Updated Research Report on American Capital - Analyst Blog

February 24 2014 - 7:30PM

Zacks

On Feb 19, 2014, we issued an updated research report on

American Capital, Ltd. (ACAS). The company

recently reported dismal fourth-quarter 2013 results that reflected

higher operating expenses and a declining top line. We believe a

low interest-rate environment and regulatory issues may continue to

pressure top-line growth in the upcoming quarters.

American Capital reported earnings of 14 cents per share, lagging

the Zacks Consensus Estimate of 11 cents. Also, this was below 26

cents earned in the prior-year quarter. Net operating income for

the quarter came in at $38 million, significantly down from $83

million reported in the prior-year quarter.

With this, the company missed the Zacks Consensus Estimate in all

four quarters of 2013 by an average of 64.0%.

Total operating revenue stood at $118 million for the quarter, down

34% from the prior-year quarter. This was primarily due to lower

interest and dividend income.

Though American Capital is focused on expense management, the

quarter in review witnessed a 2% year-over-year increase in its

operating expenses. This was primarily driven by elevated salaries,

benefits and stock-based compensation.

Going forward, the high debt level may weigh on the company’s

financials. As of Dec 31, 2013, American Capital’s total debt stood

at $791 million.

Weak fundamentals and dismal results at American Capital triggered

a downward revision in the Zacks Consensus Estimate, as analysts

turned more bearish on the stock’s future performance. This is

evident from the movement witnessed in the Zacks Consensus Estimate

over the past 30 days. For 2014, it decreased 7.3% to $1.02 per

share while it declined 28.4% to $1.01 for 2015.

American Capital currently carries a Zacks Rank #5 (Strong

Sell).

Key Picks from the Sector

Some better-ranked stocks worth considering include Apollo

Investment Corp. (AINV), Gladstone Investment

Corp. (GAIN) and Horizon Technology Finance

Corp. (HRZN). All these carry a Zacks Rank #2 (Buy).

AMER CAP LTD (ACAS): Free Stock Analysis Report

APOLLO INV CP (AINV): Free Stock Analysis Report

GLADSTONE INVES (GAIN): Free Stock Analysis Report

HORIZON TECHNOL (HRZN): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

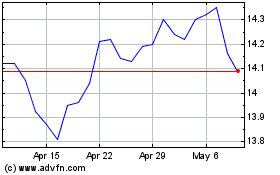

Gladstone Investment (NASDAQ:GAIN)

Historical Stock Chart

From May 2024 to Jun 2024

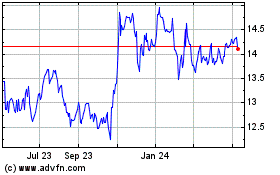

Gladstone Investment (NASDAQ:GAIN)

Historical Stock Chart

From Jun 2023 to Jun 2024