UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of August 2024

Commission File Number: 001-38631

CHEER HOLDING, INC.

22F, Block B, Xinhua Technology Building,

No. 8 Tuofangying South Road,

Jiuxianqiao, Chaoyang District, Beijing, China

100016

(Address of principal executive office)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ☒ Form

40-F ☐

Other Events

On August 29, 2024, Cheer

Holding, Inc. (the “Company”) issued a press release announcing the results of its 2024 Annual General Meeting, which was

held on August 28, 2024, in Beijing, China. At the 2024 Annual General Meeting, the Company’s shareholders:

| (1) | re-elected Messrs. Yong Li and Bing Zhang as Class II directors of the Company to serve until the 2027

Annual General Meeting of the Company and until his successor is appointed and duly qualified, or until his earlier resignation or removal. |

| (2) | approved a proposal, as a special resolution, subject to the determination, confirmation and approval

of the board of directors of the Company that this resolution should be implemented, that: |

| a. | The authorized share capital of the Company be increased as follows: |

FROM: US$200,200 divided into 200,000,000 ordinary

shares of a par value of US$0.001 each and 2,000,000 preferred shares of a par value of US$0.0001 each;

TO: US$200,700 divided into 200,000,000 Class A

ordinary shares of a par value of US$0.001 each, 500,000 Class B ordinary shares of a par value of US$0.001 each and 2,000,000

preferred shares of a par value of US$0.0001 each;

BY: the creation of 500,000 Class B ordinary shares

of a par value of US$0.001 each with the rights attaching to such shares as set out in the Third Amended and Restated Memorandum and Articles

of Association in the form set forth in Annex A to the Notice of the 2024 Annual General Meeting of the Company; and

| b. | the Second Amended and Restated Memorandum and Articles of Association of the Company currently in effect be amended and restated

by the deletion in their entirety and the substitution in their place of the Third Amended and Restated Memorandum and Articles of Association

in the form set forth in Annex A to the Notice of the 2024 Annual General Meeting of the Company. |

| (3) | approved a proposal, as an ordinary resolution, subject to the approval and implementation of Proposal

No. 2, Mr. Bing Zhang, the Chairman, Director, Chief Executive Officer and Chief Financial Officer of the Company be allotted and issued

all 500,000 Class B ordinary shares at par for an aggregate purchase price of US$500, or US$0.001 per share. Such payment may be made

in Renminbi. |

| (4) | approved a proposal, as an ordinary resolution, that the Cheer Holding, Inc. 2024 Equity Incentive Plan

be approved and adopted in all respects. |

| (5) | ratified the appointment of Assentsure PAC as the independent registered public accounting firm of the

Company for the financial year ending December 31, 2024. |

A copy of the press release

is attached hereto as Exhibit 99.1, and a copy of the Cheer Holding, Inc. 2024 Equity Incentive Plan is attached hereto as Exhibit 99.2.

Incorporation by Reference

This report and Exhibits 99.1

and 99.2 attached to this Form 6-K shall be deemed to be incorporated by reference into the Company’s registration statements on Form S-8 (File No. 333-237788) and on Form F-3 (File No. 333-279221), to be a part thereof from the date on which this report

is submitted, to the extent not superseded by documents or reports subsequently filed or furnished.

Exhibit Index

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| Dated: August 29, 2024 |

Cheer Holding, Inc. |

| |

|

| |

By: |

/s/ Bing Zhang |

| |

Name:

|

Bing Zhang

|

| |

Title: |

Chief Executive Officer |

4

Exhibit 99.1

Cheer Holding Announces Results of 2024 Annual

General Meeting

BEIJING, Aug. 29, 2024 (GLOBE NEWSWIRE) --

Cheer Holding, Inc. (NASDAQ: CHR) (“Cheer” or the “Company”), a leading provider of advanced mobile

internet infrastructure and platform services, today announced the results of its 2024 Annual General Meeting, which was held on

August 28, 2024, in Beijing, China.

At the 2024 Annual General

Meeting, the Company’s shareholders:

| (1) | re-elected Messrs. Yong Li and Bing Zhang as Class II directors of the Company to serve until the 2027

Annual General Meeting of the Company and until his successor is appointed and duly qualified, or until his earlier resignation or removal. |

| (2) | approved a proposal, as a special resolution, subject to the determination, confirmation and approval

of the board of directors of the Company that this resolution should be implemented, that: |

| (a) | The authorized share capital of the Company be increased as follows: |

FROM: US$200,200 divided into 200,000,000 ordinary shares

of a par value of US$0.001 each and 2,000,000 preferred shares of a par value of US$0.0001 each;

TO: US$200,700 divided into 200,000,000 Class A ordinary

shares of a par value of US$0.001 each, 500,000 Class B ordinary shares of a par value of US$0.001 each and 2,000,000 preferred shares

of a par value of US$0.0001 each;

BY: the creation of 500,000 Class B ordinary shares

of a par value of US$0.001 each with the rights attaching to such shares as set out in the Third Amended and Restated Memorandum and Articles

of Association in the form set forth in Annex A to the Notice of the 2024 Annual General Meeting of the Company; and

| (b) | the Second Amended and Restated Memorandum and Articles of Association of the Company currently in effect be amended and restated

by the deletion in their entirety and the substitution in their place of the Third Amended and Restated Memorandum and Articles of Association

in the form set forth in Annex A to the Notice of the 2024 Annual General Meeting of the Company. |

| (3) | approved a proposal, as an ordinary resolution, subject to the approval and implementation of Proposal

No. 2, Mr. Bing Zhang, the Chairman, Director, Chief Executive Officer and Chief Financial Officer of the Company be allotted and issued

all 500,000 Class B ordinary shares at par for an aggregate purchase price of US$500, or US$0.001 per share. Such payment may be made

in Renminbi. |

| (4) | approved a proposal, as an ordinary resolution, that the Cheer Holding, Inc. 2024 Equity Incentive Plan

be approved and adopted in all respects. |

| (5) | ratified the appointment of Assentsure PAC as the independent registered public accounting firm of the

Company for the financial year ending December 31, 2024. |

About Cheer Holding, Inc.

As a preeminent provider of next-generation

mobile internet infrastructure and platform services in China, Cheer Holding is dedicated to building a digital ecosystem that integrates

“platforms, applications, technology, and industry” into a cohesive digital eco-system, thereby creating a new, open business

environment for web3.0 that leverages AI technology. The Company is developing a 5G+VR+AR+AI shared universe space that builds on cutting-edge

technologies including blockchain, cloud computing, extended reality, and digital twin.

Cheer Holding’s portfolio includes a

wide range of products and services, such as AI-powered content creation platform CHEERS Telepathy, CHEERS Lifestyle, CHEERS e-Mall, Yaoshi

TTX, CheerReal, CHEERS Open Data Platform, CheerCar, CheerChat, CHEERS Fresh Group-Buying E-commerce Platform, Polaris Intelligent Cloud,

Digital Innovation Research Institute, AI-animated short drama series, CHEERS video matrix, IP short video matrix, variety show series,

CHEERS Livestreaming, and more. These offerings provide diverse application scenarios that seamlessly blend “online/offline”

and “virtual/reality” elements.

With “CHEERS+” at the core of

Cheer Holding’s digital ecosystem, the Company is committed to utilizing innovative product applications and technologies to drive

its long-term sustainable and scalable growth.

For more information, please visit http://ir.gsmg.co/.

Safe Harbor Statement

Certain statements made in this release are

“forward looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities

Litigation Reform Act of 1995. When used in this press release, the words “estimates,” “projected,” “expects,”

“anticipates,” “forecasts,” “plans,” “intends,” “believes,” “seeks,”

“may,” “will,” “should,” “future,” “propose” and variations of these words

or similar expressions (or the negative versions of such words or expressions) are intended to identify forward-looking statements. These

forward-looking statements are not guarantees of future performance, conditions or results, and involve a number of known and unknown

risks, uncertainties, assumptions and other important factors, many of which are outside the Company’s control, that could cause

actual results or outcomes to differ materially from those discussed in the forward-looking statements. Important factors, among others,

are: the ability to manage growth; ability to identify and integrate other future acquisitions; ability to obtain additional financing

in the future to fund capital expenditures; fluctuations in general economic and business conditions; costs or other factors adversely

affecting our profitability; litigation involving patents, intellectual property, and other matters; potential changes in the legislative

and regulatory environment; a pandemic or epidemic; the occurrence of any event, change or other circumstances that could affect the Company’s

ability to continue successful development and launch of its metaverse experience centers; the possibility that the Company may not succeed

in developing its new lines of businesses due to, among other things, changes in the business environment and technological developments,

competition, changes in regulation, or other economic and policy factors; disruptions or other business interruptions that may affect

the operations of our products and services, the possibility that the Company’s new lines of business may be adversely affected

by other economic, business, and/or competitive factors; other factors, risks and uncertainties set forth in documents filed by the Company

with the Securities and Exchange Commission from time to time, including the Company’s latest Annual Report on Form 20-F filed with

the SEC on March 22, 2023, as amended. The Company undertakes no obligation to update or revise any forward-looking statements, whether

as a result of new information, future events or otherwise, except as required by applicable law. Such information speaks only as of the

date of this release.

For investor and media

inquiries, please contact:

Wealth Financial Services

LLC

Connie Kang, Partner

Email: ckang@wealthfsllc.com

Tel: +86 1381 185 7742

(CN)

Exhibit 99.2

CHEER HOLDING, INC.

2024 EQUITY INCENTIVE PLAN

1. Purposes of the

Plan. The purposes of this Cheer Holding, Inc. 2024 Equity Incentive Plan (“Plan”) are:

| |

● |

to attract and retain the best available personnel for positions of substantial responsibility, |

| |

● |

to provide additional incentive to Employees, Directors and Consultants, and |

| |

● |

to promote the success of the Company’s business. |

The Plan permits the grant

of Incentive Share Options, Nonstatutory Share Options, Restricted Shares, Share Appreciation Rights, Restricted Shares, Restricted Share

Units, Performance Units, Performance Shares, and Other Share Based Awards.

2. Definitions.

As used herein, the following definitions will apply:

(a) “Administrator”

means the Board or the Committee appointed by the Board to administer the Plan, in accordance with Section 4 of the Plan.

(b) “Applicable Laws”

means the legal requirements relating to the Plan and the Awards under applicable provisions of the corporate, securities, tax and other

laws, rules, regulations and government orders, and the rules of any applicable stock exchange or national market system, of any jurisdiction

applicable to Awards granted to residents therein.

(c) “Award”

means, individually or collectively, a grant under the Plan of Options, SARs, Restricted Shares, Restricted Share Units, Performance Units,

Performance Shares or Other Share Based Awards.

(d) “Award Agreement”

means the written or electronic agreement setting forth the terms and provisions applicable to each Award granted under the Plan. Each

Award Agreement entered into hereunder shall be subject to the terms and conditions of the Plan.

(e) “Awarded Shares”

means the Ordinary Shares subject to an Award.

(f) “Board”

means the Board of Directors of the Company, from time to time.

(g) “Change in Control”

means the occurrence of any of the following events:

(i) An acquisition (whether

directly from the Company or otherwise) of any voting securities of the Company by any “person” (as such term is used in Section

13(d) or 14(d) of the Exchange Act), immediately after which such person becomes the “beneficial owner” (as defined in Rule

13d-3 of the Exchange Act), directly or indirectly, of securities of the Company representing more than fifty percent (50%) of the total

voting power represented by the Company’s then issued and outstanding voting securities;

(ii) The consummation of the

sale or disposition by the Company of all or substantially all of the Company’s assets;

(iii) A change in the composition

of the Board occurring within a two-year period, as a result of which fewer than a majority of the directors are Incumbent Directors.

“Incumbent Directors” means directors who either (A) are Directors as of the effective date of the Plan, or (B) are elected,

or nominated for election, to the Board with the affirmative votes of at least a majority of the Incumbent Directors at the time of such

election or nomination (but will not include an individual whose election or nomination is in connection with an actual or threatened

proxy contest relating to the election of directors to the Company); or

(iv) The consummation of a

merger or consolidation of the Company with any other company or corporation, other than a merger or consolidation which would result

in the voting securities of the Company issued and outstanding immediately prior thereto continuing to represent (either by remaining

issued and outstanding or by being converted into voting securities of the surviving entity or its parent) more than fifty percent (50%)

of the total voting power represented by the voting securities of the Company or such surviving entity or its parent issued and outstanding

immediately after such merger or consolidation.

(h) “Code”

means the Internal Revenue Code of 1986, as amended, and the rulings issued and regulations promulgated thereunder. Any reference to a

section of the Code herein will be a reference to any successor or amended section of the Code.

(i) “Committee”

means the compensation committee of the Board, or such other committee of at least two persons as the Board shall designate.

(j) “Company”

means Cheer Holding, Inc., an exempted company incorporated under the laws of the Cayman Islands, or any successor thereto.

(k) “Consultant”

means any consultant or adviser if: (a) the consultant or adviser renders bona fide services to the Company or a Parent or Subsidiary;

(b) the services rendered by the consultant or adviser are not in connection with the offer or sale of securities in a capital-raising

transaction and do not directly or indirectly promote or maintain a market for the Company’s securities; and (c) the consultant

or adviser is a natural person who has contracted directly with the Company or a Parent or Subsidiary.

(l) “Director”

means a director of the Company.

(m) “Disability”

means a total and permanent disability incurred by a Participant whereby the Participant is unable to engage in any substantial gainful

activity by reason of any medically determinable physical or mental impairment that can be expected to result in death or can be expected

to last for a continuous period of not less than twelve (12) months, provided that in the case of Awards other than Incentive Share Options,

the Administrator in its discretion may determine whether a permanent and total disability exists in accordance with uniform and non-discriminatory

standards adopted by the Administrator from time to time.

(n) “Dividend Equivalent”

means a credit, made at the discretion of the Administrator, for the account of a Participant in an amount equal to the value of dividends

paid on one Share for each Share represented by an Award held by such Participant.

(o) “Employee”

means any person, including Officers and Directors, employed by the Company or any Parent or Subsidiary of the Company. Neither service

as a Director nor payment of a director’s fee by the Company will be sufficient to constitute “employment” by the Company.

(p) “Exchange Act”

means the Securities Exchange Act of 1934, as amended.

(q) “Fair Market Value”

means, as of any date, the value of the Ordinary Shares determined as follows:

(i) If the Ordinary Shares

are listed on any established stock exchange or a national market system, including without limitation the NASDAQ, its Fair Market Value

will be the closing sales price for such shares (or the closing bid, if no sales were reported) as quoted on such exchange or system for

the day of determination, as reported in The Wall Street Journal or such other source as the Administrator deems reliable;

(ii) If the Ordinary Shares

are regularly quoted by a recognized securities dealer but selling prices are not reported, the Fair Market Value of a Share will be the

mean between the high bid and low asked prices for the Ordinary Shares for the day of determination, as reported in The Wall Street

Journal or such other source as the Administrator deems reliable; or

(iii) In the absence of an

established market for the Ordinary Shares, the Fair Market Value will be determined in good faith by the Administrator by such other

methodology as the Administrator determines in good faith to be reasonable and in accordance with Section 409A of the Code.

(r) “Fiscal Year”

means the fiscal year of the Company.

(s) “Incentive Share

Option” means an Option intended to qualify as an “incentive stock option” within the meaning of Section 422 of the

Code and otherwise meets the requirements set forth in the Plan.

(t) “Non-Employee Director”

means a member of the Board who qualifies as a “Non-Employee Director” as defined in Rule 16b-3(b)(3) of the Exchange Act,

or any successor definition adopted by the Board.

(u) “Nonstatutory Share

Option” means an Option that by its terms does not qualify or is not intended to qualify as an Incentive Share Option.

(v) “Ordinary Shares”

means the ordinary shares of the Company, par value US$0.001, (provided however, in the event the Company adopts a multi-class share structure,

“Ordinary Shares shall means Class A ordinary shares of the Company, par value US$0.001),and any shares or other securities into

which such ordinary shares may be substituted, converted or into which they may be exchanged).

(w) “Officer”

means a person who is an officer of the Company within the meaning of Section 16 of the Exchange Act and the rules and regulations promulgated

thereunder.

(x) “Option”

means a share option granted pursuant to the Plan.

(y) “Other Share Based

Awards” means any other awards not specifically described in the Plan that are valued in whole or in part by reference to, or

are otherwise based on, Ordinary Shares and are created by the Administrator pursuant to Section 12.

(z) “Outside Director”

means a Director who is not an Employee.

(aa) “Parent”

means a “parent corporation,” whether now or hereafter existing, as defined in Section 424(e) of the Code.

(bb) “Participant”

means the holder of an outstanding Award granted under the Plan.

(cc) “Performance Share”

means an Award granted to a Service Provider pursuant to Section 10 of the Plan.

(dd) “Performance Unit”

means an Award granted to a Service Provider pursuant to Section 10 of the Plan.

(ee) “Period of Restriction”

means the period during which the transfer of Restricted Shares is subject to restrictions and a substantial risk of forfeiture. Such

restrictions may be based on the passage of time, the achievement of target levels of performance, or the occurrence of other events as

determined by the Administrator.

(ff) “Plan”

means this 2024 Equity Incentive Plan, as amended from time to time.

(gg) “Restricted Shares”

means Ordinary Shares issued pursuant to an Award under Section 8 or issued pursuant to the early exercise of an Option.

(hh) “Restricted Share

Unit” means an unfunded and unsecured promise to issue Ordinary Shares, cash, other securities or other property, subject to

certain restrictions (including, without limitation, a Period of Restriction requiring that the Participant remain continuously employed

or provide continuous services for a specified period of time), granted under Section 11 of the Plan.

(ii) “Rule 16b-3”

means Rule 16b-3 of the Exchange Act or any successor to Rule 16b-3, as in effect when discretion is being exercised with respect to the

Plan.

(jj) “Section 16(b)”

means Section 16(b) of the Exchange Act.

(kk) “Service Provider”

means an Employee, Director or Consultant.

(ll) “Share”

means an Ordinary Share, as adjusted in accordance with Section 15 of the Plan.

(mm) “Share Appreciation

Right” or “SAR” means an Award that pursuant to Section 9 of the Plan is designated as a SAR and which meets

all of the requirements of Section 1.409A-1(b)(5)(i)(B) of the Treasury Regulations.

(nn) “Subsidiary”

means any entities Controlled by the Company, provided, however, for the purpose of Incentive Share Options, “subsidiary”

means a “subsidiary corporation,” whether now or hereafter existing, as defined in Section 424 (f) of the Code. “Control”

means, with respect to any entities, the possession, directly or indirectly, of the power to direct or cause the direction of the management

policies of an entity whether through the ownership of the voting securities of such entity or by contract or otherwise. For purposes

of the Plan, any “variable interest entity” that is consolidated into the consolidated financial statements of the Company

under applicable accounting principles or standards as may apply to the consolidated financial statements of the Company shall be deemed

a Subsidiary.”

3. Ordinary Shares

Subject to the Plan.

(a) Ordinary Shares

Subject to the Plan. Subject to the provisions of Section 15 of the Plan, the maximum aggregate number of Ordinary Shares that may

be issued under the Plan shall not exceed two million (2,000,000) Ordinary Shares. The Ordinary Shares subject to the Plan may be authorized,

but unissued, or reacquired Ordinary Shares. Ordinary Shares shall not be deemed to have been issued pursuant to the Plan with respect

to any portion of an Award that is settled in cash. Upon payment in Ordinary Shares pursuant to the exercise or settlement of an Award,

the number of Ordinary Shares available for issuance under the Plan shall be reduced only by the number of Ordinary Shares actually issued

in such payment. The allotment and issuance of Shares pursuant to the terms of this Plan following the exercise of an Award shall be subject

to the Company’s Memorandum and Articles of Association, as amended and in effect from time to time.

(b) Lapsed Awards.

If any outstanding Award expires or is terminated or canceled without having been exercised or settled in full, or if the Ordinary Shares

acquired pursuant to an Award subject to forfeiture or repurchase are forfeited or repurchased by the Company, the Ordinary Shares allocable

to the terminated portion of such Award or such forfeited or repurchased Ordinary Shares shall again be available for grant under the

Plan.

(d) Share Certificates.

(i) Notwithstanding anything

herein to the contrary, the Company shall not be required to issue or deliver any certificates evidencing the Shares pursuant to the exercise

of any Award, unless and until the Committee has determined, with advice of counsel, that the issuance and delivery of such certificates

is in compliance with all Applicable Laws, regulations of governmental authorities and, if applicable, the requirements of any exchange

on which the Shares are listed or traded. All Share certificates delivered pursuant to the Plan are subject to any stop-transfer orders

and other restrictions as the Committee deems necessary or advisable to comply with all Applicable Laws, and the rules of any national

securities exchange or automated quotation system on which the Shares are listed, quoted, or traded. The Committee may place legends on

any Share certificate to reference restrictions applicable to the Shares. In addition to the terms and conditions provided herein, the

Committee may require that a Participant make such reasonable covenants, agreements, and representations as the Committee, in its discretion,

deems advisable in order to comply with any such laws, regulations, or requirements. The Committee shall have the right to require any

Participant to comply with any timing or other restrictions with respect to the settlement or exercise of any Award, including a window-period

limitation, as may be imposed in the discretion of the Committee.

(ii) Notwithstanding

anything herein to the contrary, unless otherwise determined by the Committee or required by Applicable Laws, the Company shall not deliver

to any Participant certificates evidencing Shares issued in connection with any Award and instead such Shares shall be recorded on the

register of members of the Company.

(e) Share Reserve.

The Company, during the term of the Plan, shall at all times keep available such number of Ordinary Shares authorized for issuance as

will be sufficient to satisfy the requirements of the Plan.

(f) Annual Non-Employee

Director Compensation Limitation. Notwithstanding anything to the contrary contained herein, in no event will any individual Director

who is not an Employee in any Fiscal Year be granted compensation for service having an aggregate maximum value (computed as of the date

of grant in accordance with applicable financial accounting rules) exceeding $1,000,000.

4. Administration

of the Plan.

(a) Procedure.

(i) Administrative

Bodies. The Board or the Committee shall administer the Plan.

(ii) Rule 16b-3.

To the extent desirable to qualify transactions hereunder as exempt under Rule 16b-3, the transactions contemplated hereunder will be

structured to satisfy the requirements for exemption under Rule 16b-3.

(iii) Other Administration.

Other than as provided above, the Plan will be administered by (A) the Board or (B) a Committee, which committee will be constituted to

satisfy Applicable Laws.

(iv) Delegation of

Authority for Day-to-Day Administration. The Administrator may, by resolution, expressly delegate to a special committee, consisting

of one or more directors who may but need not be Officers, the authority, within specified parameters as to the number and types of Awards,

(A) to designate Officers and/or Employees of the Company or any of its Subsidiaries to be recipients of Awards under the Plan, and (B)

to determine the number of such Awards to be received by any such Participants; provided, however, that such delegation of duties and

responsibilities may not be made with respect to grants of Awards to persons subject to Section 16(b). The acts of such delegates

shall be treated as acts of the Administrator, and such delegates shall report regularly to the Administrator regarding the delegated

duties and responsibilities and any Awards granted.

(b) Powers of the Administrator.

Subject to the provisions of the Plan, and in the case of a Committee, subject to the specific duties delegated by the Board to such Committee,

the Administrator will have the authority, in its discretion and subject to the requirements of Applicable Laws:

(i) to determine the Fair

Market Value;

(ii) to select the Service

Providers to whom Awards may be granted hereunder;

(iii) to determine the number

of the Ordinary Shares to be covered by each Award granted hereunder;

(iv) to approve forms of agreement

for use under the Plan;

(v) to determine the terms

and conditions, not inconsistent with the terms of the Plan, of any Award granted hereunder. Such terms and conditions include, but are

not limited to, the exercise price, the time or times when Awards may be exercised (which may be based on performance criteria), any vesting,

acceleration or waiver of forfeiture or repurchase restrictions, and any restriction or limitation regarding any Award or the Ordinary

Shares relating thereto, based in each case on such factors as the Administrator, in its sole discretion, will determine;

(vi) to construe and interpret

the terms of the Plan and Awards granted pursuant to the Plan;

(vii) to prescribe, amend

and rescind rules and regulations relating to the Plan, including rules and regulations relating to sub-plans established for the purpose

of satisfying applicable foreign laws and/or qualifying for preferred tax treatment under applicable foreign tax laws;

(viii) to modify or amend

each Award (subject to Section 18(c) of the Plan), including (A) the discretionary authority to extend the post-termination exercisability

period of Awards longer than is otherwise provided for in the Plan and (B) accelerate the satisfaction of any vesting criteria or waiver

of forfeiture or repurchase restrictions;

(ix) to allow Participants

to satisfy withholding tax obligations by electing to have the Company withhold from the Ordinary Shares or cash to be issued upon exercise

or vesting of an Award that number of the Ordinary Shares or cash having a Fair Market Value equal to the maximum amount required to be

withheld. The Fair Market Value of any Ordinary Shares to be withheld will be determined on the date that the amount of tax to be withheld

is to be determined. All elections by a Participant to have Ordinary Shares or cash withheld for this purpose will be made in such form

and under such conditions as the Administrator may deem necessary or advisable;

(x) to authorize any person

to execute on behalf of the Company any instrument required to effect the grant of an Award previously granted by the Administrator, to

allow a Participant to defer the receipt of the payment of cash or the issue of the Ordinary Shares that would otherwise be due to such

Participant under an Award;

(xi) to determine whether

Awards will be settled in Ordinary Shares, cash or in any combination thereof;

(xii) to determine whether

Awards will be adjusted for Dividend Equivalents;

(xiii) to create Other Share

Based Awards for issuance under the Plan;

(xiv) to establish a program

whereby Service Providers designated by the Administrator can reduce compensation otherwise payable in cash in exchange for Awards under

the Plan;

(xv) to impose such restrictions,

conditions or limitations as it determines appropriate as to the timing and manner of any resales by a Participant or other subsequent

transfers by the Participant of any Ordinary Shares issued as a result of or under an Award, including without limitation, restrictions

under an insider trading policy, and

(xvi) to make all other determinations

deemed necessary or advisable for administering the Plan.

(c) Effect of Administrator’s

Decision. The Administrator’s decisions, determinations and interpretations will be final and binding on all Participants and

any other holders of Awards.

(d) Notwithstanding anything

to the contrary contained in the Plan, the Board may, in its sole discretion, at any time and from time to time, grant Awards and administer

the Plan with respect to such Awards. In any such case, the Board shall have all the authority granted to the Administrator under the

Plan

5. Eligibility.

Nonstatutory Share Options, Restricted Shares, Share Appreciation Rights, Performance Units, Performance Shares, Restricted Share Units

and Other Share Based Awards may be granted to Service Providers. Incentive Share Options may be granted only to Employees.

6. Limitations.

(a) ISO $100,000 Rule.

Each Option will be designated in the Award Agreement as either an Incentive Share Option or a Nonstatutory Share Option. However, notwithstanding

such designation, to the extent that the aggregate Fair Market Value of the Ordinary Shares with respect to which Incentive Share Options

are exercisable for the first time by the Participant during any calendar year (under all plans of the Company and any Parent or Subsidiary)

exceeds $100,000, such Options will be treated as Nonstatutory Share Options. For purposes of this Section 6(a), Incentive Share Options

will be taken into account in the order in which they were granted. The Fair Market Value of the Ordinary Shares will be determined as

of the time the Option with respect to such Ordinary Shares is granted.

(b) No Rights as a Service

Provider. Neither the Plan nor any Award shall confer upon a Participant any right with respect to continuing his or her relationship

as a Service Provider, nor shall they interfere in any way with the right of the Participant or the right of the Company or its Parent

or Subsidiaries to terminate such relationship at any time, with or without cause.

7. Share Options.

(a) Number and Term

of Option. Subject to the terms and provisions of the Plan, the Administrator, at any time and from time to time, may grant Options

under the Plan. The Administrator will have complete discretion to determine the number of Options granted to any Service Provider. The

term of each Option will be stated in the Award Agreement. In the case of an Incentive Share Option, the term will be ten (10) years from

the date of grant or such shorter term as may be provided in the Award Agreement. Moreover, in the case of an Incentive Share Option granted

to a Participant who, at the time the Incentive Share Option is granted, owns shares representing more than ten percent (10%) of the total

combined voting power of all classes of shares of the Company or any Parent or Subsidiary, the term of the Incentive Share Option will

be five (5) years from the date of grant or such shorter term as may be provided in the Award Agreement.

(b) Option Exercise

Price and Consideration.

(i) Exercise Price.

The per share exercise price for the Ordinary Shares to be issued pursuant to exercise of an Option will be determined by the Administrator,

subject to the following:

(1) In the case of an Incentive

Share Option

(A) granted to an Employee who,

at the time the Incentive Share Option is granted, owns shares representing more than ten percent (10%) of the total combined voting power

of all shares of the Company or any Parent or Subsidiary, the per share exercise price will be no less than 110% of the Fair Market Value

per Ordinary Share on the date of grant.

(B) granted to any Employee

other than an Employee described in paragraph (A) immediately above, the per share exercise price will be no less than 100% of the Fair

Market Value per Ordinary Share on the date of grant.

(2) In the case of a Nonstatutory

Share Option, the per share exercise price will be determined by the Administrator, provided that such per share exercise price will be

no less than 100% of the Fair Market Value per Ordinary Share on the date of grant.

(ii) Waiting Period

and Exercise Dates. At the time an Option is granted, the Administrator will fix the period within which the Option may be exercised

and will determine any conditions that must be satisfied before the Option may be exercised. The Administrator, in its sole discretion,

may accelerate the satisfaction of such conditions at any time.

(c) Form of Consideration.

The Administrator will determine the acceptable form of consideration for exercising an Option, including the method of payment. In the

case of an Incentive Share Option, the Administrator shall determine the acceptable form of consideration at the time of grant. Such consideration,

to the extent permitted by Applicable Laws, may consist entirely of:

(i) cash;

(ii) check, subject to collection;

(iii) promissory note;

(iv) other Ordinary Shares

which meet the conditions established by the Administrator to avoid adverse accounting consequences (as determined by the Administrator);

(v) consideration received

by the Company under a cashless exercise program implemented by the Company in connection with the Plan;

(vi) a reduction in the amount

of any Company liability to the Participant;

(vii) any combination of the

foregoing methods of payment; or

(viii) such other consideration

and method of payment for the issuance of Ordinary Shares to the extent approved by the Board and permitted by Applicable Laws.

(d) Exercise of Option.

(i) Procedure for

Exercise; Rights as a Shareholder. Any Option granted hereunder will be exercisable according to the terms of the Plan and at such

times and under such conditions as determined by the Administrator and set forth in the Award Agreement. An Option may not be exercised

for a fraction of an Ordinary Share.

An Option will be deemed exercised

when the Company receives: (x) written or electronic notice of exercise (in accordance with the Award Agreement) from the person entitled

to exercise the Option, and (y) full payment for the Ordinary Shares with respect to which the Option is exercised (including provision

for any applicable tax withholding). Full payment may consist of any consideration and method of payment authorized by the Administrator

and permitted by the Award Agreement and the Plan. Ordinary Shares issued upon exercise of an Option will be issued in the name of the

Participant. Until the Ordinary Shares are issued (as evidenced by the appropriate entry on the books of the Company or of a duly authorized

transfer agent of the Company), no right to vote or receive dividends or any other rights as a shareholder will exist with respect to

the Awarded Shares, notwithstanding the exercise of the Option. The Company will issue (or cause to be issued) such Ordinary Shares promptly

after the Option is exercised. No adjustment will be made for a dividend or other right for which the record date is prior to the date

the Ordinary Shares are issued, except as provided in Section 15 of the Plan or the applicable Award Agreement.

Exercising an Option in any

manner will decrease the number of Ordinary Shares thereafter available for sale under the Option, by the number of Ordinary Shares as

to which the Option is exercised.

(ii) Termination of

Relationship as a Service Provider. If a Participant ceases to be a Service Provider, other than upon the Participant’s death

or Disability, the Participant may exercise his or her Option within such period of time as is specified in the Award Agreement to the

extent that the Option is vested on the date of termination (but in no event later than the expiration of the term of such Option as set

forth in the Award Agreement). In the absence of a specified time in the Award Agreement, the Option will remain exercisable for three

(3) months following the Participant’s termination. Unless otherwise provided by the Administrator, if on the date of termination

the Participant is not vested as to his or her entire Option, the Ordinary Shares covered by the unvested portion of the Option will be

forfeited and will revert to the Plan and again will become available for grant under the Plan. If after termination the Participant does

not exercise his or her Option as to all of the vested Ordinary Shares within the time specified by the Administrator, the Option will

be forfeited and will revert to the Plan and again will become available for grant under the Plan.

(iii) Disability of

Participant. If a Participant ceases to be a Service Provider as a result of the Participant’s Disability, the Participant may

exercise his or her Option within such period of time as is specified in the Award Agreement to the extent the Option is vested on the

date of termination (but in no event later than the expiration of the term of such Option as set forth in the Award Agreement). In the

absence of a specified time in the Award Agreement, the Option will remain exercisable for twelve (12) months following the Participant’s

termination. Unless otherwise provided by the Administrator, if on the date of termination the Participant is not vested as to his or

her entire Option, the Ordinary Shares covered by the unvested portion of the Option will be forfeited and will revert to the Plan and

again will become available for grant under the Plan.. If after termination the Participant does not exercise his or her Option as to

all of the vested Ordinary Shares within the time specified by the Administrator, the Option will terminate, and the remaining Ordinary

Shares covered by such Option will be forfeited and will revert to the Plan and again will become available for grant under the Plan.

(iv) Death of Participant.

If a Participant dies while a Service Provider, the Option may be exercised following the Participant’s death within such period

of time as is specified in the Award Agreement to the extent that the Option is vested on the date of death (but in no event may the Option

be exercised later than the expiration of the term of such Option as set forth in the Award Agreement), by the Participant’s designated

beneficiary, provided such beneficiary has been designated prior to the Participant’s death in a form acceptable to the Administrator.

If no such beneficiary has been designated by the Participant, then such Option may be exercised by the personal representative of the

Participant’s estate or by the persons to whom the Option is transferred pursuant to the Participant’s will or in accordance

with the laws of descent and distribution. In the absence of a specified time in the Award Agreement, the Option will remain exercisable

for twelve (12) months following the Participant’s death. Unless otherwise provided by the Administrator, if at the time of death

the Participant is not vested as to his or her entire Option, the Ordinary Shares covered by the unvested portion of the Option will be

forfeited and will revert to the Plan and again will become available for grant under the Plan. If the Option is not exercised as to all

of the vested Ordinary Shares within the time specified by the Administrator, the Option will terminate, and the remaining Ordinary Shares

covered by such Option will be forfeited and will revert to the Plan and again will become available for grant under the Plan.

8. Restricted Shares.

(a) Grant of Restricted

Shares. Subject to the terms and provisions of the Plan, the Administrator, at any time and from time to time, may grant Restricted

Shares to Service Providers in such amounts as the Administrator, in its sole discretion, will determine.

(b) Restricted Share

Agreement. Each Award of Restricted Shares will be evidenced by an Award Agreement that will specify the Period of Restriction and

the applicable restrictions, the number of Ordinary Shares granted, and such other terms and conditions as the Administrator, in its sole

discretion, will determine. Unless the Administrator determines otherwise, Restricted Shares will be held by the Company as escrow agent

until the restrictions on such Restricted Shares have lapsed.

(c) Transferability.

Except as provided in this Section 8, Restricted Shares may not be sold, transferred, pledged, assigned, or otherwise alienated or hypothecated

until the end of the applicable Period of Restriction.

(d) Other Restrictions.

The Administrator, in its sole discretion, may impose such other restrictions on Restricted Shares as it may deem advisable or appropriate.

(e) Removal of Restrictions.

Except as otherwise provided in this Section 8, Restricted Shares covered by each Restricted Shares grant made under the Plan will be

released from escrow as soon as practicable after the last day of the Period of Restriction. The Board, in its discretion, may accelerate

the time at which any restrictions will lapse or be removed.

(f) Voting Rights.

During the Period of Restriction, Service Providers holding Restricted Shares granted hereunder may exercise the voting rights applicable

to those Restricted Shares, unless the applicable Award Agreement provides otherwise.

(g) Dividends and Other

Distributions. During the Period of Restriction, Service Providers holding Restricted Shares will be entitled to receive all dividends

and other distributions paid with respect to such Restricted Shares unless otherwise provided in the Award Agreement; provided that any

such dividends and other distributions will be subject to the same restrictions and risk of forfeiture as the Restricted Shares. If any

such dividends or distributions are paid in Ordinary Shares, the Ordinary Shares will be subject to the same restrictions on transferability

and forfeitability as the Restricted Shares with respect to which they were paid.

(h) Return of Restricted

Shares to Company. On the date set forth in the Award Agreement, the Restricted Shares for which the Period of Restriction has not

lapsed will be forfeited and will revert to the Company and again will become available for grant under the Plan.

9. Share Appreciation

Rights.

(a) Grant of SARs.

Subject to the terms and conditions of the Plan, a SAR may be granted to Service Providers at any time and from time to time as will be

determined by the Administrator, in its sole discretion.

(b) Number of SARs.

Subject to the terms and conditions of the Plan, the Administrator will have complete discretion to determine the number of SARs granted

to any Service Provider.

(c) Exercise Price and

Other Terms. The Administrator, subject to the provisions of the Plan, will have complete discretion to determine the per-Share exercise

price and other terms and conditions of SARs granted under the Plan; provided that such exercise price of each SAR shall not be less than

100% of the Fair Market Value of an Ordinary Share on the date of grant.

(d) Exercise of SARs.

SARs will be exercisable on such terms and conditions as the Administrator, in its sole discretion, will determine. The Administrator,

in its sole discretion, may accelerate exercisability at any time.

(e) SAR Agreement.

Each SAR grant will be evidenced by an Award Agreement that will specify the exercise price, the term of the SAR, the conditions of exercise,

and such other terms and conditions as the Administrator, in its sole discretion, will determine.

(f) Expiration of SARs.

An SAR granted under the Plan will expire upon the date determined by the Administrator, in its sole discretion, and set forth in the

Award Agreement. Notwithstanding the foregoing, the rules of Sections 7(d)(ii), 7(d)(iii) and 7(d)(iv) also will apply to SARs.

(g) Payment of SAR Amount.

Upon exercise of an SAR, a Participant will be entitled to receive payment from the Company in an amount determined by multiplying:

(i) The difference between

the Fair Market Value of an Ordinary Share on the date of exercise over the exercise price; times

(ii) The number of Shares

with respect to which the SAR is exercised.

At the discretion of the Administrator,

the payment upon SAR exercise may be in cash, in Shares of equivalent value, or in some combination thereof.

10. Performance Units

and Performance Shares.

(a) Grant of Performance

Units/Shares. Subject to the terms and conditions of the Plan, Performance Units and Performance Shares may be granted to Service

Providers at any time and from time to time, as will be determined by the Administrator in its sole discretion. Subject to the terms and

conditions of the Plan, the Administrator will have complete discretion in determining the number of Performance Units and Performance

Shares granted to each Participant.

(b) Value of Performance

Units/Shares. Each Performance Unit will have an initial value that is established by the Administrator on or before the date of grant.

Each Performance Share will have an initial value equal to the Fair Market Value of an Ordinary Share on the date of grant.

(c) Performance Objectives

and Other Terms. The Administrator will set performance objectives in its discretion which, depending on the extent to which they

are met, will determine the number or value of Performance Units/Shares that will be paid out to the Participant. The time period during

which the performance objectives must be met will be called the “Performance Period.” Each Award of Performance Units/Shares

will be evidenced by an Award Agreement that will specify the Performance Period, and such other terms and conditions as the Administrator,

in its sole discretion, will determine. The Administrator may set performance objectives based upon the achievement of Company-wide, divisional,

or individual goals, applicable securities laws, or any other basis determined by the Administrator in its discretion.

(d) Earning of Performance

Units/Shares. After the applicable Performance Period has ended, the holder of Performance Units/Shares will be entitled to receive

a payout of the number of Performance Units/Shares earned by the Participant over the Performance Period, to be determined as a function

of the extent to which the corresponding performance objectives have been achieved, as determined by the Administrator in its sole discretion.

After the grant of a Performance Unit/Share, the Board, in its sole discretion, may reduce or waive any performance objectives for such

Performance Unit/Share.

(e) Form and Timing

of Payment of Performance Units/Shares. Payment of earned Performance Units/Shares will be made after the expiration of the applicable

Performance Period at the time determined by the Administrator. The Administrator, in its sole discretion, may pay earned Performance

Units/Shares in the form of cash, in Shares (which have an aggregate Fair Market Value equal to the value of the earned Performance Units/Shares

at the close of the applicable Performance Period) or in a combination of cash and Shares.

(f) Cancellation of

Performance Units/Shares. On the date set forth in the Award Agreement, all unearned or unvested Performance Units/Shares will be

forfeited to the Company, and again will be available for grant under the Plan.

11. Restricted Share

Units. Restricted Share Units shall consist of a Restricted Share, Performance Share or Performance Unit Award that the Administrator,

in its sole discretion permits to be paid out in installments or on a deferred basis, in accordance with rules and procedures established

by the Administrator, subject to compliance with Section 409A of the Code.

12. Other Share Based

Awards. Other Share Based Awards may be granted either alone, in addition to, or in tandem with, other Awards granted under the Plan

and/or cash awards made outside of the Plan. The Administrator shall have authority to determine the Service Providers to whom and the

time or times at which Other Share Based Awards shall be made, the amount of such Other Share Based Awards, and all other conditions of

the Other Share Based Awards including any dividend and/or voting rights.

13. Leaves of Absence.

Unless the Administrator provides otherwise, vesting of Awards granted hereunder will be suspended during any unpaid leave of absence

and will resume on the date the Participant returns to work on a regular schedule as determined by the Company; provided, however, that

no vesting credit will be awarded for the time vesting has been suspended during such leave of absence. A Service Provider will not cease

to be an Employee in the case of (i) any leave of absence approved by the Company or (ii) transfers between locations of the Company or

between the Company, its Parent, or any Subsidiary. For purposes of Incentive Share Options, no leave of absence may exceed ninety (90)

days, unless reemployment upon expiration of such leave is guaranteed by statute or contract. If reemployment upon expiration of a leave

of absence approved by the Company is not so guaranteed, then three months following the 91st day of such leave any Incentive Share Option

held by the Participant will cease to be treated as an Incentive Share Option and will be treated for U.S. federal tax purposes as a Nonstatutory

Share Option.

14. Non-Transferability

of Awards. Unless determined otherwise by the Administrator, an Award may not be sold, pledged, assigned, hypothecated, transferred,

or disposed of in any manner other than by will or by the laws of descent or distribution and may be exercised, during the lifetime of

the Participant, only by the Participant. If the Administrator makes an Award transferable, such Award will contain such additional terms

and conditions as the Administrator deems appropriate.

15. Adjustments; Dissolution

or Liquidation; Change in Control.

(a) Adjustments.

In the event that any dividend or other distribution (whether in the form of cash, Ordinary Shares, other securities, or other property),

recapitalization, share capitalization, share subdivision, share consolidation, reorganization, merger, consolidation, spin-off, combination,

repurchase, or exchange of Ordinary Shares or other securities of the Company, or other change in the corporate structure of the Company

affecting the Ordinary Shares occurs such that an adjustment is determined by the Administrator (in its sole discretion) to be appropriate

in order to prevent dilution or enlargement of the benefits or potential benefits intended to be made available under the Plan, then the

Administrator shall, in such manner as it may deem equitable, adjust the number and class of Ordinary Shares which may be issued under

the Plan, the number, class and price of Ordinary Shares subject to outstanding Awards, and the numerical limits in Section 6. Notwithstanding

the preceding, the number of Ordinary Shares subject to any Award always shall be a whole number.

(b) Winding-Up, Liquidation

and Dissolution. In the event of the proposed winding up, liquidation and dissolution of the Company, the Administrator will notify

each Participant as soon as practicable prior to the effective date of such proposed transaction. The Administrator in its discretion

may provide for a Participant to have the right to exercise his or her Award, to the extent applicable, until ten (10) days prior to such

transaction as to all of the Awarded Shares covered thereby, including Ordinary Shares as to which the Award would not otherwise be exercisable.

In addition, the Administrator may provide that any Company repurchase Option or forfeiture rights applicable to any Award shall lapse,

and that any Award vesting shall accelerate, provided the proposed winding up, liquidation and dissolution n takes place at the time and

in the manner contemplated. To the extent it has not been previously vested and, if applicable, exercised, an Award will terminate immediately

prior to the consummation of such proposed action.

(c) Change in Control.

(i) Share Options

and SARs. In the event of a Change in Control, each outstanding Option and SAR shall be assumed or an equivalent Option or SAR substituted

by the acquiring or successor company or corporation or a Parent of the acquiring or successor company or corporation. Unless determined

otherwise by the Administrator, in the event that the successor company or corporation refuses to assume or substitute for the Option

or SAR, the Participant shall fully vest in and have the right to exercise the Option or SAR as to all of the Awarded Shares, including

those as to which it would not otherwise be vested or exercisable; provided, that any Option or SAR for which the exercise price is equal

to or less than the consideration offered by the acquiring or successor company or corporation shall terminate as of the effective date

of the Change in Control. If an Option or SAR is not assumed or substituted in the event of a Change in Control, the Administrator shall

notify the Participant in writing or electronically that the Option or SAR shall be exercisable, to the extent vested, for a period of

up to fifteen (15) days from the date of such notice, and the Option or SAR shall terminate upon the expiration of such period. For the

purposes of this paragraph, the Option or SAR shall be considered assumed if, following the Change in Control, the Option or SAR confers

the right to purchase or receive, for each Awarded Share subject to the Option or SAR immediately prior to the Change in Control, the

consideration (whether shares, cash, or other securities or property) received in the Change in Control by holders of the Ordinary Shares

for each Ordinary Share held on the effective date of the transaction (and if holders were offered a choice of consideration, the type

of consideration chosen by the holders of a majority of the issued and outstanding Shares); provided, however, that if such consideration

received in the Change in Control is not solely Ordinary Shares of the acquiring or successor company or corporation or its Parent, the

Administrator may, with the consent of the acquiring or successor company or corporation, provide for the consideration to be received

upon the exercise of the Option or SAR, for each Awarded Share subject to the Option or SAR, to be solely Ordinary Shares of the acquiring

or successor company or corporation or its Parent equal in fair market value to the per share consideration received by holders of Ordinary

Shares in the Change in Control. Notwithstanding anything herein to the contrary, an Award that vests, is earned, or is paid out upon

the satisfaction of one or more performance goals will not be considered assumed if the Company or the acquiring or successor company

or corporation modifies any of such performance goals without the Participant’s consent; provided, however, that a modification

to such performance goals only to reflect the acquiring or successor company or corporation’s post-Change in Control corporate structure

will not be deemed to invalidate an otherwise valid Award assumption.

(ii) Restricted Shares,

Performance Shares, Performance Units, Restricted Share Units and Other Share Based Awards. In the event of a Change in Control, each

outstanding Award of Restricted Shares, Performance Share, Performance Unit, Restricted Share Unit or Other Share Based Award shall be

assumed or an equivalent Restricted Share, Performance Share, Performance Unit, Restricted Share Unit or Other Share Based Award substituted

by the acquiring or successor company or corporation or a Parent of the acquiring or successor company or corporation. Unless determined

otherwise by the Administrator, in the event that the acquiring or successor company or corporation refuses to assume or substitute for

the Award, the Participant shall fully vest in the Award including as to Shares/Units that would not otherwise be vested, all applicable

restrictions will lapse, and all performance objectives and other vesting criteria will be deemed achieved at targeted levels. For the

purposes of this paragraph, an Award of Restricted Shares, Performance Shares, Performance Units, Other Share Based Awards and Restricted

Share Units shall be considered assumed if, following the Change in Control, the award confers the right to purchase or receive, for each

Ordinary Share subject to the Award immediately prior to the Change in Control (and if a Restricted Share Unit or Performance Unit, for

each Share as determined based on the then current value of the unit), the consideration (whether shares, cash, or other securities or

property) received in the Change in Control by holders of the Ordinary Shares for each Ordinary Share held on the effective date of the

transaction (and if holders were offered a choice of consideration, the type of consideration chosen by the holders of a majority of the

outstanding Ordinary Shares); provided, however, that if such consideration received in the Change in Control is not solely Ordinary Shares

of the successor company or corporation or its Parent, the Administrator may, with the consent of the acquiring or successor company or

corporation, provide that the consideration to be received for each Ordinary Share (and if a Restricted Share Unit or Performance Unit,

for each Ordinary Share as determined based on the then current value of the unit) be solely Ordinary Shares of the acquiring or successor

company or corporation or its Parent equal in fair market value to the per share consideration received by holders of Ordinary Shares

in the Change in Control. Notwithstanding anything herein to the contrary, an Award that vests, is earned, or is paid out upon the satisfaction

of one or more performance goals will not be considered assumed if the Company or the acquiring or successor company or corporation modifies

any of the performance goals without the Participant’s consent; provided, however, that a modification to the performance goals

only to reflect the acquiring or successor company or corporation’s post-Change in Control corporate structure will not be deemed

to invalidate an otherwise valid Award assumption.

(iii) Outside Director

Awards. Notwithstanding any provision of Section 15(c)(i) or 15(c)(ii) to the contrary, with respect to Awards granted to an Outside

Director that are assumed or substituted for, if on the date of or following the assumption or substitution the Participant’s status

as a Director or a director of the acquiring or successor company or corporation, as applicable, is terminated other than upon a voluntary

resignation by the Participant, then the Participant shall fully vest in and have the right to exercise his or her Options and Share Appreciation

Rights as to all of the Awarded Shares, including those as to which such Awards would not otherwise be vested or exercisable, all restrictions

on Restricted Shares and Restricted Share Units, as applicable, will lapse, and, with respect to Performance Shares, Performance Units,

and Other Share Based Awards, all performance goals and other vesting criteria will be deemed achieved at target levels and all other

terms and conditions met; provided, that any Option or SAR for which the exercise price is equal to or less than the consideration offered

by the acquiring or successor company or corporation shall terminate as of the effective date of the Change in Control.

(d) Outstanding Awards –

Other Changes. In the event of any other change in the capitalization of the Company or corporate change other than those specifically

referred to in this Section 15, the Committee may, in its absolute discretion, make such adjustments in the number and class of shares

subject to Awards outstanding on the date on which such change occurs and in the per share grant or exercise price of each Award as the

Committee may consider appropriate to prevent dilution or enlargement of rights.

16. Date of Grant.

The date of grant of an Award will be, for all purposes, the date on which the Administrator makes the determination granting such Award,

or such later date as is determined by the Administrator, consistent with applicable laws; provided that with respect to the grant of

an Option, such date is determined in a manner consistent with Section 409A of the Code. Notice of the determination will be provided

to each Participant within a reasonable time after the date of such grant.

17. Term of Plan.

Subject to Section 22 of the Plan, the Plan will become effective pursuant to the resolution adopting the Plan by the Board. It will continue

in effect for a term of ten (10) years unless terminated earlier under Section 18 of the Plan.

18. Amendment and

Termination of the Plan.

(a) Amendment and Termination.

The Board may at any time amend, alter, suspend or terminate the Plan.

(b) Shareholder Approval.

The Company will obtain shareholder approval of any Plan amendment to the extent necessary or, as determined by the Administrator in its

sole discretion, desirable to comply with Applicable Laws.

(c) Effect of Amendment

or Termination. No amendment, alteration, suspension, or termination of the Plan will impair the rights of any Participant with respect

to outstanding Awards, unless mutually agreed otherwise between the Participant and the Administrator, which agreement must be in writing

and signed by the Participant and the Company. Termination of the Plan will not affect the Administrator’s ability to exercise the

powers granted to it hereunder with respect to Awards granted under the Plan prior to the date of such termination.

19. Conditions Upon

Issuance of Ordinary Shares.

(a) Legal Compliance.

Ordinary Shares will not be issued pursuant to the exercise of an Award unless the exercise of such Award and the issuance of such Ordinary

Shares will comply with Applicable Laws and will be further subject to the approval of counsel for the Company with respect to such compliance.

(b) Investment Representations.

As a condition to the exercise or receipt of an Award, the Company may require the person exercising or receiving such Award to represent

and warrant at the time of any such exercise or receipt that the Ordinary Shares are being purchased only for investment and without any

present intention to sell or distribute such Ordinary Shares if, in the opinion of counsel for the Company, such a representation is required.

20. Severability.

Notwithstanding any contrary provision of the Plan or an Award to the contrary, if any one or more of the provisions (or any part thereof)

of this Plan or the Awards shall be held invalid, illegal, or unenforceable in any respect, such provision shall be modified so as to

make it valid, legal, and enforceable, and the validity, legality, and enforceability of the remaining provisions (or any part thereof)

of the Plan or Award, as applicable, shall not in any way be affected or impaired thereby.

21. Inability to Obtain

Authority. The inability of the Company to obtain authority from any regulatory body having jurisdiction, which authority is deemed

by the Company’s counsel to be necessary to the lawful issuance and sale of any Ordinary Shares hereunder, will relieve the Company

of any liability in respect of the failure to issue or sell such Ordinary Shares as to which such requisite authority will not have been

obtained.

22. Section 409A. The

Plan and all Awards granted hereunder are intended to comply with, or otherwise be exempt from, the requirements of Section 409A of the

Code. The Plan and all Awards granted under this Plan shall be administered, interpreted, and construed in a manner consistent with Section

409A of the Code to the extent necessary to avoid the imposition of additional taxes under Section 409A(a)(1)(B) of the Code. Notwithstanding

anything in this Plan to the contrary, in no event shall the Administrator exercise its discretion to accelerate the payment or settlement

of an Award where such payment or settlement constitutes deferred compensation within the meaning of Section 409A of the Code unless,

and solely to the extent that, such accelerated payment or settlement is permissible under Section 1.409A-3(j)(4) of the Treasury Regulations.

If a Participant is a “specified employee” (within the meaning of Section 1.409A-1(i) of the Treasury Regulations) at any

time during the twelve (12)-month period ending on the date of his or her termination of employment, and any Award hereunder subject to

the requirements of Section 409A of the Code is to be satisfied on account of the Participant’s termination of employment, satisfaction

of such Award shall be suspended until the date that is six (6) months after the date of such termination of employment.

23. Shareholder Approval.

The Plan will be subject to approval by the shareholders of the Company within twelve (12) months after the date the Plan is adopted.

Such shareholder approval will be obtained in the manner and to the degree required under Applicable Laws.

24. Interpretation.

In this Plan:

(a) any forfeiture of Shares

described herein will take effect as a surrender of shares for no consideration of such Shares as a matter of Cayman Islands law;

(b) any share dividends described

herein will take effect as share capitalizations as a matter of Cayman Islands law;

(c) any share splits described

herein will take effect as share sub-divisions as a matter of Cayman Islands law;

(d) the allotment and issuance

of Shares pursuant to the terms of this Plan following the exercise of an Option or Award shall be subject to the Memorandum and Articles

of Association of the Company, as amended and in effect from time to time.; and

(e) as a matter of Cayman Islands

law, Shares shall not in fact be legally issued, transferred, redeemed, repurchased or forfeited until the time at which the appropriate

entries are made in Register of Members of the Company (the Register of Members being prima facie evidence of legal title to shares).

25. Choice of Law.

The Plan will be governed by and construed in accordance with the laws of the State of California without regard to principles of conflicts

of laws.

As approved by the Board of the Company on July

15, 2024.

As approved by the shareholders of the Company

on August 28, 2024.

17

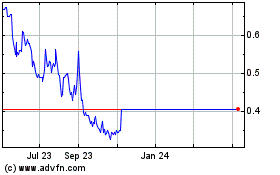

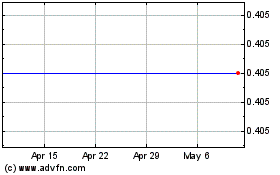

Glory Star New Media (NASDAQ:GSMG)

Historical Stock Chart

From Oct 2024 to Nov 2024

Glory Star New Media (NASDAQ:GSMG)

Historical Stock Chart

From Nov 2023 to Nov 2024