Form 8-K - Current report

August 08 2024 - 4:08PM

Edgar (US Regulatory)

false000174027900017402792024-08-082024-08-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): August 08, 2024 |

IN8bio, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-39692 |

82-5462585 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

350 5th Avenue, Suite 5330 |

|

New York, New York |

|

10118 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 646 600-6438 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, $0.0001 par value per share |

|

INAB |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On August 8, 2024, IN8bio, Inc. (the “Company”) issued a press release announcing its financial results for the second quarter ended June 30, 2024. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information in this Form 8-K, including Exhibit 99.1 hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 3.01 Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

On August 6, 2024, the Company received a letter from the Listing Qualifications Staff of The Nasdaq Stock Market LLC (“Nasdaq”) notifying the Company that for the last 31 consecutive business days, the bid price of the Company’s common stock had closed below $1.00 per share, the minimum closing bid price required by the continued listing requirements of Nasdaq Listing Rule 5450(a)(1).

The notification received has no immediate effect on the listing of the Company’s common stock on the Nasdaq Stock Market. In accordance with Nasdaq Listing Rule 5810(c)(3)(A), the Company has 180 calendar days, or until February 3, 2025 (the “Compliance Date”), to regain compliance with the minimum bid price requirement. To regain compliance, the closing bid price of the Company’s common stock must be at least $1.00 per share for a minimum of ten consecutive business days before the Compliance Date.

If the Company’s common stock does not achieve compliance by the Compliance Date, the Company may be eligible for an additional 180-day period to regain compliance if the Company applies to transfer the listing of its common stock to the Nasdaq Capital Market. To qualify, the Company would be required to meet the continued listing requirement for market value of publicly held shares and all other initial listing standards, with the exception of the bid price requirement, and provide written notice to Nasdaq of its intention to cure the deficiency during the second compliance period by effecting a reverse stock split, if necessary. In the event the Company fails to regain compliance or transfer to The Nasdaq Capital Market before the Compliance Date, the Company will receive a written notification from Nasdaq that its common stock is subject to delisting. If the Company were to receive such a notification, the Company could appeal Nasdaq’s determination to delist its common stock, but there can be no assurance Nasdaq would grant the Company’s request for continued listing.

The Company intends to actively monitor the closing bid price of its common stock between now and the Compliance Date and will evaluate available options to resolve the deficiency and regain compliance with the minimum bid price rule.

Item 9.01 Financial Statements and Exhibits.

d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

IN8bio, Inc. |

|

|

|

|

Date: |

August 8, 2024 |

By: |

/s/ Patrick McCall |

|

|

|

Patrick McCall |

|

|

|

Chief Financial Officer and Secretary (Principal Financial and Accounting Officer) |

IN8bio Reports Second Quarter 2024 Financial Results and Recent Corporate Highlights

- Presented positive Phase 1 data showing 100% 1-year complete remission (CR) in evaluable patients with hematologic malignancies including acute myelogenous leukemia (AML) for INB-100 at the European Hematology Association (EHA) 2024 Congress

- Continues to be an industry leader in the manufacturing and the clinical advancement of gamma-delta T cells for the treatment of solid and hematologic cancers

- Demonstrated robust and reproducible manufacturing platform for DeltEx gamma-delta T cells highlighted during oral presentation at the American Society of Gene & Cell Therapy (ASGCT) 2024 Annual Meeting

- Presented positive data with 92% of glioblastoma (GBM) patients treated with INB-200 exceeding the median seven-month progression-free survival (PFS) with standard-of-care treatment at the 2024 American Society of Clinical Oncology (ASCO) Annual Meeting

NEW YORK, August 8, 2024 -- IN8bio, Inc. (Nasdaq: INAB), a clinical-stage biopharmaceutical company developing innovative gamma-delta T cell therapies for solid and hematologic cancers, today reported financial results for the second quarter ended June 30, 2024 and recent corporate highlights.

“Gamma-delta T cell therapies have the potential to revolutionize cancer treatment,” said William Ho, CEO and co-founder of IN8bio. “In the second quarter of 2024, our team presented industry-leading data demonstrating that our gamma-delta T cell therapeutic approach in INB-100 and INB-200 can drive durable complete remissions compared to the current standard-of-care in certain aggressive cancers like GBM and AML, where patients have typically faced poor outcomes. This novel approach that leverages gamma-delta T cells seeks to target residual tumors, including chemo-resistant and cancerous stem cells that often result in relapse. We look forward to providing additional updates on our gamma-delta T cell programs as we generate longer patient follow-up and advance our pipeline.”

Corporate Highlights and Recent Developments

•Presented data at EHA 2024, showing 100% of treated patients with leukemia (n=10/10) in the Phase 1 trial of INB-100 remained progression-free for at least one year, including high-risk and relapsed AML and one with acute lymphocytic leukemia (ALL) who had previously failed multiple lines of therapy, including CAR-T.

oData continue to show long-term in vivo expansion and persistence of haplo-matched allogeneic gamma-delta T cells 365 days following a single administration post-transplant, demonstrating the first-ever durable persistence and in vivo expansion of an allogeneic cellular therapy.

oAs of May 31, 2024, two of the patients treated with INB-100 remain alive and relapse free for over three and a half years, and a third patient is nearing three years.

•Poster presentation at ASCO 2024 demonstrated that 92% of evaluable patients treated with INB-200 exceeded a median PFS of seven months with concomitant temozolomide (TMZ), as of a data cutoff date of May 30, 2024.

oThe survival data along with radiographic improvements are indicative of positive treatment effects, which highlight the potential of IN8bio’s genetically modified, chemotherapy-resistant gamma-delta T cells as a potential first-in-class therapy for patients with newly diagnosed GBM to extend PFS.

oThe safety profile of gamma-delta T cells continues to be strong across all three dose cohorts with no cell therapy-related toxicities such as immune effector cell-associated neurotoxicity syndrome or cytokine release syndrome reported in any patients across both Phase 1 trials to date (up to the maximum dose of six infusions of therapy).

•Multiple presentations at the International Society for Cell & Gene Therapy (ISCT) 2024 demonstrated how IN8bio’s manufacturing process influences product characteristics and the ability to generate a robust, activated and reproducible final product.

oDeltEx gamma-delta T cell manufacturing platform has enabled the development of multiple investigational candidates which are now moving into multi-center Phase 2 clinical trials and are designed to target and potentially eradicate cancer cells to help improve patient outcomes.

•The cellular characteristics of products from the company’s proprietary clinical-scale gamma-delta T cell manufacturing platform were shown across different donor populations at the ASGCT 2024 Annual Meeting.

oData demonstrated that the manufacturing process results in investigational products with upregulated markers of potency, effector functions and trafficking capabilities, which IN8bio believes represents a significant advancement in the characterization of gamma-delta T cell-based therapies.

Second Quarter 2024 Financial Highlights

•Research and Development (R&D) expenses: R&D expenses were $5.2 million, compared to $4.1 million for the comparable prior year period. The increase was primarily due to a $0.5 million increase in personnel-related costs, including salaries and non-cash stock-based compensation due to increased headcount. Direct clinical costs increased by $0.5 million due to increased enrollment costs for our clinical programs, partially offset by a decrease of $0.1 million in facilities costs.

•General and administrative expenses: General and administrative expenses remained flat at $3.5 million, compared to $3.6 million for the comparable prior year period.

•Net loss: Net loss was $8.6 million, or $0.19 per basic and diluted common share, compared to a net loss of $7.7 million, or $0.27 per basic and diluted common share, for the comparable prior year period.

•Cash position: As of June 30, 2024, the Company had cash of $10.2 million, compared to $21.3 million, as of December 31, 2023.

About IN8bio

IN8bio is a clinical-stage biopharmaceutical company developing gamma-delta T cell-based immunotherapies for cancer patients. Gamma-delta T cells are a specialized population of T cells that possess unique properties, including the ability to differentiate between healthy and diseased tissue. The company’s lead program INB-400 is in a Phase 2 trial in glioblastoma multiforme (GBM). Additional programs include Phase 1 trials in solid and hematologic tumors, including INB-200 for GBM and INB-100 for patients with hematologic malignancies undergoing transplantation. For more information about IN8bio, visit www.IN8bio.com.

Forward Looking Statements

This press release may contain forward-looking statements made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These statements may be identified by words such as “aims,” “anticipates,” “believes,” “could,” “estimates,” “expects,” “forecasts,” “goal,” “intends,” “may,” “plans,” “possible,” “potential,” “seeks,” “will” and variations of these words or similar expressions that are intended to identify forward-looking statements, although not all forward-looking statements contain these words. Forward-looking statements in this press release include, but are not limited to, statements regarding: IN8bio’s ability to continue advancing our gamma-delta T-cell programs; the potential of gamma-delta T cell therapies to revolutionize cancer treatment;

the ability of INB-100 and INB-200 to target difficult to treat cancers, including chemo-resistant and cancerous stem cells; the continued ability of IN8bio’s manufacturing process to influence product characteristics and generate a robust, [activated,] reproducible final product; and IN8bio’s ability to achieve anticipated milestones, including expected presentations and data readouts from its trials, enrollment of additional patients in its clinical trials, advancement of clinical development plans and submission of INDs. IN8bio may not actually achieve the plans, intentions or expectations disclosed in these forward-looking statements, and you should not place undue reliance on these forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in these forward-looking statements as a result of various factors, including: risks to site initiation, clinical trial commencement, patient enrollment and follow-up, as well as IN8bio’s ability to meet anticipated deadlines and milestones, presented by public health crises as well as rising inflation and regulatory developments; uncertainties inherent in the initiation and completion of preclinical studies and clinical trials and clinical development of IN8bio’s product candidates; the risk that IN8bio may not realize the intended benefits of its DeltEx platform; availability and timing of results from preclinical studies and clinical trials; whether the outcomes of preclinical studies will be predictive of clinical trial results; whether initial or interim results from a clinical trial will be predictive of the final results of the trial or the results of future trials; the risk that trials and studies may be delayed and may not have satisfactory outcomes; potential adverse effects arising from the testing or use of IN8bio’s product candidates; expectations for regulatory approvals to conduct trials or to market products; IN8bio’s reliance on third parties, including licensors and clinical research organizations; and other important factors, any of which could cause our actual results to differ from those contained in the forward-looking statements, are described in greater detail in the section entitled “Risk Factors” in our Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission (SEC) on August 8, 2024, as well as in other filings IN8bio may make with the SEC in the future. Any forward-looking statements contained in this press release speak only as of the date hereof, and IN8bio expressly disclaims any obligation to update any forward-looking statements contained herein, whether because of any new information, future events, changed circumstances or otherwise, except as otherwise required by law.

IN8BIO, INC.

CONDENSED BALANCE SHEETS

(In thousands, except share and per share data)

|

|

|

|

|

|

|

|

|

|

|

June 30, |

|

|

|

|

|

|

2024 |

|

|

December 31, |

|

|

|

(unaudited) |

|

|

2023 |

|

Assets |

|

|

|

|

|

|

Current assets |

|

|

|

|

|

|

Cash |

|

$ |

10,217 |

|

|

$ |

21,282 |

|

Prepaid expenses and other current assets |

|

|

2,465 |

|

|

|

3,343 |

|

Total Current Assets |

|

|

12,682 |

|

|

|

24,625 |

|

Non-current assets |

|

|

|

|

|

|

Property and equipment, net |

|

|

3,112 |

|

|

|

3,514 |

|

Construction in progress |

|

|

265 |

|

|

|

182 |

|

Restricted cash |

|

|

259 |

|

|

|

256 |

|

Right-of-use assets - finance leases |

|

|

1,531 |

|

|

|

1,364 |

|

Right-of-use assets - operating leases |

|

|

4,327 |

|

|

|

3,513 |

|

Other non-current assets |

|

|

320 |

|

|

|

255 |

|

Total Non-Current Assets |

|

|

9,814 |

|

|

|

9,084 |

|

Total Assets |

|

$ |

22,496 |

|

|

$ |

33,709 |

|

Liabilities and Stockholders' Equity |

|

|

|

|

|

|

Liabilities |

|

|

|

|

|

|

Current liabilities |

|

|

|

|

|

|

Accounts payable |

|

$ |

1,444 |

|

|

$ |

924 |

|

Accrued expenses and other current liabilities |

|

|

1,533 |

|

|

|

2,955 |

|

Short-term finance lease liability |

|

|

895 |

|

|

|

694 |

|

Short-term operating lease liability |

|

|

887 |

|

|

|

820 |

|

Total Current Liabilities |

|

|

4,759 |

|

|

|

5,393 |

|

Long-term finance lease liability |

|

|

526 |

|

|

|

525 |

|

Long-term operating lease liability |

|

|

3,590 |

|

|

|

2,854 |

|

Total Non-Current Liabilities |

|

|

4,116 |

|

|

|

3,379 |

|

Total Liabilities |

|

|

8,875 |

|

|

|

8,772 |

|

Stockholders' Equity |

|

|

|

|

|

|

Preferred stock, par value $0.0001 per share; 10,000,000 shares authorized at June 30, 2024 and December 31, 2023, respectively. No shares issued and outstanding |

|

|

— |

|

|

|

— |

|

Common stock, par value $0.0001 per share; 490,000,000 shares authorized at June 30, 2024 and December 31, 2023; 46,434,656 and 43,287,325 shares issued and outstanding at June 30, 2024 and December 31, 2023, respectively |

|

|

5 |

|

|

|

4 |

|

Additional paid-in capital |

|

|

122,026 |

|

|

|

116,152 |

|

Accumulated deficit |

|

|

(108,410 |

) |

|

|

(91,219 |

) |

Total Stockholders' Equity |

|

|

13,621 |

|

|

|

24,937 |

|

Total Liabilities and Stockholders' Equity |

|

$ |

22,496 |

|

|

$ |

33,709 |

|

IN8BIO, INC.

CONDENSED STATEMENTS OF OPERATIONS

(In thousands, except share and per share data)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

June 30, |

|

|

Six Months Ended

June 30, |

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

Research and development |

$ |

5,156 |

|

|

$ |

4,134 |

|

|

$ |

10,059 |

|

|

$ |

8,519 |

|

General and administrative |

|

3,533 |

|

|

|

3,581 |

|

|

|

7,275 |

|

|

|

7,051 |

|

Total operating expenses |

|

8,689 |

|

|

|

7,715 |

|

|

|

17,334 |

|

|

|

15,570 |

|

Interest income |

|

60 |

|

|

|

— |

|

|

|

143 |

|

|

|

— |

|

Other income |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

330 |

|

Loss from operations |

|

(8,629 |

) |

|

|

(7,715 |

) |

|

|

(17,191 |

) |

|

|

(15,240 |

) |

Net loss |

$ |

(8,629 |

) |

|

$ |

(7,715 |

) |

|

$ |

(17,191 |

) |

|

$ |

(15,240 |

) |

Net loss per share – basic and diluted |

$ |

(0.19 |

) |

|

$ |

(0.27 |

) |

|

$ |

(0.39 |

) |

|

$ |

(0.57 |

) |

Weighted-average number of shares used in computing net loss per common share, basic and diluted |

|

45,126,064 |

|

|

|

28,472,346 |

|

|

|

44,493,815 |

|

|

|

26,612,794 |

|

Corporate Contact:

IN8bio, Inc.

Glenn Schulman, PharmD, MPH

203.494.7411

gdschulman@IN8bio.com

Investors

Meru Advisors

Lee M. Stern

lstern@meruadvisors.com

Media Contact

Kimberly Ha

KKH Advisors

917.291.5744

kimberly.ha@kkhadvisors.com

Document And Entity Information

|

Aug. 08, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 08, 2024

|

| Entity Registrant Name |

IN8bio, Inc.

|

| Entity Central Index Key |

0001740279

|

| Entity Emerging Growth Company |

true

|

| Entity File Number |

001-39692

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

82-5462585

|

| Entity Address, Address Line One |

350 5th Avenue, Suite 5330

|

| Entity Address, City or Town |

New York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10118

|

| City Area Code |

646

|

| Local Phone Number |

600-6438

|

| Entity Information, Former Legal or Registered Name |

Not Applicable

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Ex Transition Period |

false

|

| Title of 12(b) Security |

Common Stock, $0.0001 par value per share

|

| Trading Symbol |

INAB

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

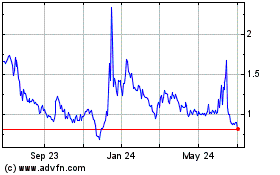

IN8bio (NASDAQ:INAB)

Historical Stock Chart

From Dec 2024 to Jan 2025

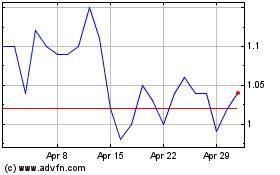

IN8bio (NASDAQ:INAB)

Historical Stock Chart

From Jan 2024 to Jan 2025