Dutton Associates Announces Investment Opinion: ImaRx Therapeutics Speculative Buy Rating In Updated Coverage By Dutton Associat

July 01 2008 - 11:15AM

Business Wire

Dutton Associates updates its coverage of ImaRx Therapeutics

(Nasdaq:IMRX) maintaining a Speculative Buy rating and a $1 target

price. The 9-page report by Dutton senior analyst Denise T. Resnik,

M.S. is available at www.jmdutton.com as well as from First Call,

Bloomberg Professional, Zacks, Reuters, Knobias, and other leading

financial portals. We continue to believe that ImaRx�s microbubble

technology may offer a medically important alternative to other

stroke therapies currently marketed and in development.

Lipid-coated microbubbles represent a new class of agents with both

diagnostic and therapeutic applications. Microbubbles have low

density, and stabilizing them with lipid coatings imparts unusual

properties for diagnostic imaging and drug delivery.

Perfluorocarbon (PFC) gases trapped within lipid coatings make

microbubbles sufficiently stable for circulation in the

vasculature. Research has shown that microbubbles can be cavitated

(expanded and contracted) with ultrasound energy to deliver

site-specific bioactive materials when the microbubbles are

associated with therapeutic agents and can be used in the treatment

of vascular thrombosis when the microbubbles do not carry drug. We

also believe that the monetization of urokinase represents a

non-dilutive mechanism for ImaRx to raise funds for the

continuation of its microbubble clinical program. However, the

Company has two large hurdles at this time. It must be able to

successfully conduct the additional stability testing now required

by the FDA, and it must find a mechanism to monetize urokinase or

otherwise develop another source of income to use to further its

clinical program. While the results from the previously-terminated

TUCSON SonoLysis clinical trial have not been made public, we

expect the success of the Company will ride on those results as

well. About Dutton Associates Dutton Associates is one of the

largest independent investment research firms in the U.S. Its 30

senior analysts are primarily CFAs, and have expertise in many

industries. Dutton & Associates provides continuing analyst

coverage of over 140 enrolled companies, and its research,

estimates, and ratings are carried in all the major databases

serving institutions and online investors. The cost of enrollment

in our one-year continuing research program is US $35,000 prepaid

for 4 Research Reports, typically published quarterly, and

requisite Research Notes. Dutton Associates received $35,000 from

the Company for 4 Research Reports with coverage commencing on

2/19/2008. The Firm does not accept any equity compensation. Our

principals and analysts are prohibited from owning or trading in

securities of covered companies. The views expressed in this

research report accurately reflect the analyst's personal views

about the subject securities or issuer. Neither the analyst's

compensation nor the compensation received by us is in any way

related to the specific ratings or views contained in this research

report or note. Please read full disclosures and analyst background

at www.jmdutton.com before investing.

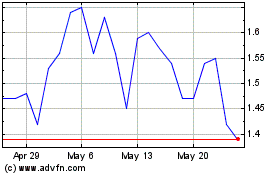

Immuneering (NASDAQ:IMRX)

Historical Stock Chart

From Jun 2024 to Jul 2024

Immuneering (NASDAQ:IMRX)

Historical Stock Chart

From Jul 2023 to Jul 2024