Thermo Fisher to Acquire One Lambda - Analyst Blog

July 17 2012 - 10:30AM

Zacks

Within one year of the Phadia

acquisition (for €2.47 billion), in August 2011, which strengthened

the company’s Specialty Diagnostics business, Thermo

Fisher Scientific (TMO) yet again announced another

strategic move to diversify its offerings. The company has decided

to acquire California based One Lambda, the global leader in the

filed of transplant diagnostics, for $925 million in cash.

The deal value is inclusive of the

cost of a three-year benefit program undertaken by One Lambda for

its key employees, amounts payable to some shareholders for

noncompetetion agreements and other contingent payments.

One Lambda

& Transplant Diagnostic

Founded in 1984, One Lambda’s

diagnostic tests are used by transplant centers for tissue typing.

This determines the compatibility of donors and recipients before

the transplant is done in addition to identification of antibodies

that can lead to transplant rejection.

As per the company, transplant

diagnostics is an attractive market, valued at $480 million in

2011, and growing in the mid- to high-single digits. The potential

for growth in this market is very high given the increasing global

demand for transplant procedures, increasing utilization (tests per

patient), and growing use of post-transplant antibody monitoring.

New evidence shows improved graft survival on continued antibody

monitoring.

One Lambda, with 320 employees,

recorded $182 million in revenues in 2011. With a wide customer

base (1,400), One Lambda derived 49% of its revenues from antibody

detection, 44% from human leukocyte antigen ("HLA") typing and the

rest from serology. Thermo Fisher expects to leverage its extensive

network in the emerging markets to drive uptake of One Lambda’s

portfolio of tests, which is currently marketed in the US (59%) and

Europe (21%).

Deal Funding &

Synergies

Thermo Fisher expects the

transaction to close in the fourth quarter of the current fiscal.

The deal is expected to be immediately accretive and add 9−11 cents

per share to the company’s adjusted earnings in 2013. It would also

generate greater tax efficiencies, and revenue and cost synergies

leading to an adjusted operating income benefit of about $15

million in 2015.

For now, the transaction will be

funded partly by the company’s existing cash balance and through

new debt financing. Thermo Fisher exited the first quarter of 2012

with $788.3 million in cash and cash equivalents compared with

$1,016.3 million at the end of fiscal 2011. The company’s

outstanding debt at quarter end was $6.7 billion.

Moody’s

Downgrades

Besides the acquisition, the

company announced an additional $500 million of stock repurchase

authorization, through December 2012. As of June 30, 2012, the

company had $250 million remaining under its existing share

repurchase authorization, which expires on November 9, 2012.

Although the debt burden will increase with the proposed

acquisition, we believe that the company will be able to deal with

it given its steady top-line growth and strong cash flow.

Rating agency, Moody’s, has however

downgraded the senior unsecured rating and all rated senior

unsecured notes of Thermo Fisher Scientific by one-notch to Baa1

from A3 with a stable rating outlook. Moody's expects the company

to incur an incremental $1.3 billion of debt to fund the

acquisition and repurchase shares. The agency expressed its concern

over the company’s strategy of funding acquisitions through

financial leverage and rewarding shareholders through share

buybacks and dividends.

Diagnostics Deals at

Large

The year 2012 has witnessed several

major deals in the diagnostics space. Agilent Technologies

Inc. (A) recently completed its acquisition of a Danish

cancer diagnostics company, Dako, for $2.2 billion (on a debt-free

basis). In addition, Hologic (HOLX), a prominent

player in the field of women’s health, is in the process of

acquiring Gen-Probe (GPRO). The deal is expected

to close next month. This will entrench Hologic’s presence in the

molecular diagnostics space.

We currently have a Neutral

recommendation on Thermo Fisher. The stock retains a Zacks #3 Rank

(Hold) in the short term.

AGILENT TECH (A): Free Stock Analysis Report

GEN-PROBE INC (GPRO): Free Stock Analysis Report

HOLOGIC INC (HOLX): Free Stock Analysis Report

THERMO FISHER (TMO): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

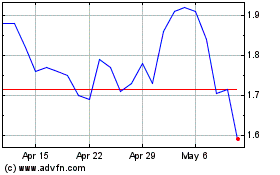

GoPro (NASDAQ:GPRO)

Historical Stock Chart

From Jun 2024 to Jul 2024

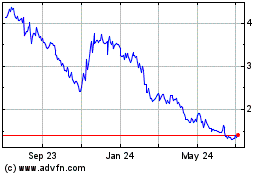

GoPro (NASDAQ:GPRO)

Historical Stock Chart

From Jul 2023 to Jul 2024