Research Alert: Four out of Five Companies Can’t Forecast Cash Flow, Study from the Hackett Group/ REL and the NACT Reveals

July 16 2009 - 9:30AM

Business Wire

Four out of five of the world�s largest companies are unable to

accurately forecast mid-term cash flow, according to a new study

from The Hackett Group, Inc. (NASDAQ:HCKT), its REL working capital

division, and the National Association of Corporate Treasurers

(NACT).

This uncertainty creates a potentially dangerous scenario when

combined with shrinking levels of cash on hand in most industries,

plummeting revenues, reduced margins, and limited availability of

credit and cash from other external sources.

The Hackett study found that only 22 percent of companies say

they can forecast mid-term (2-3 months out) operating cash flow to

within 5 percent accuracy. Previous Hackett research also showed

that only one in three companies can forecast earnings to within 5

percent accuracy, and less than half can make the same claim about

sales forecasting.

Top performers do significantly better than their peers. A total

of 74 percent are able to forecast mid-term cash within 5 percent

accuracy. These top performers also complete their forecasts in

less than half the time it takes typical companies, and require

fewer staff to complete the process.

Several major findings from the study looked at how companies

must improve organizational collaboration and alignment and the

underlying technologies that support cash forecasting.

Specifically, about 70 percent of all companies surveyed rely

almost exclusively on standalone spreadsheets as their primary cash

forecasting tool, with few turning to best-of-breed applications or

ERP-related systems. The best companies also have cross-functional

teams with significant operational involvement, which is critical

given the number of groups outside of finance that have a role in

the forecasting process. Top performers drive greater effectiveness

by achieving much higher levels of intimacy with customers and

suppliers, developing a better understanding of their customersďż˝

financial positions, and conducting more frequent credit reviews.

They also have more structured, interactive customer and supplier

dispute processes in place.

A related Hackett survey also found that while forecast accuracy

is measured by most companies, 80 percent don�t set accuracy

targets and 85 percent don�t have any form of incentives in place

to promote improved forecasting accuracy.

The study identified several other best practice areas where top

performing companies focus to improve their ability to forecast

cash flow. Performance management is one area where the best

companies excel. Top performers are much more likely to rely on an

array of analytical techniques to turn cash forecasting information

into business insight. They look at operational leading indicators

and macroeconomic assumptions 40 percent more often than typical

companies, are 62 percent more likely to rely on best/worst case

assumptions, and turn to what-if analyses 79 percent more

frequently.

Top performers also provide more detail to their analysis, and

are about 50 percent more likely to offer a range of numbers,

footnotes, and scenario analysis as part of their forecast.

The study is based on responses from 85 US and European

companies with average revenue of over $12 billion.

�It�s disturbing to think that most companies are virtually

flying blind in this critical area,ďż˝ said Hackett Chief Research

Officer Michel Janssen. �This problem is by no means a new one. But

it�s been exacerbated by the current economic climate, where it�s

more critical than ever for companies to be able to understand and

predict their cash flow from operations.ďż˝

According to REL President Mark Tennant, �The bottom line is

simple -- you can miss the mark on sales or earnings forecasts

occasionally and survive. But you can only run out of cash once.

This study clearly details the practices and procedures that

companies can use to avoid a calamity and get a handle on this key

area. Companies would be well advised to consider whether they�re

leaders or laggards here, and how they can make changes to improve

cash forecasting accuracy.ďż˝

Selected portions of this research are available free, with

registration, at the following URL:

www.thehackettgroup.com/forecastingcash.

About The Hackett Group

The Hackett Group, Inc. (NASDAQ: HCKT), a global strategic

advisory firm, is a leader in best practice advisory, benchmarking,

and transformation consulting services, including shared services,

offshoring and outsourcing advice. Utilizing best practices and

implementation insights from more than 4,000 benchmarking

engagements, executives use Hackett's empirically based approach to

quickly define and prioritize initiatives to enable world-class

performance. Through its REL brand, Hackett offers working capital

solutions focused on delivering significant cash flow improvements.

Through its Hackett Technology Solutions group, Hackett offers

business application consulting services that helps maximize

returns on IT investments. Hackett has worked with 2,700 major

corporations and government agencies, including 97% of the Dow

Jones Industrials, 73% of the Fortune 100, 73% of the DAX 30 and

45% of the FTSE 100.

Founded in 1991, The Hackett Group was acquired by Answerthink,

Inc. in 1997. Answerthink was renamed The Hackett Group, Inc. in

2008. The Hackett Group has global offices in the United States,

Europe and Asia/Pacific.

More information on The Hackett Group is available: by phone at

(770) 225-7300; by e-mail at info@thehackettgroup.com; or on the

Web at www.thehackettgroup.com.

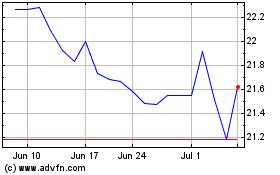

Hackett (NASDAQ:HCKT)

Historical Stock Chart

From Dec 2024 to Jan 2025

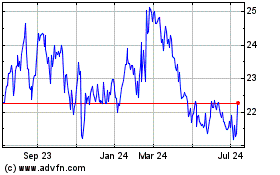

Hackett (NASDAQ:HCKT)

Historical Stock Chart

From Jan 2024 to Jan 2025