BioTelemetry, Inc. (NASDAQ:BEAT), the leading wireless medical

technology company focused on the delivery of health information to

improve quality of life and reduce cost of care, today reported

results for the first quarter ended March 31, 2016.

Company Highlights

- Recognized highest quarterly revenue in Company’s history of

$48.6 million, a 12% increase over prior year

- Achieved fifteenth consecutive quarter of year over year

revenue growth

- Realized highest quarterly EBITDA in Company’s history of $10.8

million, a 22% return

- Serviced highest quarterly patient volume in Company’s history,

a 10% increase over prior year

- Recorded $4.0 million GAAP net income for the first

quarter

- Grew CardioKey volume by 33% versus the fourth quarter of

2015

- Completed the acquisition of the ePatch division of DELTA

Danish Electronics, Light and Acoustics on April 1

- Initiated tender offer for VirtualScopics, Inc.

- Increased our 2016 EBITDA guidance to be in the range of $42

million to $44 million

President and CEO Commentary

Joseph Capper, President and Chief Executive Officer of

BioTelemetry, Inc., commented: “The record performance we delivered

last year continued into the first quarter of 2016. We are

pleased to report our strongest quarterly performance in the

Company’s history, posting record revenue, EBITDA and patient

volume. These results are validation of the effectiveness of

our strategy and our ability to deliver on key management

objectives.

“To build on this momentum, we continue to aggressively pursue

both organic and acquisition growth opportunities. We

recently completed the purchase of the ePatch division of DELTA

Danish Electronics, Light & Acoustics. The transaction

provides future cost savings relating to our next generation device

and adds another monitoring device to our product suite. We

also initiated a tender offer for VirtualScopics, Inc. which will

expand our clinical research offerings.

“We are very excited about the Company’s outlook in 2016 as

evidenced by the increase to our EBITDA guidance. We expect

our strong growth trends to continue this year supported by

numerous internal and external factors. Longer term, we are

highly optimistic about our future prospects as we see a growing

trend in healthcare toward the use of remote patient

monitoring.”

First Quarter Financial Results

Revenue for the first quarter 2016 was $48.6 million compared to

$43.4 million for the first quarter 2015, an increase of $5.2

million, or 12.0%. This increase was due to $6.1 million

higher Healthcare revenue, driven by increased patient volume and

the MCT Medicare rate increase that became effective January

1. Research revenue was essentially flat. Technology

revenue declined $0.9 million due to lower sales resulting from

customers delaying purchases as they await the release of upgraded

devices. For the first quarter 2016, Healthcare revenue was

comprised of 41.7% Medicare.

Gross profit for the first quarter 2016 increased to $30.6

million, or 63.0% of revenue, compared to $25.2 million, or 58.1%

of revenue, for the first quarter 2015. The gross profit

percentage was driven by a 390 basis point improvement related to

monitoring center efficiencies due to the higher volume, lower

device communication and device transportation costs in addition to

the 100 basis point impact of the higher MCT Medicare pricing.

On a GAAP basis, operating expense for the first quarter 2016

was $26.1 million, compared to $24.8 million for the first quarter

2015. On an adjusted basis, operating expense for the first

quarter 2016 was $24.3 million compared to $22.9 million for the

first quarter 2015. The adjusted operating expense excludes

$1.8 million for the first quarter 2016 primarily related to patent

litigation and the Company’s recently announced acquisitions and

$1.9 million for the first quarter 2015 primarily related to patent

litigation, as well as costs associated with the integration of the

2014 Mednet and BMS acquisitions. The increase was driven by

higher headcount related expense of $1.1 million in general and

administrative and sales and marketing, $0.3 million higher bad

debt and $0.2 million higher tradeshow and sales meeting

expense. These increases were partially offset by $0.2

million lower consulting expense in research and development

related to our next generation device.

On a GAAP basis, interest and other loss, net was $0.4 million

for the first quarter 2016, consistent with the first quarter

2015.

On a GAAP basis, net income for the first quarter 2016 was $4.0

million, or $0.14 per diluted share, compared to a net loss of $0.1

million for the first quarter 2015. Excluding the $1.8

million of other charges, adjusted net income for the first quarter

2016 was $5.8 million, or $0.20 per diluted share. This

compares to adjusted net income of $1.8 million, or $0.06 per

diluted share, for the first quarter 2015, which excludes the

impact of $1.9 million of other charges.

Liquidity

As of March 31, 2016, total cash was $22.8 million, an increase

of $3.8 million compared to December 31, 2015. The

significant cash uses during the quarter ended March 31, 2016

include $5.7 million for incremental employee related and payroll

tax cash outflows in the first quarter as well as $3.5 million for

capital expenditures, primarily medical devices. These uses

were more than offset by cash generated from collections.

Consolidated days sales outstanding decreased to 45 days as of

March 31, 2016, down from 47 days as of December 31,

2015.

As of March 31, 2016, the Company had total indebtedness of

$23.2 million. The Company also has access to a $15.0 million

revolving credit facility which remains undrawn.

Conference

Call

BioTelemetry, Inc. will host an earnings conference call on

Tuesday, April 26, 2016 at 5:00 PM Eastern Time. The call

will be simultaneously webcast on the investor information page of

our website, www.gobio.com. The call will be archived on our

website for two weeks.

About BioTelemetryBioTelemetry, Inc., formerly

known as CardioNet, Inc., is the leading wireless medical

technology company focused on the delivery of health information to

improve quality of life and reduce cost of care. The Company

currently provides cardiac monitoring services, original equipment

manufacturing with a primary focus on cardiac monitoring devices

and centralized cardiac core laboratory services. More

information can be found at www.gobio.com.

Cautionary Statement Regarding Forward-Looking

Statements This document includes certain forward-looking

statements within the meaning of the “Safe Harbor” provisions of

the Private Securities Litigation Reform Act of 1995. These

statements may be identified by words such as “expect,”

“anticipate,” “estimate,” “intend,” “plan,” “believe,” “promises”

and other words and terms of similar meaning. Such

forward-looking statements are based on current expectations and

involve inherent risks and uncertainties, including important

factors that could delay, divert, or change any of these

expectations, and could cause actual outcomes and results to differ

materially from current expectations. These factors include,

among other things, our ability to successfully integrate

acquisitions into our business and the effect such acquisitions

will have on our results of operation, effectiveness of our cost

savings initiatives, relationships with our government and

commercial payors, changes to insurance coverage and reimbursement

levels for our products, the success of our sales and marketing

initiatives, our ability to attract and retain talented executive

management and sales personnel, our ability to identify acquisition

candidates, acquire them on attractive terms and integrate their

operations into our business, the commercialization of new

products, market factors, internal research and development

initiatives, partnered research and development initiatives,

competitive product development, changes in governmental

regulations and legislation, the continued consolidation of payors,

acceptance of our new products and services, patent protection,

adverse regulatory action, and litigation success. For

further details and a discussion of these and other risks and

uncertainties, please see our public filings with the Securities

and Exchange Commission, including our latest periodic reports on

Form 10-K and 10-Q. We undertake no obligation to

publicly update any forward-looking statement, whether as a result

of new information, future events, or otherwise.

| |

|

|

|

Three

Months Ended |

|

Consolidated Statements of Operations |

(unaudited) |

| (In

Thousands, Except Per Share Amounts) |

|

|

|

|

|

|

|

March

31,2016 |

|

March

31,2015 |

| |

|

|

|

|

|

Revenues |

$ |

48,640 |

|

|

$ |

43,435 |

|

| Cost of

revenues |

|

18,013 |

|

|

|

18,212 |

|

| Gross

profit |

|

30,627 |

|

|

|

25,223 |

|

| Gross

profit % |

|

63.0 |

% |

|

|

58.1 |

% |

| |

|

|

|

|

| Operating

expenses: |

|

|

|

| General and

administrative |

|

12,336 |

|

|

|

11,397 |

|

| Sales and

marketing |

|

7,545 |

|

|

|

7,183 |

|

| Bad debt expense |

|

2,638 |

|

|

|

2,349 |

|

| Research and

development |

|

1,786 |

|

|

|

1,965 |

|

| Other charges |

|

1,788 |

|

|

|

1,860 |

|

| Total

operating expenses |

|

26,093 |

|

|

|

24,754 |

|

|

|

|

|

|

|

| Income from

operations |

|

4,534 |

|

|

|

469 |

|

| Interest

and other loss, net |

|

(423 |

) |

|

|

(390 |

) |

| |

|

|

|

|

| Income

before income taxes |

|

4,111 |

|

|

|

79 |

|

| Provision

for income taxes |

|

(141 |

) |

|

|

(148 |

) |

| Net Income

(loss) |

$ |

3,970 |

|

|

$ |

(69 |

) |

| |

|

|

|

|

| Net income

(loss) per share (a): |

|

|

|

| Basic |

$ |

0.15 |

|

|

$ |

(0.00 |

) |

| Diluted |

$ |

0.14 |

|

|

$ |

(0.00 |

) |

| |

|

|

|

| Weighted

average number of common shares outstanding (a): |

|

|

|

| Basic |

|

27,371 |

|

|

|

26,935 |

|

| Diluted |

|

29,182 |

|

|

|

26,935 |

|

| |

|

|

|

(a) Basic net income (loss) per share is computed by dividing

net income (loss) by the weighted average number of common shares

outstanding during the period. Diluted net income (loss) per

share is computed by giving effect to all potential dilutive common

shares, including stock options, and restricted stock units

(“RSUs”). If the outstanding options or RSUs were exercised

or converted into common stock, the result would be anti‑dilutive

for the quarter ended March 31, 2015. Accordingly, basic and

diluted net loss per share is the same for the quarter ended March

31, 2015. Please refer to the reconciliation of Non-GAAP

Financial Measures for diluted share count information for the

quarter ended March 31, 2015.

| |

|

|

Summary Financial Data |

|

| (In

Thousands) |

|

|

|

|

|

|

|

March 31,2016 |

|

December 31, 2015 |

|

|

|

(unaudited) |

|

(unaudited) |

|

|

|

|

|

|

|

| Cash and

cash equivalents |

$ |

22,841 |

|

|

$ |

18,986 |

|

|

| Healthcare

accounts receivable, net |

|

16,420 |

|

|

|

15,179 |

|

|

| Other

accounts receivable, net |

|

8,063 |

|

|

|

8,997 |

|

|

| Days sales

outstanding |

|

45 |

|

|

|

47 |

|

|

| Working

capital |

|

27,474 |

|

|

|

23,157 |

|

|

| Total

assets |

|

128,931 |

|

|

|

124,143 |

|

|

| Total

indebtedness |

|

23,240 |

|

|

|

23,582 |

|

|

| Total

shareholders’ equity |

|

80,659 |

|

|

|

75,926 |

|

|

| |

|

|

|

|

Reconciliation of Non-GAAP Financial Measures(In

Thousands, Except Per Share Amounts)

In accordance with Regulation G of the Securities and Exchange

Commission, the table set forth below reconciles certain financial

measures used in this press release that were not calculated in

accordance with generally accepted accounting principles, or GAAP,

with the most directly comparable financial measure calculated in

accordance with GAAP.

| |

|

|

|

| |

Three

Months Ended(unaudited) |

|

|

| |

March

31,2016 |

|

March

31,2015 |

|

|

| Income from operations

– GAAP |

$ |

4,534 |

|

|

$ |

469 |

|

|

|

| Other charges (a) |

|

1,788 |

|

|

|

1,860 |

|

|

|

| Adjusted income

from operations |

$ |

6,322 |

|

|

$ |

2,329 |

|

|

|

| Net income (loss) –

GAAP |

$ |

3,970 |

|

|

$ |

(69 |

) |

|

|

| Other charges (a) |

|

1,788 |

|

|

|

1,860 |

|

|

|

| Adjusted net

income |

$ |

5,758 |

|

|

$ |

1,791 |

|

|

|

| |

|

|

|

|

|

| Net income (loss) per

diluted share – GAAP |

$ |

0.14 |

|

|

$ |

(0.00 |

) |

|

|

| Other charges per

diluted share (a) |

|

0.06 |

|

|

|

0.06 |

|

|

|

| Adjusted net

income per diluted share |

$ |

0.20 |

|

|

$ |

0.06 |

|

|

|

| Weighted average number

of common shares |

|

|

|

|

|

| outstanding –

diluted |

|

29,182 |

|

|

|

28,828 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

| |

Three Months Ended |

|

| |

(unaudited) |

|

| |

|

|

|

|

| |

March

31,2016 |

|

March

31,2015 |

|

| |

|

|

|

|

| Cash provided by (used

in) operating activities |

$ |

8,182 |

|

|

$ |

(4,606 |

) |

|

| Capital

expenditures |

|

(3,513 |

) |

|

|

(2,072 |

) |

|

| Free cash flow |

$ |

4,669 |

|

|

$ |

(6,678 |

) |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

| |

Three Months Ended |

|

| |

(unaudited) |

| |

|

|

|

|

| |

March

31,2016 |

|

March

31,2015 |

|

| |

|

|

|

|

| Income from operations

– GAAP |

$ |

4,534 |

|

|

$ |

469 |

|

|

| Other charges (a) |

|

1,788 |

|

|

|

1,860 |

|

|

| Depreciation and

amortization expense |

|

3,266 |

|

|

|

2,952 |

|

|

| Stock compensation

expense |

|

1,178 |

|

|

|

1,120 |

|

|

| Adjusted EBITDA |

$ |

10,766 |

|

|

$ |

6,401 |

|

|

| |

|

|

|

|

|

|

|

|

(a) In the first quarter 2016, the Company incurred $1.8 million

of other charges primarily due to patent litigation and the

recently announced acquisitions that are expected to close in the

second quarter. In the first quarter 2015, the Company

incurred $1.9 million of other charges primarily related to patent

litigation, as well as costs associated with the integration of the

2014 Mednet and BMS acquisitions.

Contact: BioTelemetry, Inc.

Heather C. Getz

Investor Relations

800-908-7103

investorrelations@biotelinc.com

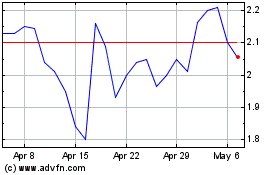

HeartBeam (NASDAQ:BEAT)

Historical Stock Chart

From Jun 2024 to Jul 2024

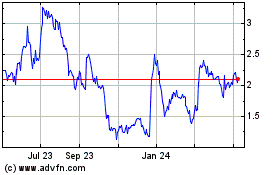

HeartBeam (NASDAQ:BEAT)

Historical Stock Chart

From Jul 2023 to Jul 2024