-- Company Posts Non-GAAP EPS of $0.47(1), Excluding $0.03 of

Transaction-Related Expenses, and GAAP EPS of $0.44 -- -- Record

STD Sales and Tepnel Acquisition Help Company Establish New

Quarterly Highs for Product Sales and Total Revenues -- --

Operating Activities Generate $31.9 Million of Cash in Quarter --

SAN DIEGO, Calif., Oct. 29 /PRNewswire-FirstCall/ -- Gen-Probe

Incorporated (NASDAQ:GPRO) today reported financial results for the

third quarter of 2009, with record product sales and total revenues

driving non-GAAP earnings per share (EPS) of $0.47. "Gen-Probe

posted very good financial results in the third quarter of 2009,

driven by strong growth in our base STD testing business and

revenue from our recent Tepnel acquisition," said Carl Hull, the

Company's president and chief executive officer. "We also advanced

several strategic priorities by acquiring the infectious disease

company Prodesse, spinning off our industrial testing business, and

initiating two pivotal clinical studies in oncology and women's

health." Comparisons to the third quarter of 2008 were negatively

affected by a one-time, $10.0 million milestone payment in the

prior year period, as described below. In the third quarter of

2009, product sales were $119.0 million, compared to $108.3 million

in the prior year period, an increase of 10%. Compared to the third

quarter of 2008, the stronger US dollar reduced product sales

growth by an estimated $2.5 million, or 2%(2). Total revenues for

the third quarter of 2009 were $122.7 million, compared to $121.2

million in the prior year period, an increase of 1%. Net income was

$23.8 million ($0.47 per share) on a non-GAAP basis in the third

quarter of 2009, compared to $29.1 million ($0.52 per share) in the

prior year period, a decrease of 18% (10% per share). Including

$1.6 million of after-tax expenses ($0.03 per share) related to the

Company's acquisitions of Tepnel and Prodesse and the industrial

spin-off, net income in the third quarter of 2009 was $22.2 million

($0.44 per share) on a GAAP basis. For the first nine months of

2009, product sales were $348.3 million, compared to $323.5 million

in the prior year period, an increase of 8%. Compared to the first

nine months of 2008, the stronger US dollar reduced product sales

growth by an estimated $11.1 million, or 3%. Total revenues for the

first nine months of 2009 were $359.4 million, compared to $363.6

million in the prior year period, a decrease of 1%. Net income was

$74.0 million ($1.43 per share) on a non-GAAP basis in the first

nine months of 2009, compared to $85.8 million ($1.55 per share) in

the prior year period, a decrease of 14% (8% per share). Including

$6.3 million of after-tax expenses ($0.12 per share) related to the

Company's acquisitions of Tepnel and Prodesse and the industrial

spin-off, net income in the first nine months of 2009 was $67.8

million ($1.31 per share) on a GAAP basis. As previously disclosed,

Gen-Probe's total revenues, net income and EPS in the first nine

months of 2008 benefited from a number of non-recurring items. The

two most significant benefits were: -- $16.4 million of royalty and

license revenue ($0.20 of EPS), which was recorded in the first

quarter of 2008 based on the settlement of patent infringement

litigation against Bayer (now Siemens Healthcare Diagnostics). --

$10.0 million of collaborative research revenue ($0.12 of EPS),

which was recorded from the Company's commercial partner, Novartis

Diagnostics, in the third quarter of 2008 based on the full

approval by the US Food and Drug Administration (FDA) of the

PROCLEIX® ULTRIO® assay on the TIGRIS® system. By comparison, the

Company's product sales, total revenues, net income and EPS in the

first nine months of 2009 benefited from $8.2 million of one-time

revenue ($0.10 of EPS) recorded in the first quarter associated

with the previously announced renegotiation of the Company's

collaboration agreement with Novartis Diagnostics. Detailed Results

Gen-Probe's clinical diagnostics sales of $69.6 million in the

third quarter of 2009 benefited from revenue associated with

Tepnel's transplant diagnostics and genetic testing products, and

continued strong growth of the APTIMA Combo 2® assay, an amplified

nucleic acid test (NAT) for simultaneously detecting Chlamydia

trachomatis and Neisseria gonorrhoeae. Clinical diagnostics sales

were negatively affected by the stronger US dollar, which reduced

growth by an estimated $0.8 million, or more than 1%, compared to

the prior year period. In blood screening, product sales of $45.4

million in the third quarter of 2009 were negatively affected by

$7.9 million of lower product shipments to Novartis. This

reduction, which was expected, resulted primarily from: lower US

shipments of the PROCLEIX HIV-1/HCV assay as customers began to

adopt the PROCLEIX ULTRIO assay; lower US shipments of the PROCLEIX

ULTRIO assay due to the post-marketing study in the prior year

period; and lower West Nile virus assay shipments due to previously

discussed ordering patterns. Blood screening sales growth also was

negatively affected by the stronger US dollar, which reduced growth

by an estimated $1.7 million, or 3%. "As we forecast three months

ago, blood screening sales in the third quarter continued to be

affected by negative ordering patterns that outweighed a 1%

increase in underlying donations tested," Mr. Hull said. Sales of

research products and services in the third quarter of 2009 were

$3.9 million. These sales, resulting from the Tepnel acquisition,

were not included in Gen-Probe's prior year results. Third quarter

product sales were, in millions: Three Months Ended Sept. 30,

Change --------------- -------------------- As Constant 2009 2008

Reported Currency ---- ---- -------- -------- Clinical Diagnostics

$69.6 $55.5 25% 27% Blood Screening $45.4 $52.7 -14% -11% Research

Products and Services $3.9 N/A N/A N/A ---- --- --- --- Total

Product Sales $119.0 $108.3 10% 12% Product sales in the first nine

months of 2009 were, in millions: Nine Months Ended Sept. 30,

Change --------------- -------------------- As Constant 2009 2008

Reported Currency ---- ---- -------- -------- Clinical Diagnostics

$196.6 $165.2 19% 21% Blood Screening $144.1 $158.2 -9% -4%

Research Products and Services $7.6 N/A N/A N/A ---- --- --- ---

Total Product Sales $348.3 $323.5 8% 11% Collaborative research

revenues in the third quarter of 2009 were $2.0 million, compared

to $11.3 million in the prior year period. As discussed above, this

significant decrease resulted primarily from a $10.0 million

milestone the Company earned from Novartis in the prior year period

based on the full FDA approval of the PROCLEIX ULTRIO assay on the

TIGRIS system. For the first nine months of 2009, collaborative

research revenues were $5.9 million, compared to $18.5 million in

the prior year period. Royalty and license revenues for the third

quarter of 2009 were $1.8 million, compared to $1.6 million in the

prior year period, an increase of 13%. For the first nine months of

2009, royalty and license revenues were $5.3 million, compared to

$21.6 million in the prior year period. As discussed above, this

significant decrease resulted primarily from $16.4 million of

revenue that was recorded in the first quarter of 2008 associated

with the settlement of Gen-Probe's patent infringement litigation

against Bayer. Gross margin on product sales in the third quarter

of 2009 was 69.5% on a non-GAAP basis that excludes $0.1 million of

acquisition-related depreciation expense, compared to 71.7% in the

prior year period. This decrease resulted primarily from the

stronger US dollar, the addition of Tepnel's generally lower-margin

revenues, and lower sales of blood screening products. For the

first nine months of 2009, gross margin on product sales was 69.1%

on a non-GAAP basis that excludes $0.2 million of

acquisition-related depreciation expense, compared to 70.4% in the

prior year period. On a GAAP basis, gross margin on product sales

was 69.4% in the third quarter of 2009, and 69.0% for the first

nine months of the year. Acquisition-related intangible

amortization expenses were $1.1 million in the third quarter of

2009 and $2.3 million in the first nine months of the year,

compared to $0 in the comparable prior year periods. Research and

development (R&D) expenses in the third quarter of 2009 were

$27.5 million, compared to $24.5 million in the prior year period,

an increase of 12% that resulted primarily from expenses associated

with clinical trials of the Company's HPV, PCA3 and trichomonas

assays, and from the addition of Tepnel's R&D activities. For

the first nine months of 2009, R&D expenses were $78.5 million,

compared to $76.9 million in the prior year period, an increase of

2%. Marketing and sales expenses in the third quarter of 2009 were

$13.5 million, compared to $10.7 million in the prior year period,

an increase of 26% that resulted primarily from the addition of

Tepnel's cost structure, and European sales force expansion and

market development efforts. For the first nine months of 2009,

marketing and sales expenses were $38.5 million, compared to $34.1

million in the prior year period, an increase of 13%. General and

administrative (G&A) expenses in the third quarter of 2009 were

$14.2 million on a non-GAAP basis that excludes $1.1 million of

transaction-related expense, compared to $12.9 million in the prior

year period. This increase of 10% resulted primarily from the

addition of Tepnel's cost structure. For the first nine months of

2009, G&A expenses were $41.0 million on a non-GAAP basis that

excludes $5.9 million of transaction-related expense, compared to

$38.5 million in the prior year period, an increase of 6%. On a

GAAP basis, G&A expenses were $15.2 million in the third

quarter of 2009, up 18% compared to the prior year period, and

$46.9 million for the first nine months of the year, up 22%

compared to the prior year period. Total other income in the third

quarter of 2009 was $4.3 million, compared to $2.2 million in the

prior year period, an increase of 95% that resulted primarily from

a $1.6 million impairment charge in the prior year period

associated with the Company's equity investment in Qualigen, Inc.

For the first nine months of 2009, total other income was $17.4

million, compared to $11.6 million in the prior year period, an

increase of 50% that resulted primarily from investment gains

realized from selling portions of the Company's municipal bond

portfolio. In the third quarter of 2009, Gen-Probe generated net

cash of $31.9 million from its operating activities, substantially

higher than GAAP net income of $22.2 million. The Company spent

$7.6 million on property, plant and equipment in the quarter. In

the third quarter of 2009, the Company repurchased approximately

1.8 million shares of its stock for $69.3 million, completing the

share repurchase program announced in August of 2008. Throughout

the program, the Company repurchased approximately 6.0 million

shares of its common stock for $249.8 million. Gen-Probe continues

to have a strong balance sheet. As of September 30, 2009, the

Company had $517.9 million of cash, cash equivalents and short-term

investments, and $240.8 million of short-term debt. The Company

currently pays interest on substantially all of this debt at a rate

0.6 percent above the one-month London Interbank Offered Rate

(LIBOR), which was recently below 0.3 percent. In October,

Gen-Probe paid approximately $60.0 million to complete its

acquisition of Prodesse. Updated 2009 Financial Guidance In the

table below, Gen-Probe's non-GAAP guidance excludes certain

expenses related to the Tepnel and Prodesse acquisitions, and the

spin-off of the Company's industrial testing business. Current

Previous Current Previous Guidance Guidance Guidance Guidance

(non-GAAP) (non-GAAP) (GAAP) (GAAP) Total revenues $493 to $500

$490 to $503 $493 to $500 $490 to $503 million million million

million Product gross margins ~ 69% 68% to 69% ~ 69% 68% to 69%

Acquisition- related intangibles amortization N/A N/A $3-4 million

$3-4 million R&D expenses ~ 22% ~ 22% ~ 22% ~ 22% Marketing and

sales expenses ~ 11% 10% to 11% ~ 11% 10% to 11% G&A expenses ~

11% 10% to 11% 12% to 13% 11% to 12% Tax rate ~ 34% ~ 34% ~ 34% ~

34% Diluted shares ~ 51.5 million ~ 52 million ~ 51.5 million ~ 52

million EPS $1.90 to $1.93 $1.85 to $1.95 $1.77 to $1.79 $1.73 to

$1.85 Recent Events -- Prodesse Acquisition. On October 22, the

Company announced that it had completed its acquisition of

Prodesse, Inc., a leader in molecular testing for influenza and

other infectious diseases, for approximately $60.0 million in cash.

Gen-Probe's purchase price could increase to up to $85.0 million if

Prodesse achieves certain financial and regulatory milestones in

2010 and 2011. -- EUA for ProFlu-ST(TM). Earlier today, Gen-Probe

announced that the FDA had granted an EUA (emergency use

authorization) for Prodesse's test, ProFlu-ST(TM), to be used in

CLIA high complexity laboratories for the diagnosis of 2009 H1N1

influenza virus infection, aided by an algorithm that relies on

seasonal influenza A/H1 virus and seasonal influenza A/H3 virus

results, from a single sample in individuals who are diagnosed with

influenza A by currently available FDA-cleared or authorized

devices. -- Industrial Spin-Off. On September 14, Gen-Probe

announced that it was spinning off its industrial testing assets

into a new, independent company focused on developing rapid, highly

accurate molecular assays for biopharmaceutical production, water

and food safety testing, and other applications. Gen-Probe owns

19.9% of the new company, Roka Bioscience, Inc. -- Prostate Cancer

Clinical Trial. On August 27, the Company announced that it had

begun a clinical trial intended to secure US regulatory approval of

its PROGENSA® PCA3 assay, a new molecular test that may help

determine the need for a repeat prostate biopsy. -- Trichomonas

Clinical Trial. On August 17, Gen-Probe announced that it had begun

a clinical trial intended to secure US regulatory approval of its

APTIMA® assay for Trichomonas vaginalis on the fully automated

TIGRIS® system. Trichomonas is a common, sexually transmitted

parasite. -- Qiagen Arbitration. In April, Gen-Probe announced that

the Company and Roche had prevailed in the arbitration with Digene

(now Qiagen) concerning the Company's supply and purchase agreement

with Roche for HPV products. In August, the arbitrators issued

their final award, which granted Gen-Probe's motion to recover

attorneys' fees and costs in the amount of $3.0 million from

Digene. Gen-Probe has filed a petition to confirm the arbitration

award in the US District Court for the Southern District of New

York, and Digene has filed a petition to vacate or modify the

award. A hearing on the petitions is set for December. -- Patent

Litigation. On October 21, Gen-Probe disclosed that it had filed a

complaint for patent infringement against Becton, Dickinson and

Company in the US District Court for the Southern District of

California. The complaint alleges that Becton Dickinson's Viper(TM)

XTR(TM) testing system and associated consumables infringe eight of

the Company's US patents. The complaint seeks monetary damages and

injunctive relief. -- R&D Re-Organization. In October, the

Company re-organized its R&D organization into several

cross-functional project teams to increase alignment with corporate

strategy, better integrate research activities into product

development, accommodate new areas of therapeutic focus, and

ultimately increase development efficiency and speed to market.

Webcast Conference Call A live webcast of Gen-Probe's third quarter

2009 conference call for investors can be accessed at

http://www.gen-probe.com/ beginning at 4:30 p.m. Eastern Time

today. The webcast will be archived for at least 90 days. A

telephone replay of the call also will be available for

approximately 24 hours. The replay number is 866-360-7718 for

domestic callers and 203-369-0170 for international callers. About

Gen-Probe Gen-Probe Incorporated is a global leader in the

development, manufacture and marketing of rapid, accurate and

cost-effective NATs used primarily to diagnose human diseases and

screen donated human blood. Gen-Probe has more than 25 years of NAT

expertise, and received the 2004 National Medal of Technology,

America's highest honor for technological innovation, for

developing NAT assays for blood screening. Gen-Probe is

headquartered in San Diego and employs approximately 1,200 people.

For more information, go to http://www.gen-probe.com/. About

Non-GAAP Financial Measures To supplement Gen-Probe's financial

results for the third quarter of 2009 and its updated 2009

financial guidance, in each case presented in accordance with GAAP,

Gen-Probe uses the following financial measures defined as non-GAAP

by the SEC: non-GAAP net income, gross margin, G&A expenses,

income tax rate, and EPS. Gen-Probe's management does not, nor does

it suggest that investors should, consider such non-GAAP financial

measures in isolation from, or as a substitute for, financial

information prepared and presented in accordance with GAAP.

Gen-Probe's management believes that these non-GAAP financial

measures provide meaningful supplemental information regarding the

Company's performance by excluding certain expenses that may not be

indicative of core business results. Gen-Probe believes that both

management and investors benefit from referring to these non-GAAP

financial measures in assessing Gen-Probe's performance and when

planning, forecasting and analyzing future periods. These non-GAAP

financial measures also facilitate management's internal

comparisons to Gen-Probe's historical performance and our

competitors' operating results. Gen-Probe believes these non-GAAP

financial measures are useful to investors in allowing for greater

transparency with respect to supplemental information used by

management in its financial and operational decision making.

Trademarks APTIMA, APTIMA COMBO 2 and TIGRIS are trademarks of

Gen-Probe. PROCLEIX and ULTRIO are trademarks of Novartis. All

other trademarks are the property of their owners. Caution

Regarding Forward-Looking Statements Any statements in this news

release about our expectations, beliefs, plans, objectives,

assumptions or future events or performance, including those under

the heading "Updated 2009 Financial Guidance," are not historical

facts and are forward-looking statements. These statements are

often, but not always, made through the use of words or phrases

such as believe, will, expect, anticipate, estimate, intend, plan

and would. For example, statements concerning Gen-Probe's financial

condition, possible or expected results of operations, regulatory

approvals, future milestones, growth opportunities, and plans of

management are all forward-looking statements. Forward-looking

statements are not guarantees of performance. They involve known

and unknown risks, uncertainties and assumptions that may cause

actual results, levels of activity, performance or achievements to

differ materially from those expressed or implied. Some of these

risks, uncertainties and assumptions include but are not limited

to: (i) the risk that we may not achieve our expected 2009

financial targets, (ii) the risk that we may not integrate

acquisitions, such as Tepnel and Prodesse, successfully, (iii) the

possibility that the market for the sale of our new products, such

as our PROGENSA PCA3 and APTIMA HPV assays, may not develop as

expected, (iv) the enhancement of existing products and the

development of new products may not proceed as planned, (v) the

risk that products, including the investigational PROGENSA PCA3 and

APTIMA HPV and trichomonas assays in US clinical trials, may not be

approved by regulatory authorities or become commercially available

in the time frame we anticipate, or at all, (vi) the risk that we

may not be able to compete effectively, (vii) the risk that we may

not be able to maintain our current corporate collaborations and

enter into new corporate collaborations or customer contracts,

(viii) our dependence on Novartis, Siemens (as assignee of Bayer)

and other third parties for the distribution of some of our

products, (ix) our dependence on a small number of customers,

contract manufacturers and single source suppliers of raw

materials, (x) changes in third-party reimbursement policies

regarding our products could adversely affect sales, (xi) changes

in government regulation or tax policy affecting our diagnostic

products could harm our sales, increase our development costs or

increase our taxes, (xii) the risk that our intellectual property

may be infringed by third parties or invalidated, and (xiii) our

involvement in patent and other intellectual property and

commercial litigation could be expensive and could divert

management's attention. This list includes some, but not all, of

the factors that could affect our ability to achieve results

described in any forward-looking statements. For additional

information about risks and uncertainties we face and a discussion

of our financial statements and footnotes, see documents we file

with the SEC, including our most recent annual report on Form 10-K

and all subsequent periodic reports. We assume no obligation and

expressly disclaim any duty to update forward-looking statements to

reflect events or circumstances after the date of this news release

or to reflect the occurrence of subsequent events. ----------------

(1) In this press release, all per share amounts are calculated on

a fully diluted basis. Non-GAAP EPS for the third quarter of 2009

excludes $1.6 million of after-tax expenses ($0.03 per share)

related to the Company's acquisitions of Tepnel and Prodesse, and

the spin-off of industrial testing assets to Roka BioScience. Some

totals may not foot due to rounding. (2) In this press release, all

estimates of "constant currency" growth exclude foreign currency

fluctuations associated with acquired Tepnel revenues, since Tepnel

was not part of Gen-Probe in the prior year period. Contact:

Michael Watts Vice president, investor relations and corporate

communications 858-410-8673 Gen-Probe Incorporated Consolidated

Balance Sheets - GAAP (In thousands, except share and per share

data) September 30, December 31, 2009 2008 ---- ---- (unaudited)

Assets Current assets: Cash and cash equivalents, including

restricted cash of $18 and $0 at September 30, 2009 and December

31, 2008, respectively $156,739 $60,122 Marketable securities

361,203 371,276 Trade accounts receivable, net of allowance for

doubtful accounts of $740 and $700 at September 30, 2009 and

December 31, 2008, respectively 44,629 33,397 Accounts receivable -

other 3,185 2,900 Inventories 58,432 54,406 Deferred income tax

8,827 7,269 Prepaid income tax 8,809 2,306 Prepaid expenses 17,956

15,094 Other current assets 4,443 6,135 ----- ----- Total current

assets 664,223 552,905 Marketable securities, net of current

portion 6,677 73,780 Property, plant and equipment, net 153,594

141,922 Capitalized software, net 12,496 13,409 Goodwill 91,114

18,621 Deferred income tax, net of current portion 12,193 12,286

Purchased intangibles, net 56,097 298 Licenses, manufacturing

access fees and other assets, net 63,255 56,310 ------ ------ Total

assets $1,059,649 $869,531 ========== ======== Liabilities and

stockholders' equity Current liabilities: Accounts payable $18,035

$16,050 Accrued salaries and employee benefits 27,815 25,093 Other

accrued expenses 11,194 4,027 Income tax payable 853 - Short-term

borrowings 240,841 - Deferred income tax 1,355 - Deferred revenue

2,238 1,278 ----- ----- Total current liabilities 302,331 46,448

Non-current income tax payable 5,401 4,773 Deferred income tax, net

of current portion 14,387 55 Deferred revenue, net of current

portion 2,249 2,333 Other long-term liabilities 3,357 2,162

Commitments and contingencies Stockholders' equity: Preferred

stock, $0.0001 par value per share, 20,000,000 shares authorized,

none issued and outstanding - - Common stock, $0.0001 par value per

share; 200,000,000 shares authorized, 48,925,449 and 52,920,971

shares issued and outstanding at September 30, 2009 and December

31, 2008, respectively 5 5 Additional paid-in capital 231,838

382,544 Accumulated other comprehensive income 4,167 3,055 Retained

earnings 495,914 428,156 ------- ------- Total stockholders' equity

731,924 813,760 ------- ------- Total liabilities and stockholders'

equity $1,059,649 $869,531 ========== ======== Gen-Probe

Incorporated Consolidated Statements of Income - GAAP (In

thousands, except per share data) (Unaudited) Three Months Ended

Nine Months Ended September 30, September 30, ------------------

------------------ 2009 2008 2009 2008 ---- ---- ---- ----

Revenues: Product sales $118,951 $108,253 $348,289 $323,461

Collaborative research revenue 2,000 11,343 5,862 18,453 Royalty

and license revenue 1,753 1,581 5,281 21,640 ----- ----- -----

------ Total revenues 122,704 121,177 359,432 363,554 Operating

expenses: Cost of product sales (excluding acquisition-related

intangibles amortization) 36,345 30,681 107,939 95,827

Acquisition-related intangibles amortization 1,136 - 2,250 -

Research and development 27,475 24,507 78,542 76,941 Marketing and

sales 13,477 10,709 38,547 34,070 General and administrative 15,234

12,908 46,903 38,516 ------ ------ ------ ------ Total operating

expenses 93,667 78,805 274,181 245,354 ------ ------ -------

------- Income from operations 29,037 42,372 85,251 118,200

Investment and interest income 4,676 4,167 19,680 12,274 Interest

expense (588) (1) (1,465) (3) Other income/(expense) 210 (1,929)

(827) (647) --- ------ ---- ---- Total other income, net 4,298

2,237 17,388 11,624 ----- ----- ------ ------ Income before income

tax 33,335 44,609 102,639 129,824 Income tax expense 11,139 15,531

34,881 44,010 ------ ------ ------ ------ Net income $22,196

$29,078 $67,758 $85,814 ======= ======= ======= ======= Net income

per share: Basic $0.45 $0.53 $1.33 $1.58 ===== ===== ===== =====

Diluted $0.44 $0.52 $1.31 $1.55 ===== ===== ===== ===== Weighted

average shares outstanding: Basic 49,614 54,363 51,133 54,174

====== ====== ====== ====== Diluted 50,136 55,552 51,767 55,357

====== ====== ====== ====== Gen-Probe Incorporated Consolidated

Statements of Income - Non-GAAP (In thousands, except per share

data) (Unaudited) Three Months Ended September 30, 2009

---------------------------- Non-GAAP Adjustments GAAP --------

----------- ---- Revenues: Product sales $118,951 $- $118,951

Collaborative research revenue 2,000 - 2,000 Royalty and license

revenue 1,753 - 1,753 ----- --- ----- Total revenues 122,704 -

122,704 Operating expenses: Cost of product sales (excluding

acquisition-related intangibles amortization) 36,252 93 36,345

Acquisition-related intangibles amortization - 1,136 1,136 Research

and development 27,475 - 27,475 Marketing and sales 13,477 - 13,477

General and administrative 14,155 1,079 15,234 ------ ----- ------

Total operating expenses 91,359 2,308 93,667 ------ ----- ------

Income from operations 31,345 (2,308) 29,037 Investment and

interest income 4,676 - 4,676 Interest expense (588) - (588) Other

income/(expense) 210 - 210 --- --- --- Total other income, net

4,298 - 4,298 ----- --- ----- Income before income tax 35,643

(2,308) 33,335 Income tax expense 11,864 (725) 11,139 ------ ----

------ Net income $23,779 $(1,583) $22,196 ======= ======= =======

Net income per share: Basic $0.48 $(0.03) $0.45 ===== ====== =====

Diluted $0.47 $(0.03) $0.44 ===== ====== ===== Weighted average

shares outstanding: Basic 49,614 - 49,614 ====== === ====== Diluted

50,136 - 50,136 ====== === ====== Gen-Probe Incorporated

Consolidated Statements of Income - Non-GAAP (In thousands, except

per share data) (Unaudited) Nine Months Ended September 30, 2009

---------------------------- Non-GAAP Adjustments GAAP --------

----------- ---- Revenues: Product sales $348,289 $- $348,289

Collaborative research revenue 5,862 - 5,862 Royalty and license

revenue 5,281 - 5,281 ----- --- ----- Total revenues 359,432 -

359,432 Operating expenses: Cost of product sales (excluding

acquisition-related intangibles amortization) 107,756 183 107,939

Acquisition-related intangibles amortization - 2,250 2,250 Research

and development 78,542 - 78,542 Marketing and sales 38,547 - 38,547

General and administrative 41,018 5,885 46,903 ------ ----- ------

Total operating expenses 265,863 8,318 274,181 ------- -----

------- Income from operations 93,569 (8,318) 85,251 Investment and

interest income 19,680 - 19,680 Interest expense (1,465) - (1,465)

Other income/(expense) (827) - (827) ---- --- ---- Total other

income, net 17,388 - 17,388 ------ --- ------ Income before income

tax 110,957 (8,318) 102,639 Income tax expense 36,934 (2,053)

34,881 ------ ------ ------ Net income $74,023 $(6,265) $67,758

======= ======= ======= Net income per share: Basic $1.45 $(0.12)

$1.33 ===== ====== ===== Diluted $1.43 $(0.12) $1.31 ===== ======

===== Weighted average shares outstanding: Basic 51,133 - 51,133

====== === ====== Diluted 51,767 - 51,767 ====== === ======

Gen-Probe Incorporated Consolidated Statements of Cash Flows - GAAP

(In thousands) (Unaudited) Nine Months Ended September 30,

------------------ 2009 2008 ---- ---- Operating activities: Net

income $67,758 $85,814 Adjustments to reconcile net income to net

cash provided by operating activities: Depreciation and

amortization 29,468 26,217 Amortization of premiums on investments,

net of accretion of discounts 4,050 5,118 Stock-based compensation

17,743 15,012 Stock-based compensation income tax benefits 1,937

3,025 Excess tax benefit from stock-based compensation (1,186)

(2,510) Deferred revenue (249) (3,399) Deferred income tax (1,318)

(961) Gain on sale of investment in MPI - (1,600) Impairment of

intangible assets - 5,086 Loss on disposal of property and

equipment 82 38 Changes in assets and liabilities: Trade and other

accounts receivable (4,379) 11,403 Inventories 2,325 (4,270)

Prepaid expenses (1,675) 7,060 Other current assets 2,156 (2,255)

Goodwill 856 - Other long-term assets (3,608) (510) Accounts

payable (2,985) 7,381 Accrued salaries and employee benefits 1

4,922 Other accrued expenses 1,672 96 Income tax payable (6,655)

2,926 Other long-term liabilities 733 426 --- --- Net cash provided

by operating activities 106,726 159,019 ------- ------- Investing

activities: Proceeds from sales and maturities of marketable

securities 410,700 94,103 Purchases of marketable securities

(338,976) (225,290) Purchases of property, plant and equipment

(22,284) (30,530) Capitalization of software development costs

(576) - Purchases of intangible assets, including licenses and

manufacturing access fees (918) (1,868) Net cash paid for business

combinations (123,713) - Cash paid for investment in DiagnoCure and

related license fees (5,500) - Proceeds from sale of investment in

MPI - 4,100 Cash paid for Roche manufacturing access fees -

(10,000) Other assets (175) 10 ---- --- Net cash used in investing

activities (81,442) (169,475) ------- -------- Financing

activities: Excess tax benefit from stock-based compensation 1,186

2,510 Repurchase and retirement of restricted stock for payment of

taxes (923) (1,309) Repurchase and retirement of common stock

(174,847) (9,992) Proceeds from issuance of common stock 5,961

17,848 Short-term borrowings, net 238,450 - ------- --- Net cash

provided by financing activities 69,827 9,057 ------ ----- Effect

of exchange rate changes on cash and cash equivalents 1,506 (198)

----- ---- Net increase (decrease) in cash and cash equivalents

96,617 (1,597) Cash and cash equivalents at the beginning of period

60,122 75,963 ------ ------ Cash and cash equivalents at the end of

period $156,739 $74,366 ======== ======= DATASOURCE: Gen-Probe

Incorporated CONTACT: Michael Watts, Vice president, investor

relations and corporate communications of Gen-Probe Incorporated,

+1-858-410-8673 Web Site: http://www.gen-probe.com/

Copyright

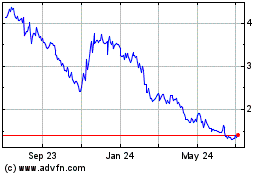

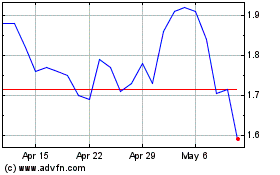

GoPro (NASDAQ:GPRO)

Historical Stock Chart

From Jun 2024 to Jul 2024

GoPro (NASDAQ:GPRO)

Historical Stock Chart

From Jul 2023 to Jul 2024