Foremost Clean Energy Ltd., (

NASDAQ: FMST)

(

CSE: FAT) (“

Foremost Clean

Energy”, “

Foremost” or the

“

Company”) an emerging North American uranium and

lithium exploration company, is pleased to announce that, further

to its announcement of July 30, 2024 with respect to the proposed

spin-out of the Winston Group of Gold and Silver Properties (the

“

Properties”) pursuant to a statutory plan of

arrangement under the Business Corporations Act (British Columbia)

(the “

Arrangement”), it has scheduled its Annual

General and Special Meeting (the "

Meeting") of

shareholders for December 09, 2024 at 11:00 a.m. (Vancouver

time). Foremost shareholders

(“

Foremost Shareholders”) will

vote on the Arrangement, among other things, at the Meeting. Full

details are provided below under “

Further Details of

AGSM”.

Pursuant to the Arrangement, the Properties will be transferred

to a newly incorporated company, named Rio Grande Resources Ltd.

(“Rio Grande”) and Foremost Shareholders will

exchange each outstanding common share of Foremost for one (1) new

Foremost common share and two (2) common shares of Rio Grande

(“Rio Grande Shares”). The Arrangement, if

completed, will result in Foremost retaining an approximate 19.95%

interest in Rio Grande, prior to the Private Placement described

below.

Foremost President and CEO states, “Having a new focused

and dedicated team work on Winston will enable us to unlock value

for our gold/silver assets. This will be a tremendous win for our

shareholders, giving each an equity interest in a new public

company at no additional cost to them.”

In connection with the Arrangement, the Company has filed an

updated independent technical report for the Properties prepared in

accordance with National Instrument 43-101 - Standards of

Disclosure for Mineral Projects ("NI 43-101")

titled "Technical Report for the Winston Gold-Silver Project:

Sierra County, New Mexico, USA”. The Properties consist of

one-hundred-forty-seven (147) unpatented lode mining claims and two

(2) patented mining claims in Sierra County and Catron County, New

Mexico. The Properties cover 1,229 hectares (3,037 acres) in the

Black Range/Chloride Mining District of central New Mexico and are

comprised of three historic past producing gold and silver mines:

Ivanhoe, Emporia and Little Granite. Exceptional results from

property-wide confirmatory sampling completed in 2021 included many

high-grade samples including 41.5 g/t Gold and 4,610 g/t Silver on

newly staked claims. Additional samples from these three mines

returned peak values of 66.5 g/t gold and 2,940 g/t silver from

Little Granite, 26.8 g/t gold and 1,670 g/t silver from Ivanhoe,

and 46.1 g/t gold and 517 g/t silver from Emporia.

Figure 1. Winston Project (yellow

ellipse) regional location map, showing the north end of Chloride

District. Porphyry Copper Deposit (PCD) in blue circles; Base-Metal

CRD Districts in purple rectangles; Epithermal Precious Metals in

red rectangles

An application has been submitted to the CSE to

list Rio Grande Shares upon completion of the Arrangement. It is a

condition of the completion of the Arrangement that the CSE, and if

required, the NASDAQ, will have conditionally approved the

Arrangement, including the listing of the new Foremost common

shares and the Rio Grande Shares.

In connection with the Arrangement, Rio Grande is

expected to complete a private placement of subscription receipts

for approximate aggregate gross proceeds of

$1,750,000 (the “Private

Placement”), with each subscription receipt automatically

converting upon the satisfaction or waiver of conditions precedent

to the Arrangement and the listing of the Rio Grande Shares on the

CSE into Rio Grande Shares. The gross proceeds of the Private

Placement will be held in escrow pending the satisfaction of the

release conditions.

Further Details of AGSM

A copy of the arrangement agreement between Rio

Grande and Foremost (the “Arrangement Agreement”)

pursuant to which the Arrangement will be affected will be filed

under Foremost’s profile on SEDAR+ at www.sedarplus.ca and on EDGAR

at www.sec.gov. Full details of the Arrangement and the other items

to be approved by the Foremost Shareholders at the Meeting will be

included in a management information circular of Foremost to be

provided to Foremost Shareholders by notice-and-access procedures

on or about November 5, 2024. Pursuant to those procedures,

Foremost Shareholders will receive a notice indicating that the

Meeting materials, including the management information circular,

have been posted and the process to access or obtain a paper copy

of those materials. The management information circular will be

posted, together with the notice of the Meeting and other meeting

materials, on Foremost’s website at www.foremostcleanenergy.com, on

SEDAR+ at www.sedarplus.ca and on EDGAR at www.sec.gov under

Foremost’s profile.

Foremost Shareholders as of December 09, 2024, will

receive 2 Rio Grande Resources Shares for every 1 Foremost Share,

if Arrangement is approved with a minimum of 66 2/3% of the votes

cast in person or by proxy, at the Meeting. The board of

directors of Foremost unanimously recommends that Foremost

Shareholders vote FOR the

resolution to approve the Arrangement. Foremost

Shareholders are urged to carefully review all Meeting materials as

they contain important information concerning the Arrangement and

the rights and entitlements of the Foremost Shareholders in

relation thereto. In addition, at the Meeting, Company shareholders

will be asked to consider those matters further described in the

notice of the Meeting.

The Arrangement is also subject to the approval of

the CSE and the Supreme Court of British Columbia, and applicable

regulatory approvals and the satisfaction of certain other closing

conditions customary for transactions of this nature. It is

anticipated that the closing of the Arrangement will take place

prior to December 31, 2024, assuming that the required Foremost

Shareholder, court and regulatory approvals have been received by

such time, and subject to the other terms and conditions set out in

the Arrangement Agreement. There can be no assurance that the

Arrangement will be completed as proposed, or at all.

About

Foremost

Foremost (NASDAQ: FMST) (CSE: FAT) (FSE: F0R0)

(WKN: A3DCC8), assuming the effectiveness of the Transaction, will

be an emerging North American uranium and lithium exploration

company with interests in 10 prospective properties spanning over

330,000 acres in the prolific, uranium-rich Athabasca Basin. As

global demand for decarbonization accelerates, the need for nuclear

power is crucial. Foremost expects to be positioned to capitalize

on the growing demand for uranium through discovery in a top

jurisdiction with the objective of supporting the world’s energy

transition goals. Alongside its exploration partner Denison,

Foremost will be committed to a strategic and disciplined

exploration strategy to identify resources by testing drill–ready

targets with identified mineralization along strike of recent major

discoveries.

Foremost also maintains a secondary portfolio of

significant lithium projects at different stages of development

spanning over 50,000 acres across Manitoba and Quebec. For further

information please visit the company’s website at

www.foremostcleanenergy.com.

Contact and Information

CompanyJason Barnard, President

and CEO+1 (604) 330-8067 info@foremostcleanenergy.com

Investor RelationsLucas A.

ZimmermanManaging DirectorMZ Group - MZ North America(949)

259-4987FMST@mzgroup.uswww.mzgroup.us

Follow us or contact us on social

media:Twitter: @fmstcleanenergyLinkedin:

https://www.linkedin.com/company/foremostcleanenergy/ Facebook:

https://www.facebook.com/ForemostCleanEnergy/

Forward-Looking Statements

Except for the statements of historical fact

contained herein, the information presented in this news release

and oral statements made from time to time by representatives of

the Company are or may constitute “forward-looking statements” as

such term is used in applicable United States and Canadian laws and

including, without limitation, within the meaning of the Private

Securities Litigation Reform Act of 1995, for which the Company

claims the protection of the safe harbor for forward-looking

statements. These statements relate to analyses and other

information that are based on forecasts of future results,

estimates of amounts not yet determinable and assumptions of

management and include statements with respect to the Meeting,

including the timing thereof, the Meeting Materials and the

delivery thereof, the Arrangement and the completion and timing

thereof, the receipt of Shareholder, Court and other approvals, the

conduct, timing and pricing of the Private Placement, the benefits

of the Arrangement and the listing of the new Foremost common

shares and Rio Grande Resources shares. Any other statements that

express or involve discussions with respect to predictions,

expectations, beliefs, plans, projections, objectives, assumptions

or future events or performance (often, but not always, using words

or phrases such as “expects” or “does not expect,” “is expected,”

“anticipates” or “does not anticipate,” “plans,” “estimates” or

“intends,” or stating that certain actions, events or results

“may,” “could,” “would,” “might” or “will” be taken, occur or be

achieved) are not statements of historical fact and should be

viewed as forward-looking statements. Such forward-looking

statements involve known and unknown risks, uncertainties and other

factors which may cause the actual results, performance or

achievements of the Company to be materially different from any

future results, performance or achievements expressed or implied by

such forward-looking statements. Such risks and other factors

include, among others, the availability of capital to fund programs

and the resulting dilution caused by the raising of capital through

the sale of shares, accidents, labor disputes and other risks of

the automotive industry including, without limitation, those

associated with the environment, delays in obtaining governmental

approvals, permits or financing or in the completion of development

or construction activities or claims limitations on insurance

coverage. Although the Company has attempted to identify important

factors that could cause actual actions, events or results to

differ materially from those described in forward-looking

statements, there may be other factors that cause actions, events

or results not to be as anticipated, estimated or intended. There

can be no assurance that such statements will prove to be accurate

as actual results and future events could differ materially from

those anticipated in such statements. Although the Company believes

that the expectations reflected in such forward-looking statements

are based upon reasonable assumptions, it can give no assurance

that its expectations will be achieved. Forward-looking information

is subject to certain risks, trends and uncertainties that could

cause actual results to differ materially from those projected.

Many of these factors are beyond the Company’s ability to control

or predict. Important factors that may cause actual results to

differ materially and that could impact the Company and the

statements contained in this news release can be found in the

Company’s filings with the Securities and Exchange Commission. The

Company assumes no obligation to update or supplement any

forward-looking statements whether as a result of new information,

future events or otherwise. Accordingly, readers should not place

undue reliance on forward-looking statements contained in this news

release and in any document referred to in this news release. This

news release shall not constitute an offer to sell or the

solicitation of an offer to buy securities. and information. Please

refer to the Company’s most recent filings under its profile at on

Sedar+ at www.sedarplus.ca and on Edgar at www.sec.gov for further

information respecting the risks affecting the Company and its

business.

The Canadian Securities Exchange has neither

approved nor disapproved the contents of this news release and

accepts no responsibility for the adequacy or accuracy hereof.

A photo accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/80aa66ef-a182-471f-b72b-04e23ff9d076

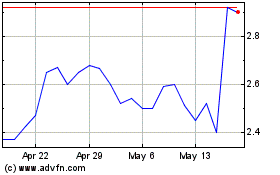

Foremost Clean Energy (NASDAQ:FMST)

Historical Stock Chart

From Nov 2024 to Dec 2024

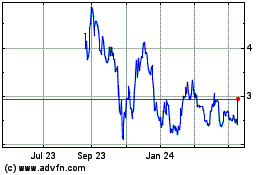

Foremost Clean Energy (NASDAQ:FMST)

Historical Stock Chart

From Dec 2023 to Dec 2024