Gen-Probe Remains Neutral - Analyst Blog

May 25 2012 - 8:15AM

Zacks

We reiterate our Neutral rating on

Gen-Probe Inc. (GPRO). Its first-quarter 2012

adjusted earnings of 55 cents per share beat the Zacks Consensus

Estimate of 51 cents. Revenues of $153.4 million were ahead of the

Zacks Consensus Estimate of $151 million.

Product sales increased 9% as

healthy sales across Blood Screening and Clinical Diagnostics

franchises were partially offset by lower revenues from the

Research Products and Services and Collaborative Research

businesses.

Revenues from Clinical Diagnostics

segment grew 7% (up 8% in constant currency) year over year, led by

strong sales of APTIMA Combo 2, APTIMA HPV and APTIMA Trichomonas

assays. Blood Screening sales rose 12% (up 13% in constant

currency) in the quarter, driven by higher shipping of TIGRIS

devices to the company’s partner Novartis (NVS).

Gen-Probe, in May 2012, received

the U.S. Food and Drug Administration’s (FDA) approval to launch

its fully-automated molecular testing platform, PANTHER. The system

has been given the initial approval to be used with its

market-leading chlamydia and gonorrhea test APTIMA COMBO 2. The

PANTHER system is expected to significantly contribute to the

company’s revenue growth in the coming years as it broadens the

testing menu for the instrument.

Gen-Probe recently announced that

women’s healthcare major, Hologic Inc. (HOLX) will buy it for $3.7

billion (or $82.75 a share). The transaction is expected to be

completed by second half of 2012, subject to certain clearances and

approval of Gen-Probe’s shareholders. Gen-Probe believes that the

merger will leverage the women’s Diagnostic product range of both

the companies and thereby, increase the focus on the molecular

diagnostics market. Further, the acquisition will benefit the

shareholders as it will offer additional cash value to their

shares.

However, the merger agreement with

Hologic can also have a negative impact on Gen-Probe’s operations,

in case customers plan to postpone their orders and purchases or

employees decide to resign in the face of acquisition-related

uncertainties. In addition, management’s focus on merger-related

issues might divert their attention away from potential business

plans resulting in failure of quarterly operating outcomes, which

could lead to fall in share prices.

Also, if the merger is not

completed due to some unforeseen circumstances, the company might

run the risk of legal proceedings along with payment of a

termination fee of $128 million to Hologic or reimburse Hologic for

its transaction-related expenses of $20 million.

Gen-Probe’s clinical diagnostics

products are susceptible to considerable reimbursement risks.

Third-party payers are increasingly seeking to curb health care

costs by limiting both coverage and the level of reimbursement for

medical products and services. Any unfavorable change in the

reimbursement policies (or levels) by third-party payers may

materially affect the demand and price levels of Gen-Probe’s

products and its revenues. In the most recent quarter,

collaborative research sales plunged 61% on account of less

reimbursement received from Novartis owing to the development of

the PANTHER instrument.

Gen-Probe is a dominant player in

the rapidly expanding nucleic acid testing (“NAT”) market, the

fastest growing segment in the clinical diagnostic market. It is a

market leader in domestic gonorrhea and chlamydia testing with its

PACE and APTIMA assay product lines. Gen-Probe competes with more

established firms in the molecular diagnostic industry such as

Roche (RHHBY), Becton, Dickinson

(BDX) and Abbott Labs (ABT).

Our recommendation on Gen-Probe is

in tandem with a short-term Zacks #3 Rank (Hold).

ABBOTT LABS (ABT): Free Stock Analysis Report

BECTON DICKINSO (BDX): Free Stock Analysis Report

GEN-PROBE INC (GPRO): Free Stock Analysis Report

HOLOGIC INC (HOLX): Free Stock Analysis Report

NOVARTIS AG-ADR (NVS): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

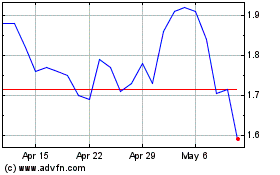

GoPro (NASDAQ:GPRO)

Historical Stock Chart

From Jun 2024 to Jul 2024

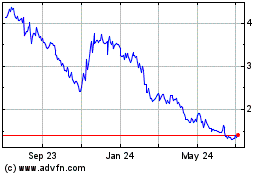

GoPro (NASDAQ:GPRO)

Historical Stock Chart

From Jul 2023 to Jul 2024