Genelux Corporation Reports Third Quarter 2024 Financial Results and Provides General Business Updates

November 14 2024 - 4:05PM

Genelux Corporation (NASDAQ: GNLX), a late clinical-stage

immuno-oncology company, today announced financial results for the

third quarter of 2024 and provided general business updates.

The Company initiated its second lung cancer

trial, a US-based, Phase 2 trial (VIRO-25) treating patients with

recurrent advanced or metastatic non-small cell lung cancer (NSCLC)

with Olvi-Vec, followed by platinum-doublet chemotherapy + immune

checkpoint inhibitor. Additionally, a Phase 1b/2 lung cancer trial

is ongoing in recurrent small cell lung cancer (SCLC) in China

which is co-sponsored with Newsoara BioPharma Co., Ltd.

Both trials utilize Olvi-Vec delivered

intravenously to treat patients who have previously failed

platinum-based chemotherapy. The trials are designed based on

earlier clinical results, including Olvi-Vec demonstrating (i)

positive outcomes in patients with primary or metastatic lung

cancer when delivered intravenously and (ii) clinical reversal of

platinum resistance and refractoriness in a Phase 2 trial in

platinum-resistant/refractory ovarian cancer (PRROC).

"Over the past quarter, we marked another

important step forward in our efforts to advance the systemic

delivery of Olvi-Vec and to demonstrate the re-sensitization to

platinum-based chemotherapy in multiple tumor types," said Thomas

Zindrick, President, CEO and Chairman of Genelux. "With interim

data from our SCLC trial anticipated by the end of 2024 and data

releases from our Phase 3 registration trial in PRROC and Phase 2

trial in NSCLC anticipated in 2025, we are confident that Genelux

is positioned to make a meaningful impact in the lives of cancer

patients."

Pipeline Highlights

The Company’s clinical program is designed to

position Olvi-Vec as an ideal backbone of combination cancer

therapy due to its unique mechanism of action to modify the tumor

immune microenvironment. Building on the promising results from our

previous clinical trials, we see the potential of Olvi-Vec to

induce platinum re-sensitization as a strategy to enhance patient

response and extend survival in platinum-resistant populations. In

addition, the VIRO-25 trial expands the program to include

combination therapies with immune checkpoint inhibitors as we aim

to unlock synergistic activity that amplify the immune response

against tumors.

- Patient enrollment continues to

progress in the Phase 3 OnPrime/GOG-3076 trial for PRROC, now

active at over 25 sites (NCT05281471). Topline results are

anticipated in the latter half of 2025.

- Phase 2 VIRO-25 is actively

enrolling recurrent NSCLC patients (NCT06463665), with interim data

expected by mid-2025.

- Interim results from the Phase 1b

portion of a Phase 1b/2 SCLC trial projected by end of 2024.

Third Quarter 2024 Financial

Results

Cash and cash equivalents, and short and

long-term investments were $35.1 million

as of September 30, 2024. The Company expects its existing cash and

cash equivalents, and short and long-term investments will provide

runway into the first quarter of 2026.

Research and development (R&D)

expenses $4.1 million and $2.8 million for the three

months ended September 30, 2024 and 2023, respectively, an increase

of $1.2 million. Significant variations between periods are

primarily a result of a $0.4 million increase in stock-related

compensation in 2024, relating to the increased cost of stock

options and restricted stock units in 2024; and a $0.9 million

increase in clinical and regulatory expenses relating to increased

clinical trial costs associated with our Phase 3 OnPrime

Registration trial in 2024.

General and administrative (G&A)

expenses were $2.9 million and $2.5 million for the three

months ended September 30, 2024 and 2023, respectively, an increase

of $0.4 million. Significant variations between periods are

primarily a result of a $0.7 million increase in stock compensation

expense in 2024, due to the increase in the cost of stock options

and restricted stock units in 2024; offset by a $0.3 million

decrease in professional service expenses in 2024, primarily

resulting from decreased corporate legal costs.

Net loss was $6.5 million for

the third quarter of 2024 or a net loss per share of $0.19, as

compared to net loss of $5.3 million for the third quarter of 2023,

or a net loss per share of $0.20.

About Genelux Corporation

Genelux is a late-stage clinical

biopharmaceutical company focused on developing a pipeline of

next-generation oncolytic immunotherapies for patients suffering

from aggressive and/or difficult-to-treat solid tumor types. The

Company's most advanced product candidate, Olvi-Vec (olvimulogene

nanivacirepvec), is a proprietary, modified strain of the vaccinia

virus. Olvi-Vec currently is being evaluated in OnPrime/GOG-3076, a

multi-center, randomized, open-label Phase 3 registrational trial

evaluating the efficacy and safety of Olvi-Vec in combination

platinum-doublet + bevacizumab compared with physician's choice of

chemotherapy and bevacizumab in patients with

platinum-resistant/refractory ovarian cancer. The core of Genelux's

discovery and development efforts revolves around its’ proprietary

CHOICE™ platform from which the Company has developed an extensive

library of isolated and engineered oncolytic vaccinia virus

immunotherapeutic product candidates, including Olvi-Vec. For more

information, please visit www.genelux.com and follow us on Twitter

@Genelux_Corp and on LinkedIn.

Forward-Looking Statements

This release contains “forward-looking

statements” within the meaning of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended, and such forward-looking statements are made

pursuant to the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995. “Forward-looking statements”

describe future expectations, plans, results, or strategies and are

generally preceded by words such as “believes,” “anticipates,”

“expect,” “may,” “plan” or “will”. Forward-looking statements in

this release include, but are not limited to, statements related to

Genelux’s future plans and prospects, Genelux’s anticipated cash

runway and the sufficiency of its resources to support its planned

operations, the planned timing of Genelux’s data results in its

ongoing clinical trials and continued development of Olvi-Vec, and

the potential capabilities and advantages of Olvi-Vec. Such

statements are subject to a multitude of risks and uncertainties

that could cause future circumstances, events, or results to differ

materially from those projected in the forward-looking statements.

These and other risks are identified under the caption “Risk

Factors” in Genelux’s filings with the Securities and Exchange

Commission. All forward-looking statements contained in this press

release speak only as of the date on which they were made and are

based on management’s assumptions and estimates as of such date.

Genelux does not undertake any obligation to publicly update any

forward-looking statements, whether as a result of the receipt of

new information, the occurrence of future events or otherwise.

Investor and Media Contacts

Ankit Bhargava, MDAllele Communications,

LLCgenelux@allelecomms.com

Source: Genelux Corporation

| Genelux

Corporation |

| Condensed

Balance Sheets |

| (in thousands,

except for share amounts and par value data) |

|

|

|

|

|

|

|

|

|

| |

September 30, |

|

December 31, |

| |

|

2024 |

|

|

|

2023 |

|

|

ASSETS |

(Unaudited) |

|

Current Assets |

|

|

|

|

|

|

|

| Cash and

cash equivalents |

$ |

6,102 |

|

|

$ |

9,418 |

|

| Short-term

investments |

|

27,955 |

|

|

|

13,773 |

|

| Prepaid

expenses and other current assets |

|

1,910 |

|

|

|

1,012 |

|

|

Total Current Assets |

|

35,967 |

|

|

|

24,203 |

|

| |

|

|

|

|

|

|

|

| Property and

equipment, net |

|

1,278 |

|

|

|

1,170 |

|

| Right of use

assets |

|

1,930 |

|

|

|

2,428 |

|

| Long-term

investments |

|

1,003 |

|

|

|

- |

|

| Other

assets |

|

92 |

|

|

|

92 |

|

|

Total Other Assets |

|

4,303 |

|

|

|

3,690 |

|

| |

|

|

|

|

|

|

|

|

TOTAL ASSETS |

$ |

40,270 |

|

|

$ |

27,893 |

|

| |

|

|

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS' EQUITY |

|

|

|

|

|

|

|

|

Current Liabilities |

|

|

|

|

|

|

|

| Accounts

payable and accrued expenses |

$ |

4,454 |

|

|

$ |

3,784 |

|

| Accrued

payroll and payroll taxes |

|

686 |

|

|

|

2,117 |

|

| Lease

liabilities, current portion |

|

415 |

|

|

|

653 |

|

|

Total Current Liabilities |

|

5,555 |

|

|

|

6,554 |

|

| |

|

|

|

|

|

|

|

| Lease

liabilities, long-term portion |

|

1,624 |

|

|

|

1,866 |

|

|

Total Liabilities |

|

7,179 |

|

|

|

8,420 |

|

| |

|

|

|

|

|

|

|

|

Shareholders' Equity |

|

|

|

|

|

|

|

| Preferred

stock, par value $0.001, 10,000,000 shares authorized; |

|

|

|

|

|

|

|

|

no shares issued and outstanding, respectively; |

|

- |

|

|

|

- |

|

| Common

stock, par value $0.001, 200,000,000 shares authorized; |

|

|

|

|

|

|

|

|

34,538,185 and 26,788,986 shares issued and outstanding |

|

35 |

|

|

|

27 |

|

| Treasury

stock, 433,333 shares, at cost |

|

(433 |

) |

|

|

(433 |

) |

| Additional

paid-in capital |

|

275,782 |

|

|

|

241,389 |

|

| Accumulated

other comprehensive income |

|

124 |

|

|

|

14 |

|

| Accumulated

deficit |

|

(242,417 |

) |

|

|

(221,524 |

) |

|

Total Shareholders' Equity |

|

33,091 |

|

|

|

19,473 |

|

| |

|

|

|

|

|

|

|

|

TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY |

$ |

40,270 |

|

|

$ |

27,893 |

|

| |

|

|

| The accompanying

notes are an integral part of these condensed financial

statements. |

| Genelux

Corporation |

| Condensed

Statements of Operations |

| (in thousands,

except for share amounts and per share data) |

| |

|

|

|

|

|

| |

|

|

|

|

|

| |

Three Months

Ended |

|

Nine Months

Ended |

| |

September 30, |

|

September 30, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| |

(Unaudited) |

|

(Unaudited) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues |

$ |

- |

|

|

$ |

- |

|

|

$ |

8 |

|

|

$ |

170 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating

expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

4,051 |

|

|

|

2,819 |

|

|

|

12,478 |

|

|

|

8,607 |

|

|

General and administrative |

|

2,890 |

|

|

|

2,488 |

|

|

|

9,478 |

|

|

|

8,727 |

|

| Total

operating expenses |

|

6,941 |

|

|

|

5,307 |

|

|

|

21,956 |

|

|

|

17,334 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss from

operations |

|

(6,941 |

) |

|

|

(5,307 |

) |

|

|

(21,948 |

) |

|

|

(17,164 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other income

(expenses): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income |

|

474 |

|

|

|

4 |

|

|

|

1,055 |

|

|

|

4 |

|

|

Interest expense |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(167 |

) |

|

Debt discount amortization |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(649 |

) |

|

Financing costs |

|

- |

|

|

|

(42 |

) |

|

|

- |

|

|

|

(3,152 |

) |

|

Debt extinguishment costs |

|

|

|

|

|

- |

|

|

|

|

|

|

|

(402 |

) |

| Total other

income (expenses), net |

|

474 |

|

|

|

(38 |

) |

|

|

1,055 |

|

|

|

(4,366 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NET

LOSS |

$ |

(6,467 |

) |

|

$ |

(5,345 |

) |

|

$ |

(20,893 |

) |

|

$ |

(21,530 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| LOSS PER

COMMON SHARE - BASIC AND DILUTED |

$ |

(0.19 |

) |

|

$ |

(0.20 |

) |

|

$ |

(0.69 |

) |

|

$ |

(0.91 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

WEIGHTED-AVERAGE COMMON SHARES OUTSTANDING - |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BASIC AND DILUTED |

|

34,532,355 |

|

|

|

26,210,068 |

|

|

|

30,405,615 |

|

|

|

23,640,995 |

|

|

|

|

|

|

|

|

| The accompanying

notes are an integral part of these condensed financial

statements. |

| Genelux

Corporation |

| Condensed

Statements of Comprehensive Loss |

| (in thousands) |

| |

|

|

|

|

|

| |

Three Months

Ended |

|

Nine Months

Ended |

| |

September 30, |

|

September 30, |

| |

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| |

(Unaudited) |

|

(Unaudited) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net

loss |

$ |

(6,467 |

) |

|

$ |

(5,345 |

) |

|

$ |

(20,893 |

) |

|

$ |

(21,530 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other

comprehensive loss: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net

unrealized gain on short and long-term investments |

|

135 |

|

|

|

- |

|

|

|

110 |

|

|

|

- |

|

|

Comprehensive loss |

$ |

(6,332 |

) |

|

$ |

(5,345 |

) |

|

$ |

(20,783 |

) |

|

$ |

(21,530 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| The accompanying

notes are an integral part of these condensed financial

statements. |

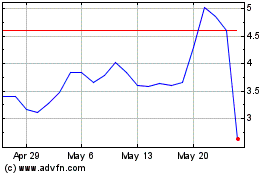

Genelux (NASDAQ:GNLX)

Historical Stock Chart

From Nov 2024 to Dec 2024

Genelux (NASDAQ:GNLX)

Historical Stock Chart

From Dec 2023 to Dec 2024