false

0001559998

0001559998

2024-08-16

2024-08-16

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report:

August

16, 2024

Gaucho

Group Holdings, Inc.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-40075 |

|

52-2158952 |

| State

of |

|

Commission

|

|

IRS

Employer |

| Incorporation |

|

File

Number |

|

Identification

No. |

112

NE 41st Street, Suite 106

Miami,

FL 33137

Address

of principal executive offices

212-739-7700

Telephone

number, including

Area

code

Former

name or former address if changed since last report

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| |

☐ |

Written

communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

|

| |

☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

|

| |

☐ |

Pre-commencement

communication pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

|

| |

☐ |

Pre-commencement

communication pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405)

or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock |

|

VINO

|

|

The

Nasdaq Stock Market LLC |

Item

3.02 Unregistered Sales of Equity Securities.

As

described in our Current Reports on Forms 8-K as filed with the SEC on May 21, 2024 and July 3, 2024, Gaucho Group Holdings, Inc. (the

“Company”) filed a Certificate of Designation of Senior Convertible Preferred Stock with the Delaware Secretary of State,

designating 100,000 shares of preferred stock of the Company, par value $0.01, as Senior Convertible Preferred Stock (the “Senior

Convertible Preferred Stock”).

The

Board of Directors of the Company approved the commencement of a private placement of shares of Senior Convertible Preferred Stock (“Preferred

Shares”) and 8.5% promissory notes (the “Notes”) for aggregate proceeds of up to $7.2 million (up to $6 million with

a 20% overallotment) pursuant to Section 4(a)(2) of the 1933 Act and Rule 506(b) of Regulation D thereunder (the “Private Placement”).

The Preferred Shares will be issued at a price per share of $100; provided that the Company is limited to the sale of up to 6,731 Preferred

Shares for gross proceeds of $637,100 until such time as stockholder approval is granted pursuant to Nasdaq Rule 5635(d) at the Company’s

Annual General Meeting of Stockholders on August 18, 2024 (the “2024 AGM”).

The

Notes, with 8.5% annual interest, become convertible into Preferred Shares at a price of $100 per share on the date the Company obtains

stockholder approval of its Proposals No. 2, 3, and 4 at the 2024 AGM.

At

the 2024 AGM, the Company obtained the requisite stockholder approval, and the Notes comprised of $3,306,425 and $41,396 in interest

were automatically converted into an aggregate of 33,488 Preferred Shares based on a conversion price of $100 per Preferred Share. For

this sale of securities, no general solicitation was used, the Preferred Shares were only offered to a small select group of accredited

investors, all of whom have a substantial pre-existing relationship with the Company, and no commissions were paid. The Company relied

on the exemption from registration available under Section 4(a)(2) and/or Rule 506(b) of Regulation D promulgated under the Securities

Act with respect to transactions by an issuer not involving any public offering. A Form D will be filed with the SEC within 15 days of

August 16, 2024, the date of conversion of the Notes.

As

of August 16, 2024, no shares of Senior Convertible Preferred Stock have yet been sold in the Private Placement.

See

Item 5.07 for further information regarding the stockholder approval of the issuance of shares upon conversion of the Notes at 2024 AGM.

Item

5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of

Certain Officers.

At the 2024 AGM, Peter J.L. Lawrence,

a Class II director of the Company, did not stand for re-election. Mr. David R. Reinecke was elected as a Class II director effective

immediately. Mr. Reinecke is expected to be appointed to the Company’s Audit Committee and Compensation Committee to take

Mr. Lawrence’s seats.

See

Item 5.07 for further information regarding the election of directors at the 2024 AGM.

Item

5.07 Submission of Matters to a Vote of Security Holders.

The

Company convened its 2024 AGM virtually on August 16, 2024 at 12:00 p.m. Eastern Time. A quorum was present for the 2024 AGM.

At

the 2024 AGM, six proposals were submitted to the stockholders for approval as set forth in the definitive 2024 Proxy Statement

as filed with the SEC on July 1, 2024. As of the record date, June 21, 2024, a total of 899,266 shares of common stock of the Company

were issued and a total of 889,263 shares of common stock were outstanding and entitled to vote. The holders of record of 675,260 shares

of common stock were present in person or represented by proxy at said meeting for a total of 675,260 votes represented at the meeting.

Such amount represented 75.9% of the shares entitled to vote at such meeting.

At

the 2024 AGM, the stockholders approved all six proposals submitted. The votes on the proposals were cast as set forth below:

| |

1. |

Proposal

No. 1 – Election of director. The stockholders elected the director nominee presented to the stockholders – David R.

Reinecke – to serve a three-year term as a Class II director until their successors are elected and qualified. |

| Name | |

Shares FOR | | |

WITHHOLD

Authority To Vote | | |

Broker Non- Vote | |

| Class II Director — David R. Reinecke | |

| 541,508 | | |

| 16,650 | | |

| 117,102 | |

| |

2. |

Proposal

No. 2 – Approval, for purposes of complying with Nasdaq Listing Rule 5635(b), of the issuance in excess of 19.99% of the Company’s

outstanding common stock upon conversion of shares of the Company’s senior convertible preferred stock issued either directly

in connection with, or upon the conversion of convertible promissory notes issued in connection with, a private placement pursuant

to Rule 506(b) of the Securities Act of 1933, as amended, which may be deemed a “change of control” under Nasdaq Listing

Rule 5635(b). |

| Shares FOR | |

Shares AGAINST | | |

ABSTAIN | | |

Broker Non- Vote | |

| 539,871 | |

| 18,278 | | |

| 9 | | |

| 117,102 | |

| |

3. |

Proposal

No. 3 – Approval, for purposes of complying with Nasdaq Listing Rule 5635(c), of the issuance of shares of the company’s

common stock to certain advisors of the Company at a price less than the market value upon conversion of shares of the Company’s

senior convertible preferred stock issued either directly in connection with, or upon the conversion of convertible promissory notes

issued in connection with, a private placement pursuant to Rule 506(b) of the Securities Act of 1933, as amended. |

| Shares FOR | |

Shares AGAINST | | |

ABSTAIN | | |

Broker Non- Vote | |

| 540,138 | |

| 18,013 | | |

| 7 | | |

| 117,102 | |

| |

4. |

Proposal

No. 4 – Approval, for purposes of complying with Nasdaq Listing Rule 5635(d), of the issuance of shares of the Company’s

common stock upon conversion of shares of the Company’s senior convertible preferred stock issued either directly in connection

with, or upon the conversion of convertible promissory notes issued in connection with, a private placement pursuant to Rule 506(b)

of the Securities Act of 1933, as amended, without giving effect to the 19.99% cap provided under Nasdaq Listing Rule 5635(d). |

| Shares FOR | |

Shares AGAINST | | |

ABSTAIN | | |

Broker Non- Vote | |

| 545,284 | |

| 12,867 | | |

| 7 | | |

| 117,102 | |

| |

5. |

Proposal

No. 5 – Approval of Amendment to Company’s Equity Incentive Plan. The stockholders approved an amendment to the Company’s

2018 Equity Incentive Plan to increase the number of shares available for awards under the plan to 30% of our common stock outstanding

on a fully diluted basis as of the date of stockholder approval, with an automatic increase on January 1 of each year by the amount

equal to 5% of the total number of shares outstanding on a fully diluted basis on such date.________________________. |

| Shares FOR | |

Shares AGAINST | | |

ABSTAIN | | |

Broker Non- Vote | |

| 509,319 | |

| 48,811 | | |

| 28 | | |

| 117,102 | |

| |

6. |

Proposal

No. 6 – Approval of Auditor. The stockholders ratified and approved Marcum, LLP as the Company’s independent registered

accounting firm for the year ended December 31, 2024. |

| Shares FOR | |

Shares AGAINST | | |

ABSTAIN | |

| 658,071 | |

| 17,068 | | |

| 121 | |

Item

7.01 Regulation FD Disclosure.

For

a recording of the 2024 AGM which includes commentary by the Company’s President and CEO, Scott Mathis, please see: https://www.cstproxy.com/gauchogroupholdings/2024.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized, on the 21st day of August, 2024.

| |

Gaucho

Group Holdings, Inc. |

| |

|

| |

By:

|

/s/

Scott L. Mathis |

| |

|

Scott

L. Mathis, President & CEO |

Exhibit

4.1

AMENDMENT

NO. 5 TO THE GAUCHO GROUP HOLDINGS, INC.

(FORMERLY

ALGODON WINES & LUXURY DEVELOPMENT GROUP, INC.)

2018

AWLD EQUITY INCENTIVE PLAN

Section

4(a) of the Plan, as previously amended, is hereby further amended as follows:

| Section 4. |

Shares Available for Awards |

| (a) | Shares

Available. Subject to adjustment as provided in Section 4(c) of the Plan, the aggregate number

of Shares that may be issued under the Plan, excluding shares issued under the Pre-Existing

Plans, shall be 662,791 Shares (30% of the Common Stock outstanding on a fully-diluted

basis as of the date of stockholder approval of August 16, 2024), plus an automatic annual

increase to be added on January 1 of each year equal to 5.0% of the total number of Shares

outstanding on such date (including for this purpose any Shares issuable upon conversion

of any outstanding capital stock of the Company). |

| (i) | Any

Shares subject to an Award issued under this Plan or the Pre-Existing Plans that are canceled,

forfeited or expire prior to exercise or realization, either in full or in part, shall be

added to the total number of Shares available for an Award to be made under the Plan. |

| | |

| (ii) | Shares

to be issued under the Plan must be authorized but unissued Shares. |

| | |

| (iii) | Notwithstanding

the foregoing, (A) the number of Shares available for granting Incentive Stock Options under

the Plan shall not exceed the aggregate number of Shares that may be issued under the Plan

not taking into account any automatic increase in the share reserve, subject to adjustment

as provided in Section 4(c) of the Plan and subject to the provisions of Section 422 or 424

of the Code or any successor provision and (B) the number of Shares available for granting

Restricted Stock and Restricted Stock Units shall not exceed 417, subject to adjustment as

provided in Section 4(c) of the Plan. Shares tendered by Participants as full or partial

payment to the Company upon exercise of an Award, and Shares withheld by or otherwise remitted

to the Company to satisfy a Participant’s tax withholding obligations with respect

to an Award, shall not then become available for issuance under the Plan. Any Shares withheld

or otherwise remitted to the Company to satisfy tax withholding obligations, to pay the exercise

price of an Award, or Shares of Common Stock subject to a broker-assisted cashless exercise

of an Award shall reduce the number of Shares available for issuance under the Plan. |

| | |

| (iv) | The

maximum number of Shares subject to an Award granted during a Fiscal Year to any Director

(exclusive of Shares subject to an Award issued to any Director in his or her capacity as

an Employee of the Company), together with any cash fees paid to such Director during the

Fiscal Year shall not exceed a total value of $100,000 (calculating the value of any Awards

based on the grant date fair value for financial reporting purposes). |

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

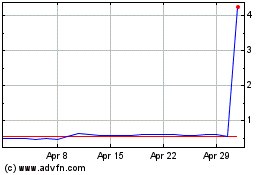

Gaucho (NASDAQ:VINO)

Historical Stock Chart

From Feb 2025 to Mar 2025

Gaucho (NASDAQ:VINO)

Historical Stock Chart

From Mar 2024 to Mar 2025