HMN Financial, Inc. (HMN or the Company) (NASDAQ:HMNF), the $784

million holding company for Home Federal Savings Bank (the Bank),

today reported net income of $1.4 million for the first quarter of

2020, a decrease of $0.2 million compared to net income of $1.6

million for the first quarter of 2019. Diluted earnings per

share for the first quarter of 2020 was $0.30, a decrease of $0.05

from diluted earnings per share of $0.35 for the first quarter of

2019. The decrease in net income between the periods was due

to a $0.6 million increase in non-interest expenses that was

primarily the result of a $0.2 million increase in legal expenses

related to a bankruptcy litigation claim and a $0.1 million

increase in compensation expense due to normal salary increases and

the opening of a new branch location in 2019. Net income also

decreased because of the $0.5 million increase in the provision for

loan losses between the periods due primarily to changes in the

economic environment related to the disruption in business activity

as a result of the COVID-19 pandemic. These decreases in net

income were partially offset by a $0.7 million increase in the gain

on sales of loans between the periods. The increase in the

gain on sales of loans was due to the increase in mortgage loan

refinance activity in the current period as a result of the lower

interest rate environment between the periods.

President’s Statement“The COVID-19 pandemic and

the related stay-at-home orders have impacted everyone in the first

quarter of 2020. The economic effects of the pandemic on our

clients combined with the net interest margin compression related

to the low interest rate environment continues to be an earnings

challenge for our bank and the financial industry as a whole,” said

Bradley Krehbiel, President and Chief Executive Officer of

HMN. “Despite these challenges, we are pleased to report the

increase in our mortgage loan origination activity and the related

gain on sales of loans that we experienced during the first quarter

of 2020. We are also encouraged by the potential positive

impact that the Small Business Administration loan programs, as

well as other economic stimulus actions implemented by the Federal

Government, will have on our clients. We continue to assist

our clients in navigating the various stimulus programs so that

they can maximize the benefits of these programs.”

First Quarter ResultsNet

Interest IncomeNet interest income was $6.9 million for the first

quarter of 2020, a decrease of $0.1 million, or 1.3%, compared to

$7.0 million for the first quarter of 2019. Interest income

was $7.8 million for the first quarter of 2020, an increase of $0.1

million, or 1.4%, from $7.7 million for the first quarter of

2019. Interest income increased primarily because of the

$49.4 million increase in the average interest-earning assets

between the periods. The average yield earned on

interest-earning assets was 4.24% for the first quarter of 2020, a

decrease of 28 basis points from 4.52% for the first quarter of

2019. The decrease in the average yield is primarily related

to the decrease in the average prime rate between the periods.

Interest expense was $0.9 million for the first

quarter of 2020, an increase of $0.2 million, or 29.3%, compared to

$0.7 million for the first quarter of 2019. The average interest

rate paid on interest-bearing liabilities and non-interest bearing

deposits was 0.53% for the first quarter of 2020, an increase of 8

basis points from 0.45% for the first quarter of 2019. The increase

in the interest paid on interest-bearing liabilities was primarily

because of the lag in the market’s response in lowering deposit

pricing when the federal funds rate decreased in the second half of

2019 and the first quarter of 2020. Net interest margin (net

interest income divided by average interest-earning assets) for the

first quarter of 2020 was 3.76%, a decrease of 35 basis points,

compared to 4.11% for the first quarter of 2019. The decrease

in the net interest margin is primarily related to the increase in

interest expense as a result of the lag in the markets response in

lowering deposit pricing when the federal funds rate decreased in

the second half of 2019 and the first quarter of 2020 coupled with

a decrease in the average yield earned on interest-earning assets

between the periods.

A summary of the Company’s net interest margin

for the three-month periods ended March 31, 2020 and 2019 is as

follows:

|

|

|

For the three-month period ended |

|

|

|

|

March 31, 2020 |

|

|

March 31, 2019 |

|

|

(Dollars in thousands) |

|

AverageOutstandingBalance |

|

InterestEarned/Paid |

|

Yield/Rate |

|

|

AverageOutstandingBalance |

|

InterestEarned/Paid |

|

Yield/Rate |

|

|

Interest-earning assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Securities available for sale |

$ |

103,269 |

|

501 |

|

1.95 |

% |

$ |

78,794 |

|

338 |

|

1.74 |

% |

|

Loans held for sale |

|

2,754 |

|

24 |

|

3.52 |

|

|

1,187 |

|

12 |

|

4.17 |

|

|

Mortgage loans, net |

|

127,235 |

|

1,276 |

|

4.03 |

|

|

115,854 |

|

1,261 |

|

4.41 |

|

|

Commercial loans, net |

|

409,781 |

|

5,097 |

|

5.00 |

|

|

400,905 |

|

5,060 |

|

5.12 |

|

|

Consumer loans, net |

|

68,418 |

|

843 |

|

4.96 |

|

|

72,572 |

|

935 |

|

5.22 |

|

|

Other |

|

32,254 |

|

103 |

|

1.28 |

|

|

25,008 |

|

126 |

|

2.04 |

|

|

Total interest-earning assets |

|

743,711 |

|

7,844 |

|

4.24 |

|

|

694,320 |

|

7,732 |

|

4.52 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest-bearing liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Checking accounts |

|

103,294 |

|

30 |

|

0.12 |

|

|

97,692 |

|

24 |

|

0.10 |

|

|

Savings accounts |

|

81,150 |

|

16 |

|

0.08 |

|

|

78,496 |

|

15 |

|

0.08 |

|

|

Money market accounts |

|

190,497 |

|

293 |

|

0.62 |

|

|

181,570 |

|

270 |

|

0.60 |

|

|

Certificates |

|

123,770 |

|

553 |

|

1.80 |

|

|

114,196 |

|

381 |

|

1.35 |

|

|

Total interest-bearing liabilities |

|

498,711 |

|

|

|

|

|

|

471,954 |

|

|

|

|

|

|

Non-interest checking |

|

173,986 |

|

|

|

|

|

|

156,454 |

|

|

|

|

|

|

Other non-interest bearing liabilities |

|

2,793 |

|

|

|

|

|

|

2,062 |

|

|

|

|

|

|

Total interest-bearing liabilities and non-interest bearing

deposits |

$ |

675,490 |

|

892 |

|

0.53 |

|

$ |

630,470 |

|

690 |

|

0.45 |

|

|

Net interest income |

|

|

$ |

6,952 |

|

|

|

|

|

$ |

7,042 |

|

|

|

|

Net interest rate spread |

|

|

|

|

|

3.71 |

% |

|

|

|

|

|

4.07 |

% |

|

Net interest margin |

|

|

|

|

|

3.76 |

% |

|

|

|

|

|

4.11 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Provision for Loan LossesThe provision for loan

losses was $0.5 million for the first quarter of 2020, an increase

of $0.5 million compared to $27,000 for the first quarter of

2019. The provision for loan losses increased between the

periods primarily because of the changes in the economic

environment related to the disruption in business activity as a

result of the COVID-19 pandemic. The amount of the increase in our

loan loss allowance related to the economic environment was based,

in part, on the amount of loans to borrowers that had their loan

payments deferred because they had been negatively impacted by the

pandemic. At March 31, 2020, the Bank had $78.6 million of

loans with deferred payment agreements with $48.4 million of these

loans related to the hotel industry and $9.6 million related to the

theater industry. The qualitative increase to our loan loss

allowance related to the current economic environment along with

the increase to the allowance related to loan growth were partially

offset by improvements in other qualitative reserves and a

reduction in the specific reserves required on loans that were paid

off during the quarter. Total non-performing assets were $2.6

million at March 31, 2020, a decrease of $0.1 million, or 2.5%,

from $2.7 million at December 31, 2019. Non-performing loans

decreased $0.2 million and foreclosed and repossessed assets

increased $0.1 million during the first quarter of 2020.

A reconciliation of the Company’s allowance for loan losses for the

first quarters of 2020 and 2019 is as follows:

|

|

|

|

|

|

|

(Dollars in thousands) |

|

2020 |

|

|

2019 |

|

| Balance at January

1, |

$ |

8,564 |

|

|

8,686 |

|

| Provision |

|

460 |

|

|

27 |

|

| Charge offs: |

|

|

|

|

| Consumer |

|

(12 |

) |

|

(39 |

) |

| Commercial

business |

|

0 |

|

|

(43 |

) |

| Recoveries |

|

24 |

|

|

42 |

|

| Balance at March 31, |

$ |

9,036 |

|

|

8,673 |

|

| Allocated to: |

|

|

|

|

| General allowance |

$ |

8,389 |

|

|

7,854 |

|

| Specific allowance |

|

647 |

|

|

819 |

|

| |

$ |

9,036 |

|

|

8,673 |

|

|

|

|

|

|

|

The following table summarizes the amounts and categories of

non-performing assets in the Bank’s portfolio and loan delinquency

information as of the end of the two most recently completed

quarters.

|

|

|

March 31, |

|

|

December 31, |

|

|

(Dollars in thousands) |

|

2020 |

|

|

2019 |

|

| Non‑performing loans: |

|

|

|

|

|

|

| Single family |

$ |

647 |

|

$ |

617 |

|

| Commercial real

estate |

|

734 |

|

|

184 |

|

| Consumer |

|

491 |

|

|

659 |

|

| Commercial |

|

40 |

|

|

621 |

|

| Total |

|

1,912 |

|

|

2,081 |

|

| |

|

|

|

|

|

|

| Foreclosed and repossessed

assets: |

|

|

|

|

|

|

| Single family |

$ |

269 |

|

|

166 |

|

| Commercial real

estate |

|

414 |

|

|

414 |

|

| Total non‑performing assets |

$ |

2,595 |

|

$ |

2,661 |

|

| Total as a percentage of total

assets |

|

0.33 |

% |

|

0.34 |

% |

| Total non‑performing loans |

$ |

1,912 |

|

$ |

2,081 |

|

| Total as a percentage of total

loans receivable, net |

|

0.31 |

% |

|

0.35 |

% |

| Allowance for loan losses to

non-performing loans |

|

472.54 |

% |

|

411.45 |

% |

| |

|

|

|

|

|

|

| Delinquency data: |

|

|

|

|

|

|

| Delinquencies (1) |

|

|

|

|

|

|

| 30+ days |

$ |

1,464 |

|

$ |

1,167 |

|

| 90+ days |

|

0 |

|

|

0 |

|

| Delinquencies as a percentage of

loan portfolio (1) |

|

|

|

|

|

|

| 30+ days |

|

0.23 |

% |

|

0.19 |

% |

| 90+ days |

|

0.00 |

% |

|

0.00 |

% |

|

|

|

|

|

|

|

|

| (1) Excludes non-accrual

loans. |

|

|

|

|

|

|

Non-Interest Income and ExpenseNon-interest

income was $2.5 million for the first quarter of 2020, an increase

of $0.8 million, or 46.1%, from $1.7 million for the first quarter

of 2019. Gain on sales of loans increased $0.7 million

between the periods primarily because of an increase in single

family loan originations and sales. Loan servicing fees

increased slightly between the periods due to an increase in the

single family loans being serviced. Fees and services charges

increased slightly due primarily to an increase in debit card

income. These increases were partially offset by a slight decrease

in other non-interest income due to an increase in the losses

realized on equity investments between the periods.

Non-interest expense was $7.0 million for the

first quarter of 2020, an increase of $0.6 million, or 8.6%, from

$6.4 million for the first quarter of 2019. Professional

services expense increased $0.2 million between the periods

primarily because of an increase in legal expenses relating to a

bankruptcy litigation claim. Compensation and benefits

expense increased $0.1 million primarily because of annual salary

increases and the opening of a new branch location in 2019.

Other non-interest expense increased $0.1 million because of an

increase in mortgage servicing expenses due to the increase in

serviced loans being refinanced between the periods.

Occupancy and equipment costs increased $0.1 million between the

periods due to an increase in depreciation and non-capitalized

software costs. Data processing costs increased slightly

between the periods due to an increase in mobile banking

expenses. Income tax expense was $0.6 million for both the

first quarter of 2020 and the first quarter of 2019.

Return on Assets and EquityReturn on average

assets (annualized) for the first quarter of 2020 was 0.72%,

compared to 0.91% for the first quarter of 2019. Return on

average equity (annualized) was 5.93% for the first quarter of

2020, compared to 7.67% for the first quarter of 2019. Book

value per common share at March 31, 2020 was $19.68, compared to

$17.63 at March 31, 2019.

General InformationHMN Financial, Inc. and the

Bank are headquartered in Rochester, Minnesota. Home Federal

Savings Bank operates twelve full service offices in Minnesota

located in Albert Lea, Austin, Eagan, Kasson, La Crescent,

Owatonna, Rochester (4), Spring Valley and Winona, one full service

office in Marshalltown, Iowa, and one full service office in

Pewaukee, Wisconsin. The Bank also operates a loan origination

office located in Sartell, Minnesota.

Safe Harbor Statement This press release may

contain forward-looking statements within the meaning of the safe

harbor provisions of the Private Securities Litigation Reform Act

of 1995. These statements are often identified by such

forward-looking terminology as “expect,” “intend,” “look,”

“believe,” “anticipate,” “estimate,” “project,” “seek,” “may,”

“will,” “would,” “could,” “should,” “trend,” “target,” and “goal”

or similar statements or variations of such terms and include, but

are not limited to, those relating to growing our core deposit

relationships and loan balances, enhancing the financial

performance of our core banking operations, maintaining credit

quality, maintaining net interest margins, reducing non-performing

assets, and generating improved financial results; the adequacy and

amount of available liquidity and capital resources to the Bank;

the Company’s liquidity and capital requirements; our expectations

for core capital and our strategies and potential strategies for

maintenance thereof; improvements in loan production; changes in

the size of the Bank’s loan portfolio; the anticipated impact of

the COVID-19 pandemic on the general economy, our clients, and the

allowance for loan losses; the anticipated benefits that will be

realized by our clients from government assistance programs related

to the COVID-19 pandemic; the amount of the Bank’s non-performing

assets and the appropriateness of the allowance therefor;

anticipated future levels of the provision for loan losses; future

losses on non-performing assets; the amount and composition of

interest-earning assets; the amount of yield enhancements relating

to non-accruing and purchased loans; the amount and composition of

non-interest and interest-bearing liabilities; the availability of

alternate funding sources; the payment of dividends by HMN; the

future outlook for the Company; the amount of deposits that will be

withdrawn from checking and money market accounts and how the

withdrawn deposits will be replaced; the projected changes in net

interest income based on rate shocks; the range that interest rates

may fluctuate over the next twelve months; the net market risk of

interest rate shocks; the future outlook for the issuer of the

trust preferred securities held by the Bank; the anticipated

results of litigation and our assessment of the impact on our

financial statements; the ability of the Bank to pay dividends to

HMN; the ability to remain well capitalized; the impact of

new accounting pronouncements; and compliance by the Bank with

regulatory standards generally (including the Bank’s status as

“well-capitalized”) and other supervisory directives or

requirements to which the Company or the Bank are or may become

expressly subject, specifically, and possible responses of the

Office of the Comptroller of the Currency (OCC), Board of Governors

of the Federal Reserve System (FRB), the Bank, and the Company to

any failure to comply with any such regulatory standard, directive

or requirement.

A number of factors, many of which may be

amplified by the COVID-19 pandemic, could cause actual results to

differ materially from the Company’s assumptions and expectations.

These include but are not limited to the adequacy and marketability

of real estate and other collateral securing loans to borrowers;

federal and state regulation and enforcement; possible legislative

and regulatory changes, including changes to regulatory capital

rules; the ability of the Bank to comply with other applicable

regulatory capital requirements; enforcement activity of the OCC

and FRB in the event of our non-compliance with any applicable

regulatory standard or requirement; adverse economic, business and

competitive developments such as continued shrinking interest

margins, reduced collateral values, deposit outflows, changes in

credit or other risks posed by the Company’s loan and investment

portfolios; changes in costs associated with traditional and

alternate funding sources, including changes in collateral advance

rates and policies of the Federal Home Loan Bank (FHLB) and the

Federal Reserve Bank; technological, computer-related or

operational difficulties including those from any third party

cyberattack; results of litigation; reduced demand for financial

services and loan products; changes in accounting policies and

guidelines, or monetary and fiscal policies of the federal

government or tax laws; domestic and international economic

developments; the Company’s access to and adverse changes in

securities markets; the market for credit related assets; the

future operating results, financial condition, cash flow

requirements and capital spending priorities of the Company and the

Bank; the availability of internal and, as required, external

sources of funding; our ability to attract and retain employees; or

other significant uncertainties. Additional factors that may cause

actual results to differ from the Company’s assumptions and

expectations include those set forth in the Company’s most recent

filing on Form 10-K with the Securities and Exchange

Commission. All forward-looking statements are qualified by, and

should be considered in conjunction with, such cautionary

statements. For additional discussion of the risks and

uncertainties applicable to the Company, see the “Risk Factors”

section of the Company’s Annual Report on Form 10-K for the year

ended December 31, 2019.

All statements in this press release, including

forward-looking statements, speak only as of the date they are

made, and we undertake no duty to update any of the forward-looking

statements after the date of this press release.

(Three pages of selected consolidated

financial information are included with this release.)

|

HMN FINANCIAL, INC. AND SUBSIDIARIES |

|

Consolidated Balance Sheets |

|

|

|

|

|

|

|

| |

|

March 31, |

|

December 31, |

|

|

(Dollars in thousands) |

|

2020 |

|

|

2019 |

|

|

|

|

|

(unaudited) |

|

|

|

|

Assets |

|

|

|

|

|

| Cash and cash equivalents |

$ |

35,744 |

|

|

44,399 |

|

|

| Securities available for

sale: |

|

|

|

|

|

| Mortgage-backed and related

securities (amortized cost $52,160 and $54,777) |

|

53,687 |

|

|

54,851 |

|

|

| Other marketable

securities (amortized cost $46,945 and $52,751) |

|

47,252 |

|

|

52,741 |

|

|

| |

|

100,939 |

|

|

107,592 |

|

|

| |

|

|

|

|

|

| Equity securities |

|

110 |

|

|

167 |

|

|

| Loans held for sale |

|

4,884 |

|

|

3,606 |

|

|

| Loans receivable, net |

|

617,645 |

|

|

596,392 |

|

|

| Accrued interest receivable |

|

2,236 |

|

|

2,251 |

|

|

| Real estate, net |

|

683 |

|

|

580 |

|

|

| Federal Home Loan Bank stock, at

cost |

|

932 |

|

|

854 |

|

|

| Mortgage servicing rights,

net |

|

2,206 |

|

|

2,172 |

|

|

| Premises and equipment, net |

|

10,426 |

|

|

10,515 |

|

|

| Goodwill |

|

802 |

|

|

802 |

|

|

| Core deposit intangible |

|

131 |

|

|

156 |

|

|

| Prepaid expenses and other

assets |

|

6,254 |

|

|

6,451 |

|

|

| Deferred tax asset, net |

|

1,208 |

|

|

1,702 |

|

|

| Total assets |

$ |

784,200 |

|

|

777,639 |

|

|

| |

|

|

|

|

|

|

Liabilities and Stockholders’ Equity |

|

|

|

|

|

| Deposits |

$ |

677,519 |

|

|

673,870 |

|

|

| Accrued interest payable |

|

344 |

|

|

420 |

|

|

| Customer escrows |

|

3,120 |

|

|

2,413 |

|

|

| Accrued expenses and other

liabilities |

|

8,182 |

|

|

8,288 |

|

|

| Total liabilities |

|

689,165 |

|

|

684,991 |

|

|

| Commitments and

contingencies |

|

|

|

|

|

| Stockholders’ equity: |

|

|

|

|

|

| Serial-preferred stock:

($.01 par value) |

|

|

|

|

|

| authorized 500,000 shares;

issued 0 |

|

0 |

|

|

0 |

|

|

| Common stock ($.01 par

value): |

|

|

|

|

|

| authorized 16,000,000

shares; issued 9,128,662 |

|

91 |

|

|

91 |

|

|

| Additional paid-in capital |

|

40,347 |

|

|

40,365 |

|

|

| Retained earnings, subject to

certain restrictions |

|

108,932 |

|

|

107,547 |

|

|

| Accumulated other comprehensive

income |

|

1,321 |

|

|

46 |

|

|

| Unearned employee stock ownership

plan shares |

|

(1,595 |

) |

|

(1,643 |

) |

|

| Treasury stock, at cost 4,300,689

and 4,284,840 shares |

|

(54,061 |

) |

|

(53,758 |

) |

|

| Total stockholders’

equity |

|

95,035 |

|

|

92,648 |

|

|

| Total liabilities and

stockholders’ equity |

$ |

784,200 |

|

|

777,639 |

|

|

|

|

|

|

|

|

|

|

HMN FINANCIAL, INC. AND

SUBSIDIARIES |

|

Consolidated Statements of Comprehensive

Income |

|

(unaudited) |

|

|

|

|

|

|

|

|

|

Three Months EndedMarch 31, |

|

(Dollars in thousands, except per share data) |

|

2020 |

|

2019 |

|

Interest income: |

|

|

|

|

|

Loans receivable |

$ |

7,240 |

|

7,268 |

|

Securities available for sale: |

|

|

|

|

|

Mortgage-backed and related |

|

289 |

|

46 |

|

Other marketable |

|

212 |

|

292 |

|

Other |

|

103 |

|

126 |

|

Total interest income |

|

7,844 |

|

7,732 |

|

|

|

|

|

|

|

Interest expense: |

|

|

|

|

|

Deposits |

|

892 |

|

690 |

|

Total interest expense |

|

892 |

|

690 |

|

Net interest income |

|

6,952 |

|

7,042 |

|

Provision for loan losses |

|

460 |

|

27 |

|

Net interest income after

provision for loan losses |

|

6,492 |

|

7,015 |

|

|

|

|

|

|

|

Non-interest income: |

|

|

|

|

|

Fees and service charges |

|

714 |

|

700 |

|

Loan servicing fees |

|

332 |

|

315 |

|

Gain on sales of loans |

|

1,134 |

|

379 |

|

Other |

|

291 |

|

297 |

|

Total non-interest income |

|

2,471 |

|

1,691 |

|

|

|

|

|

|

|

Non-interest expense: |

|

|

|

|

|

Compensation and benefits |

|

4,047 |

|

3,910 |

|

Occupancy and equipment |

|

1,123 |

|

1,060 |

|

Data processing |

|

308 |

|

301 |

|

Professional services |

|

487 |

|

272 |

|

Other |

|

1,036 |

|

903 |

|

Total non-interest expense |

|

7,001 |

|

6,446 |

|

Income before income tax expense |

|

1,962 |

|

2,260 |

|

Income tax expense |

|

577 |

|

640 |

|

Net income |

|

1,385 |

|

1,620 |

|

Other comprehensive income, net of tax |

|

1,275 |

|

484 |

|

Comprehensive income available to common shareholders |

$ |

2,660 |

|

2,104 |

|

Basic earnings per share |

$ |

0.30 |

|

0.35 |

|

Diluted earnings per share |

$ |

0.30 |

|

0.35 |

|

|

|

|

|

|

|

HMN FINANCIAL, INC. AND

SUBSIDIARIES |

|

Selected Consolidated Financial Information |

|

(unaudited) |

|

SELECTED FINANCIAL DATA: |

|

Three Months EndedMarch 31, |

|

|

|

(Dollars in thousands, except per share data) |

|

2020 |

|

|

2019 |

|

| I. OPERATING DATA: |

|

|

|

|

|

|

|

|

| Interest income |

$ |

7,844 |

|

7,732 |

|

|

|

|

| Interest

expense |

|

892 |

|

690 |

|

|

|

|

| Net interest

income |

|

6,952 |

|

7,042 |

|

|

|

|

| |

|

|

|

|

|

|

|

|

| II. AVERAGE BALANCES: |

|

|

|

|

|

|

|

|

| Assets (1) |

|

777,564 |

|

724,330 |

|

|

|

|

| Loans receivable,

net |

|

605,434 |

|

589,331 |

|

|

|

|

| Securities

available for sale (1) |

|

103,269 |

|

78,794 |

|

|

|

|

| Interest-earning

assets (1) |

|

743,711 |

|

694,320 |

|

|

|

|

| Interest-bearing

liabilities and non-interest bearing deposits |

|

675,490 |

|

630,470 |

|

|

|

|

| Equity (1) |

|

93,881 |

|

85,623 |

|

|

|

|

| |

|

|

|

|

|

|

|

|

| III. PERFORMANCE RATIOS: (1) |

|

|

|

|

|

|

|

|

| Return on

average assets (annualized) |

|

0.72 |

% |

0.91 |

% |

|

|

|

| Interest rate

spread information: |

|

|

|

|

|

|

|

|

|

Average during period |

|

3.71 |

|

4.07 |

|

|

|

|

|

End of period |

|

3.65 |

|

4.15 |

|

|

|

|

| Net interest

margin |

|

3.76 |

|

4.11 |

|

|

|

|

| Ratio of

operating expense to average total assets (annualized) |

|

3.62 |

|

3.61 |

|

|

|

|

| Return on

average common equity (annualized) |

|

5.93 |

|

7.67 |

|

|

|

|

|

Efficiency |

|

74.29 |

|

73.81 |

|

|

|

|

| |

|

March 31, |

|

December 31, |

|

March 31, |

|

|

| |

|

2020 |

|

2019 |

|

2019 |

|

|

| IV. EMPLOYEE DATA: |

|

|

|

|

|

|

|

|

| Number of

full time equivalent employees |

|

180 |

|

181 |

|

176 |

|

|

| |

|

|

|

|

|

|

|

|

| V. ASSET QUALITY: |

|

|

|

|

|

|

|

|

| Total

non-performing assets |

$ |

2,595 |

|

2,661 |

|

2,965 |

|

|

| Non-performing

assets to total assets |

|

0.33 |

% |

0.34 |

% |

0.41 |

% |

|

| Non-performing

loans to total loans receivable, net |

|

0.31 |

|

0.35 |

|

0.42 |

|

|

| Allowance for loan

losses |

$ |

9,036 |

|

8,564 |

|

8,673 |

|

|

| Allowance for loan

losses to total assets |

|

1.15 |

% |

1.10 |

% |

1.20 |

% |

|

| Allowance for loan

losses to total loans receivable, net |

|

1.46 |

|

1.44 |

|

1.45 |

|

|

| Allowance for loan

losses to non-performing loans |

|

472.54 |

|

411.45 |

|

343.90 |

|

|

| |

|

|

|

|

|

|

|

|

| VI. BOOK VALUE PER COMMON

SHARE: |

|

|

|

|

|

|

|

|

| Book value

per common share |

$ |

19.68 |

|

19.13 |

|

17.63 |

|

|

| |

Three Months EndedMar 31, 2020 |

Year EndedDec 31, 2019 |

Three Months EndedMar 31, 2019 |

|

|

| VII. CAPITAL RATIOS: |

|

|

|

|

|

|

|

|

|

Stockholders’ equity to total assets, at end of period |

|

12.12 |

% |

11.91 |

% |

11.81 |

% |

|

| Average

stockholders’ equity to average assets (1) |

|

12.07 |

|

12.06 |

|

11.82 |

|

|

| Ratio of

average interest-earning assets to |

|

|

|

|

|

|

|

|

| average

interest-bearing liabilities (1) |

|

110.10 |

|

110.18 |

|

110.13 |

|

|

| Home Federal

Savings Bank regulatory capital ratios: |

|

|

|

|

|

|

|

|

|

Common equity tier 1 capital ratio |

|

13.22 |

|

13.21 |

|

13.06 |

|

|

| Tier

1 capital leverage ratio |

|

10.97 |

|

10.89 |

|

11.27 |

|

|

| Tier

1 capital ratio |

|

13.22 |

|

13.21 |

|

13.06 |

|

|

|

Risk-based capital |

|

14.47 |

|

14.46 |

|

14.31 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Average balances were calculated based upon

amortized cost without the market value impact of ASC 320.

| CONTACT: |

Bradley Krehbiel, |

| |

Chief Executive Officer, President |

| |

HMN Financial, Inc. (507) 252-7169 |

| |

|

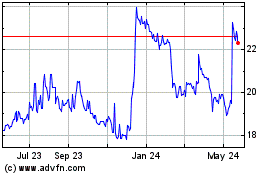

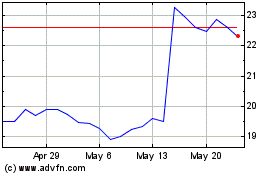

HMN Financial (NASDAQ:HMNF)

Historical Stock Chart

From Aug 2024 to Sep 2024

HMN Financial (NASDAQ:HMNF)

Historical Stock Chart

From Sep 2023 to Sep 2024