0001841925

false

0001841925

2023-10-23

2023-10-23

0001841925

INDI:ClassCommonStock0.0001ParValuePerShareMember

2023-10-23

2023-10-23

0001841925

INDI:WarrantsEachWholeWarrantExercisableForOneShareOfClassCommonStockFor11.50PerShareMember

2023-10-23

2023-10-23

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 23, 2023

INDIE SEMICONDUCTOR, INC.

(Exact name of

Registrant as specified in its charter)

| Delaware |

|

001-40481 |

|

88-1735159 |

(State or other jurisdiction of

incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

32 Journey

Aliso Viejo, California 92656

(Address of principal

executive offices, including zip code)

(949)

608-0854

(Registrant’s

telephone number, including area code)

N/A

(Former

name or former address, if changed since last report)

Check the appropriate box below

if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☒ | Written communications pursuant to Rule 425 under the Securities

Act |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Class A common stock, $0.0001 par value per share |

|

INDI |

|

The Nasdaq Stock Market LLC |

| Warrants, each whole warrant exercisable for one share of Class A common stock for $11.50 per share |

|

INDIW |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230A05 of this chapter) or Rule 12b-2 of the Securities Exchange Act

of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act.

Item 8.01. Other Events.

On October 23, 2023, indie Semiconductor, Inc.,

a Delaware corporation (the “Company”), issued a press release announcing the announcing the results of the Company’s

previously announced offer (the “Offer”) and consent solicitation (the “Consent Solicitation”) relating to its

outstanding (i) public warrants to purchase shares of Class A common stock of the Company, par value $0.0001 per share (the “Class

A common stock”), which warrants trade on The Nasdaq Capital Market under the symbol “INDIW” (the “public warrants”),

and (ii) private placement warrants to purchase shares of Class A common stock (the “private placement warrants” and, together

with the public warrants, the “warrants”).

Cautionary Statement Regarding Forward-Looking

Statements

This Current Report on

Form 8-K contains forward-looking statements within the meaning of the federal securities laws, including statements regarding the expected

timing of the Post-Offer Exchange. These forward-looking statements generally are identified by the words “believe,” “project,”

“expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,”

“opportunity,” “plan,” “may,” “should,” “will,” “would,” “will

be,” “will continue,” “will likely result,” and similar expressions, but the absence of these words does

not mean that a statement is not forward-looking. Forward-looking statements are predictions, projections, and other statements about

future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. Many factors

could cause actual future events to differ materially from the forward-looking statements in this Current Report on Form 8-K, including,

but not limited to those described under the section entitled “Risk Factors” in the Company’s Registration Statement

on Form S-4, filed September 22, 2023, as such factors may be updated from time to time in the Company’s filings with the SEC, which

are accessible on the SEC’s website at www.sec.gov.

New risks emerge from

time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business

or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any

forward-looking statements we may make. In light of these risks, uncertainties and assumptions, the forward-looking events and circumstances

discussed in this Current Report on Form 8-K may not occur and actual results could differ materially and adversely from those anticipated.

Forward-looking statements

speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and we assume

no obligation and do not intend to update or revise these forward-looking statements, whether as a result of new information, future events

or otherwise. We do not give any assurance that we will achieve our expectations.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: October 23, 2023

| |

INDIE SEMICONDUCTOR, INC. |

| |

|

|

| |

By: |

/s/ Thomas Schiller |

| |

Name: |

Thomas Schiller |

| |

Title: |

Chief Financial Officer & EVP of Strategy (Principal Financial Officer) |

2

Exhibit 99.1

indie Semiconductor Announces Expiration

and Results of Exchange Offer and Consent Solicitation Relating to its Warrants

ALISO VIEJO, California, Oct. 23, 2023 (GLOBE

NEWSWIRE) – indie Semiconductor, Inc. (NASDAQ: INDI) (“indie” or the “Company”), an Autotech solutions innovator,

today announced the expiration and results of its previously announced exchange offer (the “Exchange Offer”) and consent solicitation

(the “Consent Solicitation”) relating to its outstanding (i) public warrants to purchase shares of Class A common stock of

the Company, par value $0.0001 per share (the “Class A common stock”), which warrants trade on The Nasdaq Capital Market under

the symbol “INDIW” (the “public warrants”), and (ii) private placement warrants to purchase shares of Class A

common stock (the “private placement warrants” and, together with the public warrants, the “warrants”). The Exchange

Offer and Consent Solicitation expired at 11:59 p.m, Eastern Time, on October 20, 2023.

indie has been advised that 24,596,363 Warrants,

or approximately 89.8% of the outstanding Warrants, were validly tendered and not validly withdrawn prior to the expiration of the Exchange

Offer and Consent Solicitation. indie expects to accept all validly tendered warrants for exchange and settlement on or before October

25, 2023.

In addition, pursuant to the Consent Solicitation,

the Company received the approval of approximately 89.8% of the outstanding Warrants to the amendment to the warrant agreement governing

the warrants (the “Amendment No. 2”), which exceeds a majority of the outstanding Warrants required to effect the Amendment

No. 2. Amendment No. 2 would permit the Company to require that each Warrant that is outstanding upon settlement of the Exchange Offer

be converted into 0.2565 shares of Class A common stock, which is a ratio 10% less than the exchange ratio applicable to the Exchange

Offer.

indie expects to execute Amendment No. 2 concurrently

with the settlement of the Exchange Offer, and thereafter, expects to exercise its right in accordance with the terms of Amendment No.

2, to exchange all remaining untendered Warrants for shares of Class A common stock, following which, no Warrants will remain outstanding.

The Company engaged BofA Securities as the dealer

manager for the Offer and Consent Solicitation, D.F. King & Co., Inc. as the information agent for the Offer and Consent Solicitation,

and Continental Stock Transfer & Trust Company served as the exchange agent for the Offer and Consent Solicitation.

About indie

indie is empowering

the Autotech revolution with next generation automotive semiconductors and software platforms. We focus on developing innovative, high-performance

and energy-efficient technology for ADAS, user experience and electrification applications. Our mixed-signal SoCs enable edge sensors

spanning Radar, LiDAR, Ultrasound, and Computer Vision, while our embedded system control, power management and interfacing solutions

transform the in-cabin experience and accelerate increasingly automated and electrified vehicles. We are an approved vendor to Tier 1

partners and our solutions can be found in marquee automotive OEMs worldwide. Headquartered in Aliso Viejo, CA, indie has design centers

and regional support offices across the United States, Canada, Argentina, Scotland, England, Germany, Hungary, Morocco, Israel, Japan,

South Korea, Switzerland and China.

Cautionary Statement Regarding Forward-Looking

Statements

This press release contains forward-looking statements

within the meaning of the federal securities laws, including statements regarding the expected timing of the Post-Offer Exchange. These

forward-looking statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,”

“estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,”

“may,” “should,” “will,” “would,” “will be,” “will continue,”

“will likely result,” and similar expressions, but the absence of these words does not mean that a statement is not forward-looking.

Forward-looking statements are predictions, projections, and other statements about future events that are based on current expectations

and assumptions and, as a result, are subject to risks and uncertainties. Many factors could cause actual future events to differ materially

from the forward-looking statements in this press release, including, but not limited to those described under the section entitled “Risk

Factors” in the Company’s Registration Statement on Form S-4, filed September 22, 2023, as such factors may be updated from

time to time in the Company’s periodic filings with the SEC, which are accessible on the SEC’s website at www.sec.gov.

New risks emerge from time to time. It is not

possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any

factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements

we may make. In light of these risks, uncertainties and assumptions, the forward-looking events and circumstances discussed in this press

release may not occur and actual results could differ materially and adversely from those anticipated.

Forward-looking statements speak only as of the

date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and we assume no obligation and do

not intend to update or revise these forward-looking statements, whether as a result of new information, future events or otherwise. We

do not give any assurance that we will achieve our expectations.

Media Inquiries

media@indiesemi.com

Investor Relations

ir@indiesemi.com

Source: indie Semiconductor

v3.23.3

Cover

|

Oct. 23, 2023 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Oct. 23, 2023

|

| Entity File Number |

001-40481

|

| Entity Registrant Name |

INDIE SEMICONDUCTOR, INC.

|

| Entity Central Index Key |

0001841925

|

| Entity Tax Identification Number |

88-1735159

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

32 Journey

|

| Entity Address, City or Town |

Aliso Viejo

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

92656

|

| City Area Code |

949

|

| Local Phone Number |

608-0854

|

| Written Communications |

true

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

true

|

| Class A common stock, $0.0001 par value per share |

|

| Title of 12(b) Security |

Class A common stock, $0.0001 par value per share

|

| Trading Symbol |

INDI

|

| Security Exchange Name |

NASDAQ

|

| Warrants, each whole warrant exercisable for one share of Class A common stock for $11.50 per share |

|

| Title of 12(b) Security |

Warrants, each whole warrant exercisable for one share of Class A common stock for $11.50 per share

|

| Trading Symbol |

INDIW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=INDI_ClassCommonStock0.0001ParValuePerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=INDI_WarrantsEachWholeWarrantExercisableForOneShareOfClassCommonStockFor11.50PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

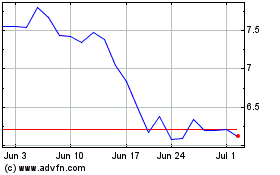

indie Semiconductor (NASDAQ:INDI)

Historical Stock Chart

From Apr 2024 to May 2024

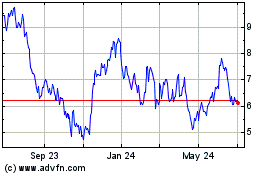

indie Semiconductor (NASDAQ:INDI)

Historical Stock Chart

From May 2023 to May 2024