0001071255false00010712552024-08-082024-08-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

________________________________________

FORM 8-K

________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 8, 2024

________________________________________

GOLDEN ENTERTAINMENT, INC.

(Exact name of registrant as specified in its charter)

________________________________________

| | | | | | | | |

| Minnesota | 000-24993 | 41-1913991 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| 6595 S Jones Boulevard | | |

Las Vegas, Nevada | | 89118 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (702) 893-7777

________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.01 par value | GDEN | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On August 8, 2024, Golden Entertainment, Inc. issued a press release announcing its financial results for the three and six months ended June 30, 2024. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

In accordance with General Instruction B.2. of Form 8-K, the information in this Item 2.02, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or the Exchange Act, or otherwise subject to the liabilities of that Section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

| | | | | | | | |

| (d) | | Exhibits |

| | |

| 99.1 | | |

| | |

| 104 | | The cover page of this Current Report on Form 8-K, formatted in Inline XBRL. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| GOLDEN ENTERTAINMENT, INC. |

| (Registrant) |

| | | |

| Dated: August 8, 2024 | | /s/ Charles H. Protell |

| | Name: | Charles H. Protell |

| | Title: | President and Chief Financial Officer |

GOLDEN ENTERTAINMENT REPORTS 2024 SECOND QUARTER RESULTS

LAS VEGAS – August 8, 2024 – Golden Entertainment, Inc. (NASDAQ: GDEN) (“Golden Entertainment” or the “Company”) today reported financial results for the second quarter ended June 30, 2024. The Company reported second quarter revenue of $167.3 million, net income of $0.6 million and Adjusted EBITDA of $41.2 million. In addition, on August 6, 2024, the Company’s Board of Directors authorized the Company’s third recurring quarterly cash dividend of $0.25 per share of the Company’s outstanding common stock payable on October 2, 2024 to shareholders of record as of September 17, 2024.

Blake Sartini, Chairman and Chief Executive Officer of Golden, commented, “In the second quarter, we continued to strengthen our balance sheet by fully repaying our outstanding bonds in April and reducing our interest rate on our term loan in May. We also aggressively returned capital to shareholders through our recurring dividend and repurchasing nearly one million shares. Our healthy operating cash flow and strong balance sheet will continue to provide us with strategic and financial flexibility while we return capital to shareholders throughout the year.”

On April 15, 2024, the Company redeemed and repaid in full all of its senior unsecured notes in the amount of $287.0 million, consisting of $276.5 million in principal and $10.5 million in accrued and unpaid interest. On May 29, 2024, the Company repriced its $396 million term loan, which reduced the annual interest rate on the term loan by 60 basis points.

The Company also paid its first and second quarterly cash dividends in the amount of $7.2 million and $7.1 million on April 4, 2024 and July 2, 2024, respectively. In addition, the Company repurchased 989,117 shares of its common stock during the quarter at an average price of $29.85 per share for total amount of $29.5 million. As of June 30, 2024, the Company had $61.4 million of availability remaining under its share repurchase authorization.

Consolidated Results

The Company reported second quarter of 2024 revenues of $167.3 million and Adjusted EBITDA of $41.2 million as compared to revenues of $286.7 million and Adjusted EBITDA of $58.4 million for the second quarter of 2023. The declines in revenues and Adjusted EBITDA over the prior year period were primarily related to the exclusion of the results for the Company’s Rocky Gap Casino Resort and distributed gaming operations in Montana and Nevada that were sold on July 25, 2023, September 13, 2023 and January 10, 2024, respectively. Net income for the second quarter of 2024 was $0.6 million, or $0.02 per fully diluted share, as compared to $12.3 million, or $0.40 per fully diluted share, for the second quarter of 2023.

Debt and Liquidity

As of June 30, 2024, the Company’s total principal amount of debt outstanding was $400.7 million, consisting primarily of $396.0 million in outstanding term loan borrowings.

As of June 30, 2024, the Company had cash and cash equivalents of $88.6 million. There continues to be no outstanding borrowings under the Company’s $240 million revolving credit facility.

Investor Conference Call and Webcast

The Company will host a webcast and conference call today, August 8, 2024 at 5:00 p.m. Eastern Time (2:00 p.m. Pacific Time), to discuss the 2024 second quarter results. The conference call may be accessed live over the phone

by dialing (800) 717-1738 or for international callers by dialing (646) 307-1865. A replay will be available beginning at 8:00 p.m. Eastern Time today and may be accessed by dialing (844) 512-2921 or (412) 317-6671 for international callers; the passcode is 1170998. The replay will be available until August 14, 2024. The call will also be webcast live through the “Investors” section of the Company’s website, www.goldenent.com. A replay of the audio webcast will also be archived on the Company’s website, www.goldenent.com.

Forward-Looking Statements

This press release contains forward-looking statements regarding future events and the Company’s future results that are subject to the safe harbors created under the Securities Act of 1933 and the Securities Exchange Act of 1934. Forward-looking statements can generally be identified by the use of words such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “forecast,” “intend,” “may,” “plan,” “project,” “potential,” “seek,” “should,” “think,” “will,” “would” and similar expressions, or they may use future dates. In addition, forward-looking statements in this press release include, without limitation statements regarding: the Company’s strategies, objectives, business opportunities and plans; anticipated future growth and trends in the Company’s business or key markets; the payment of recurring quarterly cash dividends; projections of future financial condition, operating results or other financial items; and other characterizations of future events or circumstances as well as other statements that are not statements of historical fact. Forward-looking statements are based on the Company’s current expectations and assumptions regarding its business, the economy and other future conditions. These forward-looking statements are subject to assumptions, risks and uncertainties that may change at any time, and readers are therefore cautioned that actual results could differ materially from those expressed in any forward-looking statements. Factors that could cause the actual results to differ materially include: changes in national, regional and local economic and market conditions; legislative and regulatory matters (including the cost of compliance or failure to comply with applicable laws and regulations); increases in gaming taxes and fees in the jurisdictions in which the Company operates; litigation; increased competition; reliance on key personnel (including our Chief Executive Officer, President and Chief Financial Officer, and Chief Operating Officer); the Company’s ability to comply with covenants in its debt instruments; terrorist incidents; natural disasters; severe weather conditions (including weather or road conditions that limit access to the Company’s properties); the effects of environmental and structural building conditions; the effects of disruptions to the Company’s information technology and other systems and infrastructure; factors affecting the gaming, entertainment and hospitality industries generally; and other risks and uncertainties discussed in the Company’s filings with the SEC, including the “Risk Factors” sections of the Company’s most recent Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. The Company undertakes no obligation to update any forward-looking statements as a result of new information, future developments or otherwise. All forward-looking statements in this press release are qualified in their entirety by this cautionary statement.

Non-GAAP Financial Measures

To supplement the Company’s consolidated financial statements presented in accordance with United States generally accepted accounting principles (“GAAP”), the Company uses Adjusted EBITDA because it is the primary metric used by its chief operating decision makers and investors in measuring both the Company’s past and future expectations of performance. Adjusted EBITDA provides useful information to the users of the Company’s financial statements by excluding specific expenses and gains that the Company believes are not indicative of its core operating results. Further, the Company’s annual performance plan used to determine compensation for its executive officers and employees is tied to the Adjusted EBITDA metric. It is also a measure of operating performance widely used in the gaming industry.

The presentation of this additional information is not meant to be considered in isolation or as a substitute for measures of financial performance prepared in accordance with GAAP. In addition, other companies in gaming industry may calculate Adjusted EBITDA differently than the Company does.

The Company defines “Adjusted EBITDA” as earnings before depreciation and amortization, non-cash lease expense, share-based compensation expense, gain or loss on disposal of assets and business, loss on debt extinguishment and modification, preopening and related expenses, transaction costs, interest and other non-

operating income (expense), income taxes, and other non-cash charges that are deemed to be not indicative of the Company’s core operating results, calculated before corporate overhead (which is not allocated to each reportable segment).

About Golden Entertainment

Golden Entertainment owns and operates a diversified entertainment platform, consisting of a portfolio of gaming and hospitality assets that focus on casino and branded tavern operations. Golden Entertainment owns eight casinos and 71 gaming taverns in Nevada, operating over 5,500 slots, nearly 100 table games, and over 6,000 hotel rooms. For more information, visit www.goldenent.com.

| | | | | |

| Investor Relations | |

| Charles H. Protell | James Adams |

| President and Chief Financial Officer | Vice President of Corporate Finance |

| (702) 893-7777 | (702) 495-4470 |

| james.adams@goldenent.com |

Golden Entertainment, Inc.

Consolidated Statements of Operations

(Unaudited, in thousands, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Revenues | | | | | | | | |

| Gaming | | $ | 78,247 | | | $ | 182,355 | | | $ | 165,196 | | | $ | 370,442 | |

| Food and beverage | | 43,113 | | | 46,534 | | | 86,774 | | | 92,805 | |

| Rooms | | 31,422 | | | 30,918 | | | 60,822 | | | 61,495 | |

| Other | | 14,552 | | | 26,874 | | | 28,589 | | | 39,990 | |

| Total revenues | | 167,334 | | | 286,681 | | | 341,381 | | | 564,732 | |

| Expenses | | | | | | | | |

| Gaming | | 20,764 | | | 105,380 | | | 47,655 | | | 212,306 | |

| Food and beverage | | 34,300 | | | 33,645 | | | 68,476 | | | 67,667 | |

| Rooms | | 16,452 | | | 15,359 | | | 32,686 | | | 30,140 | |

| Other | | 2,784 | | | 7,905 | | | 6,864 | | | 11,735 | |

| Selling, general and administrative | | 56,087 | | | 67,093 | | | 116,074 | | | 129,129 | |

| Depreciation and amortization | | 22,616 | | | 21,454 | | | 44,736 | | | 44,962 | |

| (Gain) loss on disposal of assets | | — | | | (34) | | | 14 | | | (120) | |

| Loss (gain) on sale of business | | 792 | | | — | | | (68,944) | | | — | |

| Preopening expenses | | 4 | | | 141 | | | 143 | | | 525 | |

| Total expenses | | 153,799 | | | 250,943 | | | 247,704 | | | 496,344 | |

| Operating income | | 13,535 | | | 35,738 | | | 93,677 | | | 68,388 | |

| Non-operating expense | | | | | | | | |

| Interest expense, net | | (8,610) | | | (18,803) | | | (19,296) | | | (37,039) | |

| Loss on debt extinguishment and modification | | (4,446) | | | (405) | | | (4,446) | | | (405) | |

| Total non-operating expense, net | | (13,056) | | | (19,208) | | | (23,742) | | | (37,444) | |

| Income before income tax benefit (provision) | | 479 | | | 16,530 | | | 69,935 | | | 30,944 | |

| Income tax benefit (provision) | | 144 | | | (4,248) | | | (27,349) | | | (7,032) | |

| Net income | | $ | 623 | | | $ | 12,282 | | | $ | 42,586 | | | $ | 23,912 | |

| | | | | | | | |

| Weighted-average common shares outstanding | | | | | | | | |

| Basic | | 28,798 | | | 28,845 | | | 28,761 | | | 28,578 | |

| Diluted | | 30,234 | | | 30,717 | | | 30,482 | | | 30,831 | |

| Net income per share | | | | | | | | |

| Basic | | $ | 0.02 | | | $ | 0.43 | | | $ | 1.48 | | | $ | 0.84 | |

| Diluted | | $ | 0.02 | | | $ | 0.40 | | | $ | 1.40 | | | $ | 0.78 | |

Golden Entertainment, Inc.

Reconciliation of Adjusted EBITDA

(Unaudited, in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Revenues | | | | | | | | |

Nevada Casino Resorts (1) | | $ | 101,093 | | | $ | 102,562 | | | $ | 202,105 | | | $ | 202,738 | |

Nevada Locals Casinos (2) | | 37,866 | | | 39,829 | | | 76,857 | | | 81,067 | |

Nevada Taverns (3) | | 28,152 | | | 27,319 | | | 55,959 | | | 54,912 | |

| Corporate and other | | 223 | | | 8,282 | | | 441 | | | 8,797 | |

| Total Revenues - Continuing Operations | | 167,334 | | | 177,992 | | | 335,362 | | | 347,514 | |

Distributed Gaming (4) | | — | | | 89,084 | | | 6,019 | | | 179,485 | |

Maryland Casino Resort (5) | | — | | | 19,605 | | | — | | | 37,733 | |

| Total Revenues - Divested Operations | | — | | | 108,689 | | | 6,019 | | | 217,218 | |

| Total Revenues | | $ | 167,334 | | | $ | 286,681 | | | $ | 341,381 | | | $ | 564,732 | |

| Adjusted EBITDA | | | | | | | | |

Nevada Casino Resorts (1) | | $ | 27,392 | | | $ | 28,044 | | | $ | 54,283 | | | $ | 59,755 | |

Nevada Locals Casinos (2) | | 16,928 | | | 19,471 | | | 34,464 | | | 39,631 | |

Nevada Taverns (3) | | 7,791 | | | 8,450 | | | 15,352 | | | 16,988 | |

| Corporate and other | | (10,919) | | | (13,403) | | | (22,399) | | | (26,557) | |

| Total Adjusted EBITDA - Continuing Operations | | 41,192 | | | 42,562 | | | 81,700 | | | 89,817 | |

Distributed Gaming (4) | | — | | | 9,950 | | | 484 | | | 19,734 | |

Maryland Casino Resort (5) | | — | | | 5,898 | | | — | | | 11,026 | |

| Total Adjusted EBITDA - Divested Operations | | — | | | 15,848 | | | 484 | | | 30,760 | |

| Total Adjusted EBITDA | | 41,192 | | | 58,410 | | | 82,184 | | | 120,577 | |

| Adjustments | | | | | | | | |

| Depreciation and amortization | | (22,616) | | | (21,454) | | | (44,736) | | | (44,962) | |

| Non-cash lease benefit (expense) | | 148 | | | 9 | | | 233 | | | (24) | |

| Share-based compensation | | (2,450) | | | (3,288) | | | (5,719) | | | (7,181) | |

| Gain (loss) on disposal of assets | | — | | | 34 | | | (14) | | | 120 | |

| (Loss) gain on sale of business | | (792) | | | — | | | 68,944 | | | — | |

| Loss on debt extinguishment and modification | | (4,446) | | | (405) | | | (4,446) | | | (405) | |

Preopening and related expenses (6) | | (4) | | | (141) | | | (143) | | | (525) | |

| Transaction costs | | (337) | | | (170) | | | (2,275) | | | (277) | |

| Other, net | | (1,606) | | | 2,338 | | | (4,797) | | | 660 | |

| Interest expense, net | | (8,610) | | | (18,803) | | | (19,296) | | | (37,039) | |

| Income tax benefit (provision) | | 144 | | | (4,248) | | | (27,349) | | | (7,032) | |

| Net income | | $ | 623 | | | $ | 12,282 | | | $ | 42,586 | | | $ | 23,912 | |

(1) Comprised of The STRAT Hotel, Casino & Tower, Aquarius Casino Resort and Edgewater Casino Resort.

(2) Comprised of Arizona Charlie’s Boulder, Arizona Charlie’s Decatur, Gold Town Casino, Lakeside Casino & RV Park and Pahrump Nugget Hotel Casino.

(3) Comprised of the operations of the Company’s branded tavern locations.

(4) Comprised of distributed gaming operations in Montana (for the three and six months ended June 30, 2023 only) and Nevada. On September 13, 2023, the Company completed the sale of its distributed gaming operations in Montana. On January 10, 2024, the Company completed the sale of its distributed gaming operations in Nevada.

(5) Comprised of the operations of the Rocky Gap Casino Resort, which was sold on July 25, 2023.

(6) Preopening and related expenses consist of labor, food, utilities, training, initial licensing, rent and organizational costs incurred in connection with the opening of branded tavern and food and beverage and other venues within the casino locations.

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

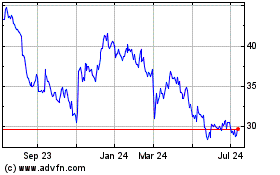

Golden Entertainment (NASDAQ:GDEN)

Historical Stock Chart

From Oct 2024 to Nov 2024

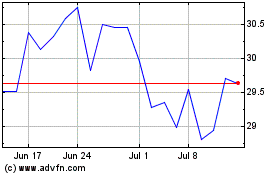

Golden Entertainment (NASDAQ:GDEN)

Historical Stock Chart

From Nov 2023 to Nov 2024