0001360214

false

0001360214

2023-07-18

2023-07-18

0001360214

HROW:CommonStock0.001ParValuePerShareMember

2023-07-18

2023-07-18

0001360214

HROW:Sec8.625SeniorNotesDue2026Member

2023-07-18

2023-07-18

0001360214

HROW:Sec11.875SeniorNotesDue2027Member

2023-07-18

2023-07-18

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): July 18, 2023

HARROW

HEALTH, INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-35814 |

|

45-0567010 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

| 102

Woodmont Blvd., Suite 610 |

|

|

| Nashville,

Tennessee |

|

37205 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (615) 733-4730

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

on exchange on which registered |

| Common

Stock, $0.001 par value per share |

|

HROW |

|

The

NASDAQ Stock Market LLC |

| 8.625%

Senior Notes due 2026 |

|

HROWL |

|

The

NASDAQ Stock Market LLC |

| 11.875%

Senior Notes due 2027 |

|

HROWM |

|

The

NASDAQ Stock Market LLC |

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2

of the Securities Act of 1934: Emerging growth company ☐

If

any emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01 Entry into a Material Definitive Agreement.

On

July 18, 2023, Harrow Health, Inc. (the “Company”) entered into the First Amendment to Credit Agreement and Guaranty

and Consent (the “Oaktree Amendment”) to the Credit Agreement and Guaranty (the “Oaktree Loan”) originally entered

into on March 27, 2023, with the lenders from time to time party thereto and Oaktree Fund Administration, LLC, as administrative agent

for the lenders (together, “Oaktree”). Under the Oaktree Amendment, the overall credit facility size was increased from $100,000,000

to $112,500,000, and the Company made other changes related to the Santen Products Acquisition (described further below under Item 8.01).

Upon satisfaction of certain conditions to funding, the Company will draw down a principal amount of $12,500,000 (the “Loan

Increase”) to fund the initial one-time payment associated with the Santen Products Acquisition and for other working capital

and general corporate purposes. No other material changes to the Oaktree Loan were provided in the Oaktree Amendment. Following entry

into the Oaktree Amendment and the funding of the Loan Increase upon closing of the Santen Products Acquisition, the Company will

have drawn down a total principal loan amount of $77,500,000 under the Oaktree Loan and an additional principal loan amount of up to

$35,000,000 remains available to the Company upon the commercialization of TRIESENCE.

The

foregoing description of the Oaktree Amendment does not purport to be complete and is qualified in its entirety by reference to the full

text of the Oaktree Amendment, which the Company expects to file as an exhibit to its Quarterly Report on Form 10-Q for the three months

ended June 30, 2023.

Item

2.02 Results of Operations and Financial Condition.

Management

expects the Company to record over $31,000,000 of total revenues and over $9,300,000 of Adjusted EBITDA (a non-GAAP measure) for the

three-month period ended June 30, 2023.

Management

utilizes Adjusted EBITDA, an unaudited financial measure that is not calculated in accordance with generally accepted accounting principles

(“GAAP”), to evaluate the Company’s financial results and performance and to plan and forecast future periods. Investors

are encouraged to review the Company’s complete results of operations and additional information provided in the Company’s

Annual Report on Form 10-K for the year ended December 31, 2022 and Quarterly Report on Form 10-Q for the quarter ended March 31, 2023.

Management believes that Adjusted EBITDA reflects an additional way of viewing aspects of the Company’s operations that, when viewed

in conjunction with GAAP results, provides a more complete understanding of the Company’s results of operations and the factors

and trends affecting its business.

Although

the Company is providing management guidance on anticipated Adjusted EBITDA, management is unable to determine with reasonable certainty

the ultimate outcome of certain items necessary to calculate net income, the most directly comparable GAAP measure, without unreasonable

effort. These items include, but are not limited to, final calculation of investment related gains/losses, inventory reserves, profit

transfers, revenue discounts, returns, chargebacks and stock-based compensation. These items are uncertain, depend on various factors,

and could have a material impact on the GAAP reported results for the period. All estimates presented are subject to completion of the

applicable quarter-end closing procedures. The Company’s actual results for such period are not expected to be available until

early August 2023 and may vary from these estimates. In addition, estimated financial information is necessarily speculative in nature,

and it can be expected that some or all of the assumptions underlying the estimated financial information described above will not materialize

or will vary significantly from actual results. Accordingly, undue reliance should not be placed on this estimate. The preliminary estimate

is not necessarily indicative of any future period and should be read together with the sections titled “Risk Factors” and

“Special Note Regarding Forward-Looking Statements,” and under similar headings in the documents filed by the Company with

the Securities and Exchange Commission (“SEC”) as well as the financial statements, related notes and other financial information

included in the Company’s filings with the SEC.

The

foregoing guidance on anticipated results for the three months ended June 30, 2023 has not been reviewed by Company’s auditors,

is based on preliminary information as of the date hereof and is subject to material changes following completion of the quarter-end

review process and other adjustments that may be made before the Company’s financial results are finalized. In addition, these

preliminary unaudited results are not comprehensive financial results for the quarter ended June 30, 2023, should not be viewed as a

substitute for complete GAAP financial statements or more comprehensive financial information, and are not indicative of the results

for any future period.

A

copy of the press release announcing the second quarter 2023 management guidance is being furnished as Exhibit 99.1 to this Current

Report on Form 8-K.

Item

7.01 Regulation FD Disclosure.

On

July 18, 2023, the Company issued a press release announcing an offering of shares of the Company’s common stock, par value $0.001

(the “Common Stock”) (the “Offering”).

A

copy of the press release for the Offering is being furnished as Exhibit 99.2 to this Current Report on Form 8-K.

In

connection with the Offering, the Company will be making road show presentations to certain existing and potential securityholders of

the Company. The road show materials are being furnished as Exhibit 99.3 to this Current Report on Form 8-K.

The

information furnished under Items 2.02 and 7.01 of this Current Report on Form 8-K, including Exhibit 99.1, Exhibit

99.2, and Exhibit 99.3 shall not be deemed to be “filed” for the purposes of Section 18 of the Securities

Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section. The information

in Items 2.02 and 7.01, including Exhibit 99.1, Exhibit 99.2, and Exhibit 99.3 shall not be

deemed incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, except to the extent

it is specifically incorporated by reference but regardless of any general incorporation language in such filing.

Item

8.01 Other Items.

Acquisition

of VEVYETM U.S. and Canadian Commercial Rights

On

July 18, 2023, the Company announced that it had acquired commercial rights of VEVYE (cyclosporine

ophthalmic solution) 0.1%, an ophthalmic drug product, for the U.S. and Canadian markets (the “VEVYE

Acquisition”). VEVYE, which is dispensed topically in a unique ten microliter per

one drop and is labeled for twice-daily (BID) dosing, is the first and only cyclosporine-based product indicated for the

treatment of both signs and symptoms of dry eye disease (DED). VEVYE was approved on May 30, 2023 by the Food and Drug

Administration. The Company acquired the commercial rights to VEVYE by entering into a license agreement with Novaliq GmbH

(“Novaliq”). As consideration, the Company will make initial payments to Novaliq totaling $8,000,000 and will pay low

double-digit royalties on net sales of VEVYE along with potential commercial milestone payments.

A

copy of the press release announcing the VEVYE Acquisition is being filed as Exhibit 99.4 to this Current Report on Form

8-K.

Acquisition

of Certain U.S. and Canadian Commercial Rights to Santen and Eyevance Products

On

July 18, 2023, the Company entered into an Asset Purchase Agreement with Eyevance

Pharmaceuticals, LLC and a License Agreement with Santen S.A.S. (collectively, the “Santen Agreements”), each a

subsidiary of Santen Pharmaceuticals Co., Ltd. (collectively, “Santen”). Pursuant to the Santen Agreements, we will be

acquiring the exclusive commercial rights to assets associated with certain ophthalmic products identified in the Santen Agreements

and described in the press release issued on July 18, 2023 (collectively, the “Santen

Products”):

The

transactions pursuant to the Santen Agreements are referred to in this Current Report on Form 8-K as the “Santen Products Acquisition.”

Under

the terms of the Santen Agreements, the Company is required to make an initial one-time payment of $8,000,000. In addition, the agreements

provide for various one-time milestone payments associated with certain manufacturing-related events as well as low-double digit royalty

payments on net sales of Verkazia and high-single digit royalty payments on net sales of Cationorm Plus. Under the Santen Agreements,

the Company also assumed certain obligations associated with other third parties that require mid-single digit royalties on sales of

Freshkote and Zerviate. Immediately following the closing and subject to certain conditions, for a period that the Company expects to

last approximately four months, and prior to the transfer of the Santen Products NDAs and other marketing authorizations to the Company,

Santen will continue to sell the Santen Products on the Company’s behalf and transfer the net profit from the sale of the Santen

Products to the Company.

A

copy of the press release announcing the Santen Products Acquisition is being filed as Exhibit 99.5 to this Current Report

on Form 8-K.

Cautionary

Note Regarding Forward-Looking Statements

This

Current Report on Form 8-K (and the exhibits attached hereto) may contain “forward-looking” statements as defined by the

Private Securities Litigation Reform Act of 1995 or by the SEC in its rules, regulations and releases. These statements include, but

are not limited to, the Company’s plans, objectives, expectations and intentions regarding the performance of its business, statements

regarding the Company’s anticipated results for the second quarter of 2023, the terms and conditions and timing of the Offering,

the intended use of proceeds of the Offering and other non-historical statements. These statements can be identified by the use of words

such as “believes,” “anticipates,” “expects,” “intends,” “plans,” “continues,”

“estimates,” “predicts,” “projects,” “forecasts,” and similar expressions. All forward

looking statements are based on management’s current expectations and beliefs only as of the date of this report and are subject

to risks, uncertainties and assumptions that could cause actual results to differ materially from those discussed in, or implied by,

the forward-looking statements, including the risks identified and discussed from time to time in the Company’s reports filed with

the SEC, including the Company’s Annual Report on Form 10-K for the year ended December 31, 2022 and Quarterly Report on Form 10-Q

for the three months ended March 31, 2023. Readers are strongly encouraged to review carefully the full cautionary statements described

in these reports. Except as required by law, the Company undertakes no obligation to revise or update publicly any forward-looking statements

to reflect events or circumstances after the date of this report, or to reflect the occurrence of unanticipated events or circumstances.

Item

9.01. Financial Statements and Exhibits

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

HARROW

HEALTH, INC. |

| |

|

|

| Dated:

July 18, 2023 |

By: |

/s/

Andrew R. Boll |

| |

|

Andrew

R. Boll |

| |

|

Chief

Financial Officer |

Exhibit

99.1

Harrow

Provides Select Preliminary Second Quarter 2023 Financial Guidance

NASHVILLE,

Tenn., July 18, 2023 – Harrow (Nasdaq: HROW), a leading U.S. eyecare pharmaceutical company, today announced the following

select preliminary second quarter 2023 financial guidance:

| |

● |

Second

quarter 2023 revenues in excess of $31.0 million compared with prior-year second quarter revenues of $23.3 million |

| |

● |

Second

quarter 2023 Adjusted EBITDA (a non-GAAP measure) in excess of $9.3 million |

Management

expects to release full second quarter 2023 financial results on August 9, 2023.

About

Harrow

Harrow

Health, Inc. (Nasdaq: HROW) is a leading U.S. eyecare pharmaceutical company engaged in the discovery, development, and commercialization

of innovative ophthalmic prescription therapies that are accessible and affordable. Harrow owns U.S. commercial rights to ten branded

FDA-approved ophthalmic pharmaceutical products. Harrow also owns and operates ImprimisRx, a leading U.S. ophthalmic-focused pharmaceutical

compounding business, which also serves as a mail-order pharmacy licensed to ship prescription medications in all 50 states. Harrow has

non-controlling equity positions in Surface Ophthalmics, Inc. and Melt Pharmaceuticals, Inc., companies that began as subsidiaries

of Harrow. Harrow also owns royalty rights in four late-stage drug candidates being developed by Surface and Melt.

Non-GAAP

Measures

Management

utilizes Adjusted EBITDA, an unaudited financial measure that is not calculated in accordance with General Accepted Accounting Principles

(“GAAP”), to evaluate the Company’s financial results and performance and to plan and forecast future periods. Investors

are encouraged to review the Company’s complete results of operations and additional information provided in the Company’s

Annual Report on Form 10-K for the year ended December 31, 2022 and Quarterly Report on Form 10-Q for the quarter ended March 31, 2023.

Management believes that Adjusted EBITDA reflects an additional way of viewing aspects of the Company’s operations that, when viewed

in conjunction with GAAP results, provides a more complete understanding of the Company’s results of operations and the factors

and trends affecting its business.

Although

we are providing management guidance on anticipated Adjusted EBITDA, we are unable to determine with reasonable certainty the ultimate

outcome of certain items necessary to calculate net income, the most directly comparable GAAP measure, without unreasonable effort. These

items include, but are not limited to, final calculation of investment related gains/losses, inventory reserves, profit transfers, revenue

discounts, returns, chargebacks and stock-based compensation. These items are uncertain, depend on various factors, and could have a

material impact on the GAAP reported results for the period. All estimates presented are subject to completion of the applicable quarter-end

closing procedures. Our actual results for such period are not expected to be available until early August 2023 and may vary from these

estimates. In addition, estimated financial information is necessarily speculative in nature, and it can be expected that some or all

of the assumptions underlying the estimated financial information described above will not materialize or will vary significantly from

actual results. Accordingly, undue reliance should not be placed on this estimate. The preliminary estimate is not necessarily indicative

of any future period and should be read together with the sections titled “Risk Factors” and “Special Note Regarding

Forward-Looking Statements,” and under similar headings in the documents filed by the Company with the U.S. Securities and Exchange

Commission (“SEC”) as well as our financial statements, related notes and other financial information included in the Company’s

filings with the SEC.

-MORE-

HROW

Provides Select Preliminary Second Quarter 2023 Financial Guidance

Page

2

July

18, 2023

The

foregoing guidance on anticipated results for the three months ended June 30, 2023, has not been reviewed by our auditors, is based on

preliminary information as of the date hereof and is subject to material changes following completion of the quarter-end review process

and other adjustments that may be made before our financial results are finalized. In addition, these preliminary unaudited results are

not comprehensive financial results for the quarter ended June 30, 2023, should not be viewed as a substitute for complete GAAP financial

statements or more comprehensive financial information, and are not indicative of the results for any future period.

Forward-Looking

Statements

This

press release contains “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act

of 1995. Any statements in this release that are not historical facts may be considered such “forward-looking statements.”

Forward-looking statements are based on management’s current expectations and are subject to risks and uncertainties which may

cause results to differ materially and adversely from the statements contained herein. Some of the potential risks and uncertainties

that could cause actual results to differ from those predicted include, among others, risks related to completion of applicable quarter-end

closing procedures. Additional risks and uncertainties are more fully described in Harrow’s filings with the Securities and Exchange

Commission (“SEC”), including its Annual Report on Form 10-K and its Quarterly Reports on Form 10-Q. Such documents may be

read free of charge on the SEC’s web site at sec.gov. Undue reliance should not be placed on forward-looking statements,

which speak only as of the date they are made. Except as required by law, Harrow undertakes no obligation to update any forward-looking

statements to reflect new information, events, or circumstances after the date they are made, or to reflect the occurrence of unanticipated

events.

Contact:

Jamie

Webb

Director

of Communications and Investor Relations

jwebb@harrowinc.com

615-733-4737

-END-

Exhibit 99.2

Harrow

Announces Proposed Public Offering of Common Stock

NASHVILLE,

Tenn., July 18, 2023 – Harrow (Nasdaq: HROW), a leading U.S. eyecare pharmaceutical company, today announced a proposed underwritten

registered public offering of its common stock, subject to market and certain other conditions. Harrow expects to grant the underwriters

a 30-day option to purchase additional shares of its common stock in connection with the offering.

The

Company expects to use the net proceeds from the sale of the common stock to fund the initial amount payable for an acquisition, with

the remaining net proceeds available for general corporate purposes, including funding future strategic product acquisitions and related

investments, making capital expenditures, and funding working capital and other cash needs, including tax withholding obligations in

connection with the settlement of outstanding equity awards vesting as a result of the achievement of stock price targets.

B.

Riley Securities, Inc. is acting as book-running manager for this offering. Lake Street Capital Markets, LLC is acting as lead-manager

and Ladenburg Thalmann & Co. Inc. is acting as co-manager for this offering.

The

common stock will be offered by Harrow under its shelf registration statement on Form S-3, which was declared effective by the Securities

and Exchange Commission (the “SEC”) on June 6, 2022. The offering of the common stock will be made solely by means of a prospectus

supplement and accompanying base prospectus, which will be filed with the SEC. Copies of the prospectus supplement and the accompanying

base prospectus may be obtained on the SEC’s website at www.sec.gov, or by contacting B. Riley Securities by phone at (703)

312-9580, or by emailing prospectuses@brileyfin.com.

This

press release shall not constitute an offer to sell or the solicitation of an offer to buy, and shall not constitute an offer, solicitation

or sale in any jurisdiction in which such offer, solicitation or sale is unlawful.

About

Harrow

Harrow

Health, Inc. (Nasdaq: HROW) is a leading U.S. eyecare pharmaceutical company engaged in the discovery, development, and commercialization

of innovative ophthalmic prescription therapies that are accessible and affordable. Harrow owns U.S. commercial rights to ten branded

FDA-approved ophthalmic pharmaceutical products. Harrow also owns and operates ImprimisRx, a leading U.S. ophthalmic-focused pharmaceutical

compounding business, which also serves as a mail-order pharmacy licensed to ship prescription medications in all 50 states. Harrow has

non-controlling equity positions in Surface Ophthalmics, Inc. and Melt Pharmaceuticals, Inc., companies that began as subsidiaries

of Harrow. Harrow also owns royalty rights in four late-stage drug candidates being developed by Surface and Melt.

HROW Announces Proposed Public Offering of Common Stock |

| Page 2 |

July 18, 2023 |

Forward-Looking

Statements

This

press release contains “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act

of 1995. Any statements in this release that are not historical facts may be considered such “forward-looking statements.”

Forward-looking statements are based on management’s current expectations and are subject to risks and uncertainties which may

cause results to differ materially and adversely from the statements contained herein. Some of the potential risks and uncertainties

that could cause actual results to differ from those predicted include, among others, risks related to: liquidity or results of operations;

our ability to successfully implement our business plan, develop and commercialize our products, product candidates and proprietary formulations

in a timely manner or at all, identify and acquire additional products, manage our pharmacy operations, service our debt, obtain financing

necessary to operate our business, recruit and retain qualified personnel, manage any growth we may experience and successfully realize

the benefits of our previous acquisitions and any other acquisitions and collaborative arrangements we may pursue; competition from pharmaceutical

companies, outsourcing facilities and pharmacies; general economic and business conditions, including inflation and supply chain challenges;

regulatory and legal risks and uncertainties related to our pharmacy operations and the pharmacy and pharmaceutical business in general;

and physician interest in and market acceptance of our current and any future formulations and compounding pharmacies generally. These

and additional risks and uncertainties are more fully described in Harrow’s filings with the Securities and Exchange Commission

(“SEC”), including its Annual Report on Form 10-K and its Quarterly Reports on Form 10-Q. Such documents may be read free

of charge on the SEC’s web site at sec.gov. Undue reliance should not be placed on forward-looking statements, which speak

only as of the date they are made. Except as required by law, Harrow undertakes no obligation to update any forward-looking statements

to reflect new information, events, or circumstances after the date they are made, or to reflect the occurrence of unanticipated events.

Contact:

Jamie

Webb

Director

of Communications and Investor Relations

jwebb@harrowinc.com

615-733-4737

Exhibit 99.3

Exhibit 99.4

Harrow

Acquires U.S. and Canadian Commercial Rights to VEVYE®

(Cyclosporine

Ophthalmic Solution) 0.1% from Novaliq

VEVYE®

is the First and Only Cyclosporine-Based Product Indicated for the Treatment

of

Both Signs and Symptoms of Dry Eye Disease with Efficacy Demonstrated After Four Weeks

VEVYE® is

the Only Water-Free Ophthalmic Product with Convenient Twice-Daily (BID) Dosing

NASHVILLE,

Tenn. And HEIDELBERG, Germany, July 18, 2023 – Harrow (Nasdaq: HROW), a leading U.S. eyecare pharmaceutical company, and Novaliq

GmbH, a German biopharmaceutical company focusing on first- and best-in-class ocular therapeutics, today announced an agreement under

which Harrow will acquire the U.S. and Canadian commercial rights for VEVYE® (cyclosporine ophthalmic solution) 0.1%, a patented,

non-preserved, ophthalmic solution prescription drug based on Novaliq’s proprietary EyeSol® water-free technology. VEVYE, which

is dispensed topically in a unique 10 microliter per one drop and is labeled for twice-daily (BID) dosing, is the first

and only cyclosporine-based product indicated for the treatment of both signs and symptoms of dry eye disease (DED). VEVYE was approved

on May 30, 2023, by the U.S. Food and Drug Administration (FDA).

In

commenting on the transaction, Mark L. Baum, Chairman and Chief Executive Officer of Harrow, said, “The acquisition of the U.S.

and Canadian commercial rights to VEVYE demonstrates

our commitment to the highly underserved dry eye and ocular surface inflammation markets. We are particularly excited about adding VEVYE

to our portfolio because of our strong belief that the U.S. DED market is in need of a cyclosporine-based product that is generally well

tolerated, improves both the signs and symptoms of DED and, critically, reduces the time it takes for patients to experience relief from

this all-too-common and, in many cases, debilitating disease. VEVYE not only feels better in the eye, but it performs differently, and

we believe it addresses the numerous unmet needs in the large and growing U.S. DED market. We look forward to making VEVYE available

in the U.S. later this year.”

“There’s

good news for dry eye patients and for our colleagues,” commented Laura M. Periman, M.D., Director of Dry Eye Services and Clinical

Research, Periman Eye Institute, in Seattle, Washington. “VEVYE, which is expected to be available soon, is a unique cyclosporine

formulation indicated for treatment of the signs and symptoms of DED. The rapid onset and magnitude of improvements on ocular surface

epithelial damage, combined with the tolerability of the non-aqueous vehicle, are key differentiators to existing cyclosporin formulations.

These features represent an exciting advancement in addressing the medical needs of dry eye patients and clinicians.”

“For

patients with chronic and symptomatic dry eye disease, the tolerability profile of the medication can be critical for compliance and

treatment success,” said Paul Karpecki, O.D., director, Cornea and External Disease, Kentucky Eye Institute,

and associate professor, University of Pikeville, Kentucky College of Optometry. “Most patients are not comfortable

with drops in their eyes that cause burning or stinging. As a water-free drug product, VEVYE does not require potentially irritating

ingredients, such as preservatives, oils or surfactants, and has demonstrated in clinical trials a high patient satisfaction rate. Having

a new treatment option with a favorable comfort and tolerability profile is a significant advancement for the dry eye patient, especially

those who experience burning and stinging with topical eye medications.”

Christian

Roesky, Ph.D., Chief Executive Officer of Novaliq, stated, “We are excited to partner with Harrow, one of the fastest growing and

most dynamic ophthalmic pharmaceutical companies in the U.S., to commercialize VEVYE in the U.S. and Canadian markets. Harrow and its

commercial team have a distinguished track record for successfully commercializing new and clinically important pharmaceutical products

in the U.S. market, and they specifically have many years of experience successfully marketing cyclosporine-based formulations to U.S.

eyecare professionals. The Novaliq team looks forward to supporting Harrow during the launch of VEVYE, a truly unique and powerful new

treatment option for U.S. eyecare professionals and the more than 16 million Americans who have been diagnosed with DED.”

HROW Acquires U.S. and Canadian Rights to VEVYE® (Cyclosporine Ophthalmic

Solution) 0.1% |

| Page 2 |

July 18, 2023 |

VEVYE

Clinical Data

The

safety and efficacy of VEVYE (development name: CyclASol®) for the treatment of dry eye disease were assessed in a total of 1,369

patients with dry eye disease, of which 738 received VEVYE.

Study

CYS-001 (NCT02113293) was the first-in-human study and was conducted to investigate the safety, tolerability, and pharmacokinetics

(PK) in healthy volunteers. In this study, VEVYE was shown to be safe, and no systemic exposure of cyclosporin was observed after ocular

administration.

Study

CYS-002 (NCT02617667, Wirta et al 2019) demonstrated that VEVYE-dosed patients showed a statistically significant early and clinically

meaningful increase in Schirmer’s tear test score at Day 29 compared to vehicle. Additionally, VEVYE showed greater improvement

in corneal and conjunctival staining compared to (i) vehicle and (ii) Restasis® over the four-month treatment period. The favorable

safety and tolerability profile of VEVYE was confirmed.

Study

CYS-003 (ESSENCE-1; NCT03292809, Sheppard et al 2021) confirmed the effects seen in CYS-002. Compared to vehicle at the end of treatment,

there was a statistically significant higher percentage of patients with increases of ≥10 mm from baseline in Schirmer’s tear

test score at Day 85. Notably, the study demonstrated statistically significant reduction in total, central corneal fluorescein and conjunctival

staining scores favoring VEVYE at all time points, in addition to VEVYE meeting the primary endpoint of the study. 52.9% of patients

responded within four weeks with a clinically meaningful improvement of ≥3 grades in total corneal staining, which was significantly

higher compared to vehicle. Responders showed statistically significant improvements in a variety of symptoms compared to non-responders.

VEVYE was safe, well tolerated, and comfortable over the three-month treatment duration.

Study

CYS-004 (ESSENCE-2; NCT04523129, Akpek et al 2023) was designed to replicate CYS-003 and met the primary corneal staining endpoint.

In this study, 71.6% of patients responded within four weeks with a clinically meaningful improvement of ≥3 grades in total corneal

staining. Again, responders showed statistically significant improvements in a variety of symptoms compared to non-responders at Day

29. Subjects with high central corneal staining at baseline were shown to benefit from VEVYE with statistically significant improvements

in their blurred vision score compared to vehicle CYS-004 studies as shown in CYS-003. Schirmer’s tear test responses of ≥10

mm increase was statistically significantly higher in the VEVYE compared vehicle at Day 29. VEVYE was safe, well tolerated, and comfortable

over the one-month duration.

Study

CYS-005 (NCT04523142, Wirta et al 2023) was an open label extension study of CYS-004. VEVYE was shown to be safe and well tolerated

during long-term use over 12 months. Sign and symptom endpoints continued to improve over the course of the study demonstrating sustained

efficacy over 52 weeks of therapy in both signs and symptoms.

| 1. | Wirta

DL, Torkildsen GL, Moreira HR, Lonsdale JD, Ciolino JB, Jentsch G, Beckert M, Ousler GM,

Steven P, Krösser S. A Clinical Phase II Study to Assess Efficacy, Safety, and Tolerability

of Waterfree Cyclosporine Formulation for Treatment of Dry Eye Disease. Ophthalmology. 2019;

126:793-800 |

| 2. | Sheppard

JD, Wirta DL, McLaurin E, Boehmer BE, Ciolino CB, Meides AS, Schlüter T, Ousler GW,

Usner D, Krösser S. A Water-free 0.1% Cyclosporine A Solution for Treatment of Dry Eye

Disease: Results of the Randomized Phase II/III ESSENCE Study. Cornea. 2021; 40:1290-1297 |

| 3. | Akpek

EK, Wirta DL, Downing JE, Tauber J, Sheppard JD, Ciolino JB, Meides AS, Krösser S: Efficacy

and Safety of a Water-Free Topical Cyclosporine, 0.1%, Solution for the Treatment of Moderate

to Severe Dry Eye Disease: The ESSENCE-2 Randomized Clinical Trial. JAMA Ophthalmology. 2023;

141(5):459-466. |

| 4. | Wirta

DL, Krösser S, Long -Term Safety and Efficacy of a Water-Free Cyclosporine Ophthalmic

Solution for the Treatment of Dry-Eye Disease: ESSENCE-2-OLE study. ASCRS 2023 paper presentation. |

HROW Acquires U.S. and Canadian Rights to VEVYE® (Cyclosporine Ophthalmic

Solution) 0.1% |

| Page 3 |

July 18, 2023 |

About

VEVYE® (cyclosporine ophthalmic solution) 0.1%

VEVYE

(cyclosporine ophthalmic solution) 0.1%, non-preserved, for topical ophthalmic use.

INDICATIONS

AND USAGE

VEVYE

is indicated for the treatment of the signs and symptoms of dry eye disease.

CONTRAINDICATIONS

None.

WARNINGS

AND PRECAUTIONS

Potential

for Eye Injury and Contamination. To avoid the potential for eye injury and/or contamination, patients should not touch the bottle

tip to the eye or other surfaces.

Use

with Contact Lenses. VEVYE should not be administered while wearing contact lenses. If contact lenses are worn, they should be removed

prior to administration of the solution. Lenses may be reinserted 15 minutes following administration of VEVYE ophthalmic solution.

ADVERSE

REACTIONS

Clinical

Trials Experience. Because clinical trials are conducted under widely varying conditions, adverse reaction rates observed in the

clinical trials of a drug cannot be directly compared to rates in the clinical trials of another drug and may not reflect the rates observed

in practice. In clinical trials with 738 subjects receiving at least 1 dose of VEVYE, the most common adverse reactions were instillation

site reactions (8%) and temporary decreases in visual acuity (3%).

USE

IN SPECIAL POPULATIONS

Pregnancy.

There are no adequate and well-controlled studies of VEVYE administration in pregnant women to inform a drug-associated risk.

Lactation.

Caution should be exercised when VEVYE is administered to a nursing woman.

For

additional information about VEVYE®, please see the Full Prescribing Information.

About

Novaliq

Novaliq

is a private biopharmaceutical company focusing on the development and commercialization of first- and best-in-class ocular therapeutics

based on EyeSol®, the worldwide first water-free technology. Novaliq GmbH is headquartered in Heidelberg, Germany, and Novaliq Inc.

has an office in Cambridge, MA, USA. The long-term shareholder is dievini Hopp BioTech holding GmbH & Co. KG, an active investor

in Life and Health Sciences companies. More on novaliq.com.

About

Harrow

Harrow

Health, Inc. (Nasdaq: HROW) is a leading U.S. eyecare pharmaceutical company engaged in the discovery, development, and commercialization

of innovative ophthalmic prescription therapies that are accessible and affordable. Harrow owns U.S. commercial rights to ten branded

FDA-approved ophthalmic pharmaceutical products. Harrow also owns and operates ImprimisRx, a leading U.S. ophthalmic-focused pharmaceutical

compounding business, which also serves as a mail-order pharmacy licensed to ship prescription medications in all 50 states. Harrow has

non-controlling equity positions in Surface Ophthalmics, Inc. and Melt Pharmaceuticals, Inc., companies that began as subsidiaries

of Harrow. Harrow also owns royalty rights in four late-stage drug candidates being developed by Surface and Melt.

HROW Acquires U.S. and Canadian Rights to VEVYE® (Cyclosporine Ophthalmic

Solution) 0.1% |

| Page 4 |

July 18, 2023 |

Harrow

Forward-Looking Statements

This

press release contains “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act

of 1995. Any statements in this release that are not historical facts may be considered such “forward-looking statements.”

Forward-looking statements are based on management’s current expectations and are subject to risks and uncertainties which may

cause results to differ materially and adversely from the statements contained herein. Some of the potential risks and uncertainties

that could cause actual results to differ from those predicted include, among others, risks related to: liquidity or results of operations;

our ability to successfully implement our business plan, develop and commercialize our products, product candidates and proprietary formulations

in a timely manner or at all, identify and acquire additional products, manage our pharmacy operations, service our debt, obtain financing

necessary to operate our business, recruit and retain qualified personnel, manage any growth we may experience and successfully realize

the benefits of our previous acquisitions and any other acquisitions and collaborative arrangements we may pursue; competition from pharmaceutical

companies, outsourcing facilities and pharmacies; general economic and business conditions, including inflation and supply chain challenges;

regulatory and legal risks and uncertainties related to our pharmacy operations and the pharmacy and pharmaceutical business in general;

and physician interest in and market acceptance of our current and any future formulations and compounding pharmacies generally. These

and additional risks and uncertainties are more fully described in Harrow’s filings with the Securities and Exchange Commission

(“SEC”), including its Annual Report on Form 10-K and its Quarterly Reports on Form 10-Q. Such documents may be read free

of charge on the SEC’s web site at sec.gov. Undue reliance should not be placed on forward-looking statements, which speak

only as of the date they are made. Except as required by law, Harrow undertakes no obligation to update any forward-looking statements

to reflect new information, events, or circumstances after the date they are made, or to reflect the occurrence of unanticipated events.

Contacts:

| Harrow: |

Novaliq: |

| |

|

| Investors |

Media |

| |

|

| Jamie

Webb |

Simone

Angstmann-Mehr |

| Director

of Communications and Investor Relations |

info@novaliq.com |

| jwebb@harrowinc.com |

|

| 615-733-4737 |

|

Media

Deb

Holliday

Holliday

Communications, Inc.

deb@hollidaycommunications.net

412-877-4519

Exhibit

99.5

Harrow

Acquires Santen’s Branded Ophthalmic Portfolio

Transaction

Includes U.S. and Canadian Commercial Rights to FLAREX®, NATACYN®, TOBRADEX® ST, VERKAZIA®, ZERVIATE®, and Non-Prescription

Brands FRESHKOTE® and Cationorm® PLUS

NASHVILLE,

Tenn., July 18, 2023 – Harrow (Nasdaq: HROW), a leading U.S. eyecare pharmaceutical company, today announced the signing of

agreements with affiliates of Santen Pharmaceutical Co., Ltd. (“Santen”) under which Harrow will acquire certain U.S. and

Canadian commercial rights for the following branded products from Santen:

U.S.

Products:

| ● | FLAREX®

(fluorometholone acetate ophthalmic suspension) 0.1%, a corticosteroid indicated for use

in the treatment of steroid-responsive inflammatory conditions of the palpebral and bulbar

conjunctiva, cornea, and anterior segment of the eye. |

| ● | NATACYN®

(natamycin ophthalmic suspension) 5%, a sterile antifungal indicated for the treatment of

fungal blepharitis, conjunctivitis, and keratitis caused by susceptible organisms, including

Fusarium solani keratitis. |

| ● | TOBRADEX®

ST (tobramycin and dexamethasone ophthalmic suspension) 0.3%/0.05%, an antibiotic and corticosteroid

combination for steroid-responsive inflammatory ocular conditions for which a corticosteroid

is indicated and where superficial bacterial ocular infection or a risk of bacterial ocular

infection exists. |

| ● | VERKAZIA®

(cyclosporine ophthalmic emulsion) 0.1%, a calcineurin inhibitor immunosuppressant indicated

for the treatment of vernal keratoconjunctivitis (VKC) in children and adults and holds orphan-drug

exclusivity. |

| ● | ZERVIATE®

(cetirizine ophthalmic solution) 0.24%, a histamine-1 (H1) receptor antagonist indicated

for treatment of ocular itching associated with allergic conjunctivitis. |

| ● | FRESHKOTE®,

used as a lubricant to reduce further irritation or to relieve dryness of the eye. |

Canadian

Products:

| ● | VERKAZIA®

(cyclosporine ophthalmic emulsion) 0.1%, a calcineurin inhibitor immunosuppressant indicated

for the treatment of vernal keratoconjunctivitis (VKC) in children from four years of age

through adolescence. |

| ● | Cationorm®

PLUS, a preservative-free emulsion for the treatment of dry eye symptoms and for the treatment

of signs and symptoms of ocular allergy. |

Please

see select Important Safety Information for these products and links to the Full Prescribing Information at the end of this release.

In

commenting on the transaction, Mark L. Baum, Chairman and Chief Executive Officer of Harrow, stated, “This acquisition furthers

Harrow’s goal of becoming a leader in the top tier of U.S. ophthalmic pharmaceutical companies, makes Harrow’s branded portfolio

one of the most comprehensive in the U.S. market, and is expected to be immediately financially accretive upon the transfer of the product

marketing authorizations. We are excited to add several high utility and trusted products that serve the ophthalmic surgical market,

a market in which we already have a strong presence, and significantly expand the breadth of our portfolio, which will now include the

only FDA-approved ophthalmic antifungal; a patented and ‘orphan-designated’ product for the nearly 50,000 Americans suffering

from the rare disease vernal keratoconjunctivitis (or VKC); a patented prescription drug to treat ocular itching associated with allergies;

and two patented non-prescription brands serving patients managing dry eye symptoms.”

| HROW Acquires Santen’s Branded Ophthalmic Portfolio |

| Page 2 |

| July 18, 2023 |

Richard

L. Lindstrom, M.D. added, “As an ophthalmic surgeon of nearly 50 years and an advisor to Mark and the Harrow leadership team for

many years, I am pleased to see Harrow step up and assemble not only a formidable posterior segment offering with products like IHEEZO®

and TRIESENCE®, but also an impressive array of innovative anterior segment products that U.S. ophthalmologists and optometrists

rely on to care for their patients. While some ophthalmic pharmaceutical companies have decided to place less emphasis on the anterior

segment despite the growing demand in this category of eyecare, with this acquisition, few companies, if any, can match the scope and

depth of Harrow’s ophthalmic product offerings, especially in the anterior segment. I believe this level of commitment to the eyecare

professional should further strengthen and expand the many relationships Harrow has been able to forge over the past 10 years.”

Financing

for the transaction was provided through the expansion of Harrow’s secured credit facility with funds managed by Oaktree Capital

Management, L.P. Harrow management expects the transaction to reduce the Company’s aggregate leverage ratio of adjusted EBITDA

to debt.

About

Harrow

Harrow

Health, Inc. (Nasdaq: HROW) is a leading U.S. eyecare pharmaceutical company engaged in the discovery, development, and commercialization

of innovative ophthalmic prescription therapies that are accessible and affordable. Harrow owns U.S. commercial rights to ten branded

FDA-approved ophthalmic pharmaceutical products. Harrow also owns and operates ImprimisRx, a leading U.S. ophthalmic-focused pharmaceutical

compounding business, which also serves as a mail-order pharmacy licensed to ship prescription medications in all 50 states. Harrow has

non-controlling equity positions in Surface Ophthalmics, Inc. and Melt Pharmaceuticals, Inc., companies that began as subsidiaries

of Harrow. Harrow also owns royalty rights in four late-stage drug candidates being developed by Surface and Melt.

Forward-Looking

Statements

This

press release contains “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act

of 1995. Any statements in this release that are not historical facts may be considered such “forward-looking statements.”

Forward-looking statements are based on management’s current expectations and are subject to risks and uncertainties which may

cause results to differ materially and adversely from the statements contained herein. Some of the potential risks and uncertainties

that could cause actual results to differ from those predicted include, among others, risks related to: liquidity or results of operations;

our ability to successfully implement our business plan, develop and commercialize our products, product candidates and proprietary formulations

in a timely manner or at all, identify and acquire additional products, manage our pharmacy operations, service our debt, obtain financing

necessary to operate our business, recruit and retain qualified personnel, manage any growth we may experience and successfully realize

the benefits of our previous acquisitions and any other acquisitions and collaborative arrangements we may pursue; competition from pharmaceutical

companies, outsourcing facilities and pharmacies; general economic and business conditions, including inflation and supply chain challenges;

regulatory and legal risks and uncertainties related to our pharmacy operations and the pharmacy and pharmaceutical business in general;

and physician interest in and market acceptance of our current and any future formulations and compounding pharmacies generally. These

and additional risks and uncertainties are more fully described in Harrow’s filings with the Securities and Exchange Commission

(“SEC”), including its Annual Report on Form 10-K and its Quarterly Reports on Form 10-Q. Such documents may be read free

of charge on the SEC’s web site at sec.gov. Undue reliance should not be placed on forward-looking statements, which speak

only as of the date they are made. Except as required by law, Harrow undertakes no obligation to update any forward-looking statements

to reflect new information, events, or circumstances after the date they are made, or to reflect the occurrence of unanticipated events.

Contacts:

| Investors |

Media |

| |

|

| Jamie Webb |

Deb Holliday |

| Director of Communications and Investor Relations |

Holliday Communications, Inc. |

| jwebb@harrowinc.com |

deb@hollidaycommunications.net |

| 615-733-4737 |

412-877-4519 |

| HROW Acquires Santen’s Branded Ophthalmic Portfolio |

| Page 3 |

| July 18, 2023 |

Information

for U.S. Products:

About

FLAREX® (fluorometholone acetate ophthalmic suspension) 0.1%

INDICATIONS

AND USAGE

FLAREX®

(fluorometholone acetate ophthalmic suspension) 0.1% is indicated for use in the treatment of steroid responsive inflammatory conditions

of the palpebral and bulbar conjunctiva, cornea, and anterior segment of the eye.

CONTRAINDICATIONS

Contraindicated

in acute superficial herpes simplex keratitis, vaccinia, varicella, and most other viral diseases of cornea and conjunctiva; mycobacterial

infection of the eye; fungal diseases; acute purulent untreated infections, which like other diseases caused by microorganisms, may be

masked or enhanced by the presence of the steroid; and in those persons who have known hypersensitivity to any component of this preparation.

SELECT

WARNINGS

FOR

TOPICAL OPHTHALMIC USE. NOT FOR INJECTION. Use in the treatment of herpes simplex infection requires great caution. Prolonged use may

result in glaucoma, damage to the optic nerve, defect in visual acuity and visual field, cataract formation and/or may aid in the establishment

of secondary ocular infections from pathogens due to suppression of host response. Acute purulent infections of the eye may be masked

or exacerbated by presence of steroid medication. Topical ophthalmic corticosteroids may slow corneal wound healing. In those diseases

causing thinning of the cornea or sclera, perforation has been known to occur. If these products are used for 10 days or longer, intraocular

pressure (IOP) should be routinely monitored.

ADVERSE

REACTIONS

Glaucoma

with optic nerve damage, visual acuity and field defects, cataract formation, secondary ocular infection following suppression of host

response, and perforation of the globe may occur.

For

complete product information about FLAREX®, including important safety information, please visit: https://dailymed.nlm.nih.gov/dailymed/drugInfo.cfm?setid=19918ea5-8568-44d6-b8ee-7b2197cee85c.

About

NATACYN® (natamycin ophthalmic suspension) 5%

INDICATIONS

AND USAGE

NATACYN®

(natamycin ophthalmic suspension) 5% is indicated for the treatment of fungal blepharitis, conjunctivitis, and keratitis caused by susceptible

organisms including Fusarium solani keratitis. As in other forms of suppurative keratitis, initial and sustained therapy of fungal

keratitis should be determined by the clinical diagnosis, laboratory diagnosis by smear and culture of corneal scrapings and drug response.

Whenever possible the in vitro activity of natamycin against the responsible fungus should be determined. The effectiveness of natamycin

as a single agent in fungal endophthalmitis has not been established.

CONTRAINDICATIONS

NATACYN®

(natamycin ophthalmic suspension) 5% is contraindicated in individuals with a history of hypersensitivity to any of its components.

SELECT

PRECAUTIONS

General:

FOR TOPICAL OPHTHALMIC USE ONLY — NOT FOR INJECTION. Failure of improvement of keratitis following 7-10 days of administration

of the drug suggests that the infection may be caused by a microorganism not susceptible to natamycin.

| HROW Acquires Santen’s Branded Ophthalmic Portfolio |

| Page 4 |

| July 18, 2023 |

ADVERSE

REACTIONS

The

following events have been identified during post-marketing use of NATACYN ® (natamycin ophthalmic suspension) 5% in clinical practice:

allergic reaction, change in vision, chest pain, corneal opacity, dyspnea, eye discomfort, eye edema, eye hyperemia, eye irritation,

eye pain, foreign body sensation, paresthesia, and tearing.

For

complete product information about NATACYN®, including important safety information, please visit: https://dailymed.nlm.nih.gov/dailymed/drugInfo.cfm?setid=2818fcb8-5bac-41fb-864e-3b598308a428.

About

TOBRADEX® ST (tobramycin and dexamethasone ophthalmic suspension) 0.3%/0.05%

INDICATIONS

AND USAGE

TOBRADEX®

ST ophthalmic suspension is indicated for steroid-responsive inflammatory ocular conditions for which a corticosteroid is indicated and

where superficial bacterial ocular infection or a risk of bacterial ocular infection exists.

CONTRAINDICATIONS

Nonbacterial

Etiology: TOBRADEX® ST, as with other ophthalmic corticosteroids, is contraindicated in most viral diseases of the cornea and

conjunctiva, including epithelial herpes simplex keratitis (dendritic keratitis), vaccinia, and varicella, and also in mycobacterial

infection of the eye and fungal diseases of ocular structures.

Hypersensitivity:

Hypersensitivity to a component of the medication.

SELECT

WARNINGS AND PRECAUTIONS

Intraocular

Pressure Increase: Prolonged use of corticosteroids may result in glaucoma with damage to the optic nerve, defects in visual acuity

and fields of vision. If this product is used for 10 days or longer, intraocular pressure (IOP) should be monitored.

Aminoglycoside

Sensitivity: Sensitivity to topically applied aminoglycosides may occur.

Cataracts:

Use of corticosteroids may result in posterior subcapsular cataract formation.

Delayed

Healing: The use of steroids after cataract surgery may delay healing.

Bacterial

Infections: Prolonged use of corticosteroids may suppress the host response and thus increase the hazard of secondary ocular infections.

Viral

Infections: Use in patients with a history of herpes simplex requires great caution as it may prolong the course and may exacerbate

the severity of many viral infections of the eye (including herpes simplex).

Fungal

Infections: Fungal infections of the cornea are particularly prone to develop coincidentally with long-term local steroid application.

Vision

Blurred: Vision may be temporarily blurred following dosing with TOBRADEX ST. Care should be exercised in operating machinery or

driving a motor vehicle.

Risk

of Contamination: Do not touch the dropper tip of the bottle to any surface, as this may contaminate the contents.

Contact

Lens Use: TOBRADEX® ST contains benzalkonium chloride, an antimicrobial preservative, that may be absorbed by soft contact lenses.

Contact lenses should not be worn during the use of TOBRADEX ST.

| HROW Acquires Santen’s Branded Ophthalmic Portfolio |

| Page 5 |

| July 18, 2023 |

ADVERSE

REACTIONS

Clinical

Trials Experience: The most frequent adverse reactions to topical ocular tobramycin (TOBREX ®) are hypersensitivity and localized

ocular toxicity, including eye pain, eyelids pruritus, eyelid edema, and conjunctival hyperemia. These reactions occur in less than 4%

of patients.

For

complete product information about TOBRADEX® ST, including important safety information, please visit: https://dailymed.nlm.nih.gov/dailymed/drugInfo.cfm?setid=c2d7325e-4f58-5590-e053-2a95a90ace1b.

About

VERKAZIA® (cyclosporine ophthalmic emulsion) 0.1%

INDICATIONS

AND USAGE

VERKAZIA®

ophthalmic emulsion is indicated for the treatment of vernal keratoconjunctivitis (VKC) in children and adults.

ADVERSE

REACTIONS

The

most common adverse reactions reported in greater than 5% of patients were eye pain (12%) and eye pruritus (8%) which were usually transitory

and occurred during instillation.

For

complete product information about VERKAZIA®, including important safety information, please visit: https://dailymed.nlm.nih.gov/dailymed/drugInfo.cfm?setid=c795cd2f-89da-78e3-e053-2a95a90a9422.

About

ZERVIATE® (cetirizine ophthalmic solution) 0.24%

INDICATIONS

AND USAGE

ZERVIATE®

(cetirizine ophthalmic solution) 0.24% is indicated for the treatment of ocular itching associated with allergic conjunctivitis.

SELECT

WARNINGS AND PRECAUTIONS

Contamination

of Tip and Solution: As with any eye drop, care should be taken not to touch the eyelids or surrounding areas with the dropper tip

of the bottle or tip of the single-use container in order to avoid injury to the eye and to prevent contaminating the tip and solution.

Keep the multi-dose bottle closed when not in use. Discard the single-use container after using in each eye.

Contact

Lens Wear: Patients should be advised not to wear a contact lens if their eye is red.

ZERVIATE

should not be instilled while wearing contact lenses.

ADVERSE

REACTIONS

The

most commonly reported adverse reactions occurred in approximately 1–7% of patients treated with either ZERVIATE or vehicle. These

reactions were ocular hyperemia, instillation site pain, and visual acuity reduced.

For

complete product information about ZERVIATE®, including important safety information, please visit: https://dailymed.nlm.nih.gov/dailymed/drugInfo.cfm?setid=3e6fecc1-df71-4c01-a654-f55635617a7f

| HROW Acquires Santen’s Branded Ophthalmic Portfolio |

| Page 6 |

| July 18, 2023 |

Information

for Canadian Products

About

VERKAZIA® (cyclosporine topical ophthalmic emulsion) 0.1% w/v

Verkazia

(cyclosporine) is indicated for treatment of severe vernal keratoconjunctivitis in children from four years of age through adolescence.

For

complete Canadian product information about Verkazia, including important safety information, please visit: https://pdf.hres.ca/dpd_pm/00048991.PDF.

About

Cationorm® PLUS

Cationorm®

PLUS is an ophthalmic sterile preservative-free eye drop emulsion used for:

treatment

of dry eye symptoms: It helps to hydrate, lubricate and protect the ocular surface. It is recommended for the relief of dry eye symptoms

characterized by stinging, itching or burning eyes or by a foreign body sensation (sand, dust, etc.).

treatment

of signs and symptoms of ocular allergy: It is recommended for the relief of ocular allergy symptoms characterized by itching, tearing,

mucous discharge and photophobia, and the protection of the ocular surface (corneal staining improvement). Cationorm® PLUS can be

used in children from four years old.

Do

not use Cationorm® PLUS if you are allergic to any of the components of the product. This product is not intended for treating other

eye conditions. Please consult your doctor or pharmacist if you have any questions. If you currently use other eye drops, you should

wait at least 5 minutes between the administrations of each successive eye drop. It is recommended to use Cationorm® PLUS last.

Cationorm®

PLUS is compatible with all kinds of contact lenses.

In

very rare cases, a transient ocular discomfort such as: eye irritation, eye pain, eye redness, watery eyes, eye discharge, temporarily

blurred vision, eyelids inflammation, eyelids edema or transient discomfort at instillation can appear. These symptoms are also part

of typical symptoms of dry eye disease linked to the underlying existing medical conditions in the patient’s eyes suffering from

dry eye or ocular allergy.

v3.23.2

Cover

|

Jul. 18, 2023 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jul. 18, 2023

|

| Entity File Number |

001-35814

|

| Entity Registrant Name |

HARROW

HEALTH, INC.

|

| Entity Central Index Key |

0001360214

|

| Entity Tax Identification Number |

45-0567010

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

102

Woodmont Blvd.

|

| Entity Address, Address Line Two |

Suite 610

|

| Entity Address, City or Town |

Nashville

|

| Entity Address, State or Province |

TN

|

| Entity Address, Postal Zip Code |

37205

|

| City Area Code |

(615)

|

| Local Phone Number |

733-4730

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock, $0.001 par value per share |

|

| Title of 12(b) Security |

Common

Stock, $0.001 par value per share

|

| Trading Symbol |

HROW

|

| Security Exchange Name |

NASDAQ

|

| 8.625% Senior Notes due 2026 |

|

| Title of 12(b) Security |

8.625%

Senior Notes due 2026

|

| Trading Symbol |

HROWL

|

| Security Exchange Name |

NASDAQ

|

| 11.875% Senior Notes due 2027 |

|

| Title of 12(b) Security |

11.875%

Senior Notes due 2027

|

| Trading Symbol |

HROWM

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=HROW_CommonStock0.001ParValuePerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=HROW_Sec8.625SeniorNotesDue2026Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=HROW_Sec11.875SeniorNotesDue2027Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

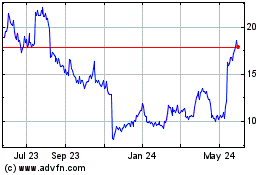

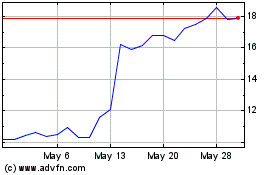

Harrow (NASDAQ:HROW)

Historical Stock Chart

From Apr 2024 to May 2024

Harrow (NASDAQ:HROW)

Historical Stock Chart

From May 2023 to May 2024