Qiagen Expands Its Points of Need - Analyst Blog

May 07 2012 - 1:25PM

Zacks

In an attempt to expand its Point of Need diagnostics portfolio,

Qiagen (QGEN) recently acquired Boston-based

privately owned company AmniSure International. Through the

acquisition, Qiagen will have access to AmniSure’s proprietary

diagnostic test AmniSure assay, which determines rupture of fetal

membranes (ROM), most commonly found in pregnant women.

With roughly 30% of pregnant women undergoing this diagnostic

test in the US, the acquisition of AmniSure will help Qiagen to

widen its scope in in the growing market of woman health. AmniSure

assay will expand Qiagen’s portfolio of test, which include the

Qiagen’s digene HPV Test which has been widely accepted as the

"gold standard" in testing for high-risk types of human

papillomavirus (HPV), primarily responsible for cervical

cancer.

This AmniSure assay earlier received clearance from the US Food

and Drug Administration (FDA) for marketing and is reimbursable

under most of the US state Medicaid plans.

Although the financial terms of the deal were not disclosed,

Qiagen anticipates this acquisition to remain neutral to the

company’s 2012 adjusted EPS, but accretive roughly by 2 cents in

fiscal 2013. Further, Qiagen expects AmniSure to contribute around

$12 million and $24 million to the company’s sales for the

remainder of 2012 and full-year 2013, respectively. However, the

company expects to incur transaction-related one-time charges and

integration costs of $5 million in 2012.

Viewing the substantial potential of the molecular diagnostic

market globally, Qiagen is currently focusing on expanding its

diagnostics products offering. The company currently derives around

50% of its total revenue from this segment, which is likely to

increase with this acquisition. Qiagen has acquired several

companies to expand its product portfolio, the significant ones are

Cellestis and Ipsogen in 2011.

We are encouraged by Qiagen’s focus on strategic initiatives to

drive growth and profitability in the molecular diagnostics market.

Its innovative tests in the genomic/esoteric arena, with a focus on

the high-margin esoteric testing business, are expected to

accelerate the company’s sales growth on the back of growing market

demand, not only domestic but worldwide.

This is also tantalizing several small clinical laboratory

companies who are coming up in this regard with their comprehensive

portfolio of genetic tests.

Major Peers in Molecular Diagnostics Space

Qiagen is facing intense competition in the molecular diagnostic

space, especially from the likes Laboratory Corporation of

America Holdings (LH) and Hologic Inc.

(HOLX). LabCorp has already expanded its area of esoteric testing

and personalized medicine business with the acquisition Genzyme

Genetics.

Also, earlier this month, Hologic decided to acquire

Gen-Probe (GPRO) -- a player in the field of

molecular diagnostics, with special focus on the women’s health

segment.

Currently, Qiagen retains a Zacks #3 Rank (short-term Hold).

Over the long term, we are Neutral on the stock, at par with

LabCorp and Hologic.

GEN-PROBE INC (GPRO): Free Stock Analysis Report

HOLOGIC INC (HOLX): Free Stock Analysis Report

LABORATORY CP (LH): Free Stock Analysis Report

QIAGEN NV (QGEN): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

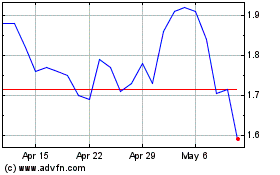

GoPro (NASDAQ:GPRO)

Historical Stock Chart

From Jun 2024 to Jul 2024

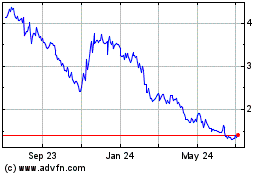

GoPro (NASDAQ:GPRO)

Historical Stock Chart

From Jul 2023 to Jul 2024