0001595353

false

--12-31

Q2

2023

2023-06-30

0001595353

2023-01-01

2023-06-30

0001595353

2023-06-30

0001595353

2022-12-31

0001595353

2023-04-01

2023-06-30

0001595353

2022-04-01

2022-06-30

0001595353

2022-01-01

2022-06-30

0001595353

us-gaap:CommonStockMember

2022-12-31

0001595353

us-gaap:AdditionalPaidInCapitalMember

2022-12-31

0001595353

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-12-31

0001595353

us-gaap:RetainedEarningsMember

2022-12-31

0001595353

us-gaap:CommonStockMember

2023-03-31

0001595353

us-gaap:AdditionalPaidInCapitalMember

2023-03-31

0001595353

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-03-31

0001595353

us-gaap:RetainedEarningsMember

2023-03-31

0001595353

2023-03-31

0001595353

us-gaap:CommonStockMember

2021-12-31

0001595353

us-gaap:AdditionalPaidInCapitalMember

2021-12-31

0001595353

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2021-12-31

0001595353

us-gaap:RetainedEarningsMember

2021-12-31

0001595353

2021-12-31

0001595353

us-gaap:CommonStockMember

2022-03-31

0001595353

us-gaap:AdditionalPaidInCapitalMember

2022-03-31

0001595353

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-03-31

0001595353

us-gaap:RetainedEarningsMember

2022-03-31

0001595353

2022-03-31

0001595353

us-gaap:CommonStockMember

2023-01-01

2023-03-31

0001595353

us-gaap:AdditionalPaidInCapitalMember

2023-01-01

2023-03-31

0001595353

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-01-01

2023-03-31

0001595353

us-gaap:RetainedEarningsMember

2023-01-01

2023-03-31

0001595353

2023-01-01

2023-03-31

0001595353

us-gaap:CommonStockMember

2023-04-01

2023-06-30

0001595353

us-gaap:AdditionalPaidInCapitalMember

2023-04-01

2023-06-30

0001595353

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-04-01

2023-06-30

0001595353

us-gaap:RetainedEarningsMember

2023-04-01

2023-06-30

0001595353

us-gaap:CommonStockMember

2022-01-01

2022-03-31

0001595353

us-gaap:AdditionalPaidInCapitalMember

2022-01-01

2022-03-31

0001595353

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-01-01

2022-03-31

0001595353

us-gaap:RetainedEarningsMember

2022-01-01

2022-03-31

0001595353

2022-01-01

2022-03-31

0001595353

us-gaap:CommonStockMember

2022-04-01

2022-06-30

0001595353

us-gaap:AdditionalPaidInCapitalMember

2022-04-01

2022-06-30

0001595353

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-04-01

2022-06-30

0001595353

us-gaap:RetainedEarningsMember

2022-04-01

2022-06-30

0001595353

us-gaap:CommonStockMember

2023-06-30

0001595353

us-gaap:AdditionalPaidInCapitalMember

2023-06-30

0001595353

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-06-30

0001595353

us-gaap:RetainedEarningsMember

2023-06-30

0001595353

us-gaap:CommonStockMember

2022-06-30

0001595353

us-gaap:AdditionalPaidInCapitalMember

2022-06-30

0001595353

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-06-30

0001595353

us-gaap:RetainedEarningsMember

2022-06-30

0001595353

2022-06-30

0001595353

2023-07-01

2023-07-31

0001595353

GLMD:OnkaiIncMember

2023-06-30

0001595353

GLMD:OnkaiIncMember

2023-05-03

2023-05-04

0001595353

GLMD:OnkaiIncMember

us-gaap:SubsequentEventMember

2023-11-29

2023-11-30

0001595353

GLMD:OnkaiIncMember

2023-01-01

2023-06-30

0001595353

GLMD:OnkaiIncMember

2023-06-18

2023-06-19

0001595353

GLMD:OnkaiIncMember

2023-06-19

0001595353

us-gaap:OperatingIncomeLossMember

2023-04-01

2023-06-30

0001595353

us-gaap:OperatingIncomeLossMember

2022-04-01

2022-06-30

0001595353

us-gaap:OperatingIncomeLossMember

2023-01-01

2023-06-30

0001595353

us-gaap:OperatingIncomeLossMember

2022-01-01

2022-06-30

0001595353

us-gaap:GainLossOnInvestmentsMember1

2023-04-01

2023-06-30

0001595353

us-gaap:GainLossOnInvestmentsMember1

2022-04-01

2022-06-30

0001595353

us-gaap:GainLossOnInvestmentsMember1

2023-01-01

2023-06-30

0001595353

us-gaap:GainLossOnInvestmentsMember1

2022-01-01

2022-06-30

0001595353

2023-06-29

2023-06-30

0001595353

2023-05-14

2023-05-15

0001595353

us-gaap:SubsequentEventMember

2023-07-17

2023-07-18

0001595353

us-gaap:SubsequentEventMember

GLMD:PrefundedWarrantsMember

us-gaap:WarrantMember

2023-07-18

0001595353

us-gaap:SubsequentEventMember

GLMD:PrefundedWarrantsMember

us-gaap:CommonStockMember

2023-07-18

0001595353

us-gaap:SubsequentEventMember

us-gaap:WarrantMember

GLMD:InvestorWarrantsMember

2023-07-18

0001595353

us-gaap:SubsequentEventMember

us-gaap:CommonStockMember

GLMD:InvestorWarrantsMember

2023-07-18

0001595353

us-gaap:SubsequentEventMember

GLMD:InvestorWarrantsMember

2023-07-18

0001595353

us-gaap:SubsequentEventMember

GLMD:PrefundedWarrantsMember

2023-07-18

0001595353

us-gaap:SubsequentEventMember

GLMD:PrefundedWarrantsMember

us-gaap:WarrantMember

2023-08-04

0001595353

us-gaap:SubsequentEventMember

GLMD:PrefundedWarrantsMember

us-gaap:CommonStockMember

2023-08-04

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

iso4217:ILS

xbrli:shares

utr:sqft

GLMD:Integer

iso4217:ILS

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

Report

of Foreign Private Issuer Pursuant to Rule 13a-16 or 15d-16

Under

the Securities Exchange Act of 1934

For

the Month of August 2023

001-36345

(Commission

File Number)

GALMED

PHARMACEUTICALS LTD.

(Exact

name of Registrant as specified in its charter)

16

Tiomkin St.

Tel

Aviv 6578317, Israel

(Address

of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form

20-F ☒ Form 40-F ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

This

Form 6-K contains the quarterly report of Galmed Pharmaceuticals Ltd. (the “Company”), which includes the Company’s

unaudited interim condensed consolidated financial statements for the three and six months ended June 30, 2023, together with related

information and certain other information. The Company is not subject to the requirements to file quarterly or certain other reports

under Section 13 or 15(d) of the Securities Exchange Act of 1934, as amended. The Company does not undertake to file or cause to be filed

any such reports in the future, except to the extent required by law.

This

Form 6-K is incorporated by reference into the Company’s Registration Statement on Form S-8 (Registration No. 333-206292

and 333-227441) and the Company’s Registration Statement on Form F-3 (Registration No. 333-254766).

FINANCIAL

INFORMATION

Financial

Statements

GALMED

PHARMACEUTICALS LTD.

Interim

Condensed Consolidated Balance Sheets (Unaudited)

U.S.

Dollars in thousands, except share data and per share data

| | |

|

As of | | |

As of | |

| | |

|

June 30, | | |

December 31, | |

| | |

|

2023 | | |

2022 | |

| Assets | |

|

| | | |

| | |

| | |

|

| | | |

| | |

| Current assets | |

|

| | | |

| | |

| Cash and cash equivalents | |

|

$ | 1,009 | | |

$ | 2,016 | |

| Restricted Cash | |

|

| 115 | | |

| 114 | |

| Marketable debt securities | |

|

| 7,556 | | |

| 11,769 | |

| Short term Deposits | |

|

| 765 | | |

| - | |

| Other receivables | |

|

| 341 | | |

| 825 | |

| Total current assets | |

|

| 9,786 | | |

| 14,724 | |

| | |

|

| | | |

| | |

| Operating lease right-of-use assets | |

|

| 129 | | |

| 223 | |

| Property and equipment, net | |

|

| 97 | | |

| 114 | |

| Investment in SAFE notes | |

|

| - | | |

| 1,500 | |

| Investment in associate at fair value | 3 |

|

| 3,265 | | |

| - | |

| Total non-current assets | |

|

| 3,491 | | |

| 1,837 | |

| | |

|

| | | |

| | |

| Total assets | |

|

$ | 13,277 | | |

$ | 16,561 | |

| | |

|

| | | |

| | |

| Liabilities and stockholders’ equity | |

|

| | | |

| | |

| | |

|

| | | |

| | |

| Current liabilities | |

|

| | | |

| | |

| Trade payables | |

|

$ | 2,140 | | |

$ | 2,560 | |

| Other payables | |

|

| 583 | | |

| 534 | |

| Total current liabilities | |

|

| 2,723 | | |

| 3,094 | |

| | |

|

| | | |

| | |

| Non-current liabilities | |

|

| | | |

| | |

| Operating lease liabilities, net of current portion | |

|

$ | - | | |

$ | 44 | |

| Total non-current liabilities | |

|

| - | | |

| 44 | |

| | |

|

| | | |

| | |

| Ordinary shares par value NIS 0.15

per share; Authorized 20,000,000;

Issued and outstanding: 1,680,232

shares as of June 30, 2023 and as of December 31, 2022 (*) | |

|

| 70 | | |

| 70 | |

| Additional paid-in capital | |

|

| 200,609 | | |

| 200,138 | |

| Accumulated other comprehensive loss | |

|

| (662 | ) | |

| (745 | ) |

| Accumulated deficit | |

|

| (189,463 | ) | |

| (186,040 | ) |

| Total stockholders’ equity | 4 |

|

| 10,554 | | |

| 13,423 | |

| | |

|

| | | |

| | |

| Total liabilities and stockholders’ equity | |

|

$ | 13,277 | | |

$ | 16,561 | |

The accompanying notes are

an integral part of the interim condensed consolidated financial statements.

GALMED

PHARMACEUTICALS LTD.

Interim

Condensed Consolidated Statements of Operations (Unaudited)

U.S.

Dollars in thousands, except share data and per share data

| | |

| | | |

| | | |

| | | |

| | |

| | |

Three months ended | | |

Six months ended | |

| | |

June 30, | | |

June 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Research and development expenses | |

| 809 | | |

| 2,580 | | |

| 1,892 | | |

| 7,376 | |

| | |

| | | |

| | | |

| | | |

| | |

| General and administrative expenses | |

| 1,062 | | |

| 1,150 | | |

| 1,981 | | |

| 2,446 | |

| | |

| | | |

| | | |

| | | |

| | |

| Total operating expenses | |

| 1,871 | | |

| 3,730 | | |

| 3,873 | | |

| 9,822 | |

| | |

| | | |

| | | |

| | | |

| | |

| Financial expense (income), net | |

| (278 | ) | |

| 4 | | |

| (450 | ) | |

| 55 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

$ | 1,593 | | |

$ | 3,734 | | |

$ | 3,423 | | |

$ | 9,877 | |

| | |

| | | |

| | | |

| | | |

| | |

| Basic and diluted net loss per share | |

$ | 0.95 | | |

$ | 2.25 | (*) | |

$ | 2.04 | | |

$ | 5.85 | (*) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted-average number of shares outstanding used in

computing basic and diluted net loss per share | |

| 1,680,232 | | |

| 1,672,561 | (*) | |

| 1,680,232 | | |

| 1,672,561 | (*) |

The

accompanying notes are an integral part of the interim condensed consolidated financial statements.

GALMED

PHARMACEUTICALS LTD.

Interim

Condensed Consolidated Statements of Comprehensive Loss (Unaudited)

U.S.

Dollars in thousands

| | |

| | | |

| | | |

| | | |

| | |

| | |

Three months ended | | |

Six months ended | |

| | |

June 30, | | |

June 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Net loss | |

$ | 1,593 | | |

$ | 3,734 | | |

$ | 3,423 | | |

$ | 9,877 | |

| | |

| | | |

| | | |

| | | |

| | |

| Other comprehensive loss: | |

| | | |

| | | |

| | | |

| | |

| Net unrealized loss (gain) on available for sale securities | |

| 17 | | |

| 366 | | |

| (83 | ) | |

| 811 | |

| | |

| | | |

| | | |

| | | |

| | |

| Comprehensive loss | |

$ | 1,610 | | |

$ | 4,100 | | |

$ | 3,340 | | |

$ | 10,688 | |

The

accompanying notes are an integral part of the interim condensed consolidated financial statements.

GALMED

PHARMACEUTICALS LTD.

Consolidated

Statements of Changes in Stockholders’ Equity (Unaudited)

U.S.

Dollars in thousands, except share data and per share data

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

| | |

| | |

| | |

Accumulated | | |

| | |

| |

| | |

| | |

Additional | | |

other | | |

| | |

| |

| | |

Ordinary

shares | | |

paid-in | | |

Comprehensive | | |

Accumulated | | |

| |

| | |

Shares | | |

Amount | | |

capital | | |

loss | | |

Deficit | | |

Total | |

| Balance – December 31, 2022 | |

| 1,680,232 | (*) | |

$ | 70 | | |

$ | 200,138 | | |

$ | (745 | ) | |

$ | (186,040 | ) | |

$ | 13,423 | |

| Stock based compensation | |

| - | | |

| - | | |

| 297 | | |

| - | | |

| - | | |

| 297 | |

| Unrealized gain from marketable debt securities | |

| - | | |

| - | | |

| - | | |

| 100 | | |

| - | | |

| 100 | |

| Net loss | |

| | | |

| | | |

| | | |

| | | |

| (1,830 | ) | |

| (1,830 | ) |

| Balance – March 31, 2023 | |

| 1,680,232 | (*) | |

$ | 70 | | |

$ | 200,435 | | |

$ | (645 | ) | |

$ | (187,870 | ) | |

$ | 11,990 | |

| Stock-based compensation | |

| - | | |

| - | | |

| 174 | | |

| - | | |

| - | | |

| 174 | |

| Unrealized loss from marketable debt securities | |

| - | | |

| - | | |

| - | | |

| (17 | ) | |

| - | | |

| (17 | ) |

| Net loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| (1,593 | ) | |

| (1,593 | ) |

| Balance – June 30, 2023 | |

| 1,680,232 | | |

$ | 70 | | |

$ | 200,609 | | |

$ | (662 | ) | |

$ | (189,463 | ) | |

$ | 10,554 | |

| | |

| | |

| | |

| | |

Accumulated | | |

| | |

| |

| | |

| | |

Additional | | |

other | | |

| | |

| |

| | |

Ordinary shares | | |

paid-in | | |

Comprehensive | | |

Accumulated | | |

| |

| | |

Shares (*) | | |

Amount | | |

capital | | |

loss | | |

Deficit | | |

Total | |

| Balance – December 31, 2021 | |

| 1,672,561 | | |

$ | 70 | | |

$ | 198,772 | | |

$ | (171 | ) | |

$ | (168,174 | ) | |

$ | 30,497 | |

| Stock based compensation | |

| - | | |

| - | | |

| 457 | | |

| - | | |

| - | | |

| 457 | |

| Unrealized loss from marketable debt securities | |

| - | | |

| - | | |

| - | | |

| (445 | ) | |

| - | | |

| (445 | ) |

| Net loss | |

| | | |

| | | |

| | | |

| | | |

| (6,143 | ) | |

| (6,143 | ) |

| Balance – March 31, 2022 | |

| 1,672,561 | | |

$ | 70 | | |

$ | 199,229 | | |

$ | (616 | ) | |

$ | (174,317 | ) | |

$ | 24,366 | |

| Balance | |

| 1,672,561 | | |

$ | 70 | | |

$ | 199,229 | | |

$ | (616 | ) | |

$ | (174,317 | ) | |

$ | 24,366 | |

| Stock-based compensation | |

| - | | |

| - | | |

| 446 | | |

| - | | |

| - | | |

| 446 | |

| Unrealized loss from marketable debt securities | |

| - | | |

| - | | |

| - | | |

| (366 | ) | |

| - | | |

| (366 | ) |

| Net loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| (3,734 | ) | |

| (3,734 | ) |

| Balance – June 30, 2022 | |

| 1,672,561 | | |

$ | 70 | | |

$ | 199,675 | | |

$ | (982 | ) | |

$ | (178,051 | ) | |

$ | 20,712 | |

| Balance | |

| 1,672,561 | | |

$ | 70 | | |

$ | 199,675 | | |

$ | (982 | ) | |

$ | (178,051 | ) | |

$ | 20,712 | |

The

accompanying notes are an integral part of the interim condensed consolidated financial statements.

GALMED

PHARMACEUTICALS LTD.

Interim

Condensed Consolidated Statements of Cash Flows (Unaudited)

U.S.

Dollars in thousands

| | |

| | | |

| | |

| | |

Six months ended | |

| | |

June 30, | |

| | |

2023 | | |

2022 | |

| Cash flow from operating activities | |

| | | |

| | |

| | |

| | | |

| | |

| Net loss | |

$ | (3,423 | ) | |

$ | (9,877 | ) |

| | |

| | | |

| | |

| Adjustments required to reconcile net loss to net cash used in operating activities | |

| | | |

| | |

| Depreciation and amortization | |

| 17 | | |

| 18 | |

| Stock-based compensation expense | |

| 471 | | |

| 903 | |

| Amortization of premium on marketable debt securities | |

| 15 | | |

| 35 | |

| Change in fair value of SAFE investment | |

| (265 | ) | |

| - | |

| Interest income from short-term deposits | |

| (16 | ) | |

| - | |

| Gain from realization of marketable debt securities | |

| (25 | ) | |

| 201 | |

| Finance expenses | |

| (2 | ) | |

| (42 | ) |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| Decrease in other accounts receivable | |

| 484 | | |

| 511 | |

| Decrease in trade payables | |

| (420 | ) | |

| (2,782 | ) |

| Increase (decrease) in other accounts payable | |

| 102 | | |

| (330 | ) |

| Net cash used in operating activities | |

| (3,062 | ) | |

| (11,363 | ) |

| | |

| | | |

| | |

| Cash flow from investing activities | |

| | | |

| | |

| Purchase of property and equipment | |

| - | | |

| (3 | ) |

| Purchase of available for sale securities | |

| (3,218 | ) | |

| 10,462 | |

| Investment in equity of Onkai | |

| (1,500 | ) | |

| - | |

| Investment in short term deposits | |

| (750 | ) | |

| - | |

| Sale of available-for-sale securities | |

| 7,524 | | |

| - | |

| Net cash provided by (used in) investing activities | |

| 2,056 | | |

| 10,459 | |

| | |

| | | |

| | |

| Decrease in cash and cash equivalents and restricted cash | |

| (1,006 | ) | |

| (904 | ) |

| Cash and cash equivalents and restricted cash at the beginning of the period | |

| 2,130 | | |

| 2,998 | |

| Cash and cash equivalents and restricted cash at the end of the period | |

$ | 1,124 | | |

$ | 2,094 | |

| | |

| | | |

| | |

| Supplemental disclosure of cash flow information: | |

| | | |

| | |

| | |

| | | |

| | |

| Cash received from interest | |

$ | 163 | | |

$ | 138 | |

| | |

| | | |

| | |

| Non-cash investment transaction: | |

| | | |

| | |

| Conversion of SAFE into equity of OnKai | |

$ | 1,765 | | |

| - | |

The

accompanying notes are an integral part of the interim condensed consolidated financial statements.

GALMED

PHARMACEUTICALS LTD.

Notes

to Interim Condensed Consolidated Financial Statements

Note

1 - Basis of presentation

Galmed

Pharmaceuticals Ltd. (the “Company”) was incorporated in Israel on July 31, 2013 and commenced operations on February 2,

2014.

The

Company holds a wholly-owned subsidiary, Galmed International Ltd., which was incorporated in Malta.

The

Company also holds two additional wholly-owned subsidiaries, Galmed Research and Development Ltd and Galtopa Therapeutics Ltd., both

of which are incorporated in Israel. In July 2023 Galmed Research and Development Ltd established a new wholly-owned subsidiary

incorporated under the laws of England and Wales called Galmed Therapeutics UK limited.

The

Company is a clinical stage biopharmaceutical company primarily focused on the development of its product candidate Aramchol for liver

and fibro-inflammatory diseases. The Company has focused almost exclusively on developing Aramchol for the treatment of NASH and is currently

developing Aramchol for PSC and exploring the feasibility of developing Aramchol for other fibro-inflammatory indications outside of

liver disease. The Company is also collaborating with the Hebrew University in the development of Amilo-5MER. The Company has an operating

history limited to pre-clinical and clinical drug development.

In

May 2023, the Company announced the initiation of a new clinical program to evaluate Aramchol meglumine for the treatment of Primary

Sclerosing Cholangitis (PSC).

In

addition, in May 2023, the Company entered into a definitive agreement with OnKai, Inc. (“Onkai”) for an equity investment

in Onkai. See note 3.

The

Company funded its research and development programs and operations to date primarily through proceeds from private placements and public

offerings. The Company currently has no products approved for marketing and has not generated any revenue from product sales to date.

As of June 30, 2023, the Company had cash and cash equivalents of $1.0 million, short term deposit of $0.8 million, restricted cash of

$0.1 million, and marketable debt securities of $7.6 million. In July 2023, the Company completed a public offering resulting in net

proceeds of approximately $6.2 million.

The

Company has incurred operating losses in each year since inception. The Company’s loss attributable to holders of its ordinary

shares for the six months period ended June 30, 2023, was approximately $3.4 million. As of June 30, 2023, the Company had an accumulated

deficit of $189.5 million. Substantially all of its operating losses resulted from costs incurred in connection with the Company’s

development program and from general and administrative costs associated with its operations.

The

Company will need to raise substantial, additional capital to fund its operations and to develop Aramchol for, and beyond its current

development stage and any future commercialization, as well as any additional indications.

Based

on the Company’s current operating plan, the Company’s management currently estimates that its cash position will support

its current clinical trials and operations as currently conducted for more than 12 months from the date of issuance of these financial

statements.

These

unaudited interim condensed consolidated financial statements have been prepared as of June 30, 2023, and for the three and six

month period then ended. Accordingly, certain information and footnote disclosures normally included in annual financial statements

prepared in accordance with U.S. GAAP have been omitted. These unaudited interim condensed consolidated financial statements should be

read in conjunction with the audited financial statements and the accompanying notes of the Company for the year ended December 31, 2022

that are included in the Company’s Annual Report on Form 20-F, filed with the Securities and Exchange Commission on March 29, 2023

(the “Annual Report on Form 20-F”). The results of operations presented are not necessarily indicative of the results to

be expected for the year ending December 31, 2023.

GALMED

PHARMACEUTICALS LTD.

Notes

to Interim Condensed Consolidated Financial Statements

Note

2 - Summary of significant accounting policies

The

significant accounting policies that have been applied in the preparation of the unaudited consolidated interim financial statements

are identical to those that were applied in preparation of the Company’s most recent annual financial statements in connection

with its Annual Report on Form 20-F, other than:

Investment

in Equity Securities

The

Company entered into an investment in which it holds approximately 24%

of the outstanding shares and voting rights of Onkai. The Company has elected the fair value option allowed by ASC 825, Financial

Instruments, with respect to this investment because management believes this approach will better reflect the economics of its equity

interest. Under the fair value option, the investment is remeasured at fair value (level 3) at each reporting period through earnings

Note

3 – Investment in Associate at Fair Value

On

May 4, 2023, the Company entered into a definitive agreement (the “Agreement”) for a $1.5 million equity investment in OnKai,

a US-based technology company developing an AI-based platform to advance healthcare for underserved populations across the United States

by facilitating alignment between healthcare stakeholders.

Previously,

on November, 2023 the Company invested $1.5 million in OnKai through a Simple Agreement for Future Equity which converted at a

15% discount into series seed preferred shares upon closing of the Investment Round.

The

Company’s investment in OnKai was part of an approximately $6

million investment round (the “Investment

Round”) with other investors that was led by the Company of which SAFE notes of approximately $3.8

million were converted into

preferred shares. On June 19, 2023, the Investment Round closed. Following the closing of the Investment Round, the Company holds 1,223,535

preferred shares which comprises

approximately 23.9%

of the outstanding share capital of OnKai on an as-converted basis. and the Company’s Chief Executive Officer and director, Allen

Baharaff serves as a board member of OnKai.

Under

the terms of the Agreement, during the three-year period following the closing of the Investment Round the Company will have the right

to merge with OnKai subject to the approval of the boards of directors of each of the Company and OnKai. The Company is granted certain

customary pre-emptive rights as well as registration rights, first refusal rights, co-sale rights and broad based weighted average anti-dilution

rights, a board seat, and certain customary protective provisions.

In

connection with the Agreement, the Company’s wholly-owned subsidiary, Galmed Research and Development Ltd. (“GRD”),

entered into a services agreement with OnKai. The Services Agreement provides that GRD will on a non-exclusive basis (i) provide support

services to OnKai relating to finance, business development, strategic planning, execution and others; and (ii) lend its experience to

OnKai in building a strategy and for the development of treatments for the underserved and that OnKai shall on a non-exclusive basis

(i) take part in plan preparation to serve GRD’s vision of developing drugs for the underserved population and (ii) when relevant,

design a process on the clinical trial dashboard that could potentially serve GDR’s future trial.

Summarized

statement of operations (in thousands):

Summary

of Statement of operations

| | |

| | | |

| | | |

| | | |

| | |

| | |

Three months ended | | |

Six months ended | |

| | |

June 30, | | |

June 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

| | |

| | |

| | |

| |

| Total operating loss | |

$ | 573 | | |

$ | 286 | | |

$ | 1,171 | | |

$ | 536 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

$ | 769 | | |

$ | 349 | | |

$ | 1,584 | | |

$ | 648 | |

GALMED PHARMACEUTICALS LTD.

Notes to Interim Condensed Consolidated Financial

Statements

Note

4 - Stockholders’ Equity

| 1. | On

March 23, 2023, the Company received a ruling from the Israel Tax Authority (“ITA”)

confirming the repricing of stock options. This repricing was accounted for as a modification

of a share-based payment award. The incremental compensation expense recognized as a result

of the modification during the period ended June 30, 2023 was approximately $0.1

million. |

| 2. | On

May 15, 2023 the Company

effected a reverse share split of the Company’s ordinary shares at the ratio of 1-for-15, such that each fifteen (15) ordinary

shares, par value NIS 0.01 per share, shall be consolidated into one (1) ordinary share, par value NIS 0.15. As

a result, all share and per share amounts were adjusted retroactively for all periods presented in these financial

statements. |

| 3. | In

July 2023, we completed a public offering resulting in net proceeds of approximately $6.2

million. See note 5 for further details. |

Note

5 – Subsequent Events

On

July 18, 2023, the Company sold to investors in a public offering (i) 380,000 ordinary shares, (ii) 5,220,000 pre-funded warrants to

purchase 5,220,000 ordinary shares (the “Pre-Funded Warrants”), and (iii) 5,600,000 warrants to purchase 5,600,000 ordinary

shares (the “Investor Warrants”), at a purchase price of $1.25 per Share and accompanying Investor Warrant and $1.249 per

Pre-Funded Warrant and accompanying Investor Warrant.

The

Pre-Funded Warrants are immediately exercisable at an exercise price of $0.001 per ordinary share and will not expire until exercised

in full. The Investor Warrants have an exercise price of $1.25 per ordinary share, are immediately exercisable, and may be exercised

until July 18, 2028. The net proceeds to the Company, were approximately $6.2 million.

As

of August 4, 2023, a total of 2,121,041 Pre-Funded Warrants were exercised into 2,121,041 ordinary shares.

Management’s

Discussion and Analysis of Financial Condition and Results of Operations

All

references to “we,” “us,” “our,” “the Company” and “our Company”, in this

Form 6-K are to Galmed Pharmaceuticals Ltd. and its subsidiaries, unless the context otherwise requires. All references to “shares”

or “ordinary shares” are to our ordinary shares, NIS 0.15 nominal par value per share. All references to “Israel”

are to the State of Israel. “U.S. GAAP” means the generally accepted accounting principles of the United States. Unless otherwise

stated, all of our financial information presented in this Form 6-K has been prepared in accordance with U.S. GAAP. Any discrepancies

in any table between totals and sums of the amounts and percentages listed are due to rounding. Unless otherwise indicated, or the context

otherwise requires, references in this Form 6-K to financial and operational data for a particular year refer to the fiscal year of our

company ended December 31 of that year.

Our

reporting currency and financial currency is the U.S. dollar. In this Form 6-K, “NIS” means New Israeli Shekel, and “$,”

“US$” and “U.S. dollars” mean United States dollars.

Cautionary

Note Regarding Forward-Looking Statements

This

Form 6-K contains forward-looking statements about our expectations, beliefs or intentions regarding, among other things, our product

development efforts, business, financial condition, results of operations, strategies or prospects. In addition, from time to time, we

or our representatives have made or may make forward-looking statements, orally or in writing. Forward-looking statements can be identified

by the use of forward-looking words such as “believe,” “expect,” “intend,” “plan,” “may,”

“should,” “anticipate,” “could,” “might,” “seek,” “target,” “will,”

“project,” “forecast,” “continue” or their negatives or variations of these words or other comparable

words or by the fact that these statements do not relate strictly to historical matters. These forward-looking statements may be included

in, among other things, various filings made by us with the SEC, press releases or oral statements made by or with the approval of one

of our authorized executive officers. Forward-looking statements relate to anticipated or expected events, activities, trends or results

as of the date they are made. Because forward-looking statements relate to matters that have not yet occurred, these statements are inherently

subject to risks and uncertainties that could cause our actual results to differ materially from any future results expressed or implied

by the forward-looking statements. Many factors could cause our actual activities or results to differ materially from the activities

and results anticipated in forward-looking statements, including, but not limited to, the factors summarized below:

| ● |

|

the

timing and cost of our pivotal Phase 3 ARMOR trial, or the ARMOR Study, for our product candidate, Aramchol, or for any other pre-clinical

or clinical trials; |

| |

|

|

| ● |

|

completion

and receiving favorable results of the ARMOR Study for Aramchol or any other pre-clinical or clinical trial; |

| |

|

|

| ● |

|

regulatory

action with respect to Aramchol or any other product candidate by the U.S. Food and Drug Administration, or the FDA, or the European

Medicines Authority, or EMA, including but not limited to acceptance of an application for marketing authorization, review and approval

of such application, and, if approved, the scope of the approved indication and labeling; |

| |

|

|

| ● |

|

the

commercial launch and future sales of Aramchol and any future product candidates; |

| |

|

|

| ● |

|

our

ability to comply with all applicable post-market regulatory requirements for Aramchol or any other product candidate in the countries

in which we seek to market the product; |

| |

|

|

| ● |

|

our

ability to achieve favorable pricing for Aramchol or any other product candidate; |

| |

|

|

| ● |

|

our

expectations regarding the commercial market for non-alcoholic steato-hepatitis, or NASH, in patients or any other targeted indication; |

| |

|

|

| ● |

|

third-party

payor reimbursement for Aramchol or any other product candidate; |

| |

|

|

| ● |

|

our

estimates regarding anticipated capital requirements and our needs for additional financing; |

| |

|

|

| ● |

|

market

adoption of Aramchol or any other product candidate by physicians and patients; |

| |

|

|

| ● |

|

the

timing, cost or other aspects of the commercial launch of Aramchol or any other product candidate; |

| |

|

|

| ● |

|

our

ability to obtain and maintain adequate protection of our intellectual property; |

| |

|

|

| ● |

|

the

possibility that we may face third-party claims of intellectual property infringement; |

| |

|

|

| ● |

|

our

ability to manufacture our product candidates in commercial quantities, at an adequate quality or at an acceptable cost; |

| |

|

|

| ● |

|

our

ability to establish adequate sales, marketing and distribution channels; |

| |

|

|

| ● |

|

intense

competition in our industry, with competitors having substantially greater financial, technological, research and development, regulatory

and clinical, manufacturing, marketing and sales, distribution and personnel resources than we do; |

| |

|

|

| ● |

|

the

development and approval of the use of Aramchol or any other product candidate for additional indications or in combination therapy; |

| |

|

|

| ● |

|

our

expectations regarding licensing, acquisitions and strategic operations; |

| |

|

|

| ● |

|

current

or future unfavorable economic and market conditions and adverse developments with respect to financial institutions and associated

liquidity risk; and |

| |

|

|

| ● |

|

our

ability to maintain the listing of our ordinary shares on The Nasdaq Capital Market. |

We

believe these forward-looking statements are reasonable; however, these statements are only current predictions and are subject to known

and unknown risks, uncertainties and other factors that may cause our or our industry’s actual results, levels of activity, performance

or achievements to be materially different from those anticipated by the forward-looking statements. We discuss many of these risks in

our Annual Report on Form 20-F for the year ended December 31, 2022, filed with the SEC on March 29, 2023 in greater detail under the

heading “Risk Factors” and elsewhere in the Annual Report and this Form 6-K. Given these uncertainties, you should not rely

upon forward-looking statements as predictions of future events.

All

forward-looking statements attributable to us or persons acting on our behalf speak only as of the date hereof and are expressly qualified

in their entirety by the cautionary statements included in this report. We undertake no obligations to update or revise forward-looking

statements to reflect events or circumstances that arise after the date made or to reflect the occurrence of unanticipated events. In

evaluating forward-looking statements, you should consider these risks and uncertainties.

Overview

We

are a biopharmaceutical company focused on the development of Aramchol. We have focused almost exclusively on developing Aramchol for

the treatment of liver disease and are currently developing Aramchol for PSC and exploring the feasibility of developing Aramchol for

other fibro-inflammatory indications outside of liver disease. We are also collaborating with the Hebrew University in the development

of Amilo-5MER, a 5 amino acid synthetic peptide.

In

September 2019, we initiated our Phase 3 ARMOR Study to evaluate the efficacy and safety of Aramchol in subjects with NASH and fibrosis.

The ARMOR Study was originally comprised of two parts, a randomized, double-blind, placebo-controlled histology-based registrational

part and a clinically based part where subjects will continue with the same treatment for approximately five years. In December 2020,

we announced the addition of a 150-patient open label part to the ARMOR Study and suspended randomization of new patients into the double-blind,

placebo-controlled histology-based registrational part of ARMOR as all enrolled patients were transitioned to the open label part.

In

May 2022, we announced our plan to expand into new anti-fibrotic indications to maximize the potential of Aramchol while at the same

time discontinuing the open label part of its ARMOR Study having reached its objectives. Simultaneously, we initiated a cost reduction

plan and initiated a process to evaluate our strategic alternatives. Following the discontinuation of our open label part of the ARMOR

Study, we do not currently expect to initiate the second part of the ARMOR Study in the near term.

In

May 2023, we announced the initiation of a new clinical program to evaluate Aramchol meglumine for the treatment of Primary Sclerosing

Cholangitis (PSC), a rare disease for which there is no approved treatment. We plan to initiate a Phase 2 study in the last quarter of

2023. The single-arm, open label, proof-of-concept clinical trial will evaluate the effects of 24 weeks of treatment with Aramchol meglumine

in approximately 15 patients with PSC. The study’s endpoints will include the conventional relevant laboratory parameters (alkaline

phosphatase and bilirubin), sophisticated imaging including liver stiffness using MR Elastography (MRE), imaging of the biliary tract

using MR cholangiopancreatography (MRCP) and hepatocyte-specific contrast agents, histological fibrosis and molecular assessment as well

as a range of biomarkers of disease activity and fibrosis. These endpoints are expected to provide a robust assessment of the underlying

disease and the effects of Aramchol.

In

addition, in May 2023, we entered into a definitive agreement (the “Agreement”) for a $1.5 million equity investment in

OnKai Inc. (“OnKai”), a US-based technology company developing an AI-based platform to advance healthcare for

underserved populations across the United States by facilitating alignment between healthcare stakeholders. The signing of the

definitive agreement followed an announcement that we made in January 2023 that we had entered into a non-binding termsheet for an

equity investment in OnKai. The Agreement provided that we will invest $1.5 million in exchange for series seed preferred shares of

OnKai (which is in addition to a $1.5 million investment that was made by the Company in OnKai through a Simple Agreement for Future

Equity and which converted at a 15% discount into series seed preferred shares upon consummation of the Investment Round (as defined

below)). The Company’s investment in OnKai was part of an approximately $6 million investment round (the “Investment

Round”) with other investors that was led by the Company of which SAFE notes of approximately $3.8 million were converted

into preferred shares. On June 19, 2023, the Investment Round closed. Following the Investment Round, we hold approximately 23.9%

of the outstanding share capital of OnKai on an as-converted and fully and our Chief Executive Officer and director, Allen Baharaff

serves as a board member of OnKai. In connection with the Agreement, the our wholly-owned subsidiary, Galmed Research and

Development Ltd. (“GRD”), entered into a services agreement (the “Services Agreement”) with OnKai. The

Services Agreement provides that GRD shall on a non-exclusive basis (i) provide support services to OnKai relating to finance,

business development, strategic planning, execution and others; and (ii) lend its experience to OnKai in building a strategy and for

the development of treatments for the underserved and that OnKai shall on a non-exclusive basis (i) take part in plan preparation to

serve GDR’s vision of developing drugs for the underserved population and (ii) when relevant, design a process on the clinical

trial dashboard that could potentially serve GDR’s future trial.

In

view of our initiation of our PSC clinical program and our investment and collaboration with Onkai, we are no longer evaluating our strategic

alternatives.

Financial

Overview

To

date, we have funded our operations primarily through proceeds from private placements and public offerings. At June 30, 2023, we had

current assets of $9.8 million, which includes cash and cash equivalents of $1.0 million, marketable debt securities of

$7.5 million, other receivables of $0.3 million and restricted cash of $0.1 million. This compares with current assets of $14.7 million

at December 31, 2022, which includes cash and cash equivalents of $2 million, marketable debt securities of $11.8 million, other receivables

if $0.8 million and restricted cash of $0.1 million. In July 2023, we completed a public offering resulting in net proceeds of approximately

$6.2 million.

Although

we provide no assurance, we believe that such existing funds will be sufficient to continue our business and operations as currently

conducted for more than 12 months from the date of issuance of this Form 6-K. However, we will continue to incur operating losses, which

may be substantial over the next several years, and we expect that we will need to obtain additional funds to further develop our research

and development programs.

Costs

and Operating Expenses

Our

current costs and operating expenses consist of two components: (i) research and development expenses; and (ii) general and administrative

expenses.

Research

and Development Expenses

Our

research and development expenses consist primarily of outsourced development expenses, salaries and related personnel expenses and fees

paid to external service providers, patent-related legal fees, costs of pre-clinical studies and clinical trials and drug and laboratory

supplies. We account for all research and development expenses as they are incurred. We expect our research and development expense to

remain our primary expense in the near future as we continue to develop Aramchol. Increases or decreases in research and development

expenditures are primarily attributable to the number and/or duration of the pre-clinical and clinical studies that we conduct.

We

expect that a substantial amount of our research and development expense in the future will be incurred in support of our current and

anticipated pre-clinical and clinical development projects. Due to the inherently unpredictable nature of pre-clinical and clinical development

studies and unpredictability of our evaluation of strategic alternatives, we are unable to estimate with any certainty the costs we will

incur in the continued development of Aramchol for NASH and other indications in our pipeline for potential partnering and/or commercialization.

Clinical development timelines, the probability of success and development costs can differ materially from expectations. We currently

expect to continue testing Aramchol in pre-clinical studies for toxicology, safety and efficacy, and to conduct additional clinical trials

for Aramchol. Nevertheless, we expect to decrease our research and development expenses as a result of the discontinuation of the Open

Label Part of the ARMOR Study and our evaluation of strategic alternatives.

The

lengthy process of completing clinical trials and seeking regulatory approval for Aramchol requires the expenditure of substantial resources.

Any failure or delay in completing clinical trials, or in obtaining regulatory approvals, could cause a delay in generating product revenue

and cause our research and development expenses to increase and, in turn, have a material adverse effect on our operations. Because of

the factors set forth above, we are not able to estimate with any certainty when we would recognize any net cash inflows from our projects.

General

and Administrative Expenses

General

and administrative expenses consist primarily of compensation for employees in executive and operational roles, including finance/accounting,

legal and other operating positions in connection with our activities. Our other significant general and administrative expenses include

non-cash stock-based compensation costs and facilities costs (including the rental expense for our offices in Tel Aviv, Israel), professional

fees for outside accounting and legal services, travel costs, investors relations, insurance premiums and depreciation.

We

anticipate increased costs associated with being a public company, including expenses related to services associated with maintaining

compliance with The Nasdaq Capital Market and SEC requirements, directors and officers insurance, increased legal and accounting costs

and investor relations costs. Our general and administrative expenses may also increase due to increases in professional and advisory

fees as we evaluate our strategic alternatives.

Financial

Income, Net

Our

financial income, net consists mainly of interest income from marketable debt securities, Change in fair value of convertible note and

foreign currency gains. Our financial expense consists of fees associated with banking activities and losses from realization of marketable

debt securities.

Results

of Operations

The

table below provides our results of operations for the three and six months ended June 30, 2023, as compared to the three and six months

ended June 30, 2022.

| | |

Three months ended June 30, | | |

Six months ended June 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

(unaudited) | | |

(unaudited) | | |

(unaudited) | | |

(unaudited) | |

| | |

(In thousands, except per

share data) | |

| Research and development expenses | |

| 809 | | |

| 2,580 | | |

| 1,892 | | |

| 7,376 | |

| General and administrative expenses | |

| 1,062 | | |

| 1,150 | | |

| 1,981 | | |

| 2,446 | |

| Total operating expenses | |

| 1,871 | | |

| 3,730 | | |

| 3,873 | | |

| 9,822 | |

| Financial income, net | |

| (278 | ) | |

| 4 | | |

| (450 | ) | |

| 55 | |

| Net loss | |

| 1,593 | | |

| 3,734 | | |

| 3,423 | | |

| 9,877 | |

| Other comprehensive loss: | |

| 17 | | |

| 366 | | |

| (83 | ) | |

| 811 | |

| Comprehensive loss | |

| 1,610 | | |

| 4,100 | | |

| 3,340 | | |

| 10,688 | |

| Basic and diluted net loss per share | |

$ | 0.95 | | |

$ | 2.25 | | |

$ | 2.04 | | |

$ | 5.85 | |

Research

and Development Expenses

Our

research and development expenses amounted to approximately $0.8 million and approximately $1.9 million during the three and six months

ended June 30, 2023, respectively, representing a decrease of approximately $1.8 million, or 69%, and approximately $5.5 million, or

74%, respectively, compared to approximately $2.6 million and approximately $7.4 million, respectively, for the comparable period in

2022.

The

decrease during the three months ended June 30, 2023, primarily resulted mainly from a decrease in chemistry and formulation studies

of approximately $0.9 million and decrease in salaries and benefits of approximately $0.3 million. The decrease during the six months

ended June 30, 2023, primarily resulted from a decrease in clinical trial expenses of approximately $2.3 million and chemistry and formulation

studies of approximately $1.4 million.

General

and Administrative Expenses

Our

general and administrative expenses amounted to approximately $1.1 million and approximately $2.0 million during the three and six months

ended June 30, 2023, respectively, representing a decrease of approximately $0.1 million, or 8%, and approximately $0.4 million, or 17%,

respectively, to approximately $1.2 million and approximately $2.4 million, respectively, for the comparable period in 2022.

The

decrease in general and administrative expenses for the three and six months ended June 30, 2023, resulted primarily from a decrease

in stock-based compensation expense of $0.2 million and $0.3 million, respectively.

Operating

Loss

As

a result of the foregoing, for the three and six months ended June 30, 2023, our operating loss was approximately $1.9 million and approximately

$3.9 million, respectively, representing a decrease of $1.8 million, or 49%, and a decrease of $5.9 million, or 60%, respectively, as

compared to approximately $3.7 million and approximately $9.8 million, respectively, for the comparable period in 2022.

Financial

Income, Net

Our

financial income, net amounted to approximately $0.3 million and approximately $0.5 million during the three and six months ended June

30, 2023, respectively, representing an increase of approximately $0.3 million, and approximately $0.5 million, respectively, compared

to financial expense, net of less than $0.1 million and $0.1 million, respectively, for the comparable period in 2022. The Increase in

financial income, net for the three and six months ended June 30, 2023, resulted primarily from income from Change in fair value of convertible

SAFE note.

Net

Loss

As

a result of the foregoing, for the three and six months ended June 30, 2023, our net loss was approximately $1.6 million and approximately

$3.4 million, respectively, representing a decrease of $2.1 million, or 57%, and a decrease of $6.5 million, or 66%, respectively, as

compared to approximately $3.7 million and approximately $9.9 million, respectively, for the comparable period in 2022.

Liquidity

and Capital Resources

To

date, we have funded our operations primarily through proceeds from private placements and public offerings and we have incurred substantial

losses since our inception. As of June 30, 2023, we had an accumulated deficit of approximately $189.5 million and positive working

capital (current assets less current liabilities) of approximately $7.1 million. We expect that operating losses will continue for the

foreseeable future.

As

of June 30, 2023, we had cash and cash equivalents of approximately $1.0 million, short term deposit of $0.8 million, restricted

cash of approximately $0.1 million, and marketable debt securities of approximately $7.6 million invested in accordance with our

investment policy, totaling approximately $9.4 million, as compared to approximately $2.0 million, $0, $0.1

million and $11.8 million as of December 31, 2022, respectively, totaling approximately $13.9 million. The decrease is mainly attributable

to the $3.1 million negative cash flow from operating activities during the six months ended June 30, 2023. In July 2023, we completed

a public offering resulting in net proceeds of approximately $6.2 million.

We

had negative cash flow from operating activities of approximately $3.1 million for the six months ended June 30, 2023, as compared to

negative cash flow from operating activities of approximately $11.3 million for the six months ended June 30, 2022. The negative cash

flow from operating activities for the six months ended June 30, 2023, is mainly attributable to our net loss of approximately $3.4 million.

We

had positive cash flow from investing activities of approximately $2.1 million for the six months ended June 30, 2023, as compared to

a positive cash flow from investing activities of approximately $10.5 million for the six months ended June 30, 2022. The positive cash

flow from investing activities for the six months ended June 30, 2023, was primarily due to net withdrawal of approximately $4.3 million

from available for sale securities, partially offset by investment in an associate of $1.5 million.

We

had no cash flow from financing activities for the six months ended June 30, 2023.

On

March 26, 2021, we entered into a Sales Agreement with Cantor Fitzgerald & Co. and Canaccord Genuity LLC, as sales agents, pursuant

to which we may offer and sell ordinary shares “at the market” having an aggregate offering price of up to $50.0 million

from time to time through the sales agents subject to the limits of General Instruction I.B.5 to Form F-3, also known as the baby shelf

rule. As of June 30, 2023, we sold 7,666 ordinary shares under our ATM program for total net proceeds of approximately $0.1 million.

Although

we provide no assurance, we believe that our existing funds will be sufficient to continue our business and operations as currently conducted

for more than 12 months from the date of issuance of this Report on Form 6-K. However, additional funding will be necessary to fund our

ARMOR Study, our Amilo-5MER program and ongoing research and development work, to advance our product candidates through regulatory approval

and into commercialization, if approved and the evaluation of our strategic alternatives. We intend to obtain additional funding through

debt or equity financings, governmental grants or through entering into collaborations, strategic alliances or license agreements to

increase the funds available to support our operating and capital needs. Although we have been successful in raising capital in the past,

there is no assurance that we will be successful in obtaining additional financing on terms acceptable to us. If funds are not available, we may be required to delay, reduce the scope

of or eliminate research or development plans for, or commercialization efforts with respect to Aramchol, Amilo-5MER and/or our other

pre-clinical and clinical programs. This may raise substantial doubts about our ability to continue as a going concern.

The

extent of our future capital requirements will depend on many other factors, including:

| |

● |

the

progress and costs of our pre-clinical studies, clinical trials and other research and development activities; |

| |

|

|

| |

● |

the

regulatory pathway of Aramchol, Amilo-5MER or any other product candidate; |

| |

|

|

| |

● |

the

scope, prioritization and number of our clinical trials and other research and development programs; |

| |

|

|

| |

● |

the

amount of revenues and contributions we receive under future licensing, development and commercialization arrangements with respect

to Aramchol or any other product candidtate; |

| |

|

|

| |

● |

the

costs of the development and expansion of our operational infrastructure; |

| |

|

|

| |

● |

the

costs and timing of obtaining regulatory approval for Aramchol, Amilo-5MER or any other product candidate; |

| |

|

|

| |

● |

the

ability of us, or our collaborators, to achieve development milestones, marketing approval and other events or developments under

our potential future licensing agreements; |

| |

|

|

| |

● |

the

costs of filing, prosecuting, enforcing and defending patent claims and other intellectual property rights; |

| |

|

|

| |

● |

the

costs and timing of securing manufacturing arrangements for clinical or commercial production; |

| |

|

|

| |

● |

the

costs of contracting with third parties to provide sales and marketing capabilities for us; |

| |

|

|

| |

● |

the

costs of acquiring or undertaking development and commercialization efforts for any future products, product candidates or platforms; |

| |

|

|

| |

● |

the

magnitude of our general and administrative expenses; |

| |

|

|

| |

● |

any

cost that we may incur under future in- and out-licensing arrangements relating to Aramchol, Amilo-5MER or any other product candidate; |

| |

|

|

| |

● |

market

conditions; |

| |

|

|

| |

● |

our

ability to identify, evaluate and complete any strategic alternative that yields value for our shareholders; and |

| |

|

|

| |

● |

the

impact of any resurgence of the COVID-19 pandemic and the Russian invasion of Ukraine, which may exacerbate the magnitude

of the factors discussed above. |

Trend

Information

We

are a development stage company, and it is not possible for us to predict with any degree of accuracy the outcome of our research, development

or commercialization efforts. As such, it is not possible for us to predict with any degree of accuracy any significant trends, uncertainties,

demands, commitments or events that are reasonably likely to have a material effect on our net loss, liquidity or capital resources,

or that would cause financial information to not necessarily be indicative of future operating results or financial condition. However,

to the extent possible, certain trends, uncertainties, demands, commitments and events are in this “Management’s Discussion

and Analysis of Financial Condition and Results of Operations”.

Controls

and Procedures

As

a “foreign private issuer”, we are only required to conduct the evaluations required by Rules 13a-15(b) and 13a-15(d) of

the Exchange Act as of the end of each fiscal year and therefore have elected not to provide disclosure regarding such evaluations at

this time.

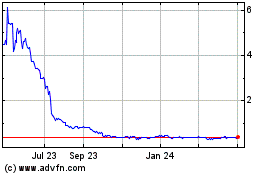

Reverse

Split

On

May 12, 2023, we effected a reverse share split of our ordinary shares at the ratio of 1-for-15, such that each fifteen (15) ordinary

shares, par value NIS 0.01 per share, were consolidated into one (1) ordinary share, par value NIS 0.15. May 15 2023 was the first date

when our ordinary shares began trading on the Nasdaq Stock Market LLC after implementation of the reverse split.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| |

Galmed

Pharmaceuticals Ltd. |

| |

|

|

| Date:

August 9, 2023 |

By: |

/s/ Allen Baharaff |

| |

|

Allen

Baharaff |

| |

|

President

and Chief Executive Officer |

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFiscal period values are FY, Q1, Q2, and Q3. 1st, 2nd and 3rd quarter 10-Q or 10-QT statements have value Q1, Q2, and Q3 respectively, with 10-K, 10-KT or other fiscal year statements having FY.

| Name: |

dei_DocumentFiscalPeriodFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fiscalPeriodItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThis is focus fiscal year of the document report in YYYY format. For a 2006 annual report, which may also provide financial information from prior periods, fiscal 2006 should be given as the fiscal year focus. Example: 2006.

| Name: |

dei_DocumentFiscalYearFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gYearItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

v3.23.2

Interim Condensed Consolidated Balance Sheets (Unaudited) - USD ($)

$ in Thousands |

Jun. 30, 2023 |

Dec. 31, 2022 |

| Current assets |

|

|

|

| Cash and cash equivalents |

|

$ 1,009

|

$ 2,016

|

| Restricted Cash |

|

115

|

114

|

| Marketable debt securities |

|

7,556

|

11,769

|

| Short term Deposits |

|

765

|

|

| Other receivables |

|

341

|

825

|

| Total current assets |

|

9,786

|

14,724

|

| Operating lease right-of-use assets |

|

129

|

223

|

| Property and equipment, net |

|

97

|

114

|

| Investment in SAFE notes |

|

|

1,500

|

| Investment in associate at fair value |

|

3,265

|

|

| Total non-current assets |

|

3,491

|

1,837

|

| Total assets |

|

13,277

|

16,561

|

| Current liabilities |

|

|

|

| Trade payables |

|

2,140

|

2,560

|

| Other payables |

|

583

|

534

|

| Total current liabilities |

|

2,723

|

3,094

|

| Non-current liabilities |

|

|

|

| Operating lease liabilities, net of current portion |

|

|

44

|

| Total non-current liabilities |

|

|

44

|

| Ordinary shares par value NIS 0.15 per share; Authorized 20,000,000; Issued and outstanding: 1,680,232 shares as of June 30, 2023 and as of December 31, 2022 () |

[1] |

70

|

70

|

| Additional paid-in capital |

|

200,609

|

200,138

|

| Accumulated other comprehensive loss |

|

(662)

|

(745)

|

| Accumulated deficit |

|

(189,463)

|

(186,040)

|

| Total stockholders’ equity |

|

10,554

|

13,423

|

| Total liabilities and stockholders’ equity |

|

$ 13,277

|

$ 16,561

|

|

|

| X |

- DefinitionCarrying value as of the balance sheet date of liabilities incurred (and for which invoices have typically been received) and payable to vendors for goods and services received that are used in an entity's business. Used to reflect the current portion of the liabilities (due within one year or within the normal operating cycle if longer). Reference 1: http://www.xbrl.org/2003/role/exampleRef

-Topic 852

-SubTopic 10

-Name Accounting Standards Codification

-Section 55

-Paragraph 10

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147481372/852-10-55-10

Reference 2: http://fasb.org/us-gaap/role/ref/legacyRef

-Name Accounting Standards Codification

-Topic 210

-SubTopic 10

-Section S99

-Paragraph 1

-Subparagraph (SX 210.5-02.19(a))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480566/210-10-S99-1

| Name: |

us-gaap_AccountsPayableCurrent |

| Namespace Prefix: |

us-gaap_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

credit |

| Period Type: |

instant |

|

| X |

- DefinitionAmount, after tax, of accumulated increase (decrease) in equity from transaction and other event and circumstance from nonowner source. Reference 1: http://fasb.org/us-gaap/role/ref/legacyRef

-Name Accounting Standards Codification

-Topic 220

-SubTopic 10

-Section 45

-Paragraph 14A

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147482790/220-10-45-14A

Reference 2: http://fasb.org/us-gaap/role/ref/legacyRef

-Topic 220

-SubTopic 10

-Name Accounting Standards Codification

-Section 45

-Paragraph 11

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147482790/220-10-45-11

Reference 3: http://www.xbrl.org/2003/role/disclosureRef

-Topic 944

-SubTopic 40

-Name Accounting Standards Codification

-Section 65

-Paragraph 2

-Subparagraph (g)(2)(ii)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480016/944-40-65-2

Reference 4: http://www.xbrl.org/2003/role/disclosureRef

-Topic 944

-SubTopic 40

-Name Accounting Standards Codification

-Section 65

-Paragraph 2

-Subparagraph (h)(2)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480016/944-40-65-2

Reference 5: http://www.xbrl.org/2003/role/disclosureRef

-Topic 210

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1

-Subparagraph (SX 210.5-02(30)(a)(4))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480566/210-10-S99-1

Reference 6: http://www.xbrl.org/2003/role/disclosureRef

-Topic 944

-SubTopic 210

-Name Accounting Standards Codification

-Section S99

-Paragraph 1

-Subparagraph (SX 210.7-03(a)(23)(a)(3))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147479440/944-210-S99-1

Reference 7: http://fasb.org/us-gaap/role/ref/legacyRef

-Name Accounting Standards Codification

-Topic 220

-SubTopic 10

-Section 45

-Paragraph 14

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147482790/220-10-45-14

| Name: |

us-gaap_AccumulatedOtherComprehensiveIncomeLossNetOfTax |

| Namespace Prefix: |

us-gaap_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

credit |

| Period Type: |

instant |

|

| X |

- DefinitionAmount of excess of issue price over par or stated value of stock and from other transaction involving stock or stockholder. Includes, but is not limited to, additional paid-in capital (APIC) for common and preferred stock. Reference 1: http://www.xbrl.org/2003/role/exampleRef

-Topic 852

-SubTopic 10

-Name Accounting Standards Codification

-Section 55

-Paragraph 10

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147481372/852-10-55-10

Reference 2: http://www.xbrl.org/2009/role/commonPracticeRef

-Topic 946

-SubTopic 210

-Name Accounting Standards Codification

-Section S99

-Paragraph 1

-Subparagraph (SX 210.6-04(18))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147479617/946-210-S99-1

Reference 3: http://fasb.org/us-gaap/role/ref/legacyRef

-Topic 210

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1

-Subparagraph (SX 210.5-02(30)(a)(1))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480566/210-10-S99-1

| Name: |

us-gaap_AdditionalPaidInCapital |

| Namespace Prefix: |

us-gaap_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

credit |

| Period Type: |

instant |

|

| X |