GoPro, Chip Supplier Ambarella Shares Tumble

September 02 2015 - 11:20AM

Dow Jones News

Shares of GoPro Inc. tumbled in morning trading Wednesday after

comments from its key chip supplier, Ambarella Inc., stoked fears

that wearable-camera sales are on the decline.

Ambarella, which makes image-processing chips for GoPro cameras,

noted on a conference call to discuss its second-quarter earnings

Tuesday that it expects chip shipments related to the wearables

market will be down in the third quarter, both sequentially and

compared to the prior year, due to a lack of product launches.

The comments sent shares of both companies sliding and prompted

analysts to cut their earnings forecasts for GoPro.

Shares of GoPro were recently down 10% to $39.30 a share, the

stock's lowest point since March. Ambarella shares fell 14% to

$77.47 a share, as the wearables outlook masked an otherwise strong

second quarter.

A GoPro spokesperson didn't immediately respond to request for

comment.

Ambarella said new products are typically launched in the third

quarter, in time for the holidays, but GoPro in June and July of

this year introduced two new products—the Hero+ LCD and Hero4

Session cameras.

Stifel analysts noted that those products have been well

received but aren't necessarily driving significant growth, and

year-over-year comparisons will be tough due to the upcoming

anniversary of the launch of GoPro's Hero4 camera line. Stifel

maintained its third-quarter outlook for GoPro but trimmed its

guidance for the fourth quarter.

For the upcoming 2016 fiscal year, Stifel said it will take a

"more conservative view...given concerns about potentially

decelerating trends for the category."

Though Amabarella's forecasts were specific to the current

quarter, the guidance has sparked concerns that the wearable camera

segment is declining faster than previously expected.

Raymond James analyst Tavis McCourt said in a note that he has

expected action camera sales to slow, but for GoPro to make up for

those declines with growth in quadcopters and drones. But without a

new camera for people to upgrade to during the holiday season, Mr.

McCourt said camera segment declines could accelerate.

Mr. McCourt cut his 2015 earnings forecast for GoPro to $1.60

from $1.73 a share, citing a weaker-than-expected fourth quarter,

and lowered his 2016 forecast to $2 from $2.35 a share citing

slowing action camera growth.

He also lowered his price target on GoPro shares by 30% to

$50.

On Tuesday, a report from Cleveland Research analyst Benjamin

Bollin warned that there could be risks to GoPro's forthcoming

third-quarter results.

The research report, which sent shares of GoPro and Ambarella

lower Tuesday, said demand for GoPro's items appears to be falling

below the company's estimates.

GoPro went public in June 2014 and has seen sales surge recently

amid big gains in Europe and Asia. Though GoPro's shares are now

trading at less than half their all-time high of $98.47 reached

last October, they are still well above their IPO price of $24 a

share.

Write to Chelsey Dulaney at Chelsey.Dulaney@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

September 02, 2015 11:05 ET (15:05 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

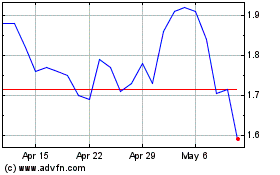

GoPro (NASDAQ:GPRO)

Historical Stock Chart

From Jun 2024 to Jul 2024

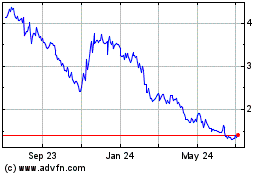

GoPro (NASDAQ:GPRO)

Historical Stock Chart

From Jul 2023 to Jul 2024