EUROPE MARKETS: European Markets Track Global Stocks Higher; Energy Companies Offer Support

March 15 2019 - 9:57AM

Dow Jones News

By Emily Horton

European stocks rose in step with global markets on Friday, with

investor enthusiasm driven by hopes over global trade.

Investors also took stock of the latest U.K. parliamentary vote

to ask E.U. leaders to extend Britain's withdrawal from the

E.U.

Heavyweight oil and gas helped drive the markets up,

particularly the FTSE 100.

How did markets perform?

The Stoxx Europe 600 added 0.5% to 380.60 on Friday, after

finishing the previous day up 0.7%, and was set for a weekly gain

of 2.7%.

The U.K.'s FTSE 100 climbed 0.6% to 7,228.75, while France's CAC

40 rose by 0.9% to 5,399.66.

Germany's DAX (DAX) climbed 0.9% to 11,693.53 and Italy's FTSE

MIB index gained 0.7% to 21,031.24.

The British pound remained flat at $1.3236, while the euro

climbed to $1.1308, unchanged from late Thursday evening in New

York.

What's driving the markets?

Chinese lawmakers on Friday approved a new law against the

forced transfer of technology by foreign companies

(http://www.marketwatch.com/story/china-approves-law-against-forced-tech-transfers-to-appease-us-2019-03-14)

-- a big complaint by the U.S. and other countries. But it remains

unclear if the move will be enough to smooth the path to a trade

deal.

Meanwhile, U.S. president Donald Trump has threaten the E.U.

with "pretty severe" economic pain if Brussels does not engage in

trade talks with Washington, the Financial Times reported

(https://www.ft.com/content/ce0cc7ea-4678-11e9-a965-23d669740bfb?emailId=5c8aeeb0cc534f000485fbec&segmentId=22011ee7-896a-8c4c-22a0-7603348b7f22&fbclid=IwAR1CzZL7FcWbK-zg0lhDEdmqN_dJxjSqfG3rwdmOfUHW2GEeyjZzJ0Ke2KE).

After turbulent week in U.K. parliament, Thursday evening saw

MPs vote to extend Article 50 for a short period until June 30. The

decision marks end of a intense three days, which during Prime

Minister Theresa May's revised withdrawal agreement was rejected

for the second time and MPs voted to rule out to leaving the EU

with no deal.

Oil prices have continued to edge higher, as extended OPEC

production cuts and lower inventories help support prices. Total

S.A. (FP.FR) rose 1%.

However, U.K. Oil & Gas PLC (UKOG.LN) fell 2% after

announcing its loss for 2018 widened more than seven times

(http://www.marketwatch.com/story/uk-oil-gas-loss-widens-on-exploration-write-offs-2019-03-15)

as it booked an impairment on exploration write-offs.

What stocks are active?

UBS Group AG fell 1.6% after the Swiss bank set aside $516

million in provision for a tax case

(http://www.marketwatch.com/story/ubs-sets-aside-516-million-for-french-tax-case-2019-03-15)in

which French judges ordered the bank to pay a hefty fine for

helping wealthy clients in France evade taxes.

H&M Hennes & Mauritz AB Series B (HM-B.SK) slid 4%,

despite the high street retailer announcing higher than expected

sales for the first quarter

(http://www.marketwatch.com/story/hennes-mauritzs-10-sales-gain-beats-forecasts-2019-03-15).

"In the last two years the company has struggled to hit its

sales targets due to large build ups in inventory. The company

appears to be succeeding in reducing these over hangs as a result

of lowering its prices," Michael Hewson chief market analyst at CMC

Markets UK told clients in a note.

Volkswagen AG (VOW3.XE) rose 0.3% as investors largely brushed

aside news the U.S. Securities and Exchange Commission charged the

German car maker with defrauding U.S. bond investors

(http://www.marketwatch.com/story/volkswagen-ex-ceo-winterkorn-face-sec-charges-of-misleading-us-investors-2019-03-15).

(END) Dow Jones Newswires

March 15, 2019 09:42 ET (13:42 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

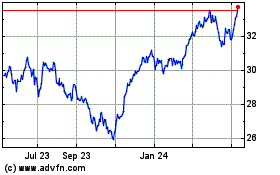

Global X Funds Global X ... (NASDAQ:DAX)

Historical Stock Chart

From Nov 2024 to Dec 2024

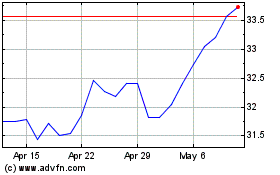

Global X Funds Global X ... (NASDAQ:DAX)

Historical Stock Chart

From Dec 2023 to Dec 2024