Current Report Filing (8-k)

December 02 2016 - 1:54PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of report (date of earliest event reported):

December 2, 2016

HERCULES OFFSHORE, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

001-37623

|

|

56-2542838

|

|

(State of incorporation

or organization)

|

|

(Commission File Number)

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

9 Greenway Plaza, Suite 2200

Houston, Texas

|

|

|

|

77046

|

|

(Address of principal executive offices)

|

|

|

|

(Zip code)

|

Registrant’s telephone number, including area code: (713) 350-5100

(Former name or former address, if changed since last report)

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Item 1.01. Entry into a Material Definitive Agreement.

On December 2, 2016, Hercules British Offshore Limited (the “

Seller

”), a subsidiary of Hercules

Offshore, Inc. (the “

Company

”), entered into a purchase and sale agreement (the “

Purchase Agreement

”) with Magni Drilling Limited (the “

Buyer

”). The Buyer is purchasing from the

Seller two jack-up drilling rigs named

Hercules Triumph

(IMO 8771320) and

Hercules Resilience

(IMO 8771332) in their entirety, together with everything onboard, including all broached and unbroached provisions, spare parts and

equipment onboard or onshore, rig site inventory, drawings, operating manuals, maintenance records, service contracts and all other documents pertaining to them for $130 million in cash. The Purchase Agreement is expected to close on or before

January 10, 2017, subject to certain closing conditions.

The summary of the Purchase Agreement set forth above does

not purport to be complete, and is qualified in its entirety by reference to the Purchase Agreement, which is filed as Exhibit 2.1 to this Current Report on Form 8-K and is incorporated into this Item 1.01 by reference.

Item 1.03. Bankruptcy or Receivership.

As previously disclosed by the Company on the Current Report on Form 8-K filed on June 6, 2016, the Company and certain of

its U.S. domestic direct and indirect subsidiaries (together with the Company, the “

Debtors

”) filed voluntary petitions for relief under chapter 11 of the United States Bankruptcy Code (“

Chapter 11

”)

on June 5, 2016 in the United States Bankruptcy Court for the District of Delaware (the “

Bankruptcy Court

”). The Chapter 11 case is being administered under the caption

In re: Hercules Offshore, Inc.

(Case

No. 16-11385).

On November 15, 2016, the Bankruptcy Court entered an order confirming the Debtors’ Modified

Joint Prepackaged Chapter 11 Plan (incorporating mediation settlement) (the “

Plan of Liquidation

”). On December 2, 2016, all applicable conditions set forth in the Plan of Liquidation were satisfied or waived and the

effective date of the Plan of Liquidation occurred (the “

Effective Date

”). The Company filed a Notice of Effective Date of the Plan of Liquidation with the Bankruptcy Court on December 2, 2016 (the “

Notice of

Effective Date

”). A copy of the Notice of Effective Date is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

The registered securities cancelled on the Effective Date included all of the Company’s common stock, $0.01 par value per

share (the “

Common Stock

”), as well as the Company’s warrants to purchase the Common Stock exercisable on or before November 8, 2021 (the “

Warrants

”).

The Common Stock and the Warrants were cancelled and extinguished on the Effective Date.

The Company intends to file Form 15 filings with the Securities and Exchange Commission (the “

SEC

”)

for the purpose of terminating the registration of the Common Stock and the Warrants under the Securities Exchange Act of 1934, as amended (the “

Exchange Act

”). Upon filing the Form 15 for the Common Stock, the Company will

immediately cease filing any further periodic or current reports under the Exchange Act.

Cautionary Statement Regarding Forward-Looking Statements

This Current Report on Form 8-K includes forward-looking statements as defined under federal law. Although the Company

believes that its expectations are based upon reasonable assumptions, no assurance can be given that the Company’s goals will be achieved, including statements regarding its ability to close the Purchase Agreement and filing the Form 15 filings

with the SEC as indicated above. Actual results may vary materially. The Company undertakes no obligation to publicly update or revise any forward-looking statement.

2

Item 3.03. Material Modification to Rights of Security Holders.

The information set forth in Item 1.03 of this Current Report on Form 8-K is incorporated by reference into this

Item 3.03.

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory

Arrangements of Certain Officers.

The Plan of Liquidation provides that the terms of all directors and officers of all

the Debtors shall be deemed to have expired on the Effective Date. As of the Effective Date, the members of the board of directors of the Company (the “

Board

”) resigned from the Board.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

|

|

|

|

|

Exhibit

Number

|

|

Description

|

|

|

|

|

2.1

|

|

Purchase and Sale Agreement, dated December 2, 2016, by and between Hercules British Offshore Limited and Magni Drilling

Limited. *

|

|

|

|

|

99.1

|

|

Notice of Effective Date.

|

* The exhibits and schedules to the Purchase Agreement have been omitted from this filing pursuant to

Item 601(b)(2) of Regulation S-K. The Company will furnish copies of such omitted exhibits and schedules to the SEC upon request.

3

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Company has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

HERCULES OFFSHORE, INC.

|

|

|

|

|

|

|

Date: December 2, 2016

|

|

|

|

By:

|

|

/s/ Beau M. Thompson

|

|

|

|

|

|

|

|

Beau M. Thompson

|

|

|

|

|

|

|

|

Senior Vice President, General Counsel and Secretary

|

4

EXHIBIT INDEX

|

|

|

|

|

Exhibit Number

|

|

Description

|

|

|

|

|

2.1

|

|

Purchase and Sale Agreement, dated December 2, 2016, by and between Hercules British Offshore Limited and Magni Drilling

Limited. *

|

|

|

|

|

99.1

|

|

Notice of Effective Date.

|

* The exhibits and schedules to the Purchase Agreement have been omitted from this filing pursuant to

Item 601(b)(2) of Regulation S-K. The Company will furnish copies of such omitted exhibits and schedules to the SEC upon request.

5

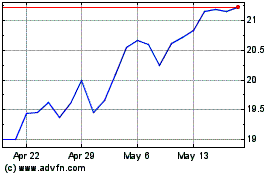

Global X Video Games and... (NASDAQ:HERO)

Historical Stock Chart

From Nov 2024 to Dec 2024

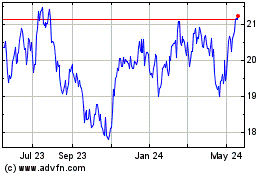

Global X Video Games and... (NASDAQ:HERO)

Historical Stock Chart

From Dec 2023 to Dec 2024