Freedom Holding Corp. Announces Completion of External Review of Allegations Made in Short-Seller Report

January 25 2024 - 4:00PM

Business Wire

Freedom Holding Corp. (the “Company”) (Nasdaq: FRHC) today

announced the conclusion of an external review commissioned by the

independent members of its board of directors. The external review

was into wide-ranging allegations made about the Company and its

business in an August 15, 2023 report published by Hindenburg

Research (the “Hindenburg Report”), an activist short-selling firm

which disclosed having a short position in the Company’s shares.

Following the publication of the Hindenburg Report, although the

Company believed the allegations were meritless and the independent

directors have full confidence in the Company and its business

model, the independent members of the Company’s board of directors

decided that it was in the best interests of the Company and its

shareholders to conduct an external review of the allegations set

out in the Hindenburg Report.

The independent members of the board of directors engaged law

firm Morgan, Lewis & Bockius LLP and engaged forensic

accounting firm Forensic Risk Alliance to conduct the external

review and report on their findings. The review took place over a

period of approximately four months and included document and data

review, site visits to Kazakhstan and Cyprus, data analytics and

testing work, and remote and in-person interviews of many senior

management and employees of the Company and personnel at certain

external advisers and counterparties of the Company. The review

focussed on the Company’s main operating subsidiaries that were the

subject of the allegations as well as on the Company’s affiliate

Freedom Securities Trading, Inc. (“FST Belize”). It was not

possible to assess certain of the allegations in the Hindenburg

Report because they were dated, vague, or lacking details.

The external review found generally that the allegations in the

Hindenburg Report did not take account of important facts and were

not supported by evidence. In particular, the findings of the

external review included the following:

- The Company’s growth in recent years was mainly attributable to

organic growth (including increases in the number of customers and

increased trading volume by customers), acquisitions and gains and

income from trading securities, as described in the Company’s

reports filed with the SEC and as indicated in its audited

financial statements. The growth was not the result of manipulative

or otherwise illegal or improper business practices.

- The Company has robust global and local sanctions and

anti-money laundering (“AML”) procedures, controls and policies in

place, which are implemented through its business and compliance

personnel.

- There was no evidence identified of sanctions evasion or

dealing with sanctioned oligarchs.

- While certain of the Company’s non-US subsidiaries have had

dealings with certain sanctioned banks and individuals, a fact

which the Company has publicly disclosed, those dealings did not

involve any material violations of US, EU, UK, or other

sanctions.

- There was no evidence identified of client accounts being

funded with cryptocurrencies or physical cash, other than cash

deposits made by existing customers at the Bank Freedom Finance

Kazakhstan JSC retail banking counter subject to standard AML

checks.

- There was no evidence identified that the Company has engaged

in market manipulation of its own stock or in respect of its

holdings of Kazakhstan Sustainability Fund bonds.

- The Company’s holdings of fixed coupon Kazakhstan

Sustainability Fund bonds do currently have a negative carry, as is

alleged, but are held as part of a deliberate and legitimate

trading strategy which is anticipated to be profitable as a result

of future interest rate movements.

- The Company maintains policies, procedures and controls for the

business dealings between its Cyprus subsidiary, Freedom Finance

Europe Limited, and FST Belize, including with regard to anti-money

laundering compliance and sanctions compliance.

- There was no evidence identified to support the allegations

made in the Hindenburg Report that the Company engaged in

transactions with FST Belize in order to generate “fake” or

inflated revenue.

- The Company’s former Russian subsidiaries were sold in a valid

sale transaction and there is no evidence to support continuing

control by the Company or the Company’s CEO Timur Turlov of the

Russian companies following that sale.

- The Company’s brokerage clients were not required to purchase

the Company’s stock in order to receive allocations of shares in US

IPOs or to participate in a program to acquire shares from US IPOs

in the secondary market at or near the IPO share price.

The Company has accepted the results of the external review and,

in particular, welcomes the finding that it has robust global and

local sanctions and AML procedures, controls and policies in place.

As part of its commitment to strong governance and compliance the

Company asked the external review team to recommend any

enhancements that could be made to such procedures, controls and

policies based on their review. In response, and in conjunction

with delivering its findings, the external review team has

recommended certain further enhancements, and the Company’s board

of directors has accepted those recommendations. Senior management

of the Company, including the Vice President of Compliance, have

already begun to implement them.

The Company’s Annual Report on Form 10-K in respect of the

financial year ended March 31, 2023, including the audited

financial statements included therein, and its other reports and

filings with SEC, are available on the SEC’s website.

Forward-Looking Statements

This press release contains “forward-looking” statements,

including, without limitation, statements related to the Company’s

business strategy, future growth and further development of its

compliance and control environment. Forward-looking statements are

subject to numerous conditions, many of which are beyond the

control of the Company, including, without limitation, those risks

and uncertainties described in our annual report on Form 10-K for

the fiscal year ended March 31, 2023, and our other reports and

filings with SEC. Copies of these documents are available on the

SEC’s website, www.sec.gov. The Company undertakes no obligation to

update these statements for revisions or changes after the date of

this release, except as required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240125790703/en/

Deborah Kostroun (US) deborah@zitopartners.com Tel.: +1 201

403-8185

Ramina Fakhrutdinova (KZ) ramina.fakhrutdinova@ffin.kz Tel.: +7

727 311 10 64, ext. 640

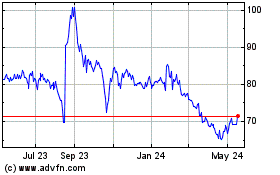

Freedom (NASDAQ:FRHC)

Historical Stock Chart

From Oct 2024 to Nov 2024

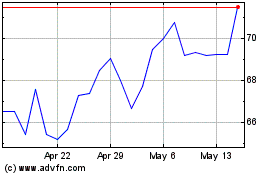

Freedom (NASDAQ:FRHC)

Historical Stock Chart

From Nov 2023 to Nov 2024