Forward Air Corporation (NASDAQ: FWRD) (“Forward,” “we,” “our,”

or “us”) today announced that GN Bondco, LLC (the “Escrow Issuer”),

a Delaware limited liability company and wholly owned subsidiary of

Omni Newco, LLC (“Omni”), has commenced a private offering of $925

million of senior secured notes due 2031 (the “Notes”), subject to

market and customary conditions.

Forward intends to use the net proceeds of the offering of the

Notes, together with the net proceeds from the initial borrowings

under the New Senior Secured Credit Facilities (as defined below)

and cash on hand, (a) to pay the cash consideration and any other

amounts payable by it in connection with its previously announced

combination with Omni (the “Merger”), (b) to repay certain existing

indebtedness of Forward and Omni and (c) to pay the fees, premiums,

expenses and other transaction costs incurred in connection with

the Merger and the other transactions contemplated by the

definitive documentation entered into with respect to the

Merger.

Unless the consummation of the offering of the Notes occurs

substantially concurrently with the consummation of the Merger, the

gross proceeds of the offering of the Notes, together with certain

additional amounts, will be deposited into an escrow account for

the Notes pending the consummation of the Merger, and the Notes

will initially be the senior secured obligations of the Escrow

Issuer, secured only by the amounts deposited in the applicable

escrow account. Upon consummation of the Merger, the Escrow Issuer

will merge with and into Clue Opco LLC, a newly formed Delaware

limited liability company and wholly owned subsidiary of Forward

(“Opco”), with Opco continuing as the surviving entity and assuming

all of the Escrow Issuer’s obligations under the Notes. In

addition, following consummation of the Merger, the Notes will be

guaranteed, jointly and severally, fully and unconditionally, on a

senior secured basis, by (i) Forward and (ii) each of Opco’s

existing and future domestic subsidiaries that guarantee Forward’s

new senior secured credit facilities expected to be entered into

upon consummation of the Merger (the “New Senior Secured Credit

Facilities”). Following consummation of the Merger, the Notes and

related guarantees will be secured, subject to permitted liens and

certain other exceptions, by first priority liens on the same

collateral that will secure the New Senior Secured Credit

Facilities.

The Notes and the related guarantees have not been, and will not

be, registered under the Securities Act of 1933, as amended (the

“Securities Act”), or any applicable state or foreign securities

laws, and will be offered only to persons reasonably believed to be

qualified institutional buyers in reliance on Rule 144A, and to

non-U.S. persons outside the United States in compliance with

Regulation S under the Securities Act. Unless so registered, the

Notes and the related guarantees may not be offered or sold in the

United States except pursuant to an exemption from the registration

requirements of the Securities Act and applicable state securities

laws. This press release will not constitute an offer to sell or a

solicitation of an offer to buy any notes or any other securities.

The offering is not being made to any person in any jurisdiction in

which the offer, solicitation or sale is unlawful.

About Forward Air Corporation

Forward is a leading asset-light provider of transportation

services across the United States, Canada and Mexico. We provide

expedited less-than-truckload (“LTL”) services, including local

pick-up and delivery, shipment consolidation/deconsolidation,

warehousing, and customs brokerage by utilizing a comprehensive

national network of terminals. In addition, we offer final mile

services, including delivery of heavy-bulky freight, truckload

brokerage services, including dedicated fleet services; and

intermodal, first-and last-mile, high-value drayage services, both

to and from seaports and railheads, dedicated contract and

Container Freight Station warehouse and handling services. We are

more than a transportation company. Forward is a single resource

for your shipping needs.

Cautionary Note on Forward-Looking Statements

This press release includes forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933 and

Section 21E of the Securities Exchange Act of 1934, which are made

pursuant to the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995, as amended. These statements may

reflect Forward’s expectations, beliefs, hopes, intentions or

strategies regarding, among other things, the potential transaction

between Forward and Omni, the expected timetable for completing the

potential transaction, the benefits and expected cost and revenue

synergies of the potential transaction (including the timing for

realizing any such synergies and the conversion of revenue

synergies to adjusted EBITDA) and future opportunities for the

combined company, as well as other statements that are other than

historical fact, including, without limitation, statements

concerning future financial performance, future debt and financing

levels (including the achievement of targeted deleveraging within

the expected time frames or at all), investment objectives,

implications of litigation and regulatory investigations and other

management plans for future operations and performance. Words such

as “anticipate(s)”, “expect(s)”, “intend(s)”, “plan(s)”,

“target(s)”, “project(s)”, “believe(s)”, “will”, “aim”, “would”,

“seek(s)”, “estimate(s)” and similar expressions are intended to

identify such forward-looking statements.

Forward-looking statements are based on management’s current

expectations, projections, estimates, assumptions and beliefs and

are subject to a number of known and unknown risks, uncertainties

and other factors that could lead to actual results materially

different from those described in the forward-looking statements.

Forward can give no assurance that its expectations will be

attained. Forward’s actual results, liquidity and financial

condition may differ from the anticipated results, liquidity and

financial condition indicated in these forward-looking statements.

We caution readers that any such statements are based on currently

available operational, financial and competitive information, and

they should not place undue reliance on these forward-looking

statements, which reflect management’s opinion only as of the date

on which they were made. These forward-looking statements are not a

guarantee of future performance and involve risks and

uncertainties, and there are certain important factors that could

cause Forward’s actual results to differ, possibly materially, from

expectations or estimates reflected in such forward-looking

statements, including, but without limitation:

- the parties’ ability to consummate the potential transaction

and to meet expectations regarding the timing and completion

thereof;

- the satisfaction or waiver of the conditions to the completion

of the potential transaction, including the receipt of all required

regulatory approvals or clearances in a timely manner and on terms

acceptable to Forward;

- the risk that the parties may be unable to achieve the expected

strategic, financial and other benefits of the potential

transaction, including the realization of expected revenue and cost

synergies, the conversion of revenue synergies to adjusted EBITDA

and the achievement of deleveraging targets, within the expected

time-frames or at all;

- the risk that the committed financing necessary for the

consummation of the potential transaction is unavailable at the

closing, and that any replacement financing may not be available on

similar terms, or at all;

- the risk that the businesses will not be integrated

successfully or that integration may be more difficult,

time-consuming or costly than expected;

- the risk that operating costs, customer loss and business

disruption (including, without limitation, difficulties in

maintaining relationships with employees, customers, clients or

suppliers) may be greater than expected following the potential

transaction;

- the risk that, if Forward does not obtain the necessary

shareholder approval for the conversion of the perpetual non-voting

convertible preferred stock, Forward will be required to pay an

annual dividend on such outstanding preferred stock;

- the risks associated with being a holding company with the only

material assets after completion of the potential transaction being

the interest in the combined business and, accordingly, dependency

upon distributions from the combined business to pay taxes and

other expenses;

- the requirement for Forward to pay certain tax benefits that it

may claim in the future, and the expected materiality of these

amounts;

- risks associated with organizational structure, including

payment obligations under the tax receivable agreement, which may

be significant, and any accelerations or significant increases

thereto;

- the inability to realize all or a portion of the tax benefits

that are currently expected to result from the acquisition of

certain corporate owners of Omni, certain pre-existing tax

attributes of Omni owners and tax attributes that may arise on the

distribution of cash to other Omni owners in connection with the

potential transaction, as well as the future exchanges of units of

Forward’s operating subsidiary and payments made under a tax

receivables agreement;

- increases in interest rates;

- changes in Forward’s credit ratings and outlook;

- risks relating to the indebtedness Forward expects to incur in

connection with the potential transaction and the need to generate

sufficient cash flows to service and repay such debt;

- the ability to generate the significant amount of cash needed

to service the indebtedness;

- the limitations and restrictions in surviving agreements

governing indebtedness;

- risks associated with the need to obtain additional financing

which may not be available or, if it is available, may result in a

reduction in the ownership of current Forward shareholders;

and

- general economic and market conditions.

These and other risks and uncertainties are more fully discussed

in the risk factors identified in “Item 1A. Risk Factors” in Part I

of Forward’s most recently filed Annual Report on Form 10-K, and as

may be identified in Forward’s Quarterly Reports on Form 10-Q and

current reports on Form 8-K. Except to the extent required by law,

Forward expressly disclaims any obligation to release publicly any

updates or revisions to any forward-looking statements contained

herein to reflect any change in Forward’s expectations with regard

thereto or change in events, conditions or circumstances on which

any statement is based.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230920697368/en/

Forward Investor Relations Attn: Brandon Hammer, 423-636-7173

bhammer@forwardair.com

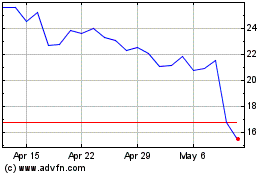

Forward Air (NASDAQ:FWRD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Forward Air (NASDAQ:FWRD)

Historical Stock Chart

From Nov 2023 to Nov 2024