Additional Proxy Soliciting Materials - Non-management (definitive) (dfan14a)

May 19 2022 - 12:38PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

(Rule

14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

The Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☒ | Definitive Additional Materials |

| ☐ | Soliciting Material Under Rule 14a-12 |

| Hasbro, Inc. |

(Name of Registrant as Specified in Its Charter)

|

| |

Alta Fox Opportunities

Fund, LP

Alta Fox SPV

3, LP

Alta Fox SPV

3.1, LP

Alta Fox GenPar,

LP

Alta Fox Equity,

LLC

Alta Fox Capital

Management, LLC

Connor Haley

Marcelo Fischer

Rani Hublou

Carolyn Johnson

|

(Name of Persons(s) Filing Proxy Statement, if Other Than the Registrant)

|

Payment of Filing Fee (Check the appropriate box):

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on

which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| ☐ | Fee paid previously with preliminary materials: |

☐ Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of

its filing.

| (1) | Amount previously paid: |

| (2) | Form, Schedule or Registration Statement No.: |

Alta Fox Opportunities

Fund, LP, together with the other participants named herein (collectively, “Alta Fox”), has filed a definitive proxy statement

and accompanying GOLD proxy card with the Securities and Exchange Commission to be used to solicit votes for the election of its slate

of highly-qualified director nominees at the 2022 annual meeting of shareholders of Hasbro, Inc., a Rhode Island corporation (the “Company”).

Item 1: On the evening

of May 18, 2022, Alta Fox issued the following press release:

Alta Fox Responds to Hasbro’s Recent Presentation

and Reinforces the Urgent Need for Boardroom Change at the 2022 Annual Meeting

Urges Shareholders to Vote on the GOLD

Proxy Card to Elect Alta Fox’s Three Highly Qualified and Independent Nominees, Who Collectively Possess Expertise in Corporate

Governance, Capital Allocation and Strategic Planning

DALLAS – May 18, 2022 – Alta Fox Capital

Management, LLC (together with its affiliates, “Alta Fox” or “we”), the beneficial owner of approximately 2.6%

of the outstanding shares of Hasbro, Inc. (NASDAQ: HAS) (“Hasbro” or the “Company”), today issued the below statement

in connection with its nomination of three highly qualified and independent candidates – Marcelo Fischer, Rani Hublou and Carolyn

Johnson – for election to the Company’s Board of Directors (the “Board”) at the 2022 Annual Meeting of Shareholders

(the “Annual Meeting”). As a reminder, Alta Fox is seeking to replace the following long-tenured members of Hasbro’s

13-member Board: Lisa Gersh, Edward M. Philip and Richard S. Stoddart. Visit www.StrengthenHasbro.com for more information about

Alta Fox’s campaign for change.

Connor Haley, Managing Partner of Alta Fox, commented:

"This election contest now comes down to

one question: should three long-tenured and underperforming members of Hasbro’s 13-member Board be given a pass at this critical

inflection point simply because the Company has a new Chief Executive Officer? The reality is the three incumbents we are targeting

have presided over chronic share price underperformance, sustained market share losses and a perpetual trading price discount relative

to intrinsic value, all while authorizing top tier compensation for bottom tier performance compared to similarly sized publicly traded

consumer companies. The recent appointment of Chris Cocks does not conceal this long-term erosion that threatens Hasbro’s viability

as a business. Indeed, even the Company’s own proxy fight presentation acknowledges ‘its underperformance over the traditional

1, 3 and 5-Year Periods’ and that ‘the company’s recent returns are behind benchmarks.’ Although we

are unequivocally supportive of Mr. Cocks and want him to succeed, we believe the best way to halt this decline of the business and ensure

better corporate decision-making is to facilitate a credible refresh of the Board at the June 8th Annual Meeting. We urge all

of our fellow shareholders to send a long overdue message to the Board that it is in fact accountable for long-term lapses in capital

allocation, corporate governance and compensation, and strategic planning.

As an investor that intends to hold the Company’s

shares for the long term, we know future growth and value creation will begin in the boardroom. Public reports indicate that a

growing number of other Hasbro shareholders, including long-term institutional investors, support our push for boardroom change at this

year’s Annual Meeting.1 We are inspired by our fellow shareholders’ acknowledgements that Marcelo Fischer, Rani

Hublou and Carolyn Johnson are the right change agents at the right time for Hasbro’s Board. Mr. Fischer is an expert in capital

allocation and transactions, Ms. Hublou has exceptional growth strategy experience and corporate governance acumen, and Ms. Johnson is

a proven expert in organizational transformations.

1 Reuters, “Hasbro shareholders push toymaker to settle with Alta Fox, refresh board,” May 10, 2022 (link) and The Wall Street Journal, “Activist Investor Ancora Has 1% Hasbro Stake,” May 2, 2022 (link).

Looking ahead, we hope shareholders make voting

decisions based on the facts rather than the Board’s contradictory and reactionary responses to our campaign for incremental change.

We find it telling that the current Board’s most recent response did not address many of the substantive issues that we and our

fellow shareholders have raised to date. Our campaign has put a spotlight on the current Board’s undisciplined capital allocation

during the ‘Brand Blueprint’ era and the impact this failure has had on long-term shareholder returns. Tellingly, rather than

contextualize past decisions or lay out a transparent capital allocation framework for the future, the Company is now suggesting that

its strategy will be reviewed by the incumbent Board and long-serving executives. In an apparent about-face, the Company is telling shareholders

it will ‘rethink how Hasbro operates as a company to drive shareholder value’ and that it is working ‘to execute

a comprehensive strategic plan review to set Hasbro’s future course and drive profitable growth.’ This last-minute pivot

designed to win support only validates our view – and those of other shareholders – that now is the perfect time to introduce

truly independent and fresh perspectives into the boardroom through the election of our three nominees.

It is especially critical for shareholders to

recognize that the current Board continues to assume no real accountability for capital allocation, which is the key lever to profitable

long-term growth. The Company’s recent presentation notes that ‘Chris will apply the growth orientation and capital

discipline that he successfully demonstrated during his time at Wizards to the entire Hasbro business.’ This is a startling

statement given that a high functioning board of directors should be actively involved in major capital deployment initiatives and, as

shareholders know, Mr. Cocks, a first-time CEO, does not yet have experience overseeing capital allocation decisions at a public entity

of Hasbro’s size and scope. It is equally startling to review slide 14 of the Company’s recent presentation, which notes ‘Hasbro’s

Management Looks to the Board on a Number of Key Topics.’ The term capital allocation is not mentioned – not once.

It is a flashing red light from a governance perspective

that the current Board wants no real ownership of capital allocation, and it is so resistant to shareholders’ desire for a credible

director refresh that it is now spending more than $12 million on two law firms, two investment banks, two proxy solicitors and an army

of public relations professionals to fight incremental change. Conversely, Alta Fox is investing its own resources and time to try to

improve Hasbro's governance by adding highly qualified and independent experts to a 13-member Board. Shareholders should not forget

that this is a contest that could have been averted if the current Board was willing to settle for one investor-designated independent

director and the formation of a committee to review capital allocation strategy and provide related support to management. In

our view, the fact that this type of reasonable framework was dismissed ahead of a defensive expansion of the Board to an excessive 13

members is all the justification shareholders should need to vote for our slate at the Annual Meeting.”

Hasbro’s Board requires substantial improvements

in corporate governance, capital allocation, compensation practices and financial disclosures. The Company’s own communications

make it clear that these skills are not present in the backgrounds of the three long-tenured incumbent directors we are seeking to remove. Their

bios completely fail to include any mention of capital allocation expertise, and notably absent is any evidence of TSR performance they

have achieved at their outside public companies. Furthermore, we find it curious that the company continues to try to re-direct

investors’ focus to industry experience, while not one of these three incumbent directors has any digital gaming/digital products

expertise as disclosed in the Company’s own, replete skillset matrix. We believe our three nominees have the backgrounds and

skilled perspectives to strengthen the Board’s composition in these key areas.

- Marcelo Fischer’s perspective as a capital allocation

expert with a proven track record of value creation would be invaluable to the Board’s assessment of capital deployment initiatives.

Under Mr. Fischer’s leadership and inclusive of all spin-offs, IDT (NYSE: IDT) has compounded shareholder value at 25% a year compared

to the S&P 500 at less than 10% a year.

- Carolyn Johnson brings extensive experience in business

transformation, corporate governance and strategic planning that will be necessary for improving disclosures and enhancing Board and management

accountability. Under Ms. Johnson’s guidance on the Board, Majesco (formerly NASDAQ: MJCO) achieved an annualized total shareholder

return of 84% compared to the S&P 500’s annualized return of 12%.

- Rani Hublou possesses the strategic planning expertise

and supply chain knowledge necessary to help Hasbro regain market share and improve its growth strategy.

In its most recent presentation, Hasbro’s army

of advisors have attempted to justify the Board’s underperformance and absolve it of accountability. Below, Alta Fox seeks to address

disingenuous claims with facts and realities:

| Hasbro’s Disingenuous Claims |

The Facts |

| “Hasbro Has Actively Refreshed the Board” |

- We believe Hasbro’s most recent Board appointments

cannot be considered a “refresh,” but rather a reactionary expansion of an 11-member Board to an outsized 13-member Board

to prevent shareholder voices from reaching the boardroom.

|

| “Hasbro acknowledges its recent underperformance, and believes it is explained by the unfortunate timing of eOne as well as broader industry headwinds” |

- Hasbro’s underperformance has been more than

just “recent.”

- The Consumer business declined 1% from FY19-FY21 including

eOne synergies while US-Toy industry sales at retail grew 32% over that same time period according to market research group NPD,

Inc.

- Hasbro lost important consumer contracts to Mattel

in the last 3 months under the leadership of an unqualified interim CEO and current Chairman, Rich Stoddart.

|

| “Hasbro’s executive compensation program is appropriate and aligns company performance with the interests of our shareholders…Hasbro's last three completed long-term incentive performance cycles realized values substantially below the targeted grant value, with our former CEO realizing a total of 47% of such targeted grant value…” |

- Hasbro’s deceptive analysis fails to mention

the extremely material cash payouts earned by management for hitting meaningfully lowered annual targets year after year.

As a reminder:

- Hasbro's organic revenue in FY21 was ~12% lower vs

FY18.

- Hasbro’s FY21 EBIT margin target was 220 basis

points lower vs FY18.

- Hasbro’s total FY21 free cash flow target was

25% lower vs FY18 despite the additional inorganic contribution from eOne.

- Hasbro’s deceptive analysis also fails to mention

that the only reason management earned a substantial performance equity payout in FY21 was because of drastic cuts to cumulative performance

targets taken in FY21. Specifically, in FY21 Hasbro’s Board lowered management’s 3-year revenue target by 8%, cumulative EPS

target by 18%, and ROIC margin by 80 basis points from the prior year.

- Our analysis of similarly sized consumer companies

in the United States indicated that Hasbro has been among the most generous in terms of compensation despite being among the worst stock

performers.2

|

2 Alta Fox Presentation Slide 22

| "Hasbro's Board is committed to strict financial discipline…Divested non-core eOne music business with proceeds used for business reinvestment and debt pay down…D&D Beyond acquisition is a recent example of both the Board's and Chris' disciplined approach." |

- In the context of the $4.6B acquisition of eOne for

>20x EV/EBIT, divesting a small component for $385M at our estimate of 10-13x EBIT, a ~50% discount to the purchase price, is hardly

proof of capital discipline. Hasbro's belief that this exemplifies financial discipline is further indication of an urgent need for

fresh perspectives in the boardroom.

- We question how the Board can possibly claim victory

on the D&D Beyond acquisition and tout that it represents an example of strict financial discipline when the acquisition has yet to

close and the Company refuses to disclose D&D Beyond's Revenue and EBIT on a pre or post-acquisition basis.

|

|

"Hasbro is the Model for Success in Play &

Entertainment. Hasbro has a first-mover advantage and other IP owners [Mattel, Spin Master, Electronic Arts] are now emulating its multimedia

strategy."

|

- Ironically, Hasbro's "defense" of its strategy

further validates investors’ concerns.

- Each of the businesses Hasbro references as validation

for its "Brand Blueprint" strategy is pursuing an asset-light approach to multimedia development, while Hasbro is pursuing

an underperforming asset-heavy strategy across both Entertainment and video games.

- To put a finer point on the matter, none of these

businesses have ever paid nearly one third of their enterprise value to assume balance sheet risk in non-core competencies. For example,

we believe investors would rightfully question if EA bought a toy business or entertainment studio for one-third of its enterprise value

and a massive premium to its own trading multiple.

- It is concerning the Board approved this characterization

in its own investor presentation, as it indicates the directors are either not aware of the differentiated (asset-light) approach other

businesses are taking to multimedia investments, or they are deceptively trying to mischaracterize their own strategy.

|

| "Accepting Mattel's $24 All-Stock Offer in 1996 Would Have Destroyed Significant Value for Shareholders. Sale to Providence Equity for a Slight Premium Would Have Deprived Shareholders of Meaningful Upside." |

- Hasbro irrationally assumes all investors would earn

the annualized market return of Mattel from acquisition to present and not the S&P 500, an objective and fair proxy for market returns

following an acquisition. Using objective market returns post offer, Hasbro’s shareholders underperformed the S&P 500

by >500% since refusing to be acquired by Mattel in 1996.

- In its analysis of Hasbro’s TSR following Providence

Equity Partners’ cash offer to buy the business, the Board wildly compares the return of Hasbro to the return of Mattel.

Not only does this not make any sense – this is clearly intentional deception from the Board. Using objective market returns

post offer, Hasbro’s shareholders underperformed the S&P 500 by nearly 300% following Hasbro’s refusal of Provide Equity

Partners.

|

|

"Alta Fox does not understand how successful

Wizards has been because Wizards has been part of Hasbro… 150% growth in high margin: MAGIC: THE GATHERING revenue driven by Hasbro's

>$1 billion investment in Wizards over the past 5 years."

|

- Hasbro touts with pride its >$1B invested in WOTC

over the last five years. Not only do investors have no way of validating this claim or have any visibility into how the capital was allocated

due to exceptionally poor disclosure, but it completely ignores that Hasbro invested well over $5B into its Consumer business since

2018 with nothing to show for it except declining Consumer revenues.

- Moreover, Alta Fox and our nominees believe that investing

only $1B into WOTC over the last five years is not nearly enough as WOTC has incredible reinvestment opportunities into its core franchises

of MTG and D&D. Our nominees are excited and motivated to analyze these reinvestments with relentless focus and discipline while ensuring

that non-core investments (such as a speculative AAA G.I. Joe Video Game), are properly scrutinized.

|

|

| Alta Fox lacks conviction in its thesis by “waffling” on a spin-off of WOTC which “assumed a significant multiple expansion through reference to fundamentally flawed and inappropriate benchmarks.” Moreover, the analysis “fails to account for significant, quantifiable dis-synergies that would result from a separation … [and] the impact of non-quantifiable dis-synergies” |

- Alta Fox's nominees are not wedded to one single

strategy and employ a disciplined capital allocation approach that is, by definition, price dependent. Their focus is on maximizing long-term

shareholder value.

- In contrast to our nominees, the Board has repeatedly

demonstrated that it is stubbornly committed to empire-building through disastrous M&A despite the growing evidence that this strategy

is eroding Hasbro’s market share and relevance in the toy industry.

|

| "Alta Fox's slate of nominees does not possess relevant industry expertise for Hasbro's Board… Alta Fox's nominees would only serve to disrupt and distract the company from executing its strategic plans for the future of Hasbro. None of Alta Fox's nominees brings relevant industry expertise to support Chris Cocks in his new position as CEO, and their nominations show that Alta Fox's interests are not aligned with Chris' vision for the company." |

- Hasbro has failed to grasp that this proxy contest

is a referendum on corporate governance, capital allocation, and ultimately alignment with minority shareholders.

- Hasbro's arrogant swift dismissal of Alta Fox's nominees

and criticisms further indicates a desperate need for fresh, objective perspectives on the Board that will address the deep corporate

governance issues that Alta Fox has highlighted.

- Alta Fox's nominees

are experts in ensuring alignment with shareholders, instituting disciplined capital allocation, and driving value in public markets

- exactly what Hasbro's Board needs.

|

Learn more about the Alta Fox slate and how to vote

for boardroom change on the GOLD proxy card by visiting www.StrengthenHasbro.com.

***

About Alta Fox

Founded in 2018 by Connor Haley, Alta Fox is a Texas-based

alternative asset management firm that employs a long-term focused investment strategy to pursue exceptional risk-adjusted returns for

a diverse group of institutions and qualified individual clients. Alta Fox focuses on identifying often overlooked and under-the-radar

opportunities across asset classes, market capitalization ranges and sectors. Learn more by visiting www.AltaFoxCapital.com.

Contacts

For Investors:

Okapi Partners

Mark Harnett, 646-556-9350

mharnett@okapipartners.com

For Media:

Longacre Square Partners

Greg Marose / Bela Kirpalani, 646-386-0091

gmarose@longacresquare.com / bkirpalani@longacresquare.com

Item 2: Also on the evening

of May 18, 2022, Alta Fox uploaded the following materials to www.strengthenhasbro.com:

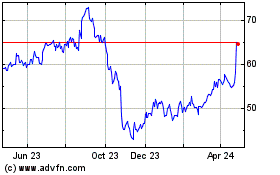

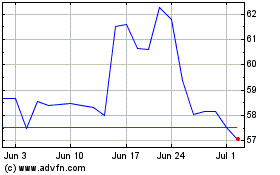

Hasbro (NASDAQ:HAS)

Historical Stock Chart

From Aug 2024 to Sep 2024

Hasbro (NASDAQ:HAS)

Historical Stock Chart

From Sep 2023 to Sep 2024