- HRZN Originates $93.1 Million of New Loans in

Q3 -

- HRZN Ends Quarter with Committed Backlog of

$189.9 Million -

Horizon Technology Finance Corporation (NASDAQ: HRZN) (“HRZN” or

“Horizon”), an affiliate of Monroe Capital, and a leading specialty

finance company that provides capital in the form of secured loans

to venture capital-backed companies in the technology, life

science, healthcare information and services, and sustainability

industries, today provided its portfolio update for the third

quarter ended September 30, 2024 and an update on the lending

platform (“Horizon Platform”) of Horizon Technology Finance

Management LLC (“HTFM”), its investment adviser.

“We made excellent progress in the third quarter with respect to

originating new, high-quality investments, as the venture

environment continues to show improvement,” said Gerald A. Michaud,

President of Horizon and HTFM. “For the quarter, we originated

$93.1 million of loans, as our venture debt portfolio returned to

meaningful growth. We also significantly increased our committed

backlog to $189.9 million of debt investments, providing Horizon

with a solid foundation for future lending opportunities. We

continue to believe Horizon remains well positioned to deliver

additional value to its shareholders.”

Third Quarter 2024 Portfolio Update

Originations

During the third quarter of 2024, HRZN funded a total of $93.1

million of loans, as follows:

- $25.0 million to a new portfolio company, Hometeam

Technologies, Inc. (dba Vesta Healthcare), a tech-enabled clinical

services company that integrates caregivers, patients and the

healthcare delivery system to monitor chronic conditions of

high-risk patients.

- $16.0 million to an existing portfolio company, Spineology,

Inc., a developer of anatomy-conserving technology solutions for

use in lumbar spinal fusion procedures.

- $15.0 million to a new portfolio company, GT Medical

Technologies, Inc., a developer of a proprietary solution to treat

brain tumors.

- $15.0 million to a new portfolio company, Infobionic, Inc., a

developer of an FDA-cleared SaaS remote monitoring system to help

treat cardiac arrythmia.

- $10.0 million to a new portfolio company, Pivot Bio, Inc., a

developer of natural microbial products that ensure crops receive

essential nitrogen needed to grow.

- $10.0 million to a new portfolio company, a developer of a

connected digital supply chain for custom manufacturing that

networks highly-vetted manufacturing partners around the

globe.

- $1.0 million to an existing portfolio company, Swift Health

Systems, Inc. (dba InBrace), a developer of teeth straightening

technology that provides an alternative to traditional braces and

aligners.

- $0.6 million to an existing portfolio company, a developer of a

breathalyzer test to detect recent cannabis use.

- $0.5 million to an existing affiliated portfolio company, a

builder of conservation memorial forests that offer sustainable

alternatives to cemeteries.

Liquidity Events and Partial Paydowns

HRZN experienced liquidity events from four portfolio companies

in the third quarter of 2024, consisting of principal prepayments

of $37.5 million, compared to $33.8 million of principal

prepayments during the second quarter of 2024:

- In July, MyForest Foods Co. (“MyForest Foods”) prepaid its

outstanding principal balance of $3.8 million on its venture loan,

plus interest, end-of-term payment and prepayment fee. HRZN

continues to hold warrants in MyForest Foods.

- In July, Lemongrass Holdings, Inc. (“Lemongrass”) prepaid its

outstanding principal balance of $6.2 million on its venture loan,

plus interest, end-of-term payment and prepayment fee. HRZN

continues to hold warrants in Lemongrass.

- In July, Slingshot Aerospace, Inc. (“Slingshot Aerospace”)

prepaid its outstanding principal balance of $20.0 million on its

venture loan, plus interest, end-of-term payment and prepayment

fee. HRZN continues to hold warrants in Slingshot Aerospace.

- In July, with the proceeds of a new loan from the Horizon

Platform, Spineology paid its outstanding principal balance of $7.5

million on its venture loan, plus interest and end-of-term payment.

HRZN continues to hold warrants in Spineology.

HRZN also received prepayments of principal from two portfolio

companies in the aggregate amount of $1.8 million during the third

quarter of 2024, compared to $11.4 million of prepayments of

principal during the second quarter of 2024.

Principal Payments Received

During the third quarter of 2024, HRZN received regularly

scheduled principal payments on investments totaling $12.4 million,

compared to regularly scheduled principal payments totaling $11.8

million during the second quarter of 2024.

Commitments

During the quarter ended September 30, 2024, HRZN closed new

loan commitments totaling $172.9 million to eight companies,

compared to new loan commitments of $12.5 million to two companies

in the second quarter of 2024.

Pipeline and Term Sheets

As of September 30, 2024, HRZN’s unfunded loan approvals and

commitments (“Committed Backlog”) were $189.9 million to 16

companies. This compares to a Committed Backlog of $137.5 million

to 13 companies at HRZN as of June 30, 2024. HRZN’s portfolio

companies have discretion whether to draw down such commitments and

the right of a portfolio company to draw down its commitment is

often subject to achievement of specific milestones and other

conditions to borrowing. Accordingly, there is no assurance that

any or all of these transactions will be funded by HRZN.

During the quarter, HTFM received signed term sheets that are in

the approval process, which may result in the Horizon Platform

providing up to an aggregate of $35.0 million of new debt

investments. These opportunities are subject to underwriting

conditions including, but not limited to, the completion of due

diligence, negotiation of definitive documentation and investment

committee approval, as well as compliance with HTFM’s allocation

policy. Accordingly, there is no assurance that any or all of these

transactions will be completed or funded by HRZN.

Warrant and Equity Portfolio

As of September 30, 2024, HRZN held a portfolio of warrant and

equity positions in 103 portfolio companies, including 92 private

companies, which provides the potential for future additional

returns to HRZN’s shareholders.

About Horizon Technology Finance

Horizon Technology Finance Corporation (NASDAQ: HRZN),

externally managed by Horizon Technology Finance Management LLC, an

affiliate of Monroe Capital, is a leading specialty finance company

that provides capital in the form of secured loans to venture

capital backed companies in the technology, life science,

healthcare information and services, and sustainability industries.

The investment objective of Horizon is to maximize its investment

portfolio’s return by generating current income from the debt

investments it makes and capital appreciation from the warrants it

receives when making such debt investments. Horizon is

headquartered in Farmington, Connecticut, with a regional office in

Pleasanton, California, and investment professionals located

throughout the U.S. Monroe Capital is a $19.5 billion asset

management firm specializing in private credit markets across

various strategies, including direct lending, technology finance,

venture debt, opportunistic, structured credit, real estate and

equity. To learn more, please visit horizontechfinance.com.

Forward-Looking Statements

Statements included herein may constitute “forward-looking

statements” within the meaning of the Private Securities Litigation

Reform Act of 1995. Statements other than statements of historical

facts included in this press release may constitute forward-looking

statements and are not guarantees of future performance, condition

or results and involve a number of risks and uncertainties. Actual

results may differ materially from those in the forward-looking

statements as a result of a number of factors, including those

described from time to time in the Company’s filings with the

Securities and Exchange Commission. Horizon undertakes no duty to

update any forward-looking statement made herein. All

forward-looking statements speak only as of the date of this press

release.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241009923474/en/

Investor Relations: ICR Garrett Edson ir@horizontechfinance.com

(646) 200-8885

Media Relations: ICR Chris Gillick HorizonPR@icrinc.com (646)

677-1819

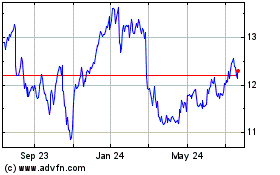

Horizon Technology Finance (NASDAQ:HRZN)

Historical Stock Chart

From Dec 2024 to Jan 2025

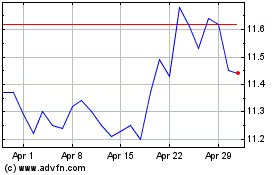

Horizon Technology Finance (NASDAQ:HRZN)

Historical Stock Chart

From Jan 2024 to Jan 2025