UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. 2)*

Hollysys Automation Technologies Ltd.

(Name of Issuer)

Ordinary Shares, par value $0.001 per share

(Title of Class of Securities)

G45667105

(CUSIP Number)

Mengyun Tang

c/o Advanced Technology (Cayman)

Limited

Suite 3501, 35/F, Jardine House

1 Connaught Place, Central

Hong Kong, China

+852-2165-9000

With Copies To:

Marcia Ellis

Rongjing Zhao

Morrison & Foerster LLP

Edinburgh Tower, 33/F

The Landmark, 15 Queen’s Road

Central Hong Kong, China

+852-2585-0888 |

Spencer Klein

Mitchell Presser

John Owen

Morrison & Foerster

LLP

250 West 55th Street

New York, NY 10019-9601

+1-212-468-8000 |

December 11, 2023

(Date of Event Which Requires Filing of this

Statement)

If the filing person has previously filed

a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of

§§ 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. ¨

| * |

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page. |

The information required on the remainder of this cover page shall

not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”)

or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see

the Notes).

CUSIP No. G45667105

| |

|

|

|

|

|

|

| 1 |

|

Name of Reporting Persons

Liang Meng |

| 2 |

|

Check the Appropriate Box if a Member of a Group

(a) ¨

(b) ¨ |

| 3 |

|

SEC Use Only |

| 4 |

|

Source of Funds

AF |

| 5 |

|

Check Box if Disclosure of Legal Proceedings Is Required Pursuant to

Item 2(d) or 2(e)

¨ |

| 6 |

|

Citizenship or Place of Organization

Hong Kong Special Administrative Region of People’s Republic

of China |

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person

With |

|

7 |

|

Sole Voting Power

0 |

| |

8 |

|

Shared Voting Power

8,491,875 |

| |

9 |

|

Sole Dispositive Power

0 |

| |

10 |

|

Shared Dispositive Power

8,491,875 |

| 11 |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

8,491,875 |

| 12 |

|

Check Box if the Aggregate Amount in Row (11) Excludes Certain Shares

¨ |

| 13 |

|

Percent of Class Represented by Amount in Row (11)

13.7%* |

| 14 |

|

Type of Reporting Person

IN |

| |

|

| * |

Based on 62,021,930 Ordinary Shares outstanding as of June 30, 2023, as provided in the Issuer’s Form 20-F filed with the Securities and Exchange Commission on September 20, 2023. |

| |

|

| |

|

|

|

|

|

|

|

CUSIP No. G45667105

| |

|

|

|

|

|

|

| 1 |

|

Name of Reporting Persons

Ascendent Capital Partners III GP Limited |

| 2 |

|

Check the Appropriate Box if a Member of a Group

(a) ¨

(b) ¨ |

| 3 |

|

SEC Use Only |

| 4 |

|

Source of Funds

AF |

| 5 |

|

Check Box if Disclosure of Legal Proceedings Is Required Pursuant to

Item 2(d) or 2(e)

¨ |

| 6 |

|

Citizenship or Place of Organization

Cayman Islands |

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person

With |

|

7 |

|

Sole Voting Power

0 |

| |

8 |

|

Shared Voting Power

8,491,875 |

| |

9 |

|

Sole Dispositive Power

0 |

| |

10 |

|

Shared Dispositive Power

8,491,875 |

| 11 |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

8,491,875 |

| 12 |

|

Check Box if the Aggregate Amount in Row (11) Excludes Certain Shares

¨ |

| 13 |

|

Percent of Class Represented by Amount in Row (11)

13.7%* |

| 14 |

|

Type of Reporting Person

CO |

| |

|

| * |

Based on 62,021,930 Ordinary Shares outstanding as of June 30, 2023, as provided in the Issuer’s Form 20-F filed with the Securities and Exchange Commission on September 20, 2023. |

| |

|

| |

|

|

|

|

|

|

|

|

CUSIP No. G45667105

| |

|

|

|

|

|

|

| 1 |

|

Name of Reporting Persons

Ascendent Capital Partners III GP, L.P. |

| 2 |

|

Check the Appropriate Box if a Member of a Group

(a) ¨

(b) ¨ |

| 3 |

|

SEC Use Only |

| 4 |

|

Source of Funds

AF |

| 5 |

|

Check Box if Disclosure of Legal Proceedings Is Required Pursuant to

Item 2(d) or 2(e)

¨ |

| 6 |

|

Citizenship or Place of Organization

Cayman Islands |

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person

With |

|

7 |

|

Sole Voting Power

0 |

| |

8 |

|

Shared Voting Power

8,491,875 |

| |

9 |

|

Sole Dispositive Power

0 |

| |

10 |

|

Shared Dispositive Power

8,491,875 |

| 11 |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

8,491,875 |

| 12 |

|

Check Box if the Aggregate Amount in Row (11) Excludes Certain Shares

¨ |

| 13 |

|

Percent of Class Represented by Amount in Row (11)

13.7%* |

| 14 |

|

Type of Reporting Person

PN |

| |

|

| * |

Based on 62,021,930 Ordinary Shares outstanding as of June 30, 2023, as provided in the Issuer’s Form 20-F filed with the Securities and Exchange Commission on September 20, 2023. |

| |

|

| |

|

|

|

|

|

|

|

CUSIP No. G45667105

| |

|

|

|

|

|

|

| 1 |

|

Name of Reporting Persons

Ascendent Capital Partners III, L.P. |

| 2 |

|

Check the Appropriate Box if a Member of a Group

(a) ¨

(b) ¨ |

| 3 |

|

SEC Use Only |

| 4 |

|

Source of Funds

AF |

| 5 |

|

Check Box if Disclosure of Legal Proceedings Is Required Pursuant to

Item 2(d) or 2(e)

¨ |

| 6 |

|

Citizenship or Place of Organization

Cayman Islands |

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person

With |

|

7 |

|

Sole Voting Power

0 |

| |

8 |

|

Shared Voting Power

8,491,875 |

| |

9 |

|

Sole Dispositive Power

0 |

| |

10 |

|

Shared Dispositive Power

8,491,875 |

| 11 |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

8,491,875 |

| 12 |

|

Check Box if the Aggregate Amount in Row (11) Excludes Certain Shares

¨ |

| 13 |

|

Percent of Class Represented by Amount in Row (11)

13.7% |

| 14 |

|

Type of Reporting Person

PN |

| |

|

| * |

Based on 62,021,930 Ordinary Shares outstanding as of June 30, 2023, as provided in the Issuer’s Form 20-F filed with the Securities and Exchange Commission on September 20, 2023. |

| |

|

| |

|

|

|

|

|

|

|

CUSIP No. G45667105

| |

|

|

|

|

|

|

| 1 |

|

Name of Reporting Persons

Advanced Technology (Cayman) Limited |

| 2 |

|

Check the Appropriate Box if a Member of a Group

(a) ¨

(b) ¨ |

| 3 |

|

SEC Use Only |

| 4 |

|

Source of Funds

WC |

| 5 |

|

Check Box if Disclosure of Legal Proceedings Is Required Pursuant to

Item 2(d) or 2(e)

¨ |

| 6 |

|

Citizenship or Place of Organization

Cayman Islands |

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person

With |

|

7 |

|

Sole Voting Power

0 |

| |

8 |

|

Shared Voting Power

8,491,875 |

| |

9 |

|

Sole Dispositive Power

0 |

| |

10 |

|

Shared Dispositive Power

8,491,875 |

| 11 |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

8,491,875 |

| 12 |

|

Check Box if the Aggregate Amount in Row (11) Excludes Certain Shares

¨ |

| 13 |

|

Percent of Class Represented by Amount in Row (11)

13.7%* |

| 14 |

|

Type of Reporting Person

CO |

| |

|

| * |

Based on 62,021,930 Ordinary Shares outstanding as of June 30, 2023, as provided in the Issuer’s Form 20-F filed with the Securities and Exchange Commission on September 20, 2023. |

| |

|

| |

|

|

|

|

|

|

|

EXPLANATORY NOTE

This Amendment No. 2 (this “Schedule 13D Amendment”)

to the Schedule 13D filed with the Securities and Exchange Commission (the “SEC”) on November 6, 2023 (the “Original

Schedule 13D” and, as amended by Amendment No. 1 filed with the SEC on November 24, 2023 and this Schedule 13D Amendment,

the “Schedule 13D”) is being filed by Mr. Liang Meng, Ascendent Capital Partners III GP Limited (“GPGP”),

Ascendent Capital Partners III GP, L.P. (“GPLP”), Ascendent Capital Partners III, L.P. (“ACP III”)

and Advanced Technology (Cayman) Limited (“Advanced Technology” and, together with Mr. Meng, GPGP, GPLP and ACP

III, the “Reporting Persons”), with respect to Ordinary Shares, $0.001 par value per share (the “Ordinary

Shares”), of Hollysys Automation Technologies Ltd., a company organized under the laws of the British Virgin Islands (the “Issuer”).

The Reporting Persons are filing this Amendment No. 2 in connection

with the execution of the Agreement and Plan of Merger (the “Merger Agreement”), dated as of December 11, 2023,

by and among the Issuer, Superior Technologies Holding Limited, an exempted company incorporated under the laws of the Cayman Islands

and a wholly owned subsidiary of Advanced Technology (“Parent”), and Superior Technologies Mergersub Limited, a business

company incorporated under the laws of the British Virgin Islands and a wholly owned subsidiary of Parent (“Merger Sub”),

and the related transactions described in Item 4 below.

Other than as set forth below, all Items in the Original Schedule 13D

are materially unchanged. Capitalized terms used in this Schedule 13D Amendment which are not defined herein have the meanings given to

them in the Original Schedule 13D.

| Item 3. |

Source and Amount of Funds or Other Consideration. |

Item 3 of the Schedule 13D is hereby amended

and supplemented to include the following:

The descriptions of the Merger Agreement,

the Equity Commitment Letters (as defined below), the Debt Commitment Letter (as defined below), the Limited Guarantee (as defined below)

and the Rollover and Support Agreement (as defined below) set forth in Item 4 of this Schedule 13D Amendment are incorporated herein by

reference.

| Item 4. |

Purpose of Transaction. |

Item 4 is amended to include the following disclosure at the end of

the Item:

On December 5, 2023, the two-week standstill provision in the

confidentiality agreement with the Issuer expired.

Agreement and Plan of Merger

On December 11, 2023, the Issuer, Parent and Merger Sub entered

into the Merger Agreement pursuant to which, among other things, Merger Sub will merge with and into the Issuer (the “Merger”),

with the Issuer surviving the Merger as a wholly owned subsidiary of Parent. The Merger Agreement was approved unanimously by the board

of directors of the Issuer (the “Board”), and the Board resolved to recommend approval of the Merger and the Merger

Agreement to the Issuer’s shareholders (the “Issuer Recommendation”).

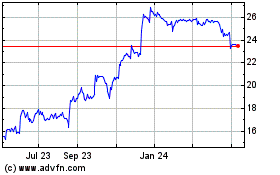

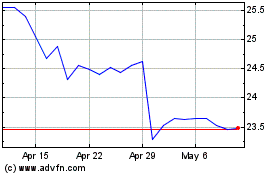

Pursuant to the Merger Agreement, (a) each Ordinary Share issued

and outstanding immediately prior to the effective time of the Merger (the “Effective Time”) will be cancelled in exchange

for the right to receive US$26.50 per Ordinary Share in cash without interest (the “Per Share Merger Consideration”),

except for (i) the Excluded Shares, as defined in the Merger Agreement, which includes Ordinary Shares held by Parent or any direct

or indirect subsidiary of Parent and Ordinary Shares owned by the Issuer as treasury shares or by any direct or indirect subsidiary of

the Issuer, (ii) Ordinary Shares in respect of which the holder thereof has duly and validly exercised a right of dissent in accordance

with Section 179 of the BVI Business Companies Act (the “BVI Act”) and not effectively waived, withdrawn, forfeited,

failed to perfect or otherwise lost its rights to dissent from the Merger (the “Dissenting Shares”) and (iii) outstanding

awards of restricted Ordinary Shares issued by the Issuer pursuant to the Issuer’s share plan that are subject to transfer and other

restrictions which lapse upon the vesting of such awards (“Company Restricted Share Awards”), (b) the Excluded

Shares (including the Rollover Securities (as defined below)) will be cancelled and extinguished, (c) the Dissenting Shares will

be cancelled and will cease to exist or be outstanding, and each dissenting shareholder will cease to be a shareholder and will cease

to have any rights as a shareholder (including any right to receive Per Share Merger Consideration), subject to and except for the right

to receive the payment of the fair value of such Dissenting Shares held by them determined in accordance with Section 179 of the

BVI Act, and (d) the Company Restricted Share Awards will be treated as described below.

At the Effective Time, the Issuer’s equity awards will be treated

in the following manner:

| • | Each outstanding share option issued by the Issuer pursuant to the Issuer’s share plan that entitles the holder thereof to purchase

Ordinary Shares upon the vesting of such award (a “Company Option”) which is vested will be cancelled in exchange for

a cash amount equal to the product of (x) the excess, if any, of the Per Share Merger Consideration over the exercise price of such

vested Company Option, multiplied by (y) the number of Ordinary Shares underlying such vested Company Option. If the exercise price

of any vested Company Option is equal to or greater than the Per Share Merger Consideration, such Company Option will be cancelled without

any payment therefor. |

| • | Each unvested Company Option will be cancelled in exchange for an employee incentive award issued by the surviving company which will

have substantially similar (and which may be settled in cash or property other than shares) terms and conditions as under the Issuer’s

share plan and the award agreement with respect to such unvested Company Option. |

| • | Each vested Company Restricted Share Award will be cancelled in exchange for a cash amount equal to the Per Share Merger Consideration. |

| • | Each unvested Company Restricted Share Award will be cancelled in exchange for an employee incentive award issued by the surviving

company which will have substantially similar (and which may be settled in cash or property other than shares) terms and conditions as

under the Issuer’s share plan and the award agreement with respect to such unvested Company Restricted Share Award. |

The Merger Agreement contains customary representations, warranties

and covenants of the Issuer, Parent and Merger Sub, including, among others, covenants by the Issuer to conduct its business in the ordinary

course of business during the period between execution of the Merger Agreement and, the earlier of, consummation of the Merger (the “Closing”)

or the termination of the Merger Agreement and prohibiting the Issuer from engaging in certain kinds of activities during such period

without the consent of Parent. The Closing is subject to the satisfaction or waiver of customary closing conditions, including: (i) the

approval of the Merger Agreement and the Merger by the affirmative vote of holders of Ordinary Shares representing at least a majority

of the Ordinary Shares present and voting in person or by proxy (the “Shareholder Approval”), (ii) certain approvals

and clearances by governmental authorities in the Peoples Republic of China (but solely for purposes of this Schedule 13D, excluding Hong

Kong, the Macau Special Administrative Region and Taiwan) under the relevant outbound direct investment measures and foreign investment

security review measures (if applicable), (iii) the absence of any order prohibiting, restraining, staying or enjoining the consummation

of the transactions contemplated by the Merger Agreement (excluding the Director Appointment (as defined below)) and (iv) the holders

of no more than 10% of the Ordinary Shares having validly served and not validly withdrawn a notice of dissent under Section 179

of the BVI Act.

The Merger Agreement requires the Issuer to include proposals to increase

the size of the Board to create three additional director seats and nominate three individuals proposed by Parent and meet the “independence”

requirement for directors as required under the applicable NASDAQ rules as independent directors to the Board (the “Director

Appointment”) at the meeting of shareholders at which the Issuer submits the Merger Agreement, the Merger and the related documents

and transactions for the Shareholder Approval (the “Shareholders Meeting”).

For 15 days following the execution of the Merger Agreement (the “Go-Shop

Period”), the Issuer has the right to initiate, solicit and encourage alternative transaction proposals and enter into and maintain

discussions or negotiations with respect to transaction proposals or otherwise cooperate with, assist or participate in, facilitate, or

take any other action in connection with any such inquiries, proposals, discussions or negotiations.

Following the Go-Shop Period, the Issuer is subject to customary “no-shop”

provisions whereby, subject to certain customary exceptions, it may not, among other things, (i) solicit, initiate, propose, knowingly

facilitate or knowingly encourage alternative transaction proposals or any proposal, offer, inquiry or request for information or request

for negotiations or discussions that would reasonably be expected to lead to any alternative transaction proposal, (ii) (A) change,

withhold, withdraw, qualify or modify in a manner adverse to Parent or Merger Sub the Issuer Recommendation, (B) fail to make the

Issuer Recommendation or fail to include the Issuer Recommendation in the proxy statement for the Shareholders Meeting, (C) adopt,

approve or recommend, or publicly propose to adopt, approve or recommend to the shareholders of the Issuer an alternative transaction

proposal, (D) fail to recommend against any transaction proposal that is a tender offer or exchange offer subject to Regulation 14D

promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), (any of the foregoing, a “Change

of Recommendation”), or (iii) take any action to grant any third party a waiver, amendment or release under any standstill,

confidentiality or similar agreement or anti-takeover statutes, “poison pills”, “shareholder rights plans” or

similar contracts to which the Issuer or any of its subsidiaries is a party or subject. The “no shop” provision allows the

Issuer, under certain circumstances and in compliance with certain obligations set forth in the Merger Agreement, to provide non-public

information and engage in discussions and negotiations with respect to an unsolicited acquisition proposal that constitutes or is reasonably

expected to lead to an alternative transaction that the special committee of the Board determines would be more favorable, from a financial

point of view, to the Issuer’s shareholders than the Merger (a “Superior Proposal”). Under certain circumstances

and in compliance with certain obligations set forth in the Merger Agreement, the Issuer is permitted to terminate the Merger Agreement

prior to receipt of the Shareholder Approval to accept a Superior Proposal, subject to the payment of a termination fee of $33,000,000

(the “Termination Fee”).

The Merger Agreement contains certain termination rights for the Issuer

and Parent. Upon termination of the Merger Agreement under specified circumstances, subject to certain exceptions, the Issuer will be

required to pay Parent the Termination Fee. Specifically, the Termination Fee is payable by the Issuer to Parent if the Merger Agreement

is terminated by (i) Parent because (A) the Merger has not occurred by December 11, 2024 (the “End Date”),

(B) the failure of the Merger to occur by the End Date is a result of any action or inaction on the part of the Issuer or any of

its subsidiaries that is in breach of its obligations under the Merger Agreement, and (C) within 12 months after the termination

of the Merger Agreement, the Issuer or any of its subsidiaries consummates, or enters into a definitive agreement in connection with,

an alternative transaction proposal, (ii) the Parent due to the Issuer’s breach of any representation, warranty, covenant or

agreement such that the conditions to the Parent’s and Merger Sub’s obligations to close would not be satisfied and such breach

is not curable or is not cured within the time period specified in the Merger Agreement, (iii) the Parent due to the Board or any

committee of the Board having made a Change of Recommendation or (iv) by the Issuer due to a Change of Recommendation as result of

receiving a Superior Proposal or an Intervening Event (as defined in the Merger Agreement).

Upon termination of the Merger Agreement under specified circumstances,

subject to certain exceptions, Parent will be required to pay the Issuer the Termination Fee. Specifically, the Termination Fee is payable

by Parent to the Issuer if the Merger Agreement is terminated by the Issuer (i) due to the Parent’s or Merger Sub’s breach

of any representation, warranty, covenant or agreement such that the conditions to the Issuer’s obligations to close would not be

satisfied and such breach is not curable or is not cured within the time period specified in the Merger Agreement or (ii) in the

event (A) all of the conditions to the Parent’s and Merger Sub’s obligations to close have been satisfied, (B) the

Issuer has notified the Parent and the Merger Sub that all of the Issuer’s obligations to close have been satisfied or that the

Issuer is willing to waive unsatisfied closing conditions and (C) Parent and Merger Sub failed to consummate the Merger within the

time period specified in the Merger Agreement.

If the transactions under the Merger Agreement are consummated the

Ordinary Shares will be delisted from the Nasdaq Global Select Market and deregistered under the Exchange Act.

Equity Commitment Letters

Pursuant to equity commitment letters (the “Equity Commitment

Letters”) each dated December 11, 2023, (1) ACP III committed to provide Parent, at or prior to the Effective Time,

with an aggregate equity contribution equal to US$70,000,000 and (2) Skyline Automation Technologies L.P., for which GPGP serves

as the general partner, committed to provide Parent, at or prior to the Effective Time, with an aggregate equity contribution equal to

US$275,000,000.

Debt Commitment Letter

Concurrently

with the execution of the Merger Agreement, pursuant to a commitment letter dated December 11, 2023 (the “Debt Commitment

Letter”) provided by Industrial Bank Co., Ltd. (a joint stock company incorporated in the People’s Republic

of China with limited liability) Hong Kong Branch (the “Lender”) to Merger Sub, the Lender has irrevocably committed

to provide on the terms and subject to the conditions set forth in the Debt Commitment Letter, at or prior to the closing of the Merger,

a term loan facility of up to US$1,055,000,000, subject to certain customary conditions.

Limited Guarantee

In

connection with the Merger Agreement, ACP III provided the Issuer with a Limited Guarantee in favor of the Issuer (the “Limited

Guarantee”). The Limited Guarantee guaranties, among other things, the payment of the termination fee under the Merger Agreement

payable by Parent and certain costs and expenses, as set forth in the Merger Agreement and the Limited Guarantee, subject to the

conditions set forth in the Limited Guarantee.

Rollover and Support Agreement

Concurrently with the execution of the Merger Agreement, Parent and

Advanced Technology entered into a Rollover and Support Agreement (the “Rollover and Support Agreement”) pursuant to

which, subject to the terms and conditions of the Rollover and Support Agreement, Advanced Technology has agreed (i) to vote the

Issuer’s securities beneficially owned by it, together with any other Ordinary Shares acquired (whether beneficially or of record)

by Advanced Technology after the date of the Merger Agreement and prior to the earlier of the Effective Time and the termination of Advanced

Technology’s obligations under the Rollover and Support Agreement (collectively, the “Rollover Securities”),

in favor of the approval of the Merger Agreement, the Merger and the other transactions contemplated by the Merger Agreement, and to take

certain other actions in furtherance of the transactions contemplated by the Merger Agreement and (ii) to contribute to Parent immediately

prior to the Effective Time all the Rollover Securities in exchange for newly issued ordinary shares of Parent. Pursuant to the Rollover

and Support Agreement, Advanced Technology also irrevocably appointed Parent as its proxy and attorney-in-fact to vote the Rollover Securities

at the Shareholders Meeting. Additionally, pursuant to the Rollover and Support Agreement, Advanced Technology is subject to certain transfer

restrictions with respect to the Rollover Securities.

Amendments to the Rights Agreements

In connection with the Merger Agreement, the Issuer entered into Amendment

No. 1 to the Amended and Restated Rights Agreement (the “Amended and Restated Rights Agreement”) with Continental

Stock Transfer & Trust Company, as rights agent (the “Rights Agent”), on December 11, 2023 (the “Rights

Agreement Amendment No. 1”) and Amendment No. 2 to Amended and Restated Rights Agreement with the Rights Agent on

December 12, 2023 (together with the Rights Agreement Amendment No. 1, the “Rights Agreement Amendments”).

The Amended and Restated Rights Agreement provides, among other things, for rights each of which entitles the holder to purchase one Preferred

Share, par value $0.001 per share, of the Issuer for US$160.00 if a person or group announces an acquisition of 15% or more of the outstanding

Ordinary Shares, or announces the commencement of a tender offer for 15% or more of the Ordinary Shares. The Rights Agreement Amendments

rendered the Amended and Restated Rights Agreement inapplicable to (i) the Merger Agreement and the transactions contemplated thereby,

including the Merger, and (ii) any acquisition of securities of the Issuer by Parent, Merger Sub and their affiliates during the

term of the Merger Agreement.

The foregoing description of the Merger Agreement, the Equity Commitment

Letters, the Debt Commitment Letter, the Limited Guarantee and the Rights Agreement Amendments is a summary only and is qualified in its

entirety by reference to the Merger Agreement, the Equity Commitment Letters, the Debt Commitment Letter, the Limited Guarantee and the

Rights Agreement Amendments attached hereto as Exhibit 99.3, Exhibits 99.4 and 99.5, Exhibit 99.6, Exhibit 99.7 and Exhibits 99.8

and 99.9, respectively, which are incorporated herein by reference.

| Item 6. |

Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer. |

Item

6 of the Schedule 13D is hereby amended and supplemented to include the following:

The information set forth in Item 4 of this Schedule 13D Amendment

is incorporated by reference in its entirety into Item 6 of the Schedule 13D.

| Item 7. |

Material to be Filed as Exhibits. |

Item

7 of the Schedule 13D is hereby amended and supplemented to include the following:

The information set forth in Item 4 of this Schedule 13D Amendment

is incorporated by reference in its entirety into Item 6 of the Schedule 13D.

Exhibit

Number |

|

Description |

| |

|

| 99.3 |

|

Agreement and Plan of Merger, dated as of December 11, 2023, by and among the Issuer, Parent and Merger Sub (incorporated herein by reference to Exhibit 99.2 of the Report on Form 6-K dated December 12, 2023 of the Issuer). |

| 99.4 |

|

Equity Commitment Letter, dated December 11, 2023, by and between Merger Sub and ACP III. |

| 99.5 |

|

Equity Commitment Letter, dated December 11, 2023, by and between Merger Sub and Skyline Automation Technologies L.P. |

| 99.6 |

|

Commitment Letter, dated December 11, 2023, by and among Merger Sub and the Lender. |

| 99.7 |

|

Limited Guarantee, dated as of December 11, 2023, made by ACP III in favor of the Issuer. |

| 99.8 |

|

Amendment No. 1 to Amended and Restated Rights Agreement, dated as of December 11, 2023, by and between the Issuer and the Rights Agent (incorporated herein by reference to Exhibit 4.1 of the Report on Form 6-K dated December 12, 2023 of the Issuer). |

| 99.9 |

|

Amendment No. 2 to Amended and Restated Rights Agreement, dated as of December 12, 2023, by and between the Issuer and the Rights Agent (incorporated herein by reference to Exhibit 4.2 of the Report on Form 6-K dated December 12, 2023 of the Issuer). |

SIGNATURES

After reasonable inquiry and to the best of my knowledge and belief, I

certify that the information set forth in this statement is true, complete and correct.

Dated: December 13, 2023

| |

Liang Meng |

| |

|

|

| |

/s/ Liang Meng |

| |

|

|

| |

Ascendent Capital Partners III GP Limited |

| |

|

|

| |

By: |

/s/ Liang Meng |

| |

Name: |

Liang Meng |

| |

Title: |

Director |

| |

|

| |

Ascendent Capital Partners III GP, L.P. |

| |

By: Ascendent Capital Partners III GP Limited, its General Partner |

| |

|

|

| |

By: |

/s/ Liang Meng |

| |

Name: |

Liang Meng |

| |

Title: |

Director |

| |

|

| |

Ascendent Capital Partners III, L.P. |

| |

By: Ascendent Capital Partners III GP, L.P., its General Partner |

| |

By: Ascendent Capital Partners III GP Limited, its General Partner |

| |

|

|

| |

By: |

/s/ Liang Meng |

| |

Name: |

Liang Meng |

| |

Title: |

Director |

| |

|

| |

Advanced Technology (Cayman) Limited |

| |

|

| |

By: |

/s/ Liang Meng |

| |

Name: |

Liang Meng |

| |

Title: |

Director |

Exhibit 99.4

CONFIDENTIAL

Execution Version

EQUITY COMMITMENT LETTER

December 11, 2023

Ascendent Capital Partners III, L.P.

Address:

Walkers Corporate Limited

Cayman Corporate Center, 27 Hospital RD

George Town, Grand Cayman, Cayman Islands

Ladies and Gentlemen:

This Equity Commitment Letter

(this “letter agreement”) sets forth the commitment of Ascendent Capital Partners III, L.P. (the “Sponsor”),

subject to (i) the terms and conditions contained in the Agreement and Plan of Merger, dated as of the date of this letter agreement

(as amended, restated, supplemented or otherwise modified from time to time, the “Merger Agreement”) by and among Hollysys

Automation Technologies Ltd. (the “Company”), Superior Technologies Mergersub Limited, a BVI business company incorporated

under the Laws of the British Virgin Islands (“Merger Sub”) and Superior Technologies Holding Limited (“Parent”),

which provides, among other things, for the merger of Merger Sub with and into the Company, with the Company continuing as the surviving

company and a wholly owned subsidiary of Parent (the “Merger”) and (ii) the terms and conditions contained herein.

Concurrently with the delivery of this letter agreement, Skyline Automation Technologies L.P. (the “Other Sponsor”)

is entering into a letter agreement substantially identical to this letter agreement (collectively, the “Other Sponsor Equity

Commitment Letter”) committing to invest, directly or indirectly, in Merger Sub. Capitalized terms used and not otherwise defined

herein shall have the meanings ascribed to such terms in the Merger Agreement.

1. Equity

Commitment.

(a) This

letter agreement confirms the commitment of the Sponsor, at or prior to the Effective Time, on the terms and subject to the conditions

set forth herein, to purchase, or to cause the purchase of equity interests of Parent and to pay, or cause to be paid to Merger Sub through

Parent in immediately available funds an aggregate cash purchase price equal to US$70,000,000 (the “Equity Commitment”),

which Merger Sub shall use for the purpose of funding, to the extent necessary to fund, such portion of the merger consideration and such

other amounts required to be paid by Parent or Merger Sub pursuant to and in accordance with the Merger Agreement, together with related

fees and expenses; provided that the Sponsor (together with its permitted assigns) shall not, under any circumstances, be obligated

to contribute more than the Equity Commitment to Merger Sub and the aggregate amount of liability of the Sponsor hereunder shall not exceed

the amount of the Equity Commitment (the “Cap”).

(b) The

Sponsor may effect the funding of the Equity Commitment directly or indirectly through one or more direct or indirect Subsidiaries of

the Sponsor or any investment fund or vehicles sponsored, advised or managed by the investment manager of the Sponsor or any Affiliate

thereof or any other investment fund or Person that is a limited partner of the Sponsor or of an Affiliate of the Sponsor or other Affiliates

of the Sponsor. The Sponsor will not be under any obligation under any circumstances to contribute more than the amount of the Equity

Commitment to Merger Sub or any other Person pursuant to the terms of this letter agreement.

2. Conditions.

The Equity Commitment shall be subject to (a) the satisfaction in full or waiver, if permissible, at or prior to the Closing, of

each of the conditions set forth in Section 7.1 and Section 7.2 of the Merger Agreement (other than any conditions that by their

nature are to be satisfied at the Closing but subject to the prior or substantially concurrent satisfaction of such conditions), (b) either

the substantially contemporaneous consummation of the Closing or the obtaining by the Company in accordance with Section 9.12 of

the Merger Agreement of a final and non-appealable order requiring Parent or Merger Sub to cause the Equity Financing to be funded and

to effect the Closing, (c) the Debt Financing and/or the Alternative Financing (if applicable) having been funded or will be funded

at the Closing in accordance with the terms thereof if the Equity Financing is funded at the Closing, and (d) the substantially contemporaneous

funding to Merger Sub of the contributions contemplated by the Other Sponsor Equity Commitment Letter, provided that the satisfaction

or failure of the condition set forth in this clause (d) shall not limit or impair the ability of Merger Sub or the Company to seek

enforcement of the obligations of the Sponsor under and in accordance with this letter agreement, if (x) Merger Sub or the Company,

as applicable, is also seeking enforcement of the Other Sponsor Equity Commitment Letter, or (y) the Other Sponsor has satisfied

or will satisfy its obligations under the Other Sponsor Equity Commitment Letter.

3. Limited

Guarantee. Concurrently with the execution and delivery of this letter agreement, the Sponsor is executing and delivering to the Company

an amended and restated limited guarantee related to certain payment obligations of Parent under the Merger Agreement (the “Limited

Guarantee”) relating to certain payment obligations of Parent under the Merger Agreement. Other than as set forth herein (including

without limitation, the rights of the Company pursuant to Section 4) or with respect to the Retained Claims (as defined in

the Limited Guarantee), (a) the Company’s remedies against the Sponsor under the Limited Guarantee shall be, and are intended

to be, the sole and exclusive (direct or indirect) remedies available to the Company and the Guaranteed Party Related Persons (as defined

in the Limited Guarantee) against the Sponsor or any of the Non-Recourse Parties (as defined in the Limited Guarantee) for any liability,

loss, damage or recovery of any kind (including consequential, indirect or punitive damages, and whether at law, in equity or otherwise)

arising out of or relating to this letter agreement or the Merger Agreement, or of the failure of any of the transactions contemplated

by any such agreement to be consummated or otherwise in connection with any of the transactions contemplated hereby and thereby or in

respect of any other document or theory of law or in equity, or in respect of any written or oral representations made or alleged to have

been made in connection with any such agreement, whether at law, in equity, in contract, in tort or otherwise, (whether or not Merger

Sub’s breach is caused by the Sponsor’s breach of its obligations under this letter agreement); and (b) the Company and

the Guaranteed Party Related Persons (as defined in the Limited Guarantee) shall not have, and they are not intended to have, any right

of recovery against the Sponsor or any of the Non-Recourse Parties in respect of any liabilities or obligations arising out of or relating

to, this letter agreement or the Merger Agreement, including in the event Merger Sub breaches its obligations under the Merger Agreement

and whether or not Merger Sub’s breach is caused by the Sponsor’s breach of its obligations under this letter agreement, except

for claims of the Company against the Sponsor pursuant to and in accordance with the Limited Guarantee.

4. Enforceability;

Third-Party Beneficiary.

(a) This

letter agreement may only be enforced by Merger Sub (in its sole discretion); provided that, if the conditions set forth in Section 2

are satisfied and the Company is entitled to seek specific performance pursuant to Section 9.12 of the Merger Agreement, the Company

is hereby made a third party beneficiary of the rights granted to Merger Sub under this letter agreement to the extent, and only to the

extent, of the rights set forth in Sections 1,

4, 5,

6, 7 and 12

and shall be entitled to an injunction, specific performance or other equitable remedy to cause the Sponsor to fund the Equity Commitment

in accordance with Section 1 hereof.

None of Merger Sub’s or the Company’s creditors or any provider or source of the Financing shall have the right to enforce

this letter agreement or to cause Merger Sub or the Company to enforce this letter agreement against the Sponsor.

(b) Notwithstanding

the foregoing, if the Company or any of its Affiliates asserts in any proceeding that (1) the Sponsor shall contribute an amount

of Equity Commitment that exceeds the Cap or (2) the Cap on the Sponsor’s liabilities hereunder or the Cap (as defined in the

Other Sponsor Equity Commitment Letter) on the Other Sponsor’s liabilities is illegal, invalid or unenforceable in whole or in part

(the “Impermissible Claims”), then (i) the obligations of the Sponsor under this letter agreement shall terminate

ab initio and be null and void, (ii) if the Sponsor has previously made any payments under this letter agreement, it shall

be entitled to recover such payments, and (iii) the Sponsor shall not have any liabilities or obligations to any Person under this

letter agreement. In no event shall the maximum amount of the liabilities of the Sponsor in the aggregate under this letter agreement

exceed the Cap.

(c) Each

party hereto acknowledges and agrees that (i) this letter agreement is not intended to, and does not, create any agency, partnership,

fiduciary or joint venture, relationship, between or among any of the parties hereto, and neither this letter agreement nor any other

document or agreement entered into by any party hereto relating to the subject matter hereof shall be construed to suggest otherwise,

and (ii) the obligations of the Sponsor under this letter agreement are solely contractual in nature.

(d) Subject

to the terms and conditions set forth herein, the Company shall be entitled to specifically enforce Merger Sub’s right to cause

the Equity Commitment to be funded to Merger Sub solely to the extent specifically permitted under Section 4 (a) and

the Company shall be a third party beneficiary for such purpose but not for any other purpose (including, without limitation, any claim

for monetary damages hereunder or under the Merger Agreement) other than as specified in Section 4(a) hereof.

The Company hereby agrees that specific performance shall be its sole and exclusive remedy with respect to any breach by the Sponsor of

this letter agreement and that the Company may not seek or accept any other form of relief that may be available for any such breach of

this letter agreement (including monetary damages); provided, that, if the Company seeks specific performance for such breach of this

letter agreement as permitted under Section 4(a),

and a court of competent jurisdiction in a final, non-appealable determination as to the availability of specific performance does not

specifically enforce the obligations of the Sponsor hereunder pursuant to any proceeding for specific performance brought against the

Sponsor, then the Company shall have the right to seek the payments contemplated by, and subject to the terms and conditions of, Section 1

of the Limited Guarantee (subject to the limitations and conditions therein). In addition, the Company shall, and shall cause each of

its Affiliates to, cause any pending proceeding to be dismissed with prejudice upon the earlier of (i) the consummation of the Closing

by Merger Sub or (ii) the payment of the Parent Termination Fee pursuant to the Merger Agreement.

(e) Each

party hereto agrees that its respective agreements and obligations set forth herein are solely for the benefit of the other party hereto

and the respective successors and permitted assigns of such other party, in accordance with and subject to the terms of this letter agreement,

and this letter agreement is not intended to, and does not, confer upon any Person other than the parties hereto and their respective

successors and permitted assigns any benefits, rights or remedies under or by reason of, or any rights to enforce or cause Merger Sub

to enforce, the obligations set forth therein; provided that the Company is a third-party beneficiary of this letter agreement

to the extent and only to the extent of its rights specifically provided in Section 4(a) in

accordance with, and subject to the terms of the Merger Agreement and this letter agreement. Except as expressly provided in the foregoing

sentence, nothing in this letter agreement, express or implied, is intended to confer upon any Person other than Merger Sub or the Sponsor,

any rights or remedies under or by reason of this letter agreement. In no event shall this letter agreement or the Equity Commitment to

be funded hereunder be enforced by any Person unless such Person is also seeking enforcement of the Other Sponsor Equity Commitment Letter

to the extent that the Other Sponsor has not performed in full its obligations under the Other Sponsor Equity Commitment Letter.

5. No

Modification; Entire Agreement. This letter agreement may not be amended or otherwise modified without the prior written consent of

(i) Merger Sub and the Sponsor, and (ii) if such amendment or modification (for the avoidance of doubt, including any amendment

or modification of Section 11) would impact the Company’s rights as a third-party beneficiary of this letter agreement

pursuant to Section 4(a), the Company.

Together with the Merger Agreement (including any schedules, exhibits and annexes thereto and any other documents and instruments referred

to thereunder), the Other Sponsor Equity Commitment Letter, the Limited Guarantee, the Rollover and Support Agreement between Parent and

Advanced Technology (Cayman) Limited, and the Confidentiality Agreement by and between Advanced Technology (Cayman) Limited and the Company

dated as of November 21, 2023, this letter agreement constitutes the sole agreement, and supersedes all prior agreements, understandings

and statements, written or oral, between, the Sponsor or any of its Affiliates, on the one hand, and Merger Sub or any of its Affiliates,

on the other hand, with respect to the transactions contemplated hereby. Each of the parties acknowledges that each party and its respective

counsel have reviewed this letter agreement and that any rule of construction to the effect that any ambiguities are to be resolved

against the drafting party shall not be employed in the interpretation of this letter agreement.

6. Governing

Law. This letter agreement and all disputes or controversies arising out of or relating to this letter agreement, or the transactions

contemplated hereby shall be interpreted, construed and governed by and in accordance with the Laws of the State of New York without regard

to the conflicts of law principles thereof.

7. Dispute

Resolution. Any dispute, controversy, difference, or claim arising out of or relating to this letter agreement, including the existence,

validity, interpretation, performance, breach, or termination thereof or any dispute regarding non-contractual obligations arising out

of or relating to it shall be submitted to the Hong Kong International Arbitration Centre (“HKIAC”) and resolved in

accordance with the HKIAC Administered Arbitration Rules in force when the Notice of Arbitration is submitted and as may be amended

by this Section 7. The law of this arbitration

clause shall be Hong Kong law. The seat of arbitration shall be Hong Kong. The language of the arbitration shall be English and the tribunal

shall consist of three arbitrators. The arbitration tribunal shall have no authority to award punitive damages. The award of the arbitration

tribunal shall be final and binding upon the disputing parties. Any party to an award may apply to any court of competent jurisdiction

for enforcement of such award and, for purposes of the enforcement of such award, the parties hereto irrevocably and unconditionally submit

to the jurisdiction of any court of competent jurisdiction and waive any defenses to such enforcement based on lack of personal jurisdiction

or inconvenient forum.

8. Waiver

of Jury Trial. EACH PARTY HERETO HEREBY IRREVOCABLY AND UNCONDITIONALLY WAIVES ANY AND ALL RIGHT TO TRIAL BY JURY IN ANY ACTION, PROCEEDING

OR COUNTERCLAIM (WHETHER BASED ON CONTRACT, TORT OR OTHERWISE) ARISING OUT OF OR RELATING TO THIS LETTER AGREEMENT, ANY OF THE AGREEMENTS

DELIVERED IN CONNECTION HEREWITH, AND THE TRANSACTIONS CONTEMPLATED HEREBY. EACH PARTY HERETO CERTIFIES AND ACKNOWLEDGES THAT (A) NO

REPRESENTATIVE, AGENT OR ATTORNEY OF ANY OTHER PARTY HAS REPRESENTED, EXPRESSLY OR OTHERWISE, THAT SUCH OTHER PARTY WOULD NOT, IN

THE EVENT OF LITIGATION, SEEK TO ENFORCE EITHER OF SUCH WAIVERS, (B) IT UNDERSTANDS AND HAS CONSIDERED THE IMPLICATIONS OF SUCH WAIVERS,

(C) IT MAKES SUCH WAIVERS VOLUNTARILY, AND (D) IT HAS BEEN INDUCED TO ENTER INTO THIS LETTER AGREEMENT BY, AMONG OTHER THINGS,

THE MUTUAL WAIVERS AND CERTIFICATIONS IN THIS SECTION 8.

9. Confidentiality.

This letter agreement shall be treated as confidential and is being provided to Merger Sub solely in connection with the Merger Agreement

and the transactions contemplated thereby. This letter agreement may not be used, circulated, quoted or otherwise referred to in any document

by either party hereto, except with the prior written consent of the other party; provided, however, that each party hereto may

disclose the existence and content of this letter agreement to the Company, to their and their Affiliates’ respective officers,

directors, employees, partners, members, investors, financing sources, advisors (including financial and legal advisors) and any representatives

of the foregoing (collectively, “Representatives”), to the Other Sponsor and its respective Representatives and to

the extent required by applicable Law, the applicable rules of any national securities exchange or in connection with any SEC filings

relating to the Merger Agreement and the transactions contemplated thereby or in connection with any litigation relating to the Merger

Agreement and the transactions contemplated thereby as permitted by or provided in the Merger Agreement and the Sponsor may disclose the

existence and content of this letter agreement to any Non-Recourse Party which needs to know of the existence of this letter agreement

and is subject to the confidentiality obligations substantially identical to the terms contained in this Section 9.

10. No

Recourse. Notwithstanding anything that may be expressed or implied in this letter agreement or any document or instrument delivered

in connection herewith, Merger Sub, by its acceptance of the benefits of the Equity Commitment provided herein, covenants, agrees and

acknowledges that no Person (other than the Sponsor or its successors or permitted assigns hereunder) shall have any liabilities or obligations

hereunder or in connection with the transactions contemplated hereby and that, notwithstanding the fact that the Sponsor or any of its

respective successors or permitted assigns may be partnerships, limited liability companies, corporations or other entities, Merger Sub

has no rights of recovery against, and no recourse hereunder or under any document or instrument delivered in connection herewith or in

respect of any oral representations made or alleged to be made in connection herewith or therewith shall be had against, any Non-Recourse

Party, whether by or through attempted piercing of the corporate (or limited liability company or limited partnership) veil, by or through

a claim (whether at law or equity or in tort, contract or otherwise), by the enforcement of any assessment or by any legal or equitable

proceeding, or by virtue of any applicable Law; it being agreed and acknowledged that no personal liability whatsoever shall attach to,

be imposed on or otherwise be incurred by any Non-Recourse Party for any obligations or liabilities of the Sponsor or any of its successors

or permitted assigns hereunder or any document or instrument delivered in connection herewith or in respect of any oral representation

made or alleged to be made in connection herewith or therewith or for any proceeding (whether at law or equity or in tort, contract or

otherwise) based on, in respect of, or by reason of such obligations or liabilities or their creation.

11. Termination.

This letter agreement and the obligation of the Sponsor to fund the Equity Commitment will terminate automatically and immediately upon

the earliest to occur of (a) the valid termination of the Merger Agreement in accordance with its terms, (b) the Closing, at

which time such obligation will be discharged, but subject to the performance of such obligation, (c) the Company or any of its controlled

Affiliates directly or indirectly taking affirmative steps to pursue remedies (including asserting a claim or initiating a proceeding)

against the Sponsor under the Limited Guarantee, or (d) the Company or any of its controlled Affiliates directly or indirectly (i) asserting

a claim or initiating a proceeding against Merger Sub, the Sponsor or any Non-Recourse Party (as defined in the Limited Guarantee) in

connection with or relating to this letter agreement, the Merger Agreement or any of the transactions contemplated under the Merger Agreement

(other than a claim seeking an order of specific performance or other equitable relief of the Sponsor’s obligation to fund the Equity

Commitment in the circumstances provided for in Section 4(a) or a claim seeking an order of specific performance or other

equitable relief pursuant to the Merger Agreement or the Other Sponsor Equity Commitment Letter), or (ii) asserting any Impermissible

Claim. Upon termination of this letter agreement, all rights and obligations of the Sponsor hereunder with respect to the Equity Commitment

shall terminate, and the Sponsor shall not have any further liabilities hereunder.

12. Representations

and Warranties.

(a) The

Sponsor hereby represents and warrants to Merger Sub that: (i) it has all necessary organizational power and authority to execute

and deliver this letter agreement and perform its obligations hereunder; (ii) the execution, delivery and performance of this letter

agreement by it has been duly and validly authorized and approved by all necessary limited partnership or corporate action (as applicable)

by it; (iii) this letter agreement has been duly and validly executed and delivered by the Sponsor and (assuming due execution and

delivery of this letter agreement, the Merger Agreement and the Limited Guarantee by all parties hereto and thereto, as applicable, other

than the Sponsor) constitutes a valid and legally binding obligation of the Sponsor, enforceable against the Sponsor in accordance with

the terms of this letter agreement (subject to the effects of bankruptcy, insolvency, fraudulent conveyance, reorganization, moratorium

or other similar Laws affecting creditors’ rights generally and general equitable principles (whether considered in a proceeding

in equity or at law)); (iv) except for the applicable requirements of the Exchange Act, no action, consent, permit, authorization

by, and no notice to or filing with, any governmental entity is required in connection with the execution, delivery or performance of

this letter agreement by the Sponsor; (v) it will, at the Closing, have sufficient funds, available lines of credit, unfunded capital

commitments that it is entitled to call to fund the Equity Commitment, or other sources of immediately available funds to fulfill its

payment obligation for the sum of the Equity Commitment and all of its other unfunded contractually binding equity commitments that are

then outstanding; and (vi) the execution, delivery and performance of this letter agreement by the Sponsor do not violate the organizational

documents of the Sponsor, any applicable Law binding on the Sponsor or the assets of the Sponsor or conflict with any material agreement

binding on the Sponsor.

13. Interpretation.

When reference is made in this letter agreement to an Article, Exhibit, Schedule or Section, such reference shall be to an Article, Exhibit,

Schedule or Section of this letter agreement unless otherwise indicated. All terms defined in this letter agreement shall have the

defined meanings when used in any certificate or other document made or delivered pursuant thereto unless otherwise defined therein. Whenever

the words “include”, “includes” or “including” are used in this letter agreement, they shall be deemed

to be followed by the words “without limitation.” The words “hereof,” “herein,” “hereby”

and “hereunder” and words of similar import when used in this letter agreement shall refer to this letter agreement as a whole

and not to any particular provision of this letter agreement. Words of any gender include each other gender and neuter genders and words

using the singular or plural number also include the plural or singular number, respectively. Any contract or Law defined or referred

to herein means such contract or Law as from time to time amended, modified or supplemented, including (in the case of contracts) by waiver

or consent and (in the case of Laws) by succession or comparable successor statutes and references to all attachments thereto and instruments

incorporated therein. The word “or” shall not be exclusive. With respect to the determination of any period of time, “from”

means “from and including”. The word “will” shall be construed to have the same meaning as the word “shall”.

Whenever this letter agreement refers to a number of days, such number shall refer to calendar days unless Business Days are specified.

The word “to the extent” shall mean the degree to which a subject or other thing extends, and such phrase shall not mean simply

“if”. References to “dollars” or “$” are to United States dollars. Any deadline or time period set

forth in this letter agreement that by its terms ends on a day that is not a Business Day shall be automatically extended to the next

succeeding Business Day. Each of the parties hereto has participated in the drafting and negotiating of this letter agreement. If an ambiguity

or question of intent or interpretation arises, this letter agreement shall be construed as if it is drafted by all the parties hereto

and without regard to any presumption or rule requiring construction or interpretation against the parties hereto drafting or causing

any instrument to be drafted.

14. No

Assignment. The Sponsor’s obligation to fund the Equity Commitment may not be assigned (whether by operation of law, merger,

consolidation or otherwise) or delegated, except that the Sponsor may assign or delegate all or a portion of its obligations to fund the

Equity Commitment to any of the Sponsor’s Affiliates, or any affiliated investment fund or investment vehicle sponsored, advised

or managed by the general partner or the investment manager of the Sponsor or any of its Affiliates thereof (including any affiliated

investment fund or investment vehicle to be set up after the date hereof that is sponsored, advised or managed by such Sponsor or any

of its Affiliates as of such assignment) without the Company’s and Merger Sub’s consent; provided that, any such assignment

or delegation shall not relieve the Sponsor of its obligations under this letter agreement. Merger Sub may not assign its rights to any

of its Affiliates or other entity owned directly or indirectly by the beneficial owners of Merger Sub, without the prior written consent

of the Sponsor. The Company may not assign its rights without the prior written consent of Merger Sub and the Sponsor. Any transfer, assignment

or delegation in violation of this Section 14 shall be null and void and of no force and effect.

15. Severability.

If any term or other provision of this letter agreement is found by a court of competent jurisdiction or an arbitration tribunal to be

invalid, illegal or incapable of being enforced by any rule of Law or public policy, all other conditions and provisions of this

letter agreement shall nevertheless remain in full force and effect so long as the economic or legal substance of the transactions contemplated

hereby is not affected in any manner materially adverse to any party hereto. Upon such determination that any term or other provision

is invalid, illegal or incapable of being enforced, the parties hereto shall negotiate in good faith to modify this letter agreement so

as to effect the original intent of the parties hereto as closely as possible in an acceptable manner to the end that the transactions

contemplated hereby are fulfilled to the greatest extent possible.

16. Notices.

All notices and other communications hereunder shall be in writing and shall be deemed to have been duly given when delivered in person

or upon confirmation of receipt when transmitted by facsimile transmission or by electronic mail or on receipt after dispatch by registered

or certified mail, postage prepaid, addressed, or on the next business day if transmitted by international overnight courier, in each

case to the parties at the following addresses (or at such other address for a party as shall be specified by like notice):

if

to the Sponsor, to:

Ascendent Capital Partners III, L.P.

Suite 3501, 35/F, Jardine House, 1 Connaught Place,

Central, Hong Kong

Attention: Liang Meng // John Wang

Email:

leon@ascendentcp.com; john@ascendentcp.com

with a copy (which shall not constitute notice) to:

Morrison & Foerster LLP

Edinburgh Tower, 33/F, The Landmark, 15 Queen’s Road

Central, Hong Kong

Email:

mellis@mofo.com; rzhao@mofo.com

Attention: Marcia Ellis // Rongjing Zhao

if

to Merger Sub, to:

Superior Technologies Mergersub Limited

Suite 3501, 35/F, Jardine House, 1 Connaught Place,

Central, Hong Kong

Attention: Liang Meng // John Wang

Email:

leon@ascendentcp.com; john@ascendentcp.com

with a copy (which shall not constitute notice) to:

Morrison & Foerster LLP

Edinburgh Tower, 33/F, The Landmark, 15 Queen’s Road

Central, Hong Kong

Email:

mellis@mofo.com; rzhao@mofo.com

Attention: Marcia Ellis // Rongjing Zhao

17. Counterparts.

This letter agreement may be executed and delivered (including by e-mail of PDF or scanned versions or by facsimile) in one or more counterparts,

and by the parties hereto in separate counterparts, each of which when executed shall be deemed to be an original but all of which taken

together shall constitute one and the same agreement.

[Remainder of page intentionally left blank]

Sincerely,

Ascendent Capital Partners III, L.P.

By: Ascendent Capital Partners III GP, L.P., its general partner

By: Ascendent Capital Partners III GP Limited, its general partner

| By: |

/s/

Liang Meng |

|

| Name: |

Liang Meng |

|

| Title: |

Director |

|

[SIGNATURE PAGE TO EQUITY COMMITMENT LETTER]

Agreed to and accepted as of the date first written

above:

Superior Technologies Mergersub Limited

| By: |

/s/ Liang Meng |

|

| Name: |

Liang Meng |

|

| Title: |

Director |

|

[SIGNATURE PAGE TO EQUITY COMMITMENT LETTER]

Exhibit 99.5

CONFIDENTIAL

Execution Version

EQUITY COMMITMENT LETTER

December 11, 2023

Skyline Automation Technologies L.P.

Address:

Walkers Corporate Limited

Cayman Corporate Center, 27 Hospital RD

George Town, Grand Cayman, Cayman Islands

Ladies and Gentlemen:

This Equity Commitment Letter

(this “letter agreement”) sets forth the commitment of Skyline Automation Technologies L.P. (the “Sponsor”),

subject to (i) the terms and conditions contained in the Agreement and Plan of Merger, dated as of the date of this letter agreement

(as amended, restated, supplemented or otherwise modified from time to time, the “Merger Agreement”) by and among Hollysys

Automation Technologies Ltd. (the “Company”), Superior Technologies Mergersub Limited, a BVI business company incorporated

under the Laws of the British Virgin Islands (“Merger Sub”) and Superior Technologies Holding Limited (“Parent”),

which provides, among other things, for the merger of Merger Sub with and into the Company, with the Company continuing as the surviving

company and a wholly owned subsidiary of Parent (the “Merger”) and (ii) the terms and conditions contained herein.

Concurrently with the delivery of this letter agreement, Ascendent Capital Partners III, L.P. (the “Other Sponsor”)

is entering into a letter agreement substantially identical to this letter agreement (collectively, the “Other Sponsor Equity

Commitment Letter”) committing to invest, directly or indirectly, in Merger Sub. Capitalized terms used and not otherwise defined

herein shall have the meanings ascribed to such terms in the Merger Agreement.

1.

Equity Commitment.

(a) This

letter agreement confirms the commitment of the Sponsor, at or prior to the Effective Time, on the terms and subject to the conditions

set forth herein, to purchase, or to cause the purchase of equity interests of Parent and to pay, or cause to be paid to Merger Sub through

Parent in immediately available funds an aggregate cash purchase price equal to US$275,000,000 (the “Equity Commitment”),

which Merger Sub shall use for the purpose of funding, to the extent necessary to fund, such portion of the merger consideration and such

other amounts required to be paid by Parent or Merger Sub pursuant to and in accordance with the Merger Agreement, together with related

fees and expenses; provided that the Sponsor (together with its permitted assigns) shall not, under any circumstances, be obligated

to contribute more than the Equity Commitment to Merger Sub and the aggregate amount of liability of the Sponsor hereunder shall not exceed

the amount of the Equity Commitment (the “Cap”).

(b) The

Sponsor may effect the funding of the Equity Commitment directly or indirectly through one or more direct or indirect Subsidiaries of

the Sponsor or any investment fund or vehicles sponsored, advised or managed by the investment manager of the Sponsor or any Affiliate

thereof or any other investment fund or Person that is a limited partner of the Sponsor or of an Affiliate of the Sponsor or other Affiliates

of the Sponsor. The Sponsor will not be under any obligation under any circumstances to contribute more than the amount of the Equity

Commitment to Merger Sub or any other Person pursuant to the terms of this letter agreement.

2. Conditions.

The Equity Commitment shall be subject to (a) the satisfaction in full or waiver, if permissible, at or prior to the Closing, of

each of the conditions set forth in Section 7.1 and Section 7.2 of the Merger Agreement (other than any conditions that by their

nature are to be satisfied at the Closing but subject to the prior or substantially concurrent satisfaction of such conditions), (b) either

the substantially contemporaneous consummation of the Closing or the obtaining by the Company in accordance with Section 9.12 of

the Merger Agreement of a final and non-appealable order requiring Parent or Merger Sub to cause the Equity Financing to be funded and

to effect the Closing, (c) the Debt Financing and/or the Alternative Financing (if applicable) having been funded or will be funded

at the Closing in accordance with the terms thereof if the Equity Financing is funded at the Closing, and (d) the substantially contemporaneous

funding to Merger Sub of the contributions contemplated by the Other Sponsor Equity Commitment Letter, provided that the satisfaction

or failure of the condition set forth in this clause (d) shall not limit or impair the ability of Merger Sub or the Company to seek

enforcement of the obligations of the Sponsor under and in accordance with this letter agreement, if (x) Merger Sub or the Company,

as applicable, is also seeking enforcement of the Other Sponsor Equity Commitment Letter, or (y) the Other Sponsor has satisfied

or will satisfy its obligations under the Other Sponsor Equity Commitment Letter.

3. Limited

Guarantee. Concurrently with the execution and delivery of this letter agreement, the Other Sponsor is executing and delivering to

the Company an amended and restated limited guarantee related to certain payment obligations of Parent under the Merger Agreement (the

“Limited Guarantee”) relating to certain payment obligations of Parent under the Merger Agreement. Other than as set

forth herein (including without limitation, the rights of the Company pursuant to Section 4) or with respect to the Retained

Claims (as defined in the Limited Guarantee), (a) the Company’s remedies against the Other Sponsor under the Limited Guarantee

shall be, and are intended to be, the sole and exclusive (direct or indirect) remedies available to the Company and the Guaranteed Party

Related Persons (as defined in the Limited Guarantee) against the Sponsor or any of the Non-Recourse Parties (as defined in the Limited

Guarantee) for any liability, loss, damage or recovery of any kind (including consequential, indirect or punitive damages, and whether

at law, in equity or otherwise) arising out of or relating to this letter agreement or the Merger Agreement, or of the failure of any

of the transactions contemplated by any such agreement to be consummated or otherwise in connection with any of the transactions contemplated

hereby and thereby or in respect of any other document or theory of law or in equity, or in respect of any written or oral representations

made or alleged to have been made in connection with any such agreement, whether at law, in equity, in contract, in tort or otherwise,

(whether or not Merger Sub’s breach is caused by the Sponsor’s breach of its obligations under this letter agreement); and

(b) the Company and the Guaranteed Party Related Persons (as defined in the Limited Guarantee) shall not have, and they are not intended

to have, any right of recovery against the Sponsor or any of the Non-Recourse Parties in respect of any liabilities or obligations arising

out of or relating to, this letter agreement or the Merger Agreement, including in the event Merger Sub breaches its obligations under

the Merger Agreement and whether or not Merger Sub’s breach is caused by the Sponsor’s breach of its obligations under this

letter agreement, except for claims of the Company against the Other Sponsor pursuant to and in accordance with the Limited Guarantee.

4. Enforceability;

Third-Party Beneficiary.

(a) This

letter agreement may only be enforced by Merger Sub (in its sole discretion); provided that, if the conditions set forth in Section 2

are satisfied and the Company is entitled to seek specific performance pursuant to Section 9.12 of the Merger Agreement, the Company

is hereby made a third party beneficiary of the rights granted to Merger Sub under this letter agreement to the extent, and only to the

extent, of the rights set forth in Sections 1,

4, 5,

6, 7 and 12

and shall be entitled to an injunction, specific performance or other equitable remedy to cause the Sponsor to fund the Equity Commitment

in accordance with Section 1 hereof.

None of Merger Sub’s or the Company’s creditors or any provider or source of the Financing shall have the right to enforce

this letter agreement or to cause Merger Sub or the Company to enforce this letter agreement against the Sponsor.

(b) Notwithstanding

the foregoing, if the Company or any of its Affiliates asserts in any proceeding that (1) the Sponsor shall contribute an amount

of Equity Commitment that exceeds the Cap or (2) the Cap on the Sponsor’s liabilities hereunder or the Cap (as defined in the

Other Sponsor Equity Commitment Letter) on the Other Sponsor’s liabilities is illegal, invalid or unenforceable in whole or in part

(the “Impermissible Claims”), then (i) the obligations of the Sponsor under this letter agreement shall terminate

ab initio and be null and void, (ii) if the Sponsor has previously made any payments under this letter agreement, it shall

be entitled to recover such payments, and (iii) the Sponsor shall not have any liabilities or obligations to any Person under this

letter agreement. In no event shall the maximum amount of the liabilities of the Sponsor in the aggregate under this letter agreement

exceed the Cap.

(c) Each

party hereto acknowledges and agrees that (i) this letter agreement is not intended to, and does not, create any agency, partnership,

fiduciary or joint venture, relationship, between or among any of the parties hereto, and neither this letter agreement nor any other

document or agreement entered into by any party hereto relating to the subject matter hereof shall be construed to suggest otherwise,

and (ii) the obligations of the Sponsor under this letter agreement are solely contractual in nature.

(d) Subject

to the terms and conditions set forth herein, the Company shall be entitled to specifically enforce Merger Sub’s right to cause

the Equity Commitment to be funded to Merger Sub solely to the extent specifically permitted under Section 4 (a) and

the Company shall be a third party beneficiary for such purpose but not for any other purpose (including, without limitation, any claim

for monetary damages hereunder or under the Merger Agreement) other than as specified in Section 4(a) hereof.

The Company hereby agrees that specific performance shall be its sole and exclusive remedy with respect to any breach by the Sponsor of

this letter agreement and that the Company may not seek or accept any other form of relief that may be available for any such breach of

this letter agreement (including monetary damages); provided, that, if the Company seeks specific performance for such breach of this

letter agreement as permitted under Section 4(a),

and a court of competent jurisdiction in a final, non-appealable determination as to the availability of specific performance does not

specifically enforce the obligations of the Sponsor hereunder pursuant to any proceeding for specific performance brought against the

Sponsor, then the Company shall have the right to seek the payments contemplated by, and subject to the terms and conditions of, Section 1

of the Limited Guarantee (subject to the limitations and conditions therein). In addition, the Company shall, and shall cause each of

its Affiliates to, cause any pending proceeding to be dismissed with prejudice upon the earlier of (i) the consummation of the Closing

by Merger Sub or (ii) the payment of the Parent Termination Fee pursuant to the Merger Agreement.

(e) Each

party hereto agrees that its respective agreements and obligations set forth herein are solely for the benefit of the other party hereto

and the respective successors and permitted assigns of such other party, in accordance with and subject to the terms of this letter agreement,

and this letter agreement is not intended to, and does not, confer upon any Person other than the parties hereto and their respective

successors and permitted assigns any benefits, rights or remedies under or by reason of, or any rights to enforce or cause Merger Sub

to enforce, the obligations set forth therein; provided that the Company is a third-party beneficiary of this letter agreement

to the extent and only to the extent of its rights specifically provided in Section 4(a) in

accordance with, and subject to the terms of the Merger Agreement and this letter agreement. Except as expressly provided in the foregoing

sentence, nothing in this letter agreement, express or implied, is intended to confer upon any Person other than Merger Sub or the Sponsor,

any rights or remedies under or by reason of this letter agreement. In no event shall this letter agreement or the Equity Commitment to