on or before October 15, 2023,

or such later date that Nasdaq determines, in order to regain compliance with the Minimum Bid Price Requirement.

In the event we are unable