CardioNet, Inc. (NASDAQ:BEAT), a leading wireless medical

technology company with an initial focus on the diagnosis and

monitoring of cardiac arrhythmias, today reported results for the

third quarter and nine months ended September 30, 2009.

Highlights and Recent Developments

- Increased patient volume in the

third quarter by 46.8% over the third quarter of 2008

- Monitored over 260,000 patients

nationally since the Company’s inception

- Increased revenue to $33.3

million in the third quarter, up 6.8% over the third quarter of

2008

- Signed 42 new payor contracts

year-to-date, covering approximately 7 million lives and bringing

the total number of covered lives to nearly 200 million

- Recognized as a Deloitte Fast 50

Company in Philadelphia and Fast 500 Company Nationally

- Awarded 15th U.S. Patent which

covers Biological Signal Management (12 additional U.S. patents are

pending; 12 international patents have been issued and 29 are

pending)

- Rebilled 100% of older net

receivables; experienced positive trends in the collection of

current receivables

- $43 million in cash and no debt

as of September 30, 2009

Chairman, President and CEO Commentary

Randy Thurman, Chairman, President and Chief Executive Officer

of CardioNet, stated, “In the quarter, CardioNet continued to

experience significant growth with patient volume up 47% over the

prior year third quarter and 9% over the second quarter of 2009.

This growth demonstrates the positive acceptance by physicians and

leading institutions of CardioNet’s MCOTTM technology and the

significant benefit brought to cardiac patients. Practices and

institutions are selecting CardioNet’s MCOTTM over the competition

citing exceptional customer service, superior clinical reporting

and the unparalleled quality of our clinical research. As a result,

physician practices and institutions are selecting CardioNet’s

MCOTTM 7 out of 10 times.

“Expanding our patient reports and value-added clinical

applications continues to be a successful strategy in improving

patient care and in generating demand. For example, in the second

quarter, we introduced SomNetTM, CardioNet’s clinical indicator for

sleep disorders, which has been adopted by nearly 8,000 physicians

to date. In the third quarter, we introduced clinical arrhythmia

indicator reporting, which enhances the ability of physicians to

diagnose and treat patients. These reporting enhancements, along

with our growing library of patents, provide evidence of our

commitment to innovation and substantially advancing the field of

wireless medicine and improving the monitoring and diagnosis of

cardiac patients.

“CardioNet is the only mobile cardiac outpatient telemetry

company to have a significant portfolio of clinical evidence

supporting the MCOTTM technology. Included in this portfolio are

studies for various applications of the technology including post

AF ablation, sleep disorder indicator, neurology and arrhythmia

diagnosis. Physician surveys indicate that our growth and success

against competitors is driven in part by our outstanding clinical

research, which includes 29 published abstracts or studies.

Physicians have also cited CardioNet’s superior patient reporting

and customer service. Complementing this research-based and strong

service-oriented strategy is our expanded sales force which now

exceeds 140 trained account executives, the largest sales

organization focused on wireless medicine.

“We are very disappointed by the CMS decision for MCOT

reimbursement to continue to be carrier priced by Highmark Medicare

Services (“HMS”) at $754. The mobile cardiac outpatient telemetry

industry has now served over 400,000 patients nationally, of which

37% were Medicare patients. The industry provided CMS and HMS

substantial data that we strongly believe justifies a significantly

higher national rate. As previously stated, this decision has

serious implications for the economic viability of the current

CardioNet business model. CardioNet will continue to work with CMS

and HMS to achieve an appropriate national rate.

“Despite the unexpected reimbursement reduction by HMS on July

10, 2009 and the commercial reimbursement trends that we previously

disclosed, we believe that CardioNet’s path forward is clear.

First, we remain committed to our sales effort in its key role in

driving volume, market share and competitive success. Second,

CardioNet must become more cost efficient and there are a number of

current programs and strategies under development to achieve

greater efficiencies. To date, CardioNet has cut costs that we

expect to deliver approximately $8 million in expense reductions in

2010. CardioNet also has a strong cash position which assures us

the time and resources to execute on this plan as well as evaluate

other strategic options. As we implement these programs, we will

ensure that patients and physicians continue to receive the

outstanding benefits of CardioNet’s MCOTTM technology.

“In addition to the unexpected HMS reimbursement cut, earnings

in Q3 reflect certain incremental investments aimed at building

market share and supporting the larger selling organization. Bad

debt continues to negatively impact earnings and we are taking

aggressive steps to address this issue. The bad debt issue is

partly attributable to the billing and collections practices

stemming from the Company’s entrepreneurial past which have taken

longer than expected to correct. In 2009, CardioNet reorganized the

billing and collections area and has recently rebilled 100% of the

net receivables over 120 days. As a result of our efforts, we are

now seeing favorable trends with our current receivables. Despite

this progress, we remain unsatisfied with the results to date.

Therefore, we recently moved the entire revenue cycle organization,

from order entry to collections, under one management team creating

a structure for improved transaction flow and enhanced

productivity. We also engaged an outside collections firm to focus

on older receivables and implemented an electronic revenue cycle

management platform, transitioning from a largely paper-based

billing system.

“To summarize, the CardioNet MCOTTM technology continues to

provide outstanding clinical value to physicians and patients. Our

volume growth and success against competitors clearly demonstrate

that point. Receivables and collections have taken longer than

anticipated to correct but specific actions have been taken as

discussed. All of that said the most significant matter affecting

CardioNet is the unexpected decrease in reimbursement by HMS, which

has negatively impacted profitability and, without significant

restructuring, has put the Company and MCOTTM technology in

jeopardy. All stakeholders should know that we are taking every

step necessary to address these issues while we simultaneously

pursue technology advancements and strategic options that will

ensure physicians and patients continued access to CardioNet’s

revolutionary technology. CardioNet’s strong cash position and lack

of debt provides us with time to effect these changes. I would

anticipate that, as developments warrant, we will communicate with

stakeholders to provide an update on our efforts and the outlook

for CardioNet’s future.”

Financial Results

Revenues for the third quarter of 2009 increased to $33.3

million compared to $31.2 million in the third quarter of 2008, an

increase of $2.1 million, or 6.8%. For the third quarter, the

Company’s payor mix was 38% Medicare and 62% commercial. While the

increased patient volume drove additional revenue, it was offset by

the September 1, 2009 decrease in Medicare reimbursement as well as

the declining commercial reimbursement trends as disclosed in the

Company’s June 30, 2009 press release. Gross profit increased to

$21.5 million in the third quarter of 2009, or 64.5% of revenues,

compared to $21.2 million in the third quarter of 2008, or 67.9% of

revenues.

On a GAAP basis, operating loss was $5.9 million in the third

quarter of 2009 compared to operating income of $1.4 million in the

third quarter of 2008. Excluding $1.3 million of expense primarily

related to restructuring, adjusted operating loss was $4.6 million

in the third quarter of 2009. This compares to adjusted operating

income of $4.3 million in the third quarter of 2008, which excludes

$2.9 million of expense related to the integration of PDSHeart and

other restructuring efforts in the prior year period.

On a GAAP basis, net loss for the third quarter of 2009 was $5.4

million, or a loss of $0.23 per diluted share, compared to net

income of $1.0 million, or $0.04 per diluted share, for the third

quarter of 2008. Adjusted net loss for the third quarter of 2009

was $2.4 million, or a loss of $0.10 per diluted share, excluding

expenses primarily related to restructuring. This compares to

adjusted net income of $2.6 million, or $0.11 per diluted share,

for the third quarter of 2008, which excludes the impact of

integration, restructuring and other nonrecurring charges.

Revenues for the nine months ended September 30, 2009 increased

to $107.3 million compared to $86.0 million in the comparable

period in the prior year. For the nine months of 2009, gross profit

increased to $71.7 million, or 66.8% of revenues, compared to $56.7

million, or 65.9% of revenues, in the comparable period in the

prior year.

On a GAAP basis, operating loss for the first nine months of the

year was $5.1 million compared to operating income of $3.3 million

in the comparable period in the prior year. Excluding $4.5 million

of expense related to restructuring and costs incurred in

connection with the since-terminated merger agreement to acquire

Biotel Inc., adjusted operating loss was $0.7 million in the first

nine months of 2009. This compares to adjusted operating income of

$8.1 million in the first nine months of 2008, which excludes $4.8

million of integration, restructuring and other nonrecurring

charges.

Net loss for the first nine months of 2009 was $4.6 million, or

a loss of $0.19 per diluted share, compared to net income of $2.3

million, or $0.10 per diluted share, for the first nine months of

2008. Adjusted net loss for the first nine months of 2009 was $0.1

million excluding expenses related to restructuring and costs

incurred in connection with the since-terminated merger agreement

to acquire Biotel Inc. This compares to adjusted net income of $5.0

million, or $0.23 per diluted share, for the first nine months of

2008, which excludes the impact of integration, restructuring and

other nonrecurring charges.

On a GAAP basis, net loss available to common shareholders,

which is derived by reducing net income by the accrued dividends

and accretion on mandatorily redeemable convertible preferred stock

was a loss of $4.6 million, or a loss of $0.19 per diluted share,

for the nine month period ended September 30, 2009, compared to a

net loss of $0.3 million, or a loss of $0.02 per diluted share, for

the same period last year. The mandatorily redeemable convertible

preferred stock, which was issued in part to finance the March 2007

PDSHeart acquisition, was converted to common stock in connection

with CardioNet’s March 2008 initial public offering.

Marty Galvan, CardioNet's Chief Financial Officer, commented:

“While our patient volume in the quarter increased by 47% over the

prior year, our total revenue grew by 7%. This rate of revenue

growth reflects the impact of lower commercial rates as well as the

September 1, 2009 reduction in Medicare reimbursement to $754.

“As Randy noted, our accounts receivables continue to be a

challenge and our days sales outstanding (“DSO”) grew to 138 days

in the quarter. This increase was largely driven by our older

receivables. In order to prevent these issues in the future, we are

currently implementing new processes for greater effectiveness and

efficiency. To assist in our efforts to collect these older

receivables, we have recently retained the services of an outside

collections firm to directly manage collections in relation to

specific accounts.

“We are beginning to see the positive impact of the increased

focus on accounts receivable with third quarter collections up 49%

over the third quarter of 2008 and up 9% over the second quarter.

Collections outpaced our revenue growth of 7% over the third

quarter of 2008 and the revenue decline as compared to the second

quarter. To build on these positive trends, we are implementing an

electronic solution provided by Emdeon which will automate key

functions throughout the revenue cycle and which will streamline

our interactions with the payors. We expect to have this system

fully implemented by mid-November.

“At this point, we believe that we are fully reserved for

uncollectable receivables and we remain optimistic about our

ability to positively impact our receivables and DSO by year-end

based on the implementation of streamlined processes and continuing

positive collection trends.

“During the quarter, we implemented a restructuring program

aimed at reducing support costs and driving efficiencies without

impacting patient care or physician support. As part of the

program, we closed one of the legacy PDS facilities, allowing us to

consolidate several monitoring groups into one location, driving

operational synergies. The cost savings are expected to reach

approximately $8 million in 2010.

“Despite the reimbursement challenges facing CardioNet, we

continue to have a strong balance sheet with $43 million in cash

and no debt. We continue to invest in the Company and our devices

with capital spending of $5.1 million in the quarter.”

Conference Call

CardioNet has suspended its investor calls. Should the Company

determine to recommence these calls in the future, it will so

announce.

About CardioNet

CardioNet is the leading provider of ambulatory, continuous,

real-time outpatient management solutions for monitoring relevant

and timely clinical information regarding an individual's health.

CardioNet's initial efforts are focused on the diagnosis and

monitoring of cardiac arrhythmias, or heart rhythm disorders, with

a solution that it markets as Mobile Cardiac Outpatient TelemetryTM

(MCOT™). More information can be found at

http://www.cardionet.com.

Forward-Looking Statements

This press release includes certain forward-looking statements

within the meaning of the "Safe Harbor" provisions of the Private

Securities Litigation Reform Act of 1995 regarding, among other

things, our growth prospects, the prospects for our products and

our confidence in the Company’s future. These statements may be

identified by words such as “expect,” “anticipate,” “estimate,”

“intend,” “plan,” “believe,” “promises” and other words and terms

of similar meaning. Such forward-looking statements are based on

current expectations and involve inherent risks and uncertainties,

including important factors that could delay, divert, or change any

of them, and could cause actual outcomes and results to differ

materially from current expectations. These factors include, among

other things, our efforts to address the operational issues and

strategic options described in this press release, the success of

our sales and marketing initiatives, our ability to attract and

retain talented executive management and sales personnel, our

ability to identify acquisition candidates, acquire them on

attractive terms and integrate their operations into our business,

the commercialization of new products, market factors, internal

research and development initiatives, partnered research and

development initiatives, competitive product development, changes

in governmental regulations and legislation, changes to

reimbursement levels for our products, the continued consolidation

of payors, acceptance of our new products and services and patent

protection and litigation. For further details and a discussion of

these and other risks and uncertainties, please see our public

filings with the Securities and Exchange Commission, including our

latest periodic reports on Form 10-K and 10-Q. We undertake no

obligation to publicly update any forward-looking statement,

whether as a result of new information, future events, or

otherwise.

Three Months Ended

Consolidated Statements of Operations (unaudited)

(In Thousands, Except Per Share Amounts) September

30, September 30, 2009 2008

Revenues $ 33,340 $ 31,223 Cost of revenues 11,829

10,014 Gross profit 21,511 21,209 Gross profit % 64.5

% 67.9 % Operating expenses: General and administrative

expense 15,165 10,511 Sales and marketing expense 9,562 5,216

Research and development expense 1,325 943 Amortization of

intangibles 215 246 Integration, restructuring and other charges

1,150 2,859 Total operating expenses

27,417 19,775 Operating income (loss) (5,906 )

1,434 Interest income, net 10 323 Income

(loss) before income taxes (5,896 ) 1,757 (Provision ) benefit from

income taxes 474 (770 ) Net income (loss) $

(5,422 ) $ 987

Earnings (loss) per Share:

Basic $ (0.23 ) $ 0.04 Diluted $ (0.23 ) $ 0.04 Weighted

Average Shares Outstanding: Basic 23,813 23,171 Diluted 23,813

24,039

Nine Months Ended

Consolidated Statements of Operations (unaudited)

(In Thousands, Except Per Share Amounts) September

30, September 30, 2009 2008

Revenues $ 107,324 $ 86,026 Cost of revenues 35,661

29,367 Gross profit 71,663 56,659 Gross profit % 66.8

% 65.9 % Operating expenses: General and administrative

expense 43,172 29,101 Sales and marketing expense 25,548 15,743

Research and development expense 4,310 3,015 Amortization of

intangibles 668 738 Integration, restructuring and other charges

3,109 4,775 Total operating expenses

76,807 53,372 Operating income (loss) (5,144 )

3,287 Interest income, net 168 702 Income

(loss) before income taxes (4,976 ) 3,989 Provision for income

taxes 395 (1,710 ) Net income (loss) $ (4,581

) $ 2,279 Dividends on and accretion of mandatorily redeemable

convertible preferred stock - (2,597 ) Net

income (loss) available to common shareholders $ (4,581 ) $ (318 )

Earnings (loss) per Share: Basic $ (0.19 ) $ (0.02 ) Diluted

$ (0.19 ) $ (0.02 ) Weighted Average Shares Outstanding:

Basic 23,742 16,644 Diluted 23,742 16,644 The following

table presents detail of the stock based compensation expense that

is included in each functional line item in the Condensed

Statements of Operations above (000’s):

Three Months Ended

Stock based compensation expense (unaudited)

(In Thousands) September 30, September

30, 2009 2008 Stock based compensation

expense included in: Cost of revenues $ 23 $ 8 Research and

development expense 19 18 General and administrative expense 1,539

807 Sales and marketing expense 115 125 Integration, restructuring

and other charges - 768 Total stock based

compensation expense $ 1,696

$ 1,726

Nine Months Ended

Stock based compensation expense (unaudited)

(In Thousands) September 30, September 30,

2009 2008 Stock based compensation expense

included in: Cost of revenues $ 77 $ 23 Research and development

expense 65 50 General and administrative expense 4,926 1,230 Sales

and marketing expense 390 363 Integration, restructuring and other

charges - 768 Total stock based compensation

expense $ 5,458

$ 2,434

Summary Consolidated

Balance Sheet Data (In Thousands) September 30,

December 31, 2009 2008 (unaudited)

Cash and cash equivalents $ 42,873 $ 58,171 Accounts

receivable, net 49,393 39,431 Working capital 80,248 84,003 Total

assets 169,018 165,773 Total debt - 72 Total shareholders’ equity

154,072 150,117 Reconciliation of Non-GAAP Financial

Measures (In Thousands, Except Per Share Amounts) In

accordance with Regulation G of the Securities and Exchange

Commission, the table set forth below reconciles certain financial

measures used in this press release that were not calculated in

accordance with generally accepted accounting principles, or GAAP,

with the most directly comparable financial measure calculated in

accordance with GAAP.

Three Months Ended

(unaudited)

September

30,2009

September

30,2008

Operating income (loss) – GAAP $ (5,906 ) $ 1,434 Nonrecurring

charges (a) 1,290 2,859

Adjusted operating income

(loss)

$ (4,616 ) $ 4,293 Net

income (loss) available to common shareholders – GAAP

$

(5,422 ) $ 987 Nonrecurring charges (net of income taxes of

($352) and $1,253, respectively) (a) 1,642

1,606

Adjusted net income (loss)

$

(3,780 ) $ 2,593

Expected impact of NOL

utilization

1,337 -

Adjusted net income (loss)

excluding NOL utilization $ (2,443 )

$ 2,593

Diluted earnings (loss) available to common shareholders per basic

and diluted share – GAAP $ (0.23 ) $ 0.04 Nonrecurring

charges per share (a) 0.07 0.07

Adjusted

earnings (loss) per diluted share $ (0.16

) $ 0.11

Expected impact of NOL

utilization

0.06 -

Adjusted earnings (loss) per diluted

share excluding NOL utilization $ (0.10 )

$ 0.11 (a) In the third quarter of

2009, we incurred $0.1 million of costs in connection with the

since-terminated definitive merger agreement to acquire Biotel,

Inc. and $1.2 million of integration, restructuring and other

charges. In the third quarter of 2008, we incurred $2.9 million of

integration, restructuring and other charges.

Nine Months Ended

(unaudited)

September

30,2009

September

30,2008

Operating income (loss) – GAAP $ (5,144 ) $ 3,287 Nonrecurring

charges (a) 4,478 4,775

Adjusted operating income

(loss)

$ (666 ) $ 8,062

Net income (loss) available to common shareholders – GAAP $ (4,581

) $ (318 )

Dividends on and accretion of

mandatorily redeemable convertible preferred stock which converted

to common stock in the first quarter of 2008

- 2,597

Net income (loss)

$ (4,581 ) $ 2,279

Nonrecurring charges (net of income taxes of $0 and $2,047

respectively) (a) 4,478 2,728

Adjusted net income (loss) $ (103 )

$ 5,007

Expected impact of NOL

utilization

- -

Adjusted net income (loss)

excluding NOL utilization

$ (103 ) $ 5,007

Income (loss) available to common shareholders per basic and

diluted share – GAAP $ (0.19 ) $ (0.02 )

Dividends on and accretion of

mandatorily redeemable convertible preferred stock which converted

to common stock in the first quarter of 2008

- 0.12

Diluted earnings (loss) per

share

$ (0.19 ) $ 0.10

Nonrecurring charges per share (a) 0.19 0.13

Adjusted earnings (loss) per diluted share $

(0.00 ) $ 0.23 Expected impact of NOL

utilization - -

Adjusted earnings

(loss) per diluted share excluding NOL utilization $

(0.00 ) $ 0.23 (a)

In the first nine months of 2009, we incurred $0.9 million of costs

in connection with the since-terminated definitive merger agreement

to acquire Biotel, Inc., $0.5 million for special bonus paid to

incoming CEO and $3.1 million of integration, restructuring and

other charges. In the first nine months of 2008, we incurred $4.8

million of integration, restructuring and other charges.

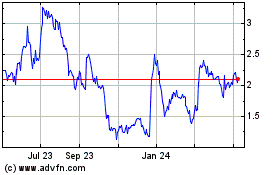

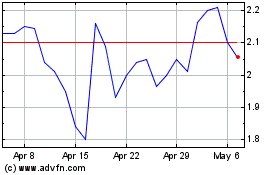

HeartBeam (NASDAQ:BEAT)

Historical Stock Chart

From Jun 2024 to Jul 2024

HeartBeam (NASDAQ:BEAT)

Historical Stock Chart

From Jul 2023 to Jul 2024