German American Bancorp, Inc. (Nasdaq: GABC) reported strong

fourth quarter 2024 earnings of $23.2 million, or $0.78 per share,

reflecting a linked quarter increase of $2.2 million, or

approximately 10% on a per share basis, from 2024 third quarter

earnings of $21.0 million, or $0.71 per share. The Company also

reported strong annual earnings of $83.8 million, or $2.83 per

share, for the year ended December 31, 2024. This level of reported

annual earnings resulted in a 12.2% return on average shareholders’

equity, marking the 20th consecutive fiscal year in which the

Company has delivered a double-digit return on shareholders’

equity. The Company also announced a 7.4% increase to its quarterly

cash dividend, marking the 13th consecutive year of increased cash

dividends, reflecting the Company’s strong operations and healthy

capital position.

The Company’s fourth quarter of 2024 operating performance was

driven by a continued expansion of its net interest margin and

broad-based loan and deposit growth. The quarter was also

highlighted by continued strong credit metrics, growing

non-interest income, and controlled non-interest expense.

Net interest income for the fourth quarter 2024 increased $2.4

million, or 5%, over linked third quarter 2024 net interest income.

Net interest margin for the fourth quarter of 2024 of 3.54%

reflects a 7 basis point expansion over linked third quarter net

interest margin of 3.47%, driven largely by lower deposit costs

resulting from a decline in the federal funds rate and, to a lesser

extent, a relatively stable yield on earning assets.

Fourth quarter 2024 end of period total deposits increased $57.8

million, or 4% on an annualized linked quarter basis, compared to

the third quarter of 2024, mostly as a result of the seasonal

inflow of public fund deposits. Non-interest bearing accounts

remained sequentially stable at just over 26% of total

deposits.

During the fourth quarter of 2024, total loans increased $63.9

million, or 6% on an annualized linked quarter basis, with all

categories of loans showing growth with the exception of

residential mortgage. The Company’s loan portfolio composition

remained diverse and its credit metrics strong, as non-performing

assets were 0.18% of period end assets and non-performing loans

totaled 0.27% of period end loans.

Both non-interest income and expenses trended favorably in the

fourth quarter of 2024 over linked third quarter 2024. Non-interest

income was up 2%, driven mostly by a 3% increase in wealth

management fees as a result of increased assets under management

due to continued strong new business and healthy capital markets.

Non-interest expense declined $287,000, or 1%, compared to the

third quarter of 2024.

The Company’s 2024 reported annual earnings represented a

decrease of only $2.1 million, or approximately 3% on a per share

basis, from the Company’s prior year 2023 earnings level of $85.9

million, or $2.91 per share.

The 2024 operating performance was highlighted by the sale of

the Company’s existing insurance division, a partial restructuring

of its securities portfolio, and the announcement of its proposed

acquisition of Columbus, Ohio-based Heartland BancCorp. These

transactions, coupled with a strong operating performance in the

back half of 2024, should provide momentum for solid balance sheet

and earnings per share growth into 2025.

In 2024, the Company was named to Piper Sandler’s Sm-All Stars,

Raymond James Community Bankers Cup, S&P Global’s Top

Performing Community Bank list, Bank Director Top Banks list,

Forbes America’s Best Bank list, and Newsweek’s Best Regional Bank

list, all of which recognize top tier performance in banking. “The

consistent profitability, growth and operational efficiency that

led to these honors is a testament to the dedication of our team of

professionals diligently serving our customers and communities each

and every day,” stated D. Neil Dauby, German American’s Chairman

and CEO.

The Company also announced a 7.4% increase in the level of its

regular quarterly cash dividend, as its Board of Directors declared

a regular quarterly cash dividend of $0.29 per share, which will be

payable on February 20, 2025 to shareholders of record as of

February 10, 2025.

Dauby stated, “We are extremely pleased to deliver yet another

quarter and year of solid operating performance as German American

positions itself for future continued growth. We are extremely

excited about the long-term growth potential in connection with a

normalizing yield curve, a strong organic growth footprint and the

Company’s pending merger with Heartland BancCorp, which has now

received all necessary shareholder and regulatory approvals. This

acquisition is a strategically compelling and financially

attractive opportunity that should drive long-term shareholder

value. Thanks to the dedicated efforts of our relationship-focused

team of professionals, we are confident that our strong community

presence, healthy financial condition and disciplined approach to

risk management and earnings growth will continue to drive future

profitability. We remain excited and committed to the vitality and

future growth of our Indiana, Kentucky and now Ohio

communities.”

Balance Sheet Highlights

Total assets for the Company totaled $6.296 billion at December

31, 2024, representing an increase of $35.0 million compared with

September 30, 2024 and an increase of $143.7 million compared with

December 31, 2023. The increase in total assets at December 31,

2024 compared with September 30, 2024 was largely related to an

increase in total loans, partially offset by a reduction in

securities available-for-sale resulting from a decline in the fair

value of the securities portfolio. The increase at December 31,

2024 compared to December 31, 2023 was largely attributable to

increases in total loans and federal funds sold and other

short-term investments, partially mitigated by a reduction of the

securities portfolio.

December 31, 2024 total loans increased $63.9 million, or 6% on

an annualized basis, compared with September 30, 2024 and increased

$155.4 million, or 4%, compared with December 31, 2023. The

increase during the fourth quarter of 2024 compared with September

30, 2024 was broad-based across most segments of the portfolio.

Commercial and industrial loans increased $0.9 million, or just

under 1% on an annualized basis, commercial real estate loans

increased $44.9 million, or 8% on an annualized basis, while

agricultural loans grew $13.6 million, or 13% on an annualized

basis, and retail loans grew by $4.5 million, or 2% on an

annualized basis.

The composition of the loan portfolio has remained relatively

stable and diversified over the past several years, including 2024.

The portfolio is most heavily weighted in commercial real estate

loans at 54% of the portfolio, followed by commercial and

industrial loans at 16% of the portfolio, and agricultural loans at

10% of the portfolio. The Company’s commercial lending is extended

to various industries, including multi-family housing and lodging,

agribusiness and manufacturing, as well as health care, wholesale,

and retail services. The Company’s commercial real estate portfolio

has limited exposure to office real estate, with office exposure

totaling approximately 5% of the total loan portfolio.

End of Period Loan Balances

12/31/2024

9/30/2024

12/31/2023

(dollars in thousands)

Commercial & Industrial Loans

$

671,038

$

670,104

$

661,529

Commercial Real Estate Loans

2,224,872

2,179,981

2,121,835

Agricultural Loans

431,037

417,473

423,803

Consumer Loans

448,872

439,382

407,889

Residential Mortgage Loans

357,448

362,415

362,844

$

4,133,267

$

4,069,355

$

3,977,900

The Company’s allowance for credit losses totaled $44.4 million

at December 31, 2024, $44.1 million at September 30, 2024 and $43.8

million at December 31, 2023. The allowance for credit losses

represented 1.08% of period-end loans at December 31, 2024, 1.09%

of period-end loans at September 30, 2024 and 1.10% of period-end

loans at December 31, 2023.

Non-performing assets totaled $11.1 million at December 31,

2024, $9.7 million at September 30, 2024 and $9.2 million at

December 31, 2023. Non-performing assets represented 0.18% of total

assets at December 31, 2024, 0.15% at September 30, 2024 and 0.15%

at December 31, 2023. Non-performing loans represented 0.27% of

total loans at December 31, 2024, 0.24% at September 30, 2024 and

0.23% at December 31, 2023.

Non-performing

Assets

(dollars in thousands)

12/31/2024

9/30/2024

12/31/2023

Non-Accrual Loans

$

10,934

$

9,701

$

9,136

Past Due Loans (90 days or more)

188

—

55

Total Non-Performing Loans

11,122

9,701

9,191

Other Real Estate

—

—

—

Total Non-Performing Assets

$

11,122

$

9,701

$

9,191

December 31, 2024 total deposits increased $57.8 million, or 4%

on an annualized basis, compared to September 30, 2024 and

increased $76.1 million, or 1%, compared with December 31, 2023.

The increase at December 31, 2024 compared to September 30, 2024

was primarily attributable to seasonal inflows of public entity

funds. The Company has continued to see some customer movement from

both interest bearing and non-interest bearing transactional

accounts to time deposits due primarily to a higher interest rate

environment. Non-interest bearing deposits have remained relatively

stable as a percent of total deposits with December 31, 2024

non-interest deposits totaling 26% of total deposits while

non-interest deposits totaled 27% at September 30, 2024 and 28% at

December 31, 2023.

End of Period

Deposit Balances

12/31/2024

9/30/2024

12/31/2023

(dollars in thousands)

Non-interest-bearing Demand Deposits

$

1,399,270

$

1,406,405

$

1,493,160

IB Demand, Savings, and MMDA Accounts

3,013,204

2,955,306

2,992,761

Time Deposits < $100,000

327,080

349,824

289,077

Time Deposits > $100,000

589,521

559,744

477,965

$

5,329,075

$

5,271,279

$

5,252,963

At December 31, 2024, the capital levels for the Company and its

subsidiary bank, German American Bank (the “Bank”), remained well

in excess of the minimum amounts needed for capital adequacy

purposes and the Bank’s capital levels met the necessary

requirements to be considered well-capitalized.

12/31/2024

Ratio

9/30/2024

Ratio

12/31/2023

Ratio

Total Capital (to

Risk Weighted Assets)

Consolidated

17.15

%

17.22

%

16.50

%

Bank

15.02

%

15.28

%

14.76

%

Tier 1 (Core)

Capital (to Risk Weighted Assets)

Consolidated

15.72

%

15.76

%

14.97

%

Bank

14.23

%

14.46

%

14.04

%

Common Tier 1 (CET

1) Capital Ratio

(to Risk Weighted

Assets)

Consolidated

15.02

%

15.04

%

14.26

%

Bank

14.23

%

14.46

%

14.04

%

Tier 1 Capital (to

Average Assets)

Consolidated

12.28

%

12.30

%

11.75

%

Bank

11.12

%

11.29

%

11.03

%

Results of Operations Highlights – Year

ended December 31, 2024

Net income for the year ended December 31, 2024 totaled

$83,811,000, or $2.83 per share, a decline of $2,077,000, or

approximately 3% on a per share basis, from the year ended December

31, 2023 net income of $85,888,000, or $2.91 per share. Net income

for the year ended December 31, 2024 included merger-related

transaction costs associated with the Company's pending merger with

Heartland BancCorp ("Heartland") that totaled approximately

$1,370,000, $1,082,000 after-tax, or $0.04 per share.

Net income for the year end December 31, 2024 was impacted by

the sale of substantially all of the assets of German American

Insurance, Inc. ("GAI") during the second quarter of 2024. The

all-cash sale price totaled $40.0 million and resulted in an

after-tax gain, net of transaction costs, of approximately

$27,476,000, or $0.93 per share. GAI net income, excluding the

after-tax gain, contributed approximately $767,000, or $0.03 per

share, during 2024 compared with net income of $1,639,000, or $0.06

per share, during the full year of 2023.

Net income for the year ended December 31, 2024 was also

impacted by a securities portfolio restructuring transaction

whereby available-for-sale securities totaling approximately $375

million in book value were sold. The approximate loss on these

securities totaled $34,893,000, $27,189,000 after tax, or $0.92 per

share, and was included in earnings for the second quarter of 2024.

The proceeds from the securities sold were reinvested by the end of

the third quarter of 2024.

Summary Average

Balance Sheet

(Tax-equivalent basis / dollars in

thousands)

Year

Ended December 31, 2024

Year

Ended December 31, 2023

Principal Balance

Income/ Expense

Yield/Rate

Principal Balance

Income/ Expense

Yield/Rate

Assets

Federal Funds Sold and Other

Short-term Investments

$

151,907

$

7,697

5.07

%

$

39,452

$

1,677

4.25

%

Securities

1,534,433

47,496

3.10

%

1,629,610

48,270

2.96

%

Loans and Leases

4,035,670

241,344

5.98

%

3,835,157

213,195

5.56

%

Total Interest Earning Assets

$

5,722,010

$

296,537

5.19

%

$

5,504,219

$

263,142

4.78

%

Liabilities

Demand Deposit Accounts

$

1,420,412

$

1,553,082

IB Demand, Savings, and

MMDA Accounts

$

3,012,073

$

54,303

1.80

%

$

3,055,251

$

40,484

1.33

%

Time Deposits

872,429

36,319

4.16

%

588,142

16,432

2.79

%

FHLB Advances and Other Borrowings

196,480

9,830

5.00

%

210,837

9,307

4.41

%

Total Interest-Bearing

Liabilities

$

4,080,982

$

100,452

2.46

%

$

3,854,230

$

66,223

1.72

%

Cost of Funds

1.76

%

1.20

%

Net Interest Income

$

196,085

$

196,919

Net Interest Margin

3.43

%

3.58

%

During the year ended December 31, 2024, net interest income, on

a non tax-equivalent basis, totaled $190,591,000, which was

relatively stable compared to the year ended December 31, 2023 net

interest income of $190,433,000.

The tax equivalent net interest margin for the year ended

December 31, 2024 was 3.43% compared with 3.58% for the year ended

December 31, 2023. The decline in the net interest margin in 2024

compared with 2023 was largely driven by an increased cost of funds

and a lower level of accretion of loan discounts on acquired loans.

The cost of funds increased 56 basis points year over year.

Accretion of loan discounts on acquired loans contributed

approximately 3 basis points to the net interest margin in 2024 and

5 basis points in 2023. Accretion of discounts on acquired loans

totaled $1,507,000 during 2024 and $2,814,000 during 2023.

During the year ended December 31, 2024, the Company recorded a

provision for credit losses of $2,775,000, as compared to the

provision for credit losses of $2,550,000 recorded for the year

ended December 31, 2023.

During the year ended December 31, 2024, non-interest income

increased $2,399,000, or 4%, compared with the year ended December

31, 2023. The year ended December 31, 2024 non-interest income was

positively impacted by the net proceeds of the sale of the GAI

assets that totaled approximately $38,323,000 and was negatively

impacted by $34,893,000 related to the net loss recognized on the

securities restructuring transaction.

Year Ended

Year Ended

Non-interest Income

12/31/2024

12/31/2023

(dollars in thousands)

Wealth Management Fees

$

14,416

$

11,711

Service Charges on Deposit Accounts

12,669

11,538

Insurance Revenues

4,384

9,596

Company Owned Life Insurance

2,058

1,731

Interchange Fee Income

17,125

17,452

Sale of Assets of German American

Insurance

38,323

—

Other Operating Income

5,419

5,830

Subtotal

94,394

57,858

Net Gains on Sales of Loans

3,054

2,363

Net Gains on Securities

(34,788

)

40

Total Non-interest Income

$

62,660

$

60,261

Wealth management fees increased $2,705,000, or 23%, during 2024

compared with 2023. The increase during 2024 was largely

attributable to continued increases in assets under management due

to healthy capital markets and strong new business results, as

compared to the year ended December 31, 2023.

Insurance revenues declined $5,212,000, or 54%, during 2024

compared with 2023, as a result of the sale of the assets of GAI

effective June 1, 2024, with only five months of revenue being

recognized by the Company during 2024. The year ended December 31,

2024 included $38,323,000 in net proceeds for the sale of the GAI

assets.

Net gains on sales of loans increased $691,000, or 29%, during

the year ended December 31, 2024 compared with the year ended

December 31, 2023. The increase during 2024 compared with 2023 was

related to both a higher volume of loans sold and improved pricing

levels. Loan sales totaled $130.7 million during 2024 compared with

$109.0 million during 2023.

The net loss on securities during the year ended December 31,

2024 totaled $34,788,000 and was primarily related to the net loss

recognized on the securities restructuring transaction previously

discussed.

During the year ended December 31, 2024, non-interest expense

totaled $146,377,000, an increase of $1,880,000, or 1%, compared to

the year ended December 31, 2023. The increase in non-interest

expenses during the year ended 2024 was in large part the result of

professional fees related to the previously mentioned GAI asset

sale and the pending merger transaction with Heartland, which

totaled approximately $2,759,000.

Year Ended

Year Ended

Non-interest

Expense

12/31/2024

12/31/2023

(dollars in thousands)

Salaries and Employee Benefits

$

82,257

$

83,244

Occupancy, Furniture and Equipment

Expense

14,944

14,467

FDIC Premiums

2,908

2,829

Data Processing Fees

12,243

11,112

Professional Fees

8,147

5,575

Advertising and Promotion

3,939

4,857

Intangible Amortization

2,032

2,840

Other Operating Expenses

19,907

19,573

Total Non-interest Expense

$

146,377

$

144,497

Salaries and benefits declined $987,000, or 1%, during the year

ended December 31, 2024 compared with the year ended December 31,

2023. The decline in salaries and benefits during 2024 compared

with 2023 was largely related to the GAI asset sale.

Data processing fees increased $1,131,000, or 10%, during the

year ended December 31, 2024 compared with the year ended December

31, 2023. The increase during 2024 compared with 2023 was largely

driven by costs associated with enhancements to the Company’s

digital banking and data systems.

Professional fees increased $2,572,000, or 46%, during the year

ended December 31, 2024 compared with 2023. The increase during

2024 compared with 2023 was attributable to the professional fees

associated with the sale of assets of GAI and the pending merger

with Heartland, which totaled $2,759,000 for the two

transactions.

Advertising and promotion expense declined $918,000, or 19%,

during 2024 compared with 2023 as the Company employed a more

targeted focus for sponsorships and contributions during 2024.

Intangible amortization expense consists primarily of

amortization associated with the core deposit intangible of

acquired deposit portfolios. Intangible amortization decreased

$808,000, or 28%, during 2024 compared with 2023 and was largely

related to the accelerated method for which the intangible assets

are amortized.

Results of Operations Highlights –

Quarter ended December 31, 2024

Net income for the fourth quarter of 2024 totaled $23,211,000,

or $0.78 per share, an increase of 10% on a per share basis,

compared with the third quarter of 2024 net income of $21,048,000,

or $0.71 per share, and an increase of 7% on a per share basis

compared with the fourth quarter of 2023 net income of $21,507,000,

or $0.73 per share.

Summary Average

Balance Sheet

(Tax-equivalent basis / dollars in

thousands)

Quarter Ended

Quarter Ended

Quarter Ended

December

31, 2024

September 30, 2024

December

31, 2023

Principal Balance

Income/ Expense

Yield/ Rate

Principal Balance

Income/ Expense

Yield/ Rate

Principal Balance

Income/ Expense

Yield/ Rate

Assets

Federal Funds Sold and Other

Short-term Investments

$

238,883

$

2,792

4.65

%

$

164,154

$

2,223

5.39

%

$

36,927

$

473

5.09

%

Securities

1,545,772

12,579

3.26

%

1,490,807

12,157

3.26

%

1,527,306

11,903

3.12

%

Loans and Leases

4,094,333

62,356

6.06

%

4,052,673

61,424

6.03

%

3,921,967

56,257

5.69

%

Total Interest Earning Assets

$

5,878,988

$

77,727

5.27

%

$

5,707,634

$

75,804

5.29

%

$

5,486,200

$

68,633

4.98

%

Liabilities

Demand Deposit Accounts

$

1,422,400

$

1,411,377

$

1,507,780

IB Demand, Savings, and

MMDA Accounts

$

3,058,257

$

13,638

1.77

%

$

2,970,716

$

13,836

1.85

%

$

3,010,984

$

12,433

1.64

%

Time Deposits

911,613

9,235

4.03

%

888,639

9,539

4.27

%

709,534

6,577

3.68

%

FHLB Advances and Other Borrowings

214,915

2,650

4.91

%

191,548

2,684

5.57

%

202,555

2,394

4.69

%

Total Interest-Bearing

Liabilities

$

4,184,785

$

25,523

2.43

%

$

4,050,903

$

26,059

2.56

%

$

3,923,073

$

21,404

2.16

%

Cost of Funds

1.73

%

1.82

%

1.55

%

Net Interest Income

$

52,204

$

49,745

$

47,229

Net Interest Margin

3.54

%

3.47

%

3.43

%

During the fourth quarter of 2024, net interest income, on a non

tax-equivalent basis, totaled $51,032,000, an increase of

$2,438,000, or 5%, compared to the third quarter of 2024 net

interest income of $48,594,000 and an increase of $5,425,000, or

12%, compared to the fourth quarter of 2023 net interest income of

$45,607,000.

The increase in net interest income during the fourth quarter of

2024 compared with both the third quarter of 2024 and the fourth

quarter of 2023 was primarily driven by an improved net interest

margin and a higher level of average earning assets.

The tax-equivalent net interest margin for the quarter ended

December 31, 2024 was 3.54% compared with 3.47% in the third

quarter of 2024 and 3.43% in the fourth quarter of 2023. The

improvement in the net interest margin during the fourth quarter of

2024 compared with the third quarter of 2024 was largely driven by

an overall lower cost of funds while the yield on earning assets

remained relatively stable. The improvement in cost of funds was

driven by the lower short-term market interest rates and the

Company's ability to correspondingly lower deposit costs. The

increase in the net interest margin during the fourth quarter of

2024 compared with the same period of 2023 was largely driven by an

increased yield on earning assets, partially mitigated by an in

increased cost of funds.

The Company’s net interest margin and net interest income have

been impacted by accretion of loan discounts on acquired loans.

Accretion of discounts on acquired loans totaled $617,000 during

the fourth quarter of 2024, $237,000 during the third quarter of

2024 and $280,000 during the fourth quarter of 2023. Accretion of

loan discounts on acquired loans contributed approximately 4 basis

points to the net interest margin in the fourth quarter of 2024 and

2 basis points in both the third quarter of 2024 and the fourth

quarter of 2023.

During both the third and fourth quarters of 2024, the Company

recorded a provision for credit losses of $625,000. The Company

recorded no provision in the fourth quarter of 2023. Net

charge-offs totaled $313,000, or 3 basis points on an annualized

basis, of average loans outstanding during the fourth quarter of

2024 compared with $447,000, or 4 basis points on an annualized

basis, of average loans during the third quarter of 2024, and

$881,000, or 9 basis points on an annualized basis, of average

loans during the fourth quarter of 2023.

During the quarter ended December 31, 2024, non-interest income

totaled $14,114,000, an increase of $313,000, or 2%, compared with

the third quarter of 2024 and a decline of $1,480,000, or 9%,

compared with the fourth quarter of 2023. The decline in the fourth

quarter of 2024 compared to the same period of 2023 was the result

of the sale of the GAI assets, with no insurance revenues

recognized in the fourth quarter of 2024 and three months of

revenue in the fourth quarter of 2023.

Quarter Ended

Quarter Ended

Quarter Ended

Non-interest

Income

12/31/2024

9/30/2024

12/31/2023

(dollars in thousands)

Wealth Management Fees

$

3,687

$

3,580

$

3,198

Service Charges on Deposit Accounts

3,344

3,330

2,885

Insurance Revenues

—

—

2,266

Company Owned Life Insurance

616

476

455

Interchange Fee Income

4,244

4,390

4,371

Sale of Assets of German American

Insurance

—

—

—

Other Operating Income

1,593

1,251

1,887

Subtotal

13,484

13,027

15,062

Net Gains on Sales of Loans

630

704

532

Net Gains (Losses) on Securities

—

70

—

Total Non-interest Income

$

14,114

$

13,801

$

15,594

Wealth management fees increased $107,000, or 3%, during the

fourth quarter of 2024 compared with the third quarter of 2024 and

increased $489,000, or 15%, compared with the fourth quarter of

2023. The increase during the fourth quarter of 2024 compared with

both the third quarter of 2024 and the fourth quarter of 2023 was

driven by increased assets under management driven by healthy

capital markets and continued strong new business results.

Service charges on deposit accounts increased $14,000, or less

than 1%, during the quarter ended December 31, 2024 compared with

the third quarter of 2024 and increased $459,000, or 16%, compared

with the fourth quarter of 2023. The increase during the fourth

quarter of 2024 compared with the fourth quarter of 2023 was

largely related to increased customer utilization of deposit

services.

No insurance revenues were recognized during the third or fourth

quarters of 2024 as a result of the sale of the assets of GAI

effective June 1, 2024. Insurance revenues declined $2,266,000

during the fourth quarter of 2024, compared with the fourth quarter

of 2023, due to the sale.

Other operating income increased $342,000, or 27%, during the

fourth quarter of 2024 compared with the third quarter of 2024 and

declined $294,000, or 16%, compared with the fourth quarter of

2023. The increase during the fourth quarter of 2024 compared with

the third quarter of 2024 was primarily attributable to fees

associated with interest rate swap transactions with loan

customers. The decline during the fourth quarter of 2024 compared

with the fourth quarter of 2023 was largely attributable to the

gain on sale of real estate related to the consolidation of various

branch office facilities during the fourth quarter of 2023.

During the quarter ended December 31, 2024, non-interest expense

totaled $35,839,000, a decline of $287,000, or 1%, compared with

the third quarter of 2024, and an increase of $105,000, or less

than 1%, compared with the fourth quarter of 2023. Non-interest

expenses were impacted during both the third and fourth quarters of

2024 by the pending merger transaction with Heartland.

Merger-related transaction costs totaled approximately $198,000

during the fourth quarter of 2024 and $747,000 during the third

quarter of 2024.

Quarter Ended

Quarter Ended

Quarter Ended

Non-interest

Expense

12/31/2024

9/30/2024

12/31/2023

(dollars in thousands)

Salaries and Employee Benefits

$

20,404

$

19,718

$

20,948

Occupancy, Furniture and Equipment

Expense

3,773

3,880

3,513

FDIC Premiums

714

755

701

Data Processing Fees

3,257

3,156

2,835

Professional Fees

1,178

1,912

1,170

Advertising and Promotion

951

941

1,151

Intangible Amortization

438

484

636

Other Operating Expenses

5,124

5,280

4,780

Total Non-interest Expense

$

35,839

$

36,126

$

35,734

Salaries and benefits increased $686,000, or 3%, during the

quarter ended December 31, 2024 compared with the third quarter of

2024 and declined $544,000, or 3%, compared with the fourth quarter

of 2023. The increase in salaries and benefits during the fourth

quarter of 2024 compared with the third quarter of 2024 was

primarily the result of increased health insurance benefit costs.

The decline in salaries and benefits during the fourth quarter of

2024 compared with the fourth quarter of 2023 was due in large part

to a lower level of full-time equivalent employees resulting from

the sale of the assets of GAI during the second quarter of

2024.

Data processing fees increased $101,000, or 3%, during the

fourth quarter of 2024 compared with the third quarter of 2024 and

increased $422,000, or 15%, compared with the fourth quarter of

2023. The increase during the fourth quarter of 2024 compared with

the fourth quarter of 2023 was largely driven by costs associated

with enhancements to the Company’s digital banking and data

systems.

Professional fees declined $734,000, or 38%, in the fourth

quarter of 2024 compared with the third quarter of 2024 and

increased $8,000, or less than 1%, compared with the fourth quarter

of 2023. The decline during the fourth quarter of 2024 compared

with the third quarter of 2024 was primarily attributable to higher

merger-related transaction fees in the third quarter of 2024.

About German American

German American Bancorp, Inc. is a Nasdaq-listed (symbol: GABC)

financial holding company based in Jasper, Indiana. German

American, through its banking subsidiary German American Bank,

operates 74 banking offices in 20 contiguous southern Indiana

counties and 14 counties in Kentucky.

Cautionary Note Regarding Forward-Looking

Statements

Certain statements in this press release may be deemed

“forward-looking statements” within the meaning of the Private

Securities Litigation Reform Act of 1995, Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. Readers are cautioned

that, by their nature, forward-looking statements are based on

assumptions and are subject to risks, uncertainties, and other

factors. Forward-looking statements can often, but not always, be

identified by the use of words like “believe”, “continue”,

“pattern”, “estimate”, “project”, “intend”, “anticipate”, “expect”

and similar expressions or future or conditional verbs such as

“will”, “would”, “should”, “could”, “might”, “can”, “may”, or

similar expressions.

These forward-looking statements include, but are not limited

to, statements relating to the goals, intentions and expectations

of German American Bancorp, Inc. ("German American"); statements

regarding German American’s business plan and growth strategies;

statements regarding the asset quality of German American’s loan

and investment portfolios; and the pending merger of Heartland

BancCorp ("Heartland") with and into German American (the "Merger")

and related benefits, including future financial and operating

results, cost savings, enhanced revenues, and accretion/dilution to

reported earnings that may be realized from the Merger; and

estimates of German American’s risks and future costs and benefits,

whether with respect to the Merger or otherwise.

Actual results and experience could differ materially from the

anticipated results or other expectations expressed or implied by

these forward-looking statements as a result of a number of

factors, including but not limited to, those discussed in this

press release. Factors that could cause actual experience to differ

from the expectations expressed or implied in this press release

include:

a.

changes in interest rates and the

timing and magnitude of any such changes;

b.

unfavorable economic conditions,

including a prolonged period of inflation, and the resulting

adverse impact on, among other things, credit quality;

c.

the soundness of other financial

institutions and general investor sentiment regarding the stability

of financial institutions;

d.

changes in our liquidity

position;

e.

the impacts of epidemics,

pandemics or other infectious disease outbreaks;

f.

changes in competitive

conditions;

g.

the introduction, withdrawal,

success and timing of asset/liability management strategies or of

mergers and acquisitions and other business initiatives and

strategies;

h.

changes in customer borrowing,

repayment, investment and deposit practices;

i.

changes in fiscal, monetary and

tax policies;

j.

changes in financial and capital

markets;

k.

capital management activities,

including possible future sales of new securities, or possible

repurchases or redemptions by German American of outstanding debt

or equity securities;

l.

risks of expansion through

acquisitions and mergers, such as unexpected credit quality

problems of the acquired loans or other assets, unexpected

attrition of the customer base or employee base of the acquired

institution or branches, and difficulties in integration of the

acquired operations;

m.

factors driving credit losses on

investments;

n.

the impact, extent and timing of

technological changes;

o.

potential cyber-attacks,

information security breaches and other criminal activities;

p.

litigation liabilities, including

related costs, expenses, settlements and judgments, or the outcome

of matters before regulatory agencies, whether pending or

commencing in the future;

q.

actions of the Federal Reserve

Board;

r.

changes in accounting principles

and interpretations;

s.

potential increases of federal

deposit insurance premium expense, and possible future special

assessments of FDIC premiums, either industry wide or specific to

German American’s banking subsidiary;

t.

actions of the regulatory

authorities under the Dodd-Frank Wall Street Reform and Consumer

Protection Act (the “Dodd-Frank Act”) and the Federal Deposit

Insurance Act and other possible legislative and regulatory actions

and reforms;

u.

impacts resulting from possible

amendments or revisions to the Dodd-Frank Act and the regulations

promulgated thereunder, or to Consumer Financial Protection Bureau

rules and regulations;

v.

the continued availability of

earnings and excess capital sufficient for the lawful and prudent

declaration and payment of cash dividends;

w.

with respect to the Merger: (i)

the required regulatory approvals remaining in effect; (ii) failure

of either company to satisfy any of the other closing conditions to

the transaction on a timely basis or at all; (iii) the occurrence

of any event, change or other circumstances that could give rise to

the right of one or both of the parties to terminate the merger

agreement; and (iv) the possibility that the anticipated benefits

of the transaction, including anticipated cost savings and

strategic gains, are not realized when expected or at all,

including as a result of the impact of, or problems arising from,

the integration of the two companies, unexpected credit quality

problems of the acquired loans or other assets, or unexpected

attrition of the customer base of the acquired institution or

branches, or as a result of the strength of the economy,

competitive factors in the areas where German American and

Heartland do business, or as a result of other unexpected factors

or events; and

x.

other risk factors expressly

identified in German American’s cautionary language included under

the headings “Forward-Looking Statements and Associated Risk” and

“Risk Factors” in German American’s Annual Report on Form 10-K for

the year ended December 31, 2023, and other documents subsequently

filed by German American with the SEC.

Such statements reflect our views with respect to future events

and are subject to these and other risks, uncertainties and

assumptions relating to the operations, results of operations,

growth strategy and liquidity of German American. Readers are

cautioned not to place undue reliance on these forward-looking

statements. It is intended that these forward-looking statements

speak only as of the date they are made. We do not undertake any

obligation to release publicly any revisions to these

forward-looking statements to reflect future events or

circumstances or to reflect the occurrence of unanticipated

events.

GERMAN AMERICAN BANCORP,

INC.

(unaudited, dollars in

thousands except per share data)

Consolidated Balance

Sheets

December 31, 2024

September 30, 2024

December 31, 2023

ASSETS

Cash and Due from Banks

$

69,249

$

77,652

$

78,805

Short-term Investments

120,043

118,403

37,025

Investment Securities

1,517,640

1,548,347

1,597,185

Loans Held-for-Sale

8,239

9,173

5,226

Loans, Net of Unearned Income

4,124,902

4,061,149

3,971,082

Allowance for Credit Losses

(44,436

)

(44,124

)

(43,765

)

Net Loans

4,080,466

4,017,025

3,927,317

Stock in FHLB and Other Restricted

Stock

14,423

14,488

14,687

Premises and Equipment

104,045

105,419

106,776

Goodwill and Other Intangible Assets

183,043

183,548

186,664

Other Assets

198,762

186,852

198,513

TOTAL ASSETS

$

6,295,910

$

6,260,907

$

6,152,198

LIABILITIES

Non-interest-bearing Demand Deposits

$

1,399,270

$

1,406,405

$

1,493,160

Interest-bearing Demand, Savings, and

Money Market Accounts

3,013,204

2,955,306

2,992,761

Time Deposits

916,601

909,568

767,042

Total Deposits

5,329,075

5,271,279

5,252,963

Borrowings

210,131

204,153

193,937

Other Liabilities

41,637

40,912

41,740

TOTAL LIABILITIES

5,580,843

5,516,344

5,488,640

SHAREHOLDERS’ EQUITY

Common Stock and Surplus

421,943

421,262

418,996

Retained Earnings

513,588

498,340

461,622

Accumulated Other Comprehensive Income

(Loss)

(220,464

)

(175,039

)

(217,060

)

SHAREHOLDERS’ EQUITY

715,067

744,563

663,558

TOTAL LIABILITIES AND SHAREHOLDERS’

EQUITY

$

6,295,910

$

6,260,907

$

6,152,198

END OF PERIOD SHARES

OUTSTANDING

29,677,093

29,679,466

29,584,709

TANGIBLE BOOK VALUE PER SHARE

(1)

$

17.93

$

18.90

$

16.12

(1) Tangible Book Value per Share is

defined as Total Shareholders’ Equity less Goodwill and Other

Intangible Assets divided by End of Period Shares Outstanding.

GERMAN AMERICAN BANCORP,

INC.

(unaudited, dollars in

thousands except per share data)

Consolidated Statements of

Income

Three Months Ended

Year Ended

December 31, 2024

September 30, 2024

December 31, 2023

December 31, 2024

December 31, 2023

INTEREST INCOME

Interest and Fees on Loans

$

62,045

$

61,140

$

56,058

$

240,241

$

212,517

Interest on Short-term Investments

2,792

2,223

473

7,697

1,677

Interest and Dividends on Investment

Securities

11,718

11,290

10,480

43,105

42,462

TOTAL INTEREST INCOME

76,555

74,653

67,011

291,043

256,656

INTEREST EXPENSE

Interest on Deposits

22,873

23,375

19,010

90,622

56,916

Interest on Borrowings

2,650

2,684

2,394

9,830

9,307

TOTAL INTEREST EXPENSE

25,523

26,059

21,404

100,452

66,223

NET INTEREST INCOME

51,032

48,594

45,607

190,591

190,433

Provision for Credit Losses

625

625

—

2,775

2,550

NET INTEREST INCOME AFTER PROVISION FOR

CREDIT LOSSES

50,407

47,969

45,607

187,816

187,883

NON-INTEREST INCOME

Net Gains on Sales of Loans

630

704

532

3,054

2,363

Net Gains (Losses) on Securities

—

70

—

(34,788

)

40

Other Non-interest Income

13,484

13,027

15,062

94,394

57,858

TOTAL NON-INTEREST INCOME

14,114

13,801

15,594

62,660

60,261

NON-INTEREST EXPENSE

Salaries and Benefits

20,404

19,718

20,948

82,257

83,244

Other Non-interest Expenses

15,435

16,408

14,786

64,120

61,253

TOTAL NON-INTEREST EXPENSE

35,839

36,126

35,734

146,377

144,497

Income before Income Taxes

28,682

25,644

25,467

104,099

103,647

Income Tax Expense

5,471

4,596

3,960

20,288

17,759

NET INCOME

$

23,211

$

21,048

$

21,507

$

83,811

$

85,888

BASIC EARNINGS PER SHARE

$

0.78

$

0.71

$

0.73

$

2.83

$

2.91

DILUTED EARNINGS PER SHARE

$

0.78

$

0.71

$

0.73

$

2.83

$

2.91

WEIGHTED AVERAGE SHARES

OUTSTANDING

29,678,443

29,679,464

29,575,398

29,656,416

29,557,567

DILUTED WEIGHTED AVERAGE SHARES

OUTSTANDING

29,678,443

29,679,464

29,575,398

29,656,416

29,557,567

GERMAN AMERICAN BANCORP,

INC.

(unaudited, dollars in

thousands except per share data)

Three Months Ended

Year Ended

December 31, 2024

September 30, 2024

December 31, 2023

December 31, 2024

December 31, 2023

EARNINGS PERFORMANCE RATIOS

Annualized Return on Average Assets

1.45

%

1.35

%

1.43

%

1.34

%

1.42

%

Annualized Return on Average Equity

12.67

%

11.97

%

15.45

%

12.22

%

14.70

%

Annualized Return on Average Tangible

Equity (1)

16.90

%

16.20

%

23.26

%

16.72

%

21.69

%

Net Interest Margin

3.54

%

3.47

%

3.43

%

3.43

%

3.58

%

Efficiency Ratio (2)

53.38

%

56.15

%

55.87

%

49.18

%

55.09

%

Net Overhead Expense to Average Earning

Assets (3)

1.48

%

1.56

%

1.47

%

1.46

%

1.53

%

ASSET QUALITY RATIOS

Annualized Net Charge-offs to Average

Loans

0.03

%

0.04

%

0.09

%

0.05

%

0.08

%

Allowance for Credit Losses to Period End

Loans

1.08

%

1.09

%

1.10

%

Non-performing Assets to Period End

Assets

0.18

%

0.15

%

0.15

%

Non-performing Loans to Period End

Loans

0.27

%

0.24

%

0.23

%

Loans 30-89 Days Past Due to Period End

Loans

0.33

%

0.28

%

0.33

%

SELECTED BALANCE SHEET & OTHER

FINANCIAL DATA

Average Assets

$

6,384,219

$

6,216,284

$

6,036,242

$

6,233,753

$

6,037,874

Average Earning Assets

$

5,878,988

$

5,707,634

$

5,486,200

$

5,722,010

$

5,504,219

Average Total Loans

$

4,094,333

$

4,052,673

$

3,921,967

$

4,035,670

$

3,835,157

Average Demand Deposits

$

1,422,400

$

1,411,377

$

1,507,780

$

1,420,412

$

1,553,082

Average Interest Bearing Liabilities

$

4,184,785

$

4,050,903

$

3,923,073

$

4,080,982

$

3,854,230

Average Equity

$

732,698

$

703,377

$

556,914

$

685,862

$

584,106

Period End Non-performing Assets (4)

$

11,122

$

9,701

$

9,191

Period End Non-performing Loans (5)

$

11,122

$

9,701

$

9,191

Period End Loans 30-89 Days Past Due

(6)

$

13,727

$

11,501

$

13,208

Tax-Equivalent Net Interest Income

$

52,204

$

49,745

$

47,229

$

196,085

$

196,919

Net Charge-offs during Period

$

313

$

447

$

881

$

2,104

$

2,953

(1)

Average Tangible Equity is defined as

Average Equity less Average Goodwill and Other Intangibles.

(2)

Efficiency Ratio is defined as

Non-interest Expense less Intangible Amortization divided by the

sum of Net Interest Income, on a tax-equivalent basis, and

Non-interest Income less Net Gains (Losses) on Securities.

(3)

Net Overhead Expense is defined as Total

Non-interest Expense less Total Non-interest Income.

(4)

Non-performing assets are defined as

Non-accrual Loans, Loans Past Due 90 days or more, and Other Real

Estate Owned.

(5)

Non-performing loans are defined as

Non-accrual Loans and Loans Past Due 90 days or more.

(6)

Loans 30-89 days past due and still

accruing.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250127825714/en/

D. Neil Dauby, Chairman and Chief Executive Officer

Bradley M Rust, President and Chief Financial Officer (812)

482-1314

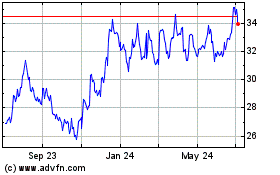

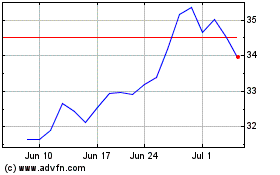

German American Bancorp (NASDAQ:GABC)

Historical Stock Chart

From Jan 2025 to Feb 2025

German American Bancorp (NASDAQ:GABC)

Historical Stock Chart

From Feb 2024 to Feb 2025