EUROPE MARKETS: Europe's Indexes Edge Up After Trump Delays Chinese Goods Tariff

February 25 2019 - 6:00AM

Dow Jones News

By Emily Horton

Pound climbs on Brexit development, weighing on FTSE 100

Europe's markets gained on Monday, albeit most of the moves were

modest, benefiting in part from news President Donald Trump delayed

the March 1 tariff deadline on Chinese goods.

The FTSE 100 bucked this trend, falling as the pound rose on

news U.K. Prime Minister Theresa May has delayed a parliamentary

vote on her Brexit deal.

How are markets performing?

The Stoxx Europe 600 gained 0.3% on Monday, after finishing up

0.6% for the week on Friday.

Italy's FTSE MIB index was the regions top climber, adding 0.9%

to 20,441.00.

The German DAX (DAX) rising 0.6% to 11,518.68, Spain's IBEX 35

rose by 0.5% to 9,252.50 and France's CAC 40 jumped by 0.3% to

5,231.81.

The FTSE 100 lagged with a gain of 0.1% to 7,191.04, held back

by a strong pound which fetched $1.3079 on Monday, a gain of

0.2%.

Meanwhile, the euro was also up, climbing to $1.1349 from

$1.1335 late in New York on Friday.

What's driving the markets?

President Donald Trump said that he would postpone the March 1

tariff deadline on $200 billion of Chinese goods, tweeting

(https://twitter.com/realDonaldTrump/status/1099800961089003522) on

Sunday that "substantial progress" had been made during

negotiations between the world's two largest economies.

Meanwhile in the UK, Prime Minister Theresa May has postponed

parliament's vote on her Brexit deal to March 12, a move described

as "a huge gamble" by Naeem Aslam, chief market analyst at Think

Markets.

"The chances are that her strategy is going to backfire because

the MPs are likely to take control of Brexit and push the prime

minister to the side," said Aslam, in a note to clients. Still,

sterling gained on the news amid relief that the March 29 Article

50 deadline will be extended.

What stocks are active?

Persimmon PLC (PSN.LN) tumbled 7% on Monday, after the

U.K.-listed home builder came under fire from housing minister

James Brokenshire for its practices in a government-funded housing

plan called "Help to Buy", Reuters reported

(https://uk.reuters.com/article/uk-persimmon-stocks/persimmon-shares-fall-after-practices-in-government-house-funding-scheme-come-under-fire-idUKKCN1QE0WV).

In sympathy, Barratt Developments PLC (BDEV.LN) and Taylor Wimpey

PLC (TW.LN) also dropped by around 3% each.

Among financials, the Bank of Ireland PLC lost 8% after the bank

said its 2018 profit fell on lower interest margins,

(http://www.marketwatch.com/story/lower-interest-margin-hits-bank-of-ireland-profit-2019-02-25)

while Banco BPM Spa (BAMI.MI) and Danske Bank AS (DANSKE.KO) both

added 3%.

Semiconductor maker AMS AG (AMS.EB) led the regions top gainers,

adding 5% to its share price.

(END) Dow Jones Newswires

February 25, 2019 05:45 ET (10:45 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

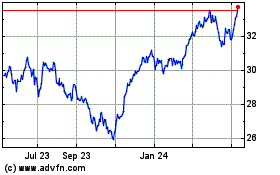

Global X Funds Global X ... (NASDAQ:DAX)

Historical Stock Chart

From Nov 2024 to Dec 2024

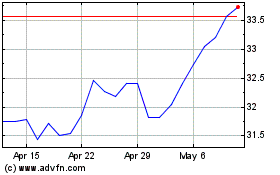

Global X Funds Global X ... (NASDAQ:DAX)

Historical Stock Chart

From Dec 2023 to Dec 2024