CardioNet, Inc. (NASDAQ:BEAT), a leading wireless medical

technology company with an initial focus on the diagnosis and

monitoring of cardiac arrhythmias, today reported results for the

quarter ended September 30, 2008. Q3 2008 Highlights Revenues of

$31.2 million, up 52.1% compared to $20.5 million in the same

period last year Gross margin of 67.9%, compared to 65.4% in the

same period last year Adjusted operating margin of 13.7%, excluding

one-time charges, in the third quarter 2008(1A) compared to 7.5% in

the third quarter 2007; GAAP operating margin of 4.6% in the third

quarter 2008 compared to 7.5% in the same period last year Secured

a new direct contract with Humana, a large healthcare third-party

payor, representing 11 million lives, bringing the total number of

lives covered by the CardioNet System to 190 million covered by 194

commercial contracts and Medicare Launched enhanced atrial

fibrillation (�AF�) reporting package, providing physicians a

comprehensive tool with which to better diagnose, manage and treat

AF patients In early October, received CPT codes from the American

Medical Association (�AMA�) for the CardioNet System, representing

a major milestone for the Company and simplifying reimbursement for

physicians President and CEO Commentary Arie Cohen, President and

CEO, commented: �Our strong third quarter results demonstrate our

continued success in driving adoption of the CardioNet System in

the physician community. With only 6% penetration in the $2 billion

cardiac arrhythmia monitoring market, we see a significant growth

opportunity for the Company. Our growth strategy is centered on

educating physicians and payors on the superior diagnostic yield

obtained with our system, demonstrated to be 3x higher versus event

monitoring. This superior diagnostic yield translates into

meaningful benefits for patients and reduced healthcare costs. A

recent example is the launch of our enhanced reporting package for

atrial fibrillation, providing physicians with improved

capabilities in diagnosing, treating and managing AF patients

through a state-of-the art technology designed specifically for

this common and potentially life threatening arrhythmia. �National

private payors continue to recognize the clinical superiority of

the CardioNet System compared to event monitors and the benefits it

offers to patients and physicians. In September, we received

further validation of these benefits when we executed a contract

with Humana for an additional 11 million covered lives, bringing

the total number of covered lives added during the year to 32

million under 27 new contracts. We are pleased to announce that the

CardioNet System is now available to 190 million people covered by

commercial payors and Medicare. We also received positive news

related to national reimbursement in early October when the AMA

assigned dedicated CPT codes for the CardioNet System. When made

effective on January 1, 2009, we believe these specific codes will

simplify the billing process for physicians and provide incremental

support for coverage from commercial payors. �During the quarter,

our corporate headquarters was impacted by a local fire that caused

water and electrical damage and temporarily displaced our

operations for one week. I would like to commend our dedicated

employees for their diligence and tireless effort during this time.

Our business continuation plan allowed us to seamlessly work

through the situation with no disruptions to our patient monitoring

operations.� Financial Results Revenues for the third quarter of

2008 increased to $31.2 million compared to $20.5 million in the

third quarter of 2007, an increase of $10.7 million, or 52.1%.

Revenues for the nine months ended September 30, 2008 increased to

$86.0 million compared to $49.0 million in the comparable period in

the prior year. After taking into account the acquisition of

PDSHeart, Inc. (�PDSHeart�), which the Company acquired in March

2007, revenue in the first nine months of 2008 increased 62.0% to

$86.0 million compared to $53.1 million in the same period last

year(1B). Gross profit increased to $21.2 million in the third

quarter of 2008, or 67.9% of revenues, compared to $13.4 million in

the third quarter of 2007, or 65.4% of revenues. The 67.9% gross

margin in third quarter of 2008 also compares favorably to the

66.5% gross margin in the second quarter of 2008. For the first

nine months of 2008, gross profit increased to $56.7 million, or

65.9% of revenues, compared to $32.2 million, or 65.7% of revenues,

in the comparable period in the prior year. After taking into

account the acquisition of PDSHeart, the 65.9% gross profit in the

year to date period compares to 65.2% gross profit in the same

period last year, an increase of 70 basis points(1B). On a GAAP

basis, operating income was $1.4 million in the third quarter of

2008 compared to $1.5 million in the third quarter of 2007.

Excluding $1.1 million of expense related to previously announced

departures from the Company�s Board of Directors, $0.9 million of

expense related to the integration of PDSHeart and other

restructuring efforts, and $0.9 million of expense related to the

Company�s recent secondary offering(1A), adjusted operating income

increased to $4.3 million in the third quarter of 2008, or 13.7% of

revenue, compared to $1.5 million, or 7.5% of revenue, in the third

quarter of 2007. On a GAAP basis, operating income for the year to

date period increased to $3.3 million compared to an operating loss

of $1.7 million in the comparable period in the prior year.

Excluding the impact of $4.8 million of integration, restructuring

and other nonrecurring charges(1A), adjusted operating income

increased to $8.1 million in the first nine months of 2008, or 9.4%

of revenue, compared to an operating loss of $1.7 million in the

first nine months of 2007. Marty Galvan remarked: �It is important

to note that our third quarter operating results were not affected

by the fire and we believe that the fire will not have a negative

impact on our overall operations for the year. However, as we

diverted internal resources to focus on patient care and to ensure

that there were no interruptions in service, we did experience a

slowdown in our cash collections. This situation has been

alleviated and we expect to fully recover cash collections by year

end.� Net income for the third quarter of 2008 was $1.0 million, or

$0.04 per diluted share, compared to $1.8 million, or $0.11 per

diluted share, for the same period last year. Adjusted net income

for the third quarter of 2008 increased to $2.6 million, excluding

the impact of integration, restructuring and other nonrecurring

charges(1A), compared to $1.8 million, for the same period last

year. Adjusted earnings per diluted share for the third quarter of

2008 was $0.11 per diluted share excluding the impact of

integration, restructuring and other nonrecurring charges(1A),

which was the same as the third quarter 2007. Net income for the

first nine months of 2008 increased to $2.3 million, or $0.10 per

diluted share, compared to a net loss of $2.5 million, or a loss of

$0.82 per diluted share, for the first nine months of 2007.

Adjusted net income for the first nine months of 2008 increased to

$5.0 million, or $0.23 per diluted share, excluding the impact of

integration, restructuring and other nonrecurring charges(1A),

compared to a net loss of $2.5 million, or a loss of $0.82 per

diluted share, for the same period last year. On a GAAP basis, net

income available to common shareholders, which is derived by

reducing net income by the accrued dividends and accretion on

mandatorily redeemable convertible preferred stock, was $1.0

million, or $0.04 per diluted share, for the third quarter of 2008,

compared to a net loss of $0.9 million, or a loss of $0.30 per

diluted share, for the third quarter of 2007. On a GAAP basis, net

loss available to common shareholders for the nine month period

ending September 30, 2008 was $0.3 million, or a loss of $0.02 per

diluted share, compared to a loss of $8.0 million, or a loss of

$2.70 per diluted share, for the same period last year. The

mandatorily redeemable convertible preferred stock, which was

issued in part to finance the March 2007 PDSHeart acquisition, was

converted to common stock in connection with CardioNet�s March 2008

initial public offering. Marty Galvan noted: �Based on our

performance through the first nine months of the year, we are

reaffirming our 2008 revenue guidance of $117 to $120 million. In

addition, the strength of our results in the third quarter

increases our level of comfort toward the high-end of that range.

We expect to continue making investments in the business and are

focused on building the infrastructure necessary to support our

growth in 2009 and beyond.� Conference Call CardioNet, Inc. will

host an earnings conference call on Thursday, October 30, 2008, at

5:00 PM Eastern Time. The call will be simultaneously webcast on

the investor information page of our website, www.cardionet.com.

The call will be archived on our website and will also be available

for two weeks via phone at 888-286-8010, access code 40141982.

CardioNet, Inc. is a leading provider of ambulatory, continuous,

real-time outpatient management solutions for monitoring relevant

and timely clinical information regarding an individual�s health.

CardioNet�s initial efforts are focused on the diagnosis and

monitoring of cardiac arrhythmias with a solution that it markets

as the CardioNet System. More information can be found at

www.cardionet.com. Forward Looking Statements This press release

includes certain forward-looking statements within the meaning of

the �Safe Harbor� provisions of the Private Securities Litigation

Reform Act of 1995 regarding, among other things, our continued

success in driving adoption among physicians, the impact of the

effectiveness of dedicated CPT codes in January 2009, the impact of

our recent fire on our operations and business, ability to deliver

sustained revenue and earnings growth, the momentum in payor

acceptance, the ability of our products and services to deliver

superior clinical outcomes and reduced heath care costs, our

ability to increase our market penetration, the size of our

potential markets and growth opportunities, our ability to leverage

our platform for other applications and markets, our expectations

with respect to our revenue mix or the continued shift from legacy

products to the CardioNet System, our expectations with respect to

future financial performance in our business, expectations with

respect to future investments, our outlook for our businesses, our

2008 revenue target, our prospects for continued growth and our

confidence in the Company�s future. These statements may be

identified by words such as "expect," "anticipate," "estimate,"

"project," "intend," "plan," "believe," and other words and terms

of similar meaning. Such forward-looking statements are based on

current expectations and involve inherent risks and uncertainties,

including important factors that could delay, divert, or change any

of them, and could cause actual outcomes and results to differ

materially from current expectations. These factors include, among

other things, the integration of PDSHeart, the continued

implementation of our restructuring plans, sales and marketing

initiatives, our ability to attract and retain talented sales

personnel, the commercialization of new products, market factors,

internal research and development initiatives, partnered research

and development initiatives, competitive product development,

changes in governmental regulations and legislation, changes to

reimbursement levels for our products, the continued consolidation

of payors, acceptance of our new products and services and patent

protection and litigation. For further details and a discussion of

these and other risks and uncertainties, please see our public

filings with the Securities and Exchange Commission, including our

latest periodic report on 10-Q. We undertake no obligation to

publicly update any forward-looking statement, whether as a result

of new information, future events, or otherwise. � � Three Months

Ended Consolidated Statements of Operations (unaudited) (In

Thousands, Except Per Share Amounts) � September 30, 2008 September

30, 2007 � Revenues $ 31,223 $ 20,530 Cost of revenues � 10,014 � �

7,100 � Gross profit 21,209 13,430 Gross profit % 67.9 % 65.4 % �

Operating expenses: Research and development expense 943 810

General and administrative expense 10,511 6,902 Sales and marketing

expense 5,216 3,937 Amortization of intangibles 246 246

Integration, restructuring and other nonrecurring charges � 2,859 �

� - � Total operating expenses 19,775 11,895 � � Operating income �

1,434 � � 1,535 � Interest income, net 323 273 � Income before

income taxes 1,757 1,808 Provision for income taxes � (770 ) � - �

Net income $ 987 $ 1,808 Dividends on and accretion of mandatorily

redeemable convertible preferred stock � - � � (2,743 ) Net income

(loss) available to common shareholders $ 987 � $ (935 ) � Earnings

(loss) per share: Basic $ 0.04 $ (0.30 ) Diluted $ 0.04 $ (0.30 ) �

� Weighted average shares outstanding: Basic 23,171 3,072 Diluted

24,039 3,072 � � � � Nine Months Ended Consolidated Statements of

Operations (unaudited) (In Thousands, Except Per Share Amounts) �

September 30, 2008 September 30, 2007 � Revenues $ 86,026 $ 49,049

Cost of revenues � 29,367 � � 16,843 � Gross profit 56,659 32,206

Gross profit % 65.9 % 65.7 % � Operating expenses: Research and

development expense 3,015 2,820 General and administrative expense

29,101 18,876 Sales and marketing expense 15,743 11,633

Amortization of intangibles 738 553 Integration, restructuring and

other nonrecurring charges � 4,775 � � - � Total operating expenses

53,372 33,882 � � Operating income (loss) � 3,287 � � (1,676 )

Interest income (expense), net 702 (774 ) � Income (loss) before

income taxes 3,989 (2,450 ) Provision for income taxes � (1,710 ) �

- � Net income (loss) $ 2,279 $ (2,450 ) Dividends on and accretion

of mandatorily redeemable convertible preferred stock � (2,597 ) �

(5,587 ) Net (loss) available to common shareholders $ (318 ) $

(8,037 ) � Earnings (loss) per share: Basic and Diluted $ (0.02 ) $

(2.70 ) � Weighted average shares outstanding: Basic and Diluted

16,644 2,982 � The following table presents detail of the

stock-based compensation expense that is included in each

functional line item in the Condensed Statement of Operations above

(000�s): � � Three Months Ended Stock based compensation expense

(unaudited) (In Thousands) � September 30, 2008 September 30, 2007

� Stock based compensation expense included in: Cost of revenues $

8 $ 7 Research and development expense 18 6 General and

administrative expense 807 62 Sales and marketing expense 125 45

Integration, restructuring and other nonrecurring charges � 768 � -

� Total stock based compensation expense $ 1,726 � $ 120 � � � Nine

Months Ended Stock based compensation expense (unaudited) (In

Thousands) � September 30, 2008 September 30, 2007 (a) � Stock

based compensation expense included in: Cost of revenues $ 23 $ 7

Research and development expense 50 6 General and administrative

expense 1,273 262 Sales and marketing expense 363 45 Integration,

restructuring and other nonrecurring charges � 768 � - � Total

stock based compensation expense $ 2,477 � $ 320 � � (a) � We began

assigning stock compensation expense to the individual cost centers

in the third quarter of 2007. Prior to the third quarter, all stock

compensation expense was recorded under general and administrative.

� � Summary Consolidated Balance Sheet Data (In Thousands) �

September 30, 2008 � December 31, 2007 (unaudited) � Cash and cash

equivalents $ 56,292 $ 18,091 Accounts receivable, net 35,851

22,854 Working capital 72,909 29,375 Total assets 164,439 103,040

Total debt 152 2,744 Mandatorily redeemable convertible preferred

stock - 115,302 Total shareholders� equity (deficit) 141,574

(26,865 ) � � Reconciliation of Non-GAAP Financial Measures (In

Thousands, Except Per Share Amounts) � In accordance with

Regulation G of the Securities and Exchange Commission, the tables

set forth below reconcile certain financial measures used in this

press release that were not calculated in accordance with generally

accepted accounting principles, or GAAP, with the most directly

comparable financial measure calculated in accordance with GAAP. �

� (1A) The following tables reconcile certain financial measures

used in this press release that were not calculated in accordance

with GAAP. � � � � Three Months Ended (unaudited) September 30,

2008 � September 30, 2007 Operating income � GAAP $ 1,434 $ 1,535

Integration, restructuring and other nonrecurring charges (a) �

2,859 � - � Adjusted operating income $ 4,293 $ 1,535 � � Net

income (loss) available to common shareholders � GAAP $ 987 $ (935

) Dividends on and accretion of mandatorily redeemable convertible

preferred stock which converted to common stock in the first

quarter of 2008 � - � 2,743 � Net income � GAAP $ 987 $ 1,808

Integration, restructuring and other nonrecurring charges (net of

income taxes of $1,253) (a) � 1,606 � - � Adjusted net income $

2,593 $ 1,808 � � Diluted earnings (loss) per share � GAAP $ 0.04 $

(0.30 ) � Dividends on and accretion of mandatorily redeemable

convertible preferred stock which converted to common stock in the

first quarter of 2008 and Integration, restructuring and other

nonrecurring charges per share (a) � 0.07 � 0.41 � Adjusted diluted

earnings per share $ 0.11 $ 0.11 � � � (a) � In the third quarter

of 2008, we incurred $2.9 million of integration, restructuring and

other nonrecurring charges. � � � Nine Months Ended (unaudited)

September 30, 2008 � September 30, 2007 Operating income (loss) �

GAAP $ 3,287 $ (1,676 ) Integration, restructuring and other

nonrecurring charges (a) � 4,775 � � - � Adjusted operating income

(loss) $ 8,062 � $ (1,676 ) � Net (loss) available to common

shareholders � GAAP $ (318 ) $ (8,037 ) Dividends on and accretion

of mandatorily redeemable convertible preferred stock which

converted to common stock in the first quarter of 2008 � 2,597 � �

5,587 � Net income (loss) � GAAP $ 2,279 $ (2,450 ) Integration,

restructuring and other nonrecurring charges (net of income taxes

of $2,047) (a) � 2,728 � � - � Adjusted net income (loss) $ 5,007 �

$ (2,450 ) � Diluted (loss) per share � GAAP $ (0.02 ) $ (2.70 ) �

Dividends on and accretion of mandatorily redeemable convertible

preferred stock which converted to common stock in the first

quarter of 2008 and integration, restructuring and other

nonrecurring charges per share (a) � 0.25 � � 1.88 � Adjusted

diluted earnings (loss) per share $ 0.23 � $ (0.82 ) � � (a) � For

the nine month period ending September 30, 2008, we incurred $3.8

million of integration, restructuring and other nonrecurring

charges and $1.0 million of expense related to the resolution of

litigation. � � � (1B) � The following table provides a

reconciliation of year to date 2007 results as if the PDSHeart

acquisition had been completed as of January 1, 2007. � � Nine

Months Ended (unaudited) September 30, 2007 � Total revenue � GAAP

$ 49,049 PDSHeart revenue prior to acquisition � January 1 to March

7, 2007 � 4,069 � Adjusted revenue $ 53,118 � Total gross profit �

GAAP $ 32,206 PDSHeart gross profit prior to acquisition � January

1 to March 7, 2007 � 2,423 � Adjusted gross profit $ 34,629 �

Adjusted gross profit % 65.2 % �

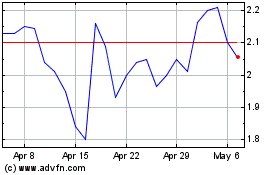

HeartBeam (NASDAQ:BEAT)

Historical Stock Chart

From Jun 2024 to Jul 2024

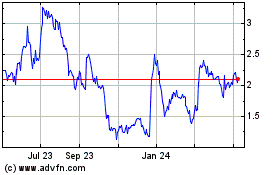

HeartBeam (NASDAQ:BEAT)

Historical Stock Chart

From Jul 2023 to Jul 2024