InflaRx (Nasdaq: IFRX), a clinical-stage biopharmaceutical company

developing anti-inflammatory therapeutics by targeting the

complement system, announced today financial results for the three

months ended March 31, 2020.

“InflaRx continues to make progress with its

clinical development programs for IFX-1 and recently reported

encouraging initial results in Pyoderma Gangraenosum, the second

neutrophil-driven devastating skin disease we are pursuing,” said

Prof. Niels C. Riedemann, Chief Executive Officer and Founder of

InflaRx. “With the upcoming scheduled FDA End of Phase II meeting

for development in Hidradenitis Suppurativa, the Company is keeping

a strong focus on potentially advancing into Phase III development

in this disease.”

Prof. Riedemann continued, “We are currently

analyzing results from the first 30 patients in our ongoing

adaptive randomized COVID-19 pneumonia trial, which will serve as

the basis for the decision to potentially continue into a

confirmatory larger second part of the study.”

R&D

highlights – Q1 2020

- IFX-1 in Hidradenitis

Suppurativa (HS): In Q1 2020, the Company requested an End

of Phase II meeting with the FDA to discuss the path forward for a

pivotal program with IFX-1 in HS. The meeting has been scheduled

for mid-year 2020.

- IFX-1 in Pyoderma

Gangraenosum (PG): In February 2020, the Company announced

positive initial data from the first 5 patients dosed in the

ongoing Phase IIa open label study. Of these 5 initial patients

dosed with IFX-1, 2 patients achieved complete closure of the

target ulcer and complete healing of all other PG ulcers. Patients

continue to enroll in higher dose groups.

- IFX-1 in ANCA-associated

vasculitis (AAV): Part 1 of the European Phase II IXCHANGE

study has been fully enrolled. After analyzing the impact of

COVID-19 on the study, a blinded interim analysis of Part 1 has

been completed. Based on the analysis, the Company intends to

continue with Part 2 of the study but decrease the number of

enrolled patients. Following a blinded interim analysis of the US

Phase II IXPLORE study with IFX-1 in patients with AAV and an

assessment of the potential impact of the COVID-19 pandemic, the

Company has decided to stop the study and read out the existing

results earlier than initially planned as part of a strategy to

align and streamline the US and EU AAV development programs.

- IFX-1 in oncology:

In Q1 2020, the Company entered into a clinical collaboration

agreement (reported on April 29, 2020) to evaluate the combination

of IFX-1 and a market leading anti-PD-1 therapy in patients with an

undisclosed tumor type. Under the terms of the agreement, InflaRx

will conduct a Phase IIa clinical study with two IFX-1 arms,

including one with the anti-PD-1 therapy.

- IFX-1 in COVID-19

pneumonia: The Company initiated a Phase II clinical

development program with IFX-1 in COVID-19 patients with severely

progressed pneumonia. After all patients have been treated in the

first part of the trial, an interim analysis will be performed to

evaluate the clinical benefit of the treatment using the assessed

clinical parameters in order to potentially initiate and adapt the

confirmatory second part of the study. Part 1 was fully enrolled

with 30 patients as of April 24, 2020.

Financial highlights - Q1

2020

Research and development

expenses decreased by €0.4 million in the three months

ended March 31, 2020 compared to the three months ended March 31,

2019. This decrease is primarily attributable to a €0.3 million

decrease in expenses from non-cash share-based compensation.

General and administrative

expenses decreased by €0.7 million to €2.6 million for the

three months ended March 31, 2020, from €3.3 million for the three

months ended March 31, 2019. This decrease is primarily

attributable to a €0.9 million decrease in non-cash share-based

compensation expense. Legal, consulting and other expenses

increased by €0.1 million to €1.1 million for the three months

ended March 31, 2020, from €1.0 million for the three months ended

March 31, 2019.

Net financial result increased

by €0.4 million to €1.5 million for the three months ended March

31, 2020, from €1.1 million for the three months ended March 31,

2019. This increase is mainly attributable to (a) higher foreign

exchange gains, which increased by €0.8 million and (b) interest on

marketable securities, which decreased by €0.4 million.

Net loss for the three months

ended March 31, 2020 was €8.2 million or €(0.32) per common share,

compared to €9.8 million or €(0.38) per common share for the three

months ended March 31, 2019. On March 31, 2020, the Company’s

total funds available were approximately €108.0

million, mostly composed of cash and cash equivalents (€21.1

million) and marketable securities (€86.3 million).

Net cash used in operating

activities increased to €10.5 million for the three months

ended March 31, 2020, from €8.5 million in the three months ended

March 31, 2019, mainly due to the increase of cash expenses, such

as third-party expenses for manufacturing and clinical trials for

our lead program IFX-1 and higher personnel costs.

Additional information regarding these results

is included in the notes to the consolidated financial statements

as of March 31, 2020, as well as the financial statements as of

December 31, 2019 in “ITEM 18. Financial statements,” which is

included in InflaRx’s Annual Report on Form 20-F as filed with the

U.S. Securities and Exchange Commission (SEC).

InflaRx N.V. and

subsidiaryConsolidated Statements of Comprehensive

Loss for the three months ended March 31, 2020 and

2019

| in € |

2020(unaudited) |

|

2019(unaudited) |

|

| |

|

|

| Operating

Expenses |

|

|

|

Research and development expenses |

(7,298,799 |

) |

|

(7,695,150 |

) |

| General and administrative

expenses |

(2,564,803 |

) |

|

(3,301,166 |

) |

| Total Operating

Expenses |

(9,863,601 |

) |

|

(10,996,316 |

) |

| Other income |

94,960 |

|

|

64,836 |

|

| Other expenses |

(5,720 |

) |

|

(3,886 |

) |

| Operating

Result |

(9,774,362 |

) |

|

(10,935,366 |

) |

| Finance income |

1,658,991 |

|

|

1,159,205 |

|

| Finance expenses |

(118,026 |

) |

|

(61,710 |

) |

| Net Financial

Result |

1,540,965 |

|

|

1,097,495 |

|

| Loss for the

Period |

(8,233,397 |

) |

|

(9,837,871 |

) |

| |

|

|

| Share

Information |

|

|

| Weighted average number of

shares outstanding |

26,105,255 |

|

|

25,964,379 |

|

| Loss per share

(basic/diluted) |

(0.32 |

) |

|

(0.38 |

) |

| |

|

|

|

|

| Loss for the

Period |

(8,233,397 |

) |

|

(9,837,871 |

) |

| Other comprehensive income

that may be reclassified to profit or loss in subsequent

periods: |

|

|

|

|

|

| Exchange differences on

translation of foreign currency |

1,713,868 |

|

|

2,317,546 |

|

| Total Comprehensive

Loss |

(6,519,529 |

) |

|

(7,520,325 |

) |

| |

|

|

|

|

|

InflaRx N.V. and subsidiaryConsolidated

Statements of Financial Position as of March 31, 2020 and December

31, 2019

| in € |

2020(unaudited) |

|

2019 |

|

| |

|

|

| ASSETS |

|

|

| Non-current

assets |

|

|

|

Property, plant and equipment |

540,606 |

|

|

576,373 |

|

| Right-of-use assets |

748,785 |

|

|

836,924 |

|

| Intangible assets |

430,368 |

|

|

452,400 |

|

| Non-current other assets |

445,403 |

|

|

452,217 |

|

| Non-current financial assets |

272,718 |

|

|

272,614 |

|

| Total non-current

assets |

2,437,880 |

|

|

2,590,528 |

|

| Current

assets |

|

|

| Current other assets |

3,319,222 |

|

|

3,500,884 |

|

| Current financial assets |

86,680,961 |

|

|

82,353,867 |

|

| Cash and cash equivalents |

21,083,608 |

|

|

33,131,280 |

|

| Total current

assets |

111,083,791 |

|

|

118,986,031 |

|

| TOTAL

ASSETS |

113,521,671 |

|

|

121,576,558 |

|

| |

|

|

| EQUITY AND

LIABILITIES |

|

|

| Equity |

|

|

| Issued capital |

3,132,631 |

|

|

3,132,631 |

|

| Share premium |

211,006,606 |

|

|

211,006,606 |

|

| Other capital reserves |

26,043,246 |

|

|

25,142,213 |

|

| Accumulated deficit |

(142,514,552 |

) |

|

(134,362,006 |

) |

| Other components of equity |

3,860,246 |

|

|

2,227,228 |

|

| Total

equity |

101,528,177 |

|

|

107,146,673 |

|

| Non-current

liabilities |

|

|

| Lease liabilities |

245,478 |

|

|

330,745 |

|

| Other non-financial

liabilities |

39,148 |

|

|

39,013 |

|

| Total non-current

liabilities |

284,625 |

|

|

369,758 |

|

| Current

liabilities |

|

|

| Trade and other payables |

10,490,938 |

|

|

12,413,662 |

|

| Lease liabilities |

513,374 |

|

|

515,203 |

|

| Employee Benefits |

571,960 |

|

|

975,629 |

|

| Social securities, other tax and

non-financial liabilities |

108,221 |

|

|

105,634 |

|

| Provisions |

24,374 |

|

|

50,000 |

|

| Total current

liabilities |

11,708,869 |

|

|

14,060,128 |

|

| Total

Liabilities |

11,993,494 |

|

|

14,429,886 |

|

| TOTAL EQUITY AND

LIABILITIES |

113,521,671 |

|

|

121,576,558 |

|

| |

|

|

InflaRx N.V. and subsidiaryCondensed

Consolidated Statements of Changes in Shareholders’

Equity for the three months ended March 31,

2020 and 2019

| in € |

Issuedcapital |

|

Sharepremium |

|

Othercapitalreserves |

|

Accumulateddeficit |

|

Othercomponentsof equity |

|

Totalequity |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance at January 1, 2020 |

3,132,631 |

|

211,006,606 |

|

25,142,213 |

|

(134,362,006 |

) |

|

2,227,228 |

|

107,146,673 |

|

| Loss for the period |

— |

|

— |

|

— |

|

(8,233,397 |

) |

|

— |

|

(8,233,397 |

) |

| Exchange differences on

translation of operations in foreign currency |

— |

|

— |

|

— |

|

— |

|

|

1,713,868 |

|

1,713,868 |

|

| Total comprehensive

loss |

— |

|

— |

|

— |

|

(8,233,397 |

) |

|

1,713,868 |

|

(6,519,529 |

) |

| Transactions with

owners of the Company |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Contributions |

|

|

|

|

|

|

|

|

|

| Equity-settled share-based

payment |

— |

|

— |

|

901,033 |

|

— |

|

|

— |

|

901,033 |

|

| Total

Contributions |

— |

|

— |

|

901,033 |

|

— |

|

|

— |

|

901,033 |

|

| Total transactions

with owners of the Company |

— |

|

— |

|

901,033 |

|

— |

|

|

— |

|

901,033 |

|

| Balance at March 31,

2020* |

3,132,631 |

|

211,006,606 |

|

26,043,246 |

|

(142,595,403 |

) |

|

3,941,097 |

|

101,528,177 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance at January 1,

2019 |

3,115,725 |

|

211,021,835 |

|

18,310,003 |

|

(81,107,188 |

) |

|

50,196 |

|

151,390,571 |

|

| Loss for the period |

— |

|

— |

|

— |

|

(9,837,871 |

) |

|

— |

|

(9,837,871 |

) |

| Exchange differences on

translation of operations in foreign currency |

— |

|

— |

|

— |

|

— |

|

|

2,317,546 |

|

2,317,546 |

|

| Total comprehensive

loss |

— |

|

— |

|

— |

|

(9,837,871 |

) |

|

2,317,546 |

|

(7,520,325 |

) |

| Transactions with

owners of the Company |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Contributions |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Equity-settled share-based

payment |

— |

|

— |

|

2,097,780 |

|

— |

|

|

— |

|

2,097,780 |

|

| Total

Contributions |

|

|

|

|

2,097,780 |

|

— |

|

|

— |

|

2,097,780 |

|

| Total transactions

with owners of the Company |

— |

|

— |

|

2,097,780 |

|

— |

|

|

— |

|

2,097,780 |

|

| Balance at March 31,

2019* |

3,115,725 |

|

211,021,835 |

|

20,407,783 |

|

(90,945,059 |

) |

|

2,367,742 |

|

145,968,026 |

|

| *

unaudited |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

InflaRx N.V. and subsidiaryCondensed

Consolidated Statements of Cash Flows for the three months ended

March 31, 2020 and 2019

| in € |

2020(unaudited) |

|

2019(unaudited) |

|

| |

|

|

|

|

| Operating

activities |

|

|

|

Loss for the period |

(8,233,397 |

) |

|

(9,837,871 |

) |

| Adjustments for: |

|

|

|

Depreciation & Amortization of property, plant, equipment,

right-of-use assets and intangible assets |

182,356 |

|

|

116,519 |

|

|

Net financial result |

(1,540,965 |

) |

|

(1,097,495 |

) |

|

Share-based payment expense |

901,033 |

|

|

2,097,780 |

|

|

Other non-cash adjustments |

(129,122 |

) |

|

81,346 |

|

| Changes in: |

|

|

|

Other assets |

188,476 |

|

|

(581,651 |

) |

|

Employee benefits |

(428,526 |

) |

|

(333,864 |

) |

|

Social securities, other current non-financial liabilities |

1,953 |

|

|

457,497 |

|

|

Trade and other payables |

(1,922,724 |

) |

|

364,158 |

|

| Interest received |

462,342 |

|

|

241,817 |

|

| Interest paid |

(2,246 |

) |

|

(6,682 |

) |

| Net cash flows from

operating activities |

(10,520,819 |

) |

|

(8,498,447 |

) |

| Investing

activities |

|

|

| Purchase of intangible assets,

laboratory and office equipment |

(27,686 |

) |

|

(254,316 |

) |

| Purchase of current financial

assets |

(23,412,469 |

) |

|

(10,599 |

) |

| Disposal of current financial

assets |

— |

|

|

3,088 |

|

| Securities matured |

20,724,386 |

|

|

— |

|

| Net cash flows from

investing activities |

(2,715,769 |

) |

|

(261,827 |

) |

| Financing

activities |

|

|

| Repayment of leasing

liabilities |

(88,339 |

) |

|

(54,781 |

) |

| Net cash flows from

financing activities |

(88,339 |

) |

|

(54,781 |

) |

| Net (decrease)/increase in cash

and cash equivalents |

(13,324,927 |

) |

|

(8,815,054 |

) |

| Effect of exchange rate changes

on cash and cash equivalents |

1,277,255 |

|

|

592,005 |

|

| Cash and cash equivalents at

beginning of period |

33,131,280 |

|

|

55,386,240 |

|

| Cash and cash equivalents

at end of period |

21,083,608 |

|

|

47,163,191 |

|

| |

|

|

About IFX-1:

IFX-1 is a first-in-class monoclonal anti-human

complement factor C5a antibody, which highly and effectively blocks

the biological activity of C5a and demonstrates high selectivity

towards its target in human blood. Thus, IFX-1 leaves the formation

of the membrane attack complex (C5b-9) intact as an important

defense mechanism, which is not the case for molecules blocking the

cleavage of C5. IFX-1 has been demonstrated to control the

inflammatory response driven tissue and organ damage by

specifically blocking C5a as a key “amplifier” of this response in

pre-clinical studies. IFX-1 is believed to be the first monoclonal

anti-C5a antibody introduced into clinical development.

Approximately 300 people have been treated with IFX-1 in clinical

trials, and the antibody has been shown to be well tolerated. IFX-1

is currently being developed for various indications, including

Hidradenitis Suppurativa, ANCA-associated vasculitis, Pyoderma

Gangraenosum and COVID-19 pneumonia.

About InflaRx N.V.:

InflaRx (Nasdaq: IFRX) is a clinical-stage

biopharmaceutical company focused on applying its proprietary

anti-C5a technology to discover and develop first-in-class, potent

and specific inhibitors of C5a. Complement C5a is a powerful

inflammatory mediator involved in the progression of a wide variety

of autoimmune and other inflammatory diseases. InflaRx was founded

in 2007, and the group has offices and subsidiaries in Jena and

Munich, Germany, as well as Ann Arbor, MI, USA. For further

information please visit www.inflarx.com.

Contacts:

InflaRx N.V.Jordan Zwick –

Global Head of Business Development & Corporate StrategyEmail:

jordan.zwick[at]inflarx.deTel: +1 917-338-6523

MC Services AGKatja Arnold,

Laurie Doyle, Andreas Jungfer Email: inflarx[at]mc-services.eu

Europe: +49 89-210 2280US: +1-339-832-0752

FORWARD-LOOKING STATEMENTS

This press release contains forward-looking

statements. All statements other than statements of historical fact

are forward-looking statements, which are often indicated by terms

such as “may,” “will,” “should,” “expect,” “plan,” “anticipate,”

“could,” “intend,” “target,” “project,” “believe,” “estimate,”

“predict,” “potential” or “continue” and similar expressions.

Forward-looking statements appear in a number of places throughout

this release and may include statements regarding our intentions,

beliefs, projections, outlook, analyses and current expectations

concerning, among other things, our ongoing and planned preclinical

development and clinical trials; the impact of the COVID-19

pandemic on the Company; the timing and our ability to commence and

conduct clinical trials; potential results from current or

potential future collaborations; our ability to make regulatory

filings, obtain positive guidance from regulators, and obtain and

maintain regulatory approvals for our product candidates; our

intellectual property position; our ability to develop commercial

functions; expectations regarding clinical trial data; our results

of operations, cash needs, financial condition, liquidity,

prospects, future transactions, growth and strategies; the industry

in which we operate; the trends that may affect the industry or us

and the risks uncertainties and other factors described under the

heading “Risk Factors” in InflaRx’s periodic filings with the

Securities and Exchange Commission. These statements speak only as

of the date of this press release and involve known and unknown

risks, uncertainties and other important factors that may cause our

actual results, performance or achievements to be materially

different from any future results, performance or achievements

expressed or implied by the forward-looking statements. Given these

risks, uncertainties and other factors, you should not place undue

reliance on these forward-looking statements, and we assume no

obligation to update these forward-looking statements, even if new

information becomes available in the future, except as required by

law.

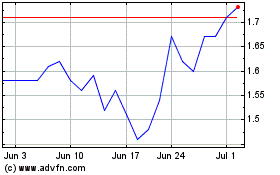

InflaRx NV (NASDAQ:IFRX)

Historical Stock Chart

From Mar 2024 to Apr 2024

InflaRx NV (NASDAQ:IFRX)

Historical Stock Chart

From Apr 2023 to Apr 2024