Gen-Probe's EPS Trounces, Net Slips - Analyst Blog

February 15 2012 - 7:00AM

Zacks

Diagnostic products maker

Gen-Probe’s (GPRO) fourth-quarter fiscal 2011

adjusted (excluding one-time charges) earnings of 72 cents a share

topped the Zacks Consensus Estimate by 4 cents while exceeded the

year-ago adjusted earnings of 61 cents.

However, the California-based

company’s profit (as reported) plummeted 27% in the quarter to

$19.9 million (or 42 cents a share), hammered by a $12.7 million

charge related to the impairment of goodwill and

intangible assets .

For the full year, adjusted

earnings of $2.34 a share outperformed the Zacks Consensus Estimate

of $2.31 and surpassed the year-ago earnings of $2.19. Profit (as

reported) for the year more than halved year over year to $50.1

million or $1.04 a share.

Revenue

Analysis

Revenues for the quarter surged 16%

year over year to $158.2 million, essentially in line with the

Zacks Consensus Estimate. For the fiscal, sales rose 6% year over

year to $576.2 million, just missing the Zacks Consensus Estimate

of $577 million.

Product sales soared 18% to $155.2

million in the fourth quarter as double-digit growth across

clinical diagnostic and blood screening businesses more than

neutralized the decline in revenues from research products and

services.

Clinical diagnostic revenues spiked

13% year over year to $90.6 million, boosted by higher sales of

APTIMA Combo 2 assay across domestic and overseas markets and GTI

Diagnostics acquisition. However, foreign exchange swings trimmed

sales by roughly $0.1 million. The APTIMA women’s health business

remains the key growth engine for the clinical diagnostic

franchise.

Gen-Probe clocked solid growth in

its blood screening business in the quarter with sales zooming 30%

year over year to $62.1 million, paced by higher shipment of assays

and instruments (including the TIGRIS systems) to Gen-Probe’s

partner Novartis (NVS). Foreign exchange movements

had a favorable impact of $0.2 million on blood screening

sales.

Revenues from research products and

services slid 29% year over year to $2.4 million. Collaborative

research sales tanked 62% year over year to $1.4 million, hurt by

lower funding from Novartis for the development of the fully

automated PANTHER instrument for blood screening.

Gen-Probe expects to launch the

PANTHER system in international blood screening markets in 2012.

Royalty and license revenues dipped 16% to $1.6 million on account

of lower royalties from Novartis associated with the plasma testing

market.

Margins &

Expenses

Gross margin on product sales

slipped to 66.7% in the quarter from 69.4% a year-ago, resulting

from unfavorable sales mix. Total operating expenses jumped 29%

year over year to $128.7 million. Research and development expenses

rose 5% year over year to $28.2 million.

Marketing and sales expenses

climbed 13% to $17.1 million due to the investment in European

commercial infrastructure and addition of GTI Diagnostics. General

and administrative expenses rose 6% to $16.2 million as a result of

the GTI acquisition.

Financial

Health

Gen-Probe ended the fiscal with

cash and cash equivalents and marketable securities of $368

million, down 25% year over year, and short-term debt of $248

million (up 3% year over year). The company generated $53.4 million

in cash flows from operations during the fourth quarter and

invested $7.2 million in capital expenditure, resulting in a free

cash flow of $46.2 million.

The company bought back 1.7 million

shares during the fourth quarter for $100 million, thereby

completing the $100 million repurchase program announced in

November 2011.

Guidance and

Recommendation

Moving ahead, Gen-Probe expects to

register low double-digit organic sales and earnings growth in 2012

on the back of multiple new products (including APTIMA Trichomonas

and APTIMA HPV). The company envisions modest growth in its blood

screening business in 2012 while clinical diagnostic revenues are

expected to be boosted by strong sales from APTIMA Combo 2

assay.

For 2012, Gen-Probe expects

revenues in the range of $630 million to $655 million. Adjusted

earnings per share target for the year have been pegged between

$2.50 and $2.68. The current Zacks Consensus Estimates for 2012

revenue and earnings are $641 million and $2.59, respectively.

Gen-Probe expects operating margin

(on a reported basis) in the band of 24.5% to 26% and adjusted

operating margin of between 26.5% and 28% for 2012. Product gross

margin (both reported and adjusted basis) is expected between of

68% and 69.5%.

For first-quarter 2012, the company

expects sales between $148 million and $152 million and earnings in

the range of 48 cents and 52 cents a share.

Gen-Probe is a dominant player in

the rapidly expanding nucleic acid test (“NAT”) market, the fastest

growing segment of the clinical diagnostic market. It is a

market leader in domestic gonorrhea and chlamydia testing with its

PACE and APTIMA assay product lines.

We believe Gen-Probe is well placed

with a strong cadence of new products that are expected to support

growth in the years ahead. Moreover, Gen-Probe’s PANTHER molecular

testing platform will significantly contribute to its revenues as

it broadens the testing menu for the instrument.

However, Gen-Probe competes with

more established firms such as Roche (RHHBY),

Becton Dickinson (BDX), and Abbott

Labs (ABT) in the maturing molecular diagnostic industry.

Moreover, the company is exposed to foreign exchange headwinds

which may hurt its sales and margins in 2012. Higher tax is also

expected to weigh on its bottom line this year.

Currently, we have a long-term

Neutral recommendation on Gen-Probe, which is in tandem with a

short-term Zacks #3 Rank (Hold).

ABBOTT LABS (ABT): Free Stock Analysis Report

BECTON DICKINSO (BDX): Free Stock Analysis Report

GEN-PROBE INC (GPRO): Free Stock Analysis Report

NOVARTIS AG-ADR (NVS): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

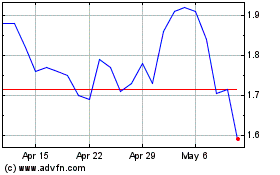

GoPro (NASDAQ:GPRO)

Historical Stock Chart

From Jun 2024 to Jul 2024

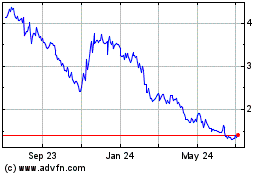

GoPro (NASDAQ:GPRO)

Historical Stock Chart

From Jul 2023 to Jul 2024