Foremost Lithium Resource & Technology Ltd.

(

NASDAQ: FMST) (

CSE: FAT)

(“

Foremost Lithium”, “

Foremost”

or the “

Company”), a North American hard-rock

lithium exploration company, announces that further to its press

releases dated February 13, 2024 and March 13, 2024, on April 29,

2024, it closed the second tranche of its non-brokered private

placement (the "

Offering") for aggregate gross

proceeds of $1,455,129.48 pursuant to an arrangement with

Wealth Creation Preservation & Donation Inc.

(“

WCPD”).

Foremost issued 247,471 flow-through units

(each, a “FT Unit”) at a subscription price of

$5.88 per FT Unit, comprised of one flow-through common share in

the capital of the Company (each, a “FT Share”)

and one non-flow-through common share purchase warrant (each, a

“Warrant”), entitling the holder thereof to

purchase an additional non-flow-through common share in the capital

of the Company (each, a “Warrant Share”), at an

exercise price of $4.00 per Warrant Share, until April 29,

2026.

The Warrants will be subject to an accelerated

expiry, if, at any time following the date of issuance, the volume

weighted average trading price of the Shares on the Canadian

Securities Exchange is or exceeds $6.00 for any 14 consecutive

trading days, the Company may elect to accelerate the expiry date

of the Warrants by giving notice to the holders, by way of a news

release, that the Warrants will expire 30 calendar days following

the date of such notice.

The gross proceeds from the issuance of the FT

Units will be used to incur Canadian exploration expenses that will

qualify, once renounced as “flow-through critical mineral mining

expenditures”, as defined in subsection 127(9) of the Income Tax

Act (Canada), and as “flow-through mining expenditures” as defined

in section 11.7(1) of the Income Taxation Act (Manitoba).

(collectively, the “Qualifying Expenditures”). In

addition, the Qualifying Expenditures renounced to a subscriber

that is an individual (other than a trust) will qualify for the

Manitoba mineral exploration tax credit described in s. 11.7(2) of

the Income Tax Act (Manitoba), a non-refundable investment tax

credit deductible against provincial income taxes payable by such

subscriber under the Income Tax Act (Manitoba).

In connection with the closing of the second

tranche of the Offering, finders’ fees comprised of approximately

$175 in cash consideration and 51 finder's warrants

("Finder's Warrants") was paid and issued to an

eligible arm’s length finder. Each Finder's Warrant is exercisable

to acquire a Share at a price of $3.40 per Share for a period of 24

months from the date of issue. All of the securities issued under

the second tranche of the Offering will be subject to a hold period

of four months and one day from the date of issuance expiring on

August 30, 2024.

The FT Units, FT Shares, Warrants, and Warrant

Shares (collectively, the “Securities”) have not

been and will not be registered under the U.S. Securities Act of

1933, as amended (the "U.S. Securities Act”) or

any state securities laws. Accordingly, the Securities of the

Company may not be offered or sold in the United States or to, or

for the account or benefit of, “U.S. persons” (as defined in

Regulation S under the U.S. Securities Act) absent registration or

an applicable exemption from the registration requirements of the

U.S. Securities Act and applicable state securities laws. Any

Securities offered and sold in the United States shall be issued as

“restricted securities” as defined in Rule 144(a)(3) under the U.S.

Securities Act. This press release shall not constitute an offer to

sell or the solicitation of an offer to buy, nor shall there be any

sale of the securities in any jurisdiction in which such offer,

solicitation or sale would be unlawful.

Secured Note

On May 10, 2022, the Company entered into a

secured promissory note in the original principal amount of

$1,145,520.08 (the “Loan”) with Jason Barnard and

Christina Barnard (the "Lenders"). Effective May

10, 2023, the Company and the Lenders agreed to amend the

promissory note to extend its term by one year and increase the

interest rate to 11.35% payable in monthly installments of $8,000,

with the balance of accrued interest payable on maturity (the

“First Amended Note”). On April 26, 2024, the

Company and the Lenders agreed to further amend the First Amended

Note by issuing a second amended note (the “Second Amended

Note”), which supersedes and replaces the First Amended

Note, in the principal amount of $1,144,205.63 having a maturity

date of May 10, 2025, accruing interest at the same rate of 11.35%

per annum compounded monthly with monthly payments of $10,835, with

the balance of accrued interest payable on maturity. The Second

Amended Note is repayable at any time without penalty and matures

on May 10, 2025.

Each of the Lenders are senior officers of the

Company, and Mr. Barnard is a director of the Company, and the

Lenders are, jointly, the largest shareholders of the Company. The

amendment of the terms of the Loan and the issuance of the Second

Amended Note constitutes a "related party transaction" under the

policies of the Canadian Securities Exchange and Multilateral

Instrument 61-101 - Protection of Minority Security Holders in

Special Transactions ("MI 61-101"). As the Loan is

less than 25% of the current market capitalization of the Company,

the Loan is exempt from the formal valuation requirements of MI

61-101 by virtue of Section 5.5(a) – Fair Market Value Not More

Than 25% of Market Capitalization. The Company is relying on

Section 5.7(1)(f) – Loan to Issuer, No Equity or Voting Component

for exemption from minority approval requirements of MI 61-101

since the Loan is not convertible into securities of the Company

and since the Loan has been obtained on reasonable commercial terms

that are not less advantageous to the Company that if the Loan was

obtained from an arm’s length person. The terms of the Second

Amended Note have been reviewed and unanimously approved by the

Company’s board of directors as well as the Company’s audit

committee.

About Foremost Lithium

Foremost Lithium (NASDAQ: FMST) (CSE: FAT) (FSE:

F0R0) (WKN: A3DCC8) is a hard-rock lithium exploration company

focused on empowering the North American clean energy economy.

Foremost’s strategically located lithium properties extend over

43,000 acres in Snow Lake, Manitoba, and hosts a property in a

known active lithium camp situated on over 11,400 acres in Quebec

called Lac Simard South.

Foremost’s four flagship Lithium Lane Projects

as well as its Lac Simard South project are located at the tip of

the NAFTA superhighway to capitalize on the world's growing EV

appetite, strongly positioning the Company to become a premier

supplier of North America's lithium feedstock. As the world

transitions towards decarbonization, the Company's objective is the

extraction of lithium oxide (Li₂O), and to subsequently play a role

in the production of high-quality lithium hydroxide (LiOH), to help

power lithium-based batteries, critical in developing a

clean-energy economy. Foremost Lithium also has the Winston

Gold/Silver Property in New Mexico USA. Learn More at

www.foremostlithium.com.

Contact and Information

CompanyJason Barnard, President and CEO+1 (604)

330-8067info@foremostlithium.com

Investor RelationsLucas A. ZimmermanManaging

DirectorMZ Group - MZ North America(949) 259-4987FMST@mzgroup.us

www.mzgroup.us

Follow us or contact us on social

media:Twitter: @foremostlithium (now X)Linkedin:

https://www.linkedin.com/company/foremost-lithium-resource-technology/

Facebook: https://www.facebook.com/ForemostLithium

The Canadian Securities Exchange has neither

approved nor disapproved the contents of this news release and

accepts no responsibility for the adequacy or accuracy hereof.

Forward-Looking Statements

This news release contains "forward-looking

statements" and "forward-looking information" (as defined under

applicable securities laws), based on management's best estimates,

assumptions, and current expectations. Such statements include but

are not limited to, statements with respect to the use of proceeds

of the Offering, plans for future exploration and development of

the Company's properties and the acquisition of additional

exploration projects. Generally, these forward-looking statements

can be identified by the use of forward-looking terminology such as

"expects", "expected", "budgeted", "forecasts", "anticipates"

"plans", "anticipates", "believes", "intends", "estimates",

"projects", "aims", "potential", "goal", "objective",

"prospective", and similar expressions, or that events or

conditions "will", "would", "may", "can", "could" or "should"

occur. These statements should not be read as guarantees of future

performance or results. Such statements involve known and unknown

risks, uncertainties and other factors that may cause actual

results, performance or achievements to be materially different

from those expressed or implied by such statements, including but

not limited to: risks related to the receipt of all necessary

regulatory and third party approvals for the proposed operations of

the Company's business and exploration activities, risks related to

the Company's exploration properties; risks related to

international operations; risks related to general economic

conditions, actual results of current exploration activities,

unanticipated reclamation expenses; changes in project parameters

as plans continue to be refined; fluctuations in prices of

commodities including lithium and gold; fluctuations in foreign

currency exchange rates, increases in market prices of mining

consumables, possible variations in reserves; failure of plant,

equipment or processes to operate as anticipated; accidents, labour

disputes, title disputes, claims and limitations on insurance

coverage and other risks of the mining industry; delays in the

completion of exploration, development or construction activities,

changes in national and local government regulation of mining

operations, tax rules and regulations, and political and economic

developments in jurisdictions in which the Company operates.

Although the Company has attempted to identify important factors

that could cause actual results to differ materially from those

contained in forward-looking statements, there may be other factors

that cause results not to be as anticipated, estimated or intended.

There can be no assurance that such statements will prove to be

accurate, as actual results and future events could differ

materially from those anticipated in such statements. The

forward-looking statements and forward-looking information are made

as of the date hereof and are qualified in their entirety by this

cautionary statement. For forward-looking statements in this news

release, the Company claims the protection of the safe harbor for

forward-looking statements contained in the Private Securities

Litigation Reform Act of 1995. The Company disclaims any obligation

to revise or update any such factors or to publicly announce the

result of any revisions to any forward-looking statements or

forward-looking information contained herein to reflect future

results, events, or developments, except as require by law.

Accordingly, readers should not place undue reliance on

forward-looking statements and information. Please refer to the

Company's most recent filings under its profile at www.sedarplus.ca

for further information respecting the risks affecting the Company

and its business. This news release shall not constitute an offer

to sell or the solicitation of an offer to buy securities.

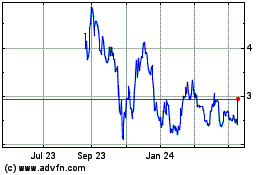

Foremost Clean Energy (NASDAQ:FMST)

Historical Stock Chart

From Dec 2024 to Jan 2025

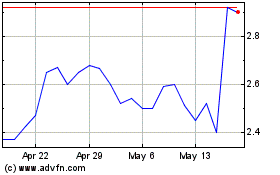

Foremost Clean Energy (NASDAQ:FMST)

Historical Stock Chart

From Jan 2024 to Jan 2025