Huazhu Group Limited Announces Preliminary Results for Hotel Operations in the First Quarter of 2022

April 28 2022 - 7:15AM

Huazhu Group Limited (NASDAQ: HTHT and HKEX: 1179) (“Huazhu”, “we”

or “our”), a world-leading hotel group, today announced preliminary

results for hotel operations in the first quarter (“Q1 2022”) ended

March 31, 2022.

COVID-19 update For our

Legacy-Huazhu business, RevPAR recovery in the first two months of

2022 was on track. Nevertheless, such recovery was significantly

interrupted by the large-scale outbreak of the Omicron variant in

over 30 provinces in China since early-March 2022. Many cities,

such as Shanghai and Jilin, have been subject to lockdown since

then, which resulted in a sharp decline of both business and

leisure traveling activities. However, such outbreak led to a rise

in demand for hotels to serve the quarantine needs of infected

persons or those in close contact with infected persons, as well as

the accommodation needs of medical teams and delivery riders. As

the Omicron variant is highly infectious, there are still

uncertainties in terms of the impact on our Legacy-Huazhu business

in the near-term. To mitigate risks, we are now implementing

several costs and cash flow management measures.

Steigenberger Hotels AG and its subsidiaries

(“DH”, or “Legacy-DH”) have been experiencing continuous RevPAR

recovery since Germany unfolded its opening-up plan in mid-February

2022. RevPAR in March 2022 recovered to 65% of the 2019 level, as

compared to only 47% of the 2019 level in January 2022. However,

since RevPAR recovery is still at an early stage, a comprehensive

cash flow improvement program remains critical. Therefore, DH will

continuously focus on efficiency improvements, negotiation of

further lease waivers, and personnel cost optimization.

Operating Results:

Legacy-Huazhu(1)

|

|

Number of hotels |

|

Number of rooms |

|

|

Openedin Q1 2022 |

Closed(2)in

Q1 2022 |

Net addedin Q1 2022 |

As ofMarch 31,

2022(3) |

|

As ofMarch 31, 2022 |

|

|

|

|

Leased and owned hotels |

3 |

(12 |

) |

(9 |

) |

653 |

|

91,163 |

|

Manachised and franchised hotels |

299 |

(128 |

) |

171 |

|

7,215 |

|

649,330 |

|

Total |

302 |

(140 |

) |

162 |

|

7,868 |

|

740,493 |

|

(1) Legacy-Huazhu refers to Huazhu and its subsidiaries,

excluding DH.(2) The reasons for hotel closures mainly

included non-compliance with our brand standards, operating losses,

and property-related issues. In Q1 2022, we temporarily closed 9

hotels for brand upgrade and business model change

purposes.(3) As of March 31, 2022,1299 hotels were

requisitioned by governmental authorities. |

|

|

As of March 31, 2022 |

|

|

Number of hotels |

Unopened hotels in pipeline |

|

Economy hotels |

4,810 |

937 |

|

Leased and owned hotels |

387 |

4 |

|

Manachised and franchised hotels |

4,423 |

933 |

|

Midscale and upscale hotels |

3,058 |

1,289 |

|

Leased and owned hotels |

266 |

19 |

|

Manachised and franchised hotels |

2,792 |

1,270 |

|

Total |

7,868 |

2,226 |

|

Operational hotels excluding hotels under

requisition |

|

|

For the quarter ended |

|

|

|

March 31, |

December 31, |

March 31, |

yoy |

|

|

2021 |

2021 |

2022 |

change |

|

Average daily room rate (in RMB) |

|

|

|

|

Leased and owned hotels |

243 |

|

286 |

|

263 |

|

8.0 |

% |

|

Manachised and franchised hotels |

203 |

|

232 |

|

218 |

|

7.5 |

% |

|

Blended |

209 |

|

239 |

|

224 |

|

7.2 |

% |

|

Occupancy Rate (as a percentage) |

|

|

|

|

Leased and owned hotels |

64.0 |

% |

67.4 |

% |

56.7 |

% |

-7.3p.p. |

|

Manachised and franchised hotels |

66.6 |

% |

68.4 |

% |

59.6 |

% |

-7.0p.p. |

|

Blended |

66.2 |

% |

68.2 |

% |

59.2 |

% |

-7.0p.p. |

|

RevPAR (in RMB) |

|

|

|

|

|

Leased and owned hotels |

156 |

|

193 |

|

149 |

|

-4.4 |

% |

|

Manachised and franchised hotels |

135 |

|

159 |

|

130 |

|

-3.8 |

% |

|

Blended |

138 |

|

163 |

|

132 |

|

-4.1 |

% |

|

|

For the quarter ended |

|

|

March 31, |

March 31, |

yoy |

|

|

2019 |

2022 |

change |

|

Average daily room rate (in RMB) |

|

|

|

Leased and owned hotels |

258 |

|

263 |

|

1.9 |

% |

|

Manachised and franchised hotels |

211 |

|

218 |

|

3.2 |

% |

|

Blended |

221 |

|

224 |

|

1.2 |

% |

|

Occupancy Rate (as a percentage) |

|

|

|

Leased and owned hotels |

83.6 |

% |

56.7 |

% |

-27.0p.p. |

|

Manachised and franchised hotels |

79.8 |

% |

59.6 |

% |

-20.3p.p. |

|

Blended |

80.6 |

% |

59.2 |

% |

-21.4p.p. |

|

RevPAR (in RMB) |

|

|

|

|

Leased and owned hotels |

216 |

|

149 |

|

-31.0 |

% |

|

Manachised and franchised hotels |

169 |

|

130 |

|

-23.0 |

% |

|

Blended |

178 |

|

132 |

|

-25.7 |

% |

|

Same-hotel operational data by class |

|

|

|

|

|

|

|

|

|

Mature hotels in operation for more than 18 months

(excluding hotels under requisition) |

|

|

Number of hotels |

Same-hotel RevPAR |

Same-hotel ADR |

Same-hotel Occupancy |

|

|

As ofMarch 31, |

For the quarter |

yoy |

For the quarter |

yoy |

For the quarter |

yoy |

|

|

endedMarch 31, |

change |

endedMarch 31, |

change |

endedMarch 31, |

change |

|

|

2021 |

2022 |

2021 |

2022 |

|

2021 |

2022 |

|

2021 |

|

2022 |

|

(p.p.) |

|

Economy hotels |

3320 |

3320 |

115 |

105 |

-8.5 |

% |

161 |

167 |

4.0 |

% |

71.5 |

% |

62.9 |

% |

-8.6 |

|

Leased and owned hotels |

380 |

380 |

121 |

114 |

-6.5 |

% |

177 |

186 |

4.9 |

% |

68.4 |

% |

61.0 |

% |

-7.4 |

|

Manachised and franchised hotels |

2940 |

2940 |

114 |

104 |

-8.9 |

% |

158 |

164 |

3.8 |

% |

72.0 |

% |

63.2 |

% |

-8.8 |

|

Midscale and upscale hotels |

1905 |

1905 |

181 |

164 |

-9.4 |

% |

281 |

289 |

2.7 |

% |

64.4 |

% |

56.8 |

% |

-7.6 |

|

Leased and owned hotels |

229 |

229 |

201 |

187 |

-7.3 |

% |

339 |

352 |

4.0 |

% |

59.4 |

% |

53.0 |

% |

-6.4 |

|

Manachised and franchised hotels |

1676 |

1676 |

177 |

160 |

-9.9 |

% |

271 |

277 |

2.3 |

% |

65.5 |

% |

57.7 |

% |

-7.8 |

|

Total |

5225 |

5225 |

144 |

131 |

-8.9 |

% |

210 |

218 |

3.5 |

% |

68.4 |

% |

60.2 |

% |

-8.2 |

|

|

|

|

Number of hotels |

Same-hotel RevPAR |

Same-hotel ADR |

Same-hotel Occupancy |

|

|

As ofMarch 31, |

For the quarter |

yoy |

For the quarter |

yoy |

For the quarter |

yoy |

|

|

endedMarch 31, |

change |

endedMarch 31, |

change |

endedMarch 31, |

change |

|

|

2019 |

2022 |

2019 |

2022 |

|

2019 |

2022 |

|

2019 |

|

2022 |

|

(p.p.) |

|

Economy hotels |

2024 |

2024 |

160 |

104 |

-34.9 |

% |

183 |

167 |

-8.7 |

% |

87.5 |

% |

62.4 |

% |

-25.1 |

|

Leased and owned hotels |

358 |

358 |

177 |

111 |

-37.4 |

% |

200 |

182 |

-9.0 |

% |

88.2 |

% |

60.7 |

% |

-27.5 |

|

Manachised and franchised hotels |

1666 |

1666 |

155 |

102 |

-34.1 |

% |

178 |

162 |

-8.6 |

% |

87.3 |

% |

62.9 |

% |

-24.4 |

|

Midscale and upscale hotels |

795 |

795 |

251 |

155 |

-38.1 |

% |

324 |

288 |

-11.1 |

% |

77.3 |

% |

53.8 |

% |

-23.5 |

|

Leased and owned hotels |

170 |

170 |

304 |

171 |

-43.9 |

% |

383 |

332 |

-13.1 |

% |

79.4 |

% |

51.3 |

% |

-28.1 |

|

Manachised and franchised hotels |

625 |

625 |

231 |

149 |

-35.4 |

% |

302 |

273 |

-9.7 |

% |

76.5 |

% |

54.7 |

% |

-21.8 |

|

Total |

2819 |

2819 |

191 |

122 |

-36.2 |

% |

227 |

205 |

-9.9 |

% |

84.0 |

% |

59.4 |

% |

-24.6 |

Operating Results:

Legacy-DH(4)

|

|

Number of hotels |

|

Number ofrooms |

|

Unopened hotelsin pipeline |

|

|

Openedin Q1 2022 |

Closedin Q1 2022 |

Net addedin Q1 2022 |

As ofMarch 31,

2022(5) |

|

As ofMarch 31,2022 |

|

As ofMarch 31,2022 |

|

|

|

Leased hotels |

1 |

- |

|

1 |

|

77 |

|

14,472 |

|

29 |

|

Manachised and franchised hotels |

- |

(5 |

) |

(5 |

) |

43 |

|

9,894 |

|

16 |

|

Total |

1 |

(5 |

) |

(4 |

) |

120 |

|

24,366 |

|

45 |

|

(4) Legacy-DH refers to DH.(5) As of March

31, 2022, a total of 3 hotels were temporarily closed. 1 hotel was

closed for renovation and 1 hotel was closed due to flood damage.

Additionally, 1 hotel was temporarily closed due to low

demand. |

|

|

For the quarter ended |

|

|

|

March 31, |

December 31, |

March 31, |

yoy |

|

|

2021 |

2021 |

2022 |

change |

|

Average daily room rate (in EUR) |

|

|

|

|

|

Leased hotels |

77.9 |

|

95.4 |

|

90.0 |

|

15.6 |

% |

|

Manachised and franchised hotels |

59.0 |

|

92.8 |

|

85.5 |

|

44.9 |

% |

|

Blended |

68.5 |

|

94.2 |

|

88.0 |

|

28.4 |

% |

|

Occupancy rate (as a percentage) |

|

|

|

|

|

Leased hotels |

14.6 |

% |

42.8 |

% |

34.1 |

% |

+19.5 p.p. |

|

Managed and franchised hotels |

26.5 |

% |

50.7 |

% |

44.0 |

% |

+17.5 p.p. |

|

Blended |

18.8 |

% |

46.1 |

% |

38.0 |

% |

+19.2 p.p. |

|

RevPAR (in EUR) |

|

|

|

|

|

Leased hotels |

11.4 |

|

40.9 |

|

30.7 |

|

169.6 |

% |

|

Managed and franchised hotels |

15.6 |

|

47.1 |

|

37.6 |

|

141.0 |

% |

|

Blended |

12.9 |

|

43.4 |

|

33.4 |

|

158.8 |

% |

Hotel Portfolio by Brand

|

|

As of March 31, 2022 |

|

|

Hotels |

Rooms |

Unopened hotels |

|

|

in operation |

in pipeline |

|

Economy hotels |

4,824 |

388,174 |

951 |

|

HanTing Hotel |

3,096 |

277,885 |

608 |

|

Hi Inn |

447 |

24,682 |

117 |

|

Ni Hao Hotel |

83 |

5,772 |

178 |

|

Elan Hotel |

965 |

55,421 |

2 |

|

Ibis Hotel |

219 |

22,751 |

32 |

|

Zleep Hotels |

14 |

1,663 |

14 |

|

Midscale hotels |

2,554 |

281,168 |

977 |

|

Ibis Styles Hotel |

82 |

8,522 |

17 |

|

Starway Hotel |

544 |

44,740 |

202 |

|

JI Hotel |

1,449 |

173,866 |

534 |

|

Orange Hotel |

449 |

49,231 |

216 |

|

CitiGO Hotel |

30 |

4,809 |

8 |

|

Upper midscale hotels |

472 |

69,267 |

270 |

|

Crystal Orange Hotel |

148 |

19,793 |

65 |

|

Manxin Hotel |

91 |

8,705 |

54 |

|

Madison Hotel |

41 |

6,164 |

56 |

|

Mercure Hotel |

128 |

21,697 |

53 |

|

Novotel Hotel |

15 |

4,032 |

16 |

|

IntercityHotel(6) |

49 |

8,876 |

26 |

|

Upscale hotels |

115 |

20,691 |

62 |

|

Jaz in the City |

3 |

587 |

1 |

|

Joya Hotel |

9 |

1,760 |

- |

|

Blossom House |

36 |

1,793 |

34 |

|

Grand Mercure Hotel |

7 |

1,485 |

6 |

|

Steigenberger Hotels & Resorts(7) |

53 |

13,889 |

13 |

|

MAXX(8) |

7 |

1,177 |

8 |

|

Luxury hotels |

15 |

2,327 |

4 |

|

Steigenberger Icon(9) |

9 |

1,848 |

2 |

|

Song Hotels |

6 |

479 |

2 |

|

Others |

8 |

3,232 |

7 |

|

Other hotels(10) |

8 |

3,232 |

7 |

|

Total |

7,988 |

764,859 |

2,271 |

(6) As of March 31, 2022, 2

operational hotels and 9 pipeline hotels of IntercityHotel were in

China.(7) As of March 31, 2022, 11 operational hotels

and 5 pipeline hotels of Steigenberger Hotels & Resorts were in

China.(8) As of March 31, 2022, 2 operational hotels and

7 pipeline hotels of MAXX were in China.(9) As of March

31, 2022, 3 operational hotels and 1 pipeline hotel of

Steigenberger Icon were in China.(10) Other hotels

include other partner hotels and other hotel brands in Yongle

Huazhu Hotel & Resort Group (excluding Steigenberger Hotels

& Resorts and Blossom House).About Huazhu Group

LimitedOriginated in China, Huazhu Group Limited is a

world-leading hotel group. As of March 31, 2022, Huazhu

operated 7,988 hotels with 764,859 rooms in operation in 17

countries. Huazhu’s brands include Hi Inn, Elan Hotel, HanTing

Hotel, JI Hotel, Starway Hotel, Orange Hotel, Crystal Orange Hotel,

Manxin Hotel, Madison Hotel, Joya Hotel, Blossom House, Ni Hao

Hotel, CitiGO Hotel, Steigenberger Hotels & Resorts, MAXX, Jaz

in the City, IntercityHotel, Zleep Hotels, Steigenberger Icon and

Song Hotels. In addition, Huazhu also has the rights as master

franchisee for Mercure, Ibis and Ibis Styles, and

co-development rights for Grand Mercure and Novotel, in the

pan-China region.

Huazhu’s business includes leased and owned,

manachised and franchised models. Under the lease and ownership

model, Huazhu directly operates hotels typically located on leased

or owned properties. Under the manachise model, Huazhu manages

manachised hotels through the on-site hotel managers that Huazhu

appoints, and Huazhu collects fees from franchisees. Under the

franchise model, Huazhu provides training, reservations and support

services to the franchised hotels, and collects fees from

franchisees but does not appoint on-site hotel managers. Huazhu

applies a consistent standard and platform across all of its

hotels. As of March 31, 2022, Huazhu operates 14 percent of

its hotel rooms under lease and ownership model, and 86 percent

under manachise and franchise models.

For more information, please visit Huazhu’s

website: http://ir.huazhu.com.

Safe Harbor Statement Under the U.S. Private

Securities Litigation Reform Act of 1995: The information in this

release contains forward-looking statements which involve risks and

uncertainties. Such factors and risks include our anticipated

growth strategies; our future results of operations and financial

condition; economic conditions; the regulatory environment; our

ability to attract and retain customers and leverage our brands;

trends and competition in the lodging industry; the expected growth

of demand for lodging; and other factors and risks detailed in our

filings with the U.S. Securities and Exchange Commission. Any

statements contained herein that are not statements of historical

fact may be deemed to be forward-looking statements, which may be

identified by terminology such as “may,” “should,” “will,”

“expect,” “plan,” “intend,” “anticipate,” “believe,” “estimate,”

“predict,” “potential,” “forecast,” “project” or “continue,” the

negative of such terms or other comparable terminology. Readers

should not rely on forward-looking statements as predictions of

future events or results.

Huazhu undertakes no obligation to update or

revise any forward-looking statements, whether as a result of new

information, future events or otherwise, unless required by

applicable law.

Contact InformationHuazhu Investor RelationsTel:

86 (21) 6195 9561Email: ir@huazhu.comhttp://ir.huazhu.com

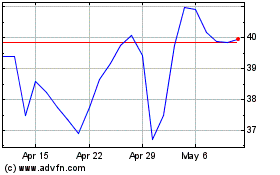

H World (NASDAQ:HTHT)

Historical Stock Chart

From Oct 2024 to Nov 2024

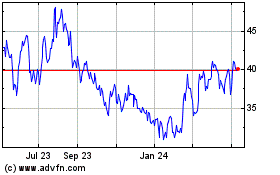

H World (NASDAQ:HTHT)

Historical Stock Chart

From Nov 2023 to Nov 2024